Average cost method

It is used more often than the previous one, and involves monthly calculation of the cost of goods using the arithmetic average. In this case, it does not matter from which specific delivery this or that product “left”. This method of writing off inventory items is suitable for companies selling products for which piece accounting is not important. This could be, for example, stationery, clothing, shoes, toys, cosmetics and any other consumer goods. The average cost method is especially beneficial for those goods for which the price is constantly changing, both up and down.

This method is the easiest to account for. The average cost of goods is calculated using the following formula:

[average cost of inventory items] = ([cost of inventory items at the beginning of the month] + [cost of inventory items received during the month]) / ([number of inventory items at the beginning of the month] + [number of inventory items received during the month])

And the cost of inventory written off per month is calculated as follows:

[cost of written-off inventory items] = [average cost of inventory items] X [number of inventory items sold per month]

Example of calculation using the average cost method

At the beginning of the month, the Stationery store had 370 ballpoint pens left at a purchase price of 10 rubles. Within a month, another 1000 pens were delivered in two batches - 500 for 9 rubles 50 kopecks and 500 for 9 rubles. We calculate the average cost.

Cost of inventory items at the beginning of the month: 370 X 10 = 3700 (rub.) Cost of the 1st new supply of inventory items: 500 X 9.5 = 4750 (rub.) Cost of the 2nd new supply of inventory items: 500 X 9 = 4500 (rub.) Average cost of goods and materials: (3700 + 4750 + 4500) : (370 + 1000) = 9.45 (rub.)

This average cost will be used to calculate the written-off goods and calculate the profit. For example, if pens are sold for 15 rubles, and 1,100 pens were sold in a month, the profit specifically for these pens will be calculated as follows:

1100 X 15 – 1100 X 9.45 = 6105 (rub.)

The advantages of the average cost calculation method are the stability of the price of materials sold and simplicity. However, from a tax accounting point of view, it is not optimal in the case where, for example, you purchase the same pens from the same supplier, and he gradually reduces your prices. Let's consider the following option.

FIFO Application Models

There are 2 types of FIFO method:

- standard (ordinary), which involves the calculation of incoming and consumable materials, and unused materials are taken into account once at the end of the month;

- modified (sliding), which assumes the reverse order of calculations - first, the balance of materials at a certain point in time is determined at the price of the last ones at the time of acquisition, and then the cost of inventories written off for production is calculated.

Example

A special additive is used in the production of Tekhnologiya LLC products. At the beginning of the month, the company’s accounting records the balance of the additive in the amount of 60 kg (the price of 1 kg is 245 rubles, the cost of the balance is 14,700 rubles).

Within a month, the warehouse received an additive for a total amount of 274,200 rubles:

- 1st arrival - 600 kg (254 rub./kg);

- 2nd entry - 300 kg (270 rub./kg);

- 3rd entry - 150 kg (272 rub./kg).

720 kg of additive were written off for production.

Calculation using the standard FIFO model:

1. Let's calculate the cost of the written-off additive:

- 60 kg from the balance at the beginning of the month (RUB 14,700);

- 600 kg from the 1st receipt (600 kg × 254 rub./kg = 152,400 rub.);

- 60 kg from the 2nd receipt (60 kg × 270 rub./kg = 16,200 rub.).

————————————————————

Total: 14,700 + 152,400 + 16,200 = 183,300 rubles.

2. Determine the cost and amount of remaining material at the end of the month:

14,700 + 274,200 − 183,300 = 105,600 rub.

60 + (600 + 300 + 150) − 720 = 390 kg.

Calculation using the modified FIFO model:

1. With a balance of 390 kg (240 kg from the 2nd receipt and 150 from the last), the cost of the additive remaining in the warehouse at the end of the month will be:

240 × 270 + 150 × 272 = 105,600 rub.

2. Calculation of the cost of the additive written off for production:

14,700 + 274,200 − 105,600 = 183,300 rub.

Conclusions from the considered example:

- the cost of written-off materials and balance are the same when using both FIFO models;

- with the second option, it is enough to accurately determine which materials from which batches make up the balance in the warehouse, and the cost of written-off materials is determined by calculation without necessarily being allocated to a specific batch;

- with the first option, you need to accurately determine from which batches the materials are written off and remain at the end of the month.

Thus, the standard FIFO calculation model has increased labor intensity if materials are purchased quite frequently during the month.

ConsultantPlus experts explained in detail how to account for goods in wholesale and retail trade. If you don't have access, get a free trial online access to the system.

For postings when writing off materials, see here.

The general concept of cost and what it shows

Cost is the sum of all costs. They mean all expenses for raw materials, supplies, delivery, storage and sale of goods, as well as wages for employees.

It may seem that calculating cost is a simple task. However, this is more difficult than it seems, so it is better to entrust the calculations to accountants.

Cost calculations must be performed regularly. The frequency depends on the characteristics of the enterprise, but cost calculations are standard every quarter, every six months or every year.

Without calculating the cost, it will not be possible to understand whether the business will pay off, whether it is worth expanding production, or how profitable the enterprise is.

Let's summarize

- The cost of production includes expenses spent on its production (raw materials, materials, workers' salaries, depreciation of equipment, workshop rent).

- Costs can be direct and indirect. Direct ones can be attributed to a specific type of product, while indirect ones relate to production as a whole.

- The different costs of raw materials are taken into account using the FIFO, LIFO and average cost methods.

- There are several ways to reduce the cost per unit of production, they are based on reducing costs and increasing output.

