Documenting

Document the release (transfer) of materials into operation (production) with the following documents:

- limit intake card (form No. M-8) is used for the systematic use of materials, when standards and plans for their consumption have been approved;

- an invoice for the release of materials to the third party (Form No. M-15) is used in cases where materials are transferred to a geographically remote unit;

- the demand invoice (Form No. M-11) or warehouse registration card (Form No. M-17) is used in other cases.

Such rules are established by paragraphs 100, 109 and 126 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Advice : standard forms of documents that are in albums of unified forms and approved by resolutions of the State Statistics Committee of Russia are not necessary to use. Therefore, organizations have the right to develop a single act for the write-off of materials. It can indicate only mandatory details and those that are important for the organization based on the specifics of the activity.

Use the same documents to write off property worth up to 40,000 rubles. (another limit established in the accounting policy), which in other respects corresponds to fixed assets. This is explained by the fact that in accounting its value is written off similarly to materials (paragraph 4, paragraph 5 of PBU 6/01, letter of the Ministry of Finance of Russia dated May 30, 2006 No. 03-03-04/4/98).

Accounting for consumption (disposal) of materials

The release of materials into production means their release from the organization's warehouse (shops) directly for the manufacture of products (performance of work, provision of services), as well as the consumption of materials for the management needs of the organization.

The release of materials to the warehouses of departments (shops) of the organization and to construction sites is considered as internal movement.

As materials are released from the warehouses of departments (shops) to workplaces, they are written off from the material asset accounts and credited to the corresponding production cost accounts. The cost of materials released for management needs is charged to the appropriate accounts for accounting for these expenses.

The primary accounting documents for the release (consumption) of materials from the organization's warehouses to the organization's divisions (shops) are a limit-fetch card (standard interindustry form N M-8), a demand invoice (standard interindustry form N M-11), an invoice (standard interindustry form form N M-15).

|

|

Below are accounting entries reflecting the consumption of materials for production and administrative needs.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 | 10 | Materials were released into main production. The consumption of materials in the main production is taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 23 | 10 | Materials were released to auxiliary production. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 25 | 10 | Materials were released for general production needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 26 | 10 | Materials were released for general business needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 10 | 10 | Materials were released to warehouses (storerooms) of departments (shops) | Cost of materials | Internal movement invoice |

Accounting for other disposals (write-offs, gratuitous transfers) of materials. Accounting entries

Write-off of materials can be carried out in the following cases:

- that have become unusable after expiration of the storage period;

- obsolete;

- when identifying shortages, thefts or damage, including due to accidents, fires, and natural disasters.

The preparation of the necessary information for making a decision on the write-off of materials is carried out by the Commission with the participation of financially responsible persons. Based on the results of the inspection, the Commission draws up an Act on the write-off of materials for each division of the organization, for financially responsible persons.

The write-off of materials transferred under a gift agreement or free of charge is carried out on the basis of primary documents for the release of materials (waybills, applications for the release of materials to third parties, etc.). Article 146 “Object of Taxation” of the Tax Code of the Russian Federation states that the transfer of ownership of assets free of charge is recognized as a sale, that is, subject to VAT.

Below are accounting entries reflecting the write-off and gratuitous transfer of materials

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for shortages (damage) of materials in the presence of culprits | ||||

| 94 | 10 | The write-off of the book value of materials is reflected based on the write-off report drawn up by the commission | Actual cost of written-off materials | Material write-off act |

| 20 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the expenses of the main production | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 23 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the costs of auxiliary production | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 25 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss at the expense of overhead costs | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 26 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss at the expense of general business expenses | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 29 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the costs of service industries | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 73.2 | 94 | The write-off of shortages (losses from spoilage) of materials to the perpetrators in excess of the norms of natural loss is reflected | The amount of excess of the norm of natural loss | Accounting certificate-calculation Act of write-off of materials |

| 91.2 | 68.2 | VAT, previously claimed for deduction, was restored for shortages (losses) of materials in excess of the norms of natural loss | VAT amount | Accounting certificate-calculationInvoice |

| 50.01 | 73.2 | Repayment by the guilty person of the debt for cash shortages is reflected | Shortfall amount | Receipt cash order. Form No. KO-1 |

| 70 | 73.2 | Repayment by the guilty person of the debt for shortfalls at the expense of wages is reflected | Shortfall amount | Accounting certificate-calculation |

| Features of accounting for shortages (damage) of materials in the absence of perpetrators. In this situation, the amount exceeding the natural loss rate is written off not to account 73, but to account 91 | ||||

| 91.2 | 94 | Reflects the write-off of shortages (losses from spoilage) of materials in excess of the norms of natural loss in the absence of guilty persons or shortages, the recovery of which was refused by the court | The amount of excess of the norm of natural loss | Accounting certificate-calculation Act of write-off of materials |

| Accounting for material loss due to natural disasters | ||||

| 99 | 10 | Recorded write-off of materials lost as a result of natural disasters | Cost of lost materials | Material write-off act |

| 99 | 68.2 | VAT, previously claimed for deduction, was restored on lost materials | VAT amount | Accounting certificate-calculationInvoice |

| Accounting for free transfer of materials | ||||

| 91.2 | 10 | Disposal of materials reflected | Actual cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | VAT is charged to the budget on the cost of materials donated free of charge | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

Accounting for the sale of materials. Accounting entries

When an organization sells materials to individuals and legal entities, the sales price is determined by agreement of the parties (seller and buyer). The calculation and payment of taxes is carried out by the organization in the manner prescribed by current legislation.

The sale of materials is formalized by issuing an invoice for the release of materials to the third party, on the basis of contracts or other documents and an invoice. When transporting goods by road, a consignment note is issued.

The following are accounting entries reflecting the sale of materials.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Sale of materials with payment after shipment (transfer) | ||||

| 91.2 | 10 | The disposal of materials is reflected. The posting amount depends on the methodology for estimating the cost of materials upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of materials | Invoice (TMF No. M-15) |

| 62.01 | 90.1 | Revenue is reflected in the sales cost of materials including VAT. | Sales cost of materials (amount including VAT) | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT on materials sold is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 51 | 62.01 | The fact of repayment of the buyer’s debt for previously shipped materials is reflected. | Selling cost of materials | Bank statementPayment order |

| Sale of materials on prepayment | ||||

| 51 | 62.02 | The buyer's prepayment for materials is reflected | Advance payment amount | Bank statementPayment order |

| 76.AB | 68.2 | VAT is charged on advance payment | VAT amount | Payment orderInvoiceSales book |

| 91.2 | 10 | The disposal of materials is reflected. The posting amount depends on the methodology for estimating the cost of materials upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of materials | Invoice (TMF No. M-15) |

| 62.01 | 91.1 | Revenue is reflected in the sales cost of materials including VAT. | Sales cost of materials. Value with VAT | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | VAT is charged on materials sold | VAT amount | Invoice (TMF No. M-15) Invoice |

| 62.01 | 62.02 | The previously received prepayment is offset against the debt for the transferred materials. | Advance payment amount | Accounting certificate-calculation |

| 68.2 | 76.AB | VAT is credited from the prepaid payment | VAT amount | InvoicePurchase book |

Source: https://www.buhgalteria.ru/spravochnik/provodki/uchet_rasxoda_materialov/

Accounting

Materials transferred for production (operation) should be written off as expenses at the time they are released from the warehouse, that is, at the time of drawing up documents for the transfer of materials into operation (production) (clause 93 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

Tip : to determine the moment of actual use of materials in production, you can use additional reporting forms. For example, a report on the use of materials in production. This will allow you to reduce the costs of the reporting period by the cost of materials whose processing has not begun.

