Here's what an auditor friend told me:

To account for the movement of funds invested by an organization in bank and other deposits, the Instructions for the application of the Chart of Accounts for financial and economic activities of organizations (approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) propose using subaccount 3 “Deposit accounts” of account 55 “Special accounts in banks." The amount of funds deposited into the deposit account is at the same time recognized as a financial investment (clause 3 of the Accounting Regulations “Accounting for Financial Investments” (PBU 19/02), approved by Order of the Ministry of Finance of Russia dated December 10, 2002 N 126n). To account for financial investments, the specified Instruction prescribes the use of account 58 “Financial investments”. With this option, to account for deposits, it is logical to open a special sub-account 5 “Bank deposit (deposit)”. It is advisable to consolidate the use of a specific account in the accounting policy of the organization (clauses 4, 7 of the Accounting Regulations “Accounting Policy of Organizations” (PBU 1/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n). Financial investments are accounted for at their original cost (clauses 8, 9, 21 PBU 19/02), which in this case is equal to the amount of funds contributed to the deposit. Thus, when placing funds on a deposit account in a bank, the following posting is made: Debit 58-5 (55-3) Credit 51 - funds are transferred to the deposit account. Regardless of which accounting account the deposits are reflected in, information about them should be shown in the balance sheet as part of financial investments. Let us remind you that: - line 1170 “Financial investments” of the balance sheet indicates the cost of long-term financial investments, the circulation (repayment) period of which exceeds 12 months (clause 19 of the Accounting Regulations “Accounting Statements of an Organization” (PBU 4/99), approved By Order of the Ministry of Finance of Russia dated July 6, 1999 N 43n, clause 41 PBU 19/02); — line 1240 “Financial investments (except for cash equivalents)” shows information about the organization’s financial investments, the circulation (maturity) period of which does not exceed 12 months. Demand deposits are classified by the Accounting Regulations “Cash Flow Report” (PBU 23/2011) (approved by Order of the Ministry of Finance of Russia dated 02.02.2011 N 11n) as highly liquid financial investments that can be easily converted into a predetermined amount of cash and which are subject to an insignificant risk of changes in value (clause 5 of PBU 23/2011). Such assets are reflected in line 1250 “Cash and cash equivalents”. Interest on the deposit receivable is other income of the organization. They are recognized in accounting for each reporting period in accordance with the terms of the bank deposit agreement during its validity period (clause 34 PBU 19/02, clauses 7, 10.1, 16 of the Accounting Regulations “Organizational Income” PBU 9/99 , approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n).

Article: Accounting for deposits (Mitrich O.) (“Practical Accounting”, 2012, No. 10) IMHO, it is ambiguous. however, in 1C Bukhia I still did not find the concept of “Deposits on demand”.

Placing money on deposit - what is it?

If an organization generates free funds, then so that they do not lie like a dead weight on the current account, the organization can make them work. Thus, money not involved in circulation can generate additional income. One of the ways to obtain such income is to place funds on deposit.

A deposit account is an account in a banking institution in which a person places available funds, and the bank, according to the terms of the signed agreement, accrues interest on them in the established amount. Typically, deposit agreements are concluded for a specific period. Upon expiration, the funds are returned to their owner. Funds can only be credited to this account as a deposit.

IMPORTANT! The deposit account is not intended for settlements with third parties.

Disadvantages of deposit and account

Negative characteristics of savings accounts include:

- Lower income compared to bank deposits. The interest rate on even the most profitable savings accounts is usually lower than the average on deposits.

- Interest is calculated on the minimum account balance. Even if you initially replenished your balance by 50 thousand rubles, and a few days later withdrew 30 thousand, then income will be accrued only on the remaining 20 thousand rubles.

- A savings account can only be opened in Russian rubles.

- At any time, a banking institution can change the terms of use of a savings account and the account will lose its attractiveness for savings.

Disadvantages of savings deposits:

- strict conditions for using the deposit throughout the entire validity period;

- it is impossible to withdraw funds without losing part of the income;

- It is not always possible to replenish the deposit amount.

While the deposit is valid, it is no longer possible to change the term, interest rate, or enable capitalization. You can issue an extension or change the terms of the program, but only at a time when the previous contract has expired.

Which accounts are involved in accounting entries for accounting for deposit transactions?

The deposit account refers to the so-called special accounts in the bank, for the accounting of which account 55 is intended in the accounting department. The Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, as amended on November 8, 2010) provides for several sub-accounts for this account. Deposits are accounted for in subaccount 55.3 “Deposit accounts”.

Since deposits are recognized as financial investments in accordance with clause 3 of PBU 19/02, they can also be taken into account in account 58 “Financial investments” by opening the corresponding sub-account.

