VAT accounts

To account for VAT calculations, use account 68 “Calculations for taxes and fees,” namely, a separately opened subaccount 68.VAT.

On the credit of the account, reflect the accrual of tax, and on the debit, its payment and the amount of tax to be deducted. The difference between a credit and a debit is the VAT payable. If the debit amount is greater than the credit amount, then the difference must be reimbursed from the budget. To account for VAT to be deducted, use account 19 “Value added tax on acquired assets.” By debit, collect the amount of VAT to be deducted. And on the loan, write it off to reduce the tax payable.

The amount of VAT that you receive from a buyer or customer when selling him goods or services should be taken into account in account 90, namely in subaccount 90.03 “Value added tax”.

Results

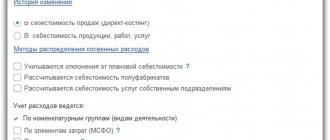

The procedure for maintaining tax accounting for VAT is determined not only by law, but also by the company’s accounting policy. In cases provided for by law, the accounting policy must establish methods and principles for maintaining separate VAT accounting.

Maintaining tax accounting for VAT involves not only the formation of the tax base in accounting accounts, but the formation of tax registers, such as books of purchases and sales. In addition, certain categories of taxpayers must keep a log of received and issued invoices.

Despite the fact that in some cases the legislation provides for the inclusion of input VAT in expenses for profit tax purposes, when maintaining tax accounting for VAT, it is necessary to take into account the most common claims of tax authorities regarding the overstatement of income tax expenses by VAT amounts.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Postings for accounting for “incoming” VAT

When purchasing goods and materials, the supplier, if he works for OSNO, will issue you an invoice with allocated VAT. You can deduct the tax if you yourself are the payer.

For example, Azbuka LLC buys pencils from Supplier LLC for subsequent resale. The price of 1 product is 12 rubles, including VAT 20% - 2 rubles. Quantity: 100,000 pieces. The ABC accountant will make the following entries in the accounting.

| Check | Credit | Amount, rub | Description |

| 41 | 60 / 76 | 1 000 000 | Goods are registered at cost excluding VAT |

| 19 | 60 / 76 | 200 000 | The amount of “input” VAT has been calculated |

Instead of 41 accounts, you can use account 10, for example, when purchasing materials for production, and when purchasing non-current assets - 08. Or cost accounts 20, 23, 25, 26, 29, 44 when purchasing services or work.

As you can see, on account 41 the goods were capitalized excluding VAT. We claim tax as a deduction. If we could not accept tax as a deduction, then inventory items would be capitalized in account 41 at full cost.

Risks of accounting for value added tax in expenses

The Tax Code of the Russian Federation in some situations (they are given in paragraph 2 of Article 170 of the Tax Code of the Russian Federation) allows input VAT to be taken into account in the profit base. However, sometimes this can be dangerous, since such VAT accounting is fraught with disputes with inspectors. Let's consider several situations related to tax accounting for VAT, on which there are comments from tax officials.

1. VAT on property contributed to the authorized capital and then sold. For example, an organization, having acquired a fixed asset, declares VAT on it for deduction. Then she enters this equipment into the management company of her “daughter”, thereby restoring the tax. Later, the parent company sells its share in the subsidiary management company. If the company includes the amount of tax recovered when the equipment was entered into the Criminal Code as expenses for profit, claims from inspectors will not be avoided.

This is evidenced by the letter of the Federal Tax Service of Russia dated April 14, 2014 No. GD-4-3/ [email protected] , in which the inspectors state the following: since the tax restored by the transferring party is subject to reimbursement by the receiving party, then the transferring party has grounds for recognizing it as expenses for the purpose of There is no income tax calculation. The Ministry of Finance adheres to a similar position (letter dated 05/04/2012 No. 03-03-06/1/228).

2. VAT on goods and materials for resale in “simplified terms”. A company operating under the simplified tax system purchased goods for the purpose of their further resale. If a company includes VAT on their cost in expenses before they are sold, most likely, it will have disputes with inspectors who believe that VAT in this case should be taken into account in expenses after shipment of goods and materials to customers. This is confirmed by the letter of the Ministry of Finance dated February 17, 2014 No. 03-11-09/6275. The same point of view is expressed by the arbitrators (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 29, 2010 No. 808/10).

3. VAT upon transition from OSN to simplified tax system. The company, being on the OSN, bought a fixed asset, on which it accepted VAT for deduction. If, after switching to the simplified tax system, a company includes it in expenses when calculating the “simplified” tax, there will be problems. Tax officials confirm that when switching from the OSN to the simplified tax system, the tax that was declared for deduction must be restored - but only in the period preceding the transition to the simplified tax system (this is the requirement of subparagraph 2, paragraph 3, article 170 of the Tax Code of the Russian Federation). This is also evidenced by the letter of the Ministry of Finance of the Russian Federation dated April 18, 2011 No. 03-07-11/97.

