When the employment relationship with an employee is terminated, a full settlement must be made. The departing employee must receive all the money he earned on the day of dismissal, in addition, compensation for vacation days if it was not used in full. In many cases, additional compensation for leaving is also due (depending on the reason and article for which the dismissal is made).

Accounting calculates these payments according to the algorithm provided by law, which is based on average earnings for a certain accounting period. Most often, the basis is taken as average daily earnings. Its calculation provides some nuances that should be followed in order to avoid financial errors.

Let's look at how this indicator is calculated in various situations and give specific examples.

How to calculate average daily earnings (except for cases of calculating vacation pay and compensation for unused vacation)?

Legislative norms

Labor law and Government Decrees of the Russian Federation require that managers and accountants, when calculating compensation and other payments upon dismissal, be guided by the provisions given:

- Art. 139 of the Labor Code of the Russian Federation - it regulates the procedure for calculating dismissal payments;

- The regulation, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922, discusses in detail the calculation methodology relating to the determination of average earnings for the accounting period in all legally valid situations.

Question: How to calculate the average daily earnings to compensate for unused vacation upon dismissal in the middle of the month, if the actual accrued wages or days worked were only in the month of dismissal, and also if there were none at all? View answer

Calculation parameters

The numbers that are taken into account when calculating the average salary of an employee are both fixed and constant values, namely:

- the period for which the calculation is made (legally determined for each case);

- the amount of all types of employee income for this period (with the exception of deductions provided for by law);

- the average number of calendar days in a month is a fixed indicator equal to 29.3 (as regulated by Federal Law No. 55 of April 2, 2014).

Question: An employee was transferred to part-time work 2 months ago. For the day of blood donation, he demands to be paid his average earnings, but this earnings will significantly exceed his average daily earnings when working part-time. Are his demands legitimate? View answer

An example of calculating compensation for unused vacation

Employee Fedorov V.A. hired at Solnyshko LLC on December 3, 2019, and left on May 25, 2021.

Fedorov was on vacation in July 2021 (28 cal. days). The employee did not have any periods not included in the vacation period. The calculation period for calculating compensation is 12 months preceding the month of dismissal, i.e. from May 2021 to April 2021. During this period, the employee earned 632,400 rubles.

Step 1 - calculate the length of service:

- from 03.12.2019 to 02.12.2020 - 12 months;

- from 12/03/2020 to 05/02/2021 - 5 months;

- from 05/03/2021 to 05/25/2021 - 22 days, which exceeds half a month, which means the full month is taken into account.

Total experience is 18 months

Step 2 - determine the number of vacation days from the start of work. 18 months x 2.33 = 42 days.

Step 3 - determine the number of days of unused vacation.

42 days - 28 days used = 14 days

Step 4 - calculate average daily earnings (ADE).

- the number of fully worked months in the billing period is 11;

- in incompletely worked August it is equal to 2.84 (29.3 / 31 days x (31 days - 28 days));

- SDZ is equal to 1,945 rubles. (RUB 632,400 / (29.3 x 11 months + 2.84 days)).

Step 5 - determine the amount of compensation for vacation.

RUB 1,945 x 14 days = 27,230 rub. When paying compensation, personal income tax must be withheld from it. Thus, Fedorov will receive 23,691 rubles. (RUB 27,230 - 13%).

Exclusion from the calculation of special periods

The first point in applying the methodology for calculating dismissal payments will be to determine the total amount of the employee’s earnings for a particular period established by law. All time actually worked by the employee and the amounts accrued to him for these working days are taken into account, except for special periods excluded by law. Amounts that an employee received during the following periods should not be included in total income when calculating his severance payments:

- while on a business trip, since during this time his earnings were retained (Article 167 of the Labor Code of the Russian Federation);

- during paid or administrative leave (Article 114 of the Labor Code of the Russian Federation);

- period of temporary disability (illness, caring for a loved one, pregnancy and childbirth);

- additional free days provided for caring for disabled children;

- downtime through no fault of the employee;

- a strike in which the employee did not take part, which interfered with the performance of his work duties;

- other periods provided for in clause 5 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

Question: An employee was hired by the organization on June 1, 2018, works at 0.5 rate and receives 12,500 rubles. from full rate 25,000 rub. There were no excluded periods. The employee went on maternity leave from 04/02/2019. What average daily earnings should the employer use to calculate maternity benefits? View answer

Exclusion of certain amounts from total income

Regardless of exactly what time within the billing period the accruals were made, some of them are not taken into account when determining the average daily earnings (during the calculation of the total income for the billing period). Such payments include social:

- financial assistance to staff;

- compensation for travel and food;

- payment of tuition fees;

- funds provided for recreation and recovery;

- money for utilities, payment for kindergarten for employees’ children, etc.

