Formation of OZ

A negative value is calculated according to the rules of clause 200.1 of the NKU

as the difference between the amount of the tax liability (TL) of the reporting (tax) period and the amount of the tax credit (TC) of such a reporting (tax) period. “Language” of the VAT declaration:

if in the current period the Tax Code (page 17) is greater than the Tax Code (page 9), then the received Tax Code in full amount is indicated on page 19 of the VAT return

This is the negative tax value for the reporting period (i.e., we declare the resulting “minus”). But whether the OZ will be transferred to the following periods depends on its movement further down the lines of the VAT declaration.

Next, the payer decides how to dispose of the resulting OZ, and depending on such a decision, as well as on the amount of the reglimit and the state of settlements with suppliers, the lines of Section III of the VAT declaration (hereinafter referred to as the Declaration) are filled in. And now about this in more detail.

“Minus” on the lines of the VAT declaration

First you need to find out the amount of the registration limit (ΣNakl). Moreover, we will need the most “recent” value of the reglimit as of the date of submission of the Declaration. We enter this value “in the reference box” on page 19.1 - “the amount calculated according to clause 2001.3 of Article 2001, Section V of the Code at the time of filing the filing declaration.”

Keep in mind: if the limit (“window” in line 19.1) turns out to be equal to or greater than HP, then line 19.1 is left empty (that is, only the “window” will be filled).

At the same time, the “reference box” on page 19.1 must always be filled out if line 19 of the VAT declaration is completed (see 101.23 of the BZ). And in page 19.1 we enter exactly the amount of excess of page 19 over the reglimmit from the “reference window”.

For the amount of OZ that appears in line 19.1, there is “one way” - it can be credited exclusively (!) to the tax account of the next period,

therefore, we immediately “lower” it into line 21 of the VAT declaration (and from there to page 16.1 of the declaration for the next reporting period).

Page 20 shows the OZ (within the registration limit) that the payer must dispose of in the current period. Carry into this line:

— value of page 19 (if page 19 ≤ registration limit);

— actually, the limit itself (page 19.1 “window”), that is, the difference: page 19 — page 19.1 (if page 19 > registration limit).

You can schematically depict filling out the lines of the Declaration when line 19 is completed as follows (see figure on page 3).

OZ, which fits into the framework of the reglimit, is, first of all, used to pay off the debt (including deferred or installments, clause “a” clause 200.4 of the Tax Code of Ukraine

) if available.

To do this, fill out line 20.1 of the VAT declaration ( clause 4, clause 5, section V of Procedure No. 21

).

Please note: fines and penalties accrued on such debt (and unpaid) also fall under the definition of tax debt (see clauses 14.1.39

and

14.1.175 of the Tax Code

). Therefore, in this case, the OZ is recorded in this line, taking into account fines and penalties (in our opinion, such an offset can be considered as payment of these additional charges)*. The remaining part of the health reserve can take part in the calculation of budgetary compensation (BR).

* Moreover, tax authorities reduce the reglimits for payers by the amount of OZ sent to pay off the tax debt for VAT (see letter of the State Federal Service of Ukraine dated January 12, 2016 No. 349/6/99-99-19-03-02-15 .). However, one can argue with this approach (see “Taxes and Accounting”, 2021, No. 44, p. 46 ).

As a result, the payer has the right to decide on the use of only that amount of OZ that “fit” into the size of the limit on the date of submission of the Declaration and, accordingly, remained after the repayment of the tax debt, if any (page 20 - page 20.1).

Depending on the decision made, we then fill out the lines in Section III of the VAT return. We indicate in the line:

— 20.2 — the amount of health insurance, which (according to the payer’s application) is subject to budget reimbursement ( clause “b” clause 200.4 of the Tax Code of Ukraine

).

The payer may demand reimbursement to the current account (p. 20.2.1 ) or to pay off obligations/debt for other payments paid to the state budget (p. 20.2.2 ; for more details, see p. 7);

- and/or 20.3 , if the OZ is included in the tax credit of the next reporting (tax) period (this amount is taken into account as a carryover “minus”) ( clause “c” clause 200.4 of the Tax Code

).

From this line we add the “minus” to the value in line 21 .

Keep in mind:

the payer himself decides whether or not to declare a BV, that is, there are no mandatory requirements for a paid Tax Code to declare a BV (!)

