If the seller is a VAT evader

Any transaction for the supply of goods or services is accompanied by the execution of a certain set of documents - contracts, specifications, invoices for payment, shipping forms (waybills, acts), invoices (invoices). If the supplier does not work with VAT, then he sends all these documents to the buyer without reflecting the amount of VAT, putting the counterparty’s mark “Without VAT” or a dash in the places designated for indicating the amount of tax.

In the text of the contract or invoice, it is advisable for the seller to indicate the basis giving him the right not to pay tax. This is important, since the reasons for VAT exemption may be different, but some of them oblige the seller to provide the buyer with an invoice. So, according to paragraph 5 of Art. 168 of the Tax Code of the Russian Federation, sellers who are exempt from VAT due to the fact that their revenue did not exceed 2 million rubles should draw up a tax return. for the last three months (Article 145 of the Tax Code of the Russian Federation) or participating in Skolkovo research projects (Article 145.1 of the Tax Code of the Russian Federation).

Attention to buyers: invoice from a supplier who does not pay VAT

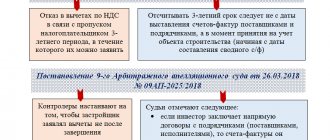

Tax officials never tire of refusing to deduct VAT on an invoice issued by a special regime person, a person exempted from the duties of a VAT payer, or a counterparty providing services not subject to VAT. However, recent judicial practice, including at the level of higher authorities, allows us to hope that by going to court, a company has a high chance of defending its right to deduction.

Marina Ozerova, especially for Klerk.Ru If among your suppliers there are special regime holders (that is, firms or individual entrepreneurs using the simplified tax system, UTII or Unified Agricultural Tax), as well as persons who are exempt from fulfilling the duties of VAT payers, then a situation cannot be ruled out in which such the counterparty can issue you an invoice with the allocated VAT amount.

In this case, the accountant will definitely have a question: can such VAT be deducted?

Turning to practice, we note that the tax authorities answer the question we identified in the negative . For example, this position is given in the letter of the Federal Tax Service for Moscow dated December 3, 2004 No. 24-11/78207.

However, the Russian Ministry of Finance spoke in favor of the taxpayer . Thus, in its letter dated July 11, 2005 No. 03-04-11/149, the financial department indicated that if a supplier company using the simplified tax system issued an invoice to the buyer, where VAT is highlighted on a separate line, then the tax amounts are deducted in the generally established manner .

True, for this you need :

— compliance with the conditions under which the right to deduction is granted;

- the amount of VAT indicated by the “simplified” in the invoice issued by him must be paid to the budget.

Let us remind you that according to clause 5 of Art. 173 of the Tax Code of the Russian Federation, persons who are not VAT payers, as well as persons exempt from fulfilling the duties of a taxpayer, are required to pay tax to the budget if they have issued an invoice highlighting the amount of VAT.

So, taking into account the position of the Ministry of Finance of Russia, we can draw the following conclusion: if a special regime person or a person exempted from fulfilling the duty of a taxpayer under Art. 145 of the Tax Code of the Russian Federation, has issued you an invoice with the amount of VAT allocated in it, then such VAT can be deducted. Subject to the above conditions.

However, we do not rule out that the tax authorities will still be against it.

True, the positive judicial practice available today will help convince inspectors. Well, if this doesn’t help, then you can safely go to court.

Thus, special attention should be paid to the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 30, 2007 No. 10627/06 in case No. A32-35519/2005-58/731, in which the judges sided with the taxpayer (you can read the text of the document itself on our website https:/ /www.nds-ks.ru/ in the “News” section of the “VAT Deduction” heading). Let us immediately note that this resolution dealt with the legality of deducting VAT by a company that provided property security services that were not subject to clauses. 4 paragraphs 2 art. 146 of the Tax Code of the Russian Federation on VAT taxation.

The essence of the dispute in question was as follows.

The company claimed VAT for deduction on the invoice issued by the private security departments for the protection of property.

According to the tax inspectorate, the organization does not have the right to take into account the amount of this tax as tax deductions, since funds received by private security departments are not subject to VAT (clause 4, clause 2, article 146 of the Tax Code of the Russian Federation).

It is noteworthy that the cassation court supported the tax inspectorate, based on the fact that the erroneous receipt of VAT by private security departments is unjust enrichment. In this case, the arbitrators considered, the organization has the right to recover from the private security departments the overpaid amounts of VAT as unjust enrichment, and not to indicate them in the tax return as tax deductions.

However, the Presidium of the Supreme Arbitration Court of the Russian Federation did not agree with this position.