Thus, if an enterprise becomes simplified from the beginning of a year, then when switching to the simplified tax system, it is obliged to take into account the input tax as an expense accepted when calculating income tax for the previous year.

To learn about in which cases it is safer to include VAT as part of other expenses, read the article “What are the grounds and how to write off VAT on 91 accounts?” .

Postings for accounting for VAT on sales

The goal of a commercial organization is to generate income through the sale of goods, products, works or services. If a company or entrepreneur is a VAT payer, then the sales procedure will be directly related to the calculation of VAT.

For example, Azbuka LLC sold IP to Ivanov I.I. pencils in the amount of 100,000 pieces at a price of 24 rubles, including VAT 20% - 4 rubles. The accountant will make the following entries upon sale.

| Check | Credit | Amount, rub | Description |

| 62 / 76 | 90.01 | 2 400 000 | Reflected revenue from the sale of pencils |

| 90.03 | 68. VAT | 400 000 | VAT charged on sales |

| 90.02 | 41 | 1 000 000 | Sold pencils written off |

Account 90 can be replaced with account 91 if the proceeds from the sale are classified as other income. For example, account 91 is used by companies when selling leftover raw materials, fixed assets, and so on.

It's all about the contract

If the terms of the contract stipulate that ownership of goods, works or services is transferred only after payment, then a problem arises with determining the date of issuance of the invoice. Let's explain why.

We quote the law. “When selling goods (work, services), the corresponding invoices are issued no later than five days counting from the date of shipment of the goods (performance of work, provision of services)” (Clause 3 of Article 168 of the Tax Code of the Russian Federation).

As you can see, from the norm of the Tax Code it follows that the countdown of the five-day period for issuing an invoice begins from the date of shipment. But! To do this, goods, works or services must be sold. Sales for tax purposes mean the transfer of ownership (Clause 1, Article 39 of the Tax Code of the Russian Federation). And in our case, ownership passes to the buyer only after payment for goods, work or services. These are the terms of the agreement. Consequently, there is no implementation until this point. When, then, is it necessary to draw up an invoice in order to comply with the requirements of the Tax Code and comply with the terms of the contract?

Posting for VAT payment

After accepting VAT for deduction, two situations are possible:

- there will be a balance on the credit of account 68. VAT is the amount of tax payable to the budget;

- there will be a balance in the debit of account 68. VAT is the amount of tax to be reimbursed from the budget.

In the first case, VAT must be paid. For example, Azbuka LLC has a credit balance of account 68.VAT of 200,000 rubles. The company transfers this amount from the current account to the budget, and the accountant makes such an entry.

| Check | Credit | Amount, rub | Description |

| 68.VAT | 51 | 200 000 | VAT paid to the budget |

The second option is rare. Most often it is associated with export operations, when sales are subject to VAT at a rate of 0%. Read more in our article “VAT on exports”.

Transactions for VAT, which cannot be deducted

VAT can be deducted only if goods and materials and services are used in activities subject to VAT. Otherwise, VAT will have to be included in the cost of goods or services.

For example, Medic LLC sells medical products that are exempt from VAT. To deliver them to the buyer, the company buys a transport service for 12,000 rubles, including VAT 20% - 2,000 rubles. “Input” VAT cannot be deducted, so the tax is written off to the cost account.

| Debit | Credit | Sum | Description |

| 20 / 23 / 25 / 26 / 29 / 44 | 60 | 10 000 | The cost of the service excluding VAT is written off as expenses. |

| 19 | 60 | 2 000 | “Incoming” VAT has been accepted for accounting |

| 20 / 23 / 25 / 26 / 29 / 44 | 19 | 2 000 | “Input” VAT is included in costs, since it cannot be deducted |

Instead of cost accounts, you can use accounts 08, 10 or 41, since inventory items can also be used in activities not subject to VAT.

Important! Goods that are exempt from VAT are listed in Art. 149 of the Tax Code of the Russian Federation.

VAT cannot be deducted if there is no properly issued invoice for it. In such a situation, VAT is written off as other expenses as an accounting entry.

| Debit | Credit | Description |

| 91 | 19 | VAT is written off as other expenses |

Court: the correctness of separate accounting must be confirmed by documents

Tax authorities began to pay attention not only to the fact of maintaining separate accounting of input VAT on accounting accounts in the program, but also to whether the tax amount was distributed correctly.

Thus, the correctness of the “posting” of input VAT can be confirmed by primary documents for the release of materials into production, as well as other primary documents, on the basis of which it is possible to identify a specific product used in activities subject to VAT or not subject to VAT.

Without such documents, the requirement of the Tax Code of the Russian Federation to maintain separate accounting is considered unfulfilled, and the taxpayer loses the right to apply a VAT deduction, and for all transactions (Resolution of the AS of the Ural District of January 27, 2021 No. F09-8377/20 in case No. A34-5026/ 2019).

Direct costs can be easily attributed to the corresponding type of activity. It's a different matter with general business expenses. They cannot be directly distributed between different types of activities.

