After the announcement of the increase in the VAT rate, accounting forums “swelled” with different opinions and assumptions about what exactly awaits us and how to keep records. No detailed instructions were received from the Federal Tax Service, although a great many questions arose.

[email protected] dated October 23, 2018 “On the procedure for applying the VAT tax rate during the transition period” with detailed explanations.

Existing VAT rates

In addition to the settlement rates applied in a special regime (clause 4 of Article 164 of the Tax Code of the Russian Federation), there are basic VAT rates. These include:

1. The VAT rate is 0%, the application of which is given in paragraph 1 of Art. 164 Tax Code of the Russian Federation.

See also the material “What is the procedure for refunding VAT at a rate of 0% (receiving confirmation)?”

2. VAT at a rate of 10% is calculated on the basis of the conditions given in paragraph 2 of Art. 164 Tax Code of the Russian Federation.

See also the materials “What is included in the list of goods subject to VAT at a rate of 10%”.

3. The VAT rate of 20% is applied on the basis of clause 3 of Art. 164 Tax Code of the Russian Federation.

Let the seller pay

The second way to return the amount of the deduction taken by the inspectors is to recover it from the seller as his unjust enrichment (Article 1102 of the Civil Code) or as compensation for losses caused by his actions (Article 15 of the Civil Code). This will be quite fair: by agreeing to the supplier’s price and the VAT charged on it, the buyer expected that he would return the tax to himself by deducting it. After the inspection refused to deduct him, it turned out that he simply donated this amount to the seller.

The buyer is faced with the task of proving that the seller acted illegally (since unjust enrichment is the retention of someone else’s property without legal grounds - Article 1102 of the Civil Code, and loss is the costs that must be incurred to restore the violated right - clause 1 of Article 15 of the Civil Code ). He will have to take into account all the arguments the tax authorities give when making claims for VAT in excess of what the seller accrued to the budget. The decision of the tax inspectorate, which justifies the refusal to deduct, will also serve as evidence. True, if the buyer has not appealed this decision in court, the arbitrators may consider it contestable and not accept it as evidence (as, for example, the Federal Antimonopoly Service of the Central District did, issuing a resolution of March 10, 2010 No. F10-442/10).

You can recover from the supplier not only the amount of unjust enrichment, but also the interest accrued on it (Article 395, paragraph 2 of Article 1107 of the Civil Code). And if the buyer prefers to claim the amount of “extra” VAT as compensation for his losses, he can also include penalties accrued by the tax authorities on the amount of the deduction withdrawn.

Elena Pustynina, expert at Calculation magazine

Cases of application of estimated VAT rates

All cases of application of estimated VAT rates are given in paragraph 4 of Art. 164 Tax Code of the Russian Federation.

Estimated rates apply:

- Upon receipt of funds related to payment for goods (work, services) provided for in Art. 162 of the Tax Code of the Russian Federation. The VAT tax base can only be increased by amounts associated with payment for goods sold, that is, in situations where these amounts are actually part of the revenue. If such amounts are considered to be attributable to sales proceeds, they should also be subject to tax. The tax rate on additional amounts of money depends on the rate on the main transactions. So, if the tax rate for the main transaction was 10%, then the additional amount will be taxed 10/110, since the estimated tax is withheld from this amount (clause 4 of Article 164 of the Tax Code of the Russian Federation). If the principal amount was taxed at a rate of 20% VAT, then the calculated rate for additional amounts received related to revenue will be 20/120.

- Receiving advances for an upcoming delivery or transfer of property rights.

See also “Acceptance for deduction of VAT on advances received.”

- Tax withholding by VAT agents.

For more details, see the material “Who is recognized as a tax agent for VAT (responsibilities, nuances)”.

- The estimated VAT rate for the sale of property taken into account along with the tax.

The Tax Code of the Russian Federation regulates the application of the settlement rate when selling property taken into account along with the tax in accordance with clause 3 of Art. 154 of the Tax Code of the Russian Federation, acquired externally. Its sale is taxed at a rate of 20/120 or 10/110. Such property includes:

- fixed assets purchased through targeted funding from the budget and paid including VAT, which is not deductible (letter of the Ministry of Finance of Russia dated April 1, 2010 No. 03-07-11/83);

- property received free of charge and accounted for at cost, taking into account the tax paid by the transferring party;

- fixed assets recorded at cost including tax;

In addition, sales transactions are taxed at the settlement rate:

- agricultural products and processed products under clause 4 of Art. 154 Tax Code of the Russian Federation;

- cars purchased from individuals for resale in accordance with clause 5.1 of Art. 154 Tax Code of the Russian Federation.

