Accounting registers

Let us recall that accounting registers are a type of accounting documents intended for registration, systematization and accumulation of information contained in primary documents accepted for accounting (Article 10 of the Federal Law of December 6, 2011 No. 402-FZ). Accounting registers are not only the basis for the summary reflection of information on accounting accounts. Accounting registers are used to prepare financial statements.

According to their purpose, accounting registers are divided into chronological and systematic registers, and according to the degree of generalization of information into synthetic registers and analytical accounting registers. For example, in contrast to chronological ones, systematic accounting registers are designed to summarize information about accounting objects for a certain period, presenting summary data on turnover and balances in the context of synthetic accounts.

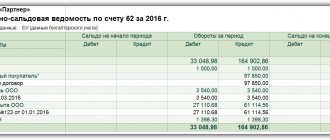

Let us show what accounting registers are with an example. One of the most common synthetic accounting registers, widely used by accountants when preparing a balance sheet, is the balance sheet. In this register, for a certain period, for each synthetic account, information is provided on the balance at the beginning of the period, turnover for the period and balance at the end of the period. Naturally, information on balances and turnover is presented separately by debit and credit of the corresponding accounts:

| Check | Balance at the beginning of the period | Period transactions | balance at the end of period | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| 01 | ||||||

| … | ||||||

| 99 | ||||||

| Total | ||||||

Structure

ZhOF is the most popular form of accounting. Even the principle of functioning of automated accounting programs is based precisely on the form in question. It represents the best combination of these types of accounting:

- Analytical. The departments that are responsible for the acceptance and storage of inventory items are responsible for it.

- Synthetic. The financial department is responsible for it.

- Chronological. Involves making entries in the order in which documents accompanying transactions are issued.

- Systematic. Involves processing of information.

If all entries are entered correctly, the totals for all entry forms should match.

Composition of accounting registers

Accounting legislation gives an organization the right to independently develop forms and types of accounting registers (Part 5, Article 10 of the Federal Law of December 6, 2011 No. 402-FZ).

Issues of maintaining accounting registers are also left to the discretion of the organization. Thus, accounting registers can be maintained on paper or in the form of an electronic document signed with an electronic signature (Part 6, Article 10 of the Federal Law of December 6, 2011 No. 402-FZ). The organization makes the choice itself.

The list of accounting registers for the Accounting Policy is a mandatory section. Types of accounting registers in the journal-order form of accounting, along with statements, can be used, in particular, the following (Letter of the USSR Ministry of Finance dated March 8, 1960 No. 63, Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n):

| Name of the accounting register | Credited accounting account |

| Journal-order No. 1 | 50 "Cashier" |

| Journal-order No. 2 | 51 “Current accounts” |

| Journal-order No. 3 | 55 “Special bank accounts” |

| Magazine order No. 4 | 66 “Settlements for short-term loans and borrowings”; 67 “Calculations for long-term loans and borrowings” |

| Journal-order No. 6 | 60 “Settlements with suppliers and contractors” |

| Journal-order No. 7 | 71 “Settlements with accountable persons” |

| Journal-order No. 8 | 60 “Settlements with suppliers and contractors”, subaccount “Advances issued”; 62 “Settlements with buyers and customers”, subaccount “Advances received”; 68 “Calculations for taxes and fees”; 76 “Settlements with various debtors and creditors”; 79 “Intra-economic settlements” |

| Magazine order No. 10 | 20 “Main production”; 21 “Semi-finished products of own production”; 23 “Auxiliary production”; 25 “General production expenses”; 26 “General business expenses”; 29 “Service industries and farms”; 69 “Calculations for social insurance and security”; 70 “Settlements with personnel for wages”; 94 “Shortages and losses from damage to valuables”; 96 “Reserves for future expenses”; 97 “Deferred expenses” |

| Journal-order No. 11 | 40 “Release of products (works; 43 “Finished products”; 45 “Shipped goods”; 46 “Completed stages of work in progress”; 62 “Settlements with buyers and customers”; 90 “Sales” |

| Magazine order No. 12 | 86 “Targeted financing” |

| Journal-order No. 13 | 01 “Fixed assets”; 02 “Depreciation of fixed assets”; 80 “Authorized capital” |

| Journal-order No. 15 | 84 “Retained earnings (uncovered loss)”; 98 “Deferred income”; 99 "Profits and losses" |

| Journal-order No. 16 | 07 “Equipment for installation”; 08 “Investments in non-current assets” |

When maintaining accounting records in specialized accounting programs, the accounting policy may provide that accounting registers are maintained in the form of special forms in electronic form and on paper, which are based on the registers provided by the program. Such registers, generated in paper form or on a computer (with an electronic signature), can be the General Ledger, the balance sheet.

Types of accounting registers

Accounting registers allow you to systematize and accumulate information received from primary accounting documentation, which will subsequently be used for reflection in accounts and accounting records. Based on data from accounting registers, financial statements of the enterprise are compiled.

