Replacing the cashier's journal (KM-4)

The cashier's journal is replaced if it has run out or is lost.

BUY MAGAZINE KM-4 tel

If the cashier-operator’s journal (form KM-4) has expired, then you need to register a new one:

- It is necessary to fill out an application (the form for such an application is given below).

- Provide the “old” journal of the cashier-operator, which should contain a record of the total amount of revenue for the period of operation, certified by the signature of the manager and the seal of the organization.

- Present a “new” magazine (laced, numbered and sealed (for legal entities)).

- Present the KKM registration card specified in the application. If several magazines are registered, then all cash registers are listed in one application and all registration cards must be submitted.

- A power of attorney for the right to register a journal with a tax authority, drawn up in the prescribed manner (Article 185 of the Civil Code of the Russian Federation), is required if the registration of the cash register will be carried out not by the manager (individual entrepreneur), but by any other employee of the organization and an identification document.

- Attention! The cashier-operator's journal (KM-4) is registered with the tax office along with the cash register. Therefore, an application for registering a journal is only necessary if the “old” one has ended.

REPLACEMENT OF CASHIER OPERATOR'S JOURNAL APPLICATION

| To the Head of the Inspectorate Federal Tax Service of the Russian Federation No. ___ for Moscow From__________________________ Taxpayer Identification Number________________________ Legal address___________________ _____________________________ Tel._________________________ |

Filling out and maintaining the cashier's journal (form KM-4)

Standard rules for the operation of cash registers when making cash settlements with the population, which also determine the procedure for keeping entries in the journal, were approved on August 30, 1993. Form KM-4 of the cashier-operator's journal was approved by Resolution of the State Statistics Committee of the Russian Federation No. 132 “On approval of unified forms of primary accounting documentation for recording trade operations” on December 25, 1998. During this time, changes have occurred in the fleet of cash register equipment. The appearance of the Z-report has changed. There were many questions about keeping a journal for a cashier-operator. This section covers in more detail the basic rules for keeping a journal for a cashier-operator.

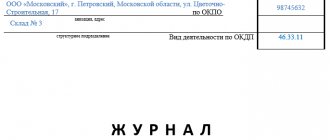

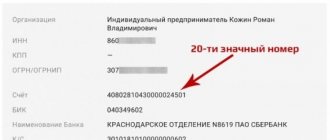

The cashier-operator's journal is the main document reflecting the movement of cash in the store's cash register. Each cash register has its own journal. Keeping a cashier's journal requires responsibility and accuracy. The cashier-operator's journal must be laced and numbered. The journal, after being signed by the head and chief (senior) accountant of the organization and sealed, is certified by the tax inspector to the Federal Tax Service. All entries in the journal are kept by the cashier-operator in chronological order in ink or a ballpoint pen. The records are confirmed by the signatures of the cashier, the organization administrator, and the senior cashier. If corrections are made to the journal, they must be agreed upon and certified by the signatures of the cashier-operator, the manager and the chief (senior) accountant of the organization and the seal. On the cover of the magazine you must indicate the details of the organization (IP), codes (OKPO, OKUD), information about the cash register, the period for which the magazine is being created, the position, surname, name, patronymic of the person responsible for maintaining the magazine.

The cashier-operator's journal contains the following columns:

Column No. 1 indicates the current date.

In column No. 2 – department (section) number. This is necessary if the cash register serves several trading sections, and the organization maintains separate revenue records for them.

In column No. 3 - last name, first name and patronymic of the cashier-operator.

Column No. 4 indicates the number of the Z-report corresponding to the current date, which must be printed on the report itself and has continuous numbering from 1 onwards. Do not be confused if you come across in some documentation the terms “shift cancellation number”, as well as “counter that records the number of transfers of summing money counters to zero”; they mean the same Z-report number.

In column No. 5 you must put a dash. The indicators in column 5 are filled out by tax inspectors only when re-registering cash registers. However, as a rule, they do not do this.

Column No. 6 contains the readings of the cash register counter “Non-zeroable cumulative total” at the beginning of the shift, which are indicated in the Z-report. The readings at the beginning of the day are the same readings as the evening of the previous day. If there is no revenue, then the meter readings are repeated daily and certified by the signature of a representative of the enterprise administration.

Attention!

Not all cash register models automatically display the readings of the “Non-zeroable cumulative total” counter in the Z-report (for example, “Mercury”-130K). In this case, you need to calculate it yourself. How to do this is indicated in the commentary to column No. 10.

In columns No. 7 and No. 8, respectively, are the signatures of the cashier-operator and the administrator (senior cashier).

