On July 1, 2021, new changes to the law “On cash registers” No. 54-FZ come into force, which are called the third wave of the transition to online cash registers. It was assumed that after this there would be no other innovations, but the latest news suggests otherwise.

Just three weeks before the target date, some without employees were released from the use of online cash registers from July 1, 2021. But the exemption is temporary, because this category is given a deferment of up to two years, i.e. maximum until July 1, 2021.

The question of who should switch to the new CCP is really confusing. The Federal Tax Service has even developed a special test for those who doubt their obligation to use the cash register. We invite you to look into this topic together.

Read about cash register innovations in 2021 in this article.

Online cash registers: changes in 2021

Legislation regulating trade, payments and cash registers is constantly changing. Thus, amendments are constantly made to 54 Federal Laws, new legislative acts, orders and other laws are issued, which a modern entrepreneur has to constantly monitor in order to be aware of the latest innovations and not face fines. In 2021, there is also the latest news regarding online cash registers: this includes mandatory labeling of goods with digital means of identification, and a VAT rate of 20%. Other large-scale changes are planned for online cash registers in 2021, which will affect the entire market. Multikas specialists closely monitor changes in legislation regarding cash registers - follow the news on our website.

CCP for settlements with accountants and for payments under GPC agreements

When an organization or individual entrepreneur makes payments to an individual under a GPC agreement, it acts as a buyer, and the individual acts as a seller.

According to paragraph 1 of Art. 1.2 of Federal Law No. 54-FZ, only organizations and individual entrepreneurs are obliged to use the cash register, but individuals and buyers are not. Accordingly, in such a situation the cash register is not used. Organizations are not required to use a cash register when paying rent to individuals for real estate.

According to the law, payments in which it is necessary to use cash register systems are considered to be the payment of funds (DC) for goods sold, work performed, services provided. The issuance of wages, financial assistance and other payments, the issuance of DS for reporting, and the return of unspent DS that were issued for reporting are not considered calculations. Therefore, the use of a cash register is also not required.

What's new in the online cash register

The transition to a new type of equipment is not without reason. New devices have a number of differences from old cash registers and fundamentally new functions:

- The fiscal drive is the cash register memory, which replaced the EKLZ. This is a small box with a seal that fits into the device body. The device records on the fiscal drive all information about the transactions carried out: sales, returns, etc., and all data is recorded in encrypted form, i.e. cannot be changed or copied. FN is issued for a certain period. This can be 15 or 36 months depending on the type of business, individual entrepreneur or LLC, and the form of taxation. The terms of use of the drive are established by law and cannot be chosen spontaneously.

- Internet connection - each cash register has the ability to connect to the Internet. The law establishes the mandatory presence of an Internet connection in an online cash register when using it - this is how the name “online cash register” appeared. The Internet in CCP is needed to send information to the tax authorities (this is fiscal data, they are also recorded on the FN) through the OFD. When the Internet is turned off, the cash register will work for up to 30 days, after which it will be automatically blocked.

- OFD - fiscal data operator. This is an intermediary organization that receives information from cash registers and sends it to the Federal Tax Service server. Connection to the OFD is paid and mandatory.

- New functions - new cash registers support wide functionality, which is designed to help the entrepreneur in running his business. This includes collecting statistics on key indicators and inventory accounting. Many cash desks support working with a personal account. It is very comfortable! You can manage your cash register from any browser from anywhere in the world. As a rule, a personal account supports many necessary and useful functions: working with goods, services, prices, purchases, documents, statistical reports and more.

- Simplified registration with the Federal Tax Service - to register a cash register, there is no longer a need to visit the territorial branch with a cash register in your hands. Now the entire procedure takes place via the Internet using an electronic signature key. The registration procedure can be completed either independently or through third-party organizations, but more on that a little later.

- New check format - a new check format has been installed, which is now uniform. The name of the product must now be indicated on the receipt.