Some industry guidelines also recommend doing this (clauses 236 and 256 of the Methodological Recommendations, approved by Order of the Ministry of Agriculture of Russia dated January 31, 2003 No. 26). In addition, the moment of actual consumption of materials is important for tax purposes. For more information about this, see What material expenses should be taken into account when calculating income tax and How to write off material expenses using the simplified tax system.

In accounting, document the release of materials by posting:

Debit 20 (23, 25, 26, 29, 44, 97...) Credit 10 (16)

- materials written off.

Transfer to units

The transfer of materials to departments can occur without indicating the purpose of their expenditure (at the time of release from the warehouse, the name of the order (product, product) for the manufacture of which the materials are released or the name of the costs is unknown). In this case, write them off as expenses based on the act, which is drawn up after the actual use of the materials. Before the act is signed, these materials are listed as the recipient's account. The issue of materials is accounted for as an internal movement (documented by posting to subaccounts within account 10). Such rules are established by paragraphs 97 and 98 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

An example of reflecting in accounting the write-off of materials when they are transferred to departments without indicating the purpose of their use

JSC "Alfa" produces blank parts from sheet metal. 100 sheets were transferred from the warehouse to the workshop (price - 50 rubles per sheet) without indicating the purpose of use (the corresponding columns of the requirement-invoice in form No. M-11 were not filled out).

These transactions were reflected in accounting as follows:

Debit 10 sub-account “Workshop” Credit 10 sub-account “Warehouse” – 5,000 rubles. (50 rubles/pcs. × 100 pcs.) – materials were transferred to the workshop without indicating the purpose of expenditure on the basis of the invoice requirement M-11.

After using the materials, a statement of their consumption was drawn up, indicating the types of workpieces for the production of which the metal was used. Based on the materials consumption report, the accountant made the following entry:

Debit 20 Credit 10 subaccount “Workshop” – 5000 rub. (50 rub./piece × 100 pieces) – materials are written off as expenses based on the materials consumption report.

Materials consumed for the manufacture of wiring products

They may be reflected within the normal limits or as a result of loss/damage.

- Operations with customer-supplied raw materials - features of accounting for materials received from another organization.

For production and for own needs, materials are released from the warehouse upon request - invoice or other documents (based on accounting policies); are written off to the production site, which then includes them in the cost of products or services.

Carrying out inventories

Every year, according to PBU, owners are required to conduct scheduled inventories on the basis of an issued order with designated responsible persons. In addition to them, there may be unscheduled (sudden) audits and inventories.

Synthetic accounting of production costs is carried out on account 20 “Main production” according to a scheme consisting of five stages. First, the direct costs of the main production for the manufacture of products are reflected in the debit of account 20 “Main production” in correspondence with the accounts of inventory, settlements with employees for wages.

Accounting entries for accounting for production costs

The main direction of use of purchased materials is their processing during the production process in order to produce finished products (perform work, provide services).

Typical entries for writing off consumed materials

Correspondence of accounts Debit Credit 1. Basic materials written off and used up for the production of finished products 20 “Main production” 10 “Materials” 2. Materials written off and used up for building repairs 25 “General production expenses” 10 “Materials” 3. Materials written off and spent for general business needs 26 “General expenses” 10 “Materials”

The accounting entries given are simple.

Suppose several batches arrived at different prices. We need to write off a certain amount of material assets into production. First, materials are taken from the first batch at the cost of this batch.

When the first batch ends, they move on to the second batch, from which the required quantity is written off at the cost of this batch; if this is not enough, then the third batch is taken, etc.

The materials remaining in the warehouse at the end of the month are valued at the cost of the last batch received at the warehouse.

The methods are convenient to use if the cost of material assets does not increase significantly from batch to batch.

Example:

We take the same conditions.

If you need to write off 800 units, take 500 units first.

The irreparable (final) defect was put into storage at a scrap price of 1,400 rubles. The culprits of the defect are the employees of the mechanical shop. Let's make accounting entries: No. of business transactions Correspondence of accounts Amount, rub.

print version

Contents 8.1. Cost accounting of main production 8.2. Accounting for auxiliary production costs 8.3. Accounting for overhead costs 8.4. Accounting for general business expenses 8.5. Accounting for losses from defects 8.6.

Accounting for deferred expenses Control tasks Accounting for production costs is regulated by the Accounting Regulations “Costs of the Organization” (PBU 10/99), approved by order of the Ministry of Finance of Russia dated 06.05.

99 No. ЗЗ no.

Task 8.3.1 The organization’s general production expenses for the month amounted to 858,800 rubles, including:

- wages of workers servicing fixed assets of production shops - 110,000 rubles;

- salary of management personnel of production shops - 150,000 rubles;

- contributions for social needs - 72,800 rubles;

- depreciation of fixed assets of production shops - 180,000 rubles;

- the cost of materials spent on current repairs of fixed assets is 46,000 rubles;

- rent for the use of production space – 300,000 rubles.

The organization produces three types of products.

Main production" (wiring D20 K28).

Accounts 23 “Auxiliary production”, 25 “General production expenses”, 26 “General expenses” are not always used by the enterprise. These are intermediate, auxiliary accounts; they are convenient to use in large production. If the company has a small production, then there is no point in entering additional accounts; all costs can be taken into account immediately on the account. 20.

Thus, it was determined that according to the debit of the account. 20, all costs associated with the main production are taken into account, that is, the cost of finished products is formed.

This cost is then written off from the credit account. 20 to the debit of the account. 40, 43 or 90.

If the cost of finished products is taken into account at standard (planned) cost, then all expenses from the credit account. 20 are debited to the account.

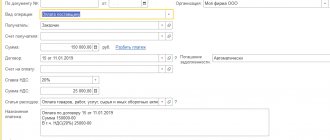

Account Dt Account Kt Posting description Posting amount Document-base 60.01 51 Paid for materials 255,690 Bank statement 10.01 60.01 Receipt of materials to warehouse from supplier 216,686 Request-invoice 19.03 60.01 VAT taken into account 39,004 Invoice 68.02 19.03 VAT accepted to be deducted 39,004 Account- invoice 20.01 10.

01 Posting: materials released from warehouse to production 100 318 Request invoice 94 10.01 Write-off of the cost of damaged sheets 2408 Write-off statement 20.

01 94 The cost of damaged sheets is written off as production costs 2408 Accounting certificate of the heading Accounting for materials on the 10th account in 1C The balance sheet report on the 10th account allows you to see the movements of the company's inventories.

The costs accounted for in account 97 “Deferred expenses” are written off from the credit of this account to the debit of the production cost accounts within the established time frame.

Analytical data on the calculation of depreciation of leased property, Accounting certificate-calculation 20 02 Accrued depreciation of fixed assets that have not passed state registration in the prescribed manner (with subsequent adjustment of profit for tax purposes). Accounting statement-calculation 20 10 Materials were released to the main production.

No. M-8 “Limit-fence card”, No. M-11 “Demand-invoice” 20 97 The share of deferred expenses relating to the reporting period was written off. Accounting certificate-calculation 20 23 The costs of auxiliary production are included in the costs of the main production.

Returning balances to the warehouse

If materials decommissioned for use (production) were not completely consumed, they must be returned to the warehouse. Issue such a return with an invoice (form No. M-11 or No. M-15) or a limit-withdrawal card (form No. M-8). This is stated in paragraph 112 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

In accounting, register the return of materials by posting:

Debit 10 (16) Credit 20 (23, 25, 26, 29, 44, 97…)

– unused materials are credited to the warehouse.