Question: How to fill out the lines “Average earnings for calculating benefits” and “Average daily earnings” on the certificate of incapacity for work if the employee’s actual earnings are less than the minimum wage? View answer

Methodology for calculating average daily earnings for payment of severance pay

The payment of additional funds upon dismissal (severance pay) is regulated by Art. 178 Labor Code of the Russian Federation. This money is not accrued in all cases of employee departure, but only when the reason for dismissal, recorded in the work book and order, is one of the following:

- health inadequacy of the position;

- exit of an employee who previously held the position from which the person being dismissed is leaving;

- conscription of an employee to military or alternative service;

- refusal to move to work in another area.

In these situations, upon leaving, the employee is entitled to funds in the amount of their average earnings for 2 weeks.

If an employee is forced to leave due to:

- liquidation or reorganization of the company;

- reduction in numbers or staff,

then he is entitled to a compensation payment in the amount of average monthly earnings.

IN ADDITION: in all of the above cases, the employee is retained his average monthly earnings for the first time after losing his job (no more than 2, in some cases - 3 months from the date of dismissal, this amount also includes severance pay).

Calculation procedure

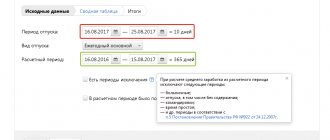

- The billing period for which the total income is determined is 12 months.

- If the length of service of the dismissed employee is less than a year, the calculation period is considered to be the time from the date of hiring to the first day of the last working month.

- It is necessary to take into account the number of days actually worked during this period.

When the last calendar year is fully worked, the calculation formula is applied:

Zwed.-days = (∑12 months / 12) / Day/month Wed.

Where:

- Zwed.-days – average daily earnings;

- ∑12 months – the employee’s total income for 12 months;

- Day/month Wed. – the average length of the month, recorded as 29.3 days.

When a billing period is not fully worked out, the formula is applied:

Zwed.-days = ∑Nmonth. / (N-1) + Days of non-weekly months

Where:

- Nmonth – number of full months worked;

- Day.week.month. – the number of days actually worked in an incomplete month.

Calculation example

Employee Rosomakhin V.M. worked for the company from April 18, 2015 with a salary of 20 thousand rubles/month. In the last year, based on the results of his work, he was awarded a bonus in the amount of 5 thousand rubles. Resigned due to staff reduction on 04/18/2017. Paid vacation days have been used in full. Over the past year, he has been on sick leave for a total of 20 days.

Let's calculate the average daily earnings for the compensation due to him. The funds received during this time amounted to 20,000 x 12 + 5,000 = 245,000 rubles. We apply the formula:

Average daily earnings Rosomakhina V.M. = 245,000 / 12 / 29.3 = 696.8 rubles.

When calculating compensation, funds paid for 20 days of temporary disability will need to be subtracted from the amount received.

Features of calculating average daily earnings upon dismissal

Since the amount of payments for performing work duties may vary, the Government of the Russian Federation has developed regulations for determining average earnings. Resolution No. 922 of December 24, 2007 states that the average salary is calculated in all situations that are provided for by the labor legislation of the Russian Federation. In particular, this happens in connection with a reduction in the company's workforce, during the liquidation of an enterprise, or when a specialist is dismissed.

This is also important to know:

Dismissal by agreement of the parties with payment of compensation: how to formalize and calculate the amount of payment

How to calculate average daily earnings upon dismissal? Next, let's see how to calculate the indicator.

Basic rules for calculating SDZ:

- Regardless of what operating mode is in effect at the enterprise, the calculation takes into account wages for the year, that is, for the 12 months preceding the moment the payment is calculated. In this case, only the actual time worked and the actual accrued salary are taken. A calendar month is defined as the period from the 1st to the last day of the month.

- The following are subject to exclusion from the billing period, as well as from the accrued salary: cases of continued earnings; cases of disability, maternity leave; downtime due to the fault of the enterprise (for independent reasons); periods of strikes; unpaid holidays; paid additional days provided for the purpose of caring for disabled children; periods of release from work duties with full or partial retention of earnings.

- If the billing period is not fully worked out, the actual earnings for the time worked are taken into account.

- The use of SDZ is allowed when calculating vacation pay, and the average daily earnings are also taken when calculating compensation for unused vacations.

- The formula for calculating SDZ takes the average monthly number of days equal to 29.3.

- When calculating the amount of earnings, you should take into account all types of remuneration to staff for performing work duties according to the organization’s SOT (remuneration system). The source of the salary does not matter.

Base for calculating average earnings

The next indicator necessary to calculate the average daily earnings for compensation upon dismissal is the base. This is the sum of all employee payments for the period defined as settlement.

Not all employee benefits need to be included in the calculation. Only income that is directly related to the performance of work duties is subject to accounting.

You need to include in the average earnings base:

- salary;

- bonuses accrued based on the results of various periods (month, quarter, half-year, year) are taken into account in a special order, which is described below;

- other incentive payments for labor achievements, according to the bonus system.

