Formula for calculating maternity benefits - regulatory aspects

The total duration of maternity leave is 140 calendar days - broken down before the moment of birth (70 days) and after (70 days). In some cases (with complicated or multiple pregnancies), the duration increases to 156/194 days.

Legislative regulation of leave under the BIR is carried out by Art. 255 of the Labor Code, Law No. 255-FZ, Order No. 1012n dated December 23, 2009. Only the expectant mother has the right to receive benefits; other relatives are not entitled to this type of social benefit. The payment is made at the place of work or from the Social Insurance Fund for certain categories of citizens - full-time students, wives of military conscripts dismissed due to the liquidation of the company, individual entrepreneurs on voluntary social insurance.

The amount of the accrued amount is affected by the amount of earnings of the pregnant employee; length of service and leave under the accounting and labor regulations, the presence of excluded periods. If the resulting value turns out to be less than the federal minimum wage, the company’s accountant needs to calculate the allowance based on the current minimum wage in the Russian Federation.

Calculation of maternity benefits in 2021

The period of pregnancy and the time allocated to care for a child is a significant reason for a woman’s incapacity for work and should be financed by the state. The benefit amount is calculated for the last 6 working months preceding the maternity leave.

According to the letter of the law, this payment is provided to a woman if she has completed compulsory insurance in specialized bodies. The benefit amount is a one-time payment for the entire period of maternity leave, namely 126 days. These days can be divided into the non-prenatal period, when the woman is in an “interesting” position, and the days set aside for caring for the newborn. If the birth occurred with complications and there are documents supporting this, then the postpartum period can be extended, and accordingly the amount of payments will be slightly higher.

Formula for calculating maternity benefits in 2021

Calculation period - to determine the amount of maternity payments in 2017, you need to take the employee’s earnings for 2015-2016. In this case, the moment of issuing the sick leave certificate is important, and not the expected date of birth. If in the indicated years the employee was on another B&R leave or on children's leave, she has the right to request a replacement for other, more favorable periods.

Earnings – for the designated time, the full amount of salary, vacation pay, bonuses and travel allowances is taken. Personal income tax is not deducted.

Excluded amounts - sick benefits, child or maternity benefits, as well as amounts from which the employer did not accrue or pay insurance premiums are not taken into account. For example, this is a time of release from work duties while maintaining earnings.

Calculation days - in 2021, calendar days for 2015-2016 are taken, that is, 731 days. Periods of illness, children's leave, maternity leave, and release (full or partial) from work are excluded.

The duration of leave under the BiR (PO) is taken from the certificate of incapacity for work, which is issued by the supervising doctor of the housing complex. In this case, the moment of drawing up the pregnant employee’s application for leave is taken into account. Simultaneous payment of salary and maternity benefits is prohibited.

Average daily earnings (AD) - determined by dividing the total earnings for the billing period by the billing days.

The total amount of payments is determined by the formula for calculating maternity benefits:

Amount of vacation pay for BiR = SD x PO.

"Children's" benefits - features of 2016-2017

There are four main types of benefits:

- when registering in the early stages of pregnancy;

- at the birth of a child (one-time);

- for pregnancy and childbirth;

- for child care.

All these payments are of a different nature, accrued, calculated and issued in different ways. In addition, there are a number of special types of benefits. For example, for pregnant wives of military personnel serving on conscription, a one-time payment when transferring a child to be raised in a family and some others.

To understand which of them are entitled to a particular woman, what their amount is in 2021, and who to contact, it is worth examining the main types of benefits in more detail.

Maternity benefit

This benefit is considered one of the main ones and is paid from the funds of the Federal Social Insurance Fund of the Russian Federation. Only women can claim it (unlike child care payments). The B&R benefit has a peculiarity - it applies to the following categories:

- working and subject to compulsory social insurance;

- full-time students;

- Individual entrepreneurs participating in VSS (voluntary social insurance);

- lawyers, military personnel, employees of the Ministry of Internal Affairs, fire departments;

- unemployed if they have been registered as unemployed for 1 year (reason - liquidation of the enterprise).

“Maternity benefits” in the vast majority of cases are paid at the place of work, study or service.

Advice : in certain situations, a woman can independently choose which employer she will receive benefits from. For example, if she leaves one place of work on maternity leave, and before that she was employed in another place (or others) for two years. Also, a woman has the right to receive benefits in several organizations if she worked in them part-time during the previous 2 years before the occurrence of the insured event.

