In a situation where an individual who is registered as an entrepreneur no longer wants to conduct business, he must formalize the termination of the activities of the individual entrepreneur. Due to the fact that there are many reasons and grounds for closing a business, you should adhere to both general recommendations on the procedure for carrying out this procedure and be guided by the situation, taking into account some of the features that we will consider below.

A business entity does not always decide to close its business on its own. Due to legislative changes or refusal to renew a license for certain types of work and activities, an individual entrepreneur may be forced to stop working in his specific field. But since not everyone is ready to quickly reorient to another line of business, it turns out that the entrepreneur’s activities are not carried out actually, but documented and according to registers, he is still a business entity that has certain obligations to the state to pay taxes and fees.

What is needed to close a sole proprietorship

In order for the termination of the activities of an individual entrepreneur to be properly formalized, you need to create a package of documents:

- Application for liquidation of an individual entrepreneur based on a decision made by him. Filled out using form No. P26001, which can be found on the official website of the Federal Tax Service.

- The completed written application must be certified by a notary (or rather, the signature in it), if the business entity does not plan to visit the tax office in person. If an individual entrepreneur submits all documents for registration of closing his business in person, upon presentation of his passport, notarization of the signature is not necessary.

- You need to pay a state fee of 160 rubles, and also submit it to the registration authority. You can also generate a receipt for payment on the Federal Tax Service website, after which you can pay at the nearest bank branch.

- Along with the above materials, you can provide the tax authority with documentary evidence of timely provision of information to the Pension Fund. But, if the individual entrepreneur does not provide the specified document, the tax office will be able to request the necessary information on its own.

This is a general procedure for terminating the activities of an individual entrepreneur if his desire to liquidate the business is accepted independently. There are situations when forced cancellation of the registration of an individual entrepreneur occurs, or a record of its liquidation is made by decision of the judicial authorities. It should be noted that according to the law, no state or local government body has the right to make such decisions regarding an entrepreneur, but only the court.

Liquidation of individual entrepreneurs by court decision

An individual is forced to terminate his activities as an individual entrepreneur in the following cases:

- when an individual entrepreneur is declared bankrupt;

- if a decision on forced liquidation is made;

- on the basis of a sentence, resolution or ruling of the court, if in connection with it the entrepreneur is sentenced in the form of a ban on the right to engage in certain activities within a specified period, or even deprivation of the right to engage in business.

Termination of the status of an individual entrepreneur also occurs in the event of expiration or cancellation of a document that gave an individual the right to temporarily reside in the territory of the Russian Federation. As well as the expiration of the validity period of a certificate or permit giving the right to temporary residence in the territory of the country of this citizen. Thus, the entrepreneurship of foreign citizens ends.

An individual entrepreneur who cannot satisfy the demands of all his creditors within three months from the date the deadline for fulfilling monetary obligations is recognized as bankrupt. It should be noted that in order for the arbitration court to declare a business entity bankrupt, it is necessary not only to have debt, but, firstly, the amount of the individual entrepreneur’s debts must exceed 10,000 rubles, and secondly, his property should not be enough to satisfy all requirements creditors.

Forcibly, by a court decision, closure of business activities may occur upon the application of the registration authority or supervisory authority (for example, the prosecutor's office, antimonopoly committee, etc.) that the individual entrepreneur systematically violates the law, or is not located at the specified place of registration, and also, that he has lost the status of a temporary resident citizen. In this case, the registering authority enters information about the liquidation upon entry into force of the specified judicial act.

Other legal grounds for termination of individual entrepreneurs

In addition to the above reasons, an entrepreneur may also lose his status if his period of stay in the country has expired. This implies the refusal of the authorized body to extend the permit for temporary stay and residence in the Russian Federation.

The legislator establishes the expiration of documents allowing to stay and reside in the country as grounds for terminating business activities. This can happen if an individual refuses to renew such documents on his own initiative, or misses the deadline for the restoration of documents, as well as if the renewal is refused. Refusal to issue such documents occurs only in cases established by law, if there has been a violation by the given citizen of the law and rules established for foreign citizens or stateless persons.

