» IP management » Cash desk

A fairly large number of individual entrepreneurs are increasingly using non-cash payments and paying less attention to making cash payments, which leads to the need to maintain special records.

Since the spring of 2014, according to the instructions of the Bank of the Russian Federation, a cash register must be kept exclusively by those entrepreneurs who pay their employees in cash, that is, directly through the cash register and the operator. Not all individual entrepreneurs pay wages using bank cards, so each such individual entrepreneur must know everything related to maintaining such an important document as a cash book. The main thing is to competently and correctly maintain cash books in 2021, making sure to know all the intricacies of filling them out.

- 2 Procedure

- 3 Basic rules for filling out the cash book 2019

- 4 Correction of mistakes made when filling out

Why keep records of income on PSN

Despite the fact that the cost of a patent does not depend on the revenue received, it is necessary to organize accounting. The income book of individual entrepreneurs on PSN is a tax register, the maintenance of which is mandatory (clause 1 of Article 346.53 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 04/27/2020 No. 03-11-10/33984).

With the help of the income accounting book (ILR), the entrepreneur confirms that he has the right to apply the patent tax system. If his income exceeds 60 million rubles, he will lose the opportunity to work for PSN (subclause 1, clause 6, article 346.45 of the Tax Code of the Russian Federation).

Recording your income helps you avoid fines. If there is no income accounting book, the entrepreneur has nothing to present to the inspectors during a tax audit - they will be fined for this (Article 93, Article 120, paragraph 1 of Article 126 of the Tax Code of the Russian Federation).

The book will also help confirm income when applying for a loan from a bank, or when participating in auctions (tenders, purchases). Information from it can be used in management accounting to analyze sales, deliveries, etc.

Why do we need a cash register for PSN and UTII payers?

For those who are familiar with the methodology for calculating tax under these special regimes, it is clear that a cash register is not required for this. The tax is calculated not on the basis of actual revenue received, but on the basis of income assumed by the state.

The basis for calculating the tax for retail trade on UTII and PSN is a physical indicator - a square meter of retail space or one retail space (with an area of up to 5 sq. m). Accordingly, the larger the retail space, the higher the tax payable.

Get a free tax consultation

The average tax amount per 1 sq. m of retail space for a store on PSN is quite difficult to display due to many nuances of regional legislation. But if we talk about calculating tax per 1 sq. m for sellers on UTII, then this can be done using the formula: DB * FP * K1 * K2 * 15%.

Starting from 2021, UTII has a new K1 coefficient of 1.868. The maximum possible regional coefficient K2 is 1. BD and FP indicators for retail are in Article 346.29 of the Tax Code of the Russian Federation.

We consider (1800 * 1 * 1.868 * 1) * 15%, we find that the maximum possible tax per 1 sq. m of retail space of the payer of the imputation will be 504.36 rubles per month. Is it a lot or a little? If we take as a calculation a small store with a sales area of 20 sq. m, then this is already 10,087.2 rubles per month or 30,261.6 rubles per quarter. The tax burden is quite decent for a small business, even if we take into account that the calculated quarterly tax can be reduced by contributions paid for employees or individual entrepreneurs for themselves.

However, the state believes that revenues from UTII payers are scanty compared to other regimes, and this is the main reason why the imputation was planned to be abolished in 2021. But they have not yet canceled it and extended it until 2021.

Why then do we need a cash register for individual entrepreneurs and organizations on EVND and PSN, if reports are not needed to calculate tax Z? Legislators explain this by protecting the interests of consumers who require confirmation of the fact of sale. Apparently, the sales receipt, which in these modes is issued by the seller at the buyer’s request, is not such a confirmation.

As a result, the new law on cash registers obligated stores and catering establishments operating on imputation and patent to use cash registers when making payments to consumers. And it is unlikely that the previous order of work without cash registers will ever be returned.

Where to get a book and how to design it

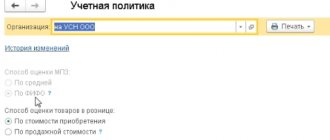

The form of the income book for individual entrepreneurs on PSN and the procedure for filling it out were approved by Order of the Ministry of Finance dated October 22, 2012 No. 135n (Appendices 3 and 4). You can buy the book, print it on paper and enter the information by hand. Or you can do it on a computer or in a special program.

Before starting to maintain a paper book, lace it up, number it, indicate the number of pages on the last page, affix the individual entrepreneur’s signature and seal (if any). The e-book is designed in the same way (numbered, stitched, certified), but all this is done after it is printed at the end of the year.

