Home • Blog • Online cash registers and 54-FZ • Tax deduction for online cash register

A tax deduction for an online cash register can be a real salvation for businessmen who were not prepared for unexpected financial costs. The state has provided compensation for the transition to a new type of equipment. Who the tax deduction applies to, what it includes, how to get it and how to switch to online cash registers most profitably - we will look below.

Time frame for the transition to online cash registers for entrepreneurs on UTII and patent

By the way, the timing of the transition to online cash register for those who pay taxes on UTII and PSN also turned out to be as remote as possible. While the majority of entrepreneurs have been working with new cash registers for a long time, this category is just beginning its thorny path to the new law. So, at what time do UTII and patent online cash registers start working:

- Already, all individual entrepreneurs and legal entities are required to use new equipment - registration of old cash desks has currently been discontinued. It is also almost impossible to buy a classic cash register - they are available only on the secondary market, and even those are mostly used. Therefore, it is logical that if you are just opening your own business or buying a new cash register for your store, the only option would be an online cash register; there is simply no other option.

- From July 1, 2021, all individual entrepreneurs on UTII and PSN who use hired labor are required to buy a new generation cash register. Please note that this applies exclusively to retail trade.

- From July 1, 2021, those individual entrepreneurs who work in the field of catering or trade and those who do not employ hired workers will switch to online cash registers.

Individual entrepreneurs and organizations providing services to the public will also switch to online cash registers next year - regardless of the form of taxation. True, until this time they are required to issue strict reporting forms to their clients - BSO.

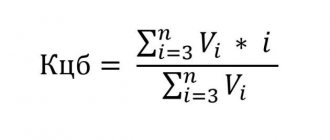

Deduction from individual entrepreneurs on UTII

The tax that an entrepreneur pays on UTII can be reduced by the amount of the deduction for cash registers down to zero. Moreover, this amount, unlike insurance premiums, can be transferred. Thus, it is beneficial for the entrepreneur to first reduce the calculated tax by the amount of insurance premiums paid during the period, and reduce the resulting result by a deduction for the introduction of cash register equipment. If the deduction does not fit into this amount, the excess part can be transferred to the next quarter.

It is known that the Federal Tax Service has prepared a new UTII declaration form so that it can reflect the data for the specified deduction. However, the first quarter has already ended, and the form has not been approved. However, the deduction can be claimed in the old declaration form.

Since there are no special fields for indicating the costs of implementing cash register equipment in the report, these amounts are not indicated. However, an explanatory note must be attached to the declaration, which reflects the expenses included in the deduction. These expenses must be taken into account when calculating the indicator for line 040 of section 3 of the declaration.

Let's explain with an example. An individual entrepreneur on UTII introduced two cash registers. Expenses amounted to:

- for the first device - 16,045 rubles , this entire amount is accepted for deduction;

- for the second device - 33,000 rubles , of which 18,000 rubles can be deducted.

The individual entrepreneur calculated the tax in the amount of 60,523 rubles . He reduced this amount by the amount of insurance premiums paid:

- for yourself - in the amount of 8,096 rubles ;

- for its employees - 22,054 rubles .

Let's do the calculation:

- 60,523 - (8,096 + 22,054) = 30,373 rubles. This is the remainder of the tax after reduction for insurance premiums.

- From this amount, the entrepreneur subtracts the cost of the first cash register: 30,373 - 16,045 = 14,328 rubles - the remainder of the tax payable after applying the deduction for the first cash register.

- From the costs of the second cash register, the entrepreneur deducts 14,328 rubles , and the balance is transferred to the next quarter. Thus, he will not have any tax to pay in the reporting period, and in the next quarter he will be able to reduce the tax in the amount of 18,000 - 14,328 = 3,672 rubles.

Section 3 of the UTII declaration for the 1st quarter of the entrepreneur from the example will look like this:

Section 3 of the UTII report

And here is an example of an explanatory note that he must attach to the declaration:

Examples of explanations about the amount of deduction by cash register

How can entrepreneurs with UTII and a patent receive a tax deduction when purchasing an online cash register?

Businessmen who purchase a patent from the state for their type of activity do not submit tax returns. Therefore, technically, the design of tax deductions in the case of UTII and PSN will be radically different.