Such legal consequences, leading to the deprivation of an individual’s right to engage in entrepreneurial activity, are established by a court verdict, resolution or ruling in case of violation of legal norms by an individual entrepreneur. These judicial acts may limit the conduct of certain types of activities for some time, or generally deprive an entrepreneur of the right to conduct business for the period established in such a judicial act.

If such situations arise, the question arises of how to close a business activity, and whether it is necessary to appear in person at the authorities to formalize the loss of individual entrepreneur status. In practice, even if the business entity has not taken any active actions, the certificate is automatically canceled, or the registration of the termination of the entrepreneur upon the entry into force of judicial acts, or notification of the Federal Tax Service that the specified person has lost the right to stay in the country, occurs by adopted judicial act.

Termination of business activity

Question:

In what case can the activities of an individual entrepreneur be forcibly terminated?

Answer:

The grounds for termination by an individual of activities as an individual entrepreneur are given in Art. 22.3 of Law No. 129-FZ

. In particular, it states that state registration when an individual ceases to operate as an individual entrepreneur can be carried out:

1) by decision of the individual entrepreneur to terminate activities;

2) in connection with the death of an individual entrepreneur;

3) in connection with a court decision to declare an entrepreneur insolvent (bankrupt);

4) in connection with the court’s decision to forcibly terminate the activities of an individual entrepreneur;

5) in connection with the entry into force of a court verdict, which sentenced the entrepreneur to deprivation of the right to engage in economic activity for a certain period.

Thus, entrepreneurial activity can be forcibly terminated on the last three grounds.

Termination of activities by decision of the individual entrepreneur is a voluntary expression of the will of the businessman himself. And the death of an entrepreneur is a confluence of circumstances beyond his control, allowing registration authorities to terminate business activities unilaterally.

Question:

Do relatives of a deceased entrepreneur (heirs) have the right to apply to the court for a refund of taxes and fees they overpaid?

Answer:

In the event of the death of an individual entrepreneur, the tax authority terminates business activities on the basis of information received by the registering authority in the manner established by the legislation of the Russian Federation about the state registration of the death of this person ( clause 2 of Article 22.3 of Law No. 129-FZ

).

By virtue of clause 3 of Art. 85 Tax Code of the Russian Federation

bodies carrying out registration (registration) of individuals at the place of residence (place of stay), registration of acts of civil status of individuals are obliged to report, respectively, the facts of registration of individuals at the place of residence, registration (deregistration) at the place of residence of a foreign worker, birth and death of individuals to the tax authorities at their location within

10 days

from the date of registration (registration, deregistration) of these persons or the day of registration of acts of civil status of individuals.

According to Art. 19 Tax Code of the Russian Federation

Taxpayers and payers of fees are, in particular, individuals who are obligated by the Tax Code to pay taxes and (or) fees, respectively.

At the same time, taking into account the provisions of Art.

44 ,

45

,

78 of the Tax Code of the Russian Federation

, the right to a refund of overpaid tax is vested directly in the taxpayer.

Civil legislation establishes that the heirs of the first priority are the children, spouse and parents of the testator ( clause 1 of Article 1142 of the Civil Code of the Russian Federation

).

Article 1112 of the Civil Code of the Russian Federation

it is determined that the inheritance includes things that belonged to the testator on the day the inheritance was opened, and other property, including property rights and obligations. The inheritance does not include rights and obligations that are inextricably linked with the personality of the testator, in particular the right to alimony, to compensation for harm caused to the life or health of a citizen, as well as rights and obligations, the transfer of which by inheritance is not allowed by the Civil Code of the Russian Federation or other laws.

Also, personal non-property rights and other intangible benefits are not included in the inheritance.

Paragraph 4, paragraph 2, art. 11 Tax Code of the Russian Federation

It is established that individual entrepreneurs are individuals registered in the prescribed manner and carrying out entrepreneurial activities without forming a legal entity, the head of peasant (farm) households. At the same time, individuals carrying out entrepreneurial activities without forming a legal entity, but in violation of the requirements of civil legislation have not registered as individual entrepreneurs, when performing the duties assigned to them by the Tax Code of the Russian Federation, do not have the right to refer to the fact that they are not individual entrepreneurs.

Consequently, the status of an individual entrepreneur and his procedural rights and obligations, including the payment of taxes and fees, are inextricably linked with his personality. We have already noted that the death of an individual entrepreneur is one of the grounds for loss of individual entrepreneur status.

