Requirement-invoice (form M-11):

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Use our demand invoice form M-11 - it contains all the necessary columns and fields. Take it as a basis and add the columns you need.

The demand invoice (Form M-11) is issued only for internal movement of goods and materials. For example, to:

- release raw materials into production,

- move property between warehouses,

- return unused inventory items and defects to the warehouse.

Complete Form M-11 immediately upon transfer of materials, not earlier. Otherwise, you may make a mistake - for example, some goods may remain in the warehouse.

You can also use the M-11 form as a tool issuance card. It is needed to monitor the turnover of household assets and their use, as well as monitor the condition of inventory.

The demand invoice (form M-11) is issued by the employee who submits the inventory items. Make at least two copies, each must have signatures. We have discussed in detail here >>

To write off unusable goods

The standard form of claim-invoice for write-off (M-11) is required for write-off only if the company has no limits on receiving materials. If the enterprise has consumption limits, then the release of valuables is done on the basis not of M-11, but of limit cards (M-8). The receipt of goods is registered with a receipt order.

Unusable goods are also written off according to an act or order for write-off, and this happens in two cases:

- When transferred for further use.

- During liquidation (for example, disposal).

A write-off act or order is prepared as the values are used . Goods are written off at average cost or original price.

The goods may also be written off in the production report for the shift. This is possible in the production of any product, as well as in the provision of services to divisions of the enterprise. In this case, the report will need to include the name, quantity of goods, prices, and materials from which it is made. The report is filled out in the 1C program.

Important! Write-off of goods is carried out if they have expired or are morally obsolete. In the event of a fire or flood, as well as other causes of damage, a procedure for disposal of valuables may also be carried out.

What form is used when writing off?

Form M-11 was approved by Resolution of the State Statistics Committee of October 30, 1997 No. 71a. The completed copy is a strict reporting form and must be kept for 5 years. The document is always created in writing. It has nine required columns.

The invoice must indicate:

- name of the structural unit;

- transaction type code;

- accounting unit of production;

- a complete list of product names with product numbers;

- serial number according to the warehouse accounting book;

- the cost of the transferred valuables and the amount excluding VAT.

The invoice is drawn up in two copies and confirms the fact that the material has been written off and posted in a new location. After signing, M-11 is transferred to the accounting department, which is responsible for recording the movement of materials. A document is issued for each write-off of goods.

Filling example:

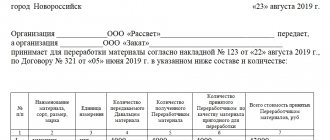

- In the “header” we indicate the document number and the name of the company. For example, Requirement-invoice No. 1. Organization: JSC "Krymstroy".

- The code according to OKPO and the form according to OKUD are entered next to it.

- Next, we indicate the date of compilation and the transaction code, as well as the name of the sender of the valuables: January 1, 2021, code - 9305, structural unit - warehouse No. 1 of Krymstroy OJSC.

- The next column after “Sender” is called “Recipient”. The name of the department is also indicated here (for example, warehouse No. 2 of Krymstroy OJSC, type of activity: storage).

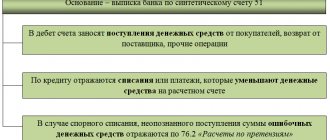

- The debit of the synthetic account is recorded in the “Corresponding account” column. Under the first part of the invoice is the signature and personal data of those through whom the movement is carried out and who requested the materials.

- The most important part of the table: a listing of all materials, their quantities and prices (for example, construction boards - 10 thousand pieces, price: 200 thousand rubles).

The quantity in the columns indicates the one that was requested and the one that was actually released. You can also indicate the serial number according to the warehouse card file. - In the “Corresponding account” column, enter a synthetic (and, if available, analytical) accounting account, name and item number of materials.

The price (excluding VAT) per unit of goods and the total amount (excluding VAT) are also indicated. - M-11 also has a reverse side, on which the table continues.

At the end, the signature of the person who received the valuables and the one who wrote them off is affixed. For example, the warehouse manager I.N. Fedorov was released, the warehouseman A.S. Sidorov was given the release.

In 1C Accounting you need to create a demand invoice and fill in all the fields. Next, you can use postings 20.01 - 10.01 to write off materials or 003.02 - 003.1 to write off customer-supplied materials for production. When writing off spoiled goods, 91.2 - 94 are used.

Requirement invoice M-11: sample filling

You can fill out the document by hand or on the computer. To avoid making mistakes in the form, download a ready-made sample of filling out the M-11 demand invoice and fill in your data.

Get a sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the sample you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Be sure to include:

- standard form number M-11,

- name of the organization and its OKPO code,

- date,

- information about the sender and recipient, for example, warehouse or packaging workshop,

- who requested the materials and allowed them to be released,

- names and units of measurement of inventory materials,

- quantity of materials requested and issued.

Indicate only the actual date - materials must be transferred within one business day. If you didn’t have time, fill out a new demand form - invoice form M11.