Therefore, you can: declare the entire “minus” from page 20.2 (or part of it) to the BV, or not declare the BV at all, and transfer such a “minus” to the next period - to the next declaration, bypassing page 20.2 (i.e. from page 20 - on pages 20.3 and 21, and from there - on page 16.1 of the declaration of the next period).

Let us remind you that the “minus” in the declaration can be declared for the BV immediately (that is, already in the first period of its occurrence, and not after a period, as was the case before 01/01/2015). Moreover, BV and OZ are not at all the same thing. After all, in order for the “minus” to “turn” into budget compensation, it is necessary to comply with the BV conditions ( clause 200.4 of the Tax Code of Ukraine

). But that’s another story (read in detail on page 7 of this issue).

page 21 is filled out in the VAT return (i.e., an OZ has arisen that passes to the next period on page 16.1), it becomes necessary to draw up table 1 of Appendix D2 .

In addition, there is another reason for the mandatory filing of Appendix D2, when the successor claims a tax credit for the amount of OZ received from the reorganized legal entity. In this case, Table 2 (statement of the reorganized payer) and table 3 (statement of the assignee) of Appendix D2 may be used (see “Taxes and Accounting”, 2021, No. 30, p. 24).

Negative VAT - refund!

This right of the taxpayer was confirmed by the decision of the Federal Arbitration Court of the North-West District dated 02.10.01.

