Who applies the progressive personal income tax rate?

Amendments to Chapter 23 of the Tax Code of the Russian Federation were introduced by Federal Law No. 372-FZ of November 23, 2020. According to the new edition, the tax rate is set in the following amounts (Article 224 of the Tax Code of the Russian Federation):

- 13% - if the amount of tax bases for the tax period is equal to or less than 5 million rubles.

- 650 thousand rubles and 15% of the amount of tax bases exceeding 5 million rubles - if the amount of tax bases for the tax period is more than 5 million rubles.

The new rate is applied by all tax agents from whom individuals receive income (clause 1 of Article 226 of the Tax Code of the Russian Federation): Russian organizations and individual entrepreneurs, notaries, lawyers, separate divisions of foreign organizations in the Russian Federation.

Date of actual receipt of income in the form of interest on the loan

For the purpose of calculating personal income tax, the date of actual receipt of income in the form of interest on the loan is determined:

- as the day of payment of such income to an individual - if interest is paid in cash (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation);

- as the day of transfer of property to an individual - if interest is paid in kind (clause 2, clause 1, article 223 of the Tax Code of the Russian Federation).

The Russian Ministry of Finance also drew attention to this in letter dated June 19, 2017 No. 03-04-05/38138.

Remember! The frequency of interest payments is established by the loan agreement. It can be daily, monthly, quarterly or some other. If there is not a word about this in the agreement, then interest must be paid every month until the day the loan amount is repaid (clause 2 of Article 809 of the Civil Code of the Russian Federation).

How to calculate the tax base for a progressive personal income tax rate

We have collected the tax bases to which the progressive tax rate is applied in the table. For residents and non-residents of the Russian Federation, the list of income is different (clause 2.1 of Article 210 of the Tax Code of the Russian Federation, paragraphs 3-7, paragraph 9 of clause 3 of Article 224 of the Tax Code of the Russian Federation).

| Residents of the Russian Federation * | Non-residents of the Russian Federation |

|

|

* This rate does not apply to the income of residents of the Russian Federation, taxed at the rates provided for in clauses 1.1, 2, 5 and 6 of Art. 224 Tax Code of the Russian Federation.

Each of the listed bases is determined separately in relation to the income of an individual - a tax resident of the Russian Federation. This is a general rule, which is enshrined in the tax code (clause 2 of Article 210). Each income is subject to different deductions and has its own basis. The totality of all bases will be compared to 5 million rubles from 2023. And in 2021 and 2022. with 5 million they will compare each database independently.

Thus, from January 1, 2021, an increased personal income tax rate of 15% was introduced in relation to the aggregate of all taxable income of an individual - a tax resident of the Russian Federation, exceeding 5 million rubles during the tax period.

Calculate the advance and salary taking into account all current indicators for today

Concept of interest-free loan

It is a mistake to equate loans and credits. A lending agreement is only a type of loan under certain conditions. In this case, the creditor is necessarily a legal entity, such as a banking or credit organization, and the loan must be returned with some interest specified in the agreement.

The features of loans include the following:

- providing not only finance;

- terms of the agreement providing for the absence of interest payments;

- the moment of conclusion of the agreement is determined by the transfer of the subject of the agreement to the borrower.

Unlike a loan, a loan can be provided by both a legal entity and an individual. Moreover, the subject of the agreement can be both money and other items united by common characteristics, without the possibility of separation. For example, issuing a loan for a vehicle is completely wrong in relation to Russian legislation, but providing sheet metal is a completely normal type of loan. Moreover, loans issued by non-financial means cannot include the payment of interest, that is, they are initially interest-free.

When a loan is issued in money, then only if certain conditions are specified in the contract can it be considered interest-free. If there is no such condition, interest is accrued at the interest rates specified in the agreement, or at the refinancing rate, unless otherwise mentioned.

There are differences in when a contract is considered concluded:

- in the case of a lending agreement, the condition for conclusion is the signing of the agreement;

- in the case of a loan agreement - only if the subject of the agreement is transferred to the borrower, the agreement is considered concluded.

Loans are issued only by accredited organizations that have the appropriate license permits. A loan can be issued by any person or organization. But if someone issues loans on an ongoing basis, this may entail the presence of a permanent income, from which it is necessary to pay tax deductions to the budget. Do I have to pay any fees for an interest-free loan?

Special calculation rules in 2021 and 2022

With regard to income received in 2021 and 2022, the tax rates established by paragraph 1 and paragraph 3.1 of Art. 224 of the Tax Code of the Russian Federation are applied to each tax base separately (clause 3 of article 2 of the Federal Law of November 23, 2020 No. 372-FZ).

