We prepare the implementation: how invoices and delivery notes are issued

Each fact of economic activity is accompanied by the preparation of primary documents.

Based on them, the accountant records the completed transaction in accounting. Operations for the sale of products, work, services, etc. are no exception. During this operation, the seller must issue a primary document (for example, a bill of lading), on the basis of which the product, work, service is transferred (or ownership is transferred) to the buyer. If the seller pays VAT, then in general cases he issues an invoice to the buyer. But he can do this not at the time of transfer of the asset or ownership of it, but within five days after shipment. Thus, the delivery note and invoice are a single set of documents for the sale of goods, but they are intended to take into account various objects. To understand the difference between a delivery note and an invoice, let's look at each document separately.

What is a bill of lading used for?

A consignment note in the form TORG-12 is one of the types of primary documents on the basis of which the transfer, for example, of goods purchased for resale or products of own production to the buyer takes place. That is, the invoice is needed to record inventory items.

The form and instructions for filling out the consignment note were approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. However, according to the Law “On Accounting” dated December 6, 2011 No. 402-FZ, economic entities have the right:

- develop your own forms of primary documentation while maintaining the necessary details;

- supplement unified forms with essential details.

Is it necessary to indicate bank details in TORG-12? What if it doesn't have a seal? You will find answers to these and other controversial questions about filling out the document in ConsultantPlus. Trial access to the legal system is free.

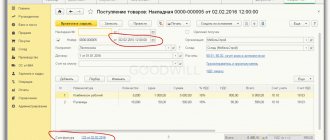

Simultaneously with the issuance of the consignment note, accounting entries are generated for the sale of:

- Dt 62.1 Kt 90.1 - reflects the fact of sale of products or goods to the buyer;

- Dt 90.2 Kt 41, 43 - cost of goods or products sold.

Based on the delivery note, the buyer will reflect in his accounting the receipt of material assets by posting Dt 10, 15, 41... Kt 60.1.

Nothing extra

Another document that is often lost or requires “rework” for the company to receive additional benefits is the invoice. There is nothing complicated about filling it out, however, inspectors identify a number of mistakes that accountants constantly make when preparing this document “manually”. Firstly, taxpayers often present whole stacks of documents issued to the same company. It turns out that the company paid the organization for the goods, transportation and consultation. Tax authorities inevitably pay attention to such a “multi-profile” enterprise. Therefore, those who constantly use fictitious documents keep special notebooks in which they write down what they provide transport and consulting services.

Another common mistake that immediately results in a fake invoice is too many stamps. On genuine documents there is only one, but on fake ones they also have stamps: corner and “Paid.” Apparently, accountants think that the more imprints on paper, the more solid it looks. It is not possible to assess the extent of falsification of primary documentation. Some inspectors claim that 50 percent of the papers are fictitious, others claim 80 percent. In fact, tax authorities are not able to check every single document in a company. They pay attention only to obvious violations; the rest is left to the accountant’s conscience.

Irina Golova, expert at Calculation magazine

What is the difference between a bill of lading and other transfer documents?

We have already found out when a delivery note is issued, but in addition to it, other transfer documents can be issued during the sales process:

- invoice for the release of materials to the third party - form No. M-15;

- act of completion of work / provision of services;

- act of acceptance and transfer of fixed assets - form No. OS-1, etc.

From the names it is clear that the execution of the listed documents occurs depending on what property is being transferred: materials, work, services, fixed assets, intangible assets, etc.

All these documents are characterized by the fact that they must contain the details of the transferring and receiving parties, the name and, if necessary, characteristics of the transferred asset, quantity, price and value, the date when the asset was transferred, etc. The documents must be certified by the signatures of authorized persons with each party to the transaction and sealed (if any).

Look at what details should be present in the primary documents.

What is the purpose of an invoice and how is it different from a delivery note?

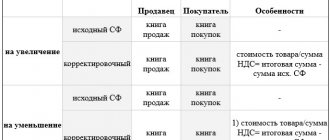

An invoice is a primary document used to record value added tax. The seller-taxpayer is obliged, when performing transactions subject to the specified tax, to issue an invoice, thus showing the accrual of VAT: Dt 90.3 Kt 68/VAT.

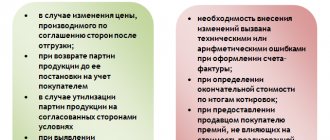

An invoice can be issued not only upon shipment, but also under other circumstances (for example, when funds are received from the buyer as an advance), when an invoice is not required, but VAT must be charged.

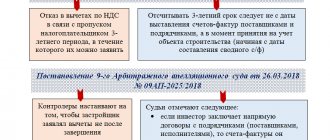

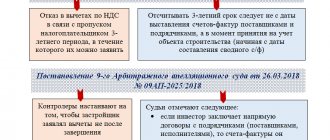

The buyer - a VAT payer has the right, on the basis of the received invoice, to accept the amount of VAT for deduction, reducing the amount of tax payable to the budget. The buyer's incoming VAT is reflected on the basis of posting Dt 19 Kt 60.1, and the tax deduction statement is Dt 68/VAT Kt 19. However, for this, the document must comply with all the requirements of tax legislation.

