Restrictions on donation

The gratuitous transfer of valuables or property rights is essentially a donation (Clause 1, Article 572 of the Civil Code of the Russian Federation).

The transferred objects can be:

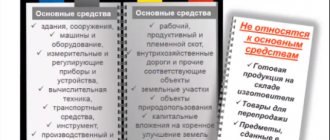

- fixed assets;

- goods;

- in cash;

- finished products;

- intangible assets;

- materials;

- securities;

- property claims (rights), for example, this may be the right to use a land plot disinterestedly transferred by a commercial organization to a non-profit institution or a disinterested assignment by a commercial enterprise of the right to demand payment of the debt of its debtor to a non-profit organization.

For commercial enterprises, an acceptable limit for the value of gratuitously transferred valuables has been established - up to 3 thousand rubles. This restriction does not apply to transactions with individuals and public organizations, charitable and other foundations, budgetary institutions, consumer cooperatives, religious and other non-profit organizations. In addition, it is possible to transfer property free of charge to commercial organizations-founders, but provided that such operations are stipulated in the charter. Donation of valuables between commercial organizations in the amount of more than 3 thousand rubles. is considered a violation of the requirements of the law, and such a transaction may be declared invalid (clause 1 of Article 168, subclause 4 of clause 1 of Article 575 of the Civil Code of the Russian Federation).

When donating valuables worth over 3 thousand rubles. a citizen or non-profit organization should draw up a written gift agreement (Articles 574 and 575 of the Civil Code of the Russian Federation).

The transaction of gratuitous transfer of valuables is confirmed by a delivery note or an acceptance certificate.

For information about the form used to draw up the consignment note, read the article “Unified form TORG-12 - form and sample.”

Income tax for an organization transferring property for free use

Since the participant transferring the property for unpaid use has no income, no income tax is charged.

Accordingly, expenses that are not taken into account for taxation in relation to the lender include:

- the total value of the freely transferred property;

- the costs of its maintenance.

Features of tax accounting

To carry out tax accounting, it is necessary to first conduct an assessment of the unpaid property received, which is made on the date of its receipt and corresponds to its market value.

This assessment can be made by:

- an independent appraiser who has the necessary license;

- the taxpayer himself.

Good to know! If the assessment is carried out by the taxpayer, he must prove the validity of the calculation of the value of the thing through documents showing the submitted prices.

A taxpayer can use the following sources of information about prices on the market:

- exchange prices;

- national statistical offices;

- institutions that regulate pricing;

- mass media.

Property transferred for free use includes:

material and production reserves:

- raw materials and materials used in the production process;

- things intended for sale;

- materials and funds used for management coordination;

- fixed assets;

- intangible funds;

items of intellectual property (prerogative right of the patent holder, copyright, property right, owner's right):

- invention, production model;

- computer utilities, databases;

- topologies of aggregate chips;

- trademark and service mark, name of the place of production of goods;

- breeding achievements;

cash deposits:

- national, municipal and other securities;

- investments in the authorized capital of other institutions;

- loans, depositary investments in credit institutions, receivable liabilities acquired through relaxation of the right to claim, etc.

When is the gratuitous transfer of property subject to VAT?

In tax legislation, values or rights transferred to the recipient without issuing counter obligations are considered to be received free of charge (clause 2 of Article 248 of the Tax Code of the Russian Federation). The accrual and payment of a particular tax occurs only if there is a tax base. For the purposes of calculating and paying VAT, the gratuitous transfer of valuables is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). This means that the party must also pay VAT on the value of the valuables transferred free of charge.

ConsultantPlus experts explained in detail how to calculate VAT when transferring property free of charge. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

VAT is calculated for the gratuitous transfer of valuables at the time the transaction itself is performed (clause 1 of Article 167 of the Tax Code of the Russian Federation). The transfer date is considered to be the date of execution of the primary documents:

- in case of transfer of goods - the date of issue of the invoice;

- if services were provided free of charge (work performed) - the date of drawing up the acceptance certificate.

Read about the details that are a mandatory component of such an act in the material “Accounting - Postings for Services”.

IMPORTANT! According to the Law “On Amendments...” dated 06/08/2020 No. 172-FZ, taxpayers have the right not to pay VAT when gratuitously transferring property used for the prevention, diagnosis or treatment of coronavirus. This provision applies to legal relations arising from January 1, 2021. In this case, the tax previously accepted for deduction does not need to be restored.