Write-off of deviations from actual costs

When accepting materials for accounting, write off the amount of deviation from the accounting value to account 16 “Deviation in the cost of material assets” in correspondence with account 15 “Procurement and acquisition of material assets.”

If the accounting price of materials is less than their actual cost, then reflect the deviation with the following posting:

Debit 16 Credit 15

– the excess of the actual cost of purchased materials over the book price is reflected.

If the accounting price of materials is greater than their actual cost, then reflect the deviation by reverse posting:

Debit 15 Credit 16

– the excess of the book price over the actual cost of purchased materials is reflected.

This procedure follows from the Instructions for the chart of accounts (accounts 15 and 16).

Based on these data, determine the average percentage of deviations using the formula:

| Average percentage of deviations related to write-off materials | = | Remaining deviations in cost at the beginning of the month + Sum of deviations for materials received during the month ____________________________________________________________________________ | × | 100 | ||

| Cost of the balance of materials at the beginning of the month (in accounting prices) + Cost of materials received during the month (in accounting prices) | ||||||

After calculating the average percentage, determine the amount of cost variances that is written off to the cost of materials sold. To do this, use the formula:

| The amount of variances written off to the cost of materials sold | = | Average percentage of deviations related to write-off materials | × | Accounting value of materials written off |

This procedure is provided for in paragraph 87 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Write off the difference accumulated on account 16 in the part related to materials written off for production (to goods sold) to the production (sales) cost accounts.

When transferring materials into production or selling goods, reflect the accumulated positive difference (the actual cost of materials exceeds accounting prices) using the following entry:

Debit 20 (23, 25, 26, 29, 44, 97...) Credit 16

– the accumulated positive difference is written off.

Reflect the accumulated negative difference (the accounting price of materials exceeds the actual cost) with a reversal entry:

Debit 20 (23, 25, 26, 29, 44, 97...) Credit 16

– the accumulated negative difference is written off.

Materials spent on wiring production

Inventory

Postings:

In addition to the fact that materials can be supplied to the enterprise from a supplier, they can also be made in-house from other materials, they can also be contributed to the authorized capital of the organization or received free of charge.

Manufacturing

When producing material assets, the cost at which they will be credited to the warehouse is the sum of all actual costs incurred during the production process. This may include: the cost of raw materials, depreciation of fixed assets used in production, staff salaries, overhead costs and other direct costs.

All production costs are collected on the account. 20 “Main production” or 23 “Auxiliary production”, after which they are written off to the account.

When reflecting the use of materials in the production process in accounting, we, on the one hand, must reflect the actual decrease in the amount of materials in the warehouse, and on the other, an increase in production costs.

Thus, if we proceed from the economic content of business transactions involving the use of materials, then they can be reflected in the accounting accounts as follows (Table

Accounting for consumption (disposal) of materials

Analytical data on the calculation of depreciation of intangible assets in the context of structural divisions, Accounting certificate-calculation 20 02 Depreciation was calculated on leased property when it is recorded on the lessor’s balance sheet.

Materials spent on the main production of wiring

Attention

If during the inspection process discrepancies in quantity or inadequate quality are identified, then an acceptance certificate form M-7 is issued.

Postings for accounting for materials upon receipt at actual cost:

Example

An organization buys 1,000 inventory items for 118,000 rubles, including VAT of 18,000 rubles. Delivery costs amounted to 11,800 rubles, including VAT of 1,800 rubles.

Inventory and materials are accounted for at actual prices. Delivery costs are reflected in a separate subaccount of account 10 – 10.ТЗР. 500 pieces were sent to production. Inventory

Postings:

Accounting at discount prices

Inventory and materials can be taken into account at accounting prices; usually this method is used if the receipt of valuables is regular.

In this case, auxiliary accounts are used to record inventory.

Materials consumed for the manufacture of wiring products

Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets”.

Postings

Before entering the 10th account, materials are accounted for in the debit of the account. 15 wiring D15 K60 at the cost indicated in the supplier’s documents, excluding VAT.

VAT is allocated separately to account 19: D19 K60, after which it is sent to deduction D68.VAT K19.

After which the inventory items are debited to the account. 10 at discount prices: D10 K15.

The difference between the actual price indicated on the invoice. 15, and accounting reflected in the account. 10, reflected on the account. 16.

If the actual price is greater than the accounting price, then posting D16 K15 is performed by an amount equal to the difference between the purchase and accounting value. At the same time, on the account. 16 a debit balance appears, which at the end of the month is written off to those accounts to which materials are written off. The amount to be debited from the account.

Materials used for wiring production are written off

Advance report 19 71.1 Incoming VAT reflected 1,449 Advance report

Free admission

Omega LLC received a free batch of stationery in the amount of 2,700 rubles.

In the accounting records of Omega LLC, the gratuitous receipt of materials is reflected by the following posting:

Dt Kt Description of transaction (operation) Amount, rub. Ground 10 91.1 Receipt of stationery is reflected 2,700 Accounting certificate

Receipt from production

Capitalization of materials of own production can occur:

- At standard cost;

- At actual cost.

In the first case, account 40 “Output of products (works, services)” is used.

Let's assume that Langur LLC brings materials produced in its own workshop to the warehouse.

Accounting entries for materials accounting:

Dt Kt Description of transaction (operation) Amount, rub. Basis 10 40 Reflection of materials at planned cost 9,500 M-4 40 20 Reflection at actual cost 10 100 Accounting certificate 10 40 Write-off of cost variance 600 Accounting certificate

In the second case, when posting materials at actual cost, one transaction is created:

Dt Kt Description of transaction (operation) Amount, rub. Basis 10 20 Receipt of materials from production 10 100 M-4 is reflected

Accounting for material disposal

Inventory can be written off as expenses, sold, donated or damaged.

Task 8.3.1 The organization’s general production expenses for the month amounted to 858,800 rubles, including:

- wages of workers servicing fixed assets of production shops - 110,000 rubles;

- salary of management personnel of production shops - 150,000 rubles;

- contributions for social needs - 72,800 rubles;

- depreciation of fixed assets of production shops - 180,000 rubles;

- the cost of materials spent on current repairs of fixed assets is 46,000 rubles;

- rent for the use of production space – 300,000 rubles.

The organization produces three types of products.

Materials consumed for production of products wiring

Accounting for loss of materials as a result of natural disasters 99 10 Recorded write-off of materials lost as a result of natural disasters Cost of lost materials Act of write-off of materials 99 68.

2 VAT, previously claimed for deduction, on lost materials was restored VAT amount Accounting certificate-calculation Invoice Accounting for gratuitous transfer of materials 91.2 10 Disposal of materials is reflected Actual cost of materials Invoice (TMF No. M-15) Invoice 91.2 68.

2 VAT is charged to the budget on the cost of materials donated free of charge VAT amount Invoice (TMF No. M-15) Invoice Sales book Accounting for the sale of materials.

Basic materials were consumed for the manufacture of wiring products

The FIFO method assumes that materials that arrived earlier than others are transferred to production first.

Materials released and consumed for the production of products

There are several ways to receive materials:

- Purchase;

- Own production;

- Free transfer, etc.

Purchasing materials from a supplier

Let’s assume that Albatros LLC purchased a batch of inventory from a supplier in the amount of 59,000 rubles, incl. VAT 9,000 rub.

The accountant reflects the following postings for materials:

Dt Kt Description of transaction (operation) Amount, rub. Reason 60 51 Reflected payment for goods 59,000 Payment order 10 60 Reflected cost of goods 50,000 Invoice 19 60 Reflected incoming VAT 9,000 Invoice

Receipt based on advance reports

For example, an accountant gave an employee 10,000 rubles from the cash register. to purchase inventory. The employee purchased inventory in the amount of RUB 9,500, incl.