The Presidium of the Supreme Arbitration Court of the Russian Federation indicated that in this case, private security departments, in violation of paragraphs. 4 paragraphs 2 art. 146 of the Tax Code of the Russian Federation and clause 3 of Art. 169 of the Tax Code of the Russian Federation issued invoices to organizations indicating the amounts of VAT, therefore, in accordance with clause 5 of Art. 173 of the Tax Code of the Russian Federation must pay the received tax amounts to the budget. In turn, the company paid the invoices and, guided by the provisions of Art. 169, 171 and 172 of the Tax Code of the Russian Federation, lawfully reflected these amounts in tax returns as tax deductions.

The taxpayers are also on the side of the federal district arbitrators.

Here are some positive decisions of arbitration courts recently. These are the FAS decisions:

— Ural District dated September 18, 2006 No. F09-8229/06-C2 in case No. A07-39194/05; dated June 19, 2006 No. F09-5025/06-S2 in case No. A76-28582/05 .

For example, in the first listed decision of the arbitrators, the judges indicated that the legislation on taxes and fees does not link the emergence of the taxpayer’s right to a tax deduction from the fact of payment of VAT to the budget by product suppliers. In this case, the argument of the Federal Tax Service that the company does not have the right to deduct VAT on an invoice issued by non-VAT payers, since they do not pay VAT, and therefore the source of VAT reimbursement has not been formed in the budget, is untenable.

In the second court decision, the servants of Themis emphasized that the inspectorate did not take into account that if persons who are not taxpayers issue an invoice to the buyer with the allocation of the amount of VAT, the amount of tax payable to the budget is calculated by this person in accordance with paragraph 5 of Art. . 173 Tax Code of the Russian Federation. In this case, the amount of tax payable to the budget is determined as the amount of tax indicated in the corresponding invoice transferred to the buyer of goods (works, services). Thus, the judges concluded, these circumstances do not prevent the taxpayer from exercising his right to a tax deduction on an invoice issued by a person who is not a VAT payer;

— Northwestern District dated December 14, 2006 No. A56-35705/2005.

Thus, one of the circumstances for which the tax inspectorate refused to deduct VAT for the organization was that its supplier, using a simplified taxation system, issued invoices and invoices inclusive of VAT. However, the judges did not take this argument into account;

- Volga-Vyatka District dated 03/02/2006 No. A79-11982/2005.

The arbitrators concluded that the provisions of Ch. 21 of the Tax Code of the Russian Federation do not provide for the possibility of refusing to accept VAT amounts for deduction if the seller does not have an obligation to pay tax due to his application of the taxation system in the form of UTII. At the same time, the judges also proceeded from the provisions of paragraph 5 of Art. 173 of the Tax Code of the Russian Federation, according to which the seller of goods, who is not a taxpayer, but has received VAT amounts from the buyer, is obliged to pay such amounts to the budget;

— West Siberian District dated March 27, 2006 No. F04-2073/2006(20905-A70-33).

Having recognized the legal deduction of VAT on an invoice issued by a “simplified” one, the arbitrators indicated that, in accordance with Art. 87 of the Tax Code of the Russian Federation, the responsibility to exercise tax control over compliance with legislation on taxes and fees is assigned to the tax authorities. If, during tax audits, facts of non-fulfillment of the obligation to pay tax by suppliers who are independent taxpayers are revealed, the tax authorities have the right in accordance with Art. 45, 46 and 47 of the Tax Code of the Russian Federation to resolve the issue of forced fulfillment of this obligation and thereby ensure the formation in the budget of a source for VAT reimbursement;

- Volga District dated April 18, 2006 No. A55-15212/2005-3; dated April 19, 2006 No. A55-21067/05-34.

The judges' argument is still the same. The “simplified” person who issued an invoice with the allocated amount of VAT is obliged to transfer this tax to the budget (clause 5 of Article 173 of the Tax Code of the Russian Federation). Therefore, the tax inspectorate’s reference to the fact that the person applying the simplified tax system and issuing the invoice does not calculate or pay VAT was rejected.

In addition, in this case, the judges emphasized that the organization provided evidence that VAT was actually paid as part of the price.

The author is the editor-in-chief of the Internet portal https://www.nds-ks.ru

If the buyer (counterparty) is a VAT defaulter

Since the responsibility for documenting the transaction lies with the seller, the supplier paying VAT issues invoices and shipping documents to the buyer, fixing the rate and the amount of VAT, even in cases where his counterparty is not a VAT payer.

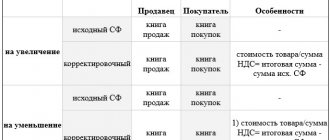

In this case, the seller - a VAT payer has the right not to transfer the SF to the buyer if he has concluded a corresponding written agreement with him (clause 1, clause 3, article 169 of the Tax Code of the Russian Federation). It is more convenient to reflect this fact in an additional agreement to the supply contract. The seller should record the transaction in the sales book, so he usually draws up one copy of the SF for himself, although he has the right to use details of other primary forms to reflect the fact of the transaction.