Adjustment of actual cost of materials

The adjustment is made if the organization's accounting policy provides for the write-off of materials based on the average monthly actual cost (weighted estimate), which includes the quantity and cost of materials at the beginning of the month and all receipts for the month (reporting period).

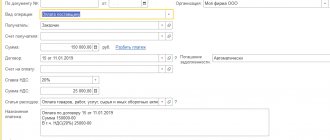

Note that with such an accounting policy, the periodic constant “Option for using average estimates of the cost of materials” should have the value “Weighted estimate (based on the average monthly cost)” on the date of the “Month Closing” document.

During the month, a sliding estimate is used in expenditure documents when writing off the cost of materials. In this case, the average cost of material assets is determined at the time of their release (that is, at the time of the document on consumption). If during the month there was a purchase of materials at prices different from the average cost of balances for the corresponding items, then the rolling estimate for write-off gives slightly different results than the weighted one*.

Note:

* The terms “weighted assessment” and “rolling assessment” were introduced into practice by Methodological guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Example.

Let’s say that as of May 1, 2002, there were 100 kg of nails worth 2,400 rubles in the warehouse of Nasha Stroika LLC. On May 4, 2003, 10 kg of nails were supplied. Their cost was 240 rubles. (2400:100×10). The balance in the warehouse after this operation is 90 kg in the amount of 2,160 rubles. On May 13, 2003, 20 kg of nails were received into the warehouse at a price of 30 rubles. for 1 kg, in the amount of 600 rubles. On May 20, 2003, 10 kg of nails were sold, their cost with a sliding estimate will be (2,160 + 600): (90 + 20) x 10 = 250.91 rubles. Thus, a total of 20 kg of nails were written off in the amount of 490.91 rubles. (240+250.91). With a weighted assessment, the cost of written-off nails will be (2,400+600): (100+20)x20=500 rubles. The difference is small (500-240-250.91=9.09), but it exists. If the release of the first 10 kg of nails occurred after the purchased batch arrived at the warehouse, then the difference would be zero.

The procedure “Adjusting the average cost of writing off materials” makes additional accounting entries so that the write-off is ultimately (for the month as a whole) made using the weighted average cost method.

The specific algorithm is as follows:

1. The average monthly cost is calculated for each material for each subaccount of account 10 (except for subaccount 10.7 “Materials transferred for processing” and subaccount 10.11 “Special equipment and special clothing in use”);

2. For each of the accounts (and objects of analytical accounting for them, that is, subconto) to which the material in question was written off, the adjustment amount is calculated: the difference between what should have been written off using the average monthly cost method (the product of the average monthly price of the material by its the amount written off within the framework of this correspondence of accounts) and the amount actually written off;

3. An entry is made for the amount of the adjustment.

Example (continued).

The adjustment in our case will be 9.09 rubles, as calculated above. If during the month both cases of material write-off were reflected in the debit of account 20 “Main production” for the same accounting object (for example, construction of a fence) and the credit of account 10.1 “Raw materials and materials”, then the following entry will be made when adjusting : Debit 20 Credit 10.1

– 9.09 rub.

If the first write-off was made to account 20, and the second to account 26 “General business expenses” (for example, for repairs of office premises), then the adjustment will be made as follows.

| Account | Written off within a month | Cost to be written off, rub. | Cost adjustment | |

| Quantity, kg | Cost, rub. | |||

| 20 “Main production” | 10 | 240,00 | 250,00 | 10,00 |

| 26 “General business expenses” | 10 | 250,91 | 250,00 | -0,91 |

| Total | 20 | 490,91 | 500,00 | 9,09 |

The average cost of 1 kg of nails per month will be 25 rubles.

Subaccounts of account 10.11 “Special equipment and special clothing in operation” have special analytics (subaccount “Purpose of use”, as well as “Employees” or “Divisions”) and a special procedure for reflecting transactions described in the Guidelines for accounting for special tools and special devices , special equipment and special clothing, approved by order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n. Therefore, for these subaccounts, the algorithm for adjusting the cost of materials is performed in a special way:

- adjustments are made only for those accounting objects, the cost of which is completely written off upon transfer to operation (for other objects, a special adjustment is not necessary, since the gradual write-off of the value of these objects begins only from the month following the month of transfer to operation, and the value of the assets will already be reflected taking into account all adjustments);

- during execution, additional analytics are taken into account (that is, for each purpose of use, etc. separately).

FIFO in accounting is...

From 01/01/2021, the rules for accounting for inventories are regulated by the new FSBU 5/2019 “Inventories” (approved by Order of the Ministry of Finance dated 11/15/2019 No. 180n), PBU 5/01 has become invalid.

Some accounting rules have been changed significantly. An analytical review from ConsultantPlus will help you learn about changes in inventory accounting. Get trial access to K+ for free and proceed to the material.

But even in the new standard, FIFO is one of the acceptable methods in accounting for writing off the cost of materials for production or when they are otherwise disposed of (clause 36 of FSBU 5/2019 (until 01/01/2021 - clause 16 of PBU 5/01)).

This material will introduce you to other methods of writing off inventories..

This method is applicable in the accounting of companies with different industry specifics:

- industrial enterprises;

- logistics companies;

- wholesale companies, etc.

For retail trade, the FIFO method is unsuitable, since it does not allow accounting to formulate the cost price for individual types of goods in an accurate estimate.

This method is based on the assumption about the order in which inventories are written off: when materials are written off for production or otherwise disposed of, they are assessed in the sequence in which they were acquired. At the same time, a strict chronology of their receipt and write-off must be observed.