This means that if the totality of all tax bases for 2021 exceeds 5 million rubles, and each base individually has not reached this amount, then the 15% rate does not apply to the income of an individual.

Example

Mikhail's salary is 300,000 rubles.

For 12 months of 2021, the base is 3,600,000 rubles. This is the main tax base. Additionally, in March he was paid dividends in the amount of 2,500,000 rubles. The amount of bases for the tax period is 6.1 million rubles, which exceeds 5 million rubles. But each base individually is less than 5 million rubles, so the 15% rate does not apply in this case. Personal income tax on Mikhail’s income will be withheld at a rate of 13% from both salary and dividends.

Is the loan subject to personal income tax?

Let's consider cases when a loan is subject to personal income tax. This happens if the company allows you to manage borrowed funds on terms that are better than in banks. This parameter is determined by the formula “2/3 of the refinancing rate” and is called the marginal rate. If the loan rate is lower than 2/3 of the refinancing rate of the Central Bank of the Russian Federation, then you are required to pay personal income tax on such material benefit. This, of course, also applies to interest-free loans from organizations.

The resulting marginal rate is multiplied by the loan amount and by the ratio of the number of days the loan is used and the number of days in the current year. Personal income tax is paid on the resulting amount of material benefit.

How to calculate personal income tax if the tax base exceeds 5 million rubles

Personal income tax must be calculated on the date of actual receipt of income. The tax is calculated on an accrual basis from the beginning of the year. This applies to all income accrued to an individual during the tax period if a progressive rate is applied to it. In this case, the amount of tax withheld in previous months of the current year is credited.

When calculating the amount of tax, it is not necessary to take into account the income that the taxpayer received from other tax agents.

Example

The director of the LLC is paid a monthly salary of 700,000 rubles. No deductions are provided. To calculate personal income tax for each month, you need to determine the tax base on an accrual basis from the beginning of the tax period. Depending on the size of the base, a progressive tax rate is applied to it and the tax withheld in previous months is offset.

- January. Tax base - 700,000 rubles, personal income tax - 91,000 rubles (700,000 × 13%).

- February. Tax base for 2 months - 1,400,000 rubles, personal income tax - 91,000 rubles ((700,000 + 700,000) × 13% - 91,000 (personal income tax for January)).

- March. Tax base - 2,100,000 rubles, personal income tax - 91,000 rubles, (700,000 × 3 × 13% - 182,000 (personal income tax for January and February).

Tax calculations from April to July will be similar. Every month, the LLC accountant will withhold 91,000 rubles from the director’s salary and transfer 609,000 rubles to him.

From August, the tax base will exceed 5 million rubles and amount to 5,600,000 rubles (700,000 rubles × 8 months). Now, a 15% rate will be applied to a base exceeding 5 million rubles. Here's how it works.

- August. Tax base - 5,600,000 rubles, personal income tax - 103,000 rubles (650,000 + (5,600,000 - 5,000,000) × 15% - 637,000).

- September. Tax base - 6,300,000 rubles, personal income tax - 105,000 rubles (650,000 + (6,300,000 - 5,000,000) × 15% - 740,000).

For October-December, the tax will need to be calculated in the same manner. In each month, the personal income tax withheld from the salary will be 105,000 rubles, and the director will receive 595,000 rubles into his account.

The total amount of personal income tax for the year is 1,160,000 rubles, of which 510,000 rubles is tax calculated at a rate of 15% on income exceeding 5 million rubles. For comparison: if there were no progressive rate, personal income tax would have been paid in the amount of 1,092,000 rubles for the year.

Interest-free loans and taxation

Interest-free loans have become widespread among both companies and individuals. It is clear that in some cases they are subject to taxation. Moreover, it is important to remember that the practice of arbitration and the pronounced position of the tax authorities are quite different. To minimize your own risks, it is worth considering all these issues.

We will consider those types of loans that are most widespread: an agreement between two individuals, between an individual and a company (in cases where either party provides an interest-free loan), and between legal entities.

Transaction between individuals

By law, any person can provide another individual with an interest-free cash loan if the total amount of the loan issued does not exceed five thousand rubles. When concluding a transaction not on a financial basis, the final amount of the loaned property is not limited.

In this case, neither party to the transaction is subject to taxation. True, this only applies if the provision of an interest-free loan is in no way connected with the business activities of the borrower and the lender. Sometimes documentary evidence of the absence of commercial benefits received by either party to the transaction is required.

Loan provided by a legal entity to an individual

A common practice is to issue interest-free loans to a company's own employees or founders. When such a transaction is completed, the Tax Code comes into force; the borrower is obliged to pay a tax at the time of return of the provided funds in the amount of thirty-five percent of three-quarters of the refinancing rate in effect at the time of completion of the transaction.

