What is UTII

The unified tax on imputed income (UTII) is a special regime that companies and entrepreneurs can voluntarily apply. Many businessmen like UTII not only because it allows them to save on taxes, but also for the simplicity and “transparency” of calculation.

“Imputation” has restrictions on types of activities. Organizations or individual entrepreneurs that are engaged in:

- retail trade;

- public catering;

- advertising;

- household services;

- road transport;

- provision of real estate for rent;

- repair and maintenance of transport;

- veterinary medicine

The full list of activities permitted for “imputation” is given in paragraph 2 of Art. 346.26 Tax Code of the Russian Federation. Local authorities independently choose which areas of business from this list can be transferred to UTII on their territory. Therefore, it is better to check with your tax office whether your activity falls under this special regime.

A business on the “imputation” should not be large: no more than 100 people on staff, and there should not be founders from among legal entities with a share of more than 25%.

The tax is calculated based on physical indicators - premises area, number of employees, number of vehicles, etc. There are also restrictions here. For example, the area of a store or cafe should not exceed 150 square meters. m.

In which region should I register for UTII?

The transition to UTII is voluntary, but this absolutely does not mean that any business entity has the right to use this special tax regime (STR).

According to paragraphs. 1–2 tbsp. 346.26 of the Tax Code of the Russian Federation, registration on UTII is possible only in those subjects where the SNR was introduced by a decision of the representative authorities of the district (city) in relation to the type of occupation chosen by the economic entity.

Only firms or individual entrepreneurs that meet the requirements of clause 2.2 of Art. can register with UTII. 346.26 Tax Code of the Russian Federation:

- The average number of personnel of a business entity did not exceed 100 people in the past calendar year. 2021 is the last year when an exception is made for consumer cooperation societies and those organizations that are wholly owned by consumer cooperation societies, as well as their unions.

- The share of other companies in the authorized capital (AC) of the taxpayer does not exceed 25%, with the exception of those companies in which 100% of the authorized capital belongs to institutions for the disabled. Provided that disabled people make up at least 50% of the average number of employees of the company, and the share of their wages is not less than a quarter of the total wage fund. An exception is also made for the organization of consumer cooperation and organizations, 100% of whose capital belongs to consumer cooperation organizations and their unions.

- They are not business partnerships.

- They do not sell their own manufactured products through retail outlets or catering facilities when combining unified agricultural tax and unified income tax, etc.

A complete list of restrictions on the use of UTII is given in the diagram below:

What to do if your company no longer meets the criteria for applying UTII or you voluntarily decided to switch to a different tax regime? How to deregister as a UTII payer, as well as answers to other questions related to the use of this special regime, can be found in the UTII Manual from ConsultantPlus. Free trial access will allow you to study the material even for those who do not yet have access to K+.

Find out everything about the calculation of UTII and declarations under this special tax regime in our articles:

- “UTII Declaration for the 1st quarter - completion and due date”;

- “How to calculate the amount of UTII tax for the 1st quarter”;

- “We remind you of the deadline for paying UTII for the 1st quarter.”

Options for “replacing” the simplified tax system with UTII

From a “technical” point of view, in all cases, to switch to “imputation” you need to submit an application to the Federal Tax Service in the form of UTII-1 (for organizations) or UTII-2 (for individual entrepreneurs). These forms are attached to the order of the Federal Tax Service of the Russian Federation dated December 11, 2012 No. ММВ-7-6/ [email protected] The document must be submitted within 5 days from the date of commencement of activities falling under UTII.

If a businessman working for the simplified tax system decides to switch to “imputation”, then the following options are possible:

- voluntary transition from simplified tax system to UTII;

- combination of simplified tax system and UTII;

- loss of the right to apply the simplified tax system and subsequent transition to UTII.

Let's look at each of these situations in more detail.

General taxation system

It’s already too late for almost everyone who trades on OSNO to read this article: they should have switched to new cash registers back in July 2021, the transition deadline has already passed. However, there was also a delay: in 2021, those individual entrepreneurs and legal entities on OSNO who belong to public catering enterprises and have employees will switch to online cash registers.