- Electronic Receipt to Buyer - Every seller is now required to send an electronic receipt to the buyer upon request. Sending occurs by email or SMS message.

New details for cash receipts

In the summer of 2021, new details will be introduced in checks that are issued between organizations and individual entrepreneurs for cash or non-cash payments (subclause “d”, paragraph 15, article 1 of Law No. 192-FZ).

These details are intended to identify the buyer in detail. It will be necessary to indicate the name of the organization or full name of the entrepreneur, TIN of the client. If an invoice is issued for settlements, the cash receipt must include details related to the subject of payment (excise tax amount, country code, registration number of the customs declaration). To make payments using the machine, you must indicate on the receipt the information about the location where the machine will be installed.

When paying out lottery winnings, as well as when receiving an insurance premium (payment), it is necessary to indicate the name of the client or policyholder and his TIN on the check. If there is no TIN, indicate the series and number of the passport.

From January 1, 2021, the receipt will need to indicate information about the product code. For marked goods, this is a unique sequence of symbols presented in the identification tool contained in the KIZ. For other goods, this is the code of the commodity item in accordance with the unified Commodity Nomenclature of Foreign Economic Activity of the EAEU.

Do you need an online cash register?

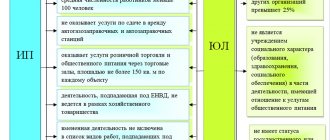

The question of whether an online cash register is needed in 2021 worries many people. By law, an online cash register is required for all individual entrepreneurs and LLCs, regardless of the form of taxation. Only the transition periods for different categories differ. There are, of course, exceptions to the general rule.

Who may not install an online cash register in 2021:

- All shoe repair shops

- All repair and key making workshops,

- Organizations providing ritual and religious services,

- Sellers of securities,

- Conductors in transport,

- Catering organizations in schools,

- Sellers of unequipped markets,

- Organizations selling printed materials,

- All those selling non-alcoholic drinks on tap, etc.

A detailed list of exceptions can be found in Federal Law 54. In any case, changes to online cash registers will affect many.

Current cash legislation

The main regulatory document for all users of cash register systems is the Law “On the use of cash register equipment in the Russian Federation” dated May 22, 2003 No. 54-FZ. Since its birth, it has been adjusted 16 times!

Among the most recent, significant changes are amendments made by three federal laws:

- dated 07/03/2016 No. 290-FZ “On Amendments to Law No. 54-FZ”;

- dated 07/03/2018 No. 192-FZ “On amendments to certain legislative acts of the Russian Federation”;

- dated 06.06.2019 No. 129-FZ “On amendments to Law No. 54-FZ”.

In addition, tax authorities have issued a huge number of explanatory letters with recommendations, explanations and examples to help both cash register users and local controllers themselves navigate the rapidly changing cash legislation.

Now the legislative process on cash regulations is actively continuing. We will tell you all the latest news about the deputies' ideas further.

Cancellation of online cash registers in 2021 - should we wait or not?

Many wait until the last minute, hoping that the government will change its mind at the last moment. Will online cash registers be canceled in 2021? It's safe to say no. There will definitely be no cancellation. This is a large-scale project in which the government has a strong interest for many reasons. The online cash register is in its own way a smart and powerful tool for business control, increasing tax collection, monitoring many business indicators, as well as financial flows. By introducing online cash registers, the state also sets an important goal - increasing the share of legal business by reducing the volume of counterfeit and counterfeit goods. It will be difficult to sell a fake using the new cash register. Mandatory product labeling will also help with this, which is precisely aimed at product traceability and identifying counterfeits.

What types of transactions need to be executed by check: the list has been expanded since July 1

As of January 1, 2019, the list of situations in which a cash register user is required to punch receipts has been expanded. The changes affect everyone who sells goods, provides services or performs work for individuals:

Cash register users should pay special attention to settlements with individuals: all non-cash settlements with them from 01/01/2019 are issued by checks. Including when an individual transfers money through an online bank, bank terminal or mobile application.

