Since 2012, tax services have been checking compliance with cash discipline. As practice shows, the availability of the necessary documents and their correct execution is the key to successful inspections. Cash documents also include a cash receipt order. In addition to the fact that it records the issuance of funds from the cash register, RKO is additionally the connecting link of accounting entries. We will provide an example of how to correctly fill out a cash receipt order and tell you about the nuances of its use.

Why destroy seals and stamps?

There can be many reasons for destroying these attributes.

Today, the most widespread law can be considered the law passed in 2015 on the abolition of mandatory visa approval of enterprise documentation using various imprints.

In other words, if previously all legal entities, without exception, had to use stamps and seals in their work, now this is only the right of the company, which must be enshrined in its internal regulatory documents.

Other reasons for destroying stamped items may be:

- wear,

- damage,

- obsolescence,

- liquidation or reorganization of a company,

- changing company details, etc.

Disposal of seals and stamps is not a strictly mandatory procedure, but if carried out in accordance with all the rules, it can to some extent protect enterprises from malicious manipulation of various kinds of documents by citizens with criminal intentions.

Printing requirements

Clause 7 of Article 2 of the Federal Law “On Joint Stock Companies” dated December 12, 1995 N 208-FZ:

“The company must have a round seal containing its full corporate name in Russian and an indication of its location.

The seal may also indicate the company name of the company in any foreign language or the language of the peoples of the Russian Federation.

The company has the right to have stamps and forms with its name, its own emblem, as well as a trademark registered in the prescribed manner and other means of visual identification.”

REQUIREMENTS FOR THE CONTENT OF THE PRINT OF A LIMITED LIABILITY COMPANY

Clause 5 of Article 2 of the Federal Law “On Limited Liability Companies” dated 02/08/98 N 14-FZ:

“The company must have a round seal containing its full corporate name in Russian and an indication of the location of the company.

The company's seal may also contain the company's corporate name in any language of the peoples of the Russian Federation and (or) a foreign language.

The company has the right to have stamps and forms with its corporate name, its own emblem, as well as a trademark registered in the prescribed manner and other means of individualization.”

REQUIREMENTS FOR THE CONTENT OF THE PRINT OF A NON-PROFIT ORGANIZATION

Clause 4 of Article 3 of the Federal Law “On Non-Profit Organizations” dated January 12, 1996 No. 12-FZ:

“A non-profit organization has a seal with the full name of this non-profit organization in Russian. A non-profit organization has the right to have stamps and forms with its name, as well as a duly registered emblem.”

REQUIREMENTS FOR THE CONTENT OF THE STAMP SEAL

Requirements for the details of seals with the coat of arms (official seals):

– the full name of the legal entity in the nominative case, in brackets – its short name (if any);

– main state registration number (OGRN);

– taxpayer identification number (TIN);

– code according to the All-Russian Classifier of Enterprises and Organizations (OKPO).

The following persons have the right to place the State Emblem of the Russian Federation on the seal:

– federal government bodies, other government bodies, organizations and institutions;

– organizations and institutions, regardless of their form of ownership, vested with separate government powers;

– bodies carrying out state registration of acts of civil status;

– notaries;

- justices of the peace.

REQUIREMENTS FOR THE CONTENT OF THE COMPANY STAMP

The current legislation does not provide for specific requirements for stamps of organizations and individual entrepreneurs.

The organization has the right to independently determine the content and order of display of information in the stamp. The stamp may include details, address and telephone number of the company, a place for the outgoing number, as well as any other information. Stamps are used to speed up document flow in an organization.

TYPES OF DIES

Corner stamp – contains the details of the organization (name, legal and actual address, contacts and bank details). The stamp with details has a wide range of applications and is indispensable when filling out a number of documents.

Registration stamp - determines the organization’s responsibility for the document, establishes the duration of its execution. The registration stamp contains the full name of the organization, date and document number, full name. responsible person.

Stamps with standard words allow you to quickly and easily indicate the status of a document or stages of its development. In office work, the following standard stamps are used with the words: “SAMPLE” – “SHIPED” – “WAREHOUSE” – “ACCOUNTING” – “HR DEPARTMENT” – “URGENT” – “PAID” – “RECEIVED” – “RECEIVERED” – “CORRECT COPY” – “A COPY IS COMPARED WITH THE ORIGINAL .

Triangular stamps are used by supply departments of commercial organizations, post offices, medical institutions, pharmacies and other organizations and institutions to carry out business transactions.