And for those who provide work and services and use strict reporting forms, an online cash register is needed only in 2021.

Regardless of the timing of the transition to online cash registers, all categories of sellers on OSNO must indicate the name and quantity of goods on the receipt.

Transition from simplified tax system to UTII

The law does not provide for the opportunity to choose UTII when registering a company or individual entrepreneur. However, if a businessman immediately begins an activity subject to this tax, then he can submit applications for the transition within 5 days from the date of registration.

And if initially, when registering, he “declared” the simplified tax system as the tax system, then in this way one of the options for switching from “simplified” to “imputed” is implemented.

It is important to remember that in this case you need to submit an application not only for the transition to UTII, but also for the termination of activities within the framework of the simplified tax system. In addition, for the first year of work, in any case, it is necessary to submit a zero declaration under the simplified tax system.

Those who have just opened their own business often choose the “simplified” system, and when they start operating, they register as “imputed”. However, lack of income is not a reason not to submit a zero declaration. And if inspectors do not see such a report at the end of the year, then they begin to act within the framework of the Tax Code of the Russian Federation, i.e. the account is blocked after 10 days of delay.

Failure to submit a declaration also results in a fine; in the case of a “zero” report, its amount will be 1,000 rubles (Article 119 of the Tax Code of the Russian Federation). The responsible official will pay from 300 to 500 rubles under Art. 15.6 Code of Administrative Offenses of the Russian Federation.

If a businessman has already started working on a “simplified” tax system, then he has the right to change the taxation system only from the beginning of the next year (Clause 3 of Article 346.13 of the Tax Code of the Russian Federation). In this case, the notification of refusal from the simplified tax system must be sent before January 15, and the application to begin using the UTII must be sent no later than January 5. It is important to meet these deadlines, otherwise you will have to wait another year.

Combine UTII with simplified tax system, patent or OSNO

UTII can be combined with any other taxation system.

A common situation is that you trade through a brick-and-mortar store and online. For a stationary point you use UTII, and the online store uses the simplified tax system. In this situation, it is necessary to keep separate records - income under the simplified tax system should be taken into account separately from income on UTII.

Distribute contributions for individual entrepreneurs between the simplified tax system and UTII or use it to reduce one of the taxes completely. Make sure that the total amount to be reduced does not exceed the amount of insurance premiums paid.

Even if you plan to conduct only activities on UTII, we recommend submitting an application for the simplified tax system. UTII is only suitable for some businesses, and therefore cannot be applied separately from other taxation systems. If you report only on UTII, there is a risk that the tax office will ask you to submit reports also on the general system. In addition, you may have “unplanned” income, for example, interest on the account balance.

Therefore, it is better to combine UTII with the simplified tax system. If the entire business is on UTII, you can report “zeros” according to the simplified tax system.

Combination of simplified tax system and UTII

The Tax Code of the Russian Federation allows for combining tax regimes. If they decide to start a new type of activity or differentiate existing ones, they have the right to submit an application to the Federal Tax Service for registration as a UTII taxpayer. Here, too, a five-day period must be observed from the date of commencement or “separation” of the activity.

In this case, you will need to report on both special regimes and pay both taxes. In addition, with such a combination, the businessman is obliged to keep separate records of income and expenses.

When to pay tax and submit a UTII return

Pay tax and report UTII every quarter.

The deadline for submitting the declaration is April 20, July, October, January.

The tax payment deadline is April 25, July, October, January.

Details in the article “Reporting on UTII”.

Submit reports in three clicks

Elba will calculate taxes and prepare business reports based on the simplified tax system, UTII and patent. It will also help you create invoices, acts and invoices.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Loss of the right to apply the simplified tax system and transition to UTII

An interesting situation arises when a businessman loses the right to use the “simplified language”. This happens, for example, when the income limit of 150 million rubles is exceeded.

A businessman is obliged to notify the tax authorities of the loss of the right to work on a simplified basis and to charge taxes according to the general system (OSNO) from the beginning of the quarter when the limit was exceeded.

