Transfer of taxes. How to prepare payment documents

On approval of the Rules for indicating information in the fields of settlement documents for the transfer of taxes, fees and other payments to the budget system of the Russian Federation

Order of the Ministry of Finance of the Russian Federation dated November 24, 2004 No. 106n, registered with the Ministry of Justice of the Russian Federation on December 14, 2004 No. 6187

From January 1, 2005 the following

come into force:

– Rules for specifying information identifying the payer and recipient of funds

, in settlement documents for the transfer of taxes, fees and other payments to the budget system of the Russian Federation;

– Rules for specifying information identifying a payment

, in settlement documents for the transfer of taxes and fees and other payments to the budget system of the Russian Federation,

administered by tax authorities

;

– Rules for specifying information identifying a payment

, in settlement documents

for the transfer of customs and other payments from foreign economic activity

;

– Rules for specifying information identifying a payment

, in settlement documents for the transfer

of other payments

to the budget system of the Russian Federation;

– Rules for indicating information identifying the person or body that issued the settlement document

for the transfer of taxes, fees and other payments to the budget system of the Russian Federation.

Taxpayers (payers of fees), tax agents, tax collectors or payers of other payments - legal entities, individual entrepreneurs, private notaries, lawyers who have established law offices, heads of peasant (farm) households and other individuals draw up settlement documents in accordance with the rules established for these categories of payers

.

Rules

indication of information identifying the payer and recipient of funds in settlement documents for the transfer of taxes, fees and other payments to the budget system of the Russian Federation, and

Rules

for indicating information identifying the payment in settlement documents for the transfer of taxes and fees and other payments to the budget system of the Russian Federation

have remained virtually unchanged

compared to those in force in 2004 .

Changes

, mainly concern

individuals

.

So, in the “Payer” field the following is entered:

– for individual entrepreneurs

- last name, first name, patronymic and in brackets - individual entrepreneur;

– for private notaries

– last name, first name, patronymic and in brackets – notary;

– for lawyers who have established law offices

, – last name, first name, patronymic and in brackets – lawyer;

– for heads of peasant (farm) households

– last name, first name, patronymic and in brackets – peasant farm;

– for other individuals

– last name, first name, patronymic and place of residence of the individual.

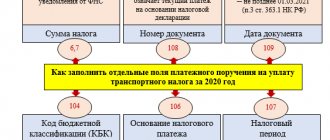

The place of residence of an individual in the “Payer” field is not filled in

when indicating

in field 108

the value of the

“Document Index”

from the notification of an individual in the approved form, filled out for the taxpayer by the tax authority.

Legal entities indicate the name of the legal entity - organization, its branch or separate division.

In field 106

indicate the payment basis indicator, which has 2 digits.

It has been established that the value "BF"

– current payments of individuals - bank clients (account holders), paid from their bank account.

As before, field 108 indicates the document number

, which, depending on the value of the payment basis indicator, can take the following form if the payment basis indicator has the value:

“TR”

– number of the tax authority’s request for payment of taxes (fees);

“RS”

– number of the decision on installment plan;

“FROM”

– number of the decision on deferment;

“RT”

– number of the decision on restructuring;

“PR”

– number of the decision to suspend collection;

“VU”

– number of the case or material considered by the arbitration court;

“AP”

– number of the inspection report;

“AR”

– the number of the enforcement document and the enforcement proceedings initiated on the basis of it.

It has been established that when a taxpayer - an individual - a bank client (account holder) fills out a settlement document for payment of tax payments in field 108

the value of the “Document Index” detail is indicated from the notification of an individual in the approved form, filled out for the taxpayer by the tax authority, and in its absence, the number of another document specified in this paragraph, on the basis of which the settlement document is filled out, is indicated.

When a taxpayer - an individual - a bank client (account holder) fills out a settlement document for payment of tax payments based on a tax return, a zero (“0”) is entered in field 108

.

In field 109

The date of the document is indicated.

When a taxpayer - an individual - a bank client (account holder) fills out a settlement document for payment of tax payments based on a tax return in field 109

the date of submission of this declaration to the tax authority or, when sending a tax declaration by mail, the date of sending the postal item is indicated.

