Where to pay contributions for injuries

Social contributions are divided into 2 types:

- contributions in case of temporary disability and in connection with maternity (VNiM) - are paid only for employees signed under an employment contract;

- Contributions for industrial accidents and occupational diseases (“accident” contributions, “injury” contributions) are transferred for all employees with whom an employment contract has been concluded, as well as for performers under the civil process agreement, which stipulates the obligation to pay such contributions.

From 2021, after the transfer of insurance premiums to the jurisdiction of the Federal Tax Service, social contributions are paid:

- to the Federal Tax Service - deductions for VNiM (see the procedure and sample for filling out such a payment form here);

- in the Social Insurance Fund - contributions for injuries.

The funds have announced details for contributions in Moscow and the region

MAIN THING IN THE ARTICLE Moscow and the region have different details for paying contributions. New BCCs will need to be written on payment cards.

The Federal Social Insurance Fund of the Russian Federation for Moscow and the region and the regional Pension Fund have published their details, according to which companies can transfer insurance premiums no later than February 15 (see Tables 1 and 2).

What else to write on payment slips to the FSS

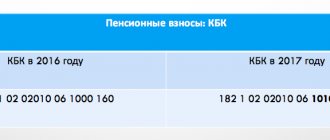

For new contributions, new BCCs are also provided (see box). If, due to an error in the KBK, the money does not end up in the correct account, the company will be charged penalties, and contributions will need to be paid a second time using the correct details.

At the top of the payment cards are Moscow ones, and those near Moscow are “In GU MORO FSS Branch No.” In the “Purpose of payment” field, the fund asks to put “Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for (month) 2010.” and registration number.

Special details of payments to the Pension Fund, FFOMS and TFOMS

Moscow companies must write “For UPFR in Moscow” at the top of the payment order. And for policyholders from the region - “For UPFR in the Moscow region.”

In the “Purpose of payment” field, enter one of four types of payments transferred to the Pension Fund (for each - a separate order): “Insurance contributions for the payment of the insurance part of the labor pension for (month) 2010”, “Insurance contributions for the payment of the funded part of the labor pension pensions for (month) 2010”, “Insurance contributions for compulsory medical insurance to the budget of the Federal Compulsory Medical Insurance Fund for (month) 2010”, “Insurance contributions for compulsory medical insurance credited to the budget of the Federal Compulsory Medical Insurance Fund for (month) 2010”. After the name they put the registration number in the fund. On the website of the capital’s Pension Fund www.pfrf.ru/ot_moscow there is a guide to filling out payment slips (section “Current information”> “Administration of insurance premiums”).

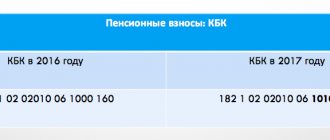

New BCCs for contributions for 2010

392 1 0200 160 – insurance contributions to the Pension Fund for the insurance part;

392 1 0200 160 – insurance contributions to the Pension Fund for the funded part;

392 1 0200 160 – insurance contributions to the Federal Compulsory Medical Insurance Fund;

392 1 0200 160 – insurance contributions to the TFOMS;

393 1 0200 160 – contributions to the Social Insurance Fund.

At the same time, the numbers from 14 to 17 in the KBK are as follows: 1000 - when paying insurance premiums, 2000 - if penalties are transferred, 3000 - if fines.

Table 1. Details for capital companies

| In the FSS of the Russian Federation | |

| TIN | 7710030933 |

| checkpoint | 770701001 |

| Recipient | UFK for Moscow (GU - Moscow regional branch of the Social Insurance Fund of the Russian Federation) |

| Checking account | 40101810800000010041 |

| BIC | 044583001 |

| payee's bank | Branch 1 of the Moscow State Technical University of the Bank of Russia, Moscow |

| To the Pension Fund | |

| TIN | 7703363868 |

| checkpoint | 770301001 |

| Recipient | UFK for the city of Moscow (for State Institutions - branches of the Pension Fund of the Russian Federation for the city of Moscow and the Moscow region) |

| Checking account | 40101810800000010041 |

| BIC | 044583001 |

| payee's bank | Branch 1 of the Moscow State Technical University of the Bank of Russia, Moscow 705 |

