Sometimes the cost is calculated incorrectly. It can be fixed.

Here are three main problems and their solutions:

- The product has no cost and negative balances.

- The product has no cost, but the balances are correct.

- The cost was calculated incorrectly.

We also wrote how to work with cost.

Problem 1.

The product has no cost and negative balances.

Cause.

The goods have not been received.

Solution.

Carry out retroactive posting.

You go into the reports and see 100% margin and zero cost. You probably added a product and immediately sold it. In this case, the program did not learn about the initial balances - you did not capitalize.

There must be order in everything: first you receive the goods into the warehouse, and then you sell them. Click "Create Document" and select "Posting".

Specify the store and change the date. The date must be earlier than the day on which the first sale was made: capitalization must be posted before the sale. Its date can be seen in the product card in History.

Then add goods to the document and indicate the initial quantity, enter the purchase price. After that - “Save”.

You can check the updated cost in reports and in the product card.

Problem 2.

The product has no cost, but the balances are correct.

Cause.

The goods were not capitalized, but were added by adjusting balances.

Solution.

Delete the adjustment and post it retroactively.

This happens if you adjust balances directly in the product card. How to fix? Find the adjustment documents in the card and delete them. Then post the receipts retroactively to the sales.

This is done in the same way: “Create a document” ⟶ “Posting” ⟶ change the date ⟶ add goods, quantity and purchase price ⟶ save.

You can check the updated cost in reports and in the product card.

Problem 3.

The cost price was calculated incorrectly

Reason.

The goods are first sold and then capitalized.

Solution.

Change the date in the posting document.

Check the story in the product card. Everything should be logical there: first capitalization, then sales. Not this way? Change the date in the posting document.

Open its edit and change the date in the upper right corner. The date must be before the sale.

You can check the updated cost in reports and in the product card.

The cost will be calculated correctly if you add goods in the right way.

Import goods with purchase price

When importing several products, you can add columns with the purchase price and initial balances. In this case, the goods are recorded automatically and the cost will also be calculated automatically.

It's easy to keep track of costs. It is important to consider three points:

- First, capitalization, then sales.

- The adjustment does not affect the cost.

- You need to add balances only through posting or purchasing.

Principles for calculating the cost of goods in “1C: Trade Management, edition 11”

What is this article about?

It would seem how much you can already write about the cost price in the “1C: Trade and Warehouse 11” configuration.

What else new can you tell? It turns out that it is possible. In this article you will not find a single formula, but you will get acquainted in detail with cost calculation analysts. You will learn how to set them up and how they affect the cost. Get acquainted with the documents that affect the cost.

Applicability

The article was written for the editors of UT 11.0. If you use this edition, great - read the article and implement the functionality discussed.

If you are working with older versions of UT 11, then this functionality is relevant. The most noticeable difference between UT 11.3 / 11.4 and version 11.0 is the Taxi interface.

Therefore, in order to master the material in the article, reproduce the presented example on your UT 11 base. This way you will reinforce the material with practice

Calculation of the cost of goods

Changing one edition to another always generates a wave of criticism. And now, to replace the seemingly well-proven program 1C: Trade Management 8 edition 10.3, edition 11 is being actively promoted.

At the same time, critics often highlight the shortcomings of the new edition of UT 11 and modestly remain silent about the shortcomings of the established edition of UT10.3. It’s just that they’ve already gotten used to it and understand that it’s basically impossible to achieve the ideal. Often the reason for criticism is simply healthy conservatism - the best is the enemy of the good. But life is structured in such a way that you cannot blindly follow this principle.

Let's not argue with critics. Let the developers listen to them. And in this article we will look at one of the most important features of UT 11, maybe even the central one. This is a calculation of the cost of goods.

It is known that the indicator of the efficiency of any trading enterprise is profit. However, in order to evaluate it, it is necessary to know the cost of disposal of goods. The disposal of goods in the 1C: Trade Management program, edition 11, refers to operations performed by the following documents:

- Sales of goods and services . This is the main document of the program. It is with its help that facts of sales of goods to their counterparties are recorded.

- Document "Movement of goods" . Designed to reflect the operations “Movement of goods” (movement between warehouses of one organization) and “Internal transfer of goods” (transfer of goods from one organization of our company to another).

- Document “Assembly (disassembly) of goods” . Designed to reflect the operations “Assembly from components” and “Disassembly into components”.

- Document “Other posting of goods” . Designed to reflect the operations “Receipt from production” and “Return from service”.

- Document Domestic Consumption of Goods . Designed to reflect the transactions “Write-off as expenses”, “Transfer for operation” and “Transfer for other purposes”.

The last four documents form a group of internal movement of goods documents.

