At the beginning of 2021, a product labeling system was launched. A new Data Matrix barcode standard has been introduced for cigarette packs, and from 2021 fur coats, shoes, scented products (perfume), and photographic equipment for professional and semi-professional use will be subject to mandatory labeling. From 2021, clothing and footwear for adults and children will be subject to mandatory labeling requirements. Due to the fact that mandatory labeling of a number of goods is being introduced, Russian legislators have made changes to the rules for using online cash registers for entrepreneurs. The main innovation is that cash registers must “read” the product labeling and transmit information through encrypted channels to a single information technology center. The absence of a cash register with the ability to transmit and read information using a barcode will provide for penalties for businessmen.

What is the essence of the law on online cash registers?

- From July 1, 2021, organizations and most individual entrepreneurs must use only new generation cash register equipment (online cash registers or cash registers with data transfer).

- From July 1, 2021, the use of online cash registers will also become mandatory for UTII payers and entrepreneurs with a patent.

- The peculiarity of the new cash desks is that all information about payments will be transmitted through the fiscal data operator directly to the tax office.

- Retailers will need to provide the required information on each cash receipt - including the name of the product (service) and VAT.

- Fines for improper use of cash register equipment are increased to 30,000 rubles, and the statute of limitations is increased to a year.

Sellers of any alcoholic beverages (including beer, cider, mead, poiret) and those entrepreneurs who carried out retail sales of alcohol in the provision of public catering services and have not previously used fiscal technology should be among the first to switch to new online cash registers.

This is due to the fact that this category of retail finds itself at the crossroads of changes in two federal laws at once - 54-FZ and 171-FZ “On state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products.” Despite the fact that among sellers of low-alcohol products there are many entrepreneurs on UTII and PSN, and according to 54-FZ they could switch to new cash registers only from July 2021, the requirements of 171-FZ oblige them to switch to online cash registers by April 1, 2017- th.

Who is exempt from using online cash registers : the list of those who should not use online cash registers at all, and those who can use cash registers without an Internet connection, can be viewed in the 1C:ITS information system.

Settlement between organizations is carried out without the participation of cash registers

When making “non-cash” payments between organizations and individual entrepreneurs, with the exception of settlements using an electronic means of payment with its presentation, the Law on Cash Register allows not to punch a cash register receipt.

As reported by the Federal Tax Service of Russia, offsets carried out between organizations are one of the forms of non-cash payments and do not contradict the requirements of Chapter 46 of the Civil Code of the Russian Federation “Settlements”. After all, when conducting mutual offsets, funds are not involved in settlements at all (letter dated August 21, 2021 No. AS-4-20 / [email protected] ).

And since the offset of a counter homogeneous claim is one of the forms of non-cash payment, then when offsetting between legal entities and entrepreneurs, cash registers do not need to be used.

Do I need a check when issuing a loan to an employee or founder?

What will happen to violators of 54-FZ

The state has already provided for quite severe measures for non-use or improper use of cash register equipment.

According to the law, non-use of cash registers will entail the seizure of proceeds received bypassing the cash register. Thus, officials will pay a fine in the amount of half the amount of the calculation carried out without using a cash register. Moreover, the fine cannot be less than 10,000 rubles. The stores themselves may lose almost all of the revenue received in this way (from 75 to 100% of revenue). The fine for legal entities starts at 30,000 rubles. Such a fine is expected for each violation of the law.

Repeated violation will result in disqualification of officials and administrative suspension of store activities. They will be disqualified for up to two years, and retail outlets will be closed for 3 months.

At the same time, the law increases the statute of limitations for bringing administrative liability. The new term will be one year. Let us remind you that previously this period was calculated as two months. At the same time, tax officials complained that it was often simply impossible to complete the proceedings within the legal deadline. Now it will become much more difficult for merchants caught violating to avoid responsibility.

What will happen to cash registers that will not be replaced : The Federal Tax Service, in a letter dated December 30, 2021 No. ED-4-20/25616, warned that if the tax authorities identify a cash register that does not comply with legal requirements, it will be deregistered unilaterally order without the user's statement.

How does the online cash register work?

The new checkout, or online checkout, is very different from what merchants are used to. Firstly, the usual cash register (EKLZ - secure electronic control tape) is replaced with a fiscal drive. This is a small device whose memory stores information about all sales made at the checkout. The fiscal drive encrypts the data and sends it to the Federal Tax Service.

The declared cost of the fiscal drive is 8,000 rubles, but at the moment, due to a shortage, the price reaches 15,000 rubles. The device has a service life of 13 months. They promise that drives with a longer shelf life of up to 36 months will be available on the market, but at the time of writing this article, such devices have not yet appeared on the market.

The owner of the cash register has the right to independently replace the fiscal drive after the period of use has expired. But, apparently, suppliers of cash register equipment will require that this be performed by certified specialists - for example, as part of a cash register service agreement. Otherwise, this may result in the cash register being removed from warranty.

The cash register must also be equipped with an interface for connecting to the Internet - wired or wireless (WiFi, mobile Internet).

Some cash registers can be upgraded to new standards. Some don't. This can only be clarified from the manufacturer.

The cost of new cash registers ranges from 18,000 to 70,000 rubles, depending on the characteristics and capabilities. When purchasing, you need to pay attention to whether the declared price includes a fiscal drive.

Who is a fiscal data operator and why is he needed?

Legislatively, in the process of transferring data from the cash desk to the Federal Tax Service, a mandatory intermediary is provided - the fiscal data operator, or OFD. These are companies to which the Federal Tax Service has delegated to collect information from fiscal cash registers and broadcast it to their servers. The OFD register is published on the Federal Tax Service website. An agreement with the OFD must be concluded for each cash register. The cost of an annual contract is 3,000 rubles.