The Federal Arbitration Court pointed out that the tax authorities’ argument that VAT-taxable turnover should be determined at a price not lower than the customs value of the imported goods cannot be recognized as correct. The court also determined that when resolving disputes related to determining the price of goods, works, services for tax purposes, one should proceed from the fact that the price indicated by the parties to the transaction can be challenged by the tax authority only in the cases listed in paragraph 2 of Article 40 of the Tax Code of the Russian Federation. Federation (hereinafter referred to as the Tax Code of the Russian Federation), namely: for transactions between related parties; on commodity exchange (barter) transactions; when there is a significant fluctuation in the level of prices applied by the taxpayer for identical (homogeneous) goods within a short period of time. Consequently, in other cases, the tax authority does not have the right to challenge the price of goods for tax purposes. Below is the full text of the said decision of the Federal Arbitration Court of the Northwestern District. FEDERAL ARBITRATION COURT OF THE NORTH-WESTERN DISTRICT DECISION of October 2, 2001 Case No. A52/545/2001/2 Federal Arbitration Court of the North-Western District composed of presiding judge A.V. Shevchenko, judges N.A. Zubareva, A.D. Petrenko , with the participation of the limited liability company “Rakurs”, director V.N. Pavlov. (decision dated April 17, 2000), from the Inspectorate of the Ministry of the Russian Federation for Taxes and Duties for the City of Velikie Luki, Ivanova S.V. (power of attorney dated March 27, 2001 N 08/41802), having considered in open court the cassation appeal of the Inspectorate of the Ministry of the Russian Federation for Taxes and Duties for the city of Velikiye Luki against the decision dated March 28, 2001 (judges Razlivanova T.A., Radionova I.M. , Manyaseva G.I.) and the decision of the appeal court dated May 28, 2001 (judges Tsittel S.G., Timaev F.I., Yakovlev A.E.) of the Arbitration Court of the Pskov Region in case No. A52/545/2001/2, ESTABLISHED: Limited Liability Company 'Rakurs' (hereinafter referred to as 'Rakurs' LLC) filed a claim with the Arbitration Court of the Pskov Region to partially invalidate the decision of the Inspectorate of the Ministry of the Russian Federation for Taxes and Duties for the City of Velikiye Luki (hereinafter referred to as the Tax Inspectorate) dated 13.02. .2001 N 01/1000 on the refusal to bring Rakurs LLC to tax liability. By a court decision dated March 28, 2001, the claim was satisfied. By the decision of the appellate court dated May 28, 2001, the court decision was left unchanged. In the cassation appeal, the tax inspectorate asks to cancel the judicial acts and dismiss the claim, citing the court's failure to apply the rules of substantive law - paragraph 4 of Article 4 and paragraph 4 of Article 7 of the Law of the Russian Federation 'On Value Added Tax'. The legality of the appealed judicial acts was verified by cassation procedure. The cassation court finds no grounds to uphold the complaint. As can be seen from the case materials, the tax inspectorate, as a result of an on-site inspection of Rakurs LLC's compliance with customs and tax legislation for the period from 05/01/2000 to 09/30/2000, revealed a number of violations. Based on the results of the inspection, a report dated January 26, 2001 was drawn up. By decision dated February 13, 2001 N 01/1000, signed by the head of the tax inspectorate, it was refused to bring Rakurs LLC to tax liability. However, the tax inspectorate reduced, in its opinion, the value added tax overcharged for reimbursement from the budget for the third quarter of 2000 by 2,707,649 rubles. According to the tax inspectorate, Rakurs LLC underestimated the turnover subject to value added tax in the third quarter of 2000, since, in violation of paragraph 4 of Article 4 and paragraph 4 of Article 7 of the Law of the Russian Federation “On Value Added Tax”, it incorrectly determined it. The tax inspectorate indicated that the turnover subject to value added tax on the sale of imported goods must be determined at the actual selling price, but not lower than the value equal to the customs value, taking into account the customs duty, which is determined by customs in accordance with customs legislation. For taxation purposes, Rakurs LLC should have calculated value added tax both from the actual sales price and from the amount of the difference between the customs value, taking into account customs duties, and the actual sales price, and this amount should have been attributed to settlements with the budget at the expense of its own sources. As follows from the case materials and established by the court, Racurs LLC in the third quarter of 2000 carried out wholesale trade in imported goods purchased from under contract dated May 11, 2000 N 643/003, and submitted for reimbursement from the budget the amount of the negative difference in value added tax , formed as a result of the excess of the amounts of value added tax paid to the customs authorities upon import of goods over the amounts of tax received from the Russian buyer. According to paragraph 2 of Article 7 of the Law of the Russian Federation 'On Value Added Tax', the amount of value added tax to be paid into the budget by enterprises engaged in the purchase and (or) sale (resale) of goods, including under commission and commission agreements, is determined in in the form of the difference between the amounts of tax received from buyers for goods (work, services) sold and the amounts of value added tax actually paid to suppliers and (or) customs authorities on goods received (accepted for accounting) intended for sale and material resources (work performed, services provided), the cost of which is included in production and distribution costs. Paragraph 3 of Article 7 of the Law of the Russian Federation 'On Value Added Tax' provides for the procedure for compensation from the budget of the negative difference in value added tax. Paragraph 19 of the Instruction of the State Tax Service of the Russian Federation dated October 11, 1995 N 39 'On the procedure for calculating and paying value added tax' states that on imported taxable goods (and raw materials for their production) after their release into free circulation for subsequent sale, the value added tax the cost at all stages of the passage and sale of goods on the territory of Russia is calculated in the manner established for domestically produced goods. Thus, in this case, the general procedure for reimbursement of value added tax from the budget applies. A special procedure for determining the object of value added tax (taking into account the adjusted customs value) was applied in accordance with paragraph 1 of Article 4 of the Law of the Russian Federation 'On Value Added Tax' until 01/01/99. Federal Law dated July 31, 1998 N 147-FZ 'On the introduction into force of part one of the Tax Code of the Russian Federation', paragraphs three through nine of paragraph 1 of Article 4 of the Law of the Russian Federation 'On Value Added Tax' are declared invalid. When resolving disputes related to determining the price of goods, works, services for tax purposes, one should proceed from the fact that the price specified by the parties to the transaction can be challenged by the tax authority for these purposes only in the cases listed in paragraph 2 of Article 40 of the Tax Code of the Russian Federation ( hereinafter referred to as the Tax Code of the Russian Federation), namely: for transactions between related parties; on commodity exchange (barter) transactions; when there is a significant fluctuation in the level of prices applied by the taxpayer for identical (homogeneous) goods within a short period of time. Consequently, in other cases, the tax authority does not have the right to challenge for tax purposes the price of goods, works, services specified by the parties to the transaction (clause 13 of the resolution of the Plenum of the Supreme Court of the Russian Federation and the Plenum of the Supreme Arbitration Court of the Russian Federation dated 06.11.99 N 41/9 'O some issues related to the entry into force of part one of the Tax Code of the Russian Federation'). The courts of the first and appellate instances, satisfying the claim of Rakurs LLC, rightfully indicated that the tax inspectorate in this case, in accordance with Article 40 of the Tax Code of the Russian Federation, for tax purposes should accept the price of the goods indicated by the parties to the transaction, since there was evidence to the contrary according to paragraph 2 of Article 40 of the Tax Code of the Russian Federation not presented. The provisions of paragraph 4 of Article 4 and paragraph 4 of Article 7 of the Law of the Russian Federation 'On Value Added Tax' are applicable in this case when determining the value added tax base for goods imported into the territory of the Russian Federation for payment of value added tax to the customs authorities. The courts of the first and appellate instances assessed all the defendant's arguments on the issues under consideration, including those indicated in the cassation appeal, since in it, in essence, he repeats everything that he referred to earlier, and this is reflected in the adopted judicial acts. Under such circumstances, there are no legal grounds for canceling judicial acts. Guided by Articles 174 and 175 (clause 1) of the Arbitration Procedural Code of the Russian Federation, the Federal Arbitration Court of the North-Western District DECIDED: decision dated 03/28/2001 and appellate resolution dated 05/28/2001 of the Arbitration Court of the Pskov Region in case No. A52/545/2001/ 2 is left unchanged, and the cassation appeal of the Inspectorate of the Ministry of the Russian Federation for Taxes and Duties for the city of Velikiye Luki is not satisfied. Chairman SHEVCHENKO A.V. Judges PETRENKO A.D. ZUBAREVA N.A.