If there is a conversation about providing an interest-free loan to an employee of a company, funds designated as tax deductions can be withheld by the organization’s accounting department from the employee’s salary. If the borrower wishes to report taxes himself, the organization transmits the necessary information to the tax service, and the payment is made by the borrower himself.

When the funds received from an interest-free loan were used to purchase residential property, you can count on relief in the form of no tax on the material benefit received.

Loan taken by a company from a private individual

It is not uncommon for a private investor to be able to provide an interest-free loan to an organization.

This benefits the following:

- the opportunity to start a business project without additional costs;

- no need to enter into relationships with banks, large creditors, entailing obligations, overpayments, interest, etc.

What is being done in this case regarding taxation? A private individual can act as a founder of an organization by providing his own capital as an interest-free loan, while for the tax authorities this will be considered as income, which in turn will lead to the accrual of additional interest on value added tax for individuals. The rate in this case will be the value of the refinancing rate adopted by the Central Bank.

Transaction concluded between organizations

If friendly organizations provide each other with financial support in the form of interest-free loans, relations with the tax service are built in different ways. For a company providing an interest-free loan, the tax authorities do not take any action.

For the loan purchaser:

- from the point of view of the tax services, income is noted that is not received from the sale of products, but in the absence of interest accrual on the loan provided;

- From the point of view of judicial and legal services, an interest-free loan is not accepted for the provision of a service for which any tax deductions must be paid.

This difference of opinion can make communication between organizations and tax accountants slightly more difficult, especially when disputes arise.

In any case, interest-free loans are quite convenient financial relationships in many cases. It is worth considering that when entering into relationships of this kind with legal entities, it is necessary to take into account the possibility of accruing any tax deductions.

How to pay personal income tax from 2021

If at the time of payment the amount of personal income tax calculated and withheld from an individual exceeded 650,000 rubles from the beginning of the year, pay tax in the following order (clause 7 of Article 226 of the Tax Code of the Russian Federation):

- separately pay at a rate of 13% the amount of personal income tax in the part not exceeding 650 thousand rubles, which relates to the part of the tax base up to 5 million rubles inclusive;

- separately pay at a rate of 15% the part of the personal income tax amount exceeding 650 thousand rubles, relating to the part of the tax base exceeding 5 million rubles.

When paying tax at a rate of 15%, indicate in the payment document KBK 182 1 0100 110 (Order of the Ministry of Finance of the Russian Federation dated October 12, 2020 No. 236N).

Generate a personal income tax payment order with new details for free

Income exceeding 5 million rubles and personal income tax at a rate of 15% are subject to reflection in separate sections of 6-NDFL. We talked about this in more detail in the article “New form of calculation of 6-NDFL from 2021”.

Sample loan agreement for a legal entity from an individual

It is necessary to approach drawing up a contract very responsibly. All parameters of the transaction will depend on its content; it can also be required by the tax authorities and have a significant impact on the calculation of taxes for both the borrower and the lender.

You can download a standard sample loan agreement from an individual to a legal entity here.

There are many types of loan agreements. They may provide for the payment of interest for the use of money or not, be secured by a pledge or guarantee or provided without security, be of a targeted or non-targeted nature, etc.

It is necessary to take into account all these points in advance when drawing up the contract, otherwise it will not always be possible to make changes later.

Interest-free type

For a long time, interest-free loans were the main way to receive funds from the founders to replenish working capital and other business expenses of the organization.

If necessary, the business owner received the funds back and no additional expenses were incurred by either party to the transaction.

But the opinion of some tax inspectorates changed, and some organizations began to receive additional tax charges on profits that they allegedly received from saving on interest.

The courts, on the contrary, sided with the borrower and declared such acts invalid. It is better to clarify this point in advance with the service organization of the Federal Tax Service, because not everyone wants to sue.

Important! An interest-free loan agreement must contain a direct indication of the absence of interest.

If there is no data on interest, the borrower must pay it based on the key rate of the Central Bank of the Russian Federation on a monthly basis.

With an interest-free loan, the lender does not make a profit from the accrued interest. Also, this type of transaction allows you to repay the debt ahead of schedule at any time, regardless of the period specified in the agreement.

Otherwise, an interest-free loan agreement may have all the same conditions, including penalties, as other similar agreements. Interest-free loan agreements can be found here.

Percentage type

If the agreement provides for the payment of remuneration to the lender for the use of borrowed funds, then it is called an interest agreement.

The interest rate is agreed upon by the parties through negotiations and can be represented as interest per day, week, month, quarter or year of use of funds.

