The accounting reflection of fines in accounting is carried out depending on the type:

- contractual penalties are recorded as income and expenses in 91 accounts;

- penalties under contracts are taken into account as part of the income tax base;

- tax penalties are not taken into account for tax purposes.

In the activities of organizations, there almost always comes a time when, through the fault of the contractor or due to circumstances, the company is subject to penalties. The specifics of accounting for fines depend on many factors.

A decision was made based on the results of a tax audit

In the operative part of the decision that inspectors make based on the results of a tax audit, the taxpayer is usually asked to:

- pay the identified VAT arrears, penalties and fines. Let us remind you that fines are assessed only in the decision to prosecute;

- make appropriate corrections to accounting and tax documents (which, in turn, may entail the need to correct reporting).

At the same time, the taxpayer is not obliged to comply with the decision based on the results of a tax audit, which has not yet entered into force (clause 1 of Article 101.3 of the Tax Code of the Russian Federation). At the same time, he has the right to voluntarily execute the decision before it comes into force (paragraph 3, paragraph 9, article 101 of the Tax Code of the Russian Federation).

Methods for collecting penalties and the negative consequences of their late payment

If the payer has neglected the opportunity to voluntarily fulfill the requirement to pay penalties, they are collected using the following methods:

- sending a collection order to the payer’s bank;

To learn about which accounts penalties can be collected, read the article “From which accounts can tax authorities collect penalties?” .

- recovery from property.

In addition, if the terms and completeness of payment of insurance premiums are violated, we are talking not only about sanctions, but also about a violation of the pension rights of the insured persons.

The negative consequences of non-payment of contributions are:

- reducing the possibility of obtaining investment income from investing pension savings;

- reduction in the amount of pension savings when indexing them.

Read about the consequences of non-payment of insurance premiums due to their failure to be reflected in the calculation in the article “What is the liability for non-payment of insurance premiums?”

When does the review decision take effect?

According to paragraph 9 of Art.

101 of the Tax Code of the Russian Federation, the final decision on a tax audit comes into force after one month from the date of its delivery to the taxpayer (or his representative). The countdown of this period begins on the next day after delivery of the decision, and expires on the corresponding date of delivery of the next month. For example, if the decision was served on the taxpayer on December 16, 2015, then it will enter into force on January 17, 2021. But this is in the general case. If the taxpayer intends to appeal the decision made based on the results of the audit, the time frame for it to enter into legal force will be different (clause 9 of Article 101, Article 101.2 of the Tax Code of the Russian Federation). In the part in which the decision has not been canceled or appealed, - from the day the higher tax authority made a decision on the appeal. If the appeal is left by the department without consideration, the inspection decision comes into force from the day the department makes the corresponding decision, but not earlier than the deadline for filing the said complaint.

Thus, when filing an appeal, the decision based on the results of the audit will enter into legal force only from the day when it was approved by a higher tax authority (or from the date of adoption of a new decision on the audit[1]). Therefore, the taxpayer has the right not to comply with the decision of a lower tax authority (Article 101.2 of the Tax Code of the Russian Federation). And such a delay can last up to three months. It consists of (clause 9 of article 101, clause 6 of article 140 of the Tax Code of the Russian Federation):

- month allotted for filing an appeal. File a complaint in accordance with clause 8 of Art. 6.1 of the Tax Code of the Russian Federation is possible until 24 hours of the last day of the deadline (for example, through TKS channels). For example, if the decision was served on the taxpayer on December 16, 2015, then the complaint can be filed until 24 hours on January 16, 2021;

- the month within which a decision on the appeal must be made;

- month by which the period for making a decision on the complaint may be extended.

As we can see, a taxpayer can legally delay the implementation of a decision made based on the results of a tax audit. But this benefit has a downside.

Pros and cons of appeal

On the one hand, filing an appeal allows the taxpayer to postpone the execution of the final decision on the audit for several months.

After all, it will come into force only from the day the higher tax authority makes a decision on the complaint or from the day the decision is made to leave the complaint without consideration (but not earlier than the deadline for filing an appeal). In addition, a higher tax authority may completely cancel the decision of a lower-level inspectorate and make a new decision on the case, which will come into force from the date of its adoption (clause 2 of Article 101.2 of the Tax Code of the Russian Federation). Therefore, in the event of a partial or complete cancellation of the audit decision or a new decision in favor of the taxpayer, he will not have to return excessively collected VAT amounts (as well as penalties and fines) from the budget. On the other hand, penalties will be accrued in any case for the entire period when the taxpayer was in arrears for this tax (clause 3 of Article 75 of the Tax Code of the Russian Federation). Therefore, delaying the execution of the decision may result in additional financial losses for the taxpayer. Consequently, the sooner the taxpayer complies with the audit decision (including ahead of schedule), the smaller the amount of penalties he will have to pay to the budget.

