Best current account offers

You can pay for the services and goods provided either in cash or by non-cash method. It is the second option that most entrepreneurs prefer.

However, does everyone without exception need an online cash register for acquiring? Let's consider this issue in more detail, and also find out the features of various types of acquiring and how to connect it to the cash register.

How does an online cash register with acquiring work?

At first glance, the principle of operation of the device is quite simple.

However, if you look from the other side, this is a whole series of complex manipulations, starting from reading information from the card and ending with printing a receipt:

- The terminal must receive information about the bank card. This can be done in two ways: attach a card or swipe a magnetic stripe through a special reader;

- The card data is transferred to the bank with which an agreement has been concluded to accept payments. Next, the identification process is carried out, which issued the payment card;

- The bank finds the client in its database, asks to enter his PIN code (this procedure takes place in 2 seconds) and checks the balance of funds available for debit;

- The bank confirms the information about the availability of the expected amount and transfers the information to the acquiring bank.

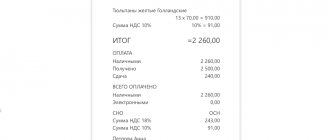

- The last stage is writing off the required amount and printing a cash receipt.

Results

Acquiring allows you to make payments using bank cards without using cash.

Nevertheless, merchants using acquiring, including online acquiring, must use modern cash registers (online cash registers), if, according to Law No. 54-FZ, they have an obligation to use cash register systems in calculations. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who uses an online cash register with acquiring?

These systems are purchased by any entrepreneur, since the scope of their application is quite diverse.

This device will be a good assistant in attracting customers and eliminating competitive firms.

They are installed in:

- small grocery stores and fairs;

- beauty salons and hairdressing salons;

- travel companies;

- cafes, bars, restaurants, canteens, etc.

- private hospitals and pharmacies;

- courier services;

- Service stations, tire shops, car washes, etc.

The list may not end there, since terminals are used in any field of activity. The main thing is to buy the right model. Let's look at the features of devices in demand today.

Features of choosing a financial organization for acquiring

Almost every major bank in the Russian Federation can offer this service. Despite their large number, the payment for connecting to the service is practically the same, and the limited number of functions does not please the end consumer.

Therefore, entrepreneurs are provided with special conditions:

- reduction in the amount received by the bank when using acquiring in stores with high traffic;

- reduction of acquiring bank tariffs for cards they issue;

- reduction of tariffs provided that the individual purchases and installs the equipment independently.

An online cash register with acquiring is needed by almost all individual entrepreneurs and LLCs on a single imputed income, on the simplified tax system or the PSN.

How the new type of equipment works

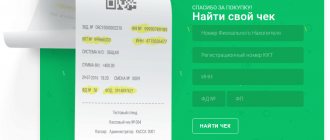

Each online cash register has a fiscal storage unit inside. He collects all data on the economic activities of the enterprise and sends them to the tax authorities. To ensure that the process goes quickly and does not cause problems, you can use the services of a fiscal data operator. The OFD will help purchase equipment, financial statements of the required volume, register them with the Federal Tax Service and take care of the timely transfer of information. This operating principle makes the economic activities of any enterprise more transparent.

Acquiring connection procedure

To connect the device, the entrepreneur must enter into an agreement with the acquiring bank. In this case, the following list of documents is collected:

- certificate of state registration of an entrepreneur;

- extract from the unified register of legal entities;

- package of constituent documents (if necessary);

- bank statement confirming the existence of your own account;

- documents confirming ownership;

- business license.

All documents are carefully analyzed by bank representatives. If the answer is positive, the entrepreneur enters into an acquiring agreement.

At this step, you should discuss with a bank employee the commission of an online cash register with acquiring. On average, at Tinkoff it is 1.59%; at Tochka Bank it charges 2.8%.

The next stage is the installation of devices with special software. The form of payment is established on the official website of the online store, and then training of the working staff is carried out.

Based on the above, it can be noted that acquiring is an assistant to any entrepreneur, since payment for most services and goods is made by non-cash form.

Important! Refusal to install acquiring may result in a decrease in customer traffic. In addition, the established acquiring system inspires additional customer confidence.

How to activate non-cash payment

There are two options: connect a bank terminal to a cash register or choose an online cash register with built-in acquiring.

Option 1. Install a pin pad

To pay with bank cards, a special terminal with an installed program is used, it is also called a pin pad. The buyer inserts or taps his card, in some cases enters a PIN code. Data about payments or errors goes to the cash register program.

The most popular payment terminal models currently (spring 2020) are Ingenico IPP320 and Ingenico ICT250.

They are compatible with all modern models of cash register equipment.

Why do we install Ingenico IPP320 for our clients?