In addition, the calculated rate is applied when transferring property rights in accordance with clauses 2–4 of Art. 155 Tax Code of the Russian Federation. The list of cases in which the use of the estimated tax rate is allowed is exhaustive (determination of the Supreme Arbitration Court of the Russian Federation dated December 24, 2008 No. VAS-15099/08, resolution of the Federal Antimonopoly Service of the Moscow District dated August 29, 2008 No. KA-A40/8063-08).

Filling out invoices for estimated rates

An invoice for the sale of property registered by an enterprise at a cost including VAT is determined by the rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. According to these rules:

- in column 5 the difference between prices is entered, taking into account tax;

- Column 8 reflects the estimated amount of tax (subparagraphs “e”, “h” of paragraph 2 of the filling rules);

- column 7 reflects the calculated rate that is applicable in this situation, the rate is indicated without the % symbol (i.e. 20/120, etc.);

- Columns 4 and 9 indicate the full price and sales price including VAT.

Read more about the rules for issuing advance invoices in the article “Rules for issuing advance invoices in 2019 - 2021.”

VAT rate

Current as of: December 20, 2021

In 2021, the VAT tax rate can take one of five values: 0%, 10%, 18%, 10/110 and 18/118.

| Bet size | Application of the rate |

| 0% | This rate is used when selling (clause 1 of Article 164 of the Tax Code of the Russian Federation): - goods for export (subject to submission to the Federal Tax Service of a certain package of supporting documents (Article 165 of the Tax Code of the Russian Federation)); — services for the international transportation of goods, which also includes freight forwarding services; — services for the international transportation of passengers and luggage; — some fairly specific types of work and services (for example, work performed by organizations for pipeline transport of oil and petroleum products). |

| 10% | Used in the sale of: - certain food products (for example, sugar, bread, milk (clause 1, clause 2, article 164 of the Tax Code of the Russian Federation)) and children's goods (diapers, shoes, notebooks, etc. (clause 2, clause 2) Article 164 of the Tax Code of the Russian Federation)); — printed periodicals (newspapers, magazines) and book products, except those of an advertising and erotic nature (clause 3, clause 2, article 164 of the Tax Code of the Russian Federation); — medicines and medical products, except those that are exempt from VAT (clause 4, clause 2, article 164 of the Tax Code of the Russian Federation); — services for domestic air transportation of passengers and baggage (clause 6, clause 2, article 164 of the Tax Code of the Russian Federation). To apply this rate, the product type code in accordance with the All-Russian Classifier of Products and the Commodity Nomenclature of Foreign Economic Activity must be present in the list approved by the Government (Resolution of the Government of the Russian Federation of September 15, 2008 No. 688, Decree of the Government of the Russian Federation of December 31, 2004 No. 908, Decree of the Government of the Russian Federation dated 01/23/2003 No. 41). |

| 18% | In all other cases, when selling goods (works, services) |

| 10/110 | The calculated rate is most often used (clause 4 of Article 164 of the Tax Code of the Russian Federation): - when receiving advances for the upcoming delivery of goods (performance of work, provision of services); — when calculating the amount of VAT transferred to the budget by the tax agent; - when a new creditor assigns monetary claims arising from an agreement for the sale of goods (works, services). |

| 18/118 |

Government without rules

But what about the government-approved Rules for maintaining journals of invoices, purchase and sales books (Resolution No. 914 of December 2, 2000)? After all, they provide that when selling property subject to tax, the tax base (i.e., inter-price difference) should be indicated in the invoice as the cost of goods shipped, the tax rate should be entered as calculated, and the tax amount should be the one that should be charged from this transaction salesman.

However, in this part the rules are not binding on taxpayers. By approving them, the Cabinet of Ministers went beyond the powers granted to it by the Tax Code. The latter instructs the government to develop only the Procedure for maintaining a log of received and issued invoices, purchase books and sales books (clause 8 of Article 169 of the Tax Code) and does not give the right to either approve the obligatory form of invoice for taxpayers, or establish the calculation of the amounts entered into it indicators. The government is authorized to issue regulations on taxation issues only within its competence, and only those that do not amend or supplement the legislation on taxes and fees (Clause 1, Article 4 of the Tax Code).

Violation of the requirements for an invoice not provided for in paragraphs 5 and 6 of Article 169 of the Tax Code cannot be grounds for refusal to deduct the amount of tax presented by the seller (Clause 2 of Article 169 of the Tax Code). Therefore, the inspectorate does not have the right to refuse a deduction to the buyer if the invoice is issued in violation of any rules from Government Resolution No. 914, but in accordance with the requirements of paragraphs 5 and 6 of Article 169. This is confirmed by arbitration practice (see, for example, resolutions FAS Volga District dated March 3, 2006 No. A55-10682/2005, FAS Northwestern District dated April 10, 2007 No. A56-11416/2006). And the indication in the invoice of the sales price and the estimated rate is fully consistent with paragraph 5 of Article 169 of the Code.