The buyer is obliged to pay the invoice taking into account the tax; he does not have the obligation to prepare tax reports. He needs to highlight the amount of tax in the total cost of delivery in payment documents, for example, in a payment order in the “Base of payment” field.

The buyer can take into account the VAT paid as follows:

- Include it in the cost of goods/services accepted for accounting (clause 3, clause 2, article 170 of the Tax Code of the Russian Federation). This method is acceptable for companies exempt from VAT on the basis of Art. 145 and 145.1 of the Tax Code of the Russian Federation, as well as UTII payers (Article 346.23 of the Tax Code of the Russian Federation).

- Including tax as part of expenses that reduce income is acceptable for “simplified” people in the “Revenues minus expenses” mode. In this case, upon receipt of the delivered goods at full cost including VAT, the buyer writes off this amount (clause 2 of Article 346.17 of the Tax Code of the Russian Federation): for fixed assets and intangible assets in equal shares from the moment the objects are put into operation;

- for goods for resale - as they are sold;

- for inventory items - when they are written off for production or sale.

Since VAT according to Ch. 26.2 of the Tax Code of the Russian Federation is considered an expense, then “simplified” in KUDiR it should be reflected for purchased goods separately (in a separate line) and confirmed by indicating the number of the payment document, invoice or invoice upon sale.

Example

Upon delivery of goods in the amount of 720,000 rubles, including VAT of 120,000 rubles. (as indicated in the documents accompanying the transaction), the “imputed” buyer accepted for accounting goods worth RUB 720,000. But in the payment order for payment for this product, he o.

If the counterparty works without VAT and pays in advance, then the seller, upon receipt of payment, draws up an advance SF in the usual manner, but in one copy - for himself. There is no need to send the SF to a buyer who does not report VAT.

How is VAT calculated on goods purchased by a VAT non-payer?

Recipients of goods, works, services who are VAT payers

in accordance with paragraph 1) paragraph 1 of Article 367 of the Tax Code of the Republic of Kazakhstan,

they can offset the amount of VAT payable for goods, works and services received ,

if they are used or will be used for the purposes of taxable sales turnover, subject to compliance with the conditions specified in Article 400 of the Tax Code of the Republic of Kazakhstan.

Consequently, VAT non-payers when purchasing goods, works, services with VAT cannot offset the amount of VAT.

In accordance with the provisions of the National Financial Reporting Standard, IAS 2 “Inventories”, IFRS for SMEs, the cost of inventories consists of the purchase price, import duties, taxes (except refundable)

.

Thus, VAT must be included in the cost of purchased goods, since for a VAT evader it is a non-refundable tax.

According to Art. 424 of the Tax Code of the Republic of Kazakhstan, the VAT declaration TNF 300.00 is submitted only by VAT payers specified in clause 1) clause 1 of Art. 367 of the Tax Code of the Republic of Kazakhstan. It is not possible to return excess VAT credit from the budget.

Invoices are issued in accordance with Art. 412 of the Tax Code of the Republic of Kazakhstan and the Rules for issuing an invoice in electronic form in the ESF IS and its forms, approved by Order of the First Deputy Prime Minister of the Republic of Kazakhstan - Minister of Finance of the Republic of Kazakhstan dated April 22, 2021 No. 370 (hereinafter referred to as the Rules for issuing ESF).

The provisions of Art. 412 of the Tax Code of the Republic of Kazakhstan establishes that when making a turnover for the sale of goods, works, services, the following are required to issue an invoice:

1) VAT payers provided for in paragraph 1) paragraph 1 of Art. 367 Tax Code of the Republic of Kazakhstan;

2) taxpayers in cases provided for by the regulatory legal acts of the Republic of Kazakhstan adopted for the purpose of implementing international treaties ratified by the Republic of Kazakhstan;

3) a commission agent who is not a VAT payer, in the cases established by Art. 416 of the Tax Code of the Republic of Kazakhstan;

4) a forwarder who is not a VAT payer, in the cases established by Art. 415 of the Tax Code of the Republic of Kazakhstan;

5) taxpayers in case of sale of imported goods;

6) a structural unit of the authorized body in the field of state material reserve when it releases goods from the state material reserve.

Clause 67 of the Rules for issuing ESF states that column 12 “VAT rate” indicates the VAT rate. In the case of an extract of the ESF for exempt turnover, as well as an extract of the ESF by a taxpayer who is not a VAT payer, it is indicated without the possibility of adjustment .

Thus, the issuance of ESF by VAT defaulters is mandatory in the cases specified in Art. 412 of the Tax Code of the Republic of Kazakhstan. For example, if an individual entrepreneur sells a product included in the List of Exemptions or an imported product, then he must issue an ESF. An individual entrepreneur, being a VAT non-payer, indicates the rate “Without VAT” when issuing an ESF.