If you don’t know which method to choose when writing off inventories, use the recommendations of ConsultantPlus experts. Get trial access and upgrade to the Ready Solution for free.

Because of this assumption, the FIFO method is often called the "pipeline model" or the "natural queue method." Based on the basic principle of the FIFO method (“first in, first out”), the materials that arrive first at the warehouse are used first.

Production of materials by the organization

Home Favorites Random article Educational New additions Feedback FAQ

⇐ PreviousPage 6 of 23Next ⇒

The actual cost of materials when manufactured by the organization is determined based on the actual costs associated with the production of these materials. Accounting and formation of costs for the production of materials is carried out by the organization in the manner established for determining the cost of relevant types of products (clause 64 of the Guidelines for accounting for inventories).

Example 3.7

In the organization's auxiliary production workshop, parts used in the main production are manufactured. During the reporting period, the following costs were incurred in the manufacture of parts:

materials - 7,000 rubles;

salary - 15,000 rubles;

deductions from wages - 3900 rubles;

depreciation of fixed assets - 800 rubles.

Let's make accounting entries and determine the actual cost of manufactured parts:

Debit 23 “Auxiliary production” Credit 10 “Materials”

— for the amount of the cost of materials used — 7,000 rubles;

Debit 23 “Auxiliary production” Credit 70 “Settlements with personnel and wages”

— for the amount of accrued wages — 15,000 rubles; Debit 23 “Auxiliary production” Credit 69 “Calculations for

social insurance and security"

- for the amount of deductions from wages - 3900 rubles; Debit 23 “Auxiliary production” Credit 02 “Depreciation of fixed assets”

- for the amount of accrued depreciation - 800 rubles;

Debit 10 “Materials” Credit 23 “Auxiliary production”

- for the amount of the actual cost of manufactured parts - 26,700 rubles. (RUB 7,000 + RUB 15,000 + RUB 3,900 + RUB 800).

Contribution of materials to the account of contribution to the authorized (share) capital of the organization

The actual cost of materials contributed to the contribution to the authorized (share) capital of the organization is determined based on the monetary value agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

If delivery costs (transportation and procurement costs) are borne by the receiving party, then the actual cost of materials increases by the amount of expenses incurred (clause 65 of the Guidelines for accounting for inventories).

Contributions of deposits in the form of material assets are recorded by entries on the credit of account 75 “Settlements with founders” in correspondence with accounts 10 “Materials”, 15 “Procurement and acquisition of material assets” (Instructions for using the Chart of Accounts. Account 75 “Settlements with founders”).

Example 3.8

As a contribution to the authorized capital of the organization, the founder contributed materials that were valued by the founders in the amount of 10,000 rubles. The organization paid the transport company 2,950 rubles for the delivery of materials. (including VAT - 450 rubles).

Let's make accounting entries:

Debit 10 “Materials” Credit 75 “Settlements with founders”

- for the amount of the cost of materials in the estimate agreed upon by the founders - 10,000 rubles;

Debit 10 “Materials” Credit 60 “Settlements with suppliers and contractors”

- for the amount of the cost of services of a transport company for the delivery of materials - 2500 rubles;

Debit 19 “Value added tax on purchased assets” Credit 60 “Settlements with suppliers and contractors”

— for the amount of VAT on transport services — 450 rubles. The actual cost of materials is 12,500 rubles.

(RUB 10,000 + RUB 2,500).

Free receipt of materials

The actual cost of materials received by an organization under a gift agreement or free of charge, as well as those remaining from the disposal of fixed assets and other property, is determined based on their current market value as of the date of acceptance for accounting. If delivery costs (transportation and procurement costs) are borne by the receiving party, then the actual cost of materials increases by the amount of expenses incurred (clause 66 of the Guidelines for accounting for inventories).

Assets received free of charge, including under a gift agreement, are other income (clause 7 of PBU 9/99).

Recognition of assets received free of charge as other income is carried out in the manner prescribed by the Instructions for the use of the Chart of Accounts (account 98 “Deferred Income”): the market value of assets received free of charge is reflected in the credit of account 98 “Deferred Income”, subaccount 2 “Gratuitous receipts” in correspondence with account 10 “Materials”; the amounts recorded in account 98 “Deferred income”, subaccount 2 “Gratuitous receipts” are written off from this account to the credit of account 91 “Other income and expenses” as material assets are written off to the accounts for recording production costs (sales expenses).

Example 3.9

In March, the organization received materials free of charge, the market value of which is 8,000 rubles. In April, part of the materials amounted to 6,000 rubles. were released into production. In May, the remaining materials were used to renovate the organization's office.

Let's make accounting entries:

in March:

Debit 10 “Materials” Credit 98 “Deferred income”, subaccount 2 “Gratuitous receipts”

- for the amount of the market value of the materials received - 8,000 rubles;

in April:

Debit 20 “Main production” Credit 10 “Materials”

- for the amount of the cost of materials released into production - 6,000 rubles;

Debit 98 “Deferred income”, subaccount 2 “Gratuitous receipts” Credit 91 “Other income and expenses”, subaccount 1 “Other income”

- for the amount of the cost of materials released into production - 6,000 rubles;

in May:

Debit 26 “General business expenses” Credit 10 “Materials”

- for the amount of the cost of materials used in the renovation of the office - 2000 rubles.

Debit 98 “Deferred income”, subaccount 2 “Gratuitous receipts” Credit 91 “Other income and expenses”, subaccount 1 “Other income”

- for the amount of the cost of materials used in the renovation of the office - 2000 rubles.