There is no need to certify the income book with the Federal Tax Service (Letter of the Ministry of Finance dated December 29, 2012 No. 03-11-09/100).

How to fill out a patent income book

When registering a CUD, follow the rules (clauses 1.1-1.3 of the Procedure for maintaining a book, approved by Order of the Ministry of Finance dated October 22, 2012 No. 135n):

- for each new tax period (the period for which the patent was issued) - a separate book;

- Make all entries in Russian continuously during the patent activity in the calendar year;

- enter in the book only those incomes received from the types of activities specified in the patent;

- Record operations in chronological order based on the primary report.

Previously, entrepreneurs kept income books separately for each patent (clause 1 of Article 346.53 of the Tax Code of the Russian Federation as amended before 01/01/2017). Now there is no such requirement.

If you have received several patents in different regions, and it is more convenient for you to keep track of income separately for each, no one can prohibit you from registering several books.

What you need to have time to do as an individual entrepreneur on UTII before July 1, 2018

To avoid penalties, an entrepreneur on UTII needs to do the following before the deadline for connecting an online cash register:

- purchase a modern online cash register that meets the requirements of the law and is approved for installation by the tax authorities (the list of cash registers approved for operation is published on the Federal Tax Service website);

- connect the outlet to the Internet (if there was no network before);

- register on the website nalog.ru, create a personal taxpayer account;

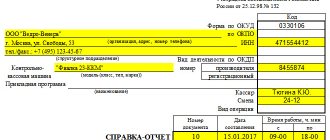

- enter into an agreement with a fiscal data operator (FDO), accredited by the tax service and licensed by Roskomnadzor and FSTEC of Russia;

- register the cash register with the Federal Tax Service.

When the above stages are completed, all that remains is to make the first payment through the new cash register and check whether the information is transmitted online (you can see if the cash register is functioning in your personal account, which will open the OFD for the business owner).

There is a lot to do: to connect an online cash register, you will have to fill out a lot of documents

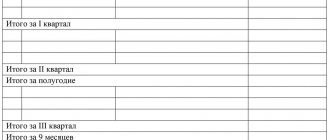

An example of the design of Section I of the income book on a patent

To fill out Section I of the book, you will need primary information: payment orders, strict reporting forms, cash receipts and other documents confirming the receipt of money for goods (work, services).

The procedure for filling out the income book of an individual entrepreneur on the PSN does not directly require indicating the name of the primary document in column 2. Therefore, formally, you can only indicate its details - for example, the date and number of the payment order. However, by supplementing this data with the name of the document, you will avoid additional questions from tax authorities.

The grace period for working without online cash registers for individual entrepreneurs on UTII may be extended until January 1, 2021

A bill was submitted to the State Duma of the Russian Federation for consideration, the essence of which is to extend the grace period for carrying out activities without online cash registers for individual entrepreneurs on UTII and PSN until January 1, 2021.

The need for deferment is explained by the fact that the laws regarding individual entrepreneurs on UTII are not sufficiently harmonized. It is worth noting that the existence of this tax regime also ends on January 1, 2021, and the further fate of the special UTII system depends on the decision of the Government.

At the moment, no decision has been made to extend the work of individual entrepreneurs on UTII without modern cash registers, so it is assumed that entrepreneurs will install online cash registers by the summer of 2021.

What income and how to take it into account in CUD

The book reflects income only from “patent” types of activities according to the rules established by tax legislation and taking into account the explanations of controllers (Article 249, paragraphs 2-5 of Article 346.53 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated December 28, 2018 No. 03-11-12 /96212).

For example, in the book of a patentee-retailer, it is necessary to take into account all amounts received under commission agreements, including commission fees (Letter of the Ministry of Finance dated December 11, 2020 No. 03-11-11/108679).

And if an individual entrepreneur, within the framework of “patent” activities, leases non-residential premises, then the amounts received as compensation for losses (damages, lost profits), penalties (fines, penalties), as well as compensation for termination of the lease agreement on the initiative of tenant. Such income is recognized as part of “patent” income (Letter of the Ministry of Finance dated October 10, 2017 No. 03-11-12/66090).

Income received from other types of business activities under other tax regimes does not need to be shown in the patenter’s income book (Letter of the Ministry of Finance dated January 25, 2019 No. 03-11-11/4350).