The procedure for carrying out the destruction procedure

Today, the state does not regulate in any way the procedure for either the production or destruction of seals, so organizations must independently develop a regulatory framework for these actions. However, in general, the procedure for recycling cliches is approximately the same:

- First, the management of the enterprise makes a decision to destroy seals and stamps that have lost their relevance (this can be made in relation to one seal, several or even all).

- Then an order is issued, which is a catalyst for starting this process.

- Based on the order, a special commission is created, which carries out the destruction of stamped items.

- To record the fact of disposal, a detailed report is drawn up.

It should be said that in some cases, organizations do not destroy seals and stamps themselves, but transfer this right to third-party companies.

As for lost or stolen stamps, it is impossible to draw up a disposal report in relation to them - in such cases it is necessary to submit appropriate applications to the tax service and the police.

How to fill out a sales receipt correctly

Every individual entrepreneur should know that accepting cash from buyers and clients must be properly processed. The documents confirming the transaction between the parties are contracts.

Individual entrepreneur's cash and sales receipts are proof of payment. Due to innovations, many businessmen cannot understand exactly whether they will all have to use cash register machines? What will the new checks be like? Is it possible to accept a sales receipt without a cash receipt, as before for some categories of entrepreneurs? What is the penalty for not having a cash register?

Articles on the topic (click to view)

- Criminal Lawyer

- How to pay your internet or TTK TV bill without commission?

- Conditions for bankruptcy of individuals

- Article 1484. Civil Code of the Russian Federation. Exclusive right to a trademark

- Sale of apartments at bankruptcy auctions in St. Petersburg

- Trademark cost calculator How much does it cost to register a trademark:

- Who can begin bankruptcy proceedings for a legal entity, what stages does bankruptcy include, and how long do such stages last?

Commission: composition and goals

The recycling commission must include at least two people . These can be any employees of the organization, but, as a rule, the following are appointed as such:

- director or any person close to the management of the company,

- employee responsible for the maintenance and storage of seals and stamps,

- HR specialist,

- lawyer,

- secretary.

Among them, the chairman of the commission and ordinary members should be highlighted.

The main task of the commission is to select stamps that have lost their relevance, directly carry out their destruction in any acceptable and most accessible way, and draw up an act about this.

For disposal, fairly simple methods are usually used:

- cutting cliches into small pieces with scissors (provided that they are made of polymers, rubber, caoutchouc and other soft materials),

- cutting using special tools (if the cliche is metal).

The main thing is that as a result of destruction, these products become completely unsuitable for further use.

Cash documents: types, registration, storage, corrections

According to the legislation of the Russian Federation, enterprises and organizations are required to keep accounting records of all business transactions. To solve this problem, primary documents are used. Confirmation of the fact of cash transactions at the cash desk of the enterprise is also carried out using primary documents.

Types of cash documents

Let's consider the main types of cash documents (hereinafter referred to as CD) and what mandatory details they can and should contain.

Types depending on the nature of operations:

- receipts;

- consumables;

- accounting registers containing registration and summarized information from the primary CDs listed above.

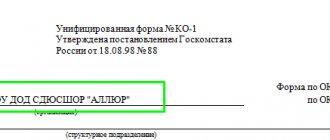

At the legislative level (Resolution of the Russian Statistics Committee No. 88), these types of design documentation have been approved:

- cash receipt order - No. КО1 (hereinafter referred to as PKO);

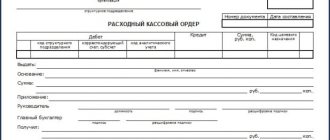

- expense cash order - No. KO2 (RKO);

- cash book - No. KO4 (КК);

- journal for registering incoming and outgoing cash documents - No. KO3 (ZhR);

- book of accounting of funds accepted and issued by the cashier - No. KO5 (KVD).

The main mandatory details of the documents listed above are highlighted , namely:

- Name;

- date of its preparation;

- the name of its compiler, in other words, the name of the organization/enterprise;

- Contents of operation;

- quantitative and monetary measurements of the transaction;

- position of the persons who committed and executed;

- signatures of the persons mentioned above.

Basic design requirements

Due to the fact that the approved and mentioned above design documentation differ from each other, let us consider the rules for drawing up each.

Design features of the PKO:

- the essence of the operation is entered in the line “Base”;

- the total amount of VAT is entered in the line “Incl.” in digital terms. This line cannot be empty. If tax is not applied, enter the phrase “without (VAT)”;

- data on additional supporting documents (if any) are entered into the PQR in the “Appendix” line.

