Answer:

The question of how to replace item groups in new configurations of 1C Integrated Automation 2 or ERP 2 arises constantly. In the old G8 configurations, there was no particular alternative for production or sales accounting analytics.

In the new programs we have three main analysts who could be considered as suitable candidates for replacement:

- Groups of financial accounting of items,

- Groups of analytical accounting of items,

- Activities.

Own materials in stock

The cost of materials, the ownership of which has been transferred to the organization, is reflected in the debit of account 10 “Materials” in:

- the actual cost of materials, if the accounting policy provides for a method of accounting for the receipt of materials at actual cost;

- accounting value, if the accounting policy stipulates that the purchase of materials is carried out at accounting prices using accounts 15 “Procurement and acquisition of material assets” and account 16 “Deviation in the cost of materials.”

Learn more Methods of accounting for materials

Accounting for materials at the actual cost of acquisition is the main method of accounting for the receipt of materials, which is correctly implemented in the 1C program.

The method of accounting for the purchase of materials using accounts 15 and 16 is not standardly implemented in 1C: Accounting 8, therefore, having specified it in the accounting policy, entries for attributing the difference from account 15 to account 16 will need to be generated manually.

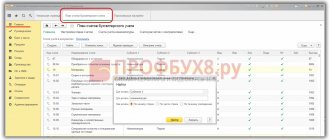

Materials in the organization’s warehouses are accounted for in the following subaccounts of account 10 “Materials”:

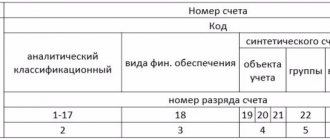

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| 10.01 | Raw materials | Nomenclature | Warehouses | Parties |

| 10.02 | Purchased semi-finished products and components, structures and parts | Nomenclature | Warehouses | Parties |

| 10.03 | Fuel | Nomenclature | Warehouses | Parties |

| 10.04 | Containers and packaging materials | Nomenclature | Warehouses | Parties |

| 10.05 | Spare parts | Nomenclature | Warehouses | Parties |

| 10.06 | Other materials | Nomenclature | Warehouses | Parties |

| 10.08 | Construction Materials | Nomenclature | Warehouses | Parties |

| 10.09 | Inventory and household supplies | Nomenclature | Warehouses | Parties |

| 10.10 | Special equipment and special clothing in stock | Nomenclature | Warehouses | Parties |

Account 10.01 records production materials, as well as other materials purchased for the needs of the organization. Account 10.05 takes into account spare parts, parts intended for repair, replacement of worn-out parts of machines, equipment, including car tires in stock and in circulation. Account 10.06 takes into account production waste (stubs, cuttings, shavings, etc.); irreparable defects and other secondary material assets not included in other subaccounts (for example, scrap metal generated during the disposal of fixed assets). Account 10.08 takes into account construction materials used directly in the process of construction, installation and repair work in an organization not engaged in construction.

Analytical accounting of materials is carried out by places of storage of materials (warehouses) and their individual names (nomenclature, batches, etc.). In 1C, it is maintained in the context of Subconto—for each subconto, a directory of the same name is organized:

- directory Nomenclature ;

- directory Warehouses .

The Batch subconto is filled in only if batch accounting is provided.

Thanks to such a system in 1C, you can get detailed analytics on the accounting of materials from the Balance Sheet for account 10.

Reports are generated by the short name of the materials, but if necessary, you can display the full name or other necessary data.

Study in more detail How to form OSV in 1C according to count 10, with the full name of the nomenclature?

Accounting for materials at accounting purchase prices

When choosing this method in the accounting policy, the purchase of materials is carried out at accounting prices using accounts 15 “Procurement and acquisition of material assets” and account 16 “Deviation in the cost of materials.”

The actual cost of materials upon receipt is reflected in account 15.01 “Procurement and acquisition of materials” (Dt 15.01 Kt 60.01):

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| 15.01 | Procurement and acquisition of materials |

Next, purchased materials are accounted for in the subaccounts of account 10 “Materials” at book value, and deviations are recorded in account 16.01 “Deviation in the cost of materials”:

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| 16.01 | Material cost variance |

Reconciliation reports

If you work with a large number of counterparties, then you know how exhausting it can be to regularly reconcile documentation with them. Call, prepare, send, receive, make changes... the cycle repeats again and again until you run out of energy.

There is a service that can facilitate this process - “Reconciliation Acts”. Processing allows you to generate “Settlement Reconciliation Report” documents with counterparties for the selected period and then send them to the counterparty’s email in the background.

What can the service do?

- Automatically fill out a list of counterparties by turnover and balances for the selected reconciliation period;

- Fill out the list of counterparties for selection (even without turnover);

- Display turnover for the selected reconciliation period in the tabular section;

- Automatically fill out already created reconciliation reports for the required period according to the entered settings;

- Save email addresses when editing them in the tabular section;

- Provide a choice of printed form, file format and the presence of a signature and seal in the reconciliation report file;

- Create custom email subject and text templates with auto-filled parameters;

- Send reconciliation reports to counterparties by email in the background, displaying progress;

- Monitor the correctness of the entered email addresses;

- Record sending dates in additional document properties.

Use of materials

When used, materials are written off to the appropriate cost accounts at the time of their release from the warehouse - at the time of drawing up documents for the transfer of materials (clause 93 of Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n). The value of written-off materials is assessed according to the method specified in the accounting policy.

Learn more Write-off of materials

However, in some cases, the cost of materials used is not recorded in the cost accounts. Let's look at them in more detail.