The question arises: if a businessman “fell away” from the simplified tax system, for example, in the 2nd quarter and started working on OSNO, then does he need to wait until the beginning of next year to switch to UTII? After all, he no longer uses the simplified tax system, which means the norms of Art. 346.13 of the Tax Code of the Russian Federation no longer applies to it. Therefore, formally, the taxpayer has the right to switch to “imputation” at any time after the “return” to OSNO. The Tax Code of the Russian Federation does not contain a direct prohibition on such a transition, but it is still better to first send a request to the local Federal Tax Service to find out their position.

Patent tax system

The online cash register for individual entrepreneurs on PSN is required in the same way as the online cash register for individual entrepreneurs on UTII.

By July 2021, individual entrepreneurs in the retail and catering sectors with employees, as well as those who sell excisable goods and beer, must switch to online cash registers - they will also have to print the names and quantities of goods on the receipt.

In 2021, the rest of the individual entrepreneurs will switch to PSN: those who sell retail and have employees, those who provide services, and so on. Everyone will need to print a full receipt with name and quantity in 2021.

Do you want to understand as simply as possible from what year you should use an online cash register? Download the table!

You will find out when you need to switch to online checkouts, and whether you need to print the names and quantities of goods on your receipt.

Receive the table by email

Conclusion

The transition from simplified tax system to UTII without restrictions is possible only at the beginning of activity. You can also submit an application at any time if a businessman decides to combine these tax regimes. It is important not to forget to submit a “simplified” declaration at the end of the “transition” year, even if there was no revenue within the framework of this special regime.

If the business is already operating, then you can completely abandon the simplified tax system and switch to “imputation” only at the end of the year.

If a taxpayer has lost the right to use the simplified tax system and “forcibly” switched to OSNO, then he can theoretically immediately switch to UTII without waiting for the new year. But because This issue is not regulated by the Tax Code of the Russian Federation, it is better to first find out the opinion of the tax authorities in your region.

A single tax on imputed income

From what year do UTII payers need an online cash register is a difficult question, because it was the “imputation” that received the main deferment from online cash registers. Therefore, let's take it in order.

A legal entity on UTII to switch to online cash registers in 2021 if the company sells retail, caters or sells excisable goods and beer - those who sell strong alcohol switched to online cash registers back in 2021. The transition period for those who provide services to UTII has been postponed until 2021. For legal entities, the name and quantity of goods on receipts is mandatory.

The postponement of the use of online cash registers on UTII also affected individual entrepreneurs : those who trade in retail or belong to public catering, but work without employees, are required to use online cash registers from 2019 (note that individual entrepreneurs on UTII retail and public catering with employees are switching to online cash registers in 2021) Individual entrepreneurs who sell excisable goods and beer and provide services are also lucky: they also need to use online cash registers on July 1, 2021. At the same time, they will need to print the names of the goods on the receipt only in 2021.

Comments

Maria 01/15/2017 at 18:02 # Reply

You can switch to UTII throughout the year, not only from January 1

Natalia 01/16/2017 at 12:09 # Reply

Maria, good afternoon. You have confused the concepts of “switching to UTII” and starting to “apply UTII”. You can start using UTII not only from January 1, but you can switch from another taxation system to UTII only from the beginning of the calendar year. For example, you cannot switch from the simplified tax system to any taxation system within a year. I quote from the Tax Code of the Russian Federation, Article 346.13, paragraph 3. “Taxpayers using the simplified taxation system do not have the right to switch to a different taxation regime before the end of the tax period, unless otherwise provided by this article.” If you have lost the right to use the simplified tax system, then you can only switch to OSNO within a year. It’s the same with other tax regimes - they can only be changed from the beginning of the calendar year. If you added another type of activity during the year for which you did not apply, for example, the simplified tax system, then you have the right for this type of activity to apply for the use of UTII within a year (within 5 days after the start of the activity on UTII). Thus, switching to UTII and starting to apply UTII are different concepts.

Inna 05/25/2017 at 12:56 # Reply

Strange article and strange answer, Natalia. “If you added another type of activity during the year for which you did not apply, for example, the simplified tax system, then you have the right for this type of activity to apply for the use of UTII within a year (within 5 days after the start of the activity on UTII). » — What if I didn’t add any new types of activities, but simply decided to provide services not to organizations, but to the population, which naturally fall under household services. I can use the simplified tax system for settlements with organizations, and UTII for settlements with the population. And don’t wait for your January 1st next year! Your article is not correct, it gives incorrect information.