Table 2. Details for companies located near Moscow

| In the FSS of the Russian Federation | |

| TIN | 7710030362 |

| checkpoint | 770401001 |

| Recipient | UFK for the Moscow region (GU – Moscow regional regional branch of the Social Insurance Fund of the Russian Federation) |

| Checking account | 40101810600000010102 |

| BIC | 044583001 |

| payee's bank | Branch 1 of the Moscow State Technical University of the Bank of Russia, Moscow 705 |

| To the Pension Fund | |

| TIN | 7703363868 |

| checkpoint | 770301001 |

| Recipient | UFK for the Moscow region (for State Institutions - branches of the Pension Fund of the Russian Federation for Moscow and the Moscow region) |

| Checking account | 40101810600000010102 |

| BIC | 044583001 |

| payee's bank | Branch 1 of the Moscow State Technical University of the Bank of Russia, Moscow 705 |

The article was published in the newspaper “UNP” No. 5, 2010

Deadline for payment of contributions for injuries

The deadline for paying contributions for injuries is no later than the 15th day of the month following the one in which the employee received income. If this day falls on a holiday or day off, it is transferred to the first working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

In 2021, the deadlines for payment of “traumatic” contributions are shifted to February, March, August and November. You can get information about the exact deadlines for paying these payments in 2021 in this article.

Where to find current details for paying insurance premiums in 2020

To avoid errors in payment orders, it is necessary to clarify information about the recipient of funds:

- Name;

- information about the recipient's bank details: personal account, bank name and other data.

You can obtain such information about the Social Insurance Fund in several ways:

- contact Social Insurance (in person, by phone or in writing), employees will definitely provide you with the current details for paying contributions in 2021;

- obtain information through the “State Services” portal, to do this, send a request through your personal account on the website, the information will be provided within 24 hours;

- check on the official website of the FSS on the Internet.

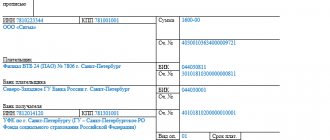

Sample payment order for injuries in the Social Insurance Fund 2021

When filling out a payment form for contributions for injuries, you should be guided by the rules prescribed in:

- Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n;

- Regulations of the Bank of the Russian Federation dated June 19, 2012 No. 383-P.

Payment order form 2020

The procedure and features of drawing up a payment order for contributions for injuries are shown in the table:

| Props name | Number (according to Appendix No. 3 to the Regulations of the Bank of Russia dated No. 383-P) | Note |

| Admission to the bank of payments. | 62 | There is no need to fill them out, the bank employee will fill them out independently. |

| Debited from account plat. | 71 | |

| № | 3 | If you generate a payment manually, the number must be greater than zero. If the document is drawn up in electronic form, this field will be filled in automatically and there is no need to further adjust it |

| date | 4 | The order in which the date is indicated also depends on how the payment is filled out:

|

| Payment type | 5 | When paying contributions for injuries, this field does not need to be filled in. |

| Payer status | 101 | Regardless of who pays the fees (individual entrepreneur or organization), the code “08” is indicated here |

| Suma in cuirsive | 6 | Write down the amount of contributions paid in words:

For example: “Eight hundred thirty-four rubles 50 kopecks” |

| Sum | 7 | We transfer the amount from field 6, but in the form of numbers. We do not indicate the words “ruble” and “kopecks” at all, but separate them from each other:

The round sum can be written in another way: “834-00” |

| TIN | 60 | We enter the TIN of the employer paying the contributions. For an organization, the number consists of 10 characters, for an individual entrepreneur - of 12 |

| checkpoint | 102 | Checkpoints are indicated only by organizations and separate divisions (OP):