D19 K60, after which VAT is sent for deduction to the debit of account 68 “Calculations for taxes and fees” subaccount “VAT” - posting D68.VAT K19.

Payment to the supplier from the current account is made by posting D60 K51.

The above accounting entries can only be made if there are supporting documents:

- commodity or delivery note from the supplier;

- invoice with allocated VAT from the supplier;

- invoice and invoice for other costs associated with the purchase and transportation;

- payment documents confirming the fact of payment of all expenses by the buyer.

When accepting inventory items, the document data is checked, the actual availability of materials is verified with what is indicated in the documents, if there are no discrepancies, then a receipt order form M-4 is issued.

Important

Auxiliary production" is intended to account for the direct costs of auxiliary production, which include the repair of fixed assets involved in the production process, transport services, and power supply.

The postings for accounting for these costs look similar, only instead of invoice. 20 is taken count. 23.

General production expenses (account 25)

This account is intended to collect costs associated with the maintenance of main and auxiliary production. These are indirect costs that are collected in the debit of the account during the month.

Source: https://realkonsalt.ru/izrashodovany-materialy-na-proizvodstvo-provodka

Cost estimation methods

To determine the price of materials decommissioned (production), that is, the amount that is debited from account 10, the organization must choose one of the methods for valuing them:

- at the cost of each unit of inventory;

- FIFO;

- at average cost.

The choice of method for estimating the cost of written-off materials is fixed in the accounting policy for accounting purposes.

Such rules are established by paragraph 73 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Estimation at cost of each unit

When using the method of estimating the cost of materials at the cost of each unit, it is assumed that it is always known exactly from which supply this or that unit of materials was taken. In this case, the organization has the opportunity to determine the cost of each written-off unit.

There are two ways to form the cost of materials written off based on this method:

- the cost includes all costs associated with the purchase of materials;

- The cost includes only the contractual cost of materials. In this case, transportation, procurement and other costs associated with the acquisition of materials must be distributed in proportion to the cost of written-off materials.

An organization should apply this method to materials for which one unit cannot easily replace another. For example, an organization is required to use this method to account for precious metals, gemstones, radioactive substances and other similar materials.

Such rules are established by paragraph 74 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

An example of calculating the cost of written-off materials using the valuation method based on the cost of each unit of inventory

CJSC Alpha reflects the write-off of materials for operation (production) using the valuation method based on the cost of each unit of inventory. The cost of write-off materials is determined taking into account all costs associated with their acquisition.

The balance of paint in the warehouse at the beginning of May was 40 cans at a price of 800 rubles. per unit (total amount 32,000 rubles). During May, the following amount of paint arrived at the Alpha warehouse:

- first delivery on May 4 - 120 cans at a price of 600 rubles, in the amount of 72,000 rubles;

- second delivery on May 11 - 20 cans at a price of 1,200 rubles, in the amount of 24,000 rubles;

- third delivery on May 17 - 10 cans at a price of 1,000 rubles, in the amount of 10,000 rubles;

- fourth delivery on May 24 – 15 cans at a price of 800 rubles, in the amount of 12,000 rubles.

During May, 110 cans of paint were released into production, including: – May 10 – 60 cans, including 20 cans from the balance at the beginning of the month and 40 cans from the first delivery.

The total cost of written-off materials was: 20 pcs. × 800 rub. + 40 pcs. × 600 rub. = 40,000 rub.;

– May 23 – 50 cans. All of them were taken from the first delivery. The total cost of written-off materials was: 50 pcs. × 600 rub. = 30,000 rub.

In total, in May, materials were written off in the amount of: 40,000 rubles. + 30,000 rub. = 70,000 rub.

Digital library

Organizational management / Accounting for small businesses / 4.3 Accounting for the release of materials into production

The release of materials into production is formalized:

· receipt order (unified form M-3, M-4);

· limit-receipt card if there are limits on the supply of materials (unified form M-8);

· a form independently approved by the organization taking into account the requirements of Art. 9 of the Federal Law “On Accounting”.

According to clause 16 of PBU 5/01, the write-off of inventories for production can be carried out in one of the following ways:

· at the cost of a unit of inventory;

· according to the average cost of inventories;

· at the cost of the first acquisition of inventories (FIFO method).

At the cost of each unit of inventory

inventories that are used by the organization in a special manner (precious metals, precious stones, etc.), as well as inventories that cannot normally replace each other, are evaluated.

Average cost

is determined for each type (group) of inventory as the quotient of dividing the total cost of the type (group) of inventory by their quantity, respectively, consisting of the cost and quantity for the balance at the beginning of the month and for incoming inventory in this month.

Valuation of inventories using the method of estimating at cost the first in time acquisition of inventories

(FIFO) is based on the assumption that material resources are used during a month or another period in the sequence of their acquisition (receipt), that is, the resources that first enter production (in trade - for sale) should be valued at the cost of the first acquisitions in time taking into account the cost of inventories listed at the beginning of the month. When applying this method, the assessment of material resources in stock (in warehouse) at the end of the month is made at the actual cost of the latest acquisitions, and the cost of sales of products (works, services) takes into account the cost of earlier acquisitions.

Example

Determine the actual cost of materials written off as production costs if the enterprise’s accounting policy provides for: the “FIFO” method and the average price method.

1. We present the calculation using the “FIFO” method in the form of a table. 4.1.

Table 4.1 Calculation of the actual cost of materials consumed using the FIFO method

| Index | Quantity, m | Price, rub. | Amount, rub. |

| 1. Balance at the beginning of the month | 10 | 2000 | 20 000 |

| 2. Materials received: | |||

| batch No. 1 | 20 | 2200 | 44 000 |

| batch No. 2 | 30 | 3000 | 90 000 |

| batch No. 3 | 30 | 3100 | 93 000 |

| 3. Total received | 80 | — | 227 000 |

| 4.Total received with the remainder | 90 | — | 247 000 |

| 5. Spent during the reporting month* | 70 | 185 000 | |

| 6. Balance at the end of the month | 20 | 3100 | 62 000 |

| *Calculation of consumed 70 m of materials using the “FIFO” method: 2000 x 10 + 2200 x 20 + 3000 x 30 + 3100 x 10 = 185,000 rub. | |||

2. Calculation of the actual cost of materials consumed at the average price is carried out in the following order:

1) the weighted average price of all materials is determined;

;

2) the actual cost of materials consumed is determined.

2744.44 * 70 = 192111 rub.

FIFO method

With the FIFO method, materials written off for use (production) are valued at the cost of the first batch purchased (from those available in the warehouse). Therefore, evaluate write-off materials first at the cost of the balance of materials at the beginning of the month, then from the first purchase, the second, etc. Such rules are established by paragraph 76 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

To apply this method, each newly received batch of homogeneous materials is reflected as an independent group, regardless of whether such materials are registered or not.

The FIFO method is beneficial to use in a situation of constant decline in prices for materials. In this case, the cost of written-off materials will be the highest, and the cost of materials on balance will be minimal.

The cost of decommissioned materials (production) can be calculated:

- weighted assessment method;

- simplified weighted assessment method;

- using the rolling assessment method.

With a weighted assessment at the end of the month, after the receipt and consumption of materials have been calculated, you need to determine at what price each write-off occurred. This is done based on a literal understanding of the FIFO method, that is, materials are first written off from the balance at the beginning of the month, after its use - from the first receipt, the second, etc.

