Benefit and its recipients

A one-time payment at the birth of a child is regulated by Federal Law-81 of 05/19/95 and is mentioned in Art. 3 along with other payments. Its size is indexed once a year, from February 1. In 2021, before indexation, the payment amount was 16,759.09 rubles, after indexation – 17,479.73 rubles. The benefit was indexed by a factor of 1.043, taking into account the inflation rate.

Is child birth benefits paid to external part-time workers ?

In regions where special coefficients for wages are established, they are taken into account. Example: In the region, a regional coefficient of 1.3 (30%) is applied. The payment for a child after February 1, 2021 will be: 17479.73 * 30% + 17479.73 = 17479.73 + 5243.92 = 22723.65 rubles.

You can receive benefits within six months after the birth of the baby. If the deadline is missed, the right to payment is considered lost.

Is a lump sum benefit paid for the birth of a still child ?

The benefit is paid for the first and second child in the same amount. If twins or triplets are born, the payment is summed up without restrictions.

Important! The benefit is calculated at the time of birth, and not at the time of applying for it (FSS letter 02-18/07-337 dated 17/01/06).

The range of people eligible to receive benefits is wide. It can be obtained not only by citizens of the Russian Federation, but also by foreigners permanently or temporarily residing on its territory.

How to prepare and submit documents to the Federal Social Insurance Fund of the Russian Federation for payment to an employee within the framework of a pilot project of a lump sum benefit for the birth of a child?

The following can receive benefits:

- mother or father;

- adoptive parent;

- guardian, guardian of a child.

The payment is due not only to working, but also to unemployed parents (persons replacing them). Usually the mother of the child applies for benefits. If she is unemployed and the father is employed, the allowance is given to him. Based on the meaning of the regulatory documents of the Ministry of Social Development, it can be argued that even if both parents are employed, the father can receive benefits instead of the mother. Unemployed parents will receive benefits from the social security authorities. In the event of a divorce, the benefit will be received by the parent with whom the child actually lives, and if the marriage has not been formalized, only the child’s mother has the right to receive the benefit (Procedure approved by order of the Ministry of Health and Social Development dated 12/23/09 No. 1012n, p. 4). We’ll talk more about where to apply for benefits later.

What funds are required by law?

Depending on the number of children, region of residence and some other factors, the sizes and types of payments vary.

The amounts below are payable in 2021: they are indexed annually and may increase slightly as a result.

- For the first child, the family receives a payment of 15.5 thousand rubles - subsequently it is issued for each child.

- For a second child, parents can apply for maternity capital, the amount of which is 450 thousand rubles.

- In each region, separate gubernatorial payments are established, which are issued to the family from the local budget. For example, in Moscow there are “Luzhkov” regional benefits for young families: parents can receive them if they are under 30 years old. For the first child they are 5 minimum wages, for the second – 7, for the third – 10. For 2021, 1 minimum wage is a little more than 15 thousand rubles.

Please note: when twins appear in a family, they are considered different children, that is, you can count on all the payments due for two children.

In addition to the above money, the spouses will receive monthly payments for the child, which will support them for a year and a half. They will be paid by one of the parents' employers or Social Security.

Where to contact

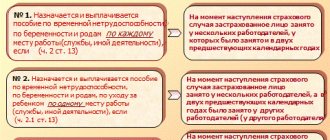

Citizens eligible to receive benefits may be employed, or may not work for some reason. The first receive benefits from the Social Insurance Fund through an application at their place of work. The second - directly at the expense of the federal budget, by submitting documents to the social protection authorities (OSZN). Military personnel can also receive benefits.

The pilot project “Direct Payments”, operating in 39 regions of the Russian Federation, allows residents of these regions to apply for benefits directly to the Social Insurance Fund. Their list is given in government decree No. 294 of 04/21/11, part 2.

Benefits received from the Social Insurance Fund are:

- working citizens;

- civilians working in military formations on the territory of other states.

By contacting the social security authorities or at the place of service, benefits are received by:

- unemployed;

- full-time students;

- contract soldiers in military and equivalent service;

- persons dismissed from military units due to the expiration of an employment contract or due to the withdrawal (redeployment) of troops.

Thus, every parent can exercise the right to receive benefits: in the form of compulsory social insurance or in the form of state social security.

What documents need to be provided

Recipients of this benefit can be a wide range of people for various reasons, and, as a result, there is no single package of documents.

