Checking your account for blocking

The Federal Tax Service monitors the status of legal accounts. persons and transactions carried out on them.

The tax service has all the information about the organization’s accounts, including the presence of blocking at any given moment.

If the tax inspectorate blocks one of the accounts, you cannot open an account with any financial organization until the restrictions are lifted.

The tax office's current account is blocked:

- The declaration was not submitted on time;

- Taxes have not been paid in full or fines for late payments have not been paid;

- The company's employees are not provided with personal income tax calculations;

- The requests or demands made by the Federal Tax Service were not satisfied.

In most cases, bank clients learn about account blocking only after payments stop flowing into their account.

You can check the blocking and find out the reason on the Nalog.ru website through the Bankinform service. To check, you will need to indicate the BIC and TIN of the bank of interest.

Data provided:

- Date of blocking;

- The amount of debt, for what period it arose;

- A demand is made to block the account or collect the debt.

Incorrect data can be contested by contacting the Federal Tax Service with a statement.

Systems "Contour-Focus" and "Contour.Sverka"

The Kontur-Focus system is a comprehensive tool that allows you to check the counterparty before starting cooperation with him. It is also intended to reduce the risk of refusal to deduct VAT. The accountant himself uses this system. He can independently select a list of criteria for checking counterparties for reliability. These could be the following criteria:

- Recent company registration.

- The company is going through bankruptcy or liquidation.

- The managers include disqualified persons.

- The counterparty is the defendant in the debt collection case.

- Enforcement proceedings are ongoing against the company.

- The company was not found to be conducting any activity at all.

- Negative financial indicators with a tendency to worsen.

FOR YOUR INFORMATION! If the counterparty receives a negative assessment based on a number of criteria at once, it makes sense to refuse to enter into contracts with him. The system has a number of advantages. It provides tracking of assessment dynamics and quick receipt of all information.

There is also the “Contour.Sverka” system. It provides automation of information reconciliation between issued and received invoices. The system allows you to check the accuracy of the information provided, the presence of errors and discrepancies. However, to use the service, not only the company itself, but also its counterparty must register.

Online check

This is one of the most popular methods. Currently, the country has a large number of free government services that provide information about organizations.

Bankruptcy of a legal entity or being at the stage of liquidation can be easily checked on a special page of the “Bulletin of State Registration” on the Federal Tax Service portal. You can use the sites:

- Nalog.ru;

- Kartoteka.ru;

- Bailiffs of Russia.

You can find out: address, phone number and account number (in the “Company Details” section).

If you have a current account in hand, it is easy to obtain information about the absence of seizures of the company's current account.

There are sites on the Internet that provide extracts from the Unified State Register of Legal Entities (USRLE) for a fee (fraud is possible).

Required details

At the first stage, the presence of all required invoice details is checked. According to paragraph 5 of Article 169 of the Tax Code of the Russian Federation, it must indicate:

1) serial number and date of discharge;

2) name, address and taxpayer and buyer identification numbers;

3) name and address of the shipper and consignee;

4) number of the payment document in case of prepayment or partial prepayment;

5) name of goods (description of work performed, services provided) and unit of measurement (if it is possible to indicate it);

6) quantity (volume) of goods (works, services);

7) price per unit of measurement;

cost of goods (work, services) without tax;

cost of goods (work, services) without tax;

9) the amount of excise duty on excisable goods;

10) tax rate;

11) tax amount;

12) cost of goods (works, services) including the amount of tax;

13) country of origin of the goods (if the country of origin of the goods is not the Russian Federation);

14) customs declaration number (if the country of origin of the goods is not the Russian Federation).

Checking account seizure online

If the account is seized by the tax service, restrictions on the current account are introduced:

- You cannot open an account or deposit in any banking institution;

- You cannot withdraw funds from your bank account.

The easiest way to check the arrest and its reason is through the Nalog.ru online service (nalog.ru).

To speed up the removal of the arrest, you must:

- Submit an application to the tax office with a request to remove the seizure;

- Pay the outstanding debt and penalties for late repaid debt (provide copies of payment documents);

- If not provided on time, submit a declaration;

- Provide confirmation of receipt of the documents requested by the Federal Tax Service.

Checking erroneous suspension of account transactions

Sometimes an order from the tax inspectorate to suspend all transactions on a current account is sent to the bank in the absence of an objective reason.

Every bank client has the legal right to check the reason for blocking their account.

If the reason indicated on the Nalog.ru website (nalog.ru) is erroneous, then the account must be immediately unblocked. In this case, the tax authorities are required to justify the occurrence of the error due to which the account was blocked.

The account owner can confirm the error by providing:

- Account statements - confirm payment of tax;

- A receipt (with inventory and stamp) from the post office, which will confirm the dispatch of the declaration in a timely manner;

- The act of reconciliation with tax data will confirm the absence of debt.

Signatures and seals

At the second stage, the presence of signatures of authorized persons should be checked.