Registration of tax deductions for UTII payers

Entrepreneurs who pay a single tax on imputed income are required to submit quarterly declarations to the Federal Tax Service. If an online cash register was purchased during the reporting period or earlier, the costs of the purchase must be reflected in the document. This applies not only to the cash register itself, but also to the fiscal drive, software and setup and registration work. The declaration must be accompanied by a package of documents, which we will present below - it will be common to UTII and the patent.

Registration of tax deductions for PSN payers

As we wrote above, patent users do not file tax returns. Therefore, refunds are made based on a personal statement. The catch is that the Federal Tax Service has not yet developed an official application form. How to be? It’s very simple - the application is written in free form.

The application must indicate:

- models of cash registers;

- registration numbers of cash registers assigned upon registration with the tax office;

- serial numbers of online cash registers;

- the amount of expenses for the purchase of equipment;

- Full name of the individual entrepreneur, his TIN;

- patent number.

Instructions for receiving a deduction

First, an individual entrepreneur needs to purchase a cash register. It must comply with all standards. The second step is to contact the tax office and register the equipment. Then you need to fill out an application for deduction. It contains the following data:

- Initials IP.

- TIN number.

- If the individual entrepreneur uses the patent system, you must indicate the patent number and the date of its registration.

- Deadlines for payment of reduced taxes and their amount.

- CCP data: model, equipment number.

- The exact amount of associated costs.

The application is sent to the tax office, where the individual entrepreneur is registered. You can submit your application either in person or electronically. In the second case, an electronic signature will be required. The document may be in written form.

In the future, you need to submit a declaration to the Federal Tax Service. It is compiled for any quarter of the year. It must be submitted no later than the 20th day of the month following the reporting month. The form of the document for “imputation” is established by order No. ММВ-7-3 / [email protected] dated July 4, 2014. You can find and download it on the official tax website.

Only after all actions have been completed, the individual entrepreneur receives a payment. Usually the deduction is sent by bank transfer. To make a transfer, individual entrepreneurs may be asked for information about their personal account.

List of documents that must be attached to the application or declaration

To confirm the costs of purchasing online cash registers for UTII and PSN, the following documents are attached to the declaration (application):

- cash register and sales receipt for the cash register;

- cash and sales receipt for the fiscal drive;

- agreement for the provision of services for settings, connections and registration;

- certificate of completed work on settings, connections and registration;

- certificate of completion of work to modernize the old cash register, if the device has been upgraded.

Documents are submitted to the tax authority at the place of business. If several cash registers are purchased, papers are submitted to each one separately.

Instructions for entrepreneurs: how to return money for an online cash register

06/05/2019 Money spent on the purchase and installation of CCPs can be returned through a tax deduction. To receive a deduction, you need to register the cash register with the tax office before July 1, 2021.

Who can get a deduction

According to 349-FZ, until July 1, 2021, the following may receive a deduction:

- Individual entrepreneur on UTII and patent without employees;

- Individual entrepreneur on UTII and patent with hired employees who are not engaged in retail trade or provide catering services (those could receive a tax deduction only in 2018).

“That is, almost all entrepreneurs of the third wave of reform can compensate for the costs of purchasing an online cash register. The exception is those who have hired employees and their business is related to catering.” Yulia Rusinova, director of business development for fiscal solutions ATOL

Let me remind you who exactly should start working with CCP before July 1, 2019, according to the latest amendments to 54-FZ (their detailed analysis is here):

- Individual entrepreneurs on UTII and patent, who sell goods not produced by themselves and who do not have employees (for example, owners of tobacco kiosks who themselves stand behind the counter);

- Individual entrepreneurs who provide services or perform work and who have employees (for example, beauty salons and auto repair shops);

- organizations and individual entrepreneurs that previously issued strict reporting forms (SRF), including carriers when selling tickets by a driver or conductor;

- vending without employees (for example, owners of vending machines in the subway).

As for those who received a deferment in the use of online cash registers until 2021, it is not yet clear whether they will be able to receive the deduction after July 1, 2021. Let me remind you that individual entrepreneurs without employees who:

- or they sell what they make themselves (for example, homemade toys, homemade pies or merino blankets);

- or perform work (for example, making custom-made furniture or repairing equipment);

- or provide services (for example, tutoring, manicure or makeup).

