A power of attorney is a document that is required quite often in the current activities of enterprises and organizations. With its help, the management of a particular company entrusts the performance of certain functions to a trusted person, and also assigns a certain share of its rights and powers to him.

Examples of powers of attorney from a legal entity to an individual:

- to court - to the tax office - to receive goods/money

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What is the “right of subrogation”

Some powers of attorney are issued with the right of substitution. This form of the document means that the principal’s representative has the opportunity, in case of some circumstances, to transfer the functions entrusted to him to another person.

Such powers of attorney are always certified by a notary, and in advance the representative is obliged to notify his principal of the need to delegate the affairs entrusted to him.

It should be noted that in practice this type of paper is not encountered very often. This is due to the fact that it is more convenient for business managers to issue powers of attorney for several people with whom they are personally acquainted rather than trusting someone with the ability to delegate delegated powers.

How to draw up a power of attorney

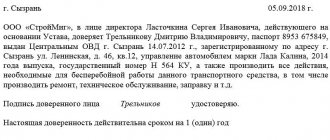

There is currently no single unified form of power of attorney from a legal entity to an individual. Representatives of organizations have every right to draw up a document in any form or according to a template in force in the company. It is important to follow only two basic rules: that in its structure the document complies with office work standards, and in its content it includes a number of mandatory information. These include:

- full name of the enterprise that issues the document, including its constituent details;

- number, place, date of drawing up the power of attorney;

- last name, first name and patronymic name of the person for whom it is issued and his passport details indicating registration at the place of residence.

The main part of the power of attorney must include a complete list of powers, rights and obligations that this document provides to the bearer. Maximum attention should be focused on this section of the power of attorney, spelling out all the points in detail and carefully. If the principal's representative receives the right to sign various types of papers, this must also be noted. Finally, you must indicate the validity period of the document.

Document validity period

This act must contain information about the validity period. It will be invalid:

- if the company has closed;

- if it has been revoked by the principal;

- if the trustee has renounced his new powers.

If notarized papers are revoked, this fact must also be registered with a notary.

According to Article 188.1 of the Civil Code of the Russian Federation, it is possible to draw up irrevocable documents. This means that the principal does not have the right to cancel it until the validity period specified in the text of the document expires. They are drawn up in extreme cases, when it is necessary to control the possible revocation of delegated powers. So such acts are rare.

The document does not cease to be valid even if the director who compiled it is fired. The next head of the company can cancel it immediately after receiving the position. The organization’s archive is kept precisely for this purpose, and papers in it can be found quickly and canceled without wasting time. Otherwise, it will turn out that the new director shares his powers with another person who received such rights from the previous director.

How to draw up a document

The law does not establish any special requirements regarding the execution of a power of attorney, as well as regarding its preparation. This means that it can be formed either on an ordinary sheet of any convenient format or on the company’s letterhead. It is permissible to write a document either by hand or in printed form - this does not play a role in determining its legality.

There is only one immutable point that needs to be taken into account: the power of attorney must contain two signatures, one of which must belong to the authorized person, the second - to his principal. In this case, the second signature certifies the authenticity of the first, therefore the use of facsimile autographs, i.e. printed by any method is excluded.

As for the seal or stamp, it is necessary to certify the form with their help only when the regulatory legal acts of the organization stipulate the requirement to use various types of stamp products.

The power of attorney is always made in one original copy.

Power of attorney to court

Represent the interests of a legal entity, that is, an organization. A citizen can go to court with a power of attorney granted to him. The main thing is to correctly document the powers that are vested in connection with this form of civil relations. This document will confirm the right of an individual (usually an employee) before a court to take certain actions for which the company has authorized him on its behalf.

Legislative requirements for such a power of attorney do not require its strict and unambiguous form, however, the presence of mandatory components is necessary:

- all details of the principal company (you can issue a power of attorney on its letterhead);

- place and date of drawing up the power of attorney (the date is usually written in words and not in digital format);

- identification data of the authorized person (indicating his registration);

- an indication of the powers granted (the more precise the better);

- permission or prohibition to transfer powers;

- validity period of the document (at the request of the principal, rights can be revoked at any time);

- signatures of the authorized representative and management of the organization;

- seal (if it is used in the company).

Sample power of attorney for the right of an individual to represent the interests of a legal entity in court

LIMITED LIABILITY COMPANY "LORELEYA" Samara, st. Arzamasskaya, 8, office 1 tel. e-mail

POWER OF ATTORNEY

The twenty-ninth of May two thousand seventeen

Limited Liability Company "Lorelei" (TIN 5467098312 OGRN 956784563123) represented by General Director Anton Vladislavovich Kramarsky, acting on the basis of the Charter,

TRUSTS

citizen Artsybashev Maxim Anatolyevich, staff lawyer of Lorelei LLC, born on August 16, 1998 (passport 03 10 No. 875412, issued on April 12, 2010 by the Central Regional Department of the Ministry of Internal Affairs of Krasnodar) residing at the address: Samara, st. Aeroflotskaya, d. 26, kv. with which it provides special rights: signatures of all documents necessary for the high-quality execution of this instruction, including petitions, reviews, settlement agreements; submission and receipt of certificates, copies, documents that may be required during the trial.

The power of attorney was issued without the right of substitution for a period of 3 years.

/Artsybashev/ M.A.Artsybashev Signature M.A. I certify Artsybashev. General Director of Lorelei LLC /Kramarsky/ A.V. Kramarsky M.P.