Without going into details, we note that the basis for calculating the cost of disposal of goods is the requirements of PBU 5/01 and Order of the Ministry of Finance No. 119n dated December 28, 2001. But since the 1C configuration: Trade Management ed. 11 is more managerial, then the requirements set out in these documents are not absolutely mandatory. For management accounting purposes, the business owner independently decides what to charge to cost.

Perhaps someone will say why fence the garden. We paid for the delivery, the cost of the goods indicated in it is their cost. This is the simplest case and, of course, there is nothing to count here. But let's imagine the situation as in the picture.

(Click to enlarge image)

An actively working trade organization is intensively supplying and selling goods. The same product may arrive at the organization several times a month. In addition, the manager often has to enter documents backdated. As a result, the sequence of document processing is disrupted.

In ed. 10.3 this leads to the fact that the value of the written-off batch of goods became incorrect. It was necessary to restore the sequence of documents. In UT 11, at the time of release of goods, its write-off cost is not calculated. For a large trading enterprise this is a significant plus. The documents do not make complex calculations and do not make entries in registers for calculating costs. As a result, program performance increases.

In addition, internal movements may be made on the same product within a month. They also affect the cost of goods. And finally, the so-called transport and procurement work, TZR.

Any TZR can be attributed to the cost of goods, to a line of business or to deferred expenses. You can set different distribution rules and expense analytics.

(Click to enlarge image)

In principle, what has been said is enough to understand that the 1C: Trade Management program, edition 11, provides a tool for flexible management of the cost of goods.

Edition 11 provides one way to calculate the cost of goods, but with two alternative options. It is denoted by the abbreviation RAUZ - advanced cost accounting analytics.

It boils down to the fact that the program automatically creates a system of linear equations (SLE) and solves them. True, the user can choose the option of forming the SLU and indicate it in the periodic information register “Setting up methods for assessing the cost of goods”:

- Monthly average.

- FIFO.

This will probably surprise some. After all, many people know that UT 11 does not support batch accounting. This is true, in UT 11 there is no standard accounting of parties, they simply do not exist. However, a certain modified FIFO method is used exclusively for compiling SLUs.

In this article we will not dwell on how the program compiles SLN. Let's look at the basic settings that need to be made to ensure correct cost calculation.

Setting up the program

In this context, setting up a program means filling out those directories and registers, the elements and records of which are used in calculating costs.

- Costing analysts

The cost of disposal of goods is calculated using several analysts at once. They are dimensions of the accumulation register “Cost of Goods” and the information register “Item Accounting Analytics”.

(Click to enlarge image)Analytics "Organization"

Directory of "Organizations". It should be immediately emphasized that cost accounting is carried out in the context of organizations and is not carried out for the enterprise as a whole. This may seem surprising, since the configuration is managerial. But it is so. In general, the enterprise does not keep cost records.

It is also important to remember that the presence of negative balances of goods will lead to incorrect calculation of their cost . Therefore, after all balances have been entered, be sure to check the “Control balances of organizations’ goods” flag. It is located in the ADMINISTRATION Finance section.

Analytics "Warehouses (warehouse areas)"

Directory "Warehouses (warehouse areas)". Compared to UT10.3 as ed. 11 the concept of warehouse has been expanded. In general, a warehouse is understood as a certain territory (warehouse territory) on which warehouse hangars can be located. In the program they are called premises.

If in the warehouse settings, in the “Use of order document flow scheme” section, you check all the boxes, then the “Use premises” flag will become available. Setting this flag will allow the warehouse being described to describe the premises it consists of.

In turn, if you specify “Use for reference placement of items” in a room, then it will be possible to describe the cells in this room.

calculation is carried out in the context of warehouses (territories). cost of goods in different rooms and different cells of the same warehouse territory is the same.

Analytics "Nomenclature"

Directory “Nomenclature” “Types of nomenclature”. The configuration provides two types of nomenclature:

- Product;

Service.

For services in ed. 11.09 the cost price is not calculated.

Analytics “Item Characteristics”

Directory "Characteristics of nomenclature". The cost price is also calculated in terms of product characteristics.

Analytics "Accounting Section"

Enumeration “Sections of accounting for the cost of goods.” It describes two meanings:

- Goods in warehouses;

- Goods transferred for commission.

Analytics "Inventory type"

Directory "Types of reserves". It is not available for manual editing. The necessary elements are created automatically when goods are delivered.

The type of inventory is a multi-valued concept. The directory “Types of Inventory” indicates the Organization on whose behalf the sale of goods will be processed: VAT taxation; Type of stock (own or commission) and a number of other parameters.