These are the costs of renting premises, utilities, stationery, drinking water, security, postal, consulting and legal services, software services, etc.

Postings for VAT from advances

An advance is a method of payment for goods or services. The buyer transfers money partially or in full until the goods are still shipped. In this case, the supplier makes the following entries for the advance received.

| Debit | Credit | Description |

| 50 / 51 / 52 | 62.02 | Advance received from buyer |

| 76 | 68.VAT | VAT is charged on the advance payment received |

| 62.01 | 90.01 | Revenue received from the sale of goods |

| 90.03 | 68.VAT | VAT charged on sales |

| 90.02 | 41 | Cost of goods sold written off |

| 62.2 | 62.1 | Previously received advance is offset against debt repayment |

| 68.VAT | 76 | VAT is credited from the advance payment upon completed shipment |

Accounting for an advance issued by a buyer looks different.

| Debit | Credit | Description |

| 60 | 50 / 51 / 52 | Advance paid to supplier |

| 19 | 60 | VAT is charged on the advance amount |

| 68.VAT | 19 | Accepted for deduction of VAT on advance payment |

| 41 | 60 | Goods received from supplier |

| 68.VAT | 19 | Accepted for deduction of VAT on the cost of goods received |

| 60 | 68.VAT | Recovered VAT from advance payment |

Instead of account 41, use cost accounts 20, 23, 25, 26, 29 or 44 for services and works. And to account for raw materials and supplies, use count 10.

Postings for VAT when returning goods

The buyer can return previously delivered goods. There are two options - standard return or buyback. Which one to use depends on the terms of the contract between the supplier and the buyer. Usually a refund is issued, but the contract may contain a buyback condition.

Postings for VAT for standard returns

For a normal return, the supplier will make the following entries.

| Debit | Credit | Description |

| 62 | 90.01 | RESTORATION of revenue on returned goods |

| 90.02 | 41 | REWARD of the cost of the returned goods |

| 90.3 | 68.VAT | REVERSE of VAT accrued upon shipment for defective goods |

The buyer's accounting department, in turn, builds such accounting records.

| Debit | Credit | Description |

| 76 | 41 | The cost of goods subject to return is reflected |

| 76 | 68 | The VAT amount on the adjustment invoice has been adjusted |

...but in practice there is

So, the fiscal authorities believe that there are no problems with determining the date of issuance of the invoice. The countdown of the five-day period begins from the moment of shipment, regardless of the terms of the contract. However, one can argue with this position. But we want to immediately warn you that, most likely, you will have to defend your case in court, since the tax authorities are unlikely to like it.

As we said earlier, sale for tax purposes means the transfer of ownership of goods, work or services (clause 1 of Article 39 of the Tax Code of the Russian Federation). If the contract stipulates that ownership is transferred only after payment for goods (work, services), and payment has not yet been received, then ownership has not been transferred. Consequently, there is no implementation.

The object of VAT taxation is the sale of goods (work, services) (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). If there is no sale, then there is no object of taxation. Naturally, the tax base does not arise either. Therefore, there is no basis for issuing an invoice before payment in the case where the terms of the contract establish the transfer of ownership upon payment. Indeed, clause 3 of Article 168 of the Tax Code of the Russian Federation clearly states that an invoice is drawn up upon sale.

Postings for VAT during reverse sales

A reverse sale is a regular sale with standard transactions. In our case, the supplier and buyer change places. Therefore, the supplier becomes the buyer and builds such accounting lines.

| Debit | Credit | Description |

| 41 | 60 | Returned goods are capitalized |

| 19 | 60 | “Input” VAT is charged on the cost of returned goods |

| 68.VAT | 19 | “Input” VAT is subject to deduction |

And the buyer becomes the supplier and makes such transactions.

| Debit | Credit | Description |

| 62 | 90.01 | Revenue from the return of defective goods is reflected |

| 90.02 | 41 | The cost of defective goods has been written off |

| 90.03 | 68 | VAT is charged on the cost of defective goods |

Other VAT entries

In the table below we have collected other VAT entries that will be useful to you in various situations.

| Debit | Credit | Description |

| 94 | 68.VAT | VAT on raw materials, goods and fixed assets has been restored when deviating from the norms of natural loss |

| 91 | 68.VAT | VAT is charged on the gratuitous transfer of assets |

| 08 | 68.VAT | VAT was charged on construction and installation work carried out by the company itself |

| 08 | 19 | VAT is charged to the increase in the value of a non-current asset |

| 91 | 19 | “Input” VAT is written off from the cost of inventory items that were used to generate other income |

| 94 | 19 | “Input” VAT is written off for shortages and losses from damage to valuables |

| 99 | 19 | “Input” VAT on lost property due to an emergency has been written off |

To account for VAT, we recommend the cloud service Kontur.Accounting. Accrue, deduct and recover VAT from anywhere in the world. When filling out the declaration, the system will automatically check its accuracy and correctness. We give all newbies a free trial period of 14 days.