Changes in issuing penalties for LLCs that occurred from October 1

In order to reduce the period of non-payment, from October 1, 2017, for Limited Liability Companies, the penalty for long-term delay has increased. If the company does not pay the tax more than 30 days after the final deadline, then on the 31st day the tax penalties become 2 times larger. Those. The new calculation rule is valid only for a debt period exceeding 30 days that arose after October 1, 2017. For individual entrepreneurs, the requirements remain the same.

Let's write down the formula for calculation starting from 31 days:

Amount of fine = 8.5%/150 x debt x number of days of delay over 30

Let's look at an example.

did not pay tax according to the simplified tax system for 9 months at the prescribed time. For the period under review, she has already had a debt of 25,000 rubles for 47 days. Let's calculate the penalties.

For 30 days = 8.5%/300 x 25,000 x 30 = 212.5 rubles.

For 31 - 47 days = 8.5%/150 x 25,000 x 17 = 240.83 rubles.

In just 47 days, Vesely Botinok LLC will pay 453.33 rubles.

Preliminary results

Based on the above, we can draw the following conclusion: the taxpayer has the opportunity to choose when and to what extent to implement the decision made based on the results of the tax audit.

In doing so, he needs to take into account the following factors. Payment of additionally accrued VAT (as well as corresponding penalties and fines) before the final decision on the audit is made is fraught with the diversion of funds from circulation (the size of which is often quite impressive). Returning them (if the outcome is favorable - when the decision is canceled by a higher tax authority or court) will take some time. By the way, the refund of overpaid (collected) taxes, penalties and fines is made with interest in accordance with clause 5 of Art. 79 Tax Code of the Russian Federation.

At the same time, delaying the execution of the inspection decision will lead to an increase in the amount of penalties.

It should be taken into account that only an appeal will provide a delay of two to three months for the execution of the inspection decision. In any case, the inspection decision that has already entered into force will be considered in court. This means that additional VAT, penalties (and possibly a fine) will still have to be paid before the end of the trial. Otherwise, they will be collected by the tax authorities forcibly (clause 4 of article 69, clause 3 of article 101.3 of the Tax Code of the Russian Federation).

Thus, before appealing a decision (in whole or in part) made as a result of a tax audit, in an appeal or in court, a taxpayer must carefully analyze his chances of success. In any case, early execution of the audit decision (even in the part that is not appealed) will minimize the amount of penalties that are charged for each calendar day of delay in tax payment. Early execution of a decision (including partial) is not an obstacle to an appeal. This is directly stated in paragraph. 3 clause 9 art. 101 Tax Code of the Russian Federation.

So, we have explained the timing for the verification decision to come into force. The next question: the procedure for reflecting the results of the audit in accounting - additional amounts of VAT, penalties and fines (issues related to making changes to tax accounting and reporting will not be considered within the framework of this material).

If the taxpayer agrees with the audit decision

In a situation where the taxpayer does not intend to challenge the decision of the audit, he can reflect its results in accounting immediately after receiving it.

This document will serve as the basis for making accounting corrections (Article 9 of the Accounting Law[2]). Additional tax assessments based on the results of a tax audit are reflected in accounting as correction of errors in the manner established by PBU 22/2010 “Correcting Errors in Accounting”[3].

The date of discovery of the error should be considered the date of entry into force of the verification decision. The period for correcting the error depends on this date, as well as on how significant the error was made. Let us recall that, according to paragraph 3 of PBU 22/2010, an error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements prepared for this period. The organization determines the level of materiality independently and establishes in the accounting policy the criteria by which this level will be established (this issue is beyond the scope of the article, so we will not delve into its nuances).

So, the procedure for reflecting additionally accrued VAT amounts in accounting depends on the cause of the errors and the period in which they were made.

If the arrears arose as a result of an understatement of the tax base or incorrect application of the tax rate (for example, instead of a rate of 18%, a rate of 10% was applied), then the additional accrued amount of VAT accrued on sales:

- the current year (the year of the inspection), is included in the cost of products sold and is reflected in the debit of account 90 “Sales” (subaccount 90-3);

- of previous years, is taken into account as part of other expenses in the debit of account 91 “Other income and expenses” (sub-account “Other expenses”) (clause 11 of PBU 10/99 “Expenses of the organization” [4]).

In turn, the last recording option is used in two cases:

- if the arrears of the previous year are identified before the approval of the annual reports, an accounting entry is made on December 31 of the previous year;

- if the arrears of previous years are identified after the approval of the annual reports and are considered insignificant.

If the amount of arrears from previous years, revealed after the approval of the annual reports, is significant, another entry is made in the accounting: Debit 84 “Retained earnings (uncovered loss)” Credit 68-VAT.