Before this date, it was allowed not to issue a check if the individual buyer transferred money through a bank branch.

Who needs an online cash register?

Who should install online cash registers in 2021:

- Individual entrepreneurs and LLCs in the service sector with and without employees (all forms of taxation),

- Individual entrepreneurs and LLCs without hired employees in the field of trade and public catering (all forms of taxation).

Transition deadline for individual entrepreneurs July 2021

Thus, 2021 makes online cash registers for individual entrepreneurs mandatory for all categories of business, except for established exceptions. The same applies to organizations. Individual entrepreneurs on UTII, OSN, simplified tax system, patent must install online cash registers before July 1, 2021.

QR check = cash receipt

The QR check has received the status of a printed check. The seller may enable the buyer to read the QR code using a mobile phone, smartphone or other computer device. A cash receipt received in this way and printed is recognized as a cash receipt on paper.

note

When selling remotely, it is allowed not to print a receipt at all at the place where the goods are transferred. The client can receive a check on his phone, e-mail or via a QR code.

Tax deduction for online cash register

The state understands that the costs of switching to online cash registers are quite high. Businessmen who installed the equipment on time, i.e. before the established deadline, have the right to submit an application for compensation to the territorial branch of the Federal Tax Service of the Russian Federation. Compensation is provided in the form of a tax deduction in the amount of RUB 18,000. for each piece of equipment (cash register). The state provides this opportunity only to entrepreneurs on UTII and a patent, as well as combined forms of taxation, including UTII or a patent. To receive a deduction, you need to provide receipts or other documents confirming the fact of purchasing the cash register, and write an application in the prescribed form.

Two checks for installment payment

If at the time of purchase the buyer pays for part of the goods immediately, and the rest in installments, give him two checks (letter of the Federal Tax Service of Russia dated February 4, 2021 No. ED-4-20 / [email protected] ).

Punch the first check when you receive the first part of the money, and the second check after the final payment. The details of these checks will differ from each other.

Firstly, when filling out the “Payment method attribute” in the first check, indicate “Partial payment and credit”, and in the second – “Loan payment”.

Secondly, in the detail “Attribute of the subject of payment” in the first check there should be “Goods”, in the second check – “Payment”.

Thirdly, in the details “Price per unit of the item of calculation, taking into account discounts and surcharges” and “Cost of the item of calculation, taking into account discounts and surcharges” in the first check write the full cost of the goods, in the second - the amount provided in installments.

But fill in the details “Name of the subject of payment” in the same way in both checks. Enter the name of the item sold here.

Fines for online cash registers

The law regulates the use of cash registers and also establishes administrative penalties for violations of the law. In this case, the penalties chosen are fines:

- For individual entrepreneurs: No cash register - up to half of revenue; repeated - suspension from work for up to 2 years.

- The cash register does not comply with 54 Federal Laws, it is not registered correctly - 3 thousand rubles.

- The check was not issued - 2000 rubles. (including electronic check).

- Lack of cash register - at least 30,000 rubles; repeatedly - suspension of the LLC’s operation for up to 3 months.

Increasing the VAT rate and ending the use of FFD 1.0

From January 1, 2021, a law will come into force according to which the VAT rate will increase from 18% to 20%.

Accordingly, the correct VAT rate must be indicated on receipts. Otherwise, it will be considered a violation of the law. In a check, the tax rate is a detail into which values are entered from the memory of the cash register itself. Since there was no new bet before, most cash desks will not be able to withdraw it.

In order for the cash register to print the correct data, you need to update the firmware of the online cash register. To do this, you should contact either the cash register manufacturers or authorized service centers. It is necessary to reflash the cash register in advance, and this can be done after the approval of the corresponding order of the Federal Tax Service on the use of a new format for check details, which obliges manufacturers to modify the firmware. At the moment there are no new firmwares yet.