This is also important to know:

Dismissal of a financially responsible person at his own request

All other accruals are not subject to inclusion in the calculation of average daily earnings for compensation. That is, there is no need to take into account vacation pay, compensation for unused vacation days, sick leave, benefits, financial assistance, prize payments, travel allowance, compensation for travel, food, communications, etc.).

What payments are taken into account when calculating SDZ:

- Accrued salaries to staff according to approved salaries (rates) for time worked.

- Accrued wages for piece workers at accepted rates.

- Earnings given in kind.

- Earnings accrued in the form of commissions or percentages of sales revenue.

- Cash remuneration for employees filling government positions.

- Salary accrued to municipal employees.

- Media employee fees.

- Earnings for teachers of educational institutions for hours of teaching, regardless of the accrual period.

- Earnings calculated at the end of the year.

- All types of additional payments and allowances - for length of service, professional skills, combination, class, knowledge of foreign languages, work with state secrets, management, increase in volumes, etc.

- All types of payments related to the characteristics of working conditions, including increasing coefficients for wages due to overtime, hard work, employment in dangerous (harmful) conditions, night shifts, work on holidays and weekends.

- Additional remuneration for the work of class teachers and teaching staff.

- Bonuses and other remunerations to personnel for the performance of labor duties approved by the LNA of the enterprise.

- Other types of payments in accordance with the payment procedure adopted by the employer.

What payments are not taken into account when calculating SDZ:

- Social benefits - various benefits, including sick leave.

- One-time payments – financial assistance, etc.

- Some compensation payments are payment for rest, travel, food, accommodation, utilities, health care, use of personal transport, etc.

Methodology for calculating average daily earnings for payments for unused vacation

The principle of calculating the average daily earnings in this case is almost identical to the previous one: the same calculation period is taken (12 months), the total earnings are looked for, to which the profit required by law (salary increase, bonuses, etc.) is added.

The difference lies in the calculation of days worked in the billing period, since in order to be granted paid leave, an employee must have at least six months of work experience. So, we perform the following actions.

- We count the number of months worked and compare them with the length of service required for vacation. If an integer number of months have been worked, we use the indicator without changes. If there is a shortfall before the end of the month or the processing of an incomplete month, we apply the following principle: days that are less than 15 are discarded, the number of days greater than 15 is counted as a month. The result is an integer - the number of months for which the employee is entitled to days of paid rest.

- The number of vacation days that the employee would be entitled to during this period is calculated.

- From the total number of allotted rest days, you need to subtract the number of days that the employee managed to spend on vacation during this period.

- To determine the amount of compensation, the resulting figure is multiplied by the average daily earnings, calculated using the same formulas as for calculating severance pay.

How are bonuses taken into account when calculating average earnings for vacation compensation?

Bonuses can be accrued based on the results of various time periods - monthly, quarterly, semi-annual, annual.

The rules for accounting for this type of additional payments when calculating compensation upon dismissal are established in clause 15 of the Regulations on Average Earnings

Monthly bonus

One bonus for each indicator for each month of the billing period is included in the general base. In this case, the bonus must be accrued in the billing period.

Example:

The employee is a specialist in the sales department, he is awarded two monthly bonuses for sales indicators and one for the return of receivables, that is, 24 bonuses were given for sales for the year, 12 bonuses for debt collection.

When calculating average earnings upon dismissal over the last 12 months, only 12 bonuses for sales performance and 12 bonuses for debt repayment can be taken into account.

Quarterly bonus

A bonus for any period longer than a month but less than a year is taken into account according to the same rules: one for each indicator for each period (for example, a quarter), and it must be accrued in the accounting year.

Example:

The employee will retire in December 2021. For the billing period, he was awarded a bonus for the 1st, 3rd quarter and half a year. All three bonuses must be included in full in the calculation.

Annual bonus

This premium is taken into account in a special way.

This is also important to know:

How does redundancy happen?

It does not matter in what period it was accrued. It must be taken into account both in the case when it is accrued in the billing period, and in the case when it is accrued in the period after the billing period. Of course, this is true if the period for which the annual bonus is assigned is included in the calculation period for average earnings.

Example:

The employee will resign on January 18, 2021. In January 2021, he was assigned an annual bonus for 2021, in January 2021 - a bonus for 2021. You only need to take into account the annual bonus that was assigned for the year that was included in the calculation period for average earnings.

This period is from January to December 2021 inclusive. This means that we include in the database only the bonus assigned for 2021 and accrued in January 2021.

It is possible that the period for calculating average earnings has not been fully worked out. In this case, you need to look at the period for which the annual premium is calculated. If this period is fully included in the calculation period, then it is taken into account in full, otherwise you need to use a formula that will allow you to calculate the part of the annual bonus that needs to be taken into account in calculating average earnings for compensation.

Part of the bonus to be included in the base = Amount of accrued annual bonus / Working days according to the production calendar in the billing period * Actual days worked in the billing period.

Also read about accounting for annual bonuses in this article.