How much can you return?

Entrepreneurs can get back the money they spent on:

- purchasing a cash register;

- purchase of a fiscal drive;

- purchasing the necessary software;

- setting up equipment;

- contract with the fiscal data operator (FDO).

The maximum tax deduction amount is RUB 18,000. for each copy of the cash register.

“For entrepreneurs on UTII, the limitation on deductions, which works for insurance premiums and sick leave benefits, does not work for cash registers - this is stated in the letter of the Ministry of Finance dated April 20, 2018 No. 03-11-11/26722. That is, they can receive a deduction for the cost of purchasing an online cash register in full.” Yulia Rusinova, director of business development for fiscal solutions ATOL

How to get a deduction

To return the costs of the online cash register, for entrepreneurs on UTII it is enough to enter data on the deduction in the tax return, for individual entrepreneurs with a patent - to send a notification to the tax office. For those who have not yet purchased an online cash register, the algorithm will be a little more complicated.

What if you have to start working with cash register systems on July 1 of this year, but you haven’t done anything about it yet?

- Buy an online cash register and a fiscal drive.

- Get an enhanced qualified electronic signature (ECES) if you don’t have one.

This signature will be needed to register the cash register without visiting the tax office, as well as to register an agreement with the OFD. To obtain a UKEP, you must submit a package of documents to a certification center (you can select the nearest one here). You need to provide:- application for signature;

extract from the Unified State Register of Individual Entrepreneurs;

- tax registration certificate;

- individual entrepreneur registration certificate;

- passport;

- SNILS;

- power of attorney, if an authorized person submits documents and receives the UKEP.

- Enter into an agreement with the OFD.

It will receive data on issued checks from your cash register and send them to the tax office. To do this, you need to select an operator (a full list of organizations can be found here) and register on its website. You can conclude an agreement online. - Register the cash register with the tax office.

You can submit an application in person or online through the taxpayer’s personal account on the Federal Tax Service website. The application will need to indicate:- taxpayer identification number;

address (for payments on the Internet - website address) and location of installation of the cash register;

- name of the cash register model and its serial number;

- name of the fiscal drive model and its serial number;

- necessary additional information, if needed (for example, if cash register is used in a mode where transfer of data to the tax office through the OFD is optional, or when selling lottery tickets, a full list of special cases is here).

UKEP can be received within 1 business day. This is a paid service, its cost is determined by the certification center.

You will receive a registration number on the same or the next business day after submitting your application. The number must be recorded in the fiscal drive and the requested data must be entered in your personal account on the Federal Tax Service website. If registration is successful, you will receive a cash register registration card (if you register through the website in electronic form). Your cash register is now registered.

At this stage, the entrepreneur must save three documents:

- invoice TORG-12 for the purchase of an online cash register;

- certificate of completion of work to connect the cash register;

- CCP registration card.

How to do this depends on your tax system.

For entrepreneurs on UTII - enter the deduction information in your tax return.

When filling out a tax return, in Section 3, in line No. 40, you must enter the amount of the quarterly tax. If it is more than 18,000 rubles, then we enter 18,000 rubles, since you cannot compensate for more.

In section No. 4, you need to fill out line No. 050 - in it, indicate the amount of expenses, but not more than 18,000 rubles, even if in fact you spent more on the purchase and installation of an online cash register.

Most likely, the tax office, having received your declaration, will ask for documents that will confirm your expenses at the cash register - here you will need a saved invoice, a certificate of completion of work and a registration card.

If the quarterly tax amount is less than 18,000 rubles. (and you spent exactly that much or even more on the online cash register), then the remaining deduction amount can be offset in the next quarter and reduce the tax amount again.

For entrepreneurs on a Patent - send the completed notification to your tax office.

This can be done in writing or electronically.

If your online checkout deduction exceeds your tax amount, you can reduce the tax you pay on another patent.

If there is something wrong with the documents, the tax office will notify you of this within 20 days from the date of receipt of the application. Then you can apply for the deduction again.