The form of the invoice and the rules for filling it out are given in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (as amended on August 19, 2017 No. 981). The invoice, as well as the delivery note, must indicate the name of the product, its quantity, unit price and total cost, VAT rate and amount, amount including VAT. In addition, the details of the seller and buyer (shipper, consignee) are provided here. The document is certified by the signatures of authorized persons (usually the manager and chief accountant of the organization or individual entrepreneur). Unlike the consignment note, there is no space for printing in it.

What details of the consignment note in the TORG-12 form are required to be filled out in order to accept expenses for tax accounting and apply VAT deductions? You will find the answer to this question from 2nd class adviser to the State Civil Service of the Russian Federation E. S. Grigorenko in K+, having received trial access to the system for free.

Filling rules

The form in question must first be filled out correctly. What you should pay attention to first of all:

- Three signatures from the seller.

- Seller's stamp.

- Name of the seller, his legal address, current account, BIC.

- OKPO and OKPD.

- The basis, that is, the contract in accordance with which the goods are supplied.

- TN number and its date.

- The tabular part of the TN represents information about the product. The table indicates its quantity, name, VAT, etc. (read about how TN TORG-12 is filled out with and without VAT).

The technical specification is generated in two copies, and its date must coincide with the actual date of shipment.

Is it possible to issue a delivery note and an invoice in one document?

So, a delivery note is intended to account for inventory items, an invoice is intended to account for VAT. Is it possible to compose them in the form of one document?

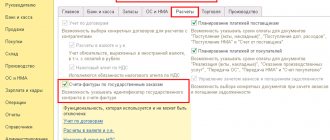

Maybe. Such a document has been in effect since 2013 - from the moment the Federal Tax Service issued a letter dated October 21, 2013 No. ММВ-20-3 / [email protected] in order to facilitate the document flow of business entities. The letter contains a new form with the details of both documents. It was called UTD (universal transfer document).

Our legislation periodically adjusts the invoice form, and therefore the UTD form also changes.

UPD replaces:

- set of invoice and transfer document;

- transfer document.

The law does not oblige the use of UPD; this is voluntary. If a business entity decides that the UTD will be issued during shipment, then it is better to register such a decision in the accounting policy.

Results

So what is the difference between an invoice and a delivery note?

They are intended to reflect two different accounting objects in the accounting and tax registers. The delivery note takes into account inventory items, and the invoice takes into account VAT. Both documents are issued upon shipment or upon transfer of title, but the invoice is issued immediately at the time of shipment, and the invoice is issued within 5 days after that. The information reflected in these two documents overlaps to some extent. That is why, in order to simplify document flow, tax authorities have developed a single form that combines the details of the invoice and the primary transfer document. A sample UPD is shown above. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to start working with EDI?

To work with electronic invoices, an organization must:

- Fill out an application on the website www.diadoc.ru. Diadoc specialists will help you choose a suitable tariff and advise you on how to start working in the system.

- The website www.diadoc.ru has regulations for the use of electronic digital signatures in the Diadoc electronic document management system. It is provided for all EDF participants. If an organization decides to work with electronic documents, it must sign a statement of adherence to this regulation. An agreement is also signed for the right to use the Diadoc computer program (a sample is on the website).

- The operator assigns an identifier to the company and registers the organization in the system.

- Next, the company buys an electronic signature certificate from any of the SKB Kontur service centers. Now each document will have legal force. An application for an EDS certificate can also be sent directly from the Diadoc system. If the organization already has a certificate, you can use it.

- Find contractors in Diadoc and start working.

For your information

Leading Russian companies have realized the advantages of electronic invoices. The BILLA trading network, Kirov Plant OJSC, the largest pharmaceutical distributor Protek and other organizations began implementing pilot projects even before the approval of electronic invoice formats. — The volume of primary documentation at our plant is enormous. The introduction of an electronic document management system will allow, firstly, to achieve a reduction in the terms of the closed period. Secondly, this will be able to increase the efficiency and transparency of the exchange of primary goods between enterprises. In addition, we will certainly reduce both direct and indirect costs of document flow,” Sergei Kulabukhov, IT Director of Kirov Plant OJSC, assessed the prospects for implementing EDI.

| Irina Tsygankova, Tax Manager, Indirect Taxation Group, PwC |

“The technological and technical process of exchanging electronic invoices was possible even before the approval of Order No. ММВ-7-6/138. But previously there was no legislative framework allowing this to be used for tax purposes, that is, the tax authorities had to have a “living” document with a stamp and signature. Now the regulatory framework is fully formed. The taxpayer asks the question: what will change in interaction with the tax authorities? After all, this is a fundamentally new way of working. Will it make me worse? Will there be any problems? The answer is obvious: it shouldn’t be worse, an electronic document is the same as a paper one. Moreover, tax authorities have indicated that they encourage the use of electronic invoices. Another question: how will electronic invoices affect the nature of the conduct and results of tax audits? I think the nature of tax audits should not change. Work will become more convenient: you no longer need to carry tons of documents to the tax office. International experience also shows that tax authorities are paying more and more attention to the analytical procedure of tax audits, and fewer and fewer complaints arise regarding the technical execution of documents. Most likely, the changes will lead to more effective interaction with regulatory authorities. Thus, a new reality arises in relations with tax authorities. We're starting to talk to them differently."