A cash book is a special internal journal of enterprises and organizations, which records all transactions carried out using cash. That is, all legal entities and individual entrepreneurs using cash payments are required to use a cash book in their activities. At the same time, the volume of cash turnover does not matter; if at least one or two such transactions occur during the reporting period, this document must still be filled out. What form of taxation is used also does not matter.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Who is responsible for maintaining the book?

Maintaining this document is the responsibility of the employee who is responsible for cash transactions at the enterprise (usually this is either a cashier or an accountant of the organization). Also, the company must organize control over the completion of the document, which is usually assigned to the chief accountant or directly to the head of the enterprise.

The cash book should be prepared in the most careful manner, since the information reflected in it is always carefully checked by tax specialists during on-site audits.

Any errors discovered may result in serious administrative penalties in the form of large fines.

Basic rules for registering a cash book

- The cash book is started annually and is maintained from the beginning to the end of the year. If it ends before the end of the reporting period, a second cash book is drawn up, entries in which continue to be made in chronological order.

- You can fill it out either handwritten or on the computer. All information must be entered in order, without gaps.

- The cash book consists of two parts:

- title page where information about the company is entered,

- main pages where data on cash financial transactions carried out for each day is indicated.

- Each sheet has two copies, one of which, after filling out, must be left in the book, and the second must be cut off and handed over to the accounting department specialists. All sheets of the cash book should be numbered in the usual order and laced together. The number of sheets in the book should be written on the last page and this information must be certified by the signature of the chief accountant, the director of the enterprise and the seal (if any).

- It is impossible to make mistakes, blots and inaccuracies in the document, but if they do happen, you should cross out the incorrect information and carefully enter the correct information next to it. The correction must be certified by the signature of the cashier and the chief accountant. You can fill out the cash book only with a ballpoint pen (pencils are not allowed).

- The cash book must be maintained daily, but if no cash transactions were carried out on a particular day, there is no need to fill out the sheets. At the end of each work shift, the cashier is required to submit the document to the accounting department, along with the rest of the “primary” documents. After checking the information entered in it, the accountant signs the book and returns it to the cashier.

- One enterprise cannot have two cash books, except in cases where a legal entity has representative offices and branches - they must have their own similar documents (in this case, copies of the cash book and payment documents must be regularly transferred to the head office).

How to fill out the cashier's book correctly?

(Commentary to clause 14 of the Regulations on the procedure for using cash register equipment, payment terminals, automatic electronic devices, vending machines and accepting cash, bank payment cards when selling goods, performing work, providing services, carrying out activities in the field of gambling, lottery activities , conducting electronic interactive games, approved by Resolution of the Council of Ministers and the National Bank of the Republic of Belarus dated July 6, 2011 No. 924/16)

The procedure for filling out the cashier's book at the beginning of the working day (shift)

A cashier working on cash register equipment must begin his working day (shift) by filling out the gr. 1–4 cashier's book, the form of which is contained in Appendix 2 to the commented Regulation (hereinafter referred to as Regulation No. 924/16) (see Table 1).

Table 1

Filling out the gr. 1–4 cashier books at the beginning of the working day (shift)

| Cashier's book column number | Information to be provided |

| Gr. 1 | Date of working day (shift) |

| Gr. 2 | Amounts of cash received by the cashier before starting work for expense transactions (if such funds were issued) |

| Gr. 3 | Indications of the increasing turnover of cash register equipment at the beginning of the working day (shift) |

| Gr. 4 | Cashier's signature |

Please note that the procedure for issuing cash to the cashier before the start of the working day is determined by the Instruction on the procedure for conducting cash transactions and the procedure for cash settlements in Belarusian rubles on the territory of the Republic of Belarus, approved by Resolution of the Board of the National Bank of the Republic of Belarus dated March 29, 2011 No. 107 (hereinafter referred to as Instruction No. 107).

Thus, the amount of cash required for expense transactions before the start of the working day is given by the chief (senior) cashier to other cashiers in advance against a signature in the book of accounting for cash accepted and issued by the cashier (hereinafter referred to as the book of accounting). The form of this book is contained in Appendix 4 to Instruction No. 107. It must be numbered, laced and sealed with the seal of a legal entity or division. The number of sheets in the accounting book of cash accepted and issued by the cashier is certified by the signatures of the head and chief accountant of the legal entity or division.