It is important to know! A catalog of franchises has opened on our website! Go to catalog...

There are several main rules for how maternity benefits are calculated:

- The basis is the average salary for the last two years, stipend, allowance (for employees in the armed forces, the Ministry of Internal Affairs, etc.).

- It should be remembered that the average earnings are calculated with the deduction of those days when the woman was on sick leave or was released from work with the same salary, but without accrual of insurance premiums.

- Another nuance is that the average salary, which is taken as the basis for calculation, is limited by law; it cannot exceed the base for calculating insurance premiums. The limits are RUB 624.0. for 2014, 670.0 rub. for 2015, 718.0 rub. for 2021. The maximum base for 2021 will be established by the Government in December 2016.

- Individual entrepreneurs and unemployed people (see the last category) will be able to receive payments, where the base is daily earnings according to the minimum wage, which in 2021 amounted to 246.58 rubles. It may change in 2021.

- In addition, the duration of the vacation under the BiR is included in the calculation. Its standard period is limited to 140 days, but in some cases it can be increased. 16 days are added for complications and difficult births, 54 days for the birth of twins, triplets, etc.

- A woman should take into account that, in connection with recent changes in legislation, her desire to work during the period of maternity leave may affect the amount of material payments to her. That is, she can receive either a B&R benefit or a salary, but not both at the same time. The rule of paying one benefit is also applicable here if a woman has the right to it in the format for BiR and for child care in the same period. Here you need to choose one thing; it is impossible to claim both types of payments.

Advice : many people postpone important actions until the last minute, and then they have difficulties with registration, receipt, confirmation... That is, we catastrophically do not have time to contact the authorities, submit documents, and, accordingly, we miss our chances for compensation, benefits, benefits . Therefore, before you start thinking about what to do to earn money while on maternity leave, you should prepare the ground for receiving assistance in this matter from the state “to the maximum.” Here you need to know that the period for applying for benefits under the BiR ends after 6 months. after the end of maternity leave. Often, many of us, for reasons of varying importance, break this rule. However, each woman has the opportunity to contact the territorial body of the Social Insurance Fund after the specified period to exercise her right to payments. In addition, you can defend your interests in court by providing strong evidence that she missed the deadline for filing an application for B&R benefits.

It is also necessary to take into account that if wage coefficients are in effect in the region, they are also used in calculating payments under the BiR.

How to receive maternity benefits?

There are strict generally accepted rules about how and by whom benefits are paid. The same strict parameters established by law include when a woman should be given financial assistance, as well as other compensation, including clearly stated deadlines for the payment of vacation pay according to the labor code, and much more.

The algorithm of actions for receiving benefits under the BiR is as follows:

- you should contact the medical institution where the woman is registered for pregnancy (or register);

- at the 30th week (or at the 28th in the case of expecting twins, triplets, or several babies), the expectant mother must be issued a sick leave certificate for temporary incapacity for work;

- the document must be submitted to the employer’s accounting department;

- payment of the BiR benefit must be made within 10 working days from the date the woman submits the documents.

Advice : if you were employed in several organizations/enterprises during the period for which benefits were calculated, and now you are working at the next place where you plan to receive payments, then you may be required by the accounting department to provide a certificate from previous employers stating that you did not submit documents to them to receive benefits under the BiR. This action is legitimate, so it is advisable to take care of this problem in advance, contact previous employers, clarify their addresses and work schedule, and pre-arrange a visit so as not to look for them later and not waste time waiting. In addition, if you plan to receive payments from several organizations (in the case of part-time work), you need to take from the medical institution as many copies of the sick leave certificate (certified copies, duplicates) as there are employers in your list.

Important nuances of calculating maternity benefits

When calculating vacation pay according to BiR, you should take into account the legally established amounts of maximum and minimum payments. The calculated value is taken as the basic value of the average daily earnings, which is then compared with the limits. In 2017 the following values apply:

The maximum average daily earnings is 1901.37 rubles.

The maximum length of maternity leave is 140 days. – 266,191.80 rub.

The maximum length of maternity leave is 156 days. – 296,613.72 rubles.

The maximum length of maternity leave is 194 days. – 368,865.78 rub.