The cost of disposal of goods in the edition of UT 11 is found by solving linear equations, SLU. The program compiles them automatically. However, the user can specify the method of their formation in the periodic information register “Setting up methods for assessing the cost of goods”:

- Monthly average;

FIFO.

The method of forming the SSL specified in this register is the default method for the regulatory document “Calculation of the cost of goods”. When actually calculating the cost using the document “Calculation of the cost of goods”, you can alternately perform the calculation in two ways. This will allow you to compare them and choose the most suitable one.

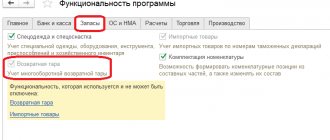

Transportation and procurement costs are determined by the expense item. They are described in terms of the types of characteristics “Items of Expenses”. The details card for each article looks like in the picture.

Distribution options

In version 10.3, we simply wrote off additional costs for a previously received batch of goods. But the 1C: Trade Management 8 edition 11 program offers three options for distributing fuel and equipment:

- For the cost of goods;

On the direction of activity;

Let's look at them.

For the cost of goods

Selecting the distribution option “For the cost of goods” means that this amount of TRP will be distributed to the cost of goods. In this case, you need to choose one of the distribution rules:

- Proportional to cost,

- Proportional to quantity.

Regardless of the selected rule, the program prompts you to specify the most suitable expense analytics:

- Stock . The amount of expenses is distributed among all goods in the warehouse. In the future, the specific warehouse will need to be specified in the “Cost Analytics” field of the distribution document.

- Nomenclature . The amount of expenses is allocated to a specific product. In the future, a specific item will need to be indicated in the “Expense Analytics” field of the distribution document.

- Order to supplier . The amount of expenses is distributed to the goods contained in the tabular part of the “Order to Supplier” document. In the future, the specific “Order to Supplier” document will need to be specified in the “Cost Analytics” field of the distribution document.

- Receipt of goods and services . The amount of expenses is distributed to the goods contained in the tabular part of the document “Receipt of goods and services”. In the future, the specific document “Receipt of goods and services” will need to be indicated in the “Expense Analytics” field of the distribution document.

- Transfer order . The amount of expenses is distributed to the goods contained in the tabular part of the “Transfer Order” document. In the future, the specific “Move Order” document will need to be specified in the “Cost Analytics” field of the distribution document.

- Movement of goods . The amount of expenses is distributed to the goods contained in the tabular part of the document “Movement of goods”. In the future, the specific document “Movement of goods” will need to be specified in the “Cost Analytics” field of the distribution document.

- Transfer of goods between organizations . The amount of expenses is distributed to the goods contained in the tabular part of the document “Transfer of goods” with the operation “Sale of goods to another organization”. In the future, the specific document “Transfer of Goods” will need to be indicated in the “Expense Analytics” field of the distribution document.

For goods movement analytics, the amount of goods and materials can only be distributed in proportion to the quantity.

Let's say that our organization used the services of a third-party carrier to move goods from one of our warehouses to another. This service (expense) can be reflected in the document “Receipt of goods and services”.

It is advisable to distribute the expense to the cost of goods by specifying the “Movement of goods” analytics. After we indicate this expense in the “Expense Item” column, in the “Expense Analytics” column the program will require you to indicate a specific document “Movement of Goods”. This is the same document with which we reflected in the database the fact of the actual movement of goods between warehouses.

On areas of activity

Even a small sales organization has several lines of business. For example, “Television sales” and “Refrigerator sales.” Program 1C: Trade Management ed. 11 allows you to describe business areas with any degree of detail.

After this, the costs can be written off to one or another area of activity. Of course, there are reports from which you can always determine the effectiveness of a particular area of activity.

And so, if the distribution option “To areas of activity” is selected, then instead of the “Distribution Rule” field, the “Distribution Method” field will be displayed. It is necessary to indicate the desired method of distribution by selecting it from the directory “Methods of distribution by areas of activity.”

The figure shows an example with two lines of business.

Actually, all areas of our company’s activities are described in the directory of the same name “Areas of Activity”. The program allows you to distribute the income and expenses of the enterprise in the specified areas. As a result, we can evaluate the profitability of a particular business.

To distribute expenses, one of the distribution rules can be selected:

- Proportional to the coefficients . In this case, in the column you must indicate the corresponding coefficient for the area of activity indicated in the table. The coefficient values can be any. It is convenient to choose so that the sum of the coefficients is equal to 100 or 1.

- Proportional to income . The amount of other expenses for each line of business is proportional to the organization's sales revenue for this line of business and inversely proportional to the distribution base. The distribution base is the total amount of revenue from sales of the organization in the areas of activity indicated in the table.