Natalia 05/25/2017 at 01:28 pm # Reply

Inna, good afternoon. Read the letter of the Ministry of Finance of the Russian Federation No. 03-11-11/29241 dated July 24, 2013, which states that UTII and the simplified tax system cannot be applied simultaneously for the same type of activity. So you will have a violation if you provide the same services to organizations using the simplified tax system and to the population using UTII. In this case, even January 1 will not help. The letter provides an example with retail trade, but if this seems strange to you, send a letter to the Federal Tax Service for a more accurate answer. Once again I will repeat the quote from the Tax Code of the Russian Federation (Article 346.13. Procedure and conditions for the beginning and termination of the application of the simplified taxation system): 3. Taxpayers using the simplified taxation system do not have the right to switch to a different taxation regime before the end of the tax period, unless otherwise provided by this article . 6. A taxpayer applying a simplified taxation system has the right to switch to a different taxation regime from the beginning of the calendar year, notifying the tax authority no later than January 15 of the year in which he intends to switch to a different taxation regime. Quote (Article 346.19. Tax period. Reporting period): 1. The tax period is a calendar year.

07/04/2017 at 01:57 pm # Reply

You can refuse the simplified tax system until January 15. But why refuse if you can, within 5 days from the start of your activity, register for secondary registration as a UTII payer at any time of the year, maintain 2 systems in parallel, and at the beginning of the year abandon the simplified tax system?

ostapx1 07/04/2017 at 16:29 # Reply

“Should we abandon the simplified tax system at the beginning of the year?” The article says “you can refuse the simplified tax system until January 15.”

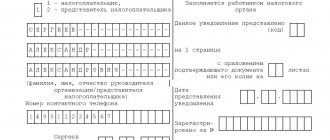

The procedure for filling out the UTII-1 form

The application form for registration as a UTII payer (UTII form-1) and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941.

At the top of the application, indicate the tax identification number and checkpoint; you can view them in the registration notice.

In the “tax authority code” field, enter the code of the tax office at the place of registration. Take it from the notice of registration of a Russian organization (clause 6 of Appendix No. 9 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941).

Also, the code of the Federal Tax Service of Russia can be determined by the registration address using the Internet service on the official website of the Federal Tax Service of Russia.

In the “organization name” field, indicate the full name that corresponds to the constituent documents (for example, charter, constituent agreement).

Indicate the OGRN number in accordance with the state registration certificate. You can also view this number in the notification of registration with Rosstat.

Enter the date from which the taxation system in the form of a single tax on imputed income will be applied for certain types of activities.

Indicate the number of pages on which the annex to the application is compiled. For example, if the application contains a two-page attachment, indicate “2—”. If you attach copies of documents to the application, indicate the number of sheets that confirm the authority of the representative of the organization.

Provide information about who is submitting the application on the title page in the field “Power of attorney and completeness of the information specified in this document, I confirm.” If this is the head of the organization, then indicate “3”, and if a representative – “4”. Below, write your last name, first name, and patronymic in full - as in your passport. Next, you need to indicate his TIN and telephone number where you can contact the person who confirms the information.

On page 2 of the UTII-1 form, in the “Code of type of entrepreneurial activity” field, indicate the code in accordance with Appendix No. 5 to the Procedure approved by Order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/353. For example, if the type of activity of the organization is the provision of repair, maintenance and washing services for vehicles, then enter the code “03”. This field must be filled in (clause 20 of Appendix No. 9 to the order of the Federal Tax Service of Russia dated December 11, 2012 No. ММВ-7-6/941).

Enter the address at which the organization or entrepreneur will conduct the imputed activity. Namely, postal code, region code, district, city, town, street, house number, building, apartment (office). Take the digital region code from the directory in Appendix No. 2 to the Procedure, approved by Order of the Federal Tax Service of Russia dated December 11, 2012 No. MMV-7-6/941.