With a simplified weighted assessment at the end of the month, you need to determine the cost of material resources in stock (in warehouse). The balance should include the last purchased materials. This means that the price of the remaining materials is determined by the cost of the last delivery, and if it is insufficient, by the penultimate one, etc. After the cost of the remaining materials is determined, the cost of all written-off materials can be calculated using the formula:

| Cost of materials written off during the month | = | Balance value at the beginning of the month | + | Arrival of materials within a month | – | Remaining materials at the end of the month |

This method allows you to quickly determine the cost of written-off materials and their balances with a large number of expenses in small batches within a month.

With rolling valuation, the cost of materials is determined before each write-off. This method is the most labor-intensive for manual processing, especially in large organizations, but accounting automation partially eliminates this problem. The advantage of this method is that it allows you to determine the cost of written-off materials before the end of the month.

Such clarifications are contained in paragraph 78 and Appendix 1 to the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

After determining the total cost of scrapped materials, determine the average cost per unit of materials:

| Average cost per unit of scrapped materials | = | Cost of written-off materials during the entire month in rubles | : | Total amount of materials written off during the month in natural units of measurement |

It will be needed when generating entries for the write-off of materials in a certain quantity (Appendix 1 to the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

An example of calculating the cost of written-off materials using the FIFO method

CJSC Alpha reflects the write-off of materials for operation (production) using the FIFO method.

The balance of paint in the warehouse at the beginning of May was 40 cans at a price of 800 rubles. per unit (total amount 32,000 rubles). During May, the following amount of paint arrived at the Alpha warehouse:

- first delivery - 120 cans at a price of 600 rubles, in the amount of 72,000 rubles;

- second delivery - 20 cans at a price of 1,200 rubles, in the amount of 24,000 rubles;

- third delivery - 10 cans at a price of 1000 rubles, in the amount of 10,000 rubles;

- fourth delivery - 15 cans at a price of 800 rubles, in the amount of 12,000 rubles.

In total for May the income amounted to:

– in monetary terms: 72,000 rubles. + 24,000 rub. + 10,000 rub. + 12,000 rub. = 118,000 rub.;

– in quantitative terms: 120 pcs. + 20 pcs. + 10 pcs. + 15 pcs. = 165 pcs.

Consumption in quantitative terms amounted to 110 cans, including 50 cans on May 17 and 60 cans on May 25.

The accountant's procedures vary depending on the specific method of applying FIFO.

1. When using the weighted assessment method.

At the end of the month, the accountant began to determine the cost of written-off materials. Monthly consumption amounted to 110 cans. So, the cost of materials was as follows:

- 40 cans from the balance at the beginning of the month in the amount of 32,000 rubles. (40 pcs. × 800 rub./pc.);

- 70 cans from the first delivery within a month in the amount of 42,000 rubles. (70 pcs. × 600 rub./pc.).

The total cost of written-off materials was: RUB 32,000. + 42,000 rub. = 74,000 rub.

The balance of materials at the end of the month was: 32,000 rubles. + 118,000 rub. – 74,000 rub. = 76,000 rub.

The average cost per unit of written-off materials is: RUB 74,000. : 110 pcs. = 673 RUR/pcs.

2. When using the simplified weighted assessment method.

At the end of the month, the accountant determined the balance of materials in quantitative terms. It amounted to: 40 pcs. + 165 pcs. – 110 pcs. = 95 pcs.

The cost of the balance was determined in the following order:

- 15 cans from the fourth batch worth 12,000 rubles;

- 10 cans from the third batch worth 10,000 rubles;

- 20 cans from the second batch worth 24,000 rubles;

- 50 cans from the first batch worth 30,000 rubles. (50 pcs. × 600 rub./pc.).

The total balance was: 12,000 rubles. + 10,000 rub. + 24,000 rub. + 30,000 rub. = 76,000 rub.

The cost of materials written off during the month is: 32,000 rubles. + 118,000 rub. – 76,000 rub. = 74,000 rub.

The average cost per unit of written-off materials is: RUB 74,000. : 110 pcs. = 673 RUR/pcs.

3. When using the rolling assessment method.

For each vacation, the accountant determined the cost of written-off materials as follows:

- when the first 40 cans were written off, their price was 800 rubles. (the balance at the beginning of the month was used) for a total amount of 32,000 rubles. (40 pcs. × 800 rub./pc.);

- when the next 70 cans were written off, their price was 600 rubles. (materials from the first delivery were used) for a total amount of 42,000 rubles. (70 pcs. × 600 rub./pc.).

The cost of materials written off during the month was: RUB 32,000. + 42,000 rub. = 74,000 rub.

Materials were written off in the following quantities:

- May 17 50 cans. Their average cost was 760 rubles/piece. ((40 pcs. × 800 rub./pc. + 10 pcs. × 600 rub./pc.) : 50 pcs.);

- May 25 60 cans. Their average cost was 600 rubles/piece.

Write-off of materials in 1C

In manufacturing organizations, materials are used to produce products.

Writing off materials is a process that includes certain specifics and follows established rules.

Before writing off the material, let’s briefly consider how to configure it correctly:

- accounting policy of the organization,

- accounting accounts for the item group and the item itself,

- How to make the receipt of materials to the warehouse.

Let's start with the most important “Accounting policy” (“Main” - “Settings” - “Accounting policy”)

In this form we indicate “Method of operation of MPZ” - “According to average”.

It is important to note: that an enterprise that is on the general taxation system (OSNO) can choose any valuation method. When we need a method of valuation based on the cost of a unit of material, we choose the FIFO method.

However, if the organization is on a simplified taxation system (USN 15%), then materials will be written off only using the FIFO method. This is due to some features of this taxation system.

Let's move on to setting up accounting accounts for the item group and the item itself.

In order to set up accounts correctly, let’s go to “Directories” - Nomenclature”

Create a product group “Materials” by clicking on the “Create group” button. Enter the Group Name and “Type of Item”

After creating the group, follow the hyperlink “Item Accounting Accounts”

In the window that opens we see a general list

We create a new record or we can copy an existing one. In this case, copy the “Materials” entry. Afterwards, a new form will open in which all accounting accounts will already be registered; all that remains is to fill out the “Nomenclature” details.

After this setting, all materials that will fall into this product group will be understood by the program that this item is “Material”.

After all the settings, we create receipts of materials. To do this, we will use the document “Receipts (acts, invoices)” (“Purchases” - “Receipts (acts, invoices)”)

Create a new document with the type of operation “Goods (invoice)”

We fill out the header of the document, after which we proceed to filling out the tabular part of the document. Adding nomenclature. Please note that accounting accounts and VAT invoices are entered automatically

We carry out the document

Write-off of materials for general business needs

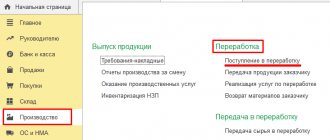

Let’s use the document “Requirement - Invoice” (“Warehouse” - “Requirement - Invoice”)

Let's create a new document and fill out the header of the document, indicating “Organization”, “Warehouse”, “Purpose of expenditure” (the purpose of using material assets is indicated).

Let's move on to filling out the document. On the “Materials” tab, add the required nomenclature

Go to the “Cost Account” tab and indicate:

- Cost account - an account in which costs are accumulated. According to the accounting system, these accounts are taken into account, since the costs are spent on general business needs.

- Department - from which the material is issued

- Cost item - the item on which costs will accumulate

We record and post the document. Then you can see the transactions that this document created.

Dt 26 Kt 10.01 - the cost of materials was written off as general business expenses, using the operation method - By average.

Write-off of materials for production

When you need to write off material for the manufacture of some product, you can use two methods:

- The document “Demand invoice” is used if the material is written off in total quantity.

- The document “Production report for a shift” is used if you need to write off a certain amount of material for a certain finished product.

Using the document “Demand invoice” on the “Materials” tab, select the item we need.