NOTE! The organization establishes the method of accounting for the movement of money on deposit in its accounting policy.

Accounts 55 and 58 are active, so an increase in funds on deposit will be by debit, and a decrease in the deposit account or returned to the owner to the current account will be by credit.

As for the entries on the receipt of interest on the current account and, accordingly, their accrual, account 91 “Other income and expenses” will be involved in them. Subaccount 1 to this account “Other income” is intended to reflect various income, including interest received, from activities not related to the main one.

Profitable deposits and savings accounts

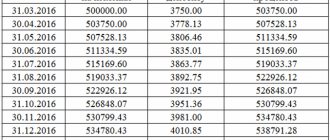

The most profitable savings deposits offered by popular Russian banks. The table contains products that can be compared based on similar criteria:

| Contribution | Minimum term | Minimum amount | Interest rate | Deposit/ withdrawal |

| “Your success” from Gazprombank | 367 days | 50 thousand rubles | 7,05% | No |

| "Time of growth" from VTB | 180 days | 30 thousand rubles | 7,25% | No |

| “Profitable start” from Sberbank | 180 days | 50 thousand rubles | 5,85% | No |

Conditions for savings accounts:

| Savings account | Interest rate | Minimum amount | Term | Deposit/ withdrawal |

| Savings account from Gazprombank | 5,30% | Unlimited, but up to 5 thousand rubles the rate is 0.01% | Is not limited | No limits |

| “Simple and profitable” from Raiffeisen Bank | 6% | Not limited | Is not limited | No limits |

| Savings account from Rosselkhozbank | 5% | Unlimited, but up to 100 rubles the rate is 0.01% | Is not limited | No limits |

Savings accounts are suitable for those who want to receive regular income and retain the ability to use funds from the account as needed. The deposit is suitable for those who can top up their balance with a large amount and not use it throughout the entire term of the deposit agreement. By depositing, if all conditions are met, you can get a higher profit.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

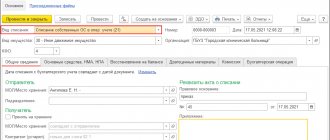

Interest accrued on the deposit - accounting entry and its significance for tax accounting

As we have already noted, the frequency of interest calculation, as well as their rate, is one of the mandatory conditions of the contract. When calculating interest from an organization that owns funds on the basis of bank documents, the following entry must be generated:

Interest on deposits must be taken into account as non-operating income when calculating income tax if the organization applies the main regime, or a single tax under the simplified tax system as they are accrued (or received) - clause 6 of Art. 250 Tax Code of the Russian Federation.

Interest can be transferred to a person’s current account as it accrues, or it can accumulate in a deposit account and be paid in a lump sum only upon expiration of the contract. The transfer of interest to the current account will be reflected in correspondence:

How to make deposits and accounts

A deposit and savings account can be opened in several ways:

- In the office. By visiting a bank branch in person. You will need to present your passport, fill out a form, and enter into an agreement with the bank.

- In Internet banking. To do this, you need to fill out a form on the website, wait for the bank’s response, and confirm the opening of an account or deposit.

- In the mobile application. The registration process is the same as for online banking.

When applying for a banking product online, some financial institutions offer customers an increased interest rate and other more favorable conditions. In your personal account, it is more convenient to transfer money to your account and control the accrual of profits; all information about the movement of funds is available around the clock.

Results

The company can place funds on deposit to receive additional income. In accounting, entries will appear using account 55 or 58, which will reflect transactions of transferring money to the deposit and their return, and account 91.1, where the interest accrued by the bank in favor of the owner of the funds will be recorded as part of other income.

The article presented the main accounting entries that should appear in accounting when reflecting transactions on deposit accounts.

How to get income from deposits and savings accounts

To get maximum income from deposits and savings accounts, study the offers of reliable banks. Check the participation of the credit institution in the insurance system. It often happens that real income turns out to be much lower than what is shown in advertising.

In a savings account, income is accrued on the minimum amount that was kept on the balance sheet during the billing period. The accumulation of income begins from the first replenishment until the last day of the month with monthly interest receipt. Under such conditions, it is more profitable to deposit money into your account at the beginning of the month and top it up with a larger amount at once. If you need to close your account, this can be done at the beginning of the next month with minimal losses. So, with a full withdrawal of funds, the minimum balance will be zero, and income will not be accrued.

When choosing a deposit, carefully study the terms of use. Determine the most profitable product and comply with the conditions specified in the contract throughout the entire period of the deposit. For foreign currency deposits, conditions may differ significantly; with strong exchange rate fluctuations, you can lose more money than you invested. Therefore, before opening an account, it is advisable to study what forecast experts give and choose the most stable currency.