The tax base is determined by the market price of the transferred property on the date of the transaction (clause 3 of Article 105.3 of the Tax Code of the Russian Federation, clause 2 of Article 154 of the Tax Code of the Russian Federation).

As for the VAT rate, in case of gratuitous transfer, the rate provided for this type of product (work, service) is applied.

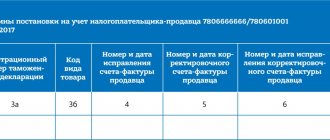

The cost of the property or other benefits transferred free of charge, as well as the amount of VAT calculated for payment to the budget, are reflected in the invoice. This document is registered in the sales book during the period of transfer of valuables (clauses 1, 3 of the rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137).

Read about the specifics of preparing an invoice for services in the article “Invoice for services - sample filling”.

In the case of accrual and payment of VAT upon gratuitous transfer, input VAT paid to suppliers for the acquisition of gratuitously transferred property can be deducted (subclause 1, clause 2, article 171 of the Tax Code of the Russian Federation).

When you don't have to pay tax

The Tax Code of the Russian Federation contains lists of gratuitous operations that:

- are not considered sales for the purposes of calculating and paying VAT (clause 2 of Article 146 of the Tax Code of the Russian Federation);

- are exempt from paying tax (Article 149 of the Tax Code of the Russian Federation).

Let's look at some of them.

Transfer of property is not a sale

Free transfer of fixed assets to state and municipal institutions, authorities and local self-government, as well as state unitary enterprises and municipal unitary enterprises is not considered a sale (subclause 5, clause 2, article 146 of the Tax Code of the Russian Federation). Therefore, the transferring party does not need to calculate VAT.

The gratuitous transfer of funds is also not regarded as a sale, therefore it is not subject to VAT on the transferring party (subclause 1, clause 3, article 39 of the Tax Code of the Russian Federation, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

The gratuitous transfer of valuables or other benefits for the implementation of the main activity specified in the charter of the enterprise and other than entrepreneurial activity to non-profit organizations will not be considered a sale (subclause 3, clause 3, article 39 of the Tax Code of the Russian Federation). In this situation, the basis for calculating and paying tax is not formed, which means there are no obligations to calculate and pay VAT.

From 07/01/2019 the following are not recognized as subject to VAT:

- free transfer of socio-cultural objects to the treasury of a constituent entity of the Russian Federation or municipal entity;

- gratuitous transfer of real estate to the treasury of the Russian Federation;

- free transfer of property to Russia for scientific research in Antarctica.

Let's consider an example of a gratuitous transfer of valuables to an educational institution.

An educational institution can act both as a non-profit organization and as a commercial one. Legally, an educational institution can be a legal entity of any organizational and legal form, the main activity of which is educational activity, which must be noted in the organization’s charter and is based on passing accreditation in the established order. Individual entrepreneurs engaged in educational activities can also be classified as educational organizations. That is, when carrying out a transaction for the gratuitous transfer of valuables to an educational institution, enterprises may encounter both institutions belonging to non-profit structures and commercial organizations.

The gratuitous transfer of property to an educational institution belonging to a non-profit organization (for example, a state educational institution), aimed at carrying out the main activities reflected in the charter of this enterprise, will not be subject to VAT.

At the same time, it is important to indicate in the gift agreement the further use of gratuitously transferred material assets and other benefits in the main (registered in the charter) activities of the recipient enterprise, which is a non-profit organization.

Drawing up an invoice for the gratuitous transfer of valuables to non-profit organizations, if the benefits received are used only in the statutory activities of the enterprise other than business, is not required (clause 3 of Article 169 of the Tax Code of the Russian Federation).

Find out whether the gratuitous transfer of gift certificates to employees is subject to VAT in ConsultantPlus. To do everything correctly, get trial access to the system and go to the material. It's free.

The gratuitous transfer of property will be subject to VAT if the recipient of assistance turns out to be a commercial enterprise (for example, a private educational institution).

When transferring property, there is a VAT benefit

It is possible not to pay tax in cases where the benefit under Art. 149 of the Tax Code of the Russian Federation, which exempts this operation from VAT.

