Why do you need an accounting certificate?

An accounting certificate is recognized as a primary document on the basis of Art. 313 Tax Code of the Russian Federation. Its use in accounting for organizations and entrepreneurs may be due to:

- The presence of errors in accounting or tax accounting. In this case, the correction of the inaccuracies can be confirmed by an accounting certificate. Such a certificate is used, for example, if an incorrect accounting account was used when recording a business transaction or an entry was made for an amount different from the amount indicated in the primary document. To justify the reflection of the corrective entry, an accounting certificate is drawn up.

- The need to indicate additional calculations that justify the accounting feature. These certificates are often used, for example, when organizing separate accounting for VAT or to justify the acceptance of the amount of expenses for the purpose of calculating income tax on standardized costs.

- The need for explanations of business operations. Explanatory certificates are drawn up, for example, when reflecting entries for writing off receivables or payables.

The format of the accounting certificate is not regulated. However, it must contain all the necessary details provided for primary documents in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ:

- Title of the document;

- Date of preparation;

- name of the organization or individual entrepreneur;

- the essence of the business operation;

- Full name of the person who compiled the document.

In this case, we recommend that the type of accounting certificate used be approved by the accounting policy.

The main points that you should pay attention to when developing an accounting policy are formulated in the material “How to draw up an organization’s accounting policy (2021)?” .

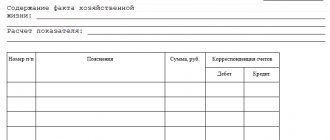

You will find a sample accounting statement below on our website:

Read about the nuances of preparing an accounting certificate in the Typical Situation from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Accounting certificate: confirming corrections

We prepare the document

Accounting statements for past reporting periods cannot be corrected. If errors are detected, an accounting certificate must be drawn up. It should describe the nature of the error made, make the necessary recalculations of amounts and indicate the procedure for making corrections. Based on this document, the accountant has the right to make corrective entries in the accounting accounts. Postings must be made on the current date, which is indicated in the certificate.

Article 313 of the Tax Code classifies an accounting certificate as a primary document that confirms tax accounting data. However, there is no unified form of the document. Therefore, companies themselves develop such a form and indicate it in their accounting policies. The accounting certificate must contain all the mandatory details approved by the law of November 21, 1996 No. 129-FZ. Namely:

- Title of the document;

- date of document preparation;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- measuring business transactions in physical and monetary terms;

- names of positions of persons responsible for carrying out a business transaction and the correctness of its execution;

- personal signatures of these persons.

Example

In March of this year, the accountant of Rassvet LLC identified an error in the amount of accrued depreciation of fixed assets for January 2007. According to the calculation, the amount of depreciation of fixed assets for January 2007 amounted to 20,000 rubles. However, the amount of RUB 30,000 was mistakenly deposited. In January, the accountant wrote:

Debit 44 Credit 02 30,000 rub. – depreciation has been calculated on fixed assets.

The error was discovered on March 6, 2007. Excessively accrued depreciation amount of RUB 10,000. must be reversed using the posting:

Debit 44 Credit 02 10,000 rub. – the excessively accrued amount of depreciation is reversed.

The basis for making corrections to the company's accounting is an accounting certificate signed by the chief accountant.

The completed document may look like this:

LLC "Rassvet" "06" March 2007 ACCOUNTING INFORMATION

Contents of operation Accounting entries Accrued depreciation on fixed assets actual Dt 44 Kt 02 – 30,000 rub. correct Dt 44 Kt 02 – 20,000 rub. correctional Dt 44 Kt 02 – 10,000 rub. Note: In January 2007, as a result of a technical error, depreciation on fixed assets was overcharged in the amount of 10,000 rubles. The error was discovered in March 2007. Corrections to the accounting accounts were made on March 6, 2007.

Accountant ________Novikova E. A.________ signature transcript of signature

Chief accountant ________Petrova I.N.________ signature transcript of signature

Will help in court

Drawing up accounting statements will be a good help in conflicts with controllers. The table shows a selection of court decisions made in favor of companies in various situations. The certificate is an explanation of the adjustments made. So that the accountant himself does not get confused in his corrections, it is worth including as much information as possible. You can attach to the certificate copies of the “primary” data on which errors were made, and documents where recalculations were made. This is necessary so that tax officials do not have questions later.