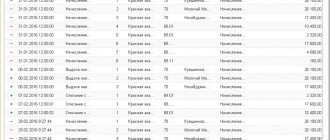

By entering data into the accounting registers, the accountant can simultaneously carry out primary registration and monitor the business activities of the enterprise by analyzing the results.

Accounting registers are divided into:

- systematic - they keep records of accounts; example - the general ledger of an enterprise;

- chronological, in which records are kept according to the calendar without any other special systematization, for example, a cash book, registration journals;

- synchronistic - combining the features of maintaining registers inherent in the groups listed above; An example of this type of accounting register would be an order journal.

Accounting registers differ in the form of construction into:

- one- or two-sided;

- checkerboards - in them, as a rule, entries for debit accounts are made horizontally, and for credit accounts - vertically.

Based on the volume of content, accounting registers are divided into types as follows:

- analytical - in such registers the indicators of a certain synthetic account are specified; they are used to monitor the condition and movement of material assets, settlements with counterparties, etc.;

- synthetic - in them, entries are made on the basis of grouped homogeneous documents in monetary terms and in a generalized form; an example would be a general ledger;

- complex - they combine the characteristics of the first two subtypes and are used mainly in the journal-order type of accounting.

By appearance, registers are divided into:

- cards - forms that look like a lined table; cards can be account-accounting, multi-column and inventory, for example, a card for analytical accounting of materials;

- books - printed and bound multi-page registers; pages in books, as a rule, are numbered, laced and signed by the chief accountant, for example, a book on accounting for fixed assets;

- free sheets are a kind of scaled cards, for example, statements;

- machinegrams are registers compiled/printed using computer technology.

Features of application

Warrant journals are created for a month. It is recommended to separate registers. To do this, you need to create several books for records. Throughout the month, entries must be entered into the register and summarized in statements.

Statements within the framework of the ZhOF can be these papers:

- The statements on the basis of which the ZhOF is created.

- Tables.

- Reporting.

- Transcript sheets.

Information from statements can be transferred at any time. But this needs to be done with some regularity. For example, you can do this once a week, month, day. At the end of the month, the results are transferred to the subsequent ZOF register - the General Ledger. You need to understand that order journals are kept specifically for the purpose of drawing conclusions.

FOR YOUR INFORMATION! Maintaining registers is also necessary for displaying balances.

Accounting registers: list

Information from the Ministry of Finance dated December 4, 2012 No. PZ-10/2012 states that unified forms of accounting registers are no longer mandatory for use, except for those established by authorized bodies. Now, when creating accounting registers at enterprises, it is only necessary to comply with the presence of mandatory details in them (clause 4 of article 10 of the law dated December 6, 2011 No. 402-FZ).

In addition, according to paragraph 5 of Art. 10 of Law No. 402-FZ, register forms provided by the chief accountant must be approved by the head of the organization. The list of used accounting and tax accounting registers must be given in the company's accounting policy.

At the same time, the forms of accounting registers of state-owned enterprises are established in accordance with the current budget laws. The list of such registers was approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n.

In practice, quite often commercial enterprises, when developing their own registers, take as a basis the list and forms of registers intended for state-owned enterprises.

Here is an excerpt from this list in the form of registers often used in practice:

- accounting of fixed assets;

- group accounting of fixed assets;

- etc.

- negotiable;

- current assets on non-financial assets;

- accumulative based on the receipt (expense) of food products.

- home;

- accounting of animals / material assets / strict reporting forms, etc.

- operations (according to the “Cash” account, with non-cash funds, settlements with accountable persons, suppliers and contractors, for wages, with debtors for income);

- for other operations.

- cards;

- delivery of documents;

- securities accounting;

- deposited amounts;

- (consolidated) receipts and disposals.

- polygraphic;

- accounting of funds and settlements;

- accounting for issued credits (loans);

- accounting (quantitative and total) of material assets;

- accounting for pending settlement documents.

- inventory cards for OS accounting;

- inventory.

- discrepancies based on inventory results;

- accounting for unidentified income.

Advantages and disadvantages

Advantages of ZhOF:

- Reducing the number of records and improving the information collection system.

- Registers are easier to subordinate to accounting-related tasks.

- Control of entries in registers.

- Facilitation and acceleration of the work of the employee responsible for accounting.

- Reducing the labor intensity of accounting.

- Increased efficiency and reliability of accounting.

- Transactions are reflected only on credit.

- Information from general and detailed accounting is the same.

- Accounting is carried out of the actions required for reporting.

- No need to duplicate entries.

- There is no need to create intermediate registers.

- Speeding up the accounting process.

- Reducing the number of defects and errors.

- Mistakes, even if they have been made, are quickly discovered.

- Accounting becomes detailed.

- It becomes easier to obtain the information you need for reporting.

- Reporting values can be taken without auxiliary samples.

But the form in question is not without its drawbacks:

- You will have to work with the form manually. It is difficult to transfer it to computer processing.

- Complicated register formation.

- Bulky.

- Employees responsible for accounting must be highly qualified.