Thus, if, under a transportation contract, an entrepreneur provides additional services (for example, sorting and loading of products), then these activities are not included and must be taxed under the general or simplified taxation system. An individual entrepreneur on PSN does not reflect revenue from these services in the income book (Resolution of the Volga-Vyatka District Administrative District dated January 30, 2019 in case No. A28-13889/2017).

Exceeding the cash limit

Companies that exceed the cash limit approved by the Central Bank of the Russian Federation are punished financially by tax officials - the fine reaches 50 thousand rubles. Basis - art. 15 Code of Administrative Offenses of the Russian Federation. The rules for maintaining cash discipline, which were introduced in 2021, stipulate that the limit should not be exceeded.

At the same time, in real life, tax inspectors are rarely able to collect such a fine from the taxpayer. In most cases, tax specialists do not have time to collect penalties within 2 months.

If tax officials collect fines after 2 months, you should boldly file a complaint with the tax inspectorate in the arbitration court: judges in such cases make a positive decision in favor of the individual entrepreneur.

The company, whose revenue in previous years amounted to 800 million rubles, has been a small enterprise since July 2015. Until 2021, individual entrepreneurs may no longer use the cash balance limit at the cash register. This was confirmed by officials from the Ministry of Economic Development and the Central Bank of the Russian Federation.

Since July 2015, the maximum amount of revenue at which a company is considered a small enterprise is not 400, but 800 million rubles. According to officials, this amendment can also be applied to last year’s revenue.

For example, the annual revenue of individual entrepreneurs in 2013 was equal to 600 million rubles, which is more than the established limit (600 > 400). In this case, in 2014 the enterprise could not be recognized as small.

The company's revenue in 2014 amounted to 750 million rubles.

Since July 2015, its revenue has been less than the new limit (750<800). Accordingly, from this date the individual entrepreneur is a small enterprise.

At the same time, in this case the following 2 criteria must be met:

- the number of employees of the organization for the previous year should not be more than 100;

- In the authorized capital of the company, the share of participation of various companies that are not considered small must be equal to 49%.

Small businesses may not set a cash balance limit. In this case, if the company became such an enterprise in July of this year, then the limit can be lifted from mid-2015.

When to include income in the book

The date of receipt of income for different incomes is determined according to its own rules (clause 2 of Article 346.53 of the Tax Code of the Russian Federation):

- If the income is received in money, the date of receipt of the income will be the day of its payment, including the transfer of income to the individual entrepreneur’s bank accounts or, on his behalf, to the accounts of third parties.

- The date of recognition of income in kind is the day on which such income is transferred.

- Income in the form of other property (work, services) and/or property rights - the date of receipt of property, work, services, property rights.

- Income for settlements with bills of exchange is the date of payment of the bill of exchange (the day the money is received from the drawer or another person obligated under the bill of exchange) or the day the taxpayer transfers the bill of exchange under endorsement to a third party.

Money that an entrepreneur received for services rendered on the PSN, but received after the expiration of the patent and the entrepreneur’s transition, for example, to a simplified system, is not entered in the individual entrepreneur’s accounting book on the PSN. Such income is taxed under the simplified tax system (Letter of the Ministry of Finance dated March 30, 2018 No. 03-11-11/20494).

Rules for storing cash

The updated version of cash discipline, which will come into force in 2019, makes the following requirement for individual entrepreneurs - the storage of cash in the company must be carried out in accordance with established regulations and laws. In most cases, a violation of the cash storage procedure occurs when the entrepreneur does not have a cash room.

A cash room is an isolated room in which cash is received, issued and stored.

If an individual entrepreneur does not have a cash register, he must pay a fine of 50,000 rubles. (Article 15 of the Code of Administrative Offenses of the Russian Federation).

The court may side with the individual entrepreneur if the tax inspectorate has collected a weak evidence base regarding this violation.

To successfully collect a fine from a company under Article 15 of the Code of Administrative Offenses of the Russian Federation, tax inspectors must:

- discover the company’s free money and fix its amount;

- make sure that they are in the cash register room;

- write in the claim a certain rule of law that the defendant violated;

- record the date and place of the administrative violation.

If tax specialists simply do not find a cash room in the company and do not present other evidence, the court rules in favor of the organization and not the state.

How often should you write in the book?

The law does not require mandatory daily filling out of the income ledger. It is important that entries are made continuously and in chronological order (clauses 1.1-1.2 of the Procedure for filling out the book, approved by Order of the Ministry of Finance dated October 22, 2012 No. 135n).