Be careful: blots and corrections are not allowed in the document. If you make a mistake, you will have to fill out the form again.

In the MoySklad service M-11 and other documents can be filled out online. This is very convenient: you will not make mistakes and save time, because the data will not need to be entered and checked manually.

Who draws up and signs the document

The invoice document is drawn up in two copies . One of them is provided for a warehouse, from the area of which inventory items need to be written off. The second copy must be delivered to the warehouse, which is preparing to accept goods and materials for their further use.

An invoice is drawn up by the person responsible in the company’s structural unit for material assets. He prepares both copies.

The documents are signed twice: by the person who received the goods and materials, and by the person who released them. At the same time, it is important that the signatures are strictly in the field intended for this, otherwise such paper will be considered invalid, since it was not made according to the standard.

After the documents have been drawn up and signed, and commodity transactions have been completed, the invoices are submitted to the company's accounting department for further accounting.

Detailed information on how to fill out the TORG-12 consignment note is provided here. If you are interested in what a consignment note is needed for, read this material.

Fill out M-11 online

Fill out form M-11

Fill out the M-11 invoice online!

Register in the MoySklad online service - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the required form in Excel or Word

Connect the M-11 template, then select Products - Movements and specify the desired product. The system will generate the document automatically: enter the number and date, and calculate the balance of inventory items in the warehouse. You can print the completed form in one click.

Information about the company, products, warehouses is saved in the system - it does not need to be re-entered into the document each time. This is convenient if you regularly ship inventory items from a warehouse, for example, transfer stationery to the office.

You can also download a blank demand invoice form (form M11) in excel and fill it out yourself.

What is the document for and where is it used?

A demand invoice is filled out and issued for one single purpose: to document the transfer of value from one employee and financially responsible person to another. This helps to control the safety and quantity of entrusted goods or materials.

Cases when drawing up an invoice is required:

- transfer of finished products to the enterprise warehouse;

- write-off of expired or spoiled products;

- returning balances to the warehouse or issuing inventory;

- posting of goods after the liquidation of divisions.

The use of a unified form is optional . Back in 2012, the Ministry of Finance allowed enterprises to use forms developed and approved independently (Information of the Ministry of Finance of the Russian Federation N PZ-10/2012). However, the requirement-invoice of a unified form is still actively used in document flow, as it is the most convenient.

The demand invoice is mainly used in trading companies and in production, where there are many warehouses with different goods or products, and valuables are often moved and recorded.

What is the responsibility for absence

The requirement is a local document of customers and suppliers. When transferring goods, materials, or valuables within the company, the standard interdepartmental form M-11 is mandatory. Based on the invoice, the operation of transferring inventory items is carried out in accounting.

Those employees who signed M-11 become financially responsible. If the storekeeper discovers theft, damage or other interference, the MOL will be held liable (including criminal).

Requirement M-11 - primary accounting document. For its absence, tax liability is provided (Article 120 of the Tax Code of the Russian Federation). And the information in the invoice is used to carry out inventory and prepare tax reports.

Creating a “Request-invoice” document based on another document

1C programs have many different useful functions, one of which is to enter a document based on.

The document that we are considering as an example can be entered according to the “Receipt” document, which was issued earlier. To do this, you need to open the receipt document and click on “Create based on”. Then, from the list that appears, you must select “Request-invoice” and, if necessary, correct this document.

What is it and what is it for?

Contents:

Often, material assets are transferred within the same company, for example, between divisions or branches. Often such valuables include defective products, leftover materials that were not needed, and waste generated during the production process.

These are also values that are registered. They can be moved, for example, for disposal, write-off, or recycling. All such procedures must be reflected in accounting. For these purposes, a special document is drawn up, which is the M-11 form.

In addition, this form is also used in situations where the person financially responsible for inventory items changes. With the help of this document, it is possible to clearly determine which employee was responsible for this property at one time or another. The invoice requirement is the primary document that records the consumption and movement of materials. Accordingly, based on the data specified in it, accounting employees make write-offs. This will be considered a production cost.

( Video : “Demand invoice”)

When is a standard interindustry form M-11 needed?

It is worth recalling that a few years ago changes were adopted in the legislation, according to which the use of unified forms is not mandatory.

Taking this into account, we can conclude that even such serious documents are allowed to be drawn up in a free style. Often organizations will develop their own templates for this. Although it must be remembered that all the most important points should be contained here. Despite the fact that the company can independently decide which template to use to draw up the demand invoice, many still continue to use the M-11 form. This is a simple and understandable form that many legal entities worked with until 2013. Accordingly, after its mandatory use is lifted, companies continue to use it. And if the manager decides to use this particular form, this should be recorded in local documentation.

Although this is not necessary, experts still recommend mentioning in the accounting policy situations in which there is a need to use this document.

There are a number of actions in which you need to issue this invoice, for example:

- transfer of valuables between financially responsible employees;

- raw materials are sent from the warehouse to the production workshop;

- goods are shipped from the warehouse for some of the organization’s own needs.