Then go to the “Cost Accounts” tab:

- We enter the cost account on January 20 - this account relates to the production of products and direct costs will be taken into account on it.

- Nomenclature group - indicates the type of product.

- Items tomorrow - indicate the cost item “material costs”

- Products - indicates the finished products for which materials will be written off.

Movements of the document that were formed after the

Dt 20.01 Kt 10.01 - shows what cost of materials was written off for production.

Let’s consider the option when materials are written off using the document “Production Report for a Shift” (“Enterprises” - “Product Output” - “Processing”).

We create a new document in which we fill in the necessary details.

On the “Products” tab, select the item that will be manufactured and in this nomenclature the “Specification” column is filled in, then on the “Materials” tab the data will appear by first clicking the “Fill” button.

Posting a document

Dt 43 Kt 20.01 - production release.

Dt 20.01 Kt 10.01 - write-off of materials for the manufacture of the required products.

Write-off of IBP.

MBP are low-value and wearable items. This category includes assets that have a service life of no more than 1 year and the cost of these assets is at least 40,000 rubles. These assets are included in account 10.09 “Inventory and household supplies”.

The transfer of IBP occurs using the document “Transfer of materials into operation” (“Warehouse” - “Workwear and equipment” - “Transfer of materials into operation”)

We create a document, indicate the organization and warehouse and go to the “Inventory and household supplies” tab.

Using the “Add” or “Selection” button, select the required inventory and transfer it to the document.

Postings of this document

Dt 44.01 Kt 10.09 - writing off the cost of inventory as expenses;

MC.04 - the cost of inventory in operation is reflected off the balance sheet.

MBP is written off using the document “Write-off of materials from service” ((“Warehouse” - “Workwear and equipment” - “Write-off of materials from service”)

Create a document and go to the “Inventory and Household Supplies” tab. Select the desired item and fill in all the required fields.

We post the document and look at the postings it created

Kt MTs.04 - write-off from off-balance sheet accounting of the cost of inventory transferred for operation.

It is important to pay attention to errors that may occur when writing off materials.

Let's briefly look at some of the most common errors.

- When there are not enough materials in the warehouse.

This error may occur if the required amount of materials was not accepted for accounting.

By default, when posting a write-off document, the program will display the error “The column “Quantity” is filled in incorrectly.”

However, this warning can be bypassed by turning it off, so to speak.

By going to the “Administration” – “Posting Documents” section, we can set the setting “Allow inventory write-off if there are no balances according to accounting data.”

If this setting is enabled and documents are posted, the debit will occur without the amount.

- Difference in receipt and debit

It happens that when a material is received, it is indicated as “Goods” (accounting account 44.01), but is written off as “Material” (accounting account 10.01). Initially, this is no longer correct, since upon receipt the material must be reflected in the program as “Material”, and not as “Product”.

To correct this error in the program, you just need to go to the required document and enter the required accounting account opposite that material.

It so happens that the program keeps records of several warehouses, so when creating a document it is worth paying attention to which warehouse receives this or that material.

Since when writing off material and selecting the wrong warehouse, the program will display a message that the warehouse does not have enough of the required quantity.

But if this mistake has already been made, then you should use the “Movement of Goods” document, which is located in the “Warehouse” menu item.

Average cost valuation method

When using the average cost valuation method, determine the cost of written-off materials using the formula:

| average cost | = | Cost of remaining materials at the beginning of the month | + | Cost of materials received per month | : | Number of materials at the beginning of the month | + | Number of materials received per month |

This is stated in paragraph 75 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

The advantage of this method is the stable price of materials sold, even if sharp fluctuations in purchase prices occur during the month.

The cost of written-off materials can be calculated:

- weighted assessment method;

- using the rolling assessment method.

With a weighted assessment, the average price of written-off materials is determined once at the end of the month.

With a rolling valuation, the price of materials is determined before each write-off. In this case, only those deliveries that were capitalized at the time the materials were written off are taken into account. This method is the most labor-intensive for manual processing, especially in large organizations, but accounting automation partially eliminates this problem. The advantage of this method is that it allows you to determine the cost of written-off materials before the end of the month.

Such clarifications are contained in paragraph 78 and Appendix 1 to the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

When writing off materials in a certain quantity, create entries based on the average cost of a unit of materials (Appendix 1 to the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

An example of calculating the cost of written-off materials using the average cost valuation method

CJSC Alfa reflects the write-off of materials for operation (production) using the average cost valuation method.

The balance of paint in the warehouse at the beginning of May was 40 cans at a price of 800 rubles. per unit (total amount 32,000 rubles). During May, the following amount of paint arrived at the Alpha warehouse:

- first delivery on May 4 - 120 cans at a price of 600 rubles, in the amount of 72,000 rubles;

- second delivery on May 11 - 20 cans at a price of 1,200 rubles, in the amount of 24,000 rubles;

- third delivery on May 17 - 10 cans at a price of 1,000 rubles, in the amount of 10,000 rubles;

- fourth delivery on May 24 – 15 cans at a price of 800 rubles, in the amount of 12,000 rubles.

In total for May the income amounted to:

– in monetary terms: 72,000 rubles. + 24,000 rub. + 10,000 rub. + 12,000 rub. = 118,000 rub.;

– in quantitative terms: 120 pcs. + 20 pcs. + 10 pcs. + 15 pcs. = 165 pcs.

In May, 110 cans of paint were released into production, including:

- May 10 – 60 cans;

- May 23 – 50 cans.

The balance at the end of the month was 95 cans (40 pcs. + 165 pcs. – 110 pcs.).

The accountant's procedures vary depending on the specific method of applying the average cost estimate.

1. When using the weighted assessment method.

At the end of the month, the accountant calculated the average cost of materials written off. It amounted to: (32,000 rub. + 118,000 rub.): (40 pcs. + 165 pcs.) = 732 rub./pc.

In total, 110 pieces were written off in a month. × 732 RUR/pcs. = 80,520 rub.

The balance at the end of the month was: 32,000 rubles. + 118,000 rub. – 80,520 rub. = 69,480 rub.

2. When using the rolling assessment method.

With each issue of materials, the accountant determined the cost of written-off materials as follows.

On May 10, the average cost was: (32,000 rub. + 72,000 rub.): (40 pcs. + 120 pcs.) = 650 rub./pc.

The total amount of materials that were written off on this day: 60 pcs. × 650 RUR/pcs. = 39,000 rub.

On May 23, the average cost was: (32,000 rubles + 72,000 rubles + 24,000 rubles + 10,000 rubles): (40 pcs. + 120 pcs. + 20 pcs. + 10 pcs.) = 726 rubles/ PC.

The total amount of materials that were written off on this day: 50 pcs. × 726 RUR/pcs. = 36,300 rub.

In total, 39,000 rubles were written off in a month. + 36,300 rub. = 75,300 rub.

The balance at the end of the month was: 32,000 rubles. + 118,000 rub. – 75,300 rub. = 74,700 rub.

Production cost accounting

Practical work

Production cost accounting

Completed by: student BU-DLE-001 Bazhenova A.