The book is used to account for:

– cash issued by the chief (senior) cashier from the cash desk of a legal entity or division to other cashiers;

– return of cash and cash documents on transactions performed to the chief (senior) cashier. The book of cash accepted and issued by the cashier is kept by the chief (senior) cashier.

At the end of the working day, cashiers report to the chief (senior) cashier about the advance received and cash accepted for transactions performed against a receipt in the accounting book (clause 60 of Instruction No. 107).

The procedure for filling out the cashier's book at the end of the working day (shift)

At the end of the working day (shift), the cashier must:

1) display on cash register equipment in accordance with the operational documentation:

– control tape – for cash register equipment with an electronic journal, when the control tape is formed in a single operating cycle with the receipt tape when registering a cash transaction, but is processed separately.

The requirement to create a control tape does not apply to cash register equipment with an installed means of control by tax authorities;

– daily (shift) report (Z-report) (clause 18 of Regulation No. 924/16);

2) fill out on the basis of the received Z-report and supporting documents, regardless of the presence or absence of sales during the day. 5–14 of the cashier's book (clause 14 of Regulation No. 924/16) (see Table 2).

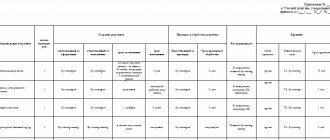

table 2

Filling out the gr. 5–14 cashier books at the end of the working day (shift)

| Cashier's book column number | Information to be provided |

| Gr. 5 | Actual indications of increasing turnover for cash register equipment in general. That is, all cash received as payment and non-cash funds processed during the working day (shift) through cash register equipment are indicated. |

| Gr. 6 | Number of daily (shift) report (Z-report) |

| Gr. 7 (total) | The actual amount of all funds received, incl. using bank payment cards, carried out using cash register equipment |

| For reference: in gr. 7 indicates the amount of revenue per day (shift), which is defined as the difference between the amounts of gr. 5 and gr. 3 cashier books | |

| Gr. 8 | Only cash carried out during the working day (shift) through cash register equipment |

| Gr. 9 | Only the amount of funds received during settlements using bank payment cards |

| For reference: the sum of the values indicated in gr. 8 and gr. 9 must be equal to the amount specified in gr. 7 | |

| Gr. 10 | The amount of cash returned to customers (consumers), if such a return took place on this working day (shift) |

| Gr. eleven | The amount of erroneously generated payment documents according to the compiled register of erroneously generated payment documents of cash register equipment in the form in accordance with Appendix 3 to Regulation No. 924/16. Erroneously generated payment documents must be attached to this register |

| Gr. 12 | To be filled in if funds are withdrawn from a cash drawer or other place of similar purpose for their subsequent delivery to the enterprise’s cash desk or to a bank (including collection). If during the working day (shift) funds were not withdrawn from the cash drawer or other place for a similar purpose, in gr. 12 is marked with a dash |

| Gr. 13 | The actual balance of cash at the end of the working day (shift), remaining in the cash drawer of cash register equipment at the end of the day (shift). If there is no remainder, a dash is placed in the column |

| Gr. 14 | Cashier's signature confirming entries made |

For more details, see “GB”, 2015, No. 16, p. 81.

Natalya Roshchina, economist

Instructions for registering a cash book

At the beginning

- On the title page of the book, first write the full name of the company to which this document belongs, the structural unit (if necessary)

- The OKPO code is entered (located in the company’s constituent papers) and the year for which the cash book is opened is entered.

- On the last page of the document, it is necessary to indicate the number of sheets in it, the signature of the manager, chief accountant and the closing date of the cash book. The specified data is recorded on the first sheet of the cash book form.

Main part of the book

- On the required sheet you should indicate the date it was filled out, as well as the number (according to the order in which the cash book is maintained).

- Then the number of the primary document is entered into the table in the first column (receipt and expense order when “cash” is received, and cash order when it is issued).

- Then information is entered about from whom the funds were received or to whom the funds were issued (both legal entities and individuals can be indicated here), and the corresponding account number. The amount must be entered in the column to which it relates (either income or expense).

- After all the necessary lines have been filled in, the empty ones must be crossed out in the form of the letter Z or a cross, and at the end of the day the final amount in each column should be calculated and indicated in the “Total” cells.

- Below, in the appropriate line, you should enter the balance of cash in the cash register at the end of the day.

- In conclusion, the document must be signed by the cashier who filled out the document, as well as the chief accountant (with transcripts of the signatures).