Test tasks

1. Situation . The organization purchased 100 kg of raw materials at a price of 708 rubles. per 1 kg (including VAT - 18%). According to the accounting policy, materials are accounted for at accounting prices. The accounting price of purchased raw materials is 630 rubles. for 1 kg. The raw materials were paid to the supplier from the bank account.

Exercise. Prepare accounting entries.

2. Situation . According to the agreement with the founder, his debt on contribution to the authorized capital is 20,000 rubles. To pay off the debt, the founder donated materials to the organization.

Exercise . Prepare accounting entries.

3. Situation . The organization received materials free of charge, the market value of which is 12,300 rubles. Part of the materials worth 4000 rubles. written off for production.

Exercise . Prepare accounting entries.

RELEASE OF MATERIALS FOR PRODUCTION

When materials are released into production or otherwise disposed of, they are assessed by the organization in one of the following ways:

a) at the cost of each unit;

b) at average cost;

c) using the FIFO method (at the cost of the first materials purchased);

(clause 73 of the Guidelines for accounting for inventories).

The assessment of materials supplied at the cost of each unit of stock should be used by the organization in the event that the stocks used cannot replace each other in the usual way or are subject to special accounting (precious metals, precious stones, radioactive substances, etc.) (clause 74 of the Guidelines for accounting for inventories ).

When writing off (dispensing) materials valued by the organization at average cost, the latter is determined for each group (type) of inventory as the quotient of dividing the total cost of the group (type) of inventory by their quantity, consisting respectively of cost and quantity by balance at the beginning of the month and by incoming inventories this month (clause 75 of the Guidelines for accounting for inventories).

Example 3.10

Using the data below, we determine the cost of materials written off for production in January and the cost of the balance of materials as of February 1.

Materials are valued at average cost.

INITIAL DATA:

| № | Contents of operation | Quantity of material, pcs. | Cost of a unit of material, rub. | Amount, rub. |

| Balance as of January 1 | 72 000 | |||

| Received in January, including: | 361 000 | |||

| January 10 | 110 000 | |||

| January 15 | 104 000 | |||

| January 20th | 147 000 | |||

| Total materials with balance at the beginning of the month | 433 000 | |||

| Released for production in January | ||||

| Balance as of February 1 |

Let's determine the average cost per unit of materials: 433,000 rubles. : 3800 pcs. = 113.95 rub.

Cost of materials written off for production in January: 3100 pcs. x 113.95 rub. = 353,245 rub. Cost of the balance of materials as of February 1: 433,000 rubles. — 353,245 rub. = 79,755 rub.

Write-off (issue) of materials using the FIFO method is carried out in an estimate calculated on the assumption that inventories are used during a month or another period in the sequence of their acquisition (receipt), i.e. the inventories that first enter production (sale) must be valued at the cost of the first acquisitions, taking into account the cost of inventories listed at the beginning of the month. When applying this method, the assessment of materials in stock (in a warehouse) at the end of the month is made at the actual cost of the materials that were most recently acquired, and the cost of goods, products, works, and services sold takes into account the cost of the earlier acquisitions (clause 76 of the Methodological Guidelines). instructions for accounting for inventories).

Example 3.11

Initial data of the EVIL example. Materials are valued using the FIFO method.

Cost of materials written off for production in January:

600 pcs. x 120 rub. + 1,000 pcs. x 10 rub. + 800 pcs. x 130 rub. + 700 pcs. x 105 rub. = 72,000 rub. + PO 000 rub. + 104,000 rub. + 73,500 rub. = 359,500 rub.

Cost of remaining materials as of February 1:

700 pcs. x 105 rub. = 73,500 rub.

As materials are released from the department's warehouses (storerooms) to sites, teams, and workplaces, they are written off from the inventory accounts and credited to the corresponding production cost accounts.

The cost of materials released for management needs is charged to the appropriate accounts for accounting for these expenses (clause 93 of the Guidelines for accounting for inventories).

The cost of materials consumed in connection with the marketing and sale of products (works, services) is credited to the sales expense accounts. Materials consumed in connection with the marketing and sale of products (works, services) include containers and packaging used for packaging finished products, not paid for separately by the buyer (in excess of the contract price for the products); materials used to fasten products to railway platforms, wagons and other vehicles; the cost of materials used in organizing promotional events, participation in fairs and exhibitions, etc. (clause 95 of the Guidelines for accounting for inventories).

Materials supplied to separate divisions of the organization, which are on separate balance sheets, are written off from accounting while simultaneously assigning their value to settlements with these divisions (clause 115 of the Guidelines for accounting for inventories).

Materials supplied to service industries and farms that are not on separate balance sheets are written off from accounting while simultaneously assigning their value to the expenses of these productions and farms (clause 116 of the Guidelines for accounting for inventories).

Example 3.12

The following materials were released from the organization's warehouse:

for main production - 12,700 rubles;

to auxiliary production - 4,300 rubles;

for management needs - 2100 rubles;

for an advertising campaign - 500 rubles;

for a separate division on a separate balance sheet - 11,000 rubles;

to a preschool institution on the balance sheet of the organization - 7,400 rubles.