You should also remember that before the beginning of 2021 you need to change the rate in the accounting systems to which the cash register is connected, since the cash register takes information for displaying the VAT rate when printing a receipt from the product directory in the program.

Also, starting from 2021, it will no longer be possible to use the fiscal data format (FDF) version 1.0. There are currently three versions of FFD in use:

FFD 1.0, interacts with the fiscal drive (FN) version 1.0;

FFD 1.1, interacts with FN 1.1;

FFD 1.05 is a transitional format and has a more complete set of details.

After this order comes into force, the cash register with FFD 1.0 will be deregistered by the Federal Tax Service unilaterally and automatically. After which you cannot work at such a cash register; this will lead to a fine for using a cash register that does not meet the established requirements.

You can check the FDF version:

1) in your FDF personal account, in any receipt, view the field “FFD version number”;

2) on a paper check about the opening of a shift;

3) in the settings and cash register drivers. For example, for cash registers of the Atol company, you can print a check “Information about CCP” with information about the version. For VikiPrint checkouts you need a special Fito program, where you can view the necessary data.

The issue of firmware for cash registers should not be put off, since the responsibility for the correct use of the cash register lies with its owner.

Use of online cash registers from 2021

Each cash register must be connected to the Internet and registered correctly. Before you start working at the cash register, you need to enter the cashiers' data and set up the workplace and access rights. Work at the cash register begins with the opening of the shift and ends with the closing and generation of the Z-report. New cash registers support full and partial refunds, as well as non-cash payments. When purchasing a cash register in our store, you will also receive introductory instructions on how to use the cash register. You can also get consulting and technical support from Multikas.

Correction check or return receipt?

When calculating at the checkout, various errors may occur that need to be identified and corrected in a timely manner.

For this purpose, it is possible to use a correction check or return the receipt. To prevent problems from the tax office, it is better to initially worry about the error in order to eliminate it. Explanations from the tax office regarding the use of a correction check are ambiguous. It must be used when breaking the law while using CCP. The regulatory authorities do not explain what exactly constitutes a violation of the law. In particular, it will be considered a violation to carry out calculations without using a cash register, for example, due to a power outage, breakdown of a cash register, etc. Let’s consider common errors and ways to solve them.

1. The amount in the check is less than what was received, and this was discovered after the buyer left. In this case, the actual availability of money is greater than reflected in fiscal data (FD). For inspection authorities, this is unaccounted revenue, which indicates the non-use of the cash register. This entails fines due to non-use of cash registers.

To eliminate this error, it is necessary to draw up a cashier's memo, indicating in it the date, time and reason for the error, due to which unaccounted revenue was generated. Assign the date and number of the document in order to then indicate this information on the basis of the correction check.

The check must contain sufficient information to identify the payment where the error was made. In particular, indicate the fiscal attribute (FP) of the incorrect document.

To adjust settlements made without a cash register, the receipt must contain details corresponding to the settlement (date, name of product, service, work, settlement address). The calculation attribute must indicate “Incoming”, the correction type “Independent operation”.

After the correction check has been entered and sent, you need to send a notification to the tax office at the place of registration and report the discovery and actions to eliminate unaccounted revenue.

2. The amount in the check is more than what was received, and this was discovered after the buyer left.

In this case, the revenue is less than reflected in the FD, this leads to a discrepancy between the fact and the accounting - a shortage is formed.

There is no need to generate a correction check in this situation. Exceeding the cash balance does not indicate that the cash register has not been used, which is not a reason for tax audits. To correct the data, just punch the refund check for the missing amount. The cashier who made a mistake must write an explanatory note indicating the reason for the shortage.

3. The error in the receipt is discovered in the presence of the buyer.

You can correct the error immediately. To do this, you need to collect the erroneous check from the client and issue a refund check for the entire amount of the incorrect check. Then punch the receipt receipt for the correct amount and then issue it to the buyer. Then the OFD and regulatory authorities receive correct information about revenue.