- Proportional to expenses . The amount of other expenses for each line of business is proportional to the cost of goods sold for that line of business and inversely proportional to the distribution base. The distribution base is the amount of cost of sales distributed among the types of activities carried out by the organization.

- Proportional to gross profit . The distribution base is the amount of sales revenue minus the cost of sales, distributed by type of activity.

Regardless of the selected distribution rule, the program offers a fairly large list of analytics to choose from:

- Organization;

- Subdivision;

- Direction of activity;

- Marketing event;

- Deal;

- Customer order;

- Partner;

- Customer complaint;

- Individual;

- Stock;

- Nomenclature;

- Order to supplier;

- Acquiring agreement;

- Project;

- Other expenses.

For deferred expenses

In this option, you must indicate the expense item. Expense analytics is the same as in the previous case.

Current Operations

During the month, the following facts of trade and economic activity are recorded in any order:

- Purchase of goods;

- Movement of goods;

- Write-off of goods;

- Sale of goods.

Now you don’t need to worry about the correct sequence of documents.

Transportation and procurement costs may arise both after and before the receipt of goods. In fact, their direct distribution to cost is carried out by regulatory documents. And the method of distribution of a specific expense can be specified in the following documents:

- Document “Receipt of goods and services” . This document formalizes not only the receipt of goods, but also the services of third-party organizations. These services must first be described in the “Nomenclature” directory.

- Document “Receipt of services and other assets” . This is a simpler document to reflect the services of third parties. The name of the service is simply typed in text. Without choosing from the “Nomenclature” directory.

- Document “Cash expenditure order” , operation “Other expenses”.

- Document “Write-off of non-cash DS”, operation “Other expenses”.

In the tabular parts of these documents, from the point of view of calculating costs, we are interested in two columns. These are “Expense Item” and “Expense Analytics”. In them we indicate which article, in what way and for which analytics should be distributed.

Documents for receipt of services and documents for writing off funds do not calculate the cost.

They only contain information on how to distribute the expense indicated in them. This information is used by regulatory documents.

Cost calculation

The final calculation of the cost of goods is made at the end of the month using the following regulatory documents:

- Document “Distribution of deferred expenses”

This document allocates expenses that were recorded in the current or previous period to future periods. Future periods, that is, from what date and over what number of months the expense will be written off, are indicated in the same document. Typically, expenses for rent, advertising, employee insurance, etc. are written off to the BPO.The tabular part of this document is filled in automatically, but only for those expenses for which the distribution method “For future expenses” is specified.

If there is nothing to distribute for future periods, then the document “Distribution of expenses for future periods” does not need to be entered.

- Document “Distribution of Income and Expenses”

The title of the document “Distribution of Income and Expenses” is confusing until we read its full name - “Distribution of Income and Expenses by Line of Business.”That is, this document distributes income and expenses not to the cost of goods and not to the BPO, but according to areas of activity.

- Document “Distribution of expenses for the cost of goods”

From the title of the document “Distribution of expenses for the cost of goods” it follows that it distributes existing expenses for the cost of goods. The tabular part of this document is filled in automatically, but only for those expenses for which the distribution method “To the cost of goods” is specified.In principle, you don’t have to draw up this document. Then the distribution of expenses for the cost of goods will be carried out by the document “Calculation of the cost of goods”.

Don't do this. Always fill out the document “Distribution of expenses for the cost of goods”.

Drawing up the document “Distribution of expenses for the cost of goods” will make it relatively easy to detect errors. Without it, it will be quite difficult to do this.

- Document "Calculation of the cost of goods"

The document “Calculation of the cost of goods” aggregates all distributions and produces the final cost calculation. It offers two calculation options: Actual and Preliminary.The preliminary calculation does not take into account additional costs. In addition, he always calculates the cost based on the monthly average. This option requires less computational resources and is usually used to evaluate intermediate results.

When choosing the actual calculation option, you can specify any method (FIFO or Monthly average). This option calculates the total cost.

Conclusion

In conclusion, let us try to schematically describe the cost calculation.

- The information base must describe all the necessary methods for distributing fuel and equipment.

- During the month we record the facts of receipt and disposal of goods.

- Within a month, we record the expenses incurred using documents for receipt of services or documents for writing off funds. We indicate in them the amount of technical equipment and the method in which it should be distributed among the cost price. This is information for regulatory documents.

- We calculate the cost using regulatory documents.

- Analysis of financial results.

Author of the article

Ilyukov Vladimir Dmitrievich, Moscow.

Other articles on “1C: Trade Management 11”:

“Calculation of cost in “1C:UT 11”. SLU"

“Complicated-simple pricing in 1C:UT 11”

“Method of valuation of goods upon disposal: FIFO, Average, RAUZ”