Let's make accounting entries:

Debit 20 “Main production” Credit 10 “Materials”

- for the amount of the cost of materials released into production - 12,700 rubles;

Debit 23 “Auxiliary production” Credit 10 “Materials”

- for the amount of the cost of materials used in auxiliary production - 4300 rubles;

Debit 26 “General business expenses” Credit 10 “Materials”

- for the amount of the cost of materials used for management needs - 2100 rubles;

Debit 44 “Sales expenses” Credit 10 “Materials”

- for the amount of the cost of materials used during the advertising campaign - 500 rubles;

Debit 79 “On-farm settlements”, subaccount 1 “Settlements for allocated property” Credit 10 “Materials”

- for the amount of the cost of materials supplied to a separate division, which is on a separate balance sheet - 11,000 rubles;

Debit 29 “Service production and facilities” Credit 10 “Materials”

— for the amount of the cost of materials supplied to a preschool institution on the organization’s balance sheet — 7,400 rubles.

Test tasks

1. Situation. The organization received 300 units of materials free of charge. The market value of a unit of materials is 150 rubles. (without VAT). In the reporting period, 200 units of materials were released for production.

Exercise . Prepare accounting entries.

2. Task. Using the data given in the table, determine the cost of materials written off for production and materials remaining in the warehouse at the end of the month when evaluating materials:

a) at average cost;

b) using the FIFO method.

| content of operations | Quantity of material, pcs. | Cost of a unit of materials, rub. | Amount, rub. |

| Balance as of January 1 | 22 000 | ||

| Received in January, including: | 70 800 | ||

| 5 January | |||

| January 9 | 12 000 | ||

| January 14 | 19 000 | ||

| January 20th | 10 800 | ||

| The 25th of January | 22 500 | ||

| Released for production in January |

SALE OF MATERIALS

When shipping (releasing) materials for sale, the amounts payable by the buyer are determined, and a settlement document is drawn up and presented to him for payment.

The seller (supplier) records the following amounts payable by the buyer as the debit of the settlement account in correspondence with the credit of the sales account:

a) the cost of shipped (issued) materials at negotiated prices;

b) value added tax in the amounts established by law (clause 122 of the Guidelines for accounting for inventories).

In the event of the formation of debts due to customers, the following are debited from the sales account:

a) the actual cost of materials (when using accounting prices, the sum of the cost of materials at accounting prices and the share of deviations or transportation and procurement costs related to these materials);

b) sales expenses related to materials sold;

c) value added tax - in amounts determined in accordance with current legislation;

d) the debit or credit balance on the sales account is written off to the financial results of the organization.

The amount paid by the buyer is reflected in the debit of the corresponding cash accounting accounts in correspondence with the credit of the settlement accounts (clause 123 of the Guidelines for accounting for inventories).

In accordance with clause 7 of PBU 9/99 and clause 11 of PBU 10/99, proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods, and related expenses are recognized as other income, respectively and expenses.

Example 3.13

The organization sells materials. Negotiated sale price RUB 8,850. (including VAT - 1350 rubles).

The cost of materials according to accounting data is 5,000 rubles.

Let's make accounting entries:

Debit 62 “Settlements with buyers and customers” Credit 91 “Other income and expenses”, subaccount 1 “Other income”

- for the amount of the contractual cost of materials - 8850 rubles;

Debit 91 “Other income and expenses”, subaccount 2 “Other expenses” Credit 68 “Calculations for taxes and fees”

- for the amount of VAT - 1350 rubles;

Debit 91 “Other income and expenses”, subaccount 2 “Other expenses” Credit 10 “Materials”

- for the amount of cost of materials - 5000 rubles;

Debit 91 “Other income and expenses”, subaccount 9 “Balance of other income and expenses” Credit 99 “Profits and losses”

- the amount of profit from the sale of materials - 2500 rubles. (8850 rub. - 1350 rub. - 5000 rub.).

Test task

1. Situation . The organization sells materials to individuals at a price of RUB 10,856. (including VAT - 18%). Cash for sold materials was deposited into the organization's cash desk. The accounting cost of materials sold is 7,000 rubles.

Exercise. Determine the financial result from the sale of materials and prepare accounting entries.

2. Situation. The organization sold materials to a legal entity. The accounting cost of materials is 1,760 rubles, the selling price is 2,478 rubles. (including VAT - 18%). The funds for the materials sold were transferred to the organization's bank account.

Exercise. Determine the financial result from the sale of materials and prepare accounting entries.

MATERIAL INVENTORY

⇐ Previous6Next ⇒

Average cost calculation: not as simple as it seems at first glance

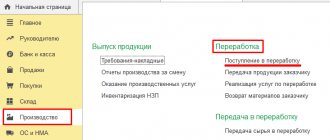

In this article we will not touch upon complex production processes, only trading operations, to understand the operation of configuration mechanisms.

When working in the accounting 3.0 and 2.0 configuration, when closing a month, we are often faced with the question of what kind of operation it is to adjust the cost of an item and why it is needed. Why, when calculating based on the average, does she add some additional transactions and change the cost of the Goods? Also, using an example, we will look at how the average cost is calculated in UT 10.3 and UT 11.4. What is their difference?

As an example, consider the following situation.

We will analyze the period November 2021. At the beginning of the period, as of November 1, 2019, the initial balance of goods was 10 pieces. costing 900 rubles.

There were 2 admissions during the period. From November 10, 10 pcs. at a price of 100 total cost 1000 and from November 20 10 pcs. at a price of 110, the total cost is 1100.

There were also 3 sales dated November 11, 11 units. from November 21, 11 pieces and from November 25, 5 pieces.

- Theoretical part.

I will take the description of the theory from the course /ut11/ut11-fast-start

There are 2 mechanisms for writing off cost by average - Weighted average cost estimate and moving average cost estimate. What is their difference:

Weighted average cost estimate.

