When the scale of a business and its existence in “survival” mode require exclusively “manual” management, entrepreneurs do not think about the benefits of formalizing the structure and type of working capital management.

Meanwhile, it is the correct understanding of the structure and relationships of working capital indicators that allows you to model the consequences of possible decisions, see the cause-and-effect relationships of financial and economic management, and through the model in the form of working capital indicators allows you to monitor the structure of working capital, timely identify, respond and manage financial risks.

Let's start with the theory.

What is coverage ratio?

Coverage ratio is a value that reflects the ability of an enterprise to pay debts using the funds at the disposal of the entity. That is, this is a parameter indicating solvency. The calculated values allow you to understand what part of the assets needs to be spent to cover the debt.

the coverage ratio of fixed assets with own funds calculated ?

To determine the ratio, information about available cash and tangible assets is needed. Intangible assets are not taken into account. The coefficient is equal to the ratio of current funds to current liabilities. All the necessary data can be taken from the accounting report.

The higher the ratio, the higher the level of solvency of the company. The value confirms that even if capital is sold urgently, part of it will remain.

How to assess the solvency of an organization based on the balance sheet ?

Standard

The normal value established for the coefficient at the legislative level is > 0.1, i.e. 10% of the company’s total assets and is considered one of the criteria for assessing the unfavorable balance sheet structure, together with other calculated indicators. 10% is the minimum, already critical value permissible for the amount of equity in the organization’s property. It shows the presence or emergence of problems - a critical level of equity sufficiency, low solvency and general destabilization of the enterprise.

Coverage Ratio Functions

Determining the coefficient serves these purposes:

- Establishing the solvency of the company as part of the sale of the subject’s reserves and the repayment of short-term receivables.

- Monitoring by investors of the current successes of the company.

- Conducting a bankruptcy risk assessment.

- Identification of the organization’s ability to pay debts within one production cycle. The latter refers to the length of time needed to produce and sell one batch of products.

- Ability to meet existing obligations using existing assets (accounts receivable, inventory, and cash).

- Obtaining the required information about the quality of the organization of the operating cycle.

- The ability to quickly convert manufactured products into cash.

- Based on the values obtained as a result of calculations, the volume of working capital can be determined.

- Displaying the level of financial stability.

The coverage ratio is a value that is useful for both investors and managers to know. If the ratio shows that there are problems with timely collection of accounts receivable and inventory turnover time, there is an increased risk of liquidity problems.

Concept and structure of current assets

As you know, current assets are assets that serve or are repaid within 12 months, or during the normal operating cycle of the organization (if it exceeds 1 year).

Many current assets are used simultaneously when they are released into production (for example, raw materials).

Current assets are one of two groups of assets of an organization (the second is non-current assets). They are also called current assets.

Composition of current assets

In accordance with the form of the balance sheet, current assets include:

- stocks;

- VAT on purchased assets;

- accounts receivable;

- financial investments (except for cash equivalents);

- cash and cash equivalents;

- other assets that meet the criteria of current assets.

Accounts receivable and financial investments are classified as current assets only if their maturity period is less than 1 year, or the period exceeds 1 year, but the organization is confident in the high liquidity of these assets and the ability to quickly and without loss convert them into cash (i.e. e. sell).

Current assets, in principle, have a higher degree of liquidity than non-current assets. And money, as part of current assets, has absolute liquidity.

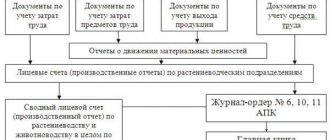

In their movement, current assets go through three successive stages of circulation: monetary, productive and commodity.

The first stage of the circulation of working capital is monetary. At this stage, cash is converted into the form of inventory.

The second stage is productive. At this stage, the cost of the created products continues to be advanced, but not in full, but in the amount of used production reserves; wage costs are advanced, as well as the transferred part of fixed assets.

At the third stage of the circuit, the product of labor (finished products) continues to be advanced. And only after the commodity form of the newly created value turns into money, the advanced funds are restored at the expense of part of the proceeds received from the sale of products.

And the cycle begins again.

Working capital is the most mobile part of an enterprise's capital, which, unlike fixed capital, is more fluid and easily transformed into cash.

Working capital usually includes cash, marketable securities, inventories, unsold finished products, and short-term debt.

Own working capital or own working capital is the amount of current assets remaining at the disposal of the enterprise after the full, one-time repayment of the enterprise's short-term debt.

Today, the terms “current assets” and “working capital” are often used interchangeably. However, there is a certain difference between these concepts:

they are on opposite sides of the balance sheet;

current assets (balance sheet assets) are formed from working capital funds (balance sheet liabilities), the sources of which can be either own or borrowed, as a rule, in order to obtain a positive economic effect or for other purposes, which ultimately dictates the requirements for the organization of the management system current assets.