4. The error was discovered after the shifts were closed.

According to the law, a correction check must be generated after the opening of the shift, but no later than the closing of the shift. This causes a lot of controversy, since unaccounted revenue is often not revealed immediately, until after the end of the shift. According to comments from tax representatives, punching correction checks for past shifts is not prohibited. The main thing is to indicate on the check the date of the error, which should be recorded in the “Description of correction” detail.

Installing an online cash register in 2021 - where to start?

Before installing the cash register, you must first perform a number of sequential actions:

- Direct purchase online cash register,

- Connection to OFD,

- Selecting a fiscal drive,

- Registration of cash register,

- Installation and configuration of the necessary software (if necessary).

After completing all these points, installing a cash register will not be difficult for you. It is worth paying special attention to the registration procedure for cash register equipment due to the increasing frequency of equipment breakdowns during self-registration. It is best to entrust registration to specialists, since performing the procedure yourself, there is a high risk of blocking the fiscal drive, incorrect registration and equipment breakdowns.

Terms and abbreviations used in the article

An online cash register is a modern cash register that has Internet access via a SIM card or built-in modem. The cash desk transmits checks electronically to the fiscal data operator, and then to the Federal Tax Service.

Fiscal storage (FN) is an electronic chip that records and encrypts purchase information and transmits it to the fiscal data operator.

Fiscal data operator (FDO) is an organization that processes, stores and transmits to the tax office information about payments made through the cash desk (fiscal data).

Fiscal data (FD) - information about payments made through the cash register.

How can a buyer check a receipt?

There are several ways to check receipts. Cash receipts can be checked at check.ofd.ru:

You can use the tax office app (by scanning the QR code) or the Federal Tax Service mobile app to check receipts:

This application allows you to:

- receive cash receipts and store them electronically;

- check the legality of checks and the integrity of sellers;

- report violations to the Federal Tax Service.

For the convenience of users, the application provides the ability to either manually enter fiscal data from a receipt, or scan a QR code from a cash receipt and automatically check it.

Which cash register is suitable for different types of trade

The choice of an online cash register is influenced by the stationarity or mobility of trade, the number of customers, the volume of items in the receipt and the presence of labeled goods in the assortment. Please note: until February 1, 2021, individual entrepreneurs in special modes may not print the nomenclature on the check if they do not sell excisable goods.

Cash desks for stationary trade

When choosing an online cash register model, you should focus on consumer activity—the cash register load per shift. If there are few buyers and you have to print up to about 200 receipts a day, you can buy an online cash register with a low printing speed and without automatic receipt cutting. Such cash registers are suitable for couriers, small kiosks, street food, small coffee shops, “islands” in shopping centers, etc. For example, you can purchase a kit that consists of a MultiPOS POS terminal and an Atol 30F receipt printer. Also, with such a check load, you can buy models MSPOS-K or MSPOS-E-F (with the ability to pay by credit card) along with a docking station. The station will allow you to charge the cash register and will serve as an adapter - it has sockets for connecting additional equipment.

If there are a lot of customers during a shift and high speed of service is important to you, the above cash desks will not be suitable. In this case, it is necessary that the receipt is printed faster, and the printer must be equipped with an auto-cut. The specified conditions are met, for example, by MSPOS T-F, a Kontur.Sigma monoblock or a set consisting of an Atol Optima POS terminal and an Atol 55F (or Atol 25F) receipt printer.

Cash desks for non-stationary trade

If you have a delivery trade, you serve customers at their home, or at your point of sale there is little space for cash register equipment, and the flow of customers is small, MSPOS-K or MSPOS-E-F with acquiring is suitable for you. For these online cash register models, you can purchase a docking station. This way you can connect additional equipment to the cash register and charge it. These cash register models are small in size and weigh 500 grams. Such cash registers can print receipts at a speed of 75 mm per second. This is enough to process about 200 checks per shift.