Thus, inheritance of the status of an individual entrepreneur and his procedural rights and obligations, including the right to a refund of overpaid tax, is not permitted by current legislation.

Summarizing the above, we get the following: relatives of a deceased individual entrepreneur do not have the right to apply to the court to recover the overpaid tax and (or) fee.

Question:

Does the obligation to pay taxes in relation to business activities cease after the closure of an individual entrepreneur? Can the inspectorate conduct an on-site tax audit of an individual for the period when he was an individual entrepreneur?

Answer:

By virtue of Art. 19 Tax Code of the Russian Federation

Taxpayers are organizations and individuals who, in accordance with the Tax Code, are obliged to pay taxes.

At the same time, legislators have provided a number of grounds on which the obligation to pay taxes and (or) fees is terminated, in particular, this may be ( clause 3 of Article 44 of the Tax Code of the Russian Federation

):

– payment of tax and (or) fee by the taxpayer;

– death of an individual taxpayer or declaring him dead in the manner established by civil procedural legislation;

– liquidation of the taxpayer organization

after all calculations with the budget have been made;

– the occurrence of other circumstances with which the legislation on taxes and fees relates to the termination of the obligation to pay the relevant tax or fee.

As we can see, the loss of the status of an individual entrepreneur as a basis for terminating a taxpayer’s obligation to pay tax is not provided for in this norm.

In addition, the status of a taxpayer is retained by an individual even after he ceases his entrepreneurial activity.

Thus, after the closure of an individual entrepreneur, the individual’s obligation to pay taxes in relation to business activities does not cease.

A similar position is reflected in the explanations of the regulatory authorities.

In the Letter of the Federal Tax Service of Russia dated September 22, 2010 No. ШС-37-3/11731

It is stated that the termination by an individual of activities as an individual entrepreneur is not a circumstance that entails the termination of the obligation to pay tax arising as a result of its implementation. Thus, in the event of termination of activity as an individual entrepreneur, an individual retains the obligation to submit tax returns and pay taxes for the period in which he carried out his activities as an individual entrepreneur.

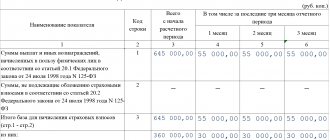

Accordingly, the amounts of taxes (fees) accrued for payment (reduction) on declarations submitted by individuals for the tax period in which they operated as an individual entrepreneur must be reflected in the information resources of the tax authorities. In this regard, the tax authorities do not close the “Settlements with the Budget” cards of individual entrepreneurs who have ceased their activities until their settlements with the budget are completed and tax obligations are closed (see also Letter of the Ministry of Finance of Russia dated 03.08.2010 No. 03-02-07/2 -124

).

The following should be noted regarding the on-site inspection.

Article

89 of the Tax Code of the Russian Federation

provides for the procedure for conducting on-site tax audits of taxpayers.

According to paragraph 4

of this article, inspectors, as part of an on-site tax audit, can monitor a period not exceeding three calendar years preceding the year in which the decision to conduct the audit was made.

Please note that the above provisions of the Tax Code of the Russian Federation do not contain a ban on conducting on-site tax audits of individuals who have ceased their activities as individual entrepreneurs.

Thus, the tax authorities have the right to carry out an on-site tax audit of individuals who have lost the status of an individual entrepreneur during the period of their activity as an individual entrepreneur.

It should be noted that the stated position is confirmed by explanations from regulatory authorities (see, for example, Letter of the Ministry of Finance of Russia dated January 23, 2012 No. 03-02-08/6

).

Moreover, judges use a similar approach to resolving controversial situations. Moreover, the position of the servants of Themis has not changed over the past years.

Considering the dispute on the merits, the Constitutional Court of the Russian Federation in the Determination of January 25, 2007 No. 95-О-О

indicated that both organizations and individuals are subject to tax control and prosecution for identified tax offenses, regardless of their acquisition or loss of a special legal status, engagement in certain activities, transition to certain taxes or special tax regimes;

Tax control in the form of tax audits and liability for tax offenses are aimed at ensuring the fulfillment of the obligation to pay a tax or fee, which is terminated on the grounds provided for in paragraph 3 of Art.