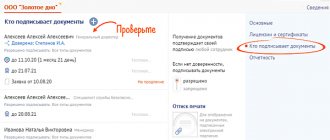

Confidant

An authorized person can be either an individual citizen or a legal entity represented by its director. The principal must have firm confidence in the chosen representative. If necessary, you can specify not one attorney, but several, this will ensure the uninterrupted execution of delegated powers. A sample power of attorney to represent the interests of a legal entity is at the end of this article.

The list of circumstances under which the power of attorney can be terminated early is given in Art. 188 Civil Code of the Russian Federation. It should be noted that the principal has the right to cancel or revoke the power of attorney issued by him at any time. The authorized representative must be promptly notified that the document has lost its legal force.

Power of attorney to the tax office

Upon provision of such a document, a representative of the company can interact with the tax authorities: give or receive any papers, sign, make extracts and perform other actions provided for by law and listed in the power of attorney.

A power of attorney is required if the employee’s right to represent the company in the INFS is not stipulated in the Charter. A notarized declaration of such a power of attorney is required. The required components of a power of attorney are similar to any document of this type: details of the parties, a list of powers, validity period, a statement of the right to sub-power, the signature of the authorized representative and its certification by the management of the company, and, of course, the signature and seal of the management. The power of attorney will not be valid if:

- the date is not indicated or it is in the wrong format (numbers must be indicated in words);

- the signature is not personal, but facsimile;

- the signature of the individual is not certified;

- there is no seal of the organization (except for those cases when it is not used according to the charter);

- blots, corrections, erasures were made;

- there is no corresponding mark on the original power of attorney, if the document is not the primary one, but is being transferred.

Sample power of attorney to the INFS authorities

LIMITED LIABILITY COMPANY "Reconstructor" 620027, Ekaterinburg, st. Lunacharskogo, 15, office 1 tel. e-mail INN 7859306748 OGRN 165728592067486

POWER OF ATTORNEY

Twenty-third of March two thousand seventeen

By this power of attorney, Limited Liability Company "Rekonstruktor" represented by General Director Natalya Mikhailovna Antropkina, acting on the basis of the Charter,

TRUSTS

manager of the branch of Reconstructor LLC in Belorechensk, Krasnodar Territory, Bogatova Anna Vladimirovna, born on July 29, 1976, passport of a citizen of the Russian Federation, series 23 99 number 15364785, issued by the Department of the Federal Migration Service of Russia for the Krasnodar Territory in Belorechensk on October 3, 1999, registered under address: Krasnodar region, Belorechensk, st. Zarechnaya, 19,

- represent the interests of Rekonstruktor LLC in the Federal Tax Service of Russia Inspectorate No. 3 for the city of Belorechensk, for which purpose it gives it the powers to:

- receive and sign acts, certificates, demands, orders on conducting tax audits at the location of the branch, on the results of the audits and other documents addressed to the LLC branch;

- submit accounting and tax reporting, letters, requests, applications and other documents required by the Federal Tax Service of Russia;

- provide explanations to tax inspectorate employees on all issues that arise during the inspection process and as a result of the activities of the LLC branch;

- submit documents and receive extracts from the Unified State Register of Legal Entities in relation to the LLC;

- sign and exercise other powers granted by the tax legislation of the Russian Federation to carry out this instruction.

This power of attorney has been issued for a period of 3 (three) years without the right of substitution.

/Bogatova/ A.V. Bogatova Signature A.V. Bogatova is certified by the General Director of Reconstructor LLC /Anthropkina/ N.M. Anthropkina

Required details

A power of attorney to represent the interests of an organization must contain the following details:

- place and date of execution of the power of attorney (in words); the absence of a date entails the invalidity of the document;

- the date on which the power of attorney comes into force;

- information about the principal;

- information about the authorized person;

- list of delegated powers.

In accordance with Art. 186 of the Civil Code of the Russian Federation, if the text of the power of attorney does not specify the specific terms of its validity, the document remains valid for 1 year from the date of its execution. The maximum possible period of validity of a power of attorney is not specified in the Civil Code of the Russian Federation.

Power of attorney to receive goods/money

This power of attorney helps the sale and purchase transaction proceed as smoothly as possible. Completion of a transaction or delivery of purchased goods always requires the signatures of specific persons - company representatives. The company authorizes its representative to perform all actions necessary for the transaction or acceptance of goods from the supplier on its behalf. Such a document is called a “power of attorney for goods and materials,” that is, for the transfer or receipt of goods and/or material assets.

The form of such a document, unlike other powers of attorney, is not free. To issue a guarantee for receiving inventory items, you need to use form M-2 if the procedure is carried out once, and M-2a if the process occurs on a regular basis. The forms were approved by Resolution of the State Statistics Committee of Russia No. 71a of October 30, 1997.

The form must be filled out on both sides. On the front side, in specially designated columns, indicate:

- OKPO code (as it appears in the statutory documents);

- the date when the power of attorney was issued, its validity period (usually for a month, then a new one can be issued), document number;

- data on legal entities - parties to the transaction;

- bank details of the company making the payment;

- passport details of the individual for whom the power of attorney is issued;

- grounds for issuing inventory items.

The reverse side is intended for information about the inventory items to be transferred: they are listed under serial numbers, the units in which they are measured, and their quantity (in words, not numbers). Blank lines are crossed out. The signature of the authorized representative is also certified on this side.

The power of attorney for goods and materials in form M-2 also has a tear-off spine where its number, expiration date are indicated, signatures are duplicated and links to permits are provided. This counterfoil is supposed to be kept in the accounting department.

In addition to the other components characteristic of any powers of attorney, the document for receipt of inventory materials requires the signature of the organization's chief accountant.

Note! Below is an example of a free form power of attorney. Typical interindustry forms M-2 and M-2a are discussed in detail on a separate page.