The cash book must be kept for at least five years.

The procedure for conducting cash transactions in Belarusian rubles

On September 1, 2014, Resolution of the Board of the National Bank of the Republic of Belarus dated March 31, 2014 No. 199 “On introducing additions and changes to the Instructions on the procedure for conducting cash transactions and the procedure for cash settlements in Belarusian rubles on the territory of the Republic of Belarus” came into force (hereinafter referred to as the Instructions No. 199). In this regard, the new edition contains the Instruction on the procedure for conducting cash transactions and the procedure for cash settlements in Belarusian rubles on the territory of the Republic of Belarus, approved by Resolution of the Board of the National Bank of the Republic of Belarus dated March 29, 2011 No. 107 (hereinafter referred to as Instruction No. 107).

Instruction No. 199 applies to:

legal entities maintaining accounting records in accordance with established requirements (with the exception of credit institutions), as well as their structural divisions allocated to a separate balance sheet;

legal entities that have switched to the simplified tax system;

individuals carrying out entrepreneurial activities, i.e. individual entrepreneurs;

notaries carrying out notarial activities in notary offices, in notary offices;

workers of notarial archives;

lawyers.

Moreover, from September 1, 2014, notaries and lawyers are required to comply with the procedure for conducting cash transactions established for individual entrepreneurs. (clause 3).

Organizations and individual entrepreneurs independently, but within the legally defined limits (clause 12 of Instruction No. 199), by order of the manager (authorized person), determine the list of issues that should be applied when conducting cash transactions. The main points that should be taken into account when drawing up an order are the following:

1) business entities independently determine the procedure and timing for the delivery of revenue. If there is a discrepancy between the working days of the business entity and the servicing bank or organization of the Ministry of Communications and Informatization of the Republic of Belarus, the proceeds are surrendered on the first working day of the servicing bank, organization of the Ministry of Communications and Informatization of the Republic of Belarus, or the business entity. If the business entity and the servicing bank work on generally established weekends, the proceeds received on these days at the cash desk of the business entity are handed over to the servicing bank, provided that these days fall on the deadline for the delivery of the proceeds of this business entity.

The procedure and timing for the delivery of revenue can be revised by decision of the manager in the event of a change in the volume of cash turnover and for other reasons. At the same time, the organizations inform the servicing bank (by decision of the head of the bank or a person authorized by him) the established deadlines for the delivery of proceeds, the amount of proceeds planned for delivery to the bank, as well as information about changes in the deadlines for the delivery of proceeds and its amounts within the time limits determined by the agreement of this entity management with the servicing bank.

The procedure and timing for the delivery of proceeds (all, with the exception of the amount of need for change cash, if established) for authorized persons (at least once every 7 calendar days), if necessary, the amount of need for change cash is established by the business entity itself and communicated to everyone to an authorized person by order of the manager. At the same time, the new procedure does not apply to legal entities, departments that receive cash from the servicing bank and have other inconsistent cash receipts (no more than 5 days in the previous calendar month). These amounts are handed over to the bank after the deadline for their payment has expired. It has also been established that this category of persons does not determine the procedure and timing for depositing cash into the bank (Part 4, Clause 10, Part 2, Clause 17 of the Instructions).

Thus, part 2 of clause 16 of Instruction No. 199 establishes that amounts received at the cash desk or received from the bank for the payment of wages, benefits, alimony, etc. and not used after the deadline for their payment has expired, are deposited and can be kept with legal entities, divisions, individual entrepreneurs who receive cash from the servicing bank and have daily or constant receipts of cash, until the established deadlines for cash delivery. Previously, these amounts were handed over to the bank immediately after the deadline for their payment had expired (Part 2, Clause 16 of Instruction No. 107).

When depositing cash early, the calculation of the subsequent deposit period begins from the date of the last deposit (clause 12 of Instruction No. 199).

2) the amount of need for change cash (if necessary) per one cashier’s workplace, an authorized person; start time of preparation and formation of the collection bag; time of delivery of proceeds by cashiers to the chief (senior) cashier; the time when the preparation of proceeds begins for subsequent delivery to a bank, an organization of the Ministry of Communications and Information of the Republic of Belarus or a collection service. At the same time, the size of the need for change cash per one cashier’s workplace is determined by the specifics of the business entity’s work (retail trade, catering, services, etc.) (clause 14 of Instruction No. 199).