Thus, the distribution of advertising magazines, booklets, leaflets and other things is exempt from VAT if no more than 100 rubles were spent on the creation or purchase of a copy of this assortment. including VAT (subclause 25, clause 3, article 149 of the Tax Code of the Russian Federation).

There is no need to pay VAT when transferring valuables free of charge for charitable purposes (subclause 12, clause 3, article 149 of the Tax Code of the Russian Federation). The exception is the transfer of excisable goods.

Charity in the legislation is considered as an activity for the disinterested (free) transfer of material assets or other benefits to legal entities or individuals on a voluntary basis (Article 1 of the Law “On Charitable Activities...” dated 08/11/1995 No. 135-FZ. But this benefit is possible only if compliance with the following conditions:

- the assistance provided must strictly correspond to the charitable purposes specified in the list of paragraph 1 of Art. 2 Law No. 135-FZ;

- recipients of material assets, as well as gratuitous assistance in the form of other benefits, can only be non-profit organizations or individuals;

- the gratuitous transfer of valuables must be documented (letters of the Ministry of Finance of Russia dated October 26, 2011 No. 03-07-07/66, Federal Tax Service of the Russian Federation for Moscow dated December 2, 2009 No. 16-15/126825): an agreement on the agreement of the parties to transfer free of charge;

- copies of documents confirming the acceptance of valuables for registration by the recipient of gratuitous assistance;

- acts or other documents confirming the intended use of the transferred values.

When a charitable transfer of material assets occurs, the transaction is considered taxable, but exempt from tax. The obligation to draw up an invoice for transactions exempt from VAT from January 1, 2014 on clause 3 of Art. 3 of the Law “On Amendments...” dated December 28, 2013 No. 420-FZ). Therefore, when transferring valuables in the form of charitable assistance, an invoice need not be drawn up.

On the application of Art. 149 of the Tax Code of the Russian Federation, read more in this section of our website.

Income tax for an organization that has received property for free use

Property (thing, labor relations, service) or owner's rights acquired free of charge are considered as non-operating income of the taxpayer.

However, transferred property is not recognized as non-operating income if it was acquired from:

- a providing institution whose investment (part of the share) is equal to 50% or more of the authorized capital of the acquiring participant, and vice versa;

- an individual whose investment (part of the share) is equal to 50% or more of the authorized capital of the acquiring participant;

- founders of the organization to increase net assets, such as the formation of surplus capital and/or funds.

Let's celebrate! If the agreement imposes the costs of maintaining the property on the lender, they are excluded from the costs of the borrower; accordingly, the taxpayer reduces the income received by the totality of available costs.

Results

The obligation to charge and pay VAT upon gratuitous transfer of property arises in cases where:

- the recipient of the valuables is a commercial organization (the transferring party will have to calculate VAT and pay it to the budget);

- a charitable transfer of valuables to a non-profit organization or individual is carried out; however, based on the benefits under sub. 12 clause 3 art. 149 of the Tax Code of the Russian Federation, tax may not be paid when registering a transaction, taking into account all established requirements.

The gratuitous transfer of property will not be subject to VAT if:

- funds are transferred (subclause 1, clause 3, article 39, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation);

- the receiving party is a non-profit organization (for example, a state educational institution) and the values received as a gift are aimed at carrying out the main activities reflected in the charter of this institution (subclause 3, clause 3, article 39 of the Tax Code of the Russian Federation);

- gratuitous transactions are not recognized as sales for the purposes of calculating VAT (clause 2 of article 146 of the Tax Code of the Russian Federation).

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sale of securities received free of charge

The specifics of determining the tax base for transactions with securities are established by Art. Art. 280 and 329 of the Tax Code of the Russian Federation. In particular, paragraph 2 of Art. 280 of the Tax Code of the Russian Federation stipulates that a taxpayer’s income from transactions involving the sale or other disposal of securities (including from the redemption or partial redemption of their nominal value) is determined based on the price of the sale or other disposal of the security. Moreover, the taxpayer’s expenses upon the sale or other disposal (including upon redemption or partial redemption of the nominal value) of securities are determined, in particular, based on the acquisition price of the security (including the costs of its acquisition) and the costs of its sale (clause 3 Article 280 of the Tax Code of the Russian Federation).