44 Tax Code of the Russian Federation .

A similar point of view is expressed in the Resolution of the Federal Antimonopoly Service of the North-West District dated November 25, 2009 No. A52-1130/2009

,

rulings of the St. Petersburg City Court dated November 7, 2011 No. 33-16454/2011

,

Moscow City Court dated August 17, 2010 No. 33-23193

.

Question:

Is it a mandatory condition for declaring an individual entrepreneur bankrupt that the amount of his obligations to creditors exceed the value of his property?

Answer:

An individual entrepreneur who is unable to satisfy the demands of creditors related to his business activities may be declared insolvent (bankrupt) by a court decision (Clause 1 of

Article 25 of the Civil Code of the Russian Federation

).

A court decision to declare an individual entrepreneur insolvent (bankrupt) is one of the grounds for state registration when an individual ceases to operate as an individual entrepreneur ( clause 3 of Article 22.3 of Law No. 129-FZ

). This procedure is carried out on the basis of a copy of the court decision declaring the individual entrepreneur insolvent (bankrupt), received by the inspectorate from the arbitrators by sending the said copy by registered mail with return receipt requested or in electronic form using public information and telecommunication networks, including the Internet.

According to paragraph 1 of Art. 3 of Federal Law No. 127-FZ

a citizen is considered unable to satisfy the claims of creditors for monetary obligations and (or) fulfill the obligation to pay mandatory payments if the corresponding obligations and (or) obligations are not fulfilled by him within three months from the date on which they should have been fulfilled, and if the amount of his obligations exceeds the value of his property.

In this case, an application to declare a citizen-debtor bankrupt is accepted by the arbitration court if the claims against the debtor amount to at least 10,000 rubles. ( Clause 2, Article 33 of Federal Law No. 127-FZ

).

The rules established by § 1

“General Provisions” of Ch. X “Bankruptcy of a citizen” of Federal Law No. 127-FZ

, taking into account the features provided for in

§ 2

and

3 of Chapter. X

(

clause 2 of article 202 of Federal Law No. 127-FZ

).

For your information

In accordance with paragraph 2 of Art. 216 of Federal Law No. 127-FZ

an individual entrepreneur declared bankrupt cannot be registered as an individual entrepreneur within a year from the moment he was declared bankrupt.

Article 214

of Federal Law No. 127-FZ

establishes that the basis for declaring an individual entrepreneur bankrupt is his inability to satisfy the demands of creditors for monetary obligations and (or) to fulfill the obligation to make mandatory payments.

The ratio of paragraph 1 of Art. 3

and

art. 214 of Federal Law No. 127-FZ,

as general and special norms, in practice gives rise to numerous disputes that have to be resolved in court.

Here are some examples of court decisions.

Thus, in paragraph 1 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated June 30, 2011 No. 51

it is stated that

Art. 214 of Federal Law No. 127-FZ

establishes the specifics of declaring bankrupt a citizen who is an individual entrepreneur, in connection with which an entrepreneur against whom there is a claim (set of claims) for a total amount of at least 10,000 rubles that has not been satisfied within three months may be recognized bankrupt, regardless of whether the amount of his liabilities exceeds the value of his property.

Clause 1 of Art.

3 of Federal Law No. 127-FZ in this part does not apply in the case of bankruptcy of individual entrepreneurs.

Shares the opinion of the Plenum of the Supreme Arbitration Court and the Presidium of the Supreme Arbitration Court. In Resolution No. 17053/10 dated April 12, 2011

The arbitrators indicated that individual entrepreneurs may be declared bankrupt if they are unable to satisfy the demands of creditors for monetary obligations and (or) fulfill the obligation to make mandatory payments. Moreover, this does not require that the total accounts payable exceed the value of the property they own.

For your information

In addition to the above conclusions, the Presidium of the Supreme Arbitration Court in Resolution No. 17053/10

came to some pretty interesting conclusions.

In particular, the court indicated that if the status of an individual entrepreneur was lost by the debtor after filing an application to the court to declare him bankrupt and before a decision was made in the bankruptcy case, the proceedings in the case cannot be terminated. However, declaring the debtor bankrupt in this case does not entail the consequences provided for in paragraph 1 of Art. 216 of Federal Law No. 127-FZ

(impossibility to re-register individual entrepreneurs within a year after bankruptcy).