Example

Let's imagine that you are the owner of a beauty salon, you have hired employees, and you have registered as an individual entrepreneur on UTII. By law, you need to purchase the cash register before July 1, 2021. You have chosen the SIGMA 7 online cash register. In this case, your costs will be as follows:

- Buying an online cash register SIGMA 7 – 11,900 rubles.

- Purchase of a fiscal storage device for 36 months – 9,400 rubles.

- Agreement with OFD – free (as a gift for SIGMA 7)

- Registration of the cash register with the tax office – 2,000 rubles.

- Registration of UKEP – 1,500 rubles.

The total cost of purchasing and installing a cash register is 24,400 rubles. The amount of costs including tax deduction is 6,400 rubles.

Return to list

How much tax deduction can you expect?

According to Federal Law No. 349 FZ, signed by President Putin on November 27, 2017, the deduction amount can be up to 18 thousand rubles for each cash register. Considering that this amount is comparable to the average price of a cash register, the state actually gives an online cash register to entrepreneurs for UTII and PSN.

If the amount of taxes for the reporting period exceeds 18 thousand rubles, the remaining portion can be transferred to the next one - and so on until this amount is completely exhausted. It's the same with a patent. If the purchased patent costs less than 18 thousand, then first you can return its full full cost, and reduce the next one by the amount of the remainder.

How to calculate and issue a deduction for cash register on UTII

An individual entrepreneur on imputation can reduce tax for all quarters of 2021, starting from the tax period in which the cash register was registered.

Example:

Quarterly tax = 10,000 rubles

Cash desk costs = 30,000 rubles

Available amount of compensation = 18,000 rubles

The registration date of the cash register with the Federal Tax Service is May 27, 2021.

At the end of the 2nd quarter, we fill out a declaration, where we indicate:

- total expenses = 30 thousand rubles

- the amount by which we reduce the tax = 10 thousand rubles (since the compensation cannot be more than the accrued tax).

As a result, the tax was reduced by 100%, and there is no need to pay it this quarter.

We indicate the remaining 8,000 in the declaration for the next quarter, and pay only 2,000.

Validity periods of tax benefits

Businessmen on UTII and patents who use hired workers are entitled to a tax deduction only if the cash register is registered before July 1, 2021. The same applies to entrepreneurs working in retail and catering.

All other individual entrepreneurs have the right to use the tax benefit for more than a year. True, there are only a few of them - these are businessmen who provide services to the population and those who own vending machines. They must purchase and register the online cash register by July 1, 2021.

An important point is that Federal Law No. 349 FZ applies only to cash registers registered with the tax authorities after February 1, 2021. You will not be able to receive a tax deduction for equipment registered before this date.

The law does not apply to cash registers purchased but not registered with the tax authorities. As we wrote above, in the application (declaration) you need to indicate the individual registration number of the device, and it is assigned only when registering with the tax office. Therefore, there is no point in delaying registration, otherwise you may miss out on benefits.

Who exactly can take advantage of the deduction?

The deduction is granted if these conditions are met:

- Using the imputation or patent system without hiring employees. In this case, you can return no more than 18,000 rubles for the purchase of equipment. This is the amount for each copy of the cash register. The deduction is carried out only when the cash register corresponds to all provisions of Federal Law No. 54 “On the use of cash register systems in settlements” dated May 22, 2003 (latest edition). The equipment must be registered with the Federal Tax Service. It is assumed that all data will be sent to the OFD (operator).

- Use of the patent system or “imputation” with the involvement of hired employees. Employment agreements must be concluded with all personnel. The deduction will also be carried out only if the cash register corresponds to all standards.

If individual entrepreneurs use other systems, they cannot claim a deduction.

FOR YOUR INFORMATION! It is recommended to purchase cash registers from reliable centers.

Bonuses prepared by fiscal data operators

All cash receipts entered at the online cash register are sent directly to the cloud service provided by fiscal data operators - OFD. This is an intermediate link between you and the tax office. It is from here that fiscal documents fly to the Federal Tax Service and to the buyer, if he asks.

So, some operators offer free services for entrepreneurs on UTII and patent. True, not for long: most offers are valid until August 1 or July 2021. In order to use the service, you must meet a number of conditions:

- the cash register itself should not be previously registered with the operator;

- you need to register a personal account on the OFD website, if this has not been done before;

- You can register a cash register that previously transmitted data through another OFD.