Task 1. LLC "Luch" in June 2004 incurred the following expenses in the production of products: labor costs for key production personnel - 30,000 rubles, unified social tax on wages - 10,680 rubles, basic materials - 10,000 rubles ., total production costs - 45,000 rubles. Reflect these transactions in the accounting records of Luch LLC.

| Contents of a business transaction | Amount, rub. | Account correspondence | |

| Debit | Credit | ||

| Accrued expenses for remuneration of key production personnel | 30 000 | 20 | 70 |

| The unified social tax is taken into account in production costs | 10 680 | 20 | 69 |

| Materials are written off as production costs | 10000 | 20 | 10 |

| General production expenses collected | 45 000 | 25 | 10, 23, 69, 70, 71 |

| General production costs are distributed within the cost of production of the main production | 45 000 | 20 | 25 |

Task 2. Luch LLC, based on the data from the previous task, produced finished products. At the beginning of the month, there were 10 units in unfinished production. products at a cost of 10,000 rubles, 100 units were put into production. At the end of the month there were 5 units in unfinished production. products with a standard cost of 5000 rubles. Find the cost of goods manufactured and record the release of finished products with postings.

| Contents of a business transaction | Amount, rub. | Account correspondence | |

| Debit | Credit | ||

| Released finished products were capitalized | 100680 | 43 (40) | 20 |

Task 3. Based on the data from tasks 1, 2, fill out the balance sheet for account 20 “Main production”.

Account 20 “Main production”

| Balance as of June 1, 2004 | Turnover for June 2004 | Balance as of July 1, 2004 | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| 10 000 | 95680 | 100680 | 5000 |

Task 4. Based on task 3, fill out line 213 of the balance sheet “For-

waste in work in progress."

| Assets | Indicator code | As of 06/01/2004 | As of 07/01/2004 |

| II. CURRENT ASSETS Inventories, including | 210 | ||

| costs in work in progress | 213 | 10000 | 5000 |

Task 5. Luch LLC produces a semi-finished product in the metalworking shop, which is then used in the assembly shop. In June 2004, the metalworking shop produced 100 tons of semi-finished product A and 50 tons of semi-finished product B. For this, the following costs were incurred:

| Type of expenses | Semi-finished product A | Semi-finished product B |

| Remuneration of key personnel | 50,000 rub. | 70,000 rub. |

| Unified social tax | RUB 18,250 | RUB 25,550 |

| Materials | 34,000 rub. | 15,000 rub. | |

General production costs for the metalworking shop amounted to 45,000 rubles. The accounting policy of the organization establishes a method for distributing general production expenses in proportion to the costs of remunerating the main production personnel, the total amount of which, according to the conditions of the example, is 120,000 rubles. (50,000 + 70,000). All semi-finished products produced are put into storage; unfinished production is not included to simplify the example. Distribute general production costs between semi-finished products A and B, determine the cost of produced semi-finished products, and reflect these operations in the accounting records of Luch LLC.

| Contents of a business transaction | Amount, rub. | Account correspondence | |

| Debit | Credit | ||

| Accrued wages to the main workers in the production of semi-finished product A | 50 000 | 21 | 70 |

| A unified social tax has been assessed on the wages of workers in the production of semi-finished product A | 18 250 | 21 | 69 |

| Materials spent on the production of semi-finished product A are written off | 34 000 | 21 | 10 |

| Accrued wages for the main workers in the production of semi-finished product B | 70 000 | 21 | 70 |

| A unified social tax has been assessed on the wages of workers in the production of semi-finished product B | 25 550 | 21 | 69 |

| Materials spent on the production of semi-finished product B were written off | 15000 | 21 | 10 |

| Collected overhead costs for the metalworking shop | 45000 | 25 | 10, 23, 69, 70, 71 |

| General production costs have been distributed across the metalworking shop for the production of semi-finished product A | 18750 | 21 | 25 |

| General production costs have been distributed across the metalworking shop for the production of semi-finished product B | 26250 | 21 | 25 |

| 100 tons of semi-finished product A were received into the warehouse for semi-finished products of our own production | 121000 | 21 | 20 |

| 50 tons of semi-finished product B were received into the warehouse of semi-finished products of our own production | 136800 | 21 | 20 |

Task 6. Based on the data from the previous task, we will draw up transactions for the following operations. In June 2004, 100 tons of semi-finished product A and 25 tons of semi-finished product B were transferred to the assembly shop. In the same month, 3 tons of semi-finished product B were sold for the amount of 23,600 rubles. (including VAT - 3600 rubles). Determine the financial result from the sale of the semi-finished product and reflect these operations in the accounting records of Luch LLC.

| Contents of a business transaction | Amount, rub. | Account correspondence | |

| Debit | Credit | ||

| 100 tons of semi-finished product A were transferred to the assembly shop | 121000 | 20 | 21 |

| 25 tons of semi-finished product B were transferred to the assembly shop | 166666 | 20 | 21 |

| Revenue from the sale of 3 tons of semi-finished product B is reflected | 23600 | 60 | 90-1 |

| The cost of sold semi-finished product B was written off | 23600 | 90-2 | 21 |

| VAT has been allocated on proceeds from the sale of semi-finished product B | 3600 | 90-3 | 68 |

| The financial result from the sale of semi-fabricated product B is reflected | 20000 | 91.9 | 99 |

Task 7. In the repair shop of Luch LLC in May 2004, the following expenses were incurred: wages were accrued to workers for the repair of the metalworking shop - 6,000 rubles, a unified social tax was charged on wages to workers of the workshop - 2,136 rubles, materials were used for repair of a metalworking shop - 7,600 rubles. General production costs for the repair shop amounted to 12,000 rubles. At the same time, the repair shop is carrying out repairs of the sanatorium: the wages charged to the workers for the repair of the sanatorium are 3,000 rubles, the unified social tax on wages to the workers of the workshop is charged - 1,068 rubles, the materials used for repairing the sanatorium are 4,500 rubles. Labor costs were chosen as the basis for the distribution of general production costs. Distribute general shop expenses and reflect the indicated operations in the accounting records of Luch LLC.

| Amount, rub. | Account correspondence | ||

| Contents of a business transaction | Debit | Credit | |

| Salaries paid to workshop workers | 6000 | 20 | 70 |

| A unified social tax was charged on wages to workshop employees | 2136 | 20 | 69 |

| The cost of materials consumed for the repair of the metalworking shop is taken into account | 7600 | 25 | 10 |

| Wages paid to workshop workers for repairs to the sanatorium building | 3000 | 29 | 70 |

| A unified social tax was charged on wages to workshop employees | 1068 | 20 | 69 |

| The cost of materials used for the renovation of the sanatorium is taken into account | 4500 | 29 | 10 |

| General production costs for the construction workshop were collected | 12 000 | 25 | 10, 69, 70, 71, 23 |

| General production costs are taken into account in the costs of repairing the metalworking shop | 12000 | 25 | 20 |

| General production costs are taken into account in the cost of repairing the sanatorium | 7500 | 25 | 29 |

Task 8. The construction shop of Luch LLC from the previous example completed the renovation of the sanatorium in the same month, the work was accepted by an inter-shop acceptance certificate. Determine the amount of costs for repairing the sanatorium, the cost of work in progress and reflect these operations in the accounting records of Luch LLC.

| Contents of a business transaction | Amount, rub. | Account correspondence | |

| Debit | Credit | ||

| The costs of repairing the sanatorium are taken into account in the expenses of service industries and farms. | 7500 | 26 | 29 |

Task 9. In the metalworking shop of Luch LLC in May 2004, the following expenses were incurred: wages were accrued for the shop manager - 5,000 rubles, a single social tax was accrued for the wages of the shop manager - 1,825 rubles, depreciation of machines and workshop building - 5,000 rubles, special clothing for workshop workers received from the warehouse - 4,500 rubles, repair of the workshop building by the construction shop - 20,000 rubles, acceptance of the supplier's invoice for the services provided for repairing the machine - 5,900 rubles. (including VAT - 900 rubles). Reflect these transactions in the accounting records of Luch LLC.