In fact, the government obliges buyers to provide information about how much the property it sold cost the company and the amount of its tax liability. However, the seller is not at all interested in disclosing this information. Moreover, he has the right not to do this - due to the provisions of the Civil and Tax Codes on commercial and tax secrets.

Error in VAT rate

If the VAT amount indicated in column 8 “Amount of tax presented to the buyer” of the invoice does not correspond to the product of columns 5 “Cost of goods (work, services), property rights without tax” and 7 “Tax rate” due to an incorrect indication of the rate VAT, then it is impossible to accept VAT as a deduction on such an invoice without a dispute with the tax authorities.

In order for the buyer to accept input VAT as a deduction, the seller must issue a corrected invoice showing the correct tax rate.

Buyer's risks: goodbye, deduction

The tax authorities will deduct from the buyer the amount of VAT that exceeds the calculated rate from the inter-price difference. The main reason will be a violation of the “mirror” principle of VAT as an indirect tax (definition of the Constitutional Court of November 4, 2004 No. 324-o), since it turns out that the seller accrued less to the budget than the buyer set for deduction. They can also refer to the decision of the Supreme Arbitration Court of June 19, 2006 No. 16305/05, where it came to the conclusion that tax legislation “excludes the deduction of amounts of value added tax paid by the taxpayer [to the seller. – Approx. ed.] in violation of the provisions of Chapter 21 of the Code.” Tax officials believe that the “extra” VAT was paid to the seller in violation of VAT legislation.

The tax authorities will deduct from the buyer the amount of VAT that exceeds the calculated rate from the inter-price difference.

There should be no fine in such a situation. It is possible only for a culpable violation of tax legislation (Article 106 of the Tax Code), and the buyer is not to blame for the fact that the VAT amount in the invoice turned out to be incorrect, according to the inspectors. In the relationship between the seller and the buyer, this is a normal implementation, in no way determined by the fact that the property is taken into account by the seller for tax purposes. The buyer cannot know that the seller is obliged to calculate VAT in a special manner on the property he has acquired, and the seller is not obliged to inform him about this when concluding the contract.

It is possible that inspectors will refuse the buyer to deduct the entire amount of VAT indicated in the invoice, for the reason that it contains, in the opinion of the inspectors, unreliable information about the rate and amount of the tax. Inspectors may consider that in this case the invoice was drawn up in violation of subparagraphs 10 and 11 of paragraph 5 of Article 169 of the Tax Code. And such invoices, as is known, cannot serve as a basis for a deduction (clause 2 of Article 169 of the Tax Code).

Having received complaints from tax authorities, the buyer should first ask the seller to correct the invoice and return the money overpaid as VAT. If the counterparty does not agree, then the further path to return this amount lies in court.

Those who are not ready to get involved in legal disputes and prefer to part with the “extra” amount of VAT can only recognize it as part of the contractual value of the acquired property and write it off as expenses recognized when calculating income tax. This will be done by the decision of the inspectorate based on the results of the tax audit that the VAT in this part was presented illegally, and therefore is not VAT at all.

The rest have two options. First: prove in court that the tax at the full rate on the sales price was legally presented, which means that its entire amount is subject to deduction. Second: do not argue with the tax authorities, but recover the amount of the removed VAT deduction from the seller.

VAT rates in the declaration

| Bid | The tax base | VAT amount |

| 18% | Page 010 column 3 | Page 010 column 5 |

| 10% | Page 020 column 3 | Page 020 column 5 |

| 18/118 | Page 030 column 3 | Page 030 column 5 |

| 10/110 | Page 040 column 3 | Page 040 column 5 |

VAT accepted for deduction on purchased goods (works, services) is reflected on page 120 of Section 3 of the declaration in the total amount without breakdown by tax rates.

Sales of goods (works, services) at a 0% rate are reflected in Section 4 of the declaration.

Due to the increase in the VAT rate from 18% to 20%, the VAT return form applicable from 01/01/2019 will be updated.

VAT on returns

Letter No. SD-4-3/ [email protected] dated October 23, 2018 states a completely new interpretation of returns, namely, now these are not returns, but adjustments to the implementation.

The legislator refers to clause 13 of Art. 171 and paragraph 10 of Art. 172 of the Tax Code of the Russian Federation, which talks about adjusting sales downward. Previously, there was some confusion with returns, because the buyer could accept the goods, but could not register it, and the return could also be a reverse sale - when a full-fledged product was returned, there could be a real return of the defective product. Now all this will be reflected in the income adjustment.