Most fiscal data operators do not limit the number of cash registers that will be serviced free of charge. Therefore, it's time to buy a new cash register. You will have to do this anyway sooner or later, but now there is an opportunity to carry out the transition with maximum benefits.

How to calculate and issue a deduction for cash register on PSN

A business with a patent has the right to use it in the tax periods 2018-2019, but no later than the quarter in which the cash register was registered.

Example:

Patent issue date: January 2021, for a period of 12 months.

Cost: 27,000 rubles, of which 9,000 rubles. have already been paid, and another 18,000 are yet to be paid.

Cash desk costs = 15,000 rubles.

Available amount of compensation = RUB 15,000.

Registration date of cash register with the Federal Tax Service: May 27, 2021

We subtract the amount of compensation from the total cost of the patent, and we receive only 12 thousand rubles for payment.

Since entrepreneurs do not submit a declaration on PSN, they need to fill out a notification to the Federal Tax Service. You can download the recommended notification form on the tax website using the link. We attach a copy of the patent, KKT registration card to it, and send it by registered mail, or sign an electronic signature and send it via the Internet. A response to the notification will be received within 20 working days.

If in this example the cost of the patent had already been paid in full, the entrepreneur could return part of the money spent. To do this, a statement indicating the amount to be refunded is attached to the notification.

Why entrepreneurs love UTII and PSN

It's simple - under these tax regimes, the amount of tax paid does not depend on revenue. You pay the cost of a patent or a tax in a fixed amount, which depends on the area of the premises and the scope of activity, as well as the location of the outlet. To be completely honest, there are a lot of ways to reduce the UTII payment - both legal and not so legal.

The legal method includes reducing the payment by the amount of insurance and pension contributions paid to the budget during the reporting period. If contributions exceed the tax amount, then you will not have to pay anything. This applies to both contributions to the individual entrepreneur himself and to his employees, if any.

A less honest way to reduce tax is to underestimate the area of the premises. According to the Tax Code, the area is determined on the basis of title documents - a property or lease agreement, as well as a certificate from the BTI. Moreover, only the area of the sales floor is taken into account - where the goods are displayed and customers are served. Most entrepreneurs set this figure “from scratch” - that is, as low as possible.

As a rule, reaching an agreement with the landlord is not a problem - he absolutely doesn’t care what footage is specified in the contract. This point is checked very rarely. This is especially true for small shops - they are simply not interesting to anyone. Moreover, they are warned about inspections in advance and in writing - there is always time to prepare for the tax office’s visit.

Another way is as follows. You rent the entire premises or are its owner. You can enter several more individual entrepreneurs or legal entities with the right to sublease. As a result, according to the papers, you seem to be photographing a small corner of the room, and the rest is someone else whom you have never seen. Entrepreneurs on UTII actively use all these approaches. The UTII rate in general is, to put it mildly, too high - in the center, for example, Nizhny Novgorod, for a premises of 20 square meters you have to pay the state 10 thousand rubles per month.

They also love UTII and patents for the opportunity to work without a cash register. Or rather, they loved it - until the adoption of Federal Law 54, obliging these categories of entrepreneurs to use online cash register systems. What does it mean? And the fact that the state, for some reason, wanted to see the business’s revenue from imputation and PSN. Why he needs this information is anyone's guess. Many entrepreneurs, not without reason, are worried that this is necessary for the next tightening of the screws. Having seen your income, the government may decide that they can extract much more from you than under UTII or a patent. It is for this reason that the state lures businesses into online reporting, actually sponsoring the purchase of online cash registers.

Main features of compensation

When returning, you need to consider the following nuances:

- The return application is drawn up in the accepted form. It has not yet been approved.

- Refunds are made for 2021.

- The right to request funds is formed from the moment the application is sent to the Federal Tax Service.

- Funds are issued only throughout 2021.

- If an individual entrepreneur uses both a patent and UTII, a deduction can be issued only for one of the modes.

- The maximum refund amount for one copy is 18,000 rubles. That is, if a company purchased two cash registers, the deduction will be 36,000 rubles.