Entrepreneurs do not have a checkpoint, so they leave this field blank or set the value “0” |

| Payer | 8 |

|

| Account No. | 9 | Bank account number of the organization or entrepreneur. It must consist of at least 20 characters |

| Payer's bank | 10 | Bank account details of an organization or individual entrepreneur paying contributions for injuries |

| BIC | 11 | |

| Account No. | 12 | |

| payee's bank | 13 | Bank details of the Social Insurance Fund branch to which contributions are paid. You can find out which department they should be transferred to from the notice sent by the fund, as well as on the website of this department |

| BIC | 14 | |

| Account No. | 15 | This field is intended to indicate the correspondent account number of the paying bank. There is no need to fill it out when paying personal injury contributions. |

| TIN | 61 | TIN and KPP of the Social Insurance branch to which contributions are transferred. You can also find out from the notification sent by the fund for the payment of these payments |

| checkpoint | 103 | |

| Recipient | 16 | The recipient of contributions is the Federal Treasury: “UFK for ___ (enter the name of the region in which contributions are transferred).” After this, you need to indicate the FSS branch to which contributions are transferred. For example: “UFK for Moscow (GU - Moscow regional branch of the FSS of Russia) |

| Account No. | 17 | Bank account number of the recipient of contributions (UFK). You can find it on the website of the regional branch of the Social Insurance Fund, to which contributions are transferred |

| Type op. | 18 | For insurance premiums for injuries, enter code “01” |

| Payment deadline. | 19 | We do not fill out these fields |

| Name pl. | 20 | |

| Essay. Plat. | 21 | The order of payment is 5, so enter the code “05” in this field |

| Code | 22 | When paying contributions on time, indicate the code “0”. If contributions are paid at the request of the Social Insurance Fund, in this field you must indicate the UIN from the request |

| Res. field | 23 | We do not fill in |

| Purpose of payment | 24 | The name of the payment and the period for which it is transferred. It is advisable to indicate the registration number of the policyholder in the Social Insurance Fund. For example, “Insurance contributions to the Social Insurance Fund for compulsory social insurance against industrial accidents and occupational diseases for January 2021. Registration number in the FSS - 7712123453" |

| M.P. | 43 | We put a stamp (as in the sample card). If the payment form is generated by a bank, it is not necessary to put a stamp. |

| Signatures | 44 | We put the signature of the person indicated in the sample signature card |

To which tax inspectorate should I pay insurance premiums?

Starting from January 1, 2021, insurance premiums, with the exception of payments from the National Tax Service and the Pension Fund, are transferred to the following tax inspectorates:

- Individual entrepreneur - at the place of residence;

- legal entities - at their location.

Separate units

Separate divisions, which have the right to calculate and pay wages to employees, are required to pay insurance premiums, as well as submit settlements at the location of the separate division. At the same time, the parent organization submits calculations for insurance premiums (clause 11 of Article 431 of the Tax Code of the Russian Federation).

If an organization has separate divisions located outside the territory of the Russian Federation, payment of payments and submission of settlements occur at the location of the parent organization (clause 14 of Article 431 of the Tax Code of the Russian Federation).

Separate divisions are required to inform the tax authority that they have the authority to pay remuneration in favor of individuals (or are deprived of such authority) within one month from the date of such a decision (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation).

Payment order for injuries: attention to important fields

The procedure for filling out fields 104-109 when paying contributions for injuries is given in the table:

| Line title | Number | Note |

| 104 | Budget classification code | Since contributions for injuries are administered by the FSS, the first 3 digits of the code will be 383. When filling out a payment form for contributions from accidents and occupational diseases, you should indicate KBK 393 1 0200 160 |

| 105 | OKTMO code | We make an OKTMO of the FSS branch, to which contributions for injuries are transferred:

|

| 106 | Payment basis code | When paying contributions for injuries, “0” is entered in these fields (clause 5 of Appendix No. 4 to Order of the Ministry of Finance dated November 12, 2013 No. 107n). When paying other contributions (for compulsory medical insurance, compulsory medical insurance and VNiM), lines 106 and 107 are filled in |

| 107 | Taxable period | |

| 108 | Document Number | |

| 109 | Document date |

Sample payment order for injury contributions

Let's sum it up

- Contributions for injuries are transferred not to the Federal Tax Service, like all other insurance contributions (for compulsory medical insurance, compulsory medical insurance and VNiM), but to the Social Insurance Fund.

- The deadline for payment of contributions for accidents and occupational diseases is until the 15th day of the month following the one in which the employee received income.

- When filling out the payment form, code “08” is indicated in field 101, regardless of who pays the injury contributions.

- Fields “106-109” are not filled in when paying “unfortunate” contributions.

- Contributions for injuries are paid to KBC - 393 1 02 02050 07 1000 160.