Travel log: is it necessary to keep it?

Most organizations use vehicles.

But the operation of transport is associated with significant costs, and it is important to control them. The main document confirming the expenses and movement of the car is the waybill. This is a primary document that reflects detailed information about the route, cargo, passengers, driver and vehicle. They should be kept in a special journal. IMPORTANT!

A waybill register (JU) must be kept by all organizations that own vehicles (clause 17 of Order of the Ministry of Transport dated September 18, 2008 No. 152).

The Accounting Law No. 402 of December 6, 2011 abolished the mandatory use of the unified document form - OKUD code 0345008. Form No. 8 was approved by Resolution of the State Statistics Committee of the Russian Federation of November 28, 1997 No. 78.

However, the institution has the right to maintain accounting records using this optional form No. 8, or it needs to approve its own version in the accounting policy, which takes into account the specifics of the organization’s activities.

In Order No. 52n on the approval of forms of primary documents and accounting registers used by public sector organizations, the form of the document is not specified.

Fulfilling the requirements of Law No. 402-FZ on the forms of accounting for business transactions and the conditions of Order of the Ministry of Transport No. 152, determine the form and procedure for filling out the accounting policy.

New details - “Transportation information”

“Information about transportation” is a new mandatory detail in waybills. In the appropriate field of the “ticket”, indicate the type of message and the type of transportation of the vehicle.

Possible types of transportation (Articles 4 and 5 of the Federal Law of November 8, 2007 No. 259-FZ):

- regular,

- according to orders,

- by passenger taxi.

Types of messages (Articles 4 and 5 of the Federal Law of November 8, 2007 No. 259-FZ):

- transportation of passengers and luggage, cargo in urban, suburban, intercity and international traffic;

- transportation in urban traffic within the boundaries of populated areas;

- transportation in suburban traffic between populated areas at a distance of up to 50 km inclusive;

- intercity transportation between populated areas over a distance of more than 50 km;

- transportation in international traffic outside the Russian Federation or into the territory of the Russian Federation crossing the State Border of the Russian Federation, including transit through Russia.

Accounting procedure

The form of the travel document, like the ZHU, can be developed and approved independently or used as approved by Resolution No. 78. The document will be invalid if at least one of the required details is missing. They are defined by 402-FZ and Order No. 152:

- Document's name.

- Document number in chronological order.

- Validity.

- Information about the organization that owns the vehicle, including OGRN.

- Vehicle type and model.

- State registration plate of a car.

- Odometer readings before leaving and upon returning to the garage (parking lot).

- Date and time of departure and return to the garage (parking lot).

- Signature and full name the responsible employee who indicated the odometer readings, date and time.

- FULL NAME. driver.

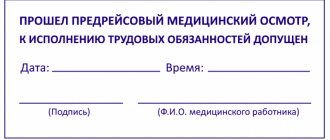

- Date and time of pre-trip and post-trip medical examinations (examinations) of the driver.

- Stamp, signature and full name. the health worker who performed the medical examination.

- A note about the inspection of the technical condition of the car before leaving, indicating the date and time (minutes and hours).

- Signature and full name person responsible for checking the technical condition of the vehicle (mechanic, inspector, foreman).

It is conducted according to a simple algorithm: all issued vouchers are indicated in the log, without exception. For accounting purposes, continuous numbering is used in compliance with chronological order.

The accounting policy is compiled for a month, and each time on a new page, unless other periods are established in the organization’s accounting policies.

For more information on how to correctly compose a travel voucher, read the article “Rules for preparing and maintaining travel vouchers in 2021.”

What kind of document is this

The waybill must contain the following information:

- driver’s personal data;

- vehicle registration number;

- personal data of the car owner or the organization that owns the vehicle;

- fuel costs (speedometer readings);

- starting and ending points of routes;

- their total length and mileage.

In the event of accidents on the roads or other offenses committed by the driver, he is also obliged to provide the traffic police officer, in addition to other documents, with his waybill for entering information about the offense into it.

The registration of the sheet must occur regardless of whether the vehicle is the property of the organization, or whether the car belongs to the driver, but is used by him for official purposes.

When transporting bulk cargo that requires a license, it is necessary to fill out the “license card” column, as well as indicate the bill of lading numbers in accordance with the cargo being transported, especially if it is of material value. At the end of the work shift, the completed waybill is handed over to the dispatcher, who is obliged to make an entry in the log while saving the completed “ticket” form.

As required by the internal regulations of the organization, the journal must be submitted to an accountant for verification. For this purpose, the accounting journal has a dedicated column for marking the submission of documentation to the accounting department.

If there is no person responsible for maintaining the log, it is possible to conclude an agreement with third-party organizations that provide technical maintenance of vehicles before leaving the line or provide parking services for vehicles. The agreement specifies relevant information about the cooperation of the parties to prevent controversial situations regarding reporting issues.

You can see how sheets are accounted for in the 1C program in the following video:

When the order on bonuses for employees is issued and what it contains - see here. If you are interested in how to calculate the profitability of an enterprise using an example, read this material.

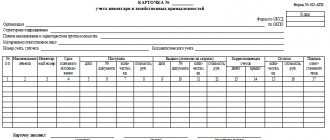

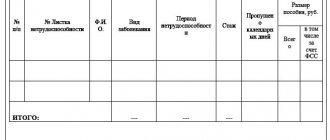

Travel log, sample filling

Let's look at how to fill out the ZHU in a budgetary institution, using an example. GBOU DOD SDYUSSHOR "ALLUR" operates a Renault Logan passenger car. In January 2021, the driver was issued 3 permits.