FOR YOUR INFORMATION! If an individual entrepreneur already has a cash register, he may not purchase a new one. It is enough to modernize existing equipment.

What expenses of the entrepreneur are compensated?

Only these expenses are returned to the individual entrepreneur:

- Online cash purchase.

- Modernization of equipment if there is already a cash register (it is assumed that the device will be equipped with a fiscal drive).

- Purchase of related software.

- Payment for the services of specialists who install and configure CCPs.

An entrepreneur may also have other expenses. However, they will not be compensated. Expenses must be documented.

What you need to pay attention to when purchasing an online cash register

When buying a cash register, make sure that the selected model is in the register of the Federal Tax Service. Otherwise, the equipment cannot be registered - only online cash registers included in the register are registered. The current list is posted on the Federal Tax Service website.

The same applies to fiscal drives for cash registers. They are also included in the tax register.

To transfer fiscal data to the tax office, you must enter into an agreement with the OFD. This is an organization authorized by the tax authorities to process and store fiscal data. There are currently 18 such organizations. The list of existing OFDs is also posted on the Federal Tax Service website.

The choice of a cash register depends on the type of business, sales volumes, range of goods and services and other factors. Online cash registers can be portable or stationary, there are large POS systems and small smart terminals. The cost of devices starts from 9,000 rubles without a fiscal drive. FN for 13 months costs about 6,000 rubles. An annual contract with a fiscal data operator will cost the entrepreneur 3,000 rubles. After some simple mathematical calculations, it becomes clear that the cost of compensation from the state will fully cover the budget online cash register. Hurry up before the state changes its mind: you will still have to buy the cash register, but you may be late with compensation.

Conditions for receiving compensation

Refunds can only be made if the conditions are met. They are indicated in Federal Law No. 349 “On Amendments to the Tax Code” dated November 27, 2021, Federal Law No. 290 “On Amendments to the Federal Law on the Application of CCP” dated July 3, 2016. Let's look at the key points:

- The equipment was purchased in 2021.

- The individual entrepreneur is registered with the tax office.

- If the individual entrepreneur does not have hired personnel, the equipment must be registered before July 1, 2019. If the individual entrepreneur has hired employees, you need to do it before July 1, 2018.

- The individual entrepreneur uses UTII or a patent.

- The deduction is provided only for equipment that is present in the cash register register. Cash registers must be reliable. They must have a fiscal drive, a function for connecting to the network with subsequent data transfer to the operator.

IMPORTANT! A cash register with the function of data transmission via a network must be purchased even if it is installed in the most remote areas with unstable Internet. The technology may not even be used. The main thing is that it simply exists.

Modern cash register: basic concepts and definitions

Cash register with online transfer of data to the tax office - this concept appeared in the latest edition of the law on cash register equipment dated May 22, 2003 No. 54-FZ.

The short name for the new generation of cash register technology, which has become widespread, is online cash register. The modern version of the cash register differs from its predecessors in several ways:

- All companies and individual entrepreneurs (with rare exceptions) are required to apply it from 07/01/2017, and from 07/01/2018 - UTII payers and entrepreneurs on PSN who work with cash.

Who has the right not to use the online cash register, read here.

Find out who has the right to use the updated car from 07/01/2019 here.

- Instead of ECLZ, the cash register should be equipped with a special memory module - a fiscal drive, which has advanced functions (information encryption, its protection, etc.).

- The cash desk must be equipped with equipment that allows real-time transmission of fiscal information to tax authorities through a fiscal data operator (FDO).

See also “How to choose an online cash register or a fiscal drive for it?”.

With the introduction of online cash registers, taxpayers are forced to bear additional costs:

- for the purchase of modern cash registers or re-equipment of existing models;

- payment for OFD and Internet services;

- connecting the cash register and setting it up.

In order to partially compensate for the costs associated with the purchase of an online cash register for certain categories of taxpayers, the Government of the Russian Federation has prepared a special offer for them - we will talk about this in the next section.

The necessary conditions

There are certain restrictions regarding the classes that are given the opportunity to apply for compensation.

Categories of persons covered by compensation, according to 349-F3:

- Entrepreneurs on UTII/PSN without employees (for example, the owner of a souvenir store, who himself sells them behind the counter).