An important question is how quickly your check will be sent to the Federal Tax Service. There is no requirement in the law to immediately send a check to the OFD. Up to 30 calendar days are allotted for this from the date the check is generated. Therefore, if the Internet “fell off”, nothing bad will happen, unsent checks will accumulate in the fiscal drive, and when the connection is restored, they will be sent to the OFD. But if the information is not transmitted within 30 days, the fiscal drive will be automatically blocked and the cash register will stop printing receipts.

Despite the presence of an intermediary, the owner of the cash register is responsible for the timely transfer of data to the Federal Tax Service.

Cash register repair - service at a service center or do it yourself, which is better?

Having the instructions for repairing cash register equipment in your hands, you can fix it. This is not at all prohibited by law.

But, if you do not have experience in repairing CCPs, then it is better not to take on this matter. The online cash register is registered with the Federal Tax Service. Having violated the integrity of the device, which has a seal, then it will be impossible to simply put the cash register aside - or even trade without it.

It is better to contact an organization that provides CCP repair services. You will spend less time and maintenance costs. And in case of other problems related to technology, the technician will always come to your aid.

So, based on all of the above, we can come to the conclusion that repairs through professionals are still better, more profitable and faster.

What information will be included in the new checks?

The checks that will be issued by online cash registers contain much more information than before. Now it includes, among others, the following information:

- information about the seller’s tax accounting system;

- payment attribute (receipt, return, etc.);

- name of goods sold;

- calculation amount with a separate indication of the VAT rate and amount;

- form of payment (cash or electronic payment).

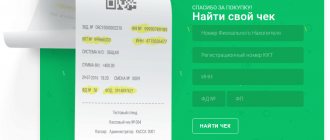

A QR code will also be placed on the check, using which buyers can use a special mobile application to find their check on the Federal Tax Service website.

The cash register receives most of the data from the program in which the company keeps inventory records. If such accounting did not exist before, and only the total purchase amount was shown on the receipts, it is necessary to organize such accounting and ensure that the necessary data is uploaded to the cash register.

To do this, data synchronization is organized between the cash register and the accounting program (for example, “1C: BusinessStart”): the product range, current retail prices, data on discounts are transferred from the program to the cash register, and a sales report is downloaded back. This is called integrating the cash register with the program.

Such a trading application can be hosted on a computer or in the “cloud” - an online service accessible to the user via the Internet.

There is a type of cash register that can operate autonomously, without connecting to a computer. They are usually used by small retail outlets, couriers, traveling sales points, etc. They have one inconvenience - if there are quite a lot of goods, then it is difficult to stuff them into such a cash register and regularly change their prices.

Special “cloud” programs have now been developed for them, which help to download items, quickly update retail prices after revaluation, and print labels and price tags. For example, the new cloud program “1C:Kassa”, with an access fee of 200 rubles per month, is precisely designed to organize convenient work with such devices.

According to the new law, in addition to a paper check, the buyer can also receive an electronic one - just ask the seller to send the check by e-mail or SMS with a link to the check on the Federal Tax Service website. Cash registers do not yet know how to send SMS and emails, and usually this task is entrusted to either a trading program or an OFD. By the way, such capabilities have already been implemented in 1C solutions.

- Important! Both paper and electronic checks have the same legal force - that is, with either of them you can return goods to the store or confirm expenses incurred (for example, payment for treatment for a tax deduction or compensation for expenses on a business trip). That is, if you have an electronic check, you don’t have to worry about losing the paper one.

Updating software on a cash register

According to the legislation of the Russian Federation, you can update the software on the cash register yourself.

However, this is not easy to do, because:

- Not all cash register models have an easy interface. To understand all the intricacies of updating software on a cash register, you need to at least re-read the instructions, and then actually determine where and how the system is updated.

- No one will notify you about updates. You must independently monitor the release of new updates. For example, updates are usually released 2 times a week. The entire system is not necessarily updated, new functions are added, errors are eliminated, etc.

It is important to update the software, because the operation of the entire outlet depends on the correct functioning of the cash register. If you don’t have enough time to follow updates, and generally deal with this issue, you can entrust it to IT specialists. The professionals of the Meta Center provide timely and fast software updates.

Remember: it is better not to use the old cash register, since the cash register may not be suitable for Federal Law No. 54. You can upgrade your equipment through the technical service center. On the website, in the Meta Center store, you will also find the best, proven and reliable online equipment.

Are there any advantages for business in the new law?

Despite the fact that, due to the new law that has come into force, small businesses will incur quite significant costs and will be forced to restructure their work in many respects, this reform has a number of advantages and disadvantages.

The main benefit from the new order will go to entrepreneurs, whose level of income depends not on the degree of cunning in relation to tax evasion, but on how useful the business they have created, how much customers value it, and how well-established business processes are. That is an honest business.

Those for whom concealing revenue was a means of increasing business efficiency will certainly suffer greatly. And the more expectations were placed on tax evasion, the more severe the blow will be dealt by the new legislation.

Other beneficial effects include the following:

There is no need to go to the Federal Tax Service for registration, re-registration, deregistration of cash registers - now all this can be done remotely on the Federal Tax Service website.

Reducing the number of checks (at least this is what is declared). Since sales data will be sent to the tax authorities automatically, fiscal officials will no longer need to conduct mass audits with employees directly visiting the locations where cash registers are installed. Checks of cash registers and payments will now be carried out automatically.

It is also declared that it will be possible to service cash registers independently - without the usual expensive contracts with Technical Service Centers (TSC). But in practice this has not yet been confirmed. Manufacturers of cash registers are trying to maintain the monopoly of their specialists on servicing equipment, threatening to remove warranties.