Net working capital is equal to the difference between current assets and short-term liabilities (liabilities).

That is, net working capital (NWC) is understood as the difference between the value of current assets (TA) and the value of current liabilities (without long-term current liabilities) (TO) of the organization as of the reporting date:

CHOC = TA - TO

Net working capital is the amount of the enterprise's own funds used to finance operating activities. As a rule, these are liquid assets of the enterprise that can easily be converted into cash.

The amount of net working capital can take zero, positive and negative values.

Positive net working capital:

- means that part of current assets is formed from current liabilities;

- and also that part of the current assets is formed from invested capital.

Positive net working capital reduces the amount of net cash flow and indicates the amount to cover current needs with long-term sources of financing.

Negative net working capital:

- means that all current assets are financed by current liabilities;

- indicates the amount of coverage of investments in non-current assets with current liabilities;

- is a free source of financing operating and investment activities.

Negative working capital increases the amount of net cash flow, since it maximally involves creditors’ funds in intra-business turnover.

Zero net working capital:

- means that the amount of current assets corresponds to the amount of current liabilities.

In terms of assessing the financial needs of an enterprise, net working capital is considered to be an estimate of the working capital requirement.

Current assets for the purpose of calculating the amount of net working capital (NWC) are the following balance sheet items:

- stocks;

- accounts receivable;

- VAT on purchased assets;

- other current assets, including VAT on advances received, accrued revenue not presented for payment, shortages and losses from damage to valuables.

Current liabilities for the purpose of calculating the amount of net working capital (NWC) are the following balance sheet items:

- short-term and long-term accounts payable (including for investment activities);

- revenue of the future periods;

- short-term estimated liabilities;

- other short-term liabilities, including VAT on advances issued.

Net working capital can be divided into operating and investment capital.

Operating - net working capital related to the operating cycle.

In this case, the operating cycle is usually understood as a set of stages:

- purchasing materials from suppliers;

- payments to suppliers;

- production of products (provision of services, performance of work);

- shipment of finished products to customers;

- and receiving funds from customers.

The amount of net operating capital consists of the following elements:

CHOCoper. = OA - DS - FV - VHOoa - (KO - KK -KZinv. - VHOko ADDITIONAL)

Where:

OA - current assets;

DS - cash;

FV - financial investments for a period of up to 12 months;

ВХОоа - intra-economic turnover in terms of current assets

KO - short-term liabilities;

KK - short-term loans and borrowings;

KZ inv. — accounts payable for investment activities;

VHOKO - intra-economic turnover in terms of short-term liabilities

TO etc. - other long-term liabilities.

Net working capital investment - shows the contribution of funds in settlements under investment agreements to the net working capital of the company:

CHOC inv. = AVinv. — KZinv.

Where:

AVinv. — advances issued for investment activities;

KZinv. — accounts payable for investment activities.

It is also necessary to say about the assessment of the amount of net working capital , which reflects the contribution of funds in settlements to the net working capital of the company.

CHOC pl. = DZ - short circuit

Where:

CHOC pl. — net working capital;

DZ - accounts receivable;

KZ - accounts payable.

This indicator can be used, along with others, to manage liquidity and solvency.

A distinction is also made between the constant need for working capital and seasonal need.

Constant need is defined as the minimum irreducible amount (level) of working capital; seasonal need is a changing amount of working capital due to the influence of seasonal factors and business activity.

How to calculate coverage ratio

The ratio represents the ratio of assets to total liabilities of the company. Intangible assets, short-term liabilities, and loans are first subtracted from assets. Formula for calculations:

Kpa = (A – NMA – KO) / (DO + KO).

The formula uses these parameters:

- A – assets.

- Intangible assets – intangible assets.

- TO – obligations that need to be repaid within a period of more than a year (long-term).

- KO – obligations that need to be repaid within a period of up to a year (short-term).

You can also use this formula:

KP = Working capital/Current debts.

Working capital is:

- Cash held on hand or in a bank account.

- Cash equivalent (assets that can be quickly sold).

- Accounts receivable (reserves used to pay off bad debts are taken into account).

- The total value of inventory inventories. Accounted inventory items must turn over quickly within a year.

- Other working capital. For example, these are stocks and bonds, planned expenses.

Current liabilities are:

- Requirements of budgetary entities and suppliers that have not yet been repaid.

- Loans that need to be repaid in a short time.

- Other current liabilities.

The more accurate the calculations are, the more accurate the result will be.

Working capital coverage ratio

The fixed assets coverage ratio with own funds is a value that reflects the share of current assets that are covered by own funds remaining after investing in non-current assets. The indicator is determined by this formula:

(Line 1300 – line 1100) / Line 1200.

All values are taken from the balance sheet. The standard value is 0.1. It makes sense to monitor changes in the indicator, that is, to observe it in dynamics. Changing the value allows you to draw the following conclusions:

- A value above the norm means the ability to finance a large number of current assets.

