Answer:

Failure to fill out or incorrectly fill out columns 10, 10a, 11 of the invoice cannot serve as the only basis for refusal to refund VAT amounts presented by the buyer of imported goods. Therefore, if the seller of goods issues an invoice without reflecting data on the country (countries) of origin of the goods, as well as the number (numbers) of customs declarations, the buyer should not be denied VAT deduction on this invoice. In addition, the law does not provide for any liability for these actions of the seller.

General Audit Department on the issue of filling out columns 10-11 of the invoice

Answer In accordance with subparagraphs 13 and 14 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation, the invoice issued for the sale of goods (work, services), transfer of property rights must indicate, including: the country of origin of the goods, the customs declaration number.

At the same time, in the last paragraph of paragraph 5 of Article 169 of the Tax Code of the Russian Federation, the information provided for in subparagraphs 13 and 14 of this paragraph is indicated in relation to goods whose country of origin is not the Russian Federation. The taxpayer selling the specified goods is responsible only for the compliance of the specified information in the invoices presented to him with the information contained in the invoices and shipping documents received by him.

Therefore, column 11 of the invoice when selling imported goods must be completed.

A similar opinion is contained in the Letter of the Ministry of Finance of the Russian Federation dated 04/07/17 No. 03-07-09/20667:

“The Department of Tax and Customs Policy reviewed the letter on the issue of filling out column 11 “Customs Declaration Number” of the invoice when selling goods imported into the Russian Federation and subjected to secondary packaging in the Russian Federation on the territory of the Russian Federation, and reports.

In accordance with subparagraphs 13 and 14 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), invoices issued for the sale of goods must indicate the country of origin of the goods and the number of the customs declaration in respect of goods whose country of origin is not the territory Russian Federation.

According to paragraph 1 of Article 58 of the Customs Code of the Customs Union, the country of origin of goods is considered to be the country in which the goods were completely produced or subjected to sufficient processing (processing) in accordance with the criteria established by the customs legislation of the Customs Union. Moreover, in accordance with paragraph 4 of the Rules for determining the country of origin of goods, which are an integral part of the Agreement between the Government of the Russian Federation, the Government of the Republic of Belarus and the Government of the Republic of Kazakhstan dated January 25, 2008 “On uniform rules for determining the country of origin of goods”, the goods are considered to originate from this country, if as a result of operations for processing or manufacturing a product, a change in the classification code of the product according to the Unified Commodity Nomenclature for Foreign Economic Activity occurred at the level of any of the first four digits.

Thus, when selling goods previously imported into the territory of the Russian Federation and subjected to secondary packaging, as a result of which the country of origin of the goods has not changed, the taxpayer, when filling out the invoice, should indicate the data of the customs declaration in column 11

, under which the goods were imported into the Russian Federation."

In accordance with paragraph 2 of Article 169 of the Tax Code of the Russian Federation, invoices are the basis for accepting tax amounts presented to the buyer by the seller for deduction when the requirements established by paragraphs 5, 5.1 and 6 of this article are met. An adjustment invoice issued by the seller to the buyer of goods (work, services), property rights when the cost of shipped goods (work performed, services rendered), transferred property rights changes downward, including in the event of a decrease in price (tariff) and (or ) a decrease in the quantity (volume) of goods shipped (work performed, services rendered), transferred property rights, is the basis for the seller of goods (work, services), property rights to accept tax amounts for deduction when fulfilling the requirements established by paragraphs 5.2 and 6 of this article.

Errors in invoices and adjustment invoices that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their value, as well as tax The rate and amount of tax presented to the buyer are not grounds for refusing to accept tax amounts for deduction.

Failure to comply with the requirements for the invoice, not provided for in paragraphs 5 and 6 of this article, cannot be grounds for refusal to accept for deduction the tax amounts presented by the seller. Failure to comply with the requirements not provided for in paragraphs 5.2 and 6 of this article for an adjustment invoice issued by the seller to the buyer of goods (work, services), property rights when the cost of shipped goods (work performed, services rendered) changes in the direction of decrease, including including in the case of a decrease in price (tariff) and (or) a decrease in the quantity (volume) of goods shipped (work performed, services rendered), transferred property rights, cannot be a basis for refusal to allow the seller to deduct the amount of tax.

Thus, since the lack of information in columns 10 and 11 of the invoice cannot prevent the tax authorities from identifying the seller, buyer, name of goods (work, services), their cost, as well as the tax rate and amount of tax, this fact cannot serve as a basis to refuse VAT deduction.

This opinion is confirmed in the Letter of the Ministry of Finance of the Russian Federation dated 02.18.11 No. 03-07-09/06:

“According to paragraph 2 of Art. 169 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), invoices are the basis for accepting the amounts of value added tax presented to the buyer by the seller for deduction when the requirements established by clauses 5, 5.1 and 6 of this article are met. Based on paragraphs. 13 and 14 paragraph 5 art. 169 of the Code, the mandatory details of an invoice are the country of origin of the goods and the customs declaration number.