Accounting for materials transferred to the counterparty for processing

Materials transferred for processing to a third party are accounted for on account 10.07 “Materials transferred for processing to third parties”:

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| 10.07 | Materials outsourced for processing | Counterparties | Nomenclature | Parties |

Analytical accounting is carried out by contractors who transferred materials and individual items (items, batches, etc.). In 1C, it is maintained in the context of Subconto—for each subconto, a directory of the same name is organized:

- directory Contractors;

- reference book Nomenclature .

Accounting for materials in use

Materials transferred into operation are accounted for in the following subaccounts of account 10.11 “Special equipment and special clothing in operation”:

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| 10.11.1 | Special clothing in use | Nomenclature | Lots of materials in operation | Employees of organizations |

| 10.11.2 | Special equipment in use | Nomenclature | Lots of materials in operation |

All materials (including inventory) transferred for operation are reflected in the off-balance sheet account of the MC “Material Assets in Operation,” which includes the following subaccounts:

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| MC.02 | Overalls in use | Nomenclature | Lots of materials in operation | Employees of organizations |

| MC.03 | Special equipment in operation | Nomenclature | Lots of materials in operation | |

| MC.04 | Inventory and household supplies in use | Nomenclature | Lots of materials in operation | Employees of organizations |

Analytical accounting of materials released into operation is carried out by employees to whom the materials were transferred and individual items (nomenclature, batches, etc.). In 1C it is maintained in the context of Subconto - a corresponding directory is organized for each subconto:

- directory Nomenclature ;

- directory Individuals .

Thanks to such a system in 1C, you can obtain detailed analytics on the accounting of materials from the Balance Sheet for account 10.11.1 or MC.

To control inventory in operation, it is necessary to generate a balance sheet for account MTs.04. This is the only account that shows inventory in use.

Accounting for materials for which ownership has not yet transferred

Materials are recognized as an asset of the organization and are reflected in account 10 “Materials” or 15 “Procurement and acquisition of materials” from the moment of transfer of ownership of them.

Before this, if the materials are already in use or at the disposal of the organization, they are taken into account in the assessment provided for in the contract (clause 14 of PBU 5/01), on off-balance sheet account 002 “Goods accepted for safekeeping”:

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| 002 | Inventory assets accepted for safekeeping | Nomenclature | Counterparties |

It is prohibited to use such materials in production before the buyer acquires the rights to them (Article 491 of the Civil Code of the Russian Federation).

The same account reflects materials accepted for safekeeping.

Analytical accounting of such materials is carried out by contractors who transferred the materials and individual items (items, batches, etc.). In 1C it is maintained in the context of Subconto - a directory of the same name is organized for each subconto:

- directory Nomenclature ;

- directory Contractors.

How to view the dynamics of accounts receivable for a period

Another useful summary report for debt analysis that “works” with deadlines is the report on the dynamics of receivables.

It is in the same subgroup as the report on debt maturities. The principle of setting the settings is also similar to the deadline report. Only when setting the interval, the period is set from the drop-down list: minimum - day, maximum - year.

The resulting report will present accounts receivable in the following context:

- changes in debt in a period (for example, with an interval of 1 day and a selected period of 1 month, the report will display a graph of daily changes in the volume of debit debts for the month);

- overdue and repayable debts on time (overdue debts will be highlighted in red in the report).

Read about the nuances of debt accounting in the article “How do settlements with debtors and creditors occur?”

Materials accepted for recycling

Such materials are accounted for in off-balance sheet account 003 “Materials accepted for processing.” The following subaccounts are provided for it:

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| 003.01 | Materials in stock | Counterparties | Nomenclature | Warehouses |

| 003.02 | Materials transferred to production | Counterparties | Nomenclature |

Analytical accounting of such materials is carried out by contractors who transferred the materials and individual items (items, batches, etc.). In addition, for materials not transferred to production, accounting is carried out at the places of their storage (warehouses). In 1C it is maintained in the context of Subconto - a directory of the same name is organized for each subconto:

- directory Contractors;

- directory Nomenclature ;

- directory Warehouses .

Test yourself! Take a test on this topic using the link >>

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Test No. 15. Accounting and analytical accounting of materials: legislation and 1C...

- Accounting and analytical accounting of fixed assets: legislation and 1C This publication describes the main fixed asset accounting accounts and the system…

- Accounting accounts and analytical accounting of cash transactions: legislation and 1C This publication describes the main accounts of cash transactions and...

- Analytical accounting of salary reflection Good afternoon! ZUP 3.1.7 In an organization, salaries need to be distributed according to...

Data control

Errors when working with documents and reference books are an inevitable evil. No matter how attentive you are, there is always a chance that you will momentarily lose concentration and make some kind of mistake. Or it will be done by another employee who has access to the document. So why not “forbid” yourself and others from making mistakes?

The Data Control service is just what you need for such a case.

With it you can:

- Limit access rights: completely deny editing access to other employees.

- Fine-tune access: allow users to edit only those documents where they are listed as responsible.

- Restrict valid document values.

- Apply the function of mandatory completion of a specific document field. Forgot to fill it out? The document will refuse to be saved.

- Establish correspondence for which counterparties from which warehouses are allowed to ship.

- Check the correctness of data entry.

- Set up restrictions for the item folder depending on its type: for example, materials - only in the "Materials" folder, goods - only in the "Products" folder.

- Data control is a great assistant in working with documents. Where the human eye becomes blurry, the service is vigilant.