Column No. 9 contains the readings of the cash register counter “Non-resetable cumulative total” at the end of the shift. This counter is called differently for different cash registers, for example: “main summing cash counter”, “cumulative total”, “total”, “total counter”, “gross total” (you can see the latest wording in the following sample Z-report).

In column No. 10 - the amount of revenue per shift, according to the readings of the cash register counter in the Z-report. This counter may also appear in the documentation under different names: “total amount”, “total”, “changeable total”. Defined as the difference between columns No. 9 and No. 6.

Attention!

If the cash register does not indicate the readings of the “Non-resetable cumulative total” counter in the Z-report, then you can immediately write down the amount of revenue for the day indicated in it, and then, by summing columns No. 6 and No. 10, display the readings of the “Non-resetable cumulative total” counter on end of the shift and enter them in column No. 9. The readings of this counter usually correspond to the actual cash revenue of the enterprise for a specific cash register. However, if you accept “non-cash” payments, make refunds to customers, and also in some other situations, you will need to use columns No. 11 and No. 15.

In column No. 11 – the amount of cash (revenue).

In columns No. 12 and No. 13, respectively, the number of payment documents (bank checks, etc., if they are accepted by the organization) and their total amount paid for these documents. If these documents are missing, columns No. 12 and No. 13 are not filled in; dashes must be added.

Column No. 14 indicates the total amount of revenue (No. 11 + No. 13).

Column No. 15 reflects the amount of money returned to customers for unused (including erroneously punched) checks. The sum of columns No. 14 and No. 15 must correspond to the amount indicated in column No. 10.

Attention!

You can return money from the daily revenue of a given cash register only using checks punched during the current shift. The checks must be accompanied by an act in form KM-3 “ON THE REFUND OF MONEY TO BUYERS FOR UNUSED CASH RECEIPT (including erroneously punched cash receipts).” In other cases, the refund is carried out upon application through the accounting department (cash office) of the enterprise.

In columns No. 16, No. 17 and No. 18 - signatures of the relevant officials. Maintaining the cashier-operator's journal is entrusted to the official appointed by order of the manager. As a rule, this is the cashier-operator, and it is he who must sign it daily. According to the “Procedure for conducting cash transactions in the Russian Federation” approved by the Central Bank of Russia dated September 22, 1993 (clause 33), an agreement on full financial responsibility must be concluded with the cashier-operator.

To replace the journal, the following documents are required: - an application in any form; - old journal of the cashier-operator; — a new cashier-operator magazine; — cash register (if the cashier-operator’s journal is lost); — power of attorney (for individuals – notarized); — last Z-report.

Useful links:

Cashier training courses

Price list for services

Forms and forms to be filled out by a cashier/accountant when working on a cash register

Laws, governing documents regulating the use of cash registers

Replacing the cashier-operator's journal upon completion

In a situation where the taxpayer - owner of a cash register no longer has space in the cashier-operator's journal to make entries on cash transactions, it is necessary to create a new document, and the old one, having made a note in it with the tax authority about its completion, keep it for storage for a period up to 5 years. In this case, the cashier must reflect, after all entries on the last page of the journal, the total amount of revenue that has accrued throughout the entire journal from the very beginning of its use until the final transaction reflected in it. The specified information is certified by the signatures of the cashier, manager and chief accountant, after which a stamp is affixed (if any). In this form, the magazine is sent to the tax office.

The new journal is registered with the tax authority simultaneously with the closure of the old journal.

To carry out these procedures, the taxpayer must submit:

- Application for replacement of the cashier-operator's journal.

- The finished magazine itself.

- Z-report, the entry for which was final in the journal used.

- New magazine.

- A document confirming the registration of the cash register.

- Power of attorney for the person who submits these documents (if this is not the manager or the chief accountant).

For information on the procedure for conducting cash transactions, see the material “Incoming and outgoing cash transactions (features).”

The cashier-operator's journal has run out - what to do next?

In form No. KM-4, which is the cashier-operator’s journal, all pages are sequentially filled out until it runs out.

Important! The period for using one journal is not established by law, therefore, if it is more convenient for an organization or individual entrepreneur to start a new journal every year, you can do this, while observing all the rules for closing an old document and opening a new one.

For information on how to fill out the KM-4 form, see the material “Unified Form No. KM-4 - Form and Sample.”

When completing the journal, you should make an entry in it about what total amount of revenue was reflected from the moment of its registration with the Federal Tax Service until the specified entry, and certify this information with the signatures of the person responsible for maintaining the journal, the chief accountant and the manager. The completed journal should be closed by submitting it along with the last Z-report to the Federal Tax Service, which, in turn, must mark the completion. Such a journal is stored for 5 years (Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”).