In the case of weighted average cost. The program analyzes all initial balances and all receipts for the period, based on this, the amount of one disposal unit is calculated, multiplied by the number of disposals and the cost of disposal is obtained.

The formula will look like this: Cost =

For our example, the cost of disposal will be equal to

(11+11+5)= 2700

Moving average cost estimate

The program analyzes the amount and quantity of receipts not for the entire period, but for the period up to the date of the disposal document; a different cost estimate is obtained for different disposal documents.

Cost =

For the first disposal document dated November 11, the cost amount will be equal to

(11)= 1045

For the second disposal document dated November 21, the cost amount will be equal to

(11)= 1131,84

For the third disposal document dated November 25

(5)= 514,48

The total cost of disposal will be 2691.32

The difference between these two methods is 8.68 rubles.

- Practical part.

Using the example of the Enterprise Accounting 2.0 and 3.0 and Trade Management 10.3 and 11.4 configurations, let’s look at the settings and capabilities for calculating the average cost.

Let's start with the Enterprise Accounting 2.0 configuration

After entering documents and analyzing cost transactions, we receive the following data

| Period | |

| 11.11.2019 | 1 045,00 |

| 11,000 | |

| 21.11.2019 | 1 131,84 |

| 11,000 | |

| 25.11.2019 | 514,48 |

| 5,000 | |

| Total | 2691,32 |

| 27,000 |

Therefore, in accounting 2.0, when entering documents sequentially, a moving average calculation is used.

After the operation to close the month, the moving average cost is reduced to the weighted average cost

| Period | ||||||||||

| 11.11.2019 | 1 045,00 | |||||||||

| 11,000 | ||||||||||

| 21.11.2019 | 1 131,84 | |||||||||

| 11,000 | ||||||||||

| 25.11.2019 | 514,48 | |||||||||

| 5,000 | ||||||||||

| 30.11.2019 | 8,68 | |||||||||

| 0,000 | ||||||||||

| Total | 2700,00 | |||||||||

| 27,000 | ||||||||||

Consequently, in accounting 2.0, the cost price is initially calculated using the moving average method, then at the end of the month it is reduced to the weighted average method. If the accountant believes that the posting to bring the write-off cost to the weighted average cost is not necessary, then the operation “adjusting the cost of the item” when closing the month can be skipped.

In the accounting 3.0 configuration, the cost calculation mechanisms are the same, but I would like to note one point. In the Administration menu – Posting documents. It is possible to choose the moment of cost calculation.

- “When closing the month” – when processing write-off documents, only the quantity of inventory will be written off, and their cost will be written off when processing “Closing the month” is performed at the weighted average cost.

- “When posting a document” - the write-off of inventory (quantity and cost) will be performed when posting the document at the moving average cost; at the end of the month, when performing the “Closing the month” operation, the write-off will be adjusted at the weighted average cost.

In the UT 10.3 configuration, after sequentially entering documents from the “Statement of batches of goods in warehouses” report, it turns out that the average cost is calculated using the moving average method.

| Posting document | Consumption | |

| Nomenclature | Quantity | Price |

| Period | ||

| 27,000 | 2 691,32 | |

| product | 27,000 | 2 691,32 |

| 11.11.2019 23:59:59 | 11,000 | 1 045,00 |

| 21.11.2019 23:41:06 | 11,000 | 1 131,84 |

| 25.11.2019 23:56:37 | 5,000 | 514,48 |

| Bottom line | 27,000 | 2 691,32 |

Usually in 10.3 trading, no one takes any additional actions. However, in the Documents – Inventory (Warehouse) section, there is a document “Adjustment of the cost of writing off goods”. We will conduct it for the month of November and reformat the report

| Consumption | ||

| Nomenclature | Quantity | Price |

| Period | ||

| 27,000 | 2 700,00 | |

| product | 27,000 | 2 700,00 |

| 11.11.2019 23:59:59 | 11,000 | 1 045,00 |

| 21.11.2019 23:41:06 | 11,000 | 1 131,84 |

| 25.11.2019 23:56:37 | 5,000 | 514,48 |

| 30.11.2019 23:59:59 | 8,68 | |

| Bottom line | 27,000 | 2 700,00 |

A line is added to the report with the write-off adjustment based on the weighted average cost.

Let's consider this example in the Trade Management 11 configuration.

Let's enter receipt and sales documents. The cost price in this edition is calculated during the month-end closing operation. After analyzing the cost in the report “Statement of batches of goods of the enterprise”, we see that the cost is written off at the weighted average cost

| Period | Consumption | |||

| Quantity | Cost price | |||

| 11.11.2019 12:00:02 | 11,000 | 1 100,00 | ||

| 20.11.2019 12:00:02 | 11,000 | 1 100,00 | ||

| 25.11.2019 12:00:01 | 5,000 | 500,00 | ||

| Total | 27,000 | 2 700,00 | ||

From the above examples, the following conclusions can be drawn.

In configurations UT 10.3 BP 2.0 and BP 3.0, it is possible to calculate both the moving average and the weighted average cost - this depends on the settings and on the entered documents.

In the UT 11 configuration, only calculations based on the weighted average cost are possible.

Very often, when moving from the UT 10.3 edition to the UT 11 edition, customers ask to transfer documents for the last year or the last six months. In principle, it is not recommended to do this, so that all the jambs from the old program do not appear. However, if you still decide to do this, and inventory items are taken into account according to the average, you need to once again make sure that the cost in UT 10.3 is reduced to the weighted average, otherwise there will be discrepancies in the written-off cost in different releases. For a 1C specialist, this will be an extra argument to refuse to transfer documents for the period.

