If an organization acquires or produces a part of a mechanism, an element of equipment, a car, and then installs it somewhere, then an act of installation of material assets may be needed to document this fact.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

This document will be a reliable basis for writing off installed material assets (after completion of the installation process). In addition, it will confirm the fact that the installer has fulfilled his duties in full.

If, before installing material assets, the organization does not have them, then they are acquired and taken into account. In addition to equipment, such a document can be issued for the installation of facade elements, decor and other functional items of the organization’s premises. This applies to canopies, doors, barriers, etc.

Mandatory requirement: the act must include several people as the chairman and members of the commission. Their captions at the bottom give the data more credibility.

There is no approved form for this document. Each organization has the right to decide for itself which form to use. The main thing is to consolidate its use by a separate order of the manager and ensure its presence in the accounting policies of the organization. The attached form and sample are forms that you should refer to as they meet all the requirements. The latter are set out in the Federal Law on Accounting No. 402-FZ of December 6, 2011, and more specifically in its 9th article.

Approximate form of a computer kit act

________________________________________ I APPROVED (name of organization) ______________________________ (name of position) ______________________________ (signature, transcript of signature) ________________ (date) ACT N _______ _________________ (date) To carry out the assembly of _____________________________________________ (name of the object), the following materials (components) were used: ————— ———————————————————— ¦ N ¦ ¦ Factory ¦ Nomenclature - ¦ Quantity ¦ Unit price, ¦ Cost, ¦ ¦ n/n ¦ Name ¦ number ¦ tour N ¦ ¦rub. ¦ rub. ¦ +—+————+————+———-+——-+————-+———-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+————+ ————+———-+——-+————-+———-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+————+————+———- +——-+————-+———-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+————+————+———-+——-+———— -+———-+ ¦ ¦ ¦ ¦ ¦ ¦ ¦ ¦ +—+————+————+———-+——-+————-+———-+ ¦ TOTAL ¦ ¦ —————————————————————+———— Vacation allowed ____________________________ Released ____________________________ The components received were capitalized as an item of fixed assets: ————————— ————————————— ¦ ¦ ¦ Cost, rub. ¦ ¦ Name ¦ Inv. Number +—————————+ ¦ ¦ ¦ Units ¦ Total ¦ +————————+————+———-+—————+ ¦ ¦ ¦ ¦ ¦ ————————-+————+———-+—————- The above object is completed (delete what is not necessary): with our own resources; with the involvement of a third party organization/individual. Upon completion of the configuration and diagnosis of conflicts, no equipment has been installed and the facility is ready for operation.

Number of copies

The installation act is a “safety cushion” for organizations that install and install various types of equipment, structures, etc. Therefore, the act is usually drawn up in at least two copies. One is needed for the customer, the other for the installation contractor.

If the customer goes to court, the contractor can always prove through an act that the work was at least carried out.

Even if an organization installed material assets on its own, this document must appear in the financial statements to calculate remuneration for the employee who carried out the installation. It is also needed to write off acquired material requirements, followed by adding their value to the total value of equipment or other property of the organization.

Certificate of completion of installation (assembly) of structures (sample)

__________________________ _____________ _____________________ (position name) (signature) (signature transcript) __________________________ _____________ _____________________ (position title) (signature) (signature transcript) __________________________ _____________ _____________________ (position name) (signature) (signature transcript)

A COMMENT

The form of this document is provided as an example. The use of this form is not necessary, since it is not included in the list of primary accounting documents approved by Resolution of the Council of Ministers of the Republic of Belarus dated March 24, 2011 N 360.

The list of mandatory information that primary accounting documents must contain is provided in subparagraph. 1.4 Decree of the President of the Republic of Belarus dated March 15, 2011 N 114 “On some issues of using primary accounting documents.”

Published in: Act, Accounting, Economics

Decor

The act can be printed or written by hand. Specialized forms of the organization and regular A4 paper are used. The main thing is that the information contained in the installation certificate meets the requirements for official documents and contains the necessary data in full.