- Accepts any type of bank cards: with an EMV chip, with a magnetic stripe, contactless (NFC).

- Works with most smart terminals and fiscal registrars.

- Connects to the cash register via USB and RS-232 interfaces.

- It has a large bright LCD display 128x64.

- Reliable rubber buttons that have been proven to last a long time. Tested by thousands of Ingenico users around the world.

- Included with the pin pad is acquiring Evotor (the solution is free when purchased in the PORT online store).

Option 2. An alternative to a separate pinpad - a cash register with built-in acquiring

These include Evotor 5i smart terminals. MSPos-E-F, aQsi 5, Litebox 5. They are all designed in such a way that they support a combined payment method (cash and cards), so they do not need a separate pin pad.

The choice of retail experts is the Evotor 5i terminal. See its benefits below in the selection.

Final step: set up acquiring

There are also two options here: choose a favorable tariff and conclude an agreement with the bank during a personal visit, or set everything up remotely.

Pay attention to the Evotor.PAY platform, which helps businesses connect to merchant acquiring without visiting the bank. All you need to do is upload your details, licenses and powers of attorney to your personal account.

This is especially relevant in light of restrictions related to the spread of coronavirus infection.

What is good about Evotor.PAY?

Clients will be able to pay as they wish

Accept payments from a card, smartphone, watch or ring.

Quick connection

This only takes 5 working days.

No visit

The manager does not have to go to the bank; it is enough to send the manager scans of the main documents.

Fast enrollment

The money is credited to your account the next day.

Any bank

You can use a current account in any Russian bank.

You pay a fixed commission

The percentage is from 1.2 to 2.7%, there are no separate requirements for cash flow.

The solution works with all Evotor terminals

and more than 150 other models class=”aligncenter” width=”1332″ height=”720″[/img]

What are the differences between acquiring and online cash registers?

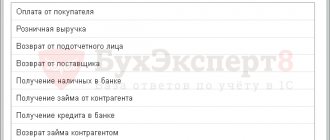

It is simply impossible to combine these two concepts, since they perform different tasks:

- Acquiring is required to accept payments by bank cards;

- The online cash register prints a purchase receipt and sends the data to the tax office.

It is worth noting that some part of the profit when using acquiring is subject to fiscalization. Therefore, it is impossible to completely eliminate the use of online cash registers. In addition to simplifying the payment procedure, online cash register and merchant acquiring perform another important function - they reduce the likelihood of accepting counterfeit bills, reducing the cost of cash collection.

A selection of models from retail experts

We tried to select solutions that will take up minimal space and fit even into a small budget. With all the listed models, you can automate your point of sale at minimal cost.

Smart terminal Evotor 5

Evotor 5 with a banking terminal will be an excellent solution for stationary trade in a small store, for couriers, coffee-to-go outlets, bakeries, market departments and outdoor events.

Advantages

- Compact dimensions: fits in a pocket, slightly larger than the palm of your hand.

- Convenient inventory system with free functionality.

- Simple and intuitive interface.

- Possibility of integration with 1C.

- Autonomous operation up to 12 hours.

- No computer connection required. The main actions are performed directly at the checkout.

ATOL Sigma 7

A good option for trade, service sector and catering. A convenient and easy-to-use terminal with reliable printing options.

Advantages

- Built-in cash register program with remote access and clear reports.

- 7 inch vertical touch screen.

- Autonomous battery life up to 5 hours.

- Support Wi-Fi, Bluetooth, 3G.

Evotor 5i terminal accepting different types of payments

It will be an excellent solution for those who do not use a commodity accounting system. You don’t have to install a computer and buy a bank terminal; such a smart terminal already combines all the functions.

Thanks to battery life up to 12 hours and the ability to accept payments by card, the model is suitable for remote and traveling trading, for any micro-business.

Advantages

- Built-in acquiring. You don't need a separate pin pad.

- Free merchandise accounting system with basic programs: sales, discounts, returns, product accounting, sales statistics, cash register and employee management in your personal account.

- Battery life up to 12 hours

- Support Wi-Fi, 3G, Bluetooth.

- Bright 5.5″ touch display.

Fiscal registrar Retail 02f

The model with Wi-Fi connection makes it possible to organize a cashier’s workplace with only a phone or tablet.

You install the inventory system on your mobile device and synchronize it with the cash register via Wi-Fi. After that, you perform all the main actions on your phone, and it, in turn, sends checks for printing through the fiscal registrar.

Advantages

- Minimum wires and the ability to work even in confined spaces.

- To work, you will need a registrar, a phone / tablet / computer and an inventory system (there are paid and free program options).

- Wi-Fi support, RS-232 and USB connectors.

- High quality printing.