When filling out the cash register, you must take into account the following nuances::

- the presence of additional documents (for example, a power of attorney) is entered in the “Appendix” line with the obligatory indication of the date and number;

- the line “Base” suggests reflecting the content of the expense transaction;

- the signature of the manager is not necessary if it is present on the attached document. For example, if the signature of the director of the enterprise is present on the order along with the resolution “I authorize” or “Agreed,” then the RKO can be accepted for work without his signature.

We will separately consider the issue of requirements for affixing stamps to RKO and PKO. According to the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014 on the conduct of cash transactions, there are no mandatory requirements for stamp imprinting, as was previously the case until 2014.

Previously, the stamps “Paid” on the incoming order and “Repaid” on the outgoing order were used. The current rules only imply the mandatory affixing of a stamp on the tear-off receipt for the PKO. Thus, the “Paid” stamp can be affixed to the receipt for the PKO.

The presence of the “Paid” stamp is confirmation of the actual deposit of money and its posting.

As for the “Redeemed” stamp:

- it is placed on statements, for example, when issuing salaries to employees;

- can be used instead of “Paid”, for example, if the stamp is lost or missing for another reason.

There are 3 basic rules for registering a CC:

- Sew.

- Number. The bottom line: each sheet is numbered (consecutive number).

- Seal. The bottom line: you need to indicate how many sheets are contained in the CC according to the numbering and certify this inscription. This inscription is placed at the end of the book and is considered certified if there are signatures of the director and chief accountant.

The QC form assumes the presence of 2 parts. Moreover, the second part is detachable. It serves as the cashier's report at the end of the day and can only be torn off after all transactions have been completed.

Journal of registration of incoming and outgoing cash documents

The name itself answers the question of what this form is intended for, namely the assignment of serial registration numbers to cash documents.

Involves filling out such information:

- No. PKO/RKO, date and amount in Russian rubles in digital terms;

- The “Note” columns are filled in if necessary.

Filling out the KVD is justified if the organization has several cashier positions on its staff, including a senior one.

Features of the design of the KVD:

- the amount transferred by the senior cashier to the subordinate employee is reflected in the line “Issued” or “Transferred”;

- It is mandatory to put the signatures of both persons in the lines “Money received”.

What mandatory rules and requirements must be followed when drawing up primary CDs:

- Signatures of the chief accountant and cashier are mandatory.

- The mandatory stamp on the tear-off receipt is “Paid.”

- A seal (stamp) is not affixed to the cash register, but the recipient’s signature is required.

- The design documentation can be completed on paper or electronically.

- The electronic version of the document is prepared using special equipment (computer, printer).

- The paper version is filled out manually with a ballpoint pen, ink or using a typewriter.

- Blank lines that do not contain information are marked with a dash.

The chief accountant is the responsible person in the matter of drawing up the design documentation. In his absence, the manager becomes the person responsible for the preparation of cash documents, which is carried out under his control.

Corrections in CD

The main rule or requirement for CDs that should be highlighted is the absence of corrections in accounting registers.

The CD should not contain corrections or blots. In practice, it is common for performers to make changes to a document using correction fluids. Such actions are not permitted.

Let's consider the main options for how corrections can be made to cash documents:

- A mistake was made in the PKO or RKO.

It is prohibited to make corrections in any way (manually, crossing out, covering up). The only solution in this case would be to cross out the PKO/RKO with errors and draw up a new one. The spoiled (crossed out) order is added to the cash register report for the day. It is prohibited to carry out the operation of spending or receiving money on the basis of a damaged document.

- An error was made in the Journals or Cash Book.

The use of correction fluid or erasers is prohibited.

Corrections made as follows are allowed:

- an incorrectly entered inscription is crossed out so that the erroneous inscription can then be read;

- Corrections are made above the crossed out inscription by writing the correct amount or text;

- near the corrected document or in the free fields of the document the following inscription is placed: “Corrected” and must be signed by all persons responsible for maintaining and forming the CD;

- signatures are deciphered, and the date of the edit is indicated;

- corrections are made to all copies.

CD storage

The manager organizes and carries out the process, determines storage locations and approves the procedure for the formation and storage of cash documents in the organization. He must ensure such storage conditions that the documents are safe for the entire period established by law.

General requirements regarding storage periods are established in the Federal Law “On Bukh. accounting”, according to which primary documents and CD registers are stored in the archive for at least 5 years. After the expiration of the established period, they can be destroyed, but provided that there are no disputes or ongoing legal proceedings regarding them.