Table

| Case details | Court findings |

| Resolution of the Federal Antimonopoly Service of the Moscow District dated December 15, 2006 No. KA-A40/11448-06 | The arbitrators came to the conclusion that the tax authorities did not take into account the corrective entries for the additional assessment and payment of the tax amount to the budget, which the accountant independently made. Primary accounting documents, namely an accounting certificate, are presented as confirmation. This information was unreasonably rejected by the inspectors due to the lack of a date for drawing up the documents and making corrective entries. The court ruled that such a refusal is formal - the documents have the date of their preparation and also contain information about corrective accounting entries. |

| Resolution of the Federal Antimonopoly Service of the Moscow District dated August 22, 2005 No. KA-A40/7273-05 | The company made a technical error when registering an advance payment from the buyer. As a result, the VAT tax base was increased by this amount. Then the accounting error was discovered in a timely manner by a specialist, and based on the accounting certificate, the identified error was eliminated. Evidence of receipt of the advance and the applicant's correction of the error by making a reversal entry was examined by the court. The tax authorities' claims were rejected by the arbitrators. |

| Resolution of the Federal Antimonopoly Service of the Moscow District dated March 5, 2003 No. KA-A40/576-03 | The inspector's argument about the unconfirmation of the corrections made by the company to the accounting records is refuted by the accounting certificate, updated declarations and payment orders for payment of taxes and penalties. |

Yu. Gorbik

What does a sample accounting certificate about writing off accounts receivable look like?

As stated earlier, the certificate drawn up when writing off receivables is an explanatory certificate.

A sample of such a certificate can be downloaded below on our website using the link below:

You can familiarize yourself with the rules for writing off receivables in the article “Procedure for writing off receivables” .

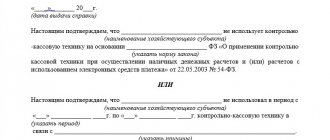

How should the certificate be dated to confirm the right to a standard tax deduction?

Question from Clerk.Ru reader Tatyana (Voronezh)

According to Article 218 Ch. 23 of the Tax Code of the Russian Federation, a standard tax deduction is provided to the parent of a full-time student, graduate student, resident, student, cadet under the age of 24 years. A document confirming the right to deduction can be a certificate from an educational institution. Question: what date should the certificate be dated to confirm the right to the deduction? Example: the certificate is dated November 26, 2009, is it possible to provide a standard deduction to the parent in 2010 based on it?

In accordance with paragraph. 8 pp. 4 clause 1, clause 3 art. 218 of the Tax Code of the Russian Federation, standard tax deductions for each full-time student, graduate student, resident, student, cadet under the age of 24 are provided to the taxpayer on the basis of his written application and documents confirming the right to such tax deductions.

Based on paragraphs. 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation, this tax deduction is provided for the period of study of the child (children) in an educational institution and (or) educational institution, including academic leave issued in the prescribed manner during the period of study. Thus, two conditions must be met simultaneously: - the child must be a full-time student (graduate student, resident, student, cadet), - the child’s age is up to 24 years.

A specific list of documents confirming the right to these deductions is not established by current legislation. A certificate from an educational institution, which may be one of the supporting documents, in my opinion, must be provided every year. This way we can determine the child’s learning period.

Typically, such certificates are provided in January (the beginning of the tax period for personal income tax (Article 216 of the Tax Code of the Russian Federation)). However, since the specific deadlines for providing a certificate (as well as the list of supporting documents itself) are not established by law, the organization can set them itself.

Also, I believe that a certificate issued by an educational institution several years ago (for example, two, three, four years ago), which indicates the estimated completion date of study, cannot serve as a supporting document.

It’s very easy to get personal advice on any tax online - you just need to fill out a special form . Every day two or three of the most interesting questions will be selected, the answers to which you can read in Natalia Lobanova’s consultations.

What type of accounting certificate does it have: sample writing for the OS and for the Social Insurance Fund

Most often, with the help of accounting statements, mistakes are corrected (for example, on depreciation charges) or the book value of fixed assets is confirmed.

a sample accounting certificate for fixed assets from our website .