After the significant decisions of the senior arbitrators, the judges at the FAS level had no choice but to follow their position when resolving similar disputes (see, for example, the FAS VSO resolution of January 31, 2012 No. A10-1858/2011

,

FAS ZSO dated December 15, 2011 No. A75-7087/2010

).

At the same time, it should be noted that even before the decisions of the Plenum of the Supreme Arbitration Court and the Presidium of the Supreme Arbitration Court, judges at the FAS level when making decisions in disputes were guided by the above point of view.

In the Resolution of the Federal Antimonopoly Service of January 26, 2011 No. A49-3171/2010

It is stated that

Federal Law No. 127-FZ

does not make the presence of signs of insolvency of an entrepreneur dependent on the value of the property owned by him.

Consequently, when deciding whether there are signs of bankruptcy of an individual entrepreneur, the general rule provided for in paragraph 1 of Art. 3 of Federal Law No. 127-FZ

, is not applicable, that is, the excess of the amount of the obligation over the value of the debtor’s property does not play a role.

From the above it follows that the possibility of declaring an individual entrepreneur insolvent (bankrupt) does not depend on the value of the property owned by him and on the excess of the amount of obligations not fulfilled by the entrepreneur over the value of his property.

Question:

Upon termination of activity, an individual entrepreneur closed his bank account.

According to paragraphs. 1 item 2 art.

23 of the Tax Code of the Russian Federation, within seven days he must report this to the tax authority at the place of registration. What are the consequences of non-compliance with this rule? When does the seven-day period begin to count?

Answer:

Violation of the period allotted in paragraphs.

1 item 2 art.

23 of the Tax Code of the Russian Federation for reporting to the tax authority about the closure of a current account entails liability under

clause 1 of Art.

118 Tax Code of the Russian Federation . According to this norm, violation by an economic entity of the deadline established by the Tax Code of the Russian Federation for submitting information to the inspectorate about opening or closing an account in any bank entails a fine of 5,000 rubles.

According to the author, the seven-day period provided for in paragraphs. 1 item 2 art. 23 Tax Code of the Russian Federation

, cannot begin to be calculated before the entrepreneur receives a certificate from the bank about closing the account.

It should be noted that the courts reason in a similar way.

Thus, from the Resolution of the FAS VSO dated December 22, 2010 No. A33-5323/2010

follows: during the audit it was established that on 02/03/2009 the company contacted the bank with an application to terminate the bank account agreement and close the current account. The company submitted a notification about the closure of the specified account on 02/04/2009 to the tax authority on 03/13/2009, which is confirmed by a covering letter and a postal stamp on the envelope.

The stated circumstances served as the reason for making a decision to bring the company to justice on the basis of Art. 118 Tax Code of the Russian Federation

in the form of a fine in the amount of 1,000 rubles. (subject to mitigating circumstances).

Disagreeing with this decision, the company applied to the arbitration court to declare it invalid.

As follows from the case materials, the bank’s certificate dated 02/05/2009 about closing the account was received by the company on 03/13/2009, which is confirmed by the incoming stamp, as well as an extract from the journal of registration of incoming documents of the company.

Under these conditions, the court concluded that the company could notify about the closure of the bank account only from March 13, 2009.

In addition, the arbitrators indicated that this conclusion corresponds to the position of the Presidium of the Supreme Arbitration Court, presented in Resolution No. 3018/10 dated July 20, 2010

.

Taking into account the above, the FAS VSO pointed out that the inspection did not prove the company’s guilt in committing the alleged offense.

Question:

Should a state fee be paid when registering the termination of an individual’s activities as an individual entrepreneur? If yes, in what size?

Answer:

State registration of termination by an individual of activities as an individual entrepreneur is a legally significant action, when applying for which to state bodies, local governments and other officials, a state fee is charged.

In subparagraph

7 of paragraph 1 of Art.

333.33 of the Tax Code of the Russian Federation states that the state fee for registering an individual’s termination of activities as an individual entrepreneur is 20% of the state fee established by

paragraphs.

6 of this paragraph. In particular, for state registration of an individual as an individual entrepreneur, a fee of 800 rubles is paid.