Separate units

Situation: what documents need to be submitted to the tax office if an organization creates a separate division at the place of business on UTII? The organization is not engaged in the transportation of passengers and cargo, distribution (distribution) trade and does not place advertising on transport.

The answer to this question depends on where the organization creates a separate division and where it is registered with the tax authorities as a payer of UTII.

According to the general rules, the organization is obliged to register with the tax inspectorates at the location of each separate division. Moreover, such an obligation does not depend on whether she is listed in these inspections for other reasons. This procedure follows from the provisions of paragraph 2 of paragraph 1, paragraph 1 of paragraph 4 of Article 83 of the Tax Code of the Russian Federation and is confirmed by letter of the Ministry of Finance of Russia dated August 16, 2012 No. 03-11-06/3/60.

To register an organization at the location of its separate division (except for branches and representative offices), you need to submit a message. Compile it according to form No. S-09-3-1, approved by order of the Federal Tax Service of Russia dated June 9, 2011 No. MMV-7-6/362. In this case, no documents confirming the creation of a separate division need to be submitted.

The tax inspectorate will register the branch or representative office at its location independently based on the information from the Unified State Register of Legal Entities. This procedure is provided for in paragraph 1 of paragraph 4 of Article 83, paragraph 2 of paragraph 2 of Article 84 of the Tax Code of the Russian Federation.

If, by the time the separate division is created, the organization is already registered in the municipality as a UTII payer, then it is not required to re-register for taxation in this capacity (letter of the Ministry of Finance of Russia dated August 16, 2012 No. 03-11-06/3/60). It is enough to send only a message in form No. S-09-3-1 to the tax office at the location of the separate division.

You can submit a message about the creation of a separate division to the tax office in one of three ways. The first is through a representative of the organization. The second way is by mail (registered mail). And the third - through telecommunication channels. Such rules are established by paragraph 7 of Article 23 of the Tax Code of the Russian Federation.

All possible options for registering separate units when using UTII are listed in the table.

An example of registering an organization as a UTII payer

An organization opens a separate division in the municipality in which it is already registered for tax purposes on a different basis.

The organization is engaged in wholesale trade (general taxation system) in the city of Pushkino, Moscow region and is registered with this municipal entity for tax purposes at the location of the head office. In May 2015, the organization opened a new retail outlet (a separate division) in Pushkino. The head office of the organization and its separate division operate in the territory under the jurisdiction of one inspection. In this regard, the organization submitted to this tax office an application in the form of UTII-1 and a message in form No. S-09-3-1 about the creation of a separate division.

Situation: does a separate division arise if the activities for which the use of UTII is allowed (provision of household services to the population) are carried out on behalf of the organization by employees working under civil law contracts?

Answer: no, it does not occur.

As a general rule, a separate division is formed only where stationary workplaces are equipped, geographically remote from the location of the organization, for a period of more than one month (Article 11 of the Tax Code of the Russian Federation). And it is mandatory to equip such places only for those with whom the organization has entered into employment contracts (paragraph 4, part 1, article 21 of the Labor Code of the Russian Federation). Labor legislation does not apply to those working under civil contracts (for example, under contract or paid services) (Article 11 of the Labor Code of the Russian Federation). That is why the place where employees work under a civil contract is not a separate unit.

However, if an organization decides to apply UTII for household services, then it will have to register for taxation at the place where such activities are carried out. The procedure for applying UTII does not depend on who performs work or provides services on behalf of the organization: full-time employees or those with whom civil contracts have been concluded. In this situation, the contractor itself under contracts concluded with customers is the organization itself as a legal entity. Therefore, if an organization provides household services in a municipality where UTII is applicable for such activities, then it needs to register as a payer of this tax on a general basis. This must be done within five working days from the date of commencement of activities (clause 3 of Article 346.28 of the Tax Code of the Russian Federation). This moment can be considered the day when the first contract for the provision of services (performance of work) was concluded. If an organization provides personal services in the territory of different municipalities (including through mobile teams of its employees), then it needs to register for tax purposes in each of these entities.

This follows from the provisions of Article 346.28 of the Tax Code of the Russian Federation.