It is also possible to indicate a specific amount that the borrower pays to the lender for part or all of the loan term.

This version of the agreement is most often used when a business raises money from employees or simply private investors.

The text of the agreement must specify the rate or specific amount of remuneration, the procedure for calculating and paying interest.

If the loan agreement does not indicate any rates, then interest will be calculated at the key rate of the Central Bank and must be paid to the lender monthly, regardless of the term of repayment of the principal debt.

Interest rate loan agreement between a legal entity and an individual can be found at this link.

Targeted loan

In most cases, loan agreements do not stipulate conditions on where the legal entity will spend them.

But there are situations, for example, if there are a large number of owners, when the lender wants to give a loan only for certain purposes and gain control over their use. In this case, enters into a targeted loan agreement ().

At the request of the lender, the organization will have to provide him with documents that confirm that the funds were sent in accordance with the terms of the loan agreement and nothing else.

If the condition of intended use is violated by the borrower, the lender may demand immediate repayment of the entire amount of the debt and the actual accrued interest.

How to get loans up to 50,000 rubles without certificates, read the article: loans up to 50,000 rubles. Where is it profitable to get an express loan in Moscow, read here.

When secured with collateral

Sometimes the lender wants to receive guarantees of repayment of funds, especially if we are talking about a fairly large loan amount. A surety or pledge is usually accepted as security.

Many lenders consider the second option much more preferable, especially if the recipient of the funds has liquid property.

The loan agreement must indicate that it is secured by collateral of the borrower’s property and specify how specifically. Additionally, you will need to conclude a collateral agreement.

A loan agreement with property pledged can be found here, and a sample collateral agreement can be found at this link.

Methods of transferring money

The parties to the transaction must indicate in the agreement how the lender will transfer funds to the borrower. This avoids confusion, because the loan agreement is considered concluded only after the transfer of money.

There are two main ways to transfer funds when an organization borrows from an individual:

- cash;

- bank transfer to a bank account.

Cash through the organization's cash desk

Transferring funds to the borrowing company is usually used if the loan amount is relatively small. In this case, they are transferred to the organization’s cash desk, and the borrower receives a receipt for the cash receipt order, which will confirm the fact of the transfer of funds.

It cannot be replaced with a simple receipt, as this will violate accounting rules and may lead to fines from regulatory authorities.

The organization is obliged to hand over the funds borrowed under the loan agreement to the servicing bank for crediting to the current account.

You cannot immediately use money in cash for expenses or issue it on account, as this violates cash discipline.

To current account

One of the most convenient ways to transfer funds from a lender, an individual, to a borrower, a company, is a transfer to a bank account.

In this case, a payment order marked by the sending bank will confirm the fact of transfer of funds.

In case of disputes with the borrower, the lender will also be able to obtain confirmation of the receipt of funds in the company's account by submitting a corresponding request through his bank.

List of required documents

Any transactions related to finance must be recorded on paper or in the form of an electronic document. The individual lender will only need a passport to complete the transaction.

The borrower organization must provide at least the following documents:

- Copies of TIN and OGRN certificates.

- A copy of the Charter.

- A copy of the Order on the appointment of a manager.

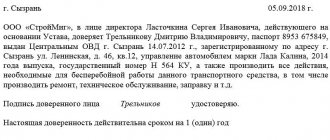

- Power of attorney (if the agreement is signed by a person other than the manager).

Some lenders additionally ask for copies of other documents:

- balance sheet, profit and loss account;

- business plan or development strategy of the organization;

- documents on the pledge (if any).

Return period

The parties have the right to independently set the loan repayment period, as well as enter into an open-ended agreement.

In the latter case, the borrower will be obliged to repay the debt amount within 30 days upon receipt of a written request from the lender.

In practice, loan agreements lasting more than 3 years for fairly small amounts raise suspicions among the tax inspectorate and can lead to the loan being equated to gratuitous assistance and additional income tax charges.

This can be avoided by providing in the main agreement a condition for a possible extension, or even better, by re-executing the loan agreement.

What are the risks of the parties?

The lender's main risk is the possible non-repayment of funds. Of course, if we are talking about a legal entity where the only founder and director is one person, then non-repayment can only happen because of a “failed” business and the borrower himself will be to blame.

But in other cases, it is better to minimize this risk by obtaining security in the form of collateral or surety.

For the borrower, there is a risk of losing the property pledged under the agreement or as a result of judicial foreclosure. Therefore, the borrowing company must make careful calculations before borrowing money.

Both parties to the transaction may also face tax risks, which will depend on the nature of the loan and other parameters of the agreement.