Note! (professional judgment of the author)

The cash limit at the cash desk (when receiving cash proceeds to the organization's cash desk) can be calculated using the formula:

V

L = - x N ,

P c

where L is the cash balance limit, in rubles;

V is the volume of cash receipts for goods sold, work performed, services rendered for the billing period, in rubles;

P - the billing period determined by a legal entity, individual entrepreneur, for which the volume of cash receipts for goods sold, work performed, services rendered is taken into account, in working days ;

N is the period of time between the days of delivery to the bank by a legal entity,

c

individual entrepreneur of cash received for sold

goods, work performed, services provided, in working days.

When calculating the cash limit, periods of peak volumes of cash receipts, as well as the dynamics of volumes of cash receipts for similar periods of previous years, can be taken into account. It should be noted here that the term “revenue” has been excluded from the new edition of the Instructions. Instead, the concept of “cash received at the cash desk” is used.

Chapter 4 of Instruction No. 199 regulates the procedure for settlements between legal entities, their separate divisions, and individual entrepreneurs. Let us briefly dwell on the main points that should be used as the basis for the calculations of each business entity in cash (regardless of whether they have a current (settlement) bank account).

The maximum amount of cash payments between legal entities and individual entrepreneurs within one day (clause 69 of Instruction No. 199). At the same time, the number of legal entities, their separate divisions, individual entrepreneurs with whom a legal entity, its separate division, individual entrepreneurs make cash payments in a total amount of no more than 100 BV during one day is not limited.

It is also determined that within 100 basic units, business entities carrying out exhibition activities accept cash from organizations and individual entrepreneurs for each payment not only for the services provided to them, but also for the rental of space.

If an organization has separate divisions... A legal entity that includes separate divisions determines the cash balance limit taking into account the cash held in separate divisions, except in the case where the separate division has its own bank account. For such a separate division, a separate limit is established in a manner similar to a legal entity.

When making cash payments, you must distinguish between the payer and the recipient.

Banks issue cash for settlements between legal entities, their separate divisions, individual entrepreneurs in the amount of no more than 100 BV within one day to each legal entity, separate division, individual entrepreneur that has opened current (settlement) accounts.

Banks issue cash (transfer funds to card accounts and other bank accounts of individuals) to reimburse expenses of individuals carried out in the interests of legal entities, their separate divisions, individual entrepreneurs with whom these individuals have an employment relationship, in the amount of not more than 100 BV for each day spent. In this case, the amount of cash previously issued from bank cash desks for cash settlements (money previously transferred to reimburse the specified expenses to card accounts and other bank accounts of individuals) for the day of expenditure is taken into account.

From September 1, 2014, in order for business entities to receive cash from current (settlement) bank accounts, a bank can issue a check or an application to receive cash (clause 21 of Instruction No. 199). It has been established that the application form for receiving cash is determined by the business entity independently or by the servicing bank by agreement of the parties and must contain the mandatory details specified in clause 21 of Instruction No. 199.

Banks issue cash (transfer funds to card accounts and other bank accounts of individuals) to reimburse expenses of individuals carried out in the interests of legal entities, their separate divisions, individual entrepreneurs with whom these individuals have an employment relationship, for the previous days in an amount exceeding 100 BV per day, but not more than the maximum permissible amount of payments for each day of expenditure.

As of September 1, 2014, the requirement for the targeted use of cash returned to the cash desk, previously received from banks by check and issued from cash desks for travel expenses, wages, and settlements carried out between legal entities, their separate divisions, and individual entrepreneurs, has been abolished. Thus, all cash returned to the cash desk, previously received from the bank and issued from the cash desks, is used for current operations (Part 3, Clause 6 of Instruction No. 199).

3) acceptance of cash by business entities can be carried out:

— using cash register equipment, payment terminals, automatic electronic devices, vending machines;

- on cash receipt orders and (or) other receipt documents in accordance with the law - by business entities that have the right not to use cash register equipment and payment terminals.

The conditions for the use or non-use of cash registers and special computer systems by legal entities, their separate divisions and individual entrepreneurs are regulated by the Resolution of the Council of Ministers of the Republic of Belarus, the National Bank of the Republic of Belarus dated 07/06/2011 N 924/16 “On the use of cash register equipment, payment terminals, automatic electronic machines, vending machines and on accepting cash, bank plastic cards as a means of making payments on the territory of the Republic of Belarus when selling goods, performing work, providing services, carrying out activities in the field of gambling, lottery activities, conducting electronic interactive games" and the Regulations on the procedure for using cash register equipment, payment terminals, automatic electronic devices, vending machines and accepting cash, bank plastic cards as a means of making payments on the territory of the Republic of Belarus when selling goods, performing work, providing services, carrying out activities in the field of gambling business, lottery activities, conducting electronic interactive games, approved by Resolution N 924/16.