The minimum length of maternity leave is 140 days. from 01/01/17 – 34,521.20 rubles, based on the minimum wage as of 01/01/17 of 7,500 rubles.

The minimum length of maternity leave is 140 days. from 07/01/17 – 35,901.37 rubles, based on the planned minimum wage of 7,800 rubles.

Features of benefit calculations

When calculating the amount of state subsidy, the last two calendar years preceding the pregnancy are taken into account. For example, to determine the amount of state aid, a specialist will take data for 2015 and 2021. It is worth noting that the annual income taken into account in the calculations should not be higher than the established limit, which is provided for in the base of compulsory social insurance contributions.

When counting the number of working days for a certain period, it is necessary to understand that days off due to illness will affect the overall indicator - it will be lower. As for vacation days, weekends, as well as days off on holidays, they are taken into account in the calculations.

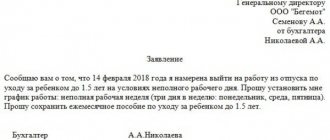

How is maternity leave issued?

To promptly calculate and issue maternity benefits, the employee must provide the company’s accounting department with a correctly executed sick leave certificate, an application, and a certificate of early registration (if available). In this case, it is allowed to postpone the start date of the vacation according to the wishes of the pregnant woman. The benefit is calculated within 10 days from the receipt of all documentation, and calculations are made as soon as possible to transfer the salary/advance payment. The maximum period for registration of maternity leave is 6 months after the end of leave under the BiR.

Early pregnancy benefit

Women can receive the above benefits if they all fit into the following categories :

- are currently working;

- resigned due to the liquidation of the enterprise, suspension of the activities of the individual entrepreneur;

- currently studying full-time;

- are military personnel or belong to similar categories (customs officers, USP, State Border Service, Department of Internal Affairs).

For housewives and temporarily unemployed persons, these payments are not provided when registering with a housing complex at an early stage.

Does length of insurance affect the amount of benefits?

The length of the insurance period has virtually no effect on the amount of benefits. A pregnant woman can only work for a company for a few days. The benefit will be based on the insurance premiums paid earlier.

IMPORTANT! The benefit is calculated based on the “white” salary. That is, even if a woman received 100,000 rubles, but her employment contract indicates a salary of 8,000, the amount will be calculated based on the official salary equal to the minimum wage.

The insurance period does not affect the amount of benefits only if the woman’s work experience is at least six months. If it is less than 6 months, maternity benefits will be 100% of the minimum wage.

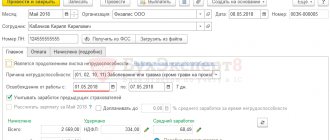

Stages of an accountant's actions

To calculate maternity benefits, the accountant must follow the following algorithm:

- The salary for the 2 years that preceded pregnancy is calculated.

- The average daily fee is calculated. To do this, you need to divide the total amount of earnings for two years by the number of calendar days. That is, you need to divide by 731 days (365 added to 366). From this number of days the number of days that were allocated for study leave and sick leave is subtracted. The average daily wage is compared with the maximum and minimum wages.

- The amount of benefit payments is calculated. To do this, the average daily payment is multiplied by the number of days of sick leave issued in connection with pregnancy.

That is, the amount of benefits depends on the woman’s earnings and the number of days on sick leave.

Changes - 2021 and 2021

In 2021, the state made a number of decisions that make changes to the existing practice of calculating benefits for expectant mothers in Russia. The mechanism itself and the calculation formulas do not change. The main innovation is the introduced rule for indexing payments.

Due to the economic situation in the country, funds paid by the state require indexation. In 2021, this also affected maternity benefits. From now on, every year on February 1, social payments will be revised upward. The coefficient is set annually. In 2021, all established social amounts should be increased by 1.054 times.

On what basis is the benefit calculated?

The benefit is calculated based on the total income received by the employee. It is formed from the following revenues:

- Wage.

- Vacation pay.

- Various bonuses awarded by the employer.

- Payments for business trips.

- Royalties received for copyrighted works, patents.

- Funds accrued for unused vacation.

Other payments may also be included in the amount of income.

When calculating benefits, it is important to take into account many points: the number of days worked, the amount of salary, the amount of bonuses and other accruals. An accountant handles all deductions. He is obliged to study all the nuances and make the calculations correctly.