- The model range includes options with a different set of interfaces (only RS/USB or additional LAN ports), a Wi-Fi option, the presence of an auto-cut and a separate connector for the cash drawer.

Mobile cash register Shtrikh-nano

The most compact and budget fiscal recorder in the line of Shtrikh-M cash registers. The manufacturer is known for its reliable models of cash register equipment.

Advantages

- The low printing speed is compensated by the low price and the ability to connect via Bluetooth.

- Bluetooth and WiFi support.

- Battery powered.

What about the scope?

We believe that the Evotor and Sigma smart terminals are suitable for both on-site and stationary locations. Systems based on a fiscal registrar and a mobile device most often need to be connected to the network, so they are not always applicable to couriers, but they will work well, for example, at order pick-up points.

Smart terminal Evotor 5

Online mobile cash register SHTRIH-NANO-F

Smart terminal ATOL Sigma 7

Online fiscal registrar RETAIL-02F RS/USB, money connector. drawer + auto cut

Online fiscal registrar RETAIL-02F RS/USB with Wi-Fi (white)

Smart terminal Evotor 5i

Mobile acquiring and online cash register

The main purpose of online cash registers and mobile acquiring is to provide on-site services, pay for courier services, and trade in off-site pavilions.

Online cash register and mobile acquiring are interconnected. In accordance with current legislation, any transaction with funds can be carried out through a mobile application.

Therefore, the need to issue a check and transfer data to the tax service remains. Transfer of a check can only be done via SMS or email.

After paying for a purchase or service, a receipt is generated using a stationary cash register. To summarize: any mobile device is a full-fledged device that allows you to pay with both cash and bank cards.

The main advantage of mobile terminals is their small size.

Cheap terminals are not capable of conducting a large number of financial transactions. Therefore, in some cases it is necessary to purchase additional equipment.

Approximate costs

The budget consists of several components, see the table.

| Buying a cash register with fiscal storage | from 12 to 40 thousand for compact models, FN for 15 months 6-7 thousand rubles, for 36 months 9-10 thousand rubles |

| Bank terminal and acquiring | about 13-15 thousand rubles. for the pin pad and payment solution Evotor PAY |

| Agreement with the fiscal data operator | for 15 months 3750 rubles, for 36 months 6700 rubles. |

| Registration of an online cash register under 54-FZ | A package of services from the ASC costs 1,500 rubles, optional contract for cash register maintenance RUB 1,950. for a year |

| Receiving an electronic digital signature (if you have not received it yet) | 2500 for the digital signature itself, plus 2000 when recording on a protected medium |

| Total | at least 25-30 thousand rubles. for each cash register with the possibility of cashless payment |

Price examples

on equipment from the article:

- Evotor 5 costs about 15 thousand rubles, Evotor 7 - 17-20 thousand, version 5i with built-in acquiring 24 thousand. The ATOL Sigma 7 terminal will require approximately 14 thousand. Fiscal recorders that can be connected to a smartphone or tablet, SHTRIH-NANO costs 5-6 thousand, Retail 02F about 11 thousand.

- We add a fiscal accumulator to the price, depending on the validity period it is from 6 to 10 thousand.

- The pin pad will cost about 15 thousand rubles (not needed when choosing a cash register like Evotor 5i with built-in acquiring).

- You can register a cash register under 54-FZ on your own, but it’s easier and faster to entrust the work to engineers. Included in the package of services for 1500 rubles. includes registration on the Federal Tax Service website, registration on the OFD site and direct fiscalization of the new cash register.

- To transfer fiscal data to the Tax Inspectorate via OFD servers, you will need an agreement. This is about 4-7 thousand, depending on the validity period of the fiscal drive.

The final budget for implementing a cash register that accepts non-cash payments depends on the cost of the device itself and related services.

On average, managers spend 30-40 thousand rubles on one cash point.

Compatibility of online cash registers and Internet acquiring

When trading or providing services on the Internet, online cash register and Internet acquiring are the best option.

Payment for purchases and services via the Internet is carried out without interaction with the seller. He is not provided with a check generated through the online cash register.

The role of acquiring devices on the Internet is special software located on the supplier’s server. The data from the bank card is entered by its owner, after which the information is transmitted to the payment system.

Important! Online stores that sell services and goods online and do not have permanent premises cannot operate without it. Therefore, rumors about a postponement for such stores are untrue.

Don’t forget about another payment acceptance channel: enable non-cash payment on the website

According to statistics, more than 40% of website visitors choose online payment. This is especially true now, when it is necessary to minimize direct interaction with employees and couriers.

If your company has a website with products, give customers the opportunity to pay for their purchases immediately.

How to do it? Connect to an online payment service. The most popular option in our country is Robokassa.

What's good about Robokassa?