According to paragraph 6 of Article 169 of the Tax Code of the Russian Federation, an invoice must contain the signatures of the head and chief accountant of the organization or other persons authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization. After signing the invoice directly by the head and chief accountant of the organization, their last names and initials are indicated. If the invoice is signed by authorized persons, then it is necessary to indicate their position, last name and initials, as well as the number and date of the power of attorney issued to exercise these powers. If the organization does not have the position of chief accountant, the responsibility for maintaining accounting records and, accordingly, signing the invoice is assigned to the manager. To avoid disputes with tax authorities, it is necessary to request a copy of the document confirming accounting, signed personally by the head of the supplier organization. The preposition “for” (“for the manager”) is not allowed, as well as putting a slash in front of the position, or facsimile reproduction of the signature.

Checking the current account number

Each bank current account has a code that is assigned at the time of its opening. Its last digits refer to the current account (there are 20 digits in total in the code).

The bank provides a service to companies, stores company finances and allows them to be used for current needs.

According to the law, companies can have several current accounts.

You can find out your account number:

Under contract

When formalizing your relationship with the organization of interest in an agreement, you will need to review the agreement and obtain information in the “Details” section. This is the easiest way. Typically, information is indicated before the signatures of interested parties.

Please note that the check must be performed for the currency used in financial transactions.

To the bank - client

Information can be obtained if financial relations have previously been maintained with the organization.

Information about payments is stored in a special department of the Internet bank. You can view the information in the “Recipient's current account” line. The counterparty's current account is provided from existing payment orders and statements.

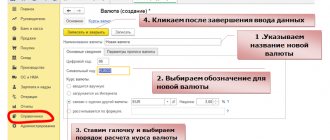

Through 1C accounting

When using this program, you need to find the company you are interested in in the “Counterparties” section and obtain information about its current accounts.

According to invoice

You must contact the organization of interest and ask for an invoice. It could be issued when purchasing a product or service. The details of the received document must indicate, among other data, the company’s current account.

Through mutual funds and the Federal Tax Service

In situations involving arrears in paying bills, for example, the necessary information can only be obtained through the court.

It is necessary to contact the judicial authorities. The court will decide whether to refuse or satisfy the request. If the decision is positive, a writ of execution will be issued. It must be presented to the mutual fund or the tax office with an application to provide data on the account of the company of interest.

You can request the following information about the organization:

- Number of open accounts;

- Banks where the accounts are held;

- Account numbers;

- The amount of money in the accounts;

- On the movement of funds across accounts.

At a banking institution

It is necessary to contact the bank where the organization of interest opened the account for information.

The bank has no right to disclose to third parties any information about its client. It is possible to check the account number of a counterparty only with good reason.

You will need to provide a statement explaining the current situation, and a writ of execution from the judicial authorities.

Punishment is provided for by law for illegally obtaining information about the accounts of clients of banking institutions.

Areas of responsibility

It would seem that small inaccuracies in the document details do not change the essence of the business transaction, but in practice, tax inspectors, when accepting “input” VAT for deduction, pay close attention to the correct execution of invoices.

Let us recall that, according to the definition given in the Tax Code, these documents serve as the basis for the buyer to accept for deduction the amounts of tax presented by the seller. The Tax Code also establishes certain requirements, subject to which the amount of tax indicated in the invoice can be deducted. Thus, any organization, when receiving and recording invoices, is forced to organize a check of the compliance of this document with the requirements of tax legislation. Where should the inspection begin and whose area of responsibility is this? The document flow of companies varies significantly depending on the type of their activity and other factors. If managers work with suppliers in an organization, it makes sense to leave this function to them. If documents are received by an office manager or secretary, then when entrusting them with the function of checking documents, special attention must be paid to explaining the basics of accounting (for example, checking the details of a payment order for an advance will require the secretary to know an accounting program). But most often, checking the correctness of incoming primary documents is the responsibility of accountants.

In any case, you will have to prepare instructions for employees who are required to check invoices for compliance with established requirements. Let's consider the main stages that it is advisable to reflect in it.

The test can include six stages and is carried out according to the scheme presented below.

SCHEME “ALGORITHM FOR CHECKING AN INVOICE”

Check by BIC

In this case you can check:

- The existence of this account;

- Correct spelling of the account number (for example, one of the indicated numbers).

This check can be carried out on the website audit-it.ru

Check in Sberbank

It is relevant if it is known for sure that the account of the organization of interest is located in this bank.

It is possible to carry out verification on the bank’s website, in the verification service by company name and tax identification number.

You can also get information in Sberbank Online in one click.

You will need to enter the name of the organization and TIN in a special line (an extract from the Unified State Register of Legal Entities will be provided).

Data about the subject of the transaction

An invoice cannot be signed for someone else.

At the next, fourth, stage, it is necessary to reconcile the names of goods (works, services) and units of measurement (if it is possible to indicate them). According to the letter of the Ministry of Finance dated December 14, 2007 No. 03-01-15/16-453, column “Name of goods (description of work performed, services provided) of property rights” is filled out according to “special” rules, namely: it must provide a complete description of the work, similar to that provided for in the contract. It is not enough to make a reference to the contract; it is necessary to briefly describe the type of work (services). When determining units of measurement, one should be guided by the All-Russian Classifier of Units of Measurement, approved by Decree of the State Standard of Russia dated December 26, 1994 No. 366. The unit of measurement may not be indicated for work, services, or property rights. The country of origin and the customs declaration number are indicated only if the country of origin of the goods is not the Russian Federation.