4) the procedure for preparing cash documents.

The main documents when conducting cash transactions are:

— cash receipts and debit orders and a journal for registering receipt and debit cash orders (Clause 49 of Instruction No. 199 for legal entities and individual entrepreneurs establishes a requirement to determine in writing the need to register receipt and debit cash orders, as well as the choice of form for maintaining their registration logs);

— cash book (Chapter 3 of Instructions No. 199).

The procedure for maintaining the cash book has changed somewhat. Thus, a cash book is not maintained if there is no cash receipts to the cash desk and no cash is issued from the organization’s cash desk. At the same time, the need to maintain a cash book by divisions, legal entities using a simplified taxation system with keeping a book of income and expenses, and individual entrepreneurs must be fixed in writing (clause 50 of Instruction No. 199).

The basis for entries in the cash book are only incoming and outgoing cash orders. Other documents (check counterfoils from checkbooks for receiving cash, receipts for announcements for cash deposits, forwarding statements, other documents used by banks to formalize transactions for accepting cash in accordance with local regulatory legal acts of banks) can be used for these purposes only by legal persons applying the simplified taxation system (STS) and keeping records in the book of income and expenses.

In paragraph 55 of Instruction No. 199 it is clarified that the cashier, after receiving the output forms “Insert sheet of the cash book” and “Cashier’s Report”, is obliged to check the correctness of the specified documents, sign them and submit the cashier’s report along with cash receipts and expenses and other receipts and expense documents to the accounting service against receipt in the output form “Insert sheet of the cash book”;

- a book of accounting for cash accepted and issued by the cashier (the procedure for application and details (book indicators) is drawn up in accordance with clause 60 of Instruction No. 199.

Confirmation of cash acceptance is:

- a receipt for the cash receipt order of form KO-1, established by Appendix 1 to the Resolution of the Ministry of Finance of the Republic of Belarus dated March 29, 2010 N 38 “On the establishment of standard forms of primary accounting documents for processing cash transactions and Instructions for filling out standard forms of primary accounting documents for processing cash transactions operations" (hereinafter referred to as Resolution No. 38);

— other receipt documents provided for by law.

Currently, when registering the receipt of cash, business entities, in addition to the cash receipt order form KO-1, approved by Decree N 38, can use receipts of the KV-1 form, coupon form 20-FS, cash receipt order form KO-1, approved by Order N 311 (made before the entry into force of Resolution No. 38) (hereinafter referred to as the old form KO-1), but provided that the forms of these documents were purchased by legal entities or individual entrepreneurs before 08/19/2011 (until the moment from which, instead of an electronic data bank on manufactured and sold forms of primary accounting documents and control marks, which included forms of forms KV-1, 20-FS and the old form KO-1, a new electronic data bank of document forms and documents with a certain degree of protection and printed materials, created on the basis of the old one in accordance with the Resolution of the Council of Ministers of the Republic of Belarus dated 07/06/2011 N 912 “On the issues of creating and maintaining an electronic data bank of document forms and documents with a certain degree of protection and printed materials, invalidating certain resolutions of the Council of Ministers of the Republic of Belarus” (hereinafter - Resolution No. 912)).

In addition, the Ministry of Trade of the Republic of Belarus, by Resolution No. 34 dated August 23, 2011, approved the form of a receipt for accepting cash for the sale of goods (performance of work, provision of services) without the use of cash registers and (or) special computer systems and payment terminals (hereinafter - receipt), which is included in the List of document forms and documents with a certain degree of protection and printed products, information about which is subject to inclusion in the electronic data bank of document forms and documents with a certain degree of protection and printed products, approved by Resolution N 912).

The receipt contains the same details as the KV-1 form. The name of goods (works, services), unit of measurement, quantity, price per unit, cost, date of receipt of cash are entered by the seller (performer) at the time of receipt of cash. The receipt is issued in two copies (the first copy remains with the seller (performer), the second is given to the buyer (customer)). Unlike KV-1, the receipt does not indicate information about the buyer (customer). When paying for a product (work, service), the buyer (customer) does not sign either the first or second copy of the receipt. The latter circumstances make this receipt unsuitable for confirming the receipt of money in cases where a certain accountable person of the organization must account for it. For example, such a receipt will not be suitable to confirm payment for rental housing services for a posted worker.