Fill out Appendix D2

General principles. The idea of filling out Appendix D2 is to decipher the OZ by periods (!) of its occurrence. Table 1 of Appendix D2 is used for this purpose.

The “highlight” that keeps payers in suspense is that the procedure for filling out Appendix D2 is not legally prescribed in any Tax Code

, nor in

Order No. 21

.

The tax authorities recognize this lack of regulation and at the same time offer their own option ( letter from the State Fiscal Service dated July 22, 2016 No. 15908/6/99-99-15-03-02-15

).

In general, today there are two approaches to filling out Appendix D2, and they differ in the procedure for determining the periods of occurrence of health problems. In any case, both of these approaches have a complete “right to life” (for more details, see “Taxes and Accounting”, 2021, No. 13, p. 5).

We will describe below the general principles for filling out Table 1 of Appendix D2, based on the recommendations of the controllers (see letters from the State Federal Service of Ukraine dated July 22, 2016 No. 24830/7/99-99-15-03-02-17

,

dated 10/11/2017 No. 2205/IPK/16-31-12-01-34

, 101.23 BZ):

1. The periods of occurrence of health problems are determined in Appendix D2 in chronological order (we will discuss the principle of chronology in more detail below). If in the current period you have line 21 for the first time, then the period of occurrence of the “first minus” will be the current (!) period .

2. The “Usyogo” line in column 4 in Appendix D2 must correspond to line 21 of the Declaration. If on page 21 (as part of the OZ) the remainder of the “old” overpayments that arose as of 07/01/2015 is still “sitting”, it is separately highlighted in the penultimate line “Balance…” of Appendix D2.

Let us recall that with the transition to special accounts from July 1, 2015, the amounts of old overpayments were “poured” into the OZ (increased it) in the declaration for July/III quarter of 2015 ( clause 3, clause 34, subsection 2, section XX of the Tax Code of Ukraine ); SFSU letter dated June 22, 2015 No. 22408/7/99-99-19-03-01-17

). Therefore, such an amount (part of it) can still “dangle” in declarations as part of the OZ. In this case, there is a “own” line for it in D2.

3. If we reflect the tax liability on the basis of a tax notice-decision (NUR), which increases the balance of the tax liability, then in column 2 of Table 1 of Appendix D2, in the period of the tax liability occurrence, we indicate the month and year in which the NUR was drawn up (see 101.23 BZ).

The principle of chronology. Detailing of the property tax, which is transferred to the tax code of the next reporting (tax) period, is carried out only in part of the periods of its occurrence . Moreover, tax authorities recommend filling out the columns of Table 1 of Appendix D2 to the Declaration in the chronological order of occurrence of the amounts of OZ reflected in Column 4 “Usoy” of Table 1 of Appendix D2.

That is, first of all, we “remove” the oldest “minus ” (from line 16.1 of the Declaration) from the lowest lines of Appendix D2, then the next one after it, etc.