Corrections to official documents are not encouraged. That's great rarity. If an error was identified before signing, the act is reprinted or rewritten. If the error was discovered after the manager’s approval and the act was entered into the appropriate registers, then corrections will have to be made according to the general requirements.

It is necessary to cross out incorrect information with one line (so that it remains readable), and write the correct information above it (or next to it). At the same time, the correction is marked with the inscription “Corrected”, the date and signatures of all persons who signed the original version.

Form OS-1. Certificate of acceptance and transfer of fixed assets (except for buildings, structures)

Acceptance and transfer certificate in form OS-1

used for registration and accounting of operations of reception, acceptance and transfer of fixed assets

(except buildings, structures)

in an organization or between organizations to include objects in fixed assets and record their commissioning, received by:

- contracts of purchase and sale, exchange of property, donation, financial lease;

- by purchasing for a fee in cash;

- production for own needs and commissioning;

- disposal from fixed assets upon transfer (sale, exchange, etc.) to another organization.

Blank form Act OS-1. Instructions for filling

To disassemble the kit, a special act is required

Trading companies often sell different but complementary products in a set. For a completed new product, a separate number is usually created in the nomenclature (if, of course, the organization uses this method of accounting for inventories - clause 3 of PBU 5/01). A new cost price is formed for the set, and the accounting cost may differ from the tax cost by the amount of expenses associated with completing the set.

The fact is that such costs are included in the accounting cost of goods (clause 6 of PBU 5/01). In tax accounting, the direct expenses of trade organizations include only the costs of delivering purchased goods to the warehouse (Art.

320 of the Tax Code of the Russian Federation). But the fun begins when the buyer returns the set because it is defective.

In this case, the company, in turn, can make claims to the suppliers of the components of the kit.

But in order to send the unusable product back to the supplier, it is necessary to practically “unstick the dumpling” - you will have to disassemble the set into its original components. To reflect the depletion in accounting, you need to draw up a corresponding act. It should indicate the name, item number, cost of the kit and its components.

There is no unified form for such a document.

Therefore, the company itself can develop the form of the act and record it in the accounting policy (of course, taking into account the requirements of paragraph 2 of Article 9 of the Federal Law of November 21, 1996 No. 129-FZ).

We offer a sample of such an act.

Form OS-1a. Certificate of acceptance and transfer of buildings (structures)

Acceptance and transfer certificate in form OS-1a

used for registration and accounting of operations of reception, acceptance and transfer

of buildings (structures)

in an organization or between organizations for the inclusion of objects in fixed assets and accounting for their commissioning, received by:

- contracts of purchase and sale, exchange of property, donation, financial lease;

- by purchasing for a fee in cash;

- production for own needs and commissioning;

- disposal from fixed assets upon transfer (sale, exchange, etc.) to another organization.

Blank form Act OS-1a. Instructions for filling

Unified form MX-3: sample of filling out form MX-3, act of return of goods and materials deposited for storage

Return of goods and materials deposited in storage

Using the unified form MX-3, an act on the return of inventory items deposited is filled out. The form of this form was approved by Decree of the State Statistics Committee of Russia dated 09.08.99 No. 66.

The company has the right to take property belonging to other companies for storage, obliging to ensure its safety on a paid (reimbursable) or free (gratuitous) basis. Typically, in this case, form MX-1 is filled out. Act MX-3 is drawn up when returning inventory items deposited for storage to the owner.

In addition to the list of valuables returned to the owner, the act also indicates the volume and cost of services that were provided by the custodian. Therefore, there is no need to draw up additional documents on the provision of storage services.

You have the right not to use the unified form MX-3, but to develop the form yourself, using the unified form MX-3 as a sample to fill out.

The unified form MX-3 must be drawn up in two copies - one for the custodian company and one copy for the bailor. The company that accepted the valuables for storage is responsible for filling out the form. An organization that provides services under storage agreements, on the basis of acts in forms MX-1 and MX-3, keeps a log of inventory items deposited in storage in form MX-2.

In the header of the form, you must write down the details of the organization that accepted the valuables (address, telephone, OKPO code, etc.) and the details of the company that handed over the valuables (name, address, telephone). In addition, it is necessary to fill in the number and date of conclusion of the storage agreement, and the type of operation.