If you operate only under a patent and receive income exclusively into your current account, it is quite possible that your bank will be able to generate an income accounting book automatically - many banks provide this service for free.

How to reflect transactions in the income book if a cash book is not maintained

Individual entrepreneurs are allowed not to draw up cash documents and not to maintain a cash book (clause 1, part 2, article 6 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ, subclause 4.1, 4.6, clause 4 of the Bank of Russia Instructions “ On the procedure for conducting cash transactions..." dated March 11, 2014 No. 3210-U).

In the absence of a cash book, income in the CUD can be shown as follows:

- register each cash receipt;

- based on the accounting certificate for the day, week or month (quarter) based on the revenue according to the OFD report.

An accounting certificate is considered a primary document only if it contains all the mandatory details mentioned in Art. 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ.

Situation No. 2: Individual entrepreneur works with both online cash register and cash transactions

Many entrepreneurs accept money for their goods or services, both online and in cash. Cash proceeds are usually handed over to the bank or used for other business purposes. For example, they pay suppliers or employees.

Such individual entrepreneurs confirm the fact of settlement with the client with cash receipts.

With this method of receiving payment, an individual entrepreneur must first of all fill out a cash register:

1

he writes an application for registering a cash register and submits it to the tax office;

2

10 days after the Federal Tax Service has assigned a registration number to the cash register, generates and submits a report on the registration of the cash register;

3

after registration is completed, he receives a cash register registration card.

After registering the cash register and during the work process, the individual entrepreneur draws up the following cash documents:

●

shift opening report;

●

receipts for receipt and receipts for return if the client returns the goods;

●

shift closing report.

If necessary, such individual entrepreneurs can also issue reports on the current state of settlements. This is usually done at the request of tax inspectors.

If you work with online cash registers, then you no longer have to maintain the following forms: KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM-8 and KM -9. You fill out the rest of the documents, just like an individual entrepreneur without a cash register.

Documents that match those maintained by individual entrepreneurs without a cash register are stored according to the same rules. Receipts, cash tapes and reports on closing and opening shifts do not require special conditions for storage, since all this data is in the fiscal drive. But the drive itself must be stored for five years after use.

How to show income from non-cash payments in the book

When receiving non-cash money for goods (work, services), an individual entrepreneur on PSN is obliged to use cash registers (except for cases established by the Federal Law “On the use of cash register equipment...” dated May 22, 2003 No. 54-FZ (Letter of the Ministry of Finance dated February 11, 2021 No. 03 -11-11/9104).

Having received a “non-cash” transfer to a bank account from a buyer or customer, issue a cash receipt and enter the received amount in column 4 of the income ledger. In column 2, indicate the details of the primary document: cash register receipt, bank statement, etc.

The income will be the entire amount of the goods sold without reduction by the acquiring commission.

How to correct errors in a book

The Rules for filling out the income book for individual entrepreneurs on the PSN do not say how to correct errors. If an inaccuracy occurs in a book that is maintained electronically and has not yet been printed, corrections are made very easily - the erroneous entry is deleted and the correct one is added.

Make corrections to entries in a paper book according to the general rules:

- carefully cross out incorrect data,

- indicate the correct ones next to them,

- certify the correction with the individual entrepreneur’s signature and seal (if used).

Don't forget to put the date the corrections were made.

We advise you to attach an accounting certificate in which you need to record the reasons for the correction, as well as the new correct data.

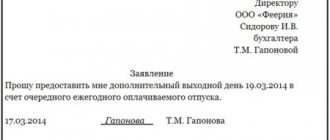

An example of an accounting certificate about correction in the CUD

There is no unified form of accounting certificate. But in order for the certificate to be considered a primary document, it must contain all the required details (Part 2 of Article 9 of Law No. 402-FZ).

In the text of the accounting certificate, justify the corrections made and decipher them:

Let's summarize.

- The income book of an individual entrepreneur on a patent is a mandatory tax register, failure to keep which can lead to fines.

- You don’t have to buy the book: you can print it out and enter information by hand, or you can keep it on a computer or using a special program.

- The procedure for making corrections to an individual entrepreneur’s KUD on a patent is not prescribed by law, so we recommend correcting erroneous entries in a paper book according to generally accepted rules: cross out the incorrect data, enter the correct data next to it, certify the correction with the entrepreneur’s signature and seal (if applicable).