In general, OZ is eliminated in the chronological order of its occurrence - “from bottom to top” . Thus, the “minus” on page 21 is formed, first of all, from the “pure” (page 17 - page 16.1) NK of the current (!) period (not OZ, namely NK). And only then, if page 21 is greater than the “pure” current tax code, then according to chronology we take the tax code from previous periods in descending order.

Let's look at the example of filling out Appendix D2, focusing on the recommendations of the fiscal authorities. For initial data, see table. 1.

Table 1. Lines of the Declaration

Based on the Declaration data from Table 1, we fill out Appendix D2 (Table 2).

Table 2. Appendix D2

| No. | Periods | ||||||||

| May | June | July | |||||||

| 2 | 3 | 4 | 2 | 3 | 4 | 2 | 3 | 4 | |

| 1 | 05 | 2018 | 10000 | 06 | 2018 | 8000 | 07 | 2018 | 5000 |

| 2 | 05 | 2018 | 3000 | ||||||

| Total in gr. 4 | 10000 | 11000 | 5000 | ||||||

May 2021. In the Declaration for May, the first “minus” appeared (line 21), therefore, it is obvious that the first period of occurrence of the CP in Appendix D2 is May 2021 (see Table 2).

June 2021. OZ from the Declaration for May “flows” into line 16.1 of the Declaration for June (10,000). Here, an OZ in the amount of 11,000 was generated (line 21 of the Declaration for June). Since line 21 (11000) is greater than the “net” current tax income for June 2018 (8000), the full amount of such a current loan falls into Appendix D2 as a “fresh minus”. The remaining amount of OZ is subject to further decoding in Appendix D2, which is calculated as the difference between line 21 (11000) and the current “clean” Tax Code (8000), which means that the remaining part of OZ “originally” from May is 3000 (11000 - 8000).

July 2021. The generated OZ for a total amount of 5,000 (page 21 of the Declaration) is less than the current “net” NC (10,000), therefore, in Appendix D2 we reflect the entire amount of OZ (5,000) with the period of occurrence in July 2021 (see Table 2).

Another approach is to compare line 9 with the current “net” loan (page 17 - page 16.1). Each reporting period in which the current “net” loan exceeds line 9 is considered the period of occurrence of the OZ.

So, based on our example, for May 2021 , Appendix D2 will be filled out in exactly the same way as in the first option (see Table 2).

In June 2021, in Appendix D2 we also show two periods of occurrence of health problems. But we leave the entire amount of HP “originally” from May 2021 (10,000) and add HP from June 2021 - 1000 (page 9 - - (page 17 - page 16.1)) for June 2021.

In Appendix D2 to the Declaration for July 2021, there remains the OZ that arose in June 2021 (1000) and the outstanding balance of the OZ that arose in May 2021 (4000). In July, the “minus” does not arise, since line 9 is greater than the current “net” loan (line 17 - line 16.1) of such a Declaration.

Interesting point. The absence of a legal requirement to comply with chronology allows the payer to repay the “minus” in any other order. That is, having chosen a mechanism that is beneficial for itself, the payer can always save the “necessary minus”. For example, in the future you plan to declare a BV and want to keep the “old” BV, which is “hard” confirmed by a paid Tax Code (for example, an import customs declaration). In this case, first of all, you can repay the more “recent” minus with current BUTs, and then “pull out the “necessary minus” in Appendix D2. In general, the principle of chronology can be called conditional, because no mandatory rules for its compliance have been established by law, and letters from tax officials are only advisory in nature, which they, in fact, themselves agree with (see letter of the SFSU dated May 11, 2018 No. 2082/ 6/99-99-15-03-02-15/ IPK

).

Although, we think, the approach of the tax authorities is more beneficial for the payer, since it allows one to avoid problems with long-standing health insurance. After all, tax officials used to constantly try to “mow down” the old OZ. More on this below.

OZ has no statute of limitations

Let us remind you that the statute of limitations established by clause 102.5 of the Tax Code

, concerns the return of excessively transferred tax amounts and/or their return from the budget. And as you well know, OZ is neither one nor the other.