Step 1. Fill out the title page, OKPO code and name of the organization, indicate the period for which we are filling out the ZhU.

Step 2. Fill out the tabular part. We write down the voucher number and date of issue. We indicate your full name. (completely) the driver and his personnel number. We put the garage number of the car. In the note we indicate the destination and other information.

Step 3. We ask the driver, dispatcher and accountant to sign the registration form. We reflect the rest of the vouchers in the same way.

After filling out the magazine for a month (or another period established by the organization), it must be numbered and stitched, stamped, indicate the number of sheets on the back of the magazine, the date of the firmware and certified by the manager.

Procedure for filling out vouchers from 2021

Based on Order of the Ministry of Transport of the Russian Federation dated September 11, 2020 No. 368, the list of mandatory details and the mechanism for filling out vouchers have been changed.

Now they have one more detail - “Transportation information”. According to clause 6 of the Appendix to Order No. 368, this information must include data on types of messages and types of transportation.

Information can be found in the Motor Transport Charter, approved by Federal Law No. 259-FZ on November 8, 2002:

- Art. 4 – about types of messages;

- Art. 5 – about types of transportation.

In addition, based on paragraphs. 1 clause 4 of the Appendix to Order No. 368, vouchers are required to include the model of the vehicle, and not just its make.

Additionally, starting from 2021, vouchers will include odometer readings when the car leaves the parking lot and when entering the parking lot at the end of a shift or day. This is indicated in paragraphs. 3, paragraph 4 of the Appendix to Order No. 368. In addition, the new order contains clarifications regarding marks on vehicle inspection and medical examination of drivers before the trip and upon return.

Vouchers are registered in the travel log. According to clauses 17 and 18 of the Appendix to Order No. 368, it is allowed to be drawn up both on paper and electronically. In the first option, all sheets must be numbered, laced and sealed. In the second option, the information in the journal is certified by an enhanced digital signature. In addition, the user must be able to print an electronic journal of travel documents.

Attention! In connection with the entry into force of Order No. 368, business entities need to make appropriate amendments to their accounting policies, for example, fix the form of the electronic journal of waybills and the rules for filling it out.

Storage periods and responsibility

Current legislation does not establish precise storage limits for this case. Keep the filed and numbered document in the organization for at least 5 years, as it contains information about the primary document (waybills). Determine by a separate order the person responsible for maintaining and storing the property. Under the signature, familiarize him with the procedure for maintaining the document.

If the organization does not keep a log of the issuance of waybills, the sample is not approved, then the tax authorities can fine you under clause 1 of Art. 126 of the Tax Code of the Russian Federation. That is, at the request of the tax inspectorate, the institution must provide the required documentation within the prescribed period. If this is not done, the Federal Tax Service will issue a fine of 200 rubles for each document.

There is still no standard waybill

An organization can develop a “ticket” form itself, taking into account the requirements for primary documentation. Or modify the unified forms from the Resolution of the State Statistics Committee of Russia dated November 28, 1997 No. 78.

Download the old Waybill form in Excel format to add new details yourself.

A car

Freight car

These Forms of waybills - according to recent changes in legislation - have not been canceled and their use is possible, but only if changes are made to the form in accordance with the current requirements for issuing waybills. If an organization adds any details to a unified form, it must approve the finished document as a primary document in its accounting policy. The use of a unified form in this case will not be enough.

Sample of a completed waybill with details for 2021 for:

Passenger car

Truck

Attention:

These samples are just one example of refinement of the unified form.

What amendments affected 1C: Government Accounting 8 (rev. 2)?

How to register a trip in the program taking into account the innovations?

Formation of waybills

In 1C: Government Accounting 8 (rev. 2), vouchers can be filled out using standardized forms, the forms of which are regulated by Resolution of the State Statistics Committee of November 28, 1997 No. 78.

In order to comply with the requirements established by Order No. 368, adjustments have been made to the document forms in 1C:

- a new field “Transportation information” is included;

- added the ability to specify not only the make, but also the model of the vehicle, as well as the trailer.

To fill out the travel voucher using the new form, you need to click the “Print” button, select the travel voucher, which has in brackets – pr. No. 368 dated 09/11/2020.

When you select an updated voucher, a printed form will open, which contains the adjustments required by law.

Filling out the “Transportation Information” field in the printed form is carried out according to the information in this detail of the travel document form. For a vehicle, you can set the default value of this indicator in the document depending on the type of trip. To configure, you need to go to “Fuels and Lubricants”, then “Settings” and select “Settings for filling out fuel and lubricants accounting documents”. Then, when the user selects a vehicle, the “Transportation Information” detail in the waybill will be filled in according to the setting specified for a specific type of waybill.

In the line “Information about transportation” you need to write “For the organization’s own needs” if the company uses the vehicle for its own purposes. In the case where the settings do not indicate that the value is indicated by default, then this information is manually entered in this attribute. If necessary, the user can change it.

In order for the vehicle or trailer model to be indicated on the waybill in printed form, it is initially entered in the directory “Fixed assets, intangible assets, legal acts...” for a specific element. To do this, you need to go to the form of the element (fixed asset), then go to the “Inventory number” tab, then follow the hyperlink to the “Vehicle Passport” field. There will be a “Model” attribute, and it needs to be adjusted - the necessary information must be entered. When the information has been entered, you need to click the “Save and close” button to save it.

When performing these actions, the printed form of the waybill will reflect not only the make, but also the model of the vehicle. The same should be done for trailers.