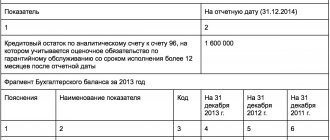

Deposit on balance sheet

In the current regulatory documents on deposit accounting there is a contradiction in the procedure for recording and reflecting deposits. According to the Chart of Accounts, accounting for funds invested in bank deposits is carried out in subaccount 55.3 “Deposit accounts”. According to paragraph 3 of PBU 19/02 “Accounting for financial investments”, approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n, deposits are classified as financial investments. Thus, the question arises: in which account should the deposit be accounted for and on which line should it be reflected in the balance sheet?

Current legislation allows an organization to independently choose the accounting method, and it can be enshrined in the accounting policy and disclosed in the explanatory note to the financial statements. Please note that, regardless of the accounting method, the organization must maintain analytical accounting of deposits for each deposit.

We will offer several options for reflecting deposits in accounting accounts.

1. Deposits, regardless of their type, are reflected in a special account 55.3 “Deposit accounts”. At the same time, it is recommended to organize separate accounting by types of deposits - time deposits, demand deposits, certified by a certificate of deposit, etc.

2. Deposits, regardless of their type, are reflected in account 58 “Financial investments”. According to many experts, this reflection of deposits is the most appropriate. In this case, accounting for deposits should be organized in a separate sub-account.

According to paragraph 2 of PBU 19/02, in order to accept assets for accounting as financial investments, it is necessary that the following conditions be simultaneously met:

- the presence of properly executed documents confirming the existence of the organization’s right to financial investments and to receive funds or other assets arising from this right;

- transition to organizing financial risks associated with financial investments (risk of price changes, risk of debtor insolvency, liquidity risk, etc.);

- the ability to bring economic benefits (income) to the organization in the future in the form of interest, dividends or an increase in their value (in the form of the difference between the sale (redemption) price of a financial investment and its purchase value as a result of its exchange, use in repaying the organization’s obligations, an increase in the current market value and so on.).

Funds invested in deposits fully meet the requirements of this provision: 1) the deposit is formalized by a bank account agreement; 2) at the time of opening a deposit, funds are temporarily removed from circulation, since the organization cannot actually manage them. An exception may be called demand deposits; 3) during the period when the organization’s funds are in deposits, it bears risks associated with the activities of a particular bank and the functioning of the market as a whole; 4) the main purpose of opening a deposit is to generate income. The bank is obliged to pay interest on deposits in accordance with the terms of the bank deposit agreement.

3. Mixed accounting depending on the types of deposit. Let's give an example of accounting for deposits in different accounts. Deposits certified by certificates are reflected in account 58 “Financial investments”. Deposits that are not certified by certificates are reflected in a special account 55.3 “Deposit accounts”.

>If demand deposits are included in the “Cash” item, then the movement of funds between the current and deposit accounts is not reflected in the cash flow statement.

When addressing the issue of tax accounting, it should be remembered that the procedure for accounting for income in the form of interest, including received under bank deposit agreements, is defined in Article 328 of the Tax Code of the Russian Federation. In accordance with this article, the taxpayer, on the basis of analytical accounting of non-operating income and expenses, breaks them down in the form of interest on securities, under bank account agreements, bank deposits, etc.

Just as in accounting, there are several options when reflecting deposit transactions in financial statements.

1. Reflection of deposits, regardless of type, as part of the group of indicators “Financial investments”.

2. Reflection of deposits depending on the type: for time deposits, including those certified by certificates, as part of the group of indicators “Financial investments”; for demand deposits – as part of the “Cash” item.

Let's pay attention to the following. If demand deposits are included in the “Cash” item, then the movement of funds between the current and deposit accounts is not reflected in the cash flow statement.

Interest on deposits is reflected in the income statement in the item “Interest receivable” and in the statement of cash flows in the item “Interest received”. At the same time, we note that according to IFRS, deposits are reflected as follows:

- demand deposits – as part of cash;

- time deposits in banks - as part of short-term or long-term financial investments.

In the reporting of insurance organizations, a special item has been introduced as part of other investments to reflect deposits. In form No. 1-insurer this is line 142 “Deposit deposits”, in form No. 5-insurer – line 335 “Deposit deposits”.

What are cash and cash equivalents?

Cash and cash equivalents include all cash and highly liquid assets with short maturities (typically 90 days or 3 months). This item is always classified as current assets on line 1250 of the balance sheet.

Take our proprietary course on choosing stocks on the stock market →

training course

Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days.

However, cash equivalents often do not include shares or shareholdings because they can fluctuate in value.

Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with maturities of three months or less. Marketable securities and money market assets are considered cash equivalents because they are liquid and not subject to significant fluctuations in value.

Procedure for opening a foreign currency account

The procedure for opening a foreign currency account in a bank is similar to the procedure for opening a current account.