Field 110 indicates the payment type indicator, which has two signs.

Additional new payment type values have been set

:

“PL”

– payment payment;

“GP”

– payment of duty;

“VZ”

– payment of the fee.

It is clarified that the presence of blank fields in the payment document is not allowed

.

The calculation and payment of the tax amount is carried out by the tax agent at the end of the tax period, as well as when he makes a payment of funds or withdrawal of securities (payment of income in kind) to the taxpayer before the expiration of the next tax period.

For the purposes of this paragraph, the payment of funds means the payment of cash, the transfer of funds to the bank account of an individual or to the account of a third party at the request of an individual, except for transfers of the Client’s funds from the Company’s accounts for the purchase of securities or financial instruments, and also repayments of loans provided by the Company for the purpose of transferring long positions.

When a tax agent makes a payment of cash or income in kind before the end of the next tax period, the tax is calculated from the tax base determined as follows:

When paying income in kind, the payment amount is determined in the amount of actually incurred and documented expenses for the acquisition of securities transferred to the taxpayer.

The company calculates the financial result on the date of payment of income. Moreover, if the amount of money paid to the taxpayer does not exceed the amount calculated for him in the amount of the financial result for transactions for which the Company acts as a tax agent, tax is paid on the payment amount.

If the amount of money paid to a taxpayer exceeds the amount of the financial result calculated for him, the tax is paid on the entire amount corresponding to the amount of the financial result calculated for this taxpayer.

When a tax agent pays a taxpayer money (income in kind) more than once during a tax period, the tax amount is calculated on an accrual basis, taking into account previously paid tax amounts.

Payment of tax at the expense of the Company's funds is not permitted.

Tax is withheld on the date the client's income is paid. The calculation on the basis of which the Company withholds tax is sent to the client by email. The transfer of tax to the budget is made by the Company no later than 14:00 of the next banking day.

If it is impossible to withhold the calculated amount of tax from the taxpayer, the Company, within one month from the moment this circumstance arises, notifies in writing the tax authority at the place of its registration about the impossibility of the specified withholding and the amount of the taxpayer's debt. Payment of tax in this case is made in accordance with Article 228 of the Tax Code.

Example of personal income tax calculation:.

Mr. Petr Semenovich Ivanov (client code No. 555) has an agreement with the Company for brokerage services. When paying him money, the Company withholds income tax as follows:

1. On February 10, 2010, an application was received from client No. 555 to withdraw funds in the amount of 50,000 rubles. As of February 10, 2010, the financial result for transactions with securities (income minus expenses) amounted to 100,000 rubles.

Calculation: 50,000 < 100,000, which means the tax base for calculating personal income tax is the payment amount, and the tax amount is:

50,000 * 13% = 6,500 rubles, withholding 6,500 rubles.

2. On March 10, 2010, client No. 555 withdraws 100,000. As of March 10, 2010, the financial result changed and amounted to 160,000 rubles.

Calculation: the amount of withdrawn funds on an accrual basis is 150,000 rubles (50,000 + 100,000) < 160,000, which means that the tax base for calculating personal income tax is the payment amount, and the tax amount taking into account the previous withdrawal of funds is:

150,000 * 13% = 19,500 rub.

But on February 10, 2010, a tax amount of 6,500 rubles had already been withheld, so the amount to be withheld is 13,000 rubles (19,500 – 6,500).

3. On 04/10/2010, client No. 555 withdraws 100,000. As of 04/10/2010, the financial result did not change and remained equal to 160,000 rubles.

Calculation: the amount of withdrawn funds on an accrual basis is 250,000 rubles (50,000 + 100,000 + 100,000) > 160,000, which means the tax base for calculating personal income tax is the financial result, and the tax amount is:

160,000 * 13% = 20,800 rub.

As of 04/10/2010, a tax amount of 19,500 rubles (6,500 – 02/10/10 and 13,000 – 03/10/10) had already been withheld, so the amount to be withheld is 1,300 rubles (20,800 – 19,500).

Payment details

The payment order is generated with current payment details. Data from the Internet services of the Federal Tax Service of Russia are:

- unique document index;

- details of the recipient of payments from individuals administered by tax authorities;

- payment amount;

- details of the payer in case of payment of debts on taxes and fees.