Thus, today, in the situation under consideration, an individual entrepreneur who decides to “wind up” his business must pay a state fee in the amount of 160 rubles. (20% of 800 rub.).

It should be noted that legislators periodically review state duty tariffs. In this regard, in practice there are situations when an entrepreneur submits to the tax authority, along with a package of necessary documents, a receipt for payment of a state duty in a smaller amount (for non-current tariffs). In such cases, controllers refuse to register business termination for business entities, citing improper fulfillment of the obligation to pay state duty.

However, there is certainly logic in the actions of representatives of the registration authority. The courts also understand this. Thus, from the Resolution of the Federal Antimonopoly Service dated 09/08/2011 No. A55-25910/2010

it is clear that one of the grounds for the decision to refuse to register information about the termination of an individual’s activities as an individual entrepreneur was the failure to provide a document confirming payment of the state fee for the said procedure in the amount of 160 rubles.

As follows from the case materials, the business entity submitted to the inspection only an application with attachments on one sheet and a document confirming payment of the state duty in the amount of 80 rubles

.

In accordance with paragraphs. 6 clause 1 art. 333.33 Tax Code of the Russian Federation

as amended by

Federal Law No. 374-FZ dated December 27, 2009

, which came into force on January 29, 2010, the fee for state registration of an individual as an individual entrepreneur is paid in the amount of 800 rubles. (before this date, the duty under this norm was 400 rubles).

Therefore, taking into account the provisions of paragraphs. 7 clause 1 art. 333.33 Tax Code of the Russian Federation

, for state registration of termination of activities as an individual entrepreneur, a fee of 160 rubles must be paid.

At the same time, the individual entrepreneur paid a fee in the amount of 80 rubles, which indicates the absence of evidence of payment of the state fee for state registration of termination by an individual of activities as an individual entrepreneur in the appropriate amount (160 rubles).

Thus, FAS PO came to the conclusion that the individual entrepreneur did not provide the necessary list of documents for state registration, therefore, the inspectorate rightfully refused to register the procedure for closing his business activity.

Question:

What documents are submitted to the tax authority upon state registration of termination by an individual of activities as an individual entrepreneur?

Answer:

According to paragraph 1 of Art. 22.3 of Law No. 129-FZ

State registration when an individual ceases to operate as an individual entrepreneur in connection with his decision to terminate this activity is carried out on the basis of the following documents submitted to the registration authority:

– statements

on state registration in form No. P26001, approved

by Decree of the Government of the Russian Federation No. 439

(Appendix 20);

– payment document

, confirming payment of the state duty in the prescribed amount;

– a document confirming the submission of information about personalized accounting

.

Let us consider each of the named documents in more detail.

When filling out an application on form No. P26001

individual entrepreneurs should be guided by

the Methodological Explanations

approved

by Order of the Federal Tax Service of Russia No. SAE-3-09/

[email protected] .

They describe in sufficient detail what, where and in what order should be in the form to be filled out. The only point that needs to be paid attention to concerns the signature of the individual entrepreneur, which is affixed on page 02 of the application form. By virtue of paragraph 7 of section. IV Methodological Explanations

it must be certified by a notary.

At the same time, in accordance with clause 1.2 of Art. 9 of Law No. 129-FZ

witnessing the signature of an individual registered as an individual entrepreneur on an application in a notarial manner is not required if the specified individual submits the documents provided for by this law directly to the registration authority simultaneously with an identification document (

Letter of the Ministry of Economic Development of Russia dated October 18, 2010 No. D05-3722

). In other words, personally appearing at the inspection office with a passport can save the entrepreneur from having to notarize his signature on the application.

Regarding the document confirming payment of state duty

, the following should be noted.

In practice, when filling out a payment document, business entities quite often make mistakes, which become the causes of various kinds of troubles. However, sometimes undesirable consequences can be avoided.

In the Resolution dated 03/09/2011 No. A70-5103/2010

FAS ZSO came to the conclusion that due to an incorrect TIN of the recipient in the payment slip, tax authorities do not have the right to refuse to register a procedure for terminating business activities.