Regarding the changed rate: if the sale was before 01/01/2019, then the adjustment invoice indicates a rate of 18%. If an adjustment is issued to an organization on the simplified tax system, then one consolidated document is created, which reflects data on all such operations.

Materials from the newspaper “Progressive Accountant”

VAT and rates

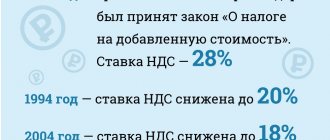

VAT is an indirect tax levy fixed at the federal level. Its size is included in the total cost of goods and services sold in our country. Payment of VAT is the responsibility of the buyer at the time of purchase or receipt of the product. This fee is subject to transfer to the federal budget.

Most goods and services sold include VAT. A list of products that are exempt from this tax is established by law.

In accordance with paragraph 3 of Article No. 164 of the Tax Code (hereinafter referred to as the Tax Code of Russia), the VAT rate of 18% is in effect by default and applies to all types of goods and services, if they are not included in the list in accordance with which they are taxed differently, rates provided by law.

There are currently five value added tax rates, which are divided into two types:

- basic;

- calculated

To calculate the amount of the basic rate, you need to multiply the size of the tax base by the VAT rate. At the moment there are three rates that are considered basic:

- 18%;

- 10%;

- 0%.

Estimated rates separate VAT from the total cost of a product or service, which already includes tax.

The Tax Code of Russia defines two types of such rates:

- 18÷118;

- 10÷110.

To exclude goods and services that are not subject to the 18% VAT rate, we will consider cases when it is necessary to use other rates.

VAT at the rate of 10%

Sales of socially significant products are carried out using a VAT rate of 10%. According to the Tax Code of Russia, these include:

- Food products according to the list specified in clause 1, clause 2 of Art. No. 164 Tax Code of Russia.

- Products intended for children, in accordance with the list specified in clause 2, clause 2 of Art. No. 164 Tax Code of Russia.

- Periodicals of any type, the frequency of publication of which is at least once a year, as well as book products, except for publications that are of an advertising or erotic nature. The list is indicated in paragraph 3 of paragraph 2 of Art. No. 164 Tax Code of Russia.

- Medical products, in accordance with paragraph 4, paragraph 2 of Art. No. 164 Tax Code of Russia.

- Work related to the transportation of passengers and luggage in Russia, except for the cases specified in clause 4.1, clause 1 of Art. No. 164 Tax Code of Russia.

VAT at 0% rate

Sale of exported goods and services, as well as those that are the subject of transit through Russia.

These include:

- Goods exported under the export system and subject to the free customs zone regime, subject to the conditions specified in Article No. 165 of the Tax Code of Russia.

- Services provided during the transportation of products between countries, taking into account work on support, organization, transportation, loading and unloading of goods.

- Services for the transportation of goods in the customs service area or in transit.

- Passenger transportation and luggage transportation, in cases where the places of departure and destination are located outside the territory of the Russian Federation.

VAT at rates 18÷118 and 10÷110

Estimated rates are calculated not as percentages, but in the form of formulas. The application of these rates is regulated by paragraph 4 of Article No. 164 of the Tax Code of Russia.

They are intended for taxation of goods and services sold using advance (preliminary) payments for future deliveries.

The following formulas are used for calculation:

- VAT amount = Amount of advance (preliminary) payment * 18÷118.

- VAT amount = Amount of advance (preliminary) payment * 10÷110.

Example: the advance payment is 236 thousand rubles. and is taxed at a rate of 18÷118. In this case, the VAT amount will be equal to: 236,000 * 18÷118 = 36,000 rubles.

In addition to advance payments, rates 18/118 and 10/110 apply in the following cases:

- During the sale of goods that were purchased from third parties and include the standard VAT rate.

- In cases of withholding of tax fees by tax agents.

- When selling vehicles whose seller was an individual.

- During the procedure for assigning rights to property.

- During the sale of product groups related to agricultural products.

VAT at the rate of 18%

Due to the fact that clauses 1, 2 and 4 of Article No. 164 of the Tax Code of Russia are of a closed type, the vast majority of transactions for the sale of goods and services within the Russian Federation are taxed at the basic rate.

This means that if the product or service being sold does not fall within the scope of the above exceptions and is not subject to a different rate, then the standard rate is used - 18%.