- Individual entrepreneurs with hired personnel who have occupied a niche of services, but do not represent the catering sector, and are not engaged in retail sales. For example: hairdressers, car washes, repair shops.

- Persons who used strict reporting forms for servicing.

- Owners of vending services who did not use hired force (for example, street vending machines for snacks).

Thus, most businessmen use this service, with rare exceptions. When combining two types of taxation, it is necessary to use only one of the options.

The restrictions apply not only to different types of entrepreneurs, but also to various cash register equipment.

Categories of cash register equipment allowed for use to apply for a tax deduction:

- Cash register equipment must be included in the appropriate register of the Federal Tax Service, published on their own portal.

- The cash register must be registered with the Federal Tax Service, otherwise, even if other conditions are met, the refund will be refused.

We also recommend that you register your cash register as soon as possible, so that you can pay for as much of the period of its initial maintenance as possible, since the time preceding registration is not taken into account when applying for compensation.

List of costs reimbursed by the state for new online cash registers:

- Purchase of a cash register.

- Purchase of related software.

- Installation of the fiscal system.

- Cash equipment setup package.

- Conclusion of an agreement with the OFD.

At the same time, in order to receive the maximum amount of payments, you need to issue a deduction separately for each cash register device.

Expert opinion

Kirill

Cashier specialist

Ask a Question

Therefore, whether you receive the required payments depends on the type of products/services you provide and compliance with the specified parameters of the time of registration of online cash registers, however, this is limited by the condition of the presence of at least one person providing services for the sale of goods and working under an employment contract drawn up for an individual entrepreneur.