Cash desks when selling marked goods

If the assortment includes labeled goods (for example, alcohol and tobacco), then you need to purchase an online cash register that can recognize such goods and send information about the purchase to the operator of the labeling system and to the Unified State Automated Information System. The table below shows examples of such cash registers.

| Types of labeled products | Suitable online cash register models |

| Light alcohol: beer, cider, mead, poiret | MSPOS-K MSPOS-E-F, POS terminal MultiPOS + receipt printer Atol 30F, MSPOS T-F, Contour.Sigma |

| Any alcohol | POS terminal Atol Optima + receipt printer Atol 55F or Atol 25F |

| Tobacco | POS terminal MultiPOS + receipt printer Atol 30F, POS terminal Atol Optima + receipt printer Atol 55F or Atol 25F |

Cash registers for remote payment

If payment is made through a bank cash desk, ATM or online banking, then the cash receipt can be generated before the end of the next business day. For remote payments, you can use any online cash register model. If direct interaction with the buyer is not expected, then a paper receipt may not be printed. It is enough to generate an electronic receipt and send it to the buyer by email or phone number. If it is not possible to send an electronic check using these methods, then you can include a paper check in the parcel with the goods or hand it over during the first contact with the client.

Please note: according to clause 2.1. Article 1.2 of Law No. 54-FZ, from July 1, 2021, when making remote payments for goods or services, two checks must be generated: the first is an advance payment or advance upon receipt of money from the buyer to the account, the second is a credit for the advance upon shipment of goods.

Cash registers for vending

When selling goods through vending machines (vending), you do not need to build a cash register into each vending machine. It is enough to install one online cash register in your office, which will collect information about sales from all your vending machines and transmit the data to the Federal Tax Service through the OFD. In this case, there is no need to give the buyer a paper check. An electronic check should only be sent if the buyer has provided an email address or phone number. And by February 1, 2021, vending machines must be equipped with displays from which QR codes can be read. This will allow customers to identify the cash receipt.

However, if excisable and marked goods, technically complex goods, food products and goods for which certain storage and sale conditions are established are sold through vending machines, then an online cash register must be built into each such machine. If the cash register operates in autonomous mode, then it must also be placed directly in the vending machine body. Such a cash register should issue paper receipts to customers.

On models of online cash registers that are intended for vending, the letters “FA” are indicated. It is also important that vending machines have clearly readable serial numbers.

General recommendations when choosing a cash register

If you need to indicate long names of goods or services on receipts, it is better to use online cash registers with the ability to print a wide cash register tape (for example, MSPOS T-F). Also in this case, the Wiki Print 80 plus F, Atol 25F or Atol FPrint-22 PTK printers are suitable.

When choosing an online checkout, remember to upload the product range into it. This can be done manually through the interface of the cash register itself, entering each item one by one. But with an assortment of over 50 items, it is much more convenient to enter the nomenclature through special software. Cash register and software purchased from the same seller are usually compatible. It is enough to upload the items into the service and synchronize it with the online cash register. If you purchase cash register equipment and software from different places, check with the manufacturers about the compatibility of the online cash register and software.

Cash registers can be push-button or touch-sensitive. Often push-button CCTs are inexpensive. When purchasing such a cash register, keep in mind that working with the nomenclature and settings will take much more time. In addition, not all push-button cash registers can connect additional equipment, such as a scanner.

Complete set for online cash register: cash register at a special price, OFD, configuration of cash register with registration with the Federal Tax Service and a discounted inventory system Send a request

How tax authorities check checks

Tax authorities control fiscal documents using a special automated system ASK KKT:

ASK KKT is a new platform for administering cash register equipment, allowing you to see all retail sales online. On the Federal Tax Service website in real time you can see publicly available data from this system:

Tax authorities have access to the program (login and password) for each user of online cash registers.