It should be noted that the period of 5 years is counted from the date of creation of the document, but from the date of the reporting year in which they were generated.

Storage can be organized both in the archive at the enterprise and with the involvement of specialized companies. They provide storage on a contractual and paid basis for as many years as you need.

The above-mentioned law establishes that when conducting cash transactions in electronic form, the shelf life of electronic media should also be the same as that of paper media - no less than 5 years. The exception is payroll, according to which employees receive their salaries. They are stored for 75 years.

CD storage must be carried out on the basis of the following rules:

- Documents must be stapled on a daily basis. The deadline for stitching is no later than the next working day.

- Inside the stitching, CDs must be selected according to the following order: in ascending order of accounting account numbers. In the sequence, first of all, according to Dt of the account, and then according to Kt.

- All sheets of stitching are subject to numbering.

- When transferred to the archive, an inventory is generated indicating the quantity and name of the CD stitching; an article can be entered in accordance with the nomenclature approved by the organization.

Source: https://IPprof.ru/buhgalteriya/kassa/kassovye-dokumenty.html

How to draw up an act

Legislators have not developed a standard unified form for the act on the destruction of seals and stamps. This means that enterprises are free to write it in any form or according to a template approved in the company’s accounting policy. In this case, there is a number of information that must be indicated in the document:

- number, place and date of creation of the act,

- Name of the organization,

- data about the stamp itself: details of the company displayed on the cliche (if there are several stamps to be recycled, information about all of them is entered in the same way),

- composition of the commission (positions, surnames, first names and patronymics of employees),

- the reason for the destruction of the seal or stamp,

- basis for destruction (i.e. provide a link to the document),

- time, place and method of destruction.

In addition, in the form of the act it is necessary to put imprints of the stamps being destroyed and to attest in writing to the fact that the manipulations made led to the complete unsuitability of the cliches for further use.

Online cash registers for individual entrepreneurs on UTII and PSN: the deferment until 2021 has not passed

Thus, we are talking about deferring online cash registers for individual entrepreneurs in almost all areas of small business. The goal is to support entrepreneurs, to give them time to prepare: both for work under the new order and for the costs of equipment.

In addition, the phased introduction of online cash registers allows us to avoid supply queues and equipment shortages. In 2021, more than 1.5 million entrepreneurs installed online cash registers on time and without delays.

- repair clothes, shoes and jewelry,

- are engaged in tutoring or caring for the sick,

- provide hairdressing, beauty or cleaning services,

- contain a dry cleaner, laundry or photo studio,

- make keys and metal haberdashery,

- repair household appliances, transport, computers, radio-electronic equipment, furniture, housing,

- provide veterinary, funeral, motor transport, installation, welding and other production services,

- rent out real estate,

- make handicrafts.

How to draw up a deed

The execution of the act is also left to enterprises: it can be created in handwritten form or printed on letterhead or a simple sheet of A4 or A5 format.

The only rule that must be observed is that all information provided must be certified by the autographs of the members of the commission who carried out the disposal.

After this, the act is submitted for certification to the head of the company or another person who has the right to sign such papers.

A note about the act is placed in a special journal for recording the movement of seals and stamps , which must be maintained at the enterprise when its employees use stamp products.

The act is drawn up in at least one copy, but copies can be made if necessary.

To be or not to be a seal for an individual entrepreneur: that is the question

A private individual engaged in business is not required to disclose to the world that he has a company imprint that will be used in his professional activities. But if he independently expresses such a desire, he can go through registration procedures at the following “points”:

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

At any time, an entrepreneur can get rid of the seal himself if its presence seems burdensome to him or his activities are suspended. To do this, it is necessary to destroy the print and draw up an act certified by the personal signature of the person.

Online cash registers – 2020 in questions and answers

Please note: you can fulfill all the requirements of Law 54-FZ for the details in a cash receipt using the “Kontur.Market” service. The service also ensures the transfer of data on punched checks to the INFS through the OFD.

In addition, “Kontur.Market” is integrated with the service for maintaining records and submitting reports “Kontur.Accounting”, which allows you to quickly and accurately reflect sales data in tax and accounting.

- understand your commands;

- print the names and prices of goods stored in the electronic catalog on the receipt;

- send information about sales to the tax office;

- send sales data to the inventory service (it stores product items) so that the service shows statistics, reports, and inventory balances.