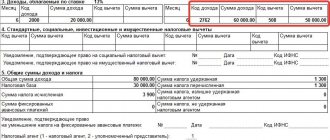

If the benefit is provided by the Social Insurance Fund, you must:

- a statement from a parent or a person replacing him;

- registry office certificate of birth;

- court decision, agreement on transfer to a family, decision of the guardianship authorities - copies, if we are talking about persons replacing the child’s parents;

- a certificate from the other parent’s place of work or service that no benefits were awarded to him;

- a certificate from the OSZN in relation to the other non-working parent that the benefit was not assigned to him.

If the benefit is issued through OSZN, additional documents are required:

- A certified extract from the work record book (military ID, other document) about the last place of work, service, or study. If the applicant for benefits does not work anywhere, is not an individual entrepreneur, does not conduct private practice as a lawyer or notary, or is not engaged in other licensed activities, he indicates this information.

- For foreigners (stateless persons) permanently residing in Russia or having refugee status, an identity card is required that shows a valid residence permit, a refugee certificate - copies;

- For foreigners (stateless persons) temporarily residing in Russia - residence permit - copy;

- A certificate from the Social Insurance Fund that the person who applied for the benefit did not receive it through payments from the Fund, if we are talking about licensed activities (individual entrepreneurship), i.e. not registered with the Social Insurance Fund as an insurer. Documents confirming your status will also be required. In all cases, copies of documents are required.

The benefit can also be received at the place of stay (actual residence). You need a certificate from the OSZN at your place of residence stating that the benefit was not previously received there.

If the parents are divorced and/or the child lives with one of them, the following is required:

- certificate of divorce;

- a document confirming cohabitation with one of the parents in the Russian Federation.

If a serviceman applies to his place of duty, he writes not an application, but a report with a request for the assignment of benefits. In addition, an extract from the order of the commander of the military unit on payment of benefits is required. The order must indicate the gender, name, date of birth of the child (children) and the amount in rubles and kopecks that must be paid (based on materials from the official websites of the Ministry of Defense, the Social Insurance Fund and the State Services website).

Who will get the money

The only condition for receiving a one-time benefit is the Russian citizenship of the mother and child.

Such requirements do not apply to the father. Refugees and persons permanently residing in the country, but who still do not have Russian citizenship, can also apply.

Subsidies can be received by:

- Any spouse. If both have jobs, they need to choose where to receive the money. If parents are unemployed, they should contact Social Security.

- The spouse with whom the child actually lives if the family is divorced.

- Adoptive parents, if the children are not their own.

- Any person, if neither spouse can do it themselves. You will first need to draw up a power of attorney and have it certified by a notary.

It is worth noting: no matter who the recipient of the subsidy is, this does not in any way affect the amount of the payment; it is strictly fixed and does not depend on the circumstances.

Money will not be paid:

- Russian citizens who left the country for permanent residence;

- parents who abandoned their children;

- deprived of parental rights for any reason.

You may be interested in an article about child benefits for single mothers.

Read an article about the specifics of receiving severance pay upon dismissal here.

Nuances

It is important for personnel officers and accountants involved in calculating employee benefits to remember some of the nuances of such payments. It will also be useful for benefit recipients to know about them. In 2021, a new form of certificate from the registry office about the birth of a child is in effect. It was introduced by Order of the Ministry of Justice No. 200 dated 01/10/18. Old forms are invalid.

The package of documents for processing the payment must include a certificate confirming that the same amount has not already been paid to the other parent. If for certain reasons it is not possible to obtain a document (for example, an employer or parent refuses to provide it), the benefit recipient has the right to submit a written request asking for the necessary information.

Some regions (Moscow, Moscow Region, St. Petersburg, etc.) have their own maternity support programs. Additional one-time benefits are paid from regional budgets on the occasion of the birth of a child. For them you need to contact not the employer, but the SZN service. There you can also clarify whether residents of a particular region are entitled to an additional payment.

Who is not entitled to benefits?

The payment is not assigned if there was a stillbirth (Federal Law No. 81 of 05/19/95, Art. 11). Payment also cannot be assigned:

- parents deprived of rights or limited in their rights;

- parents whose children are on state support;

- parents who have changed their place of residence to a permanent one in another country.

Briefly

- In the general case, workers receive a one-time benefit on the occasion of the birth of a child through Social Insurance Fund payments, and non-working employees of the Armed Forces exercise their right by applying to OSZN. They register it at the place of work (or service). It is possible to contact directly the services that control the payment of benefits. Unemployed people and students apply for benefits to OSZN.