| Contents of a business transaction | Amount, rub. | Account correspondence | |

| Debit | Credit | ||

| Salary accrued to the workshop manager | 5000 | 25 | 70 |

| A unified social tax on wages has been charged to the shop manager | 1825 | 25 | 69 |

| Depreciation of machines and workshop building has been calculated | 5000 | 25 | 02 |

| The cost of special clothing issued to workshop employees is taken into account as part of overhead costs | 4500 | 25 | 10 |

| The costs of repairing the workshop building by auxiliary production were taken into account as part of general production expenses. | 20 000 | 25 | 23 |

| The supplier's invoice for the services provided for machine repair was accepted | 5000 | 20 | 60 |

| VAT allocated for machine repair services | 900 | 19 | 60 |

Task 10. Luch LLC, as a basis for the distribution of general production expenses, established the amount of expenses for remuneration of the main workers. In May 2003, general production expenses for the metalworking shop amounted to 36,825 rubles. The workshop produces two products. For product A, labor costs amounted to 5,000 rubles, for product B - 12,000 rubles. The workshop also corrected defects that had occurred earlier; the amount of labor costs to correct the defects amounted to 2,000 rubles. Distribute general shop expenses for products A, B and for correcting defects and reflect these operations in the accounting records of Luch LLC.

| Contents of a business transaction | Amount, rub. | Account correspondence | |

| Debit | Credit | ||

| General production costs taken into account | 36 825 | 25 | 20 |

| The share of overhead costs is allocated to product A | 9690,8 | 20 | 25 |

| The share of overhead costs is allocated to product B | 23257,9 | 20 | 25 |

| A share of overhead costs is allocated to calculating the cost of correcting defects | 3876,3 | 28 | 25 |

Task 11. LLC "Luch" in May 2004 incurred the following expenses: accrued wages to accounting department employees - 30,000 rubles, accrued a single social tax on the payroll fund for accounting department employees - 10,950 rubles, accrued depreciation of the 1C program - 1000 rub., taken into account as part of intangible assets, the supplier’s invoice for communication services was accepted - 59,000 rubles. (including VAT - 9,000 rubles), stationery goods received from the warehouse using a limit-fence card - 5,000 rubles, depreciation of computers accrued - 5,000 rubles. Reflect these transactions in the accounting records of Luch LLC.

| Contents of a business transaction | Amount, rub. | Account correspondence | |

| Debit | Credit | ||

| 1 Accrued wages for accounting department employees | 30 000 | 26 | 70 |

| A unified social tax has been accrued on the payroll of accounting department employees | 10 950 | 26 | 69 |

| Depreciation of the 1C program has been calculated | 1000 | 04 | 05 |

| Communication services are taken into account as part of general business expenses | 50 000 | 26 | 60 |

| VAT allocated for communication services | 9000 | 19 | 60 |

| The cost of stationery was written off as general business expenses. | 5000 | 26 | 10-9 |

| Computers are depreciated | 5000 | 08 | 02 |

Task 12. On the balance sheet of Luch LLC, in addition to the main one, there is an auxiliary production that provides services to third parties. According to the accounting policy of the organization, general business expenses are distributed between the main and auxiliary production in proportion to the direct costs of their maintenance.

The amount of direct costs of main production amounted to 140,000 rubles. Direct costs of auxiliary production for the provision of external services amounted to 25,000 rubles. Reflect these operations in the accounting records of Luch LLC and distribute general business expenses between the main and auxiliary productions.

Taxes

For information on how to reflect the disposal of materials for income tax purposes, see What material expenses should be taken into account when calculating income tax.

For information on how to reflect the write-off of the cost of materials upon transfer to operation (production) by an organization in a simplified manner, see How to write off material costs using the simplified tax system.

If an organization pays UTII, writing off materials will not affect the calculation of this tax. Payers of UTII calculate this tax based on imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

For information on how to reflect the write-off of the cost of materials upon transfer to operation (production) by an organization that applies the general taxation system and pays UTII, see How to take into account expenses for income tax when combining OSNO with UTII.

Orient Solutions

12.03.2019

The procedure for writing off materials and other inventories, as well as coordinating key aspects of accounting. The write-off of materials and other inventories in accounting is reflected in the following entries:

- write-off of materials and other supplies used for administrative expenses;

| Dt | CT |

| 7210 “Administrative expenses” | 1310 “Raw materials and supplies”, 1320 “Finished products”, 1330 “Goods”, 1350 “Other supplies” |

- write-off of loss of materials and other supplies within normal limits;

| Dt | CT |

| 7210 “Administrative expenses” | 1310 “Raw materials and materials”, 1350 “Other supplies” |

- write-off of excess losses, damage and shortages of materials and other supplies when the culprits have not been identified;

| Dt | CT |

| 7470 “Other expenses” | 1310 “Raw materials and supplies”, 1320 “Finished products”, 1330 “Goods”, 1350 “Other supplies” |

- shortage of materials and other supplies, repaid at the expense of the guilty parties;

| Dt | CT |

| 1250 “Short-term receivables from employees” | 1310 “Raw materials and supplies”, 1320 “Finished products”, 1330 “Goods”, 1350 “Other supplies” |

- free transfer of materials and other supplies;

| Dt | CT |

| 7410 “Asset disposal expenses” | 1310 “Raw materials and supplies”, 1320 “Finished products”, 1330 “Goods”, 1350 “Other supplies” |

- write-off of cost of materials sold and other inventories;

| Dt | CT |

| 7410 “Asset disposal expenses” | 1310 “Raw materials and materials”, 1350 “Other supplies” |

- write-off of materials and other inventories for production;

| Dt | CT |

| 8110 “Main production”, 8310 “Auxiliary production” | 1310 “Raw materials and materials”, 1350 “Other supplies” |

- write-off of materials and other inventories for general production expenses;

| Dt | CT |

| 8410 "Overhead" | 1310 “Raw materials and materials”, 1350 “Other supplies” |

- write-off of cost of goods sold.

| Dt | CT |

| 7010 “Cost of products sold and services provided” | 1330 "Goods" |

Recognition of materials and inventories as expenses

Let us turn to the practical implementation in the “1C: Accounting 8 for Kazakhstan” configuration of the presented accounting records in the focus of a certain illustrative example.

IP Shumsky D.V. in order to carry out routine repairs of the warehouse building No. 1, it writes off the building materials available in the warehouse, in particular, the dry construction mixture “Alinex” in the amount of 90 bags

In the information base, the user needs to register the document “Write-off of inventories”, this document is available through the menu “Warehouse” – “Write-off of inventories” (Fig. 1)

Rice. 1 “Document of the information base “Write-off of inventories”

The document contains sectoral delimitation, represented by fields grouped in the document header and bookmarks.

The header of the document “Write-off of inventories” contains the fields:

- “Number” – the serial number of the document assigned by the information base automatically after clicking on the “Write” button;

- “from” – the field contains information about the date of registration of the transaction in the “1C: Accounting 8 for Kazakhstan” configuration;

- “Structural unit” – you must indicate the name of the organization;

- “Warehouse” – information about the warehouse from which materials and inventories are written off;

- “Type of accounting NU” – indicates the corresponding type of accounting, which subsequently has an impact on tax accounting;

- The “Take into account CIT” attribute characterizes the income tax liability.

The “TMZ” tab contains information reflecting the essential provisions of the operation being performed; thus, the tabular part of the tab includes information about the inventory and materials being written off, the cost write-off account, etc. The provided options “Fill”, “Selection” allow you to fill it out automatically (based on the document “Inventory of goods and materials in the warehouse”) or by selecting from a directory containing item items (Fig. 2).

Rice. 2 “Option “Selection” of the document “Write-off of inventories”

The “Additional” tab contains information reflecting information about the basis document, reasons for writing off inventory items and other accompanying information (Fig. 3).