- The value is below the norm - the balance of your funds does not cover a larger amount of working capital.

- The value increases - a positive sign.

- The value decreases - a negative sign.

The exact value of the parameter depends on the specific conditions.

Definition

The coefficient of coverage of working capital by own sources of formation (Ratio of own funds) is an indicator that answers the question of what proportion of current assets is covered by own financial resources that remain after financing non-current assets.

To simplify, it looks like this: it is assumed that the enterprise’s own capital (section 3 of the balance sheet) is used to finance first non-current assets (section 1), and then - if there is any left - then to finance current assets (section 2).

If the indicator is below zero, it means that no current assets are covered by the balance of equity capital.

Values of the obtained coefficient

The higher the coefficient, the higher the solvency of the subject and financial stability. However, a very high rate is not an unambiguously positive sign. An increased ratio means that liquid assets are being used ineffectively. It indicates that the company has a lot of reserves (money in current accounts, short-term financial deposits, accounts receivable), but they do not work. Let's consider all coefficient values:

| Coefficient value | Financial position of the company |

| Ratio less than 2 | The company is having problems paying off its long-term and short-term liabilities. Increased risk of bankruptcy. |

| Coefficient greater than 2 and less than 3 | Average solvency of the subject. Good ratio of assets and liabilities. Low bankruptcy rate. |

| Coefficient greater than 3 | Average solvency of the subject. Good ratio of assets and liabilities. Low bankruptcy rate. |

This is the most approximate decoding of the coefficients. The exact one depends on the specifics of the enterprise’s activities. For comparison, you can pay attention to the industry averages. It also makes sense to conduct analysis over time. That is, the coverage ratio must be calculated regularly, and then current and previous indicators must be compared.

REFERENCE! The coverage ratio does not fully reflect the performance of the enterprise. For a complete analysis, it is also necessary to determine liquidity and solvency ratios.

FOR YOUR INFORMATION! The optimal value for different industries is considered to be from 1.5 to 2.5. This value varies depending on the industry, market conditions and other indicators.

Economic meaning of the coefficient

Non-current assets of the enterprise are characterized by low liquidity. They are more difficult and take longer to exchange for other material goods. Therefore, they must be covered by a highly liquid source - equity capital. However, part of the capital must remain to finance current activities. In this case, the enterprise is guaranteed to be able to function normally and will be considered financially stable.

Reference! Non-current assets include buildings, structures, land, investments in subsidiaries and affiliates, loans for a period of more than 1 year, expenses for business reputation, rights and patents, property leased or rented.

Advantages and disadvantages of using a coefficient

Coverage ratio is used by many companies. It has the following advantages:

- Availability and ease of payments.

- All information used in the formulas is publicly available.

- Assessing the correctness of the formation of the balance sheet structure.

- Obtaining general information about the financial stability of the subject.

- Efficient express analysis.

However, the coefficient also has disadvantages:

- Display information only as of the reporting date.

- Sometimes additional information is needed (for example, management reporting, explanations of the balance sheet).

- Inability to obtain complete information on sustainability.

Using the coefficient under consideration in combination with other values allows you to get a general idea of the financial condition of the company.

Calculation example

The coefficient of provision with own working capital is best analyzed using a specific example ().

Table 2. Coefficient over time

| Year | SOS at the beginning of the year | SOS at the end of the year | OS at the beginning of the year | OS at the end of the year | KOSOS |

| 2017 | 61 500 | 73 650 | 215 000 | 312 500 | 0,26 |

| 2016 | 51 300 | 61 500 | 197 000 | 215 000 | 0,27 |

| 2015 | 51 500 | 51 300 | 187 000 | 197 000 | 0,27 |

| 2014 | 42 800 | 51 500 | 177 000 | 187 000 | 0,26 |

| 2013 | 22 500 | 42 800 | 255 000 | 177 000 | 0,15 |

| 2012 | 15 000 | 22 500 | 147 000 | 255 000 | 0,09 |

| 2011 | 17 500 | 15 000 | 115 000 | 147 000 | 0,12 |

| 2010 | 13 500 | 17 500 | 120 000 | 115 000 | 0,13 |

Thus, the value of the coefficient for the last 8 years was more than 0.1, except for one year - 2012. In this year, the EOS was 0.09. This means that the share of own working capital turned out to be 9%, and the balance sheet structure was considered unsatisfactory. Moreover, two years before this, the value of the coefficient was equally low - 0.12 and 0.13; but not so critical. After the crisis of 2012 at the enterprise, the indicator began to grow year after year, and for the last few years its value has been at the level of 0.26-0.27%. The company's financial stability has increased; judging by the value of the COSOS, there is no threat of bankruptcy.

Rice. 1. KOSOS in dynamics