At the end of the article, I would like to note that from the point of view of PBU 18 5/01 paragraph 18, the weighted average cost is considered more correct

“The assessment of inventories at average cost is carried out for each group (type) of inventories by dividing the total cost of the group (type) of inventories by their quantity, consisting respectively of the cost price and the amount of balance at the beginning of the month and the inventory received during the given month.”

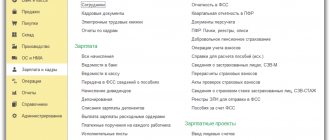

Types of cost

Before you start calculating the cost, it is worth finding out what types and types it is divided into. There are 2 types of cost:

- Full - consists of absolutely all expenses of the enterprise. It includes all costs, including the purchase of equipment and tools, transportation of finished goods, etc. It is worth noting that the calculation indicator is averaged.

- Limit: its calculations are based on the number of goods produced. This cost reflects the cost of producing all units of the product in excess of the norm. The data obtained during the calculation allows us to calculate the possibilities for expanding production.

Now about the types of costs. It happens:

- Shop - includes the costs of all structural divisions that manufacture new products.

- Production is the general workshop cost and total costs.

- Full - consists of the costs of production and sale of goods.

- General economic costs include costs that are not directly related to the production process. Consists of administrative expenses.

There is also a distinction between actual and standard costs. When calculating the first, the costs that make up the price of the product are taken into account. This is not the most convenient indicator for calculation: the difficulties arise from the fact that data on the cost of a product must be obtained before it is sold. This affects business profitability.

Calculation of standard cost is based on data from production standards. This allows you to control the consumption of materials and avoid unnecessary waste.

Types of cost

The cost can be:

- planned;

- actual.

The essence of the concepts of these types of costs is presented in Table 1.

Table 1. Planned and actual costs

| Type of cost | Essence |

| Planned cost | Planned cost is understood as an average indicator of the expected costs of performing work, services or producing products for a certain planned period. This type of cost is planned based on existing average standards for resource consumption (fuel, energy, materials, raw materials, labor costs, etc.) and certain, established expense standards for general production and general business expenses. The planning period when forming the planned cost can be a quarter or a year. |

| Actual cost | Actual cost is understood as the totality of expenses actually incurred for the manufacture of products or performance of work (rendering services). This type of cost is formed on the basis of actual production costs incurred. |

Cost structure

Every business is unique. Even companies operating in the same field have differences. What can we say about polarly different enterprises, for example, those producing soft toys and dumplings. Therefore, the calculation of product costs must be calculated individually, based on the production characteristics of the company. And this is easy to do - this is facilitated by the flexibility of the cost structure.

As mentioned above, cost = the sum of all expenses of the enterprise. In this case, the costs are divided into:

- costs of raw materials and supplies used to produce products;

- energy costs, fuel;

- expenses for equipment and tools;

- employee wages, taxes, social benefits;

- production costs: advertising, rent of premises, etc.;

- expenses for social events;

- depreciation deductions;

- administrative costs;

- payment for contractors' services.

All expenses are determined as a percentage. This allows you to quickly identify the company's weaknesses. It is worth emphasizing that the cost is constantly changing. Its size is influenced by various factors, for example, inflation, the number of competitors, loan rates, etc. Timely calculation of costs allows you to prevent bankruptcy of the company and adjust production strategies.

Why calculate direct and indirect costs

When a company produces only one type of product, calculating the cost of production is quite simple, but what if there are several products? In this case, dividing costs into direct and indirect will help.

Direct costs are what is spent on the production of a particular product. This could be raw materials, wages of piece workers, insurance premiums from it. Indirect costs relate to the entire production as a whole, for example, rent of premises, fixed salaries of production workers and business expenses.

Vladislav Ilyin, General Director:

“We produce functional foods and probiotics. Direct costs are raw materials, packaging, many auxiliary materials that are used for production, and wages for people working in production. Indirect costs: rent, maintenance of the workshop building, cleaning, garbage removal. As a rule, these costs do not change when production volumes change.”

To understand how many indirect costs are incurred for each type of product, you need to determine its share in the total production volume. And then distribute the amount of costs in proportion to this share.

In April, Mikhail decided to produce another type of product, dumplings with cherries. To calculate the cost, we had to divide the costs into direct and indirect. Since all employees receive a fixed salary, it and insurance premiums are included in indirect costs. And the raw materials are direct.

The production volume of dumplings was 500 kilograms, and dumplings - 2000. The share of dumplings in the total production volume is 20%, therefore, 20% of indirect costs should be attributed to the cost of dumplings. The cost of one kilogram of dumplings was 148 rubles, and vareniki - 103 rubles.

FIFO or average cost - which is better?

Both of these methods work quite well. However, FIFO is considered more accurate than the average cost method. It is especially beneficial in terms of taxes if the price of the goods you purchase is constantly decreasing. Then the cost of the written-off goods will be the greatest, and the balance will be the minimum. Therefore, the answer to the question of which is better, FIFO or average cost, in most cases will be the first option.

Which method of writing off materials has been cancelled?

Until 2008, FIFO and LIFO were considered acceptable methods for writing off materials. The basic principle of LIFO is that materials that are the last to arrive at the warehouse are removed from the inventory first.

Since 01/01/2008, by order of the Ministry of Finance dated 03/26/2007 No. 26n, LIFO was excluded from possible write-off methods for accounting purposes, therefore, at present, consideration of examples of calculation using the LIFO method has become irrelevant.