How to fill out the cashier-operator's journal during a planned replacement of EKLZ?

How to fill out the columns of the cashier's journal (form No. KM-4) during the planned replacement of a secure electronic control tape (ECLZ), in particular, columns 10, 11, 12, 13, 14, 15? Is it necessary to indicate the words “Act No..” if the replacement took place, for example, on April 17, 2015, and there were no more cash transactions on that day?

The cashier-operator's journal (form No. KM-4, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132) is used to record transactions for the receipt and expenditure of cash (revenue) for each cash register machine of the organization, and is also a control and registration document of meter readings.

Instructions for the use and completion of primary documentation forms for recording cash settlements with the population when carrying out trade operations using cash registers, approved. Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132, does not regulate the procedure for filling out the Cashier-Operator Journal (form No. KM-4) in the event of replacing secure electronic control tapes (EKLZ).

In our opinion, on the day of replacing the EKLZ, the following entries must be reflected in the cashier's journal (form No. KM-4):

1) First of all, create a record indicating the readings of the Z-report taken immediately before replacing the ECLZ:

• in column No. 1 – the date of the Z-report;

• in column No. 2 – department number;

• in column No. 5 – Z-report number;

• in column No. 6 – meter readings at the beginning of the working day (for example, 10,000 rubles);

• in column No. 9 – the amount before replacing the ECLZ (for example, 17,900 rubles);

• in columns No. 10, 11, 12, 13 and 14 - the amount of revenue at the time of replacement of the EKLZ (column No. 9 minus column No. 6 (for example, 7,900 rubles)).

2) Next, you should create a record, indicating the readings of the Z-report with the verification amount of the accumulation (for example, 1.11 rubles):

• in column No. 1 – the date of the Z-report;

• in column No. 2 – department number;

• in column No. 5 – Z-report number;

• in column No. 6 - meter readings at the time of replacement of the EKLZ (in our case - 17,900 rubles);

• in column No. 9 – the amount together with the taken test Z-report (RUB 17,901 11 kopecks);

• in column No. 10 – check amount 1 rub. 11 kopecks This amount is entered when the cash register is put into operation to check the correctness of its operation and is reflected in the act in form No. KM-2 “On taking readings of control and summing cash counters when handing over (sending) the cash register for repair and when returning it to the organization” , approved Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132. The act in form No. KM-2 is the basis for the appearance of this amount in the memory of the cash register.

Please note that the verification amount is 1.11 rubles. is not subject to accounting and tax accounting, since in its essence it is a control (technical) one, while:

- not indicated in columns No. 11, 12, 13 and No. 14, since it is not handed over in cash to the cash desk and is not paid by card;

- reflected in column No. 15.

3) Then you should create a record, indicating the readings of the Z-report and the amount of revenue after replacing the ECLZ:

• columns No. 1, 2 and 5 are filled in similarly to the previous order;

• in column No. 6 – 17,901 rubles are indicated. 11 kopecks;

• in column No. 9 – meter readings at the end of the working day are reflected (for example, 17,901 rubles 11 kopecks, since in your case there were no more cash transactions on that day).

• in columns No. 10, No. 11, 12, 13 and No. 14 - indicate the amount of revenue after replacing the EKLZ (for example, in the case under consideration, 0 rubles, since there were no other cash transactions).

All the most complete information on the procedure for using cash register equipment (CCT) can be found in the “Cash register equipment” directory in the “Legal support” section in IS 1C:ITS.

The 1C:ITS information system is updated every day and contains ready-made advice on accounting, tax and personnel records.

It is quite possible that the answers to the specific practical questions that you are currently looking for are already in the “Auditor Answers” section of the 1C:ITS Information System. And in order not to miss the latest expert consultations and other useful information, you can subscribe to the free newsletter: https://its.1c.ru/news/subscription.php

You can enter into an information technology support agreement with a recommended partner

More about 1C:ITS

Application form to the tax office for registration of a cashier-operator's journal using the KM-4 form

- home

- About company

- Services Price list for works and

- Repair of commercial equipment

- Cash register repair

- Replacing the fiscal drive in a cash register

- Repair of scales

- Checking the scales

- Maintenance and repair of banknote detectors

- Maintenance and repair of banknote counters and sorters

- Maintenance and repair of payment terminals

- Questionnaire for generating a commercial offer for automated deposit machines

- Application for trade automation

- CCP with online data transfer

- EGAIS

- All news

- Forum of specialists

- general information

- Our client is the chain of branded confectionery shops "Sever-Metropol"

- CEO