Example 1

Based on the results of the on-site tax audit for the period 2012 - 2014, the LLC was additionally charged the amount of VAT for the third quarter of 2014 in the amount of 125,000 rubles. The arrears arose as a result of an understatement of the taxable base (VAT was not charged on a taxable transaction). The company agreed with the amount of additional charges. The decision based on the results of the audit came into force on November 10, 2015. The amount of VAT arrears in accordance with the company's accounting policy is recognized as significant.

The decision was received after the approval of the annual reports for 2014, therefore all corrections related to additional tax assessments will be reflected in the financial statements for 2015.

In accounting, the company will reflect the amount of additional accruals with the following entry: Debit 84 Credit 68‑VAT – additional VAT has been accrued in the amount of 125,000 rubles. for the third quarter of 2014.

Important

It is necessary to correct not only the tax amount in accounting, but also the amount of previously incorrectly calculated revenue. As stated in paragraph 4 of PBU 22/2010, their consequences, along with errors, are subject to mandatory correction. In other words, it is necessary to reflect in accounting not only the amount of additional tax charged, but also to make corrections to the entries that form the financial result (for example, make a correction entry - Debit 62 “Settlements with buyers and customers” Credit 84).

If the VAT arrears arose in connection with an illegal deduction, then the procedure for recording the additional accrued tax depends on the transaction to which the accrued tax amounts relate and the period for which this arrears were identified. Such situations are possible here.

“Input” tax by virtue of clause 2 of Art. 170 of the Tax Code of the Russian Federation was subject to inclusion in the cost of goods (work, services), but was declared by the taxpayer for deduction.

Additional accrued VAT relating to the period for which annual reporting has not yet been approved is included in the cost of such goods (work, services) or reflected in expenses based on the following entries:

Reversal Debit 68‑VAT Credit 19 – additional VAT accrued based on the results of the audit;

Debit 01 (04, 10, 41) Credit 19 – input VAT is included in the cost of the object (if its cost has not yet been written off as expenses)

or Debit 20 (26, 44) Credit 19 – input VAT is written off as expenses (if the cost of the objects for which the deduction was claimed has already been written off as expenses).

If the additional accrued VAT relates to previous periods (and the amount of arrears is not significant), on the date of entry into force of the decision on the audit, the following entries are made in accounting:

Debit 19 Credit 68‑VAT – “input” VAT, previously unlawfully accepted for deduction, has been restored;

Debit 91-2 Credit 19 - input tax included in other expenses

or Debit 01 (04, 10, 41) Credit 19 - input tax is included in the cost of objects that have not yet been written off as expenses.

In the event that the amount of arrears exceeds the materiality threshold (enshrined in the “accounting” accounting policy), the amount of additional accrual is reflected in the accounting record - Debit 84 Credit68‑VAT.

The deduction was claimed on a “defective” invoice.

Additional accrued tax relating to the period for which annual reporting has not yet been approved is reflected in Debit 91-2 Credit 68‑VAT. The same entry is made if additional tax has been assessed for previous periods and the amount of arrears is considered insignificant. Accordingly, if the amount of additional tax accrued for previous periods is significant, an entry is made in accounting - Debit 84 Credit 68‑VAT.

Example 2

During a tax audit of the organization’s activities for 2014 and 2013, tax authorities’ claims resulted in consulting services worth RUB 236,000. (including VAT - 36,000 rubles). As a result, additional VAT was charged, which, according to the inspectors, the organization unlawfully declared for deduction. The organization did not challenge the audit decision and corrected the error relating to past periods on the effective date of October 24, 2015.

In accordance with the accounting policy of the organization, the indicated error was considered insignificant, therefore the following entries were made in the accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| As of the date the cost of consulting services is recognized as an expense | |||

| The cost of consulting services is taken into account | 26 | 60 | 200 000 |

| The amount of “input” VAT is reflected | 19 | 68‑VAT | 36 000 |

| “Input” VAT has been accepted for deduction | 68‑VAT | 19 | 36 000 |

| On the effective date of the inspection decision | |||

| An accounting error has been corrected due to the tax authorities recognizing the unreality of the transaction. | 60 | 84 | 236 000 |

| Additional VAT was charged as a result of an illegal deduction | 84 | 68‑VAT | 36 000 |

If the taxpayer does not agree with the audit decision

It was noted above that even if the taxpayer does not agree with the decision of the audit, the amount of additional VAT accrued based on the results of the audit (regardless of the reasons leading to this) is more advisable to pay rather than wait for the results of an appeal of the tax authorities’ decision.