In addition to LIFO and FIFO, Russian taxpayers use the average cost write-off method. The essence of this method is described in the material “The procedure for writing off materials at average cost.”

FIFO method in warehouse program

Despite the fact that the FIFO method is quite simple in terms of understanding the principle of its operation, manually calculating the cost each time is very labor-intensive. Especially if you have a small business, and you yourself are the director, the cashier, the accountant, and the chief buyer. It is much easier if you simply enter data on deliveries and sales and immediately get the result. This is exactly how you can work with the MyWarehouse service. The program fully automates trading processes and itself calculates the cost of written-off goods using the FIFO method. MyWarehouse calculates profitability for each product or product group, stores and displays current and historical balances, as well as many other data that may be useful. This way, you save time and can be confident in the accuracy of the indicators on which you make decisions.

Company accounting policy

According to the law, the organization itself chooses how to calculate the cost of goods. It is important that the method you consider is necessarily reflected in the company's accounting policies. This is stated in Article 313 of the Tax Code of the Russian Federation, as well as in paragraph 73 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 28, 2001 No. 119n.

Changes to accounting policies can be made once a year. That is, you can deposit them earlier, but they will take effect according to the law next year - at the beginning of the new tax period. The accounting policy is drawn up by an accountant and approved by the head of the organization.

For management accounting purposes, you are free to use any costing method. Our advice is to use the same one that is written down in your accounting policy - this way there will be less confusion.

FIFO method. Calculation example

This is the most popular cost calculation method. It uses the queuing principle. It is assumed that the items that were delivered first are written off first. Hence the name FIFO method (English: “first in, first out” - “first in, first out”). However, unless the shelf life is important, it is not necessary to ship goods from an earlier delivery first - this is used as an assumption in the calculations. That is, the cost of goods that are sold first is calculated at the price of the balances from the “oldest” delivery. When the balances are quantitatively exhausted, inventory items are written off at the price of the next delivery, then the next one, and so on.

Example of calculation using the FIFO method

As can be seen from the example of calculation using the FIFO method, the profit indicator in this case is lower than in the example with average cost. Accordingly, income tax will be less.

Accounting for finished products at actual cost

In the accounting department of an economic entity, operations for accounting for finished products are carried out using account 43, which has the appropriate name “Finished Products”. The release of finished products from production at actual cost is reflected in the accounting entry, where the credit is account 20 (i.e., production of products from the main production), account 23 (product release from auxiliary production), and the debit is account 43.

When a sale is made, the accounting department of a business entity writes off the actual cost of products sold. In this case, the posting is made as follows, where the credit indicates account 43 (meaning the write-off of the actual cost of products sold), and the debit indicates account 90, subaccount 2 (which reflects the cost of sales).

You can find more complete information on the topic in ConsultantPlus.

Free access to the system for 2 days.

How to find unit cost

The calculation method depends on the type of product. If the goods are serial, then first of all the cost of the entire series is calculated, and then the resulting figure is divided by the entire volume. If an enterprise produces piece goods, then the indicator is calculated individually for each of them.

Here are examples of calculations for both cases with real numbers:

- Calculation for mass production.

If 320 units of equipment are produced with a cost of 2,750,000 rubles, then the cost of 1 unit will be: 2,750,000 / 320 = 8,593.75 rubles.

- Calculation for piece production.

Let's say 3 kitchen sets were produced with different sets of furniture and characteristics. In this case, cost estimates will be carried out on the basis of each individual set - only this method will allow you to calculate the cost. Suppose calculations showed that the cost of one of them is 350 thousand rubles, the second - 420 thousand rubles, the third - 210 thousand rubles. Then the total cost will be: 350,000 + 420,000 + 210,000 = 980 thousand rubles.

How to reduce production costs

Reducing costs will allow the company to operate more efficiently and, depending on its goals, earn more or have a competitive price. Mikhail decided to find out if he could reduce the cost of his products and calculated different savings options in the table:

Option 1. Reducing the cost of raw materials

You can buy larger quantities, negotiate a discount, or find a new supplier. Mikhail’s most expensive direct cost item is minced meat; reducing its cost by 5% results in a reduction in cost by 3 rubles.

Option 2. Increasing labor productivity

The more products are produced, the lower the indirect costs per unit of production. You can make workplaces more convenient, optimize work and motivate employees. If you increase the number of dumplings produced by 20%, then the cost will fall by 13 rubles. Plus, production will require more raw materials, therefore, you can ask the supplier for more favorable conditions.

Option 3. Automation of production

This method will allow you to replace employees with equipment and save on labor costs. Of course, you need to maintain a balance; too expensive equipment may not pay for itself with small volumes. Mikhail plans to buy an automatic machine for 150,000 rubles for making dumplings. Its installation will eliminate the need for one of the kitchen workers. Despite the high cost, its depreciation will be 6,250 rubles with an estimated service life of 24 months. This is significantly less than the employee's salary. As a result of production modernization, the cost of dumplings will decrease by 13 rubles.

Option 4. Saving electricity, water, reducing rent

They will also lead to a reduction in indirect costs and a reduction in production costs. Reducing these costs by 25% will reduce the cost of production by 5 rubles.

Oksana Bondarenko, director:

“With the help of cost, you can not only formulate a pricing policy, but also monitor the success of your business. For example, if the cost goes down, this is a good sign. The more a business produces, the smaller the share of expenses in expenses begins to be taken up by renting premises and depreciation. Costs are also reduced by increasing the efficiency of employees: we produce more, but we pay the same as before.”