The VAT rate of 18% is calculated using the following formula:

VAT amount = Tax base amount * 18%

Example: an organization engaged in tailoring sold its goods in the amount of 500 thousand rubles. This product is not subject to the rates of 0%, 10%, 18÷118 or 10÷110, respectively, VAT will be paid at the basic rate of 18%. In this case, VAT is calculated as follows:

500,000 * 18% = 90,000 rub.

Exceptions in codes when importing goods

When determining the VAT rate, it is necessary to monitor situations in which exceptions to the rules apply for one or more categories of goods when importing products.

As an example, let’s look at two nomenclature codes for goods of foreign economic activity (TN FEA), which include groups of goods subject to taxation at different rates, despite the fact that the entire category is subject to the 18% rate.

TN VED 2106909200

According to the foreign economic activity classifier, the code 2106909200 hides various food products. They are subject to a VAT rate of 18%. However, in accordance with Russian Government Decree No. 908 dated December 31, 2004, diabetic and baby food imported into Russia is subject to VAT at a rate of 10%.

Everything about buying and selling a share of land.

Do you need temporary registration in Krasnodar? It will be useful for you to read our article.

Have you already remodeled your apartment? Now it definitely needs to be legalized! How to do it right, read

TN VED 1901909900

Foreign trade code 1901909900 covers ready-to-eat goods made from grains, flour, milk and milk-containing products, starch, including confectionery products made from flour. All goods in this group are subject to the basic VAT rate of 18%, with the exception of the category of goods intended for baby food. They are subject to a VAT rate of 10%, in accordance with Decree of the Government of Russia No. 908 of December 31, 2004.

When filling out the declaration, you need to clearly monitor the rates for all product groups subject to declaration. Some may include exceptions, as in the examples above.

The determination of the VAT rate always follows the reverse principle. By excluding goods and services that are taxed at different rates, you can be sure that the remaining products will be taxed at the standard rate of 18%. To clarify the size of the rate, you should check the foreign economic activity classifier, which indicates all exceptions to the rules.

Didn't find the answer to your question? Call hotline 8. It's free.

Vyacheslav Sadchikov Lawyer. Practice in real estate, labor law, family law, consumer protection Subscribe to us in Yandex Zen

Seller's risks: owes to the budget

For the seller, despite the fact that he calculated the tax payable to the budget correctly in the declaration, inspectors will try to charge additional VAT to the amount indicated in the invoice. In such cases, tax authorities refer to paragraph 5 of Article 173 of the Tax Code. This paragraph establishes an exhaustive list of cases in which it is necessary to transfer VAT to the budget in excess of that provided by law. Non-payers of this tax and those who are exempt from payer obligations under Article 145 of the Tax Code, as well as payers for non-taxable transactions, are required to pay the VAT voluntarily allocated in the invoice. And although this paragraph does not apply to invoices issued by VAT payers for taxable transactions, the courts sometimes take the side of the tax authorities.

Thus, the Federal Arbitration Court of the Central District decided that “the difference between the tax amounts received from buyers and transferred to the budget is subject to payment to the budget” (resolution dated February 6, 2008 No. A09-8975/06-30-20). When considering a similar dispute, the Federal Arbitration Court of the West Siberian District came to the same conclusion (resolution dated April 17, 2007 No. F04-2265/2007(33421-A03-7)).

There are also court decisions in favor of taxpayers. The Federal Arbitration Court of the Volga-Vyatka District considered it illegal to apply paragraph 5 of Article 173 of the Tax Code in such a case (resolution of December 20, 2006 No. A39-8335/2005A). The Federal Arbitration Court of the Ural District reasoned in exactly the same way (resolution dated August 16, 2006 No. F09-5627/06-S2). The Cassation Court of the West Siberian District, recognizing the inspector's decision as unlawful, relied on the fact that the company, when drawing up the declaration, did not violate the procedure for calculating tax, therefore the obligation to pay it was fulfilled in full. Issuing an invoice with a VAT amount exceeding that paid to the budget is not the basis for its additional assessment (Resolution of July 28, 2007 No. F04-5206/2004 (A46-3250-32)). In another ruling (dated September 17, 2008 No. Ф04-5554/2008(11392-А46-14)), the same court referred to the definition of tax in Article 8 of the Tax Code. Based on it, the arbitrators decided that there are no rules in tax legislation obliging those who presented buyers with a larger amount of VAT than established by law to transfer to the budget the difference between the amount of tax actually received and the amount subject to calculation in accordance with Chapter 21 of the Tax Code. code.

As additional arguments in his defense, the seller can point out that the Tax Code (Article 166) requires that VAT payable to the budget be calculated based on the tax base, and not on invoices issued to buyers.

Topic: VAT 18 or 18/118

Quick transition Accounting and Taxation Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries