How to work as a tutor? Do I need to open an individual entrepreneur and pay taxes? What documents should I fill out? How to accept payment for services rendered? In this article you will find answers to these and many other questions.

- 1

- 2

- From January 1, 2021, tax holidays for tutors are cancelled. To officially work, you must register as self-employed or open an individual entrepreneur

- A tutor working as an individual entrepreneur can choose a simplified taxation system or a patent, if there is one for this type of activity in your region

Who can become a tutor

Currently, individual training for children and adults, preparation for school and exams, is among the services that are in high demand.

Tutor is a teacher who provides educational services on an individual basis.

Most often, experienced or novice teachers who combine their main job with providing individual services, or those for whom tutoring is the only source of income, become tutors. In all cases, teachers receive money by teaching individually or in groups. This teaching mode is convenient for both teachers and students. There is an opportunity to attend private lessons and gain the necessary knowledge in the chosen subject.

Open an IP for free

Today, many companies providing educational services have opened, but tutors continue to be in high demand. And you don’t even need any special advertising. Word of mouth works great here when parents of students recommend this teacher to others.

OKVED for training courses and information business

In recent years, Internet entrepreneurship has become a very popular area of running your own business.

Indeed, who doesn’t want to work for themselves, determine their own work schedule and optimal income, while practically not leaving home? Moreover, if you have something to share with the world, for example, in the form of seminars, trainings and various kinds of courses and consultations (info business). And then one day the moment comes when a simple desire develops into a detailed business plan, and a workplace is organized in your own apartment.

So, the decision has been made - you are starting a new Internet project, opening your own business on the Internet. And for this you officially register as an entrepreneur.

Did you remember to choose the OKVED code for training courses (info business), other types of income and everything else that you are going to “do” on the Internet? After reading this article, you will learn which codes are suitable for various types of online learning.

Where to watch OKVED for training courses

As a rule, at the initial stages of organizing an Internet business, it is difficult to estimate the entire volume of future services, but at least the main directions can be identified. The All-Russian Classifier of Types of Economic Activities (OKVED2) and your business plan will help with this.

The algorithm for selecting the required OKVED code is quite simple - write down on a piece of paper all the types of activities that you plan to engage in, open the Classifier (easily found by searching for “OKVED”), leaf through it and select the appropriate OKVED codes for training courses and your other intended activities activities. A surprise may await you here in the form of discovering “forgotten” types of activities that you did not put on your list, so I strongly recommend scrolling through OKVED from beginning to end. Of course, you can leave agriculture alone :-)

You can turn to professional consultants for help, and they will select the necessary codes, but first you should try to do it yourself. It is not difficult!

The classifier traditionally consists of sections and subsections, so first of all we study them, and only then, having selected the appropriate ones, we look at the detailed codes of the types of economic activities themselves. And carefully read the description of the codes, because... their names may sound inappropriate, but their description may be quite suitable for you.

An important point: when registering, it is advisable to indicate the most comprehensive type of activity, i.e. There must be at least three digits in the code, and preferably four or more. As for the number of codes, it is not limited by law, and yet the number of codes more than 20-25 is fraught with the risk of increasing errors.

What did you decide to do?

For clarity, let’s look at the selection of the necessary codes using a specific example, select the OKVED code for training courses, various related types of online earnings and add services. Let's look at my example. Let's say I want to provide accounting and consulting services, or rather:

- provide accounting services to individual entrepreneurs and legal entities;

- analyze the financial condition of the business;

- advise clients on tax issues.

In addition to this, I want to create and use my own website for:

- placement of banner and contextual advertising for the purpose of generating income;

- placing advertisements in mailing lists to subscribers;

- promoting affiliate products and programs.

Those who engage in online learning are very likely to engage in these activities as well.

And most importantly, you have so much knowledge in your head that you are ready to share it. Therefore, in your plans:

- writing books and courses in electronic form and then selling them via the Internet;

- conducting paid webinars and online trainings;

- recording and selling CDs with training courses (now this is of course an atavism, but suddenly someone needs it).

Have you forgotten anything? Then let's start studying the classifier.

We select OKVED for training services

Let's start with the types of activities specifically related to educational products, if you conduct courses or trainings:

85.41 — Additional education for children and adults

You can, but not necessarily, choose a code and more precisely:

85.41.9 — Additional education for children and adults, other, not included in other groups

This includes:

- education that is not determined by qualification level, academic education, training centers offering remedial courses, exam preparation courses, language training, computer courses

- further education, as well as trainings and courses for various professions, hobbies and activities for personal growth

- camps and schools providing group and individual instruction in sports, instruction in the arts, drama or music, or other instruction or special education

Also pay attention to the following OKVED codes for training services, specific to certain topics:

62.02.3 — User training activities (in the field of computer technology)

85.41.2 – Education in the field of culture (providing training in the field of arts, drama and music as a hobby, for recreation and for self-development purposes)

85.41.1 — Education in the field of sports and recreation (sports, group or individual, including classes in sports camps and schools, including training in martial arts and yoga)

If you, as an individual entrepreneur, are going to work on a patent and conduct training courses for the population, OKVED (main) is chosen to be of an educational nature.

We choose OKVED for conducting seminars and consultations

Often group training programs are accompanied by individual consultations. Also, not every seminar can be characterized as educational. Therefore, it is also useful to look at the following codes (mainly depending on the topic):

62.02 — Advisory activities and work in the field of computer technology

63.91 — Activities of news agencies

63.99 — Other activities of information services, not included in other groups (includes activities for the provision of consulting and information services)

69.10 — Activities in the field of law

69.20 — Activities in the provision of services in the field of accounting, financial auditing, tax consulting

70.22 — Consulting on business and management issues

71.11 — Activities in the field of architecture

74.90.4 — Providing consulting services in the field of agriculture

74.90.5 — Providing consulting services in the field of ecology

74.90.6 — Providing other technical advice, activities of consultants other than architects, designers and management consultants

82.99 — Activities providing other support services for business, not included in other groups

88.99 — Providing other social services without providing accommodation, not included in other groups (consulting on home budgets, marriage and family issues, raising children, credits and loans)

as well as a universal code if you have something exclusive:

96.09 — Provision of other personal services not included in other categories

If you also work as a freelancer, then you should also look at this article on OKVED codes.

Codes for auxiliary aspects of information business

Most likely, your business will need the basis of a content platform - its own website on which you will post useful content. Most online entrepreneurs are happy to “partner” by advertising each other’s products and services.

In addition, learning can occur not only at the moment of transfer of knowledge from teacher to student, but also recorded in the format of a book (at least electronic) or disk.

There are codes for these types of activities, add them too, sooner or later they will come in handy:

58.11 — Publishing books (printed and electronic)

58.14 — Publishing of magazines and periodicals (printed and electronic, including publication on the Internet)

59.11 — Group “Production of films, videos and television programs”

59.20 — Group “Activities in the field of sound recording and publishing of musical works”

63.12 — Activities of web portals

73.11 — Activities of advertising agencies

73.12 — Representation in the media

73.20 — Market research and public opinion research

There are a lot of codes, so you need to decide which one will be your main one.

At the final stage of selecting OKVED codes, it is necessary to check whether the planned types of activities are subject to licensing. The federal law of May 4, 2011 No. 99-FZ “On licensing of certain types of activities” will help you with this.

If you need advice on selecting OKVED codes for courses or other activities, as well as help with accounting and taxation, write to me on the Contacts page. Find out how I can help Internet entrepreneurs, take a look at the Services page.

Source: https://buh-v-seti.ru/infobiznes/okved-dlya-infobiznesa-internet-biznesa-i-ne-tolko/

How the law regulates the activities of tutors

The Federal Law “On Education” of 2012 regulated the activities of only individual entrepreneurs providing educational services independently or with the involvement of additional teachers. There were no work options for individuals without the formation of an individual entrepreneur until 2021, until changes were made to the Tax Code. Then, in addition to individual entrepreneurs, the status of a citizen appeared, providing services to individuals for personal, household and other needs.

A new paragraph 70 was added to Article 217, where income received by individuals from individuals for the provision of such services was excluded from taxation. This list includes those who look after and care for people, do housekeeping, clean rooms and tutors. Tax holidays were introduced for these categories until the end of 2021. Most likely, they will be extended further.

Register your business for free and without visiting the tax office

It's simple: the bank prepares the documents and sends them to the tax office, and in the meantime you do business!

Open an individual entrepreneur or LLC

Explanations and clarifications

It is enough to have professional knowledge and skills in any field, and at the same time be able to easily convey this skill to other people - and you can engage in teaching and tutoring. This business does not require many investments; it can be carried out directly by the entrepreneur, or the businessman will organize it, coordinating the relationship of clients with his employees - full-time or freelance.

If an entrepreneur creates an organization providing educational services, he can do this in different forms:

- Preschool education – programs aimed at developing personality, developing various skills, and training preschool children in one way or another. Such a business cannot include the services of a nanny looking after children during the day - such activities are classified as social services.

- Primary education – assistance in children’s mastery of reading, writing, counting, norms of behavior, in the development of thinking and speech, attention, perception and other mental processes. Adults are not trained in this type of business.

- Basic education includes not only the mastery of basic school subjects, but also the development of personal qualities, more professional pursuits of various hobbies, and the initial stages of professional activity in a particular field.

- Higher education is the acquisition of professional skills in a particular specialty.

- Additional education in special fields:

NOTE! Foreign language teaching and religious education are not included in this type of activity.

Such a business can be carried out individually or in a group, at the client’s home or on the basis of specially equipped premises and centers.

A tutor can no longer work officially and not pay taxes

From January 1, 2021, tax holidays for tutors are cancelled. During the previous three years, a tutor could provide educational services privately and not pay anyone anything. For this it was necessary:

- work without opening an individual entrepreneur

- teach independently, without the involvement of other teachers

- submit a tax notice

To submit a notification, you had to download an electronic form from the Federal Tax Service website, print it out and fill out two copies. With your passport and notification, contact the tax office at your place of residence. They will put a mark there and that’s it, work calmly. You don’t need to submit any reports, and you don’t need to pay taxes either.

At the same time, you will carry out your activities strictly within the framework of current legislation. There is no time limit for submitting notifications. This can be done at any time. Today, everyone providing tutoring services is required to register their activities and pay taxes.

OKVED of all business sectors that will receive government support - finance on vc.ru

Loans for people and businesses in difficult times. Financier – https://myfinansist.ru/

12 business sectors that experienced an economic downturn during quarantine

The operation of catering establishments and shops was limited due to the travel ban. Travel agents and guides have temporarily ceased operations. This caused financial losses for many organizations and individual entrepreneurs.

The state supports companies and individual entrepreneurs affected by the coronavirus. But not all. Financier IgorGeneral Director

Companies from obviously unprofitable areas, such as tourism or air transportation, can take advantage of the help. “Financier” helps everyone get money for business.

How does the state help?

Companies from industries that suffered after quarantine can receive:

- loan benefits;

- reduction of insurance premiums;

- postponement of tax payment deadlines;

- grants.

Let us list which organizations and individual entrepreneurs receive government support.

Complete list of industries with OKVED

On April 3, 2021, the Government of the Russian Federation compiled a list of activities that suffered more than others due to quarantine (Resolution No. 434). The list includes 12 industries. Each position is divided into subparagraphs with the designation OKVED.

If the specified code is your main field of activity, you can count on benefits. We publish a complete list of industries (OKVED - in brackets) with current additions.

Transport

The category includes companies engaged in passenger and cargo transportation:

- automobile (49.4);

- aquatic, including sea (50.1, 50.3);

- railway (49.10.1);

- air transportation (51.1, 51.21);

- other land (49.3).

Sea, water and rail intercity transport were added to the list when the government approved Resolution No. 927 on June 26.

https://www.youtube.com/watch?v=YX_W4nuzN_k

Bus terminals and stations will receive support (52.21.21). You will receive a subsidy if your organization sells tickets or accepts luggage for storage. Transportation of different distances is taken into account: within the city, suburban, intercity and international.

Advertisement on vc.ru Disable advertising

Benefits are provided for companies that provide assistance in air transportation (52.23). On May 26, the Government of the Russian Federation approved Resolution No. 745, after which space transport was added to this category.

Retail

On April 18, Resolution No. 540 was issued, thanks to which a section on retail trade was added to the list. On May 12, the list was supplemented with items from Resolution No. 657. The state offers benefits to stores that sell non-food products:

- vehicles – cars (45.11.2, 45.11.3), trucks (45.19.2, 45.19.3), motorcycles (45.40.2, 45.40.3), parts for them (45.32, 45.40.2, 45.40.3 );

- products sold through vending machines (47.99.2);

- other species (47.19, 47.7).

The government will also support the markets (47.82, 47.89). Specialized stores that sell communication devices (47.4), household (47.5), and entertainment (47.6) products can count on benefits.

Culture and leisure

Among the organizations that will receive state assistance are organizers of creative events: theater and concert productions, exhibitions and event advertising (90).

On April 10 (Resolution No. 479), cinemas were added to the list (59.14). Since April 18 (Resolution No. 540), cultural and entertainment establishments have appeared on the list - museums (91.02), zoos (91.04.1). On May 12 (Resolution No. 657), manufacturers of decorative goods, pottery and other handicrafts were added to the list (32.99.8).

Exceptions are libraries, private galleries, archives.

Hotel business

Involves renting out housing for a short period of time. The category includes hotels, hostels, apart-hotels (55). Landlords who rent out homes for a long time do not receive support.

Sport

The category includes institutions that:

- organize sports and entertainment events (93);

- offer physical education and health services, including baths, solariums, gyms (96.04);

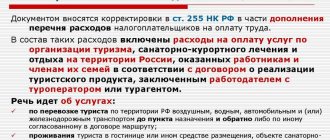

- accept visitors for sanatorium holidays (86.90.4).

Assistance is provided for coaches, resort owners, and registered independent athletes. Benefits are provided if you are involved in advertising sporting events.

Tourism

The government provides benefits for travel agencies, tour guides, and organizations involved in tourism advertising (79). The category includes companies that offer reservations for tickets, rooms and apartments.

Public catering

This group includes cafes, restaurants, bistros, food courts, street stalls and other catering establishments (56). If you sell prepared food or drinks, you can count on benefits. The format (on-site or take-out) does not matter. But you will not receive government support if you sell semi-finished products or food that cannot be eaten immediately.

Domestic services

- repair shops for clothing, shoes, furniture, technical, sports, household and other equipment (95);

- laundry and dry cleaning (96.01);

- beauty, massage and manicure salons, barbershops, hairdressers (96.02).

If you are a restorer of paintings, sculptures, books, no benefits are provided.

Medicine

From April 10, dentistry was included in the list of industries affected by coronavirus (86.23). The government helps specialized (pediatrics, orthodontics, operating rooms and other services) clinics and general dental practice establishments.

Education and child care

In this category, the government provides benefits for 2 types of organizations in the following areas:

- additional education - sports clubs, creative activities, trainings, language courses, preparation for exams (85.41);

- day care for children - services of nannies, governesses (88.91).

If you teach from home, are officially registered and pay taxes, you can also count on support.

Exhibitions and conferences

State aid will be received by companies and individual entrepreneurs that organize such events (82.3):

- business meetings, negotiations;

- conferences;

- Exhibitions.

You can count on government support if you are a recruiter or HR manager and are recruiting personnel for these events.

mass media

From May 26 (Resolution No. 745), printing (11.18) and publishing (58.13) of newspapers, books, educational materials, booklets, audiobooks in printed or electronic form (11.58), as well as the media were added to the list of industries:

- television and radio programs, including targeted ones, which are distributed for a fee, by subscription (60);

- digital publications (63.12.1);

- magazines and periodicals that are published no more than 4 times a week (58.14).

You will also receive support if you own a news agency.

Source: https://vc.ru/finance/152987-okved-vseh-otrasley-biznesa-kotorye-poluchat-podderzhku-pravitelstva

Why does an individual entrepreneur need a tutor?

Can a tutor work without creating an individual entrepreneur? Yes, if you become self-employed. Currently, the self-employment regime operates on an experimental basis in 23 regions and has already shown its relevance. Tutors who do not open individual entrepreneurs will be able to switch to it.

What can you recommend to tutors today? If tutoring is your permanent and only income, you do not have an official job, open an individual entrepreneur or become self-employed, pay taxes and contributions to the pension fund. In this case, your work experience will continue and your pension savings will increase.

How to register for tutoring legally

on one's own

by personally submitting documents to the tax office or sending them electronically on the Federal Tax Service website

through MFC

using one of the banks offering this service

When submitting documents in person, you must print out the application form (you can download it on our website in the article “Documents for registering individual entrepreneurs and LLCs” or on the Federal Tax Service website). Then you fill out all the fields, following the rules, make a copy of your passport, pay the state fee of 800 rubles, and go to the tax office. Don't forget to take a receipt confirming payment of the fee.

When sending documents electronically on the Federal Tax Service portal, the application is filled out directly on the website, then, using a special program, it is packaged together with a copy of the passport and sent to tax specialists.

There is no need to pay a state fee, but an electronic signature will be required to sign the application. You need to do it yourself using one of the registration centers (list on the tax website). It’s even easier to create an individual entrepreneur through a bank.

IP via bank

Fill out the application, indicating your phone number, answer the questions in the electronic form. The bank will independently prepare a package of documents for registration and send it to the tax office. The bank will also provide an electronic digital signature for you. In this case, no duty is paid. Banking services are also free. This method is currently the simplest and most profitable.

Fill out the application, indicating your phone number, answer the questions in the electronic form. The bank will independently prepare a package of documents for registration and send it to the tax office. The bank will also provide an electronic digital signature for you. In this case, no duty is paid. Banking services are also free. This method is currently the simplest and most profitable.

Open an individual entrepreneur through a bank

How an OKVED copywriter chose an individual entrepreneur for registration

Makeeva MaryFollow Feb 25, 2021 5 min read

When filling out an application for registration of an individual entrepreneur (form No. P21001), you must enter OKVED codes. All types of activities are included in the all-Russian classifier and each is assigned its own digital code.

When creating a business, you need to immediately indicate what exactly you plan to do and insert these same codes into the application.

Do you think it’s easy to find copywriting in this list? To be honest, I had to work hard to find something close to my work.

You need to choose a code that has at least 4 digits; too general data is unacceptable, and overly detailed data is not always advisable.

Here is my list of selected codes when filling out the first application.

When I filled out the application for individual entrepreneur registration on the second attempt, this list had changed a little. I just couldn't find all the codes I found before.

List of OKVEDs that now appear in my extract from the Unified State Register of Individual Entrepreneurs:

Now I’m thinking, why did I include “Book Publishing” here? I'm not going to compete with MYTH. Or do I still subconsciously want to open my own publishing house?