To open a foreign currency account in a bank, an organization must provide the following documents:

Application for opening a foreign currency account, signed by the head and chief accountant of the organization; Bank account agreement (two copies) in the account currency, signed on each sheet; Certificate of state registration of a legal entity; Copy of an extract from the unified state register of legal entities certified by a notary or the issuing authority a document with an issue date not exceeding 1 month before the submission of documents; A copy of the duly approved charter (regulations) with amendments and additions, certified by a notary or the body that registered the document; A copy of the constituent agreement, certified by a notary or a higher authority; Minutes of the meeting of founders; Copy of the labor agreement agreements with the head of the organization; A copy of the order on the assumption of the position of the head and the appointment of the chief accountant, certified by the seal and signature of the head of the organization; Card with sample signatures and the unsubscribed seal of the head of the enterprise and the chief accountant, certified by a notary; Photocopy of the passports of the persons stated in the sample signature card; The original certificate of registration with the tax authority and its notarized copy; A copy of the information letter from the territorial body of state statistics with assigned codes and confirming registration with the state territorial statistical body, certified by a seal and signatures of officials of the organization (optional); Copies of licenses for activities that require licenses.

The list of required documents, as well as when opening a current account, is fixed by Bank of Russia Instruction No. 153-I dated May 30, 2014 (as amended on December 24, 2018) “On opening and closing bank accounts, deposit accounts, and deposit accounts” ( Registered with the Ministry of Justice of Russia on June 19, 2014 N 32813).

Data taken from the article: “Accounting for funds in a current account.”

The importance of using these categories

There are several main reasons why these categories are significant. They are reflected in the table below.

| No. | Cause | Characteristics and description | Clarification |

| Source of liquidity | Cash equivalents are held to satisfy short-term cash obligations and not for investment or other purposes and are an important source of liquidity. Thus, companies want to have a cash cushion to withstand unforeseen situations such as revenue shortfalls, equipment repairs or replacements, or other unforeseen circumstances not budgeted for. | Liquidity ratio calculations are important in determining the rate at which a company can pay off its short-term debt. Various options for liquidity ratios include: total liquidity ratio, current ratio, quick ratio. Total liquidity ratio: (cash and cash equivalents + marketable securities) ÷ current liabilities Current ratio: current assets ÷ current liabilities. Quick ratio: (Current asset - stock) ÷ Current liabilities. | |

| Speculative acquisition strategy | Another good reason for saving is an acquisition in the near future. | As an example, consider the cash balance on Apple Inc's balance sheet: · Cash = $13.844 billion · Total assets = $231.839 billion Cash as % of total assets = 13,844 / 231,839 ~ 6% · Total sales in 2014 = $182,795 Cash as % of Total Sales = 13,844 / 182,795 ~ 7.5% Investments of $13.844 billion (cash) + $11.233 billion (short-term investments) + $130.162 billion (long-term investments) amount to $155.2 billion. The combination of all this indicates that Apple may be looking for some kind of acquisition in the near future. |

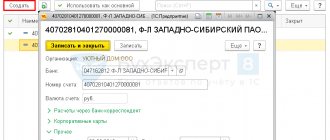

Deposit account

In the current accounting system, there are contradictions in the accounting of deposit funds. There are two options for accounting for deposit funds; they are taken into account in the account:

- 55.03 “Deposit accounts”;

- 58.03 “Loans provided.”

According to the current Chart of Accounts, a separate account has been allocated for recording deposit funds, it is called 55.03.

But since the deposit is opened by an organization (firm) in order to receive material benefits in the form of interest, it is advisable to take it into account in account 58.03.

Funds are transferred to the deposit account from the current account, and accounting entries are generated:

- Debit account 55.03 “Deposit account” and account credit. 51 “Current account”.

Is an invoice drawn up in foreign currency in 2020-2021?

When issuing an invoice in foreign currency, the taxpayer should consider 2 factors:

- clause 7 art. 169 of the Tax Code of the Russian Federation allows that an organization has the right to indicate an amount in foreign currency in an invoice if it is the means of payment;

- clause 1 section Government Resolution II “On filling out documents for VAT calculations” dated December 26, 2011 No. 1137 contains a provision according to which, if payments in ruble equivalent are indicated in the contract with the total contract price in foreign currency, the invoice must be issued in rubles.

The resulting inconsistency is a source of trouble for organizations that take the rules of the Tax Code too literally. During audits, tax authorities quite often file complaints on this basis. However, judicial practice shows that in such disputes the taxpayer wins. The judges believe that the Tax Code of the Russian Federation has an advantage over the decision of the Government of the Russian Federation.

Read more about the rules for issuing foreign currency invoices in the material “Invoice in foreign currency - how to issue?” .