The issuance of cash from the cash desks of legal entities, divisions, individual entrepreneurs, private notaries involved in business activities, ensuring the implementation of private notarial activities of individuals under employment and (or) civil law contracts is carried out according to (clause 27 of Instruction No. 199):

- expense cash order form KO-2, established by Resolution No. 38;

— payroll with the attachment of a cash order for the total amount of cash paid according to the payroll(s) without drawing up a cash order for each recipient. For the total amount of cash issued for several pay slips, it is allowed to draw up one cash order, the date and number of which are indicated on each pay slip.

As a general rule, when issuing cash according to a payroll, recipients present documents certifying (certificate confirming) their identity (clause 28 of Instruction No. 199). However, the issuance by legal entities, divisions, individual entrepreneurs of cash to their employees can be made according to a certificate issued by the legal entity, division, individual entrepreneur, if it contains a photograph and personal signature of the owner of the certificate, the signature of an official and the seal of the legal entity, individual entrepreneur who issued the certificate .

The issuance of cash to persons who are not on the staff of a legal entity, division, individual entrepreneur, or private notary, according to the general rule (clause 30 of Instruction No. 199), should be made according to cash receipts issued separately for each person, or according to a separate payroll with the preparation expenditure cash order for the total amount of cash paid according to the payroll sheet(s).

If cash is issued to persons involved in agricultural and loading and unloading work, as well as to eliminate the consequences of natural disasters, then the procedure established by clause 30 of Instruction No. 199 may be applied.

Money can be issued to persons who have a power of attorney executed in accordance with the procedure established by law. If the power of attorney is issued for a one-time receipt of cash, it is attached to the cash order or payroll slip, and if it is issued for the receipt of cash for a certain time, its copy, certified in the manner prescribed by law, is kept by a legal entity, division, individual entrepreneur, private notary.

According to paragraph 34 of Instruction No. 199, the issuance of funds on account of future expenses for the purposes established by law to employees of business entities is carried out both in cash and using corporate cards.

The deadlines are specified, which are determined by the manager (his authorized person), for which cash is issued, including using corporate cards, for reporting on upcoming expenses, including the day of issuance (receipt from a corporate card) of cash for reporting:

- no more than 3 working days - for expenses incurred at the location of a legal entity, division, individual entrepreneur, private notary;

- no more than 10 working days - for expenses incurred outside the location of a legal entity, division, individual entrepreneur, private notary;

- up to 30 working days - in an amount not exceeding the size of one basic amount as a whole for a legal entity, division, individual entrepreneur, private notary.

In this way, cash is issued no more than the amount of cash settlements between legal entities, their separate divisions, and individual entrepreneurs, established by Chapter 4 of Instruction No. 199.

From September 1, 2014, the following changes have been made in relation to cash transactions for receiving and issuing funds on account for upcoming expenses and expenses associated with business trips:

— the list of documents confirming expenses for the acquisition of goods (performance of work, provision of services) has been specified (clause 37 of the Instructions);

— a requirement has been established to send a report on the amounts spent on paper when submitting it through the automated subsystem of documented support. When sending a report by mail, the date of submission will be the date of delivery of the registered postal item to the post office (previously this date was the date of departure) (part 3, paragraph 35 of the Instructions);

— the rule that determined that when using a corporate (personal) card solely to receive cash for expenses related to business trips, the report must be submitted by the employee no later than 3 business days from the date of return from the business trip has been excluded. In the case under consideration, the report will be submitted in accordance with the general procedure no later than 15 working days;

— it is allowed to transfer funds to the client’s account to which a corporate (personal) debit card has been issued to pay expenses associated with business trips, without submitting a report on funds previously transferred to this account. Previously, this was allowed only during the period the employee was on one business trip, subject to the initial transfer of travel allowances to his card (part 2, paragraph 42 of the Instructions);

— when sending several employees on one business trip, it is allowed to transfer funds intended for non-cash payment of travel expenses to and from the business trip, as well as rental of living quarters, to a corporate (personal) debit card under the report of one business traveler. A report on the amounts spent for these purposes is submitted by this person (clause 44 of the Instructions).