Payment of the arrears will not interfere with the appeal process (first the appellate process, and then the trial process), but will allow the taxpayer to save (often a significant amount) on penalties. At the same time, the mere transfer to the budget of the amount reflected in the audit decision does not mean that the taxpayer recognizes the VAT debt owed to the budget. Arrears (in case of an unfavorable outcome) are recognized only on the date of entry into force of the relevant appeal or court decision. Since it is on this date that the organization’s tax obligations for this tax are finally determined. Until the appeal procedure is completed (takes from two to three months from the date of delivery of the inspection decision) or court proceedings (they can take from several months to one and a half to two years), additionally accrued VAT on the credit of account 68 should not be reflected . Otherwise, the information reflected in accounting and reporting and the actual actions of the taxpayer will contradict each other. In other words, financial statements will not reflect the real position of an economic entity and the results of its activities, which, for obvious reasons, will lead to misinformation of its users.

Due to the fact that uncertainty in settlements with the budget can drag on over time (as noted earlier, from two months to one and a half to two years), a logical question arises: how to reflect this in accounting?

We believe that in this case, the organization needs to remember PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”[5] and reflect in accounting the estimated liability for the amount of additionally accrued tax. Let us recall that, by virtue of clause 4 of this standard, an obligation with an uncertain amount and (or) deadline is recognized. And it can arise, among other things, from a court decision (exactly our case).

The estimated liability is recognized in accounting if the following conditions are simultaneously met (clause 5):

- there is an obligation resulting from past events in its economic life, the fulfillment of which the organization cannot avoid. When doubt arises as to the existence of such a liability, an entity recognizes a provision if, based on an analysis of all circumstances and conditions, including the opinions of experts, it is more likely than not that a liability exists;

- a decrease in the economic benefits of the organization necessary to fulfill the estimated liability is likely;

- the amount of the provision can be reasonably estimated.

In relation to the situation when an organization challenges an inspection decision, all of the above requirements are met: as a result of past events in the organization’s economic life, an obligation has arisen to pay arrears, the amount of which is determined in the decision, while there is no 100% certainty as a result of appealing the indicated decision.

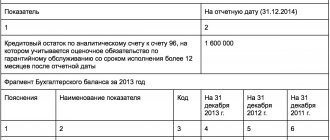

Thus, in the analyzed situation, the organization makes sense to reflect an estimated liability equal to the amount of the additional accrued tax. In this case, the following entry will be made in the accounting: Debit 91-2 Credit 96 “Reserves for future expenses” - an estimated obligation to pay the amount of VAT to the budget is recognized. Accordingly, the transfer of additionally accrued tax to the budget is not recognized as an expense of the organization and is reflected in the accounting records as the debit of account 76 “Settlements with various debtors and creditors” in correspondence with the credit of account 51 “Current accounts”.

The further fate of this estimated liability directly depends on the results of challenging the inspection decision.

In the case of a positive outcome (when the organization has proven the illegality of the additionally assessed tax), on the date the court decision comes into force, it is written off based on the following accounting entry: Debit 96 Credit 91-1 - the estimated liability to pay the amount of VAT to the budget is written off.

If an organization loses a dispute in arbitration and a judicial act recognizes that the VAT payer has an arrears on this tax, a different entry is made in the accounting (as of the date the court decision comes into force): Debit 96 Credit 68‑VAT – additional VAT has been accrued for payment to the budget.

Example 3

Let's use the data from example 1.

The organization did not agree with the conclusions made by the inspectorate in the inspection decision. She intends to appeal this decision in accordance with the established procedure. Having paid the VAT arrears indicated therein after receiving the decision, the organization filed an appeal with a higher tax authority. However, the higher authority agreed with the inspectors' conclusions. Then the taxpayer filed an application with the court. But the arbitrators also recognized that the inspectors were right and that the organization had arrears.

The following entries were made in the organization's accounting:

| Contents of operation | Debit | Credit | Amount, rub. |

| On the date of payment of additional accrued tax | |||

| An estimated liability for payment of VAT to the budget has been recognized | 91-2 | 96 | 125 000 |

| On the effective date of the inspection decision | |||

| Additional VAT payable to the budget | 96 | 68‑VAT | 125 000 |

If the amount of the recognized estimated liability turns out to be greater than the amount of additional VAT assessed by court decision (for example, 100,000 rubles instead of 125,000), then the excess amount of the estimated liability (in the amount of 25,000 rubles) is recognized as other income and is credited to account 91- 1 (clause 22 PBU 8/2010).

What are the entries for calculating penalties on taxes?

For the taxpayer, penalties are an expense that must be reflected in account 99 or account 91, depending on the type of tax. That is, there are two options for calculating penalties in accounting:

- through account 99 by analogy with tax sanctions - posting Dt 99 Kt 68;

- through account 91 by analogy with contractual penalties - posting Dt 91-2 Kt 68.

For which taxes the Ministry of Finance requires penalties to be reflected on account 99, and for which on account 91, find out from the Typical Situation from ConsultantPlus by receiving a free trial access.

And the posting for payment of penalties will look like this: Dt 68 Kt 51.

To learn how the differences that arise will be reflected in the accounting records, read the article “How to calculate accounting profit (formula)?”