- Workers who are not familiar with the system will have to be trained.

- Different documentation structure.

- Complicated formation of individual registers.

The system has its drawbacks, but it is still widely used by both large enterprises and small companies.

Order on approval of accounting registers

Accounting registers - their list and forms must be approved by the relevant order. The forms of accounting registers are developed by the chief accountant, and the manager approves them.

Samples of maintaining tax registers can be found in the article “How to maintain tax registers (sample)?”

Such an order will necessarily be requested for review by the inspector during a tax audit. Based on the registers listed there, the tax inspector will request printouts of the forms he is interested in.

You can learn about how the audit will be carried out in the article “Procedure for conducting an on-site tax audit (nuances).”

After all, today almost all companies maintain registers in the form of machine diagrams.

And in accordance with paragraph 6 of Art. 10 of Law No. 402-FZ, registers must be drawn up either on paper or electronically and signed with a digital signature. Therefore, the registers will have to be printed or sent to the Federal Tax Service in the form of an electronic document signed with an electronic signature.

New accounting law

On January 1, 2013, the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ) came into force, which introduced significant changes to the requirements for accounting in Russia.

Let us recall that Law No. 402-FZ applies to economic entities, which, in particular, include commercial and non-profit organizations, individual entrepreneurs and individuals engaged in private practice, as well as branches and representative offices of foreign and international organizations located in the Russian Federation.

According to the provisions of the new Accounting Law No. 402-FZ, the concept of accounting objects, principles and subjects of accounting regulation have been changed; new requirements for chief accountants have been established; the composition and procedure for presenting accounting (financial) statements have been changed, the obligation to use unified forms of primary accounting documents, etc. has been abolished.* The changes also affected accounting registers.

* For more information about the provisions of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, read: No. 2 (February), page 4; No. 3 (March), p. 13; No. 4 (April), p. 9; No. 5 (May), p. 7; No. 6 (June), p. 7; No. 8 (August), p. 9; No. 11 (November), p. 4; No. 12 (December), page 4 “BUKH.1S” for 2012; in No. 1 (January), p. 6; No. 2 (February), p. 4; No. 3 (March), page 4 “BUKH.1S” for 2013.

Accounting registers - the basis of accounting (financial) reporting

According to Part 2 of Article 1 of Law No. 402-FZ: “Accounting is the formation of documented, systematized information about the objects provided for by this Federal Law, in accordance with the requirements established by this Federal Law, and the preparation of accounting (financial) statements on its basis.”

It “must give a reliable picture of the financial position of an economic entity as of the reporting date, the financial result of its activities and cash flows for the reporting period, necessary for users of these reports to make economic decisions” (Part 1 of Article 13 of Law No. 402-FZ).

Each fact of economic life is subject to registration with a primary accounting document (Article 9 of Law No. 402-FZ).

In accordance with Part 1 of Article 10 of Law No. 402-FZ, the data contained in primary accounting documents are subject to timely registration and accumulation in accounting registers.

The register forms are approved by the head of the economic entity upon the recommendation of the official responsible for maintaining accounting records (Part 5, Article 10 of Law No. 402-FZ). This is confirmed in the Information of the Ministry of Finance of Russia dated December 4, 2012 No. PZ - 10/2012.

In contrast to the previously existing Federal Law No. 129-FZ of November 21, 1996, Law No. 402-FZ establishes the mandatory details of accounting registers (Part 4, Article 10 of Law No. 402-FZ):

1) name of the register;

2) the name of the economic entity that compiled the register;

3) the start and end date of maintaining the register and (or) the period for which the register was compiled;

4) chronological and (or) systematic grouping of accounting objects;

5) the monetary measurement of accounting objects indicating the unit of measurement;

6) names of positions of persons responsible for maintaining the register;

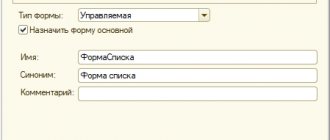

7) signatures of the persons responsible for maintaining the register, indicating their last names and initials or other details necessary to identify these persons (Fig. 1).

The accounting register is compiled on paper and (or) in the form of an electronic document signed with an electronic signature (ES) (Part 6, Article 10 of Law No. 402-FZ).

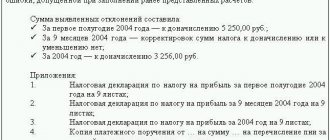

A correction in the register must contain the date of correction, as well as the signatures of the persons responsible for maintaining this register, indicating their last names and initials or other details necessary to identify these persons (Part 8 of Article 10 of Law No. 402-FZ). Corrections not authorized by the persons responsible for their maintenance are not permitted in the register.

Main

- The details of an accounting document are divided into mandatory and additional.

- Without the former, it loses legal force, while the latter clarify the basic data already entered.

- Details must be entered in such a way that information about the fact of economic life is clearly readable, otherwise disagreements may arise with business partners and regulatory authorities.

- Corrections in the document details, if necessary, are made so that the amount being corrected, the date and details of the person responsible for the correction are visible.