Online cash registers suitable for receiving tax deductions

| Name of the KKT model | Retail price | Composition of the proposal |

| Oka MF | 14 950 | KKT+FN+OFD |

| Viki Print 57 F | 15,800 (Start cash register software free) | KKT+FN+OFD |

| Dreamkas-F | 15 900 | KKT+FN+OFD |

| Agat 1F | 16 500 | KKT+FN+OFD |

| ATOL 90F | 16 900 | KKT+FN+OFD |

| Terminal-FA | 16 900 | KKT+FN+OFD |

| ELVES-MF | 16 990 | KKT+FN+OFD |

| ORION-100F | 17 00 | KKT+FN+OFD |

| Pioneer-114F | 17 500 | KKT+FN+OFD |

| OKA-102F | 17 500 | KKT+FN+OFD |

| Mercury-115F | 17 900 | KKT+FN+OFD |

| Mercury-130F | 17 900 | KKT+FN+OFD |

| Mercury-180F | 17 900 | KKT+FN+OFD |

| Mercury-185F | 17 900 | KKT+FN+OFD |

| Cashier 57F | 18 000 | KKT+FN+OFD |

| MICRO 106-F | 18 000 | KKT+FN+OFD |

| Oka MF | 11,950 (13.15 months) 14,950 (36 months) | KKT+FN |

| Agat 1F | 13 500 | KKT+FN |

| ATOL 90F | 13 900 | KKT+FN |

| Terminal-FA | 13 900 | KKT+FN |

| ELVES-MF | 13 990 | KKT+FN |

| Pioneer-114F | 14 500 | KKT+FN |

| OKA-102F | 14,500 (13.15 months) 17,500 (36 months) | KKT+FN |

| Mercury-115F | 14 900 | KKT+FN |

| Mercury-130F | 14 900 | KKT+FN |

| Mercury-180F | 14 900 | KKT+FN |

| Mercury-185F | 14 900 | KKT+FN |

| Cashier 57F | 15 200 | KKT+FN |

| Viki Print 57 F | 15,300 (Start cash register software free) | KKT+FN |

| ATOL 30F | 15 400 | KKT+FN |

| Dreamkas-F | 15 900 | KKT+FN |

| Minika-1102MK-F | 15 990 | KKT+FN |

| RP System 1FA | 16 500 | KKT+FN |

| PORT-100F | 16 800 | KKT+FN |

| Felix-RMF | 16 990 | KKT+FN |

| ORION-100F | 17,000 CCT with FN (36 months) | KKT+FN |

| AMS-300.1F | 17 000 | KKT+FN |

| PAYONLINE-01-FA | 17 200 | KKT+FN |

| ATOL 15F | 17 900 | KKT+FN |

| MOBIUS.NET.T18-F | 17 900 | KKT+FN |

| Mercury-119F | 17 900 | KKT+FN |

| Mercury-IF | 17 900 | KKT+FN |

| RR-04 F | 17 950 | KKT+FN |

| BARCH-ON-LINE | 17 990 | KKT+FN |

| EVOTOR ST2F | 17 990 | KKT+FN* |

| ars.vera 01F | 17 990 | KKT+FN |

| PRIM 06-F | 17 990 | KKT+FN |

| EKR-2102K-F | 17 990 | KKT+FN |

| SHTRIH-FR-02F | 18 000 | KKT+FN |

| MICRO 106-F | 18 000 | KKT+FN |

| MICRO 35G-F | 18 000 | KKT+FN |

| KASBI-02F | 18 000 | KKT+FN |

| AMS-300F | 18 000 | KKT+FN |

* Cash register equipment + fiscal storage + fiscal data operator services 1 year

* Cash register equipment + fiscal storage

When choosing a cash register, you should find out whether it is possible to print marketing offers on receipts, whether the online cash register is compatible with a commodity accounting program, and whether the cash register can work in EGAIS if you sell alcohol.

Manufacturers of cash registers are interested in customers, so they willingly answer questions by calling the hotline.

Why it's better to prepare in advance

This year, before July 1, there was a real rush on the cash register market - there were not enough fiscal storage units. Next year it may be the same, because the FN will need even more. According to rough estimates, at the second stage about 1.5-2.5 million online cash registers will be installed. Plus, those who did this at the first stage will need new FNs. The drive is designed to operate for 13 months (for special regime workers and the service sector - for 36 months), after which it must be replaced. So, almost everyone who connected an online cash register by July 1, 2017 will line up for FN along with newcomers. And this is another 1.2 million drives.

Is it possible to save money?

The authorities promise that entrepreneurs will receive benefits for purchasing cash registers in the form of a tax deduction. The proposal is currently at the draft law stage, although it has already been adopted in the first reading. Let's hope that soon all the procedures will be completed and the deduction will work.

Only individual entrepreneurs who register their cash register in 2021 will be able to count on the preference. So it makes sense for entrepreneurs to take their time for another couple of months. The deduction amount is 18 thousand rubles for each device, which is comparable to the price of the most budget models. The benefit can be applied in the next tax period, i.e. in 2019. The application for deduction will be submitted along with the reporting.

Will the old cash register be suitable?

If you already have a cash register, it may be possible to upgrade it. This is done by service center specialists. First, it is worth checking whether the model is subject to modification to new conditions - such information is contained in the mentioned CCP Register. Modernization involves installing a fiscal drive in place of the ECLZ, equipping it with a module for Internet access, and reflashing it.

Is it possible to receive a deduction of 18 thousand rubles? other taxpayers using online cash registers?

Business entities using the OSNO or simplified tax system cannot apply a deduction of 18 thousand rubles. for the purchase of online cash registers. But they have the right to take into account the costs of purchasing a cash register and all related costs when determining the taxable base for income tax or the simplified tax system “income minus expenses” (subclause 35, clause 1, article 346.16 of the Tax Code of the Russian Federation).

It is important to take into account that the expenses of simplifiers reduce the amount of income only after their actual payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

If the taxpayer took into account the costs of purchasing a cash register as expenses during the period of application of OSNO or the simplified tax system of 15%, and subsequently switched to UTII or PSN, then he does not have the right to reduce the amount of tax by the amount of the deduction.

Another situation is possible when the deduction can be lost. For example, a taxpayer purchased a cash register using UTII in 2021, and from January 2021 switched to the simplified tax system. The deduction cannot be applied, because It is not yet possible to reduce the amount of UTII for the tax periods of 2021, and in 2018 a regime is applied in which no deduction is provided. It is also impossible to recognize costs using a simplified approach, because they were incurred even before the transition to the simplified tax system (letter of the Federal Tax Service dated February 21, 2018 No. SD-3-3/ [email protected] ).

And we talked about how to transfer deductions in a similar situation when switching from UTII to PSN in this material.