As follows from the case materials, the tax authority refused state registration of the termination of the entrepreneur’s activities due to failure to provide the necessary documents. At the same time, tax officials pointed out the absence of a document confirming the payment of state duty, properly executed. The fact is that in the receipt submitted for state registration, the entrepreneur mistakenly indicated the wrong TIN of the payment recipient.

Disagreeing with the inspection’s decision, the individual entrepreneur filed a lawsuit to declare it invalid.

Taking the position of a merchant in the dispute, the courts of the first and appellate instances came to the conclusion that they had submitted a proper document confirming the payment of a certain mandatory payment for carrying out registration actions, therefore, an incorrect indication of the TIN cannot be considered as the only basis for refusal of registration, since if there is the correct budget classification code, as well as the account number and type of payment, it entered the federal budget precisely as a state duty.

The cassation court also took the side of the individual entrepreneur, adding that, in accordance with paragraph 3 of Art. 333.18 Tax Code of the Russian Federation

The state duty is paid at the place where the legally significant action is performed in cash or non-cash form. The fact of payment of the state duty by the payer in cash is confirmed either by a receipt of the established form issued to the payer by the bank, or by a receipt issued to the payer by an official or the cash desk of the body to which the payment was made.

Thus, if the registration authority is presented with a receipt, from which it follows that the state duty was paid not at the place where legally significant actions were performed, this circumstance may be the basis for a decision to refuse state registration.

During the consideration of the case by the courts, it was established that from January 11, 2010, the functions of state registration were transferred from the Interregional Inspectorate of the Federal Tax Service No. 7 to the Interregional Inspectorate of the Federal Tax Service No. 14 for the Tyumen Region.

Under such circumstances, the individual entrepreneur had the right until January 11, 2010 to submit an application for termination of activity to MRI No. 7, indicating in the receipt for payment of the state duty the TIN of the payee of this inspection.

The tax authority does not dispute that the individual entrepreneur sent an application to terminate his activities to MRI No. 7 on December 29, 2009 through the organization of postal services.

From the documents submitted for state registration it follows that the state fee was paid to the registration authority in force at the time of submission of documents, indicating the INN MRI No. 7 for the Tyumen region. In addition, as established by the courts and not disputed by the parties, the entrepreneur correctly indicated the budget classification code, as well as the account details of the registering authority and the type of payment.

Based on the above, the FAS ZSO considered that the document on payment of the state duty was presented in accordance with the requirements of Law No. 129-FZ

, since, as the courts rightly pointed out, at the time of filing the application for state registration, the individual entrepreneur correctly indicated the details of the state duty, since he did not have and could not have information about other details that would be necessary after 01/01/2010 in connection with the transfer of functions under the state registration of legal entities and entrepreneurs from one body to another.

As a result, the tax authority’s decision was declared illegal by the court.

Form of a document confirming the submission of information about personalized accounting to the territorial body of the Pension Fund

, has not been defined by legislators today, so a copy of the report with a mark of delivery can be submitted as it.

At the same time, if the specified document is not submitted by the entrepreneur, in accordance with paragraphs. "c" clause 1 art. 22.3 of Law No. 129-FZ

it is provided at the interdepartmental request of the tax authority by the relevant territorial body of the Pension Fund of the Russian Federation in electronic form in the manner and within the time frame established by the Government of the Russian Federation.

Let us recall that this norm came into force in 2011, and before this date, in the absence of a document confirming the submission of relevant information to the territorial body of the Pension Fund of the Russian Federation, controllers refused to register the termination of business activity. Arbitration courts, when resolving disputes in this situation, were on the side of the controllers ( Determination of the Supreme Arbitration Court of the Russian Federation dated January 11, 2012 No. VAS-17128/11

,

Resolution of the Federal Antimonopoly Service of November 3, 2011 No. A12-4595/2011

).

Please note that starting from 01/01/2012, individual entrepreneurs who pay insurance premiums based on the cost of the insurance year (who do not have employees) are exempt from the need to submit annual reports to the Pension Fund. The corresponding changes were made by Federal Law dated December 3, 2011 No. 379-FZ

(

Clause 6, Article 6

).

Prior to this, the absence of a corresponding document meant a refusal to register the procedure for terminating the activities of an individual entrepreneur (see, for example, Resolution of the Federal Antimonopoly Service No. F03-1820/2011 of May 31, 2011

).