Then you need to put the number and date of the form. The main part of the document is a table of 10 columns:

- Product serial number;

- Product name and type of packaging;

- Code;

- Product Detail;

- Name of the unit of measurement;

- OKEI code;

- Quantity (mass);

- Price;

- Price;

- Note.

Further, under the table describing the goods transferred for storage, there is another small table about the services performed by the custodian company and accepted by the company that deposited the valuables. The table consists of nine columns:

It is worth noting that you have the right to expand or narrow columns and rows, and add rows to the table. If necessary, you can enter additional details into the document. However, please note that changing or deleting details approved by the State Statistics Committee of Russia in the form is prohibited.

Next, the cost of services is written down in words and the amount of VAT, the act is signed by the parties. A line is provided for special marks, if any.

In order not to waste a lot of time and fill out the form without errors, check out the example of filling out the MX-3 act:

Certificate of acceptance and transfer of goods and materials for storage

Primary documents | 11:36 December 15, 2014

Form OS-1b. Act on acceptance and transfer of groups of fixed assets (except buildings, structures)

Acceptance and transfer certificate in form OS-1b

used for registration and accounting of transactions of reception, acceptance and transfer of groups of fixed assets objects

(except buildings, structures)

in an organization or between organizations for inclusion of objects in fixed assets and accounting for their commissioning, received by:

- contracts of purchase and sale, exchange of property, donation, financial lease;

- by purchasing for a fee in cash;

- production for own needs and commissioning;

- disposal from fixed assets upon transfer (sale, exchange, etc.) to another organization.

Blank form Act OS-1b. Instructions for filling

Act of staffing objects

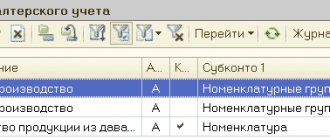

— — After selecting the accounting procedure Depreciation calculation, details become available on the tab, which must be filled in for the correct calculation of depreciation.

Similarly, fill out the Tax Accounting tab to calculate tax depreciation for this fixed asset.

I will tell you in more detail about fixed asset accounting in a special course. After entering all the details, we submit the document.

When posting, the following transactions will be generated: Form OS-1 Certificate of Acceptance and Transfer of Assets is printed from the document. Thus, the acquisition, installation and acceptance for accounting of a fixed asset from several components is reflected in the 1C Enterprise Accounting program 8.2. After a group of specialists decides to begin partial liquidation, the head of the company must issue another order, which will determine the accounting procedure for this process. To document partial liquidation, a commission is created by order of the General Director, which includes the chief accountant and employees responsible for the safety of objects (clause

77 Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). After a group of specialists decides to begin partial liquidation, the head of the company must issue another order, which will determine the accounting procedure for this process. In the meantime, the commission draws up an act for writing off the original fixed asset as a result of its partial liquidation.

Equipment installation certificate

Inventory card for group accounting of fixed assets

An inventory card according to this form is used to record the availability of fixed assets, as well as to record their movements within the organization. The document is kept in a single copy by the accounting department of the enterprise for a group of objects. An inventory card is created for a group of objects at the time these objects are accepted for accounting on the basis of acts of acceptance and transfer of fixed assets and accompanying documents (technical passports of manufacturing plants, etc.).

Form form Card OS-6a. Instructions for filling

Add-ons

Since there is no generally accepted form, for greater efficiency and convenience, the heads of organizations (perhaps at the suggestion of clerks, accountants, personnel officers or other employees) change the standard form of the document, supplementing it with the following points of the main part:

- Links to acts according to which material assets are accepted for installation.

- If a legal entity or individual entrepreneur used the services of other organizations, then the manufacturer, supplier, shipper, carrier, as well as the direct installation organization carrying out work on connecting structural elements may be designated.

- In addition to the name of the part (structural element or other material assets for installation), the passport number or marking, brand, date of receipt or manufacture are entered.