To correct errors in reports submitted to extra-budgetary funds, you will also need to submit an accounting certificate. Here is a sample of writing an accounting certificate in the Social Insurance Fund, it can be downloaded from the link below:

Sample on how to draw up an accounting statement

There is nothing complicated in compiling this paper. Let's consider, for example, a sample accounting certificate about the correction of an error, or, as it is called, reversal. In it, the accountant must outline the essence of the transaction, as well as the circumstances under which the error occurred. It is also necessary to write entries with corrections and indicate how this affected taxes. If there have been changes in their calculation, you need to indicate which updated reports need to be submitted. The chief accountant certifies the accounting certificate with his signature.

Only on the basis of such paper can an accountant make corrections in the General Ledger of the organization, where no corrections are allowed.

accounting certificate

Results

Accounting statements are primary documents for business operations that do not have other supporting documents for their implementation.

Most often, such operations involve corrections, additional calculations or clarifications. An important point for drawing up a certificate is to indicate in it the mandatory details inherent in the primary document, as well as to correctly state the essence of the business transaction being justified. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The year is ending, and the accountant of the agricultural enterprise needs to review and analyze the documentary relationships with his employees. Laws require the issuance of various certificates and extracts from reports to employees. Some monthly without statements, others - only on occasion or at the request of the employee. Using the tables below, you will quickly determine which documents need to be issued and when.

If you issue documents to employees on time, you will avoid fines. Documents can be divided into three groups.

Without a statement from an employee

| Document | Form and example of filling | Issue date |

| Pay slip | Free form. Approve it from the manager and coordinate with the trade union (if there is one) | Once a month when paying wages (Article 136 of the Labor Code) |

| Certificate of income, if it is not possible to withhold tax | Free form. You can issue a document in the form of a 2-NDFL form or an income certificate. Both forms were approved by order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/566 | No later than March 1 of the following year |

According to the employee

| Document | Form and example of filling | Issue date |

| Work book with records of work in the organization, its copy or extract from it | The form was approved by Government Decree No. 225 dated April 16, 2003 | Within three working days |

| Information on labor activity according to the STD-R form | The form was approved by order of the Ministry of Labor dated January 20, 2020 No. 23n. Valid from 03/07/2020. Issued to employees who have switched to electronic work books. | |

| A copy of the employment order | Unified No. T-1 or No. T-1a or your own with mandatory details (clause 2 of Article 9 of Law dated December 6, 2011 No. 402-FZ) | |

| Copy of the transfer order | Unified No. T-5 or No. T-5a or your own with mandatory details (clause 2 of Article 9 of Law dated December 6, 2011 No. 402-FZ) | |

| A copy of the dismissal order | Unified No. T-8 or No. T-8a or your own with mandatory details (clause 2 of Article 9 of Law dated December 6, 2011 No. 402-FZ) | |

| Certificate of income and amounts of personal income tax withheld | The certificate form was approved by order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/566 | |

| Other work-related documents | Free form This may include the following information:

| |

| Extract from SZV-M | The form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p | Within five calendar days |

| Copy of section 3 Calculation of insurance premiums | The form was approved by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551 | |

| Copy of SZV-STAZH | The form was approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p |

Upon dismissal

| Document | Form and example of filling | Issue date |

| Paper work record book with notice of dismissal | The form was approved by Government Decree No. 225 dated April 16, 2003 | Last day of work |

| Information on labor activity according to the STD-R form | The form was approved by order of the Ministry of Labor dated January 20, 2020 No. 23n. Valid from 03/07/2020. Issued to employees who have switched to electronic work books. | |

| Certificate of earnings | The form was approved by order of the Ministry of Labor dated April 30, 2013 No. 182n | |

| Extract from SZV-M | The form was approved by Resolution of the Pension Fund Board of February 1, 2016 No. 83p | |

| Copy of section 3 Calculation of insurance premiums | The form was approved by order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/470 | |

| Form SZV-STAZH | The form was approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p | |

| Notification - if it is impossible to issue a work book and other documents on the day of dismissal | The form is arbitrary. Send the notification by mail with a description of the attachment | |

| Notification in case of staff reduction | Free form | At least two months before staff reduction |

| Offer another job in case of staff reduction | Free form | |

| Help for unemployment benefits | The form of the regional employment center or recommended by the Ministry of Labor or a free form | Within three working days (Article 62 of the Labor Code) |