- One parent has the right to receive if the marriage is registered. If they are divorced, the right goes to the parent with whom the newborn lives. A mother raising a child alone can only receive money personally. All legal provisions apply equally to blood and non-blood parents.

- The amount of the benefit is determined by the moment of birth. You need to apply for it no later than 6 months after birth.

- The most important documents to obtain: the baby’s birth certificate or a document confirming the right to replace blood parents, and an application for payment. You also need a certificate from the other parent stating that he did not arrange the payment for himself.

Will the employer pay a lump sum benefit upon the birth of a child?

According to Russian legislation, upon the birth of a child, one of the parents is paid state benefits. One of these benefits is a one-time benefit for the birth of a child. Which parent is paid this benefit and where to apply to receive it will be discussed in this article.

One of the parents of the newborn has the right to a lump sum benefit at the birth of a child. When two or more children are born, the benefit is paid for each child. If a child is stillborn, a lump sum birth benefit is not paid.

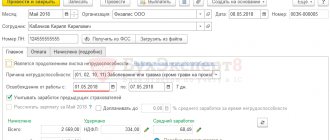

How much is the lump sum payment for the birth of a child?

The initial amount of a one-time benefit for the birth of a child is set at 8,000 rubles. This type of benefit is subject to indexation and from January 1, 2013 its amount is 13,087.61 rubles.

In districts and localities where regional coefficients for wages are established, the amount of a one-time benefit for the birth of a child is paid taking into account the regional coefficient. In addition, in a number of constituent entities of the Russian Federation, additional payments are established at the birth of a child.

Who pays a lump sum benefit upon the birth of a child?

The benefit is assigned and paid to one of the parents or the person replacing him at the place of work (service, study). If the parents or the person replacing them do not work (do not serve, do not study), the benefit is paid by the social protection authority at the child’s place of residence.

What documents are provided to receive a lump sum benefit upon the birth of a child?

To assign and pay benefits, the mother or father of the child (another person replacing him) submits:

- application for benefits

- birth certificate of a child issued by civil registry authorities

- a certificate from the place of work (service, study) of the other parent stating that the benefit was not assigned

If the child’s parents are divorced and the child lives with one of the parents, then instead of a certificate from the other parent’s place of work (service, study):

- divorce certificate

- a document confirming the joint residence of a child with one of the parents on the territory of the Russian Federation, issued by an organization authorized to issue it

Additionally, the following documents may be required:

- an extract from the work book, military ID or other document about the last place of work (service, study), if the assignment and payment of benefits are carried out by the social protection body (if there is no work book, then in the application for the assignment of a one-time benefit for the birth of a child, the recipient indicates information about that he has not worked and does not work anywhere)

- extract from the decision to establish guardianship over a child - for a person in loco parentis (guardian, adoptive parent, adoptive parent)

- a copy of an identity document with a note on the issue of a residence permit or a copy of a refugee certificate (for foreign citizens and stateless persons permanently residing in the territory of the Russian Federation, as well as for refugees) - if the assignment and payment of benefits is carried out by the social protection body

- a copy of the temporary residence permit as of December 31, 2006 - for foreign citizens and stateless persons temporarily residing in the territory of the Russian Federation and not subject to compulsory social insurance

- copies of documents confirming status - for lawyers, notaries and other persons whose professional activities are subject to state registration and (or) licensing - if the assignment and payment of benefits to them is carried out by social protection authorities

If a lump sum benefit for the birth of a child is assigned by the social protection body, an additional certificate from the territorial body of the Federal Social Insurance Fund of Russia is submitted stating that the citizen is not registered as an insurer and did not receive benefits from compulsory social insurance funds.

Sample application for benefits

When applying for benefits to an employer, the application is written as follows.

General Director of Zarya LLC N.M. Mikhailov from economist I.D. Nikolaeva

Statement

I ask you to pay me a one-time benefit in connection with the birth of Nikolaev I.I.’s child.

Application:

1. Certificate from the registry office about the birth of a child Nikolaev I.I.

2. Certificate from the place of work of I.L. Nikolaev’s husband stating that he did not receive this benefit.

Date, signature.

When is a lump sum benefit paid upon the birth of a child?

A one-time benefit for the birth of a child is paid no later than 10 days from the date of submission of all necessary documents. The benefit is assigned if the application is made no later than 6 months from the date of birth of the child.