Information with a unique accrual identifier (UIN) is transmitted electronically to credit organizations in the manner established by the Agreement on information interaction between the Federal Tax Service of Russia and a credit organization when making payments to individuals administered by tax authorities.

GLAVBUKH-INFO

In accordance with Art. 12 of the Tax Code of the Russian Federation, the system of taxes and fees in the Russian Federation includes federal taxes and fees, regional and local taxes.Federal taxes and fees are taxes and fees that are established by the Tax Code of the Russian Federation and are obligatory for payment throughout the territory of the Russian Federation.

Regional taxes are taxes that are established by the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation on taxes and are obligatory for payment in the territories of the corresponding constituent entities of the Russian Federation;

Local taxes are taxes that are established by the Tax Code of the Russian Federation and regulatory legal acts of representative bodies of municipalities on taxes and are obligatory for payment in the territories of the corresponding municipalities.

Tax is understood as a mandatory, individually gratuitous payment levied on organizations and individuals in the form of alienation of funds belonging to them by right of ownership, economic management or operational management for the purpose of financial support for the activities of the state and/or municipalities.

A fee is understood as a mandatory fee levied on organizations and individuals, the payment of which is one of the conditions for state bodies, local governments, other authorized bodies and officials to carry out legally significant actions in relation to fee payers, including the granting of certain rights or the issuance of permits (licenses). ).

Federal taxes and fees, in particular, include:

- value added tax;

- excise taxes;

- personal income tax;

- unified social tax;

- corporate income tax;

- state duty, etc.

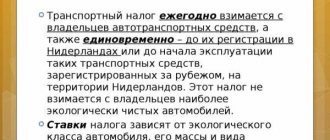

Regional taxes and fees, in particular, include:

- corporate property tax;

- transport tax.

Local taxes and fees, in particular, include:

- land tax;

- property tax for individuals.

A tax is considered established when the taxpayers and elements of taxation are determined, namely:

- object of taxation;

- the tax base;

- taxable period;

- tax rate;

- tax calculation procedure;

- procedure and deadlines for tax payment.

Typically, taxes are determined (calculated) by multiplying legally established tax percentages by a certain amount called the tax base.

Transactions on the accrual and payment of taxes to the budget are subject to reflection in accounting.

Information on settlements with the budget for taxes and fees paid by the organization, and taxes from employees of this organization is taken into account on account 68 “Settlements for taxes and fees” for the corresponding sub-accounts opened for each type of taxes and fees.

The accrual of taxes and fees is reflected in the credit of account 68 “Calculations for taxes and fees” (according to the corresponding subaccounts) and the debit of various accounts (depending on the Sources of reimbursement of taxes and fees).

Accrued taxes and fees may:

- included in the cost of materials, goods, products (work, services) and capital investments (credit account 68 - debit accounts 08, 10, 20, 23, 25, 26, 29, 41, 44) - for example, a single social tax;

- be credited to accounts for accounting for sales and other income and expenses (credit account 68 - | debit accounts 90, 91) - for example, value added tax and corporate property tax;

- be credited to the profit and loss account (credit to account 68 - debit to account 99) - for example, income tax;

- withheld from the income of individuals. employees of the organization, founders, etc. (credit account 68 - debit accounts 70, 75) - for example, personal income tax.

The transfer of taxes and fees to budgets of various levels is reflected in the debit of account 68 “Calculations for taxes and fees” and the credit of cash accounting accounts.

In addition to the amounts of taxes and fees actually transferred to the budgets of various levels, the debit of account 68 “Calculations for taxes and fees” also reflects the amounts of value added tax and excise taxes written off from account 19 “Value added tax on acquired assets” (corresponding subaccounts ) and presented for deduction in settlements with the budget.

Analytical accounting for account 68 “Calculations for taxes and fees” is carried out by type of taxes and fees.

This section discusses the main taxes paid by organizations. At the same time, it is necessary to recall that accounting for taxes related to the remuneration of employees and organizations (personal income tax and unified social tax) is described in detail separately.

| Next > |