Form OS-6b. Inventory book for accounting of fixed assets

This form of fixed asset accounting can be used in small enterprises. Records about fixed assets are made by an accountant on the basis of primary documents confirming: receipt, movement, repair, disposal and other types of business transactions. Such documents may be: Form OS-1 “Act of acceptance and transfer of fixed assets”, Form OS-2 “Invoice for internal movement of fixed assets” and others.

Form form Book OS-6b. Instructions for filling

Installation of spare parts

If there is a need for repairs and installation of spare parts, the organization can perform the required work on its own, if there are appropriate specialists on staff, or with the involvement of outside workers and concluding an agreement with them to provide the necessary services. In this case, the document will be considered the basis for further write-off of spare parts that were used, and will also serve as confirmation of the subsequent completion of work on the installation of parts.

An organization does not always have parts for repairs; then, before carrying out work, you must first purchase spare parts and register them as material assets belonging to the company, and only after that carry out replacement with the execution of the necessary installation certificate.

Private companies have no restrictions on the use of forms. Details can be entered into the list on the basis of invoices or receipt orders received, and the organization, if there is such a need, can develop some original forms for this purpose. The use of unified forms is not required by law, but any form must contain the company’s current details. After purchase, spare parts are processed in the warehouse and entered into the documents used for accounting, or, if necessary, sent directly to the company department that needs these parts.

For those organizations that are institutions, there are guidelines and forms for such a case. For received spare parts and their registration, a corresponding receipt order and a special approved form are used. Accounting is carried out in the appropriate book or cards of material assets, and issuance to departments is made when the corresponding invoice is issued, with the completion of the statement.

After installing the spare parts, the commission makes an appropriate decision to write off the used valuables, and also draws up a special act confirming this. The document is signed by the manager and sent to the accounting department. Institutions use an approved form for write-offs.

Certificate of installation of material reserves sample 230 download in Excel

The completed and signed form is sent to the manager for approval. At this point, the formation of the act of writing off supplies is considered completed.

In budgetary institutions, an institution located in the budget department, when moving material assets and displaying relevant transactions in accounting, can use the document forms given in Instruction No. 62 n (clauses 24-25).

This is how inventories and food products are written off in budgetary institutions on the basis of such forms as: 0504202 Menu-requirement on the basis of which food products are issued 0504203 Statement allowing the issuance of feed and fodder 0504210 Statement on the issuance of material assets for the needs of the organization 0504230 act on write-off of inventories 0504143 act on write-off of soft and household equipment In some cases, budgetary organizations may use non-unified forms of documents.

In an institution, the write-off is documented in a document in the form 0504230 - an act on the write-off of inventories. Act of installation of material assets: sample Since there is no legally approved form for such an act, the organization has the right to develop and approve the form of this document itself. First of all, the installation report indicates information common to all primary accounting documents:

- title of the document (for example, “Act of installation of spare parts on a car”);

- date of document preparation;

- name of company;

- information about the equipment (vehicle, etc.) on which spare parts are installed (brand, number and other characteristics);

- information about installed spare parts (name, characteristics, cost, service life);

- information about the persons who drew up the act and their signatures.

We draw up an act on the write-off of inventories - f. 0504230

Attention

The second remains with the financially responsible person as a document confirming the disposal of the material. How long to store The act is stored in the archives of the institution for at least five years. Responsibility The commission is responsible for drawing up documents, checking materials, establishing complete wear and tear or unsuitability of items.

Form 0504230. act on write-off of inventories

Important

In case of destruction of inventory items, approved documents must be attached. The responsible persons in the document are members of the commission for the receipt and disposal of assets. They are appointed by order of the head of the institution. Approved by the head of the organization (in the form).

Step 3.

Blanker.ru

After transferring the property and filling out the above points of the document, the commission members sign in accordance with the reality of the transaction, thereby bearing collective responsibility in the event of an unjustified or other criminal act related to the write-off of tangible assets. The completed document, according to the rules, must be handed over to the authorities exercising control over the actions of this type of organization or institution. If the facts reflected in the document raise doubts or are clearly untrue, an inventory check of the property may be ordered, which will reveal the validity and correctness of the write-off of material assets. Below is a standard form and a sample act on the write-off of inventories, a version of which can be downloaded for free.