For your information

In accordance with paragraph 8 of Art. 16 of Federal Law No. 212-FZ

in case of termination by an individual of activities as an individual entrepreneur, payment of insurance premiums is made no later than 15 calendar days from the date of state registration of termination of his activities, inclusive.

O. N. Malov / magazine expert

“Current issues of accounting and taxation”/

The procedure for terminating a business on a voluntary basis

If the basis for closing a business is the will of a business entity, this places an obligation on the individual entrepreneur to carry out all procedures independently, including visiting the tax office and funds, employment center and bank to close the account. Let's figure out how to close the activities of an individual entrepreneur on your own, and in what order this happens, as well as what is needed to close an individual entrepreneur.

Stage 1 – collection of necessary documents: application and receipt for payment of state duty; these are the main and main documents established by the legislator, on the basis of which the termination of entrepreneurship takes place;

Stage 2 - do not forget that if there are hired employees, they should also be notified that they will be fired for the specified reason (termination of business); since the employment center must be warned that an individual entrepreneur is dismissing its employees due to liquidation at least two weeks in advance, then the employees themselves must be warned, under a personal signature, about the impending termination of employment contracts within the same period;

Stage 3 – dismissal of employees, the procedure for this procedure is regulated by the Labor Code of the Russian Federation, and does not impose obligations on the entrepreneur for further employment or payment of additional compensation payments, other than those specified in the employment contract and the law;

Stage 4 – deregistration from funds and the employment center as an employer; This stage occurs after the dismissal of the last employee; the entrepreneur receives a certificate stating that he is no longer listed as an employer in the Social Insurance Fund, the Pension Fund of the Russian Federation and the employment center;

Stage 5 – pay all debts to the budget and extra-budgetary funds; for this purpose, it is recommended to request from the funds acts of reconciliation of mutual settlements, and a receipt for payment of debt; and, although the legislator allows an entrepreneur to liquidate if there is a debt, sooner or later it will have to be paid;

Stage 6 – an individual entrepreneur ceases activities upon making an entry in the Unified Register about the registration of the fact of closure of an individual entrepreneur; the tax authority issues the applicant a document confirming the fact of such registration and after that, the individual is no longer an entrepreneur;

Stage 7 – closing the account and notifying the tax office and the Pension Fund about this, and at the same time, providing the specified services with receipts for payment of arrears of taxes and mandatory insurance payments.

What happens after the closure of an individual enterprise

After all the documents have been collected, submitted to the authorized tax authority at the place of registration, all due checks have been carried out, receipts for payment of state duties and debts to the budget have been submitted, the entrepreneur, on the sixth working day, receives a document stating that the termination of business activity has occurred. However, we should not forget that the mere presence of such a document does not relieve the former individual entrepreneur, already as an individual, from liability for all his unfulfilled obligations. This means that any counterparty or creditor has the right at any time to go to court with a citizen with claims for repayment of debt or fulfillment of an obligation in kind.

After the liquidation of an individual entrepreneur, he must also be issued a certificate of deregistration with the Pension Fund. All other documents that the business entity had while conducting its business remain in its hands. There is no need to hand them over anywhere. It is recommended to store these documents for at least four years. After all, the tax office can check all payments and transactions of an individual entrepreneur after he ceases to be an entrepreneur.

Become an author

Become an expert

What you need to remember about terminating activities as an individual entrepreneur

- Closing an individual entrepreneur is possible voluntarily (upon an application or claim for declaring the individual entrepreneur bankrupt) or forcibly.

- The presence of debts (for wages, taxes, contributions, to other creditors) is not a basis for deregistering an individual entrepreneur.

- The property liability of the former entrepreneur passes to his property as an individual (except for the list specified in Article 446 of the Code of Civil Procedure of the Russian Federation).

- Before closing an individual entrepreneur, you must: fire employees; submit reports for employees; deregister from the funds; close the current account; deregister the cash register; reconcile settlements with the Federal Tax Service, funds and counterparties (recommended).

- If you have significant debts, it is worth assessing the feasibility of initiating bankruptcy.

- You must store documents related to business activities for at least 4 years, and be prepared for the fact that the tax inspectorate may conduct an audit even after the termination of your individual entrepreneur status.