In addition, the statute of limitations begins to run from the moment the overpayment occurs and/or from the moment the right to such compensation is acquired. The thing is that the OZ “flows” through the lines of the Declaration (page 16.1 and page 21) from period to period, that is, it is declared during each period until its full repayment or until the VAT payer’s registration is cancelled. Consequently, there is no point at which the limitation period is calculated.

In general, tax authorities agree and allow the payer to declare a BV formed at the expense of the “old” OZ, without regard to the period of 1095 days. However, at the same time, a condition is put forward - the VAT amounts from which the OZ is formed must be paid to suppliers of goods/services (see letters from the State Federal Service of Ukraine dated January 5, 2018 No. 72/6/99-99-12-03-02-15/IPK

,

dated March 16, 2018 No. 1054/6/99-99-15-03-02-15/IPK

).

Indeed, an OZ consisting of an invoice generated upon receipt of goods that have not been paid to suppliers cannot take part in the BV, since the conditions for recognizing such an amount of BV are not met ( clause 200.4 of the Tax Code of Ukraine

). However, this does not mean at all that such an amount cannot continue to be taken into account as part of the “flowing” OZ until it is fully paid off by tax obligations.

In addition, we are convinced that this conclusion is valid even if 1095 days have expired under the transaction for which the Tax Code formed such an OZ. After all, the statute of limitations for a transaction is not always limited to 1095 days (for more details, see “Taxes and Accounting”, 2021, No. 78, 2021, No. 58, p. 92). The fact is that in N.K.U.

There are no rules that require “removing” health insurance from the Declaration, tied to any deadline, at all.

As for adjusting the “incoming” tax code for goods received but after the statute of limitations has expired, and for unpaid goods, that’s a completely different story. Here it is necessary to consider the specific conditions for the expiration of the statute of limitations for each individual transaction, and not the entire amount of OZ under the Declaration. Moreover, the issue of adjusting the “incoming” tax code is quite controversial (see “Taxes and Accounting”, 2021, No. 57, p. 6).

conclusions

- The payer has the right to decide on the use of only that amount of tax that “fit” into the size of the limit on the date of submission of the Declaration and, accordingly, remained after the repayment of the tax debt, if any (p. 20 - p. 20.1).

- There are two approaches to filling out Appendix D2, and they depend on the order in which the periods of occurrence of health problems are determined. The payer can independently decide which approach to use.

- Tax officials recognize the “old” OZ, without regard to the period of 1095 days. True, with the “incoming” tax code for goods received but not paid for after 1095 days (.

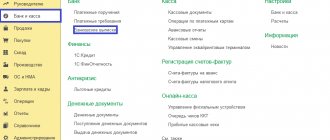

VAT payment deadlines in 2020

According to Art. 174 of the Tax Code of the Russian Federation, taxpayers must pay VAT no later than the 25th of each month during the quarter following the reporting quarterly period. In this case, you need to divide the calculated tax amount into 3 equal parts. If the date of VAT transfer falls on a weekend, it is postponed to the next working day.

The deadlines for paying VAT in 2021, taking into account postponements due to holidays, are as follows:

- 4 sq. 2021 - January 27, February 25, March 25;

- 1 sq. 2021 - April 27, May 25, June 25;

- 2 sq. 2021 - July 27, August 25, September 25;

- 3 sq. 2021 - October 26, November 25, December 25;

- 4 sq. 2021 - January 25, February 25, March 25, 2021

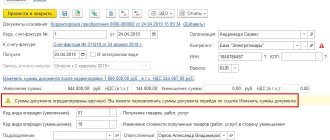

Example of VAT payment

The company calculated the amount of VAT for the 4th quarter of 2021 in the amount of RUB 53,461. Therefore, she must pay it in three installments:

53,461 / 3 = 17,820.33 rubles.

Since the quotient of the division turned out to be in kopecks, the first two payments must be rounded to a whole number - 17,820 rubles. These payments had to be made by January 27 and February 25. And then the third payment, which must be paid before March 25, 2021, is equal to:

53,461 - 17,820 - 17,820 = 17,821 rubles.

Important! Rounding of VAT amounts to whole rubles is permitted only when transferring tax. This cannot be done in primary and reporting documents, otherwise the tax office will charge a fine.

The company has the right to transfer the entire tax amount at a time, for example, within the 1st month after the reporting quarter. The main condition is that the first and second payments must be at least 1/3 of the calculated tax amount.