At the same time, in accordance with paragraph. 2 p. 2 art. 169 of the Code, errors in invoices that do not prevent the tax authorities from identifying the seller, buyer of goods (work, services, property rights), the name of the goods (work, services, property rights), their cost, as well as the tax rate and amount when conducting a tax audit tax presented to the buyer are not grounds for refusal to accept tax amounts for deduction.

Thus, if column 11 “Customs declaration number” of the invoice contains incomplete information about the customs declaration number (there is no serial number of the goods from column 32 of the main or additional sheet of the customs declaration or from the list of goods (if when declaring, instead of additional sheets, list of goods)) and such an invoice does not prevent the tax authorities from identifying

the seller, the buyer of the goods, the name of the goods, their value, as well as the tax rate and the amount of tax presented to the buyer, then such an invoice

is not a basis for refusing to accept tax amounts for deduction

.”

A similar opinion is contained in the Resolution of the Eighth Arbitration Court of Appeal dated 02/09/16 No. 08AP-13789/2015 in case No. A70-5889/2015:

“At the same time, the tax authority’s arguments about violation of the requirements of Decree of the Government of the Russian Federation of December 26, 2011 N 1137 “On forms and rules for filling out (maintaining) documents used in calculations of value added tax” due to non-indication in the issued invoices for the goods of the country of origin of the goods - China (in column 10 “Country of origin” of the invoices “RF” is indicated, column 11 “Cargo customs declaration number” is not filled in), were rightfully rejected by the court of first instance due to the following.

In accordance with subparagraphs 13 and 14 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation, the invoice must contain information about the country of origin of the goods and the customs declaration number. This information is indicated in relation to goods whose country of origin is not the Russian Federation. The taxpayer selling the specified goods is responsible only for the compliance of the specified information in the invoices presented to him with the information contained in the invoices and shipping documents received by him.

Federal Law dated December 17, 2009 N 318-FZ in the Tax Code of the Russian Federation establishes a direct rule prohibiting tax authorities from refusing VAT deductions on formal grounds

: paragraph 2 of Article 169 of the Tax Code of the Russian Federation has been supplemented with a paragraph according to which errors in invoices that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights during a tax audit , their cost, as well as the tax rate and the amount of tax presented to the buyer, are not grounds for refusing to accept tax amounts for deduction.

Taking into account the above, the appellate court supports the conclusion of the first instance court that the case file contains sufficient evidence confirming the reality of the business transactions carried out between the applicant and the specified counterparty.”

The Resolution of the Arbitration Court of the Moscow District dated 06.06.16 No. F05-7118/2016 in case No. A40-112900/2015[1] states:

“Also, the courts indicated that judicial practice proceeds from the fact that an incorrect customs declaration number indicated in the invoice cannot serve as a basis for refusal to deduct VAT if an imported product is purchased on the domestic market from a Russian supplier and the customs declaration number is in the invoice indicated with an error."

The decision in favor of the tax authorities is contained in the Resolution of the Arbitration Court of the Volga-Vyatka District dated 02.19.16 No. F01-6045/2015 in case No. A43-29967/2014:

“An invoice is a document that serves as the basis for accepting the presented amounts of tax for deduction or reimbursement in the manner prescribed by Chapter 21 (clause 1 of Article 169) of the Code.

Invoices drawn up and issued in violation of the procedure established by paragraphs 5 and 6 of this article cannot be the basis for accepting tax amounts presented to the buyer by the seller for deduction or reimbursement (clause 2 of Article 169 of the Code).

Thus, in order to apply a deduction for value added tax, it is necessary that the transaction be of a real nature, and the documents confirming the legality of applying tax deductions contain reliable information about the participants in business transactions.

<�…>

A number of invoices issued on behalf of Dales LLC and TD Dales LLC contain the numbers of cargo customs declarations according to which the goods were imported in later periods. Thus, invoices dated February and May 2011 contain details of the cargo customs declaration registered in November 2011, and invoices dated September 2011 contain a link to the cargo customs declaration registered in May 2012.”

In this Resolution, the indication of an incorrect customs declaration number served as one of the arguments of the tax authority. However, as in the above-mentioned Resolution, the essence of the claims was the unreality of business transactions. In addition, indicating an incorrect customs declaration number is not the only violation of the procedure for filling out invoices: they were signed by unauthorized persons.

Summarizing the above, an invoice with blank columns 10 and 11 may serve as the basis for claims by the tax authorities. However, taking into account the norm of paragraph 2 of Article 169 of the Tax Code of the Russian Federation, the official explanation of the Ministry of Finance of the Russian Federation and judicial practice, the Organization has a high chance of defending its position in court, provided that due diligence is exercised when choosing a counterparty.

In addition to the above, we draw your attention to the fact that when selling goods imported into the Russian Federation from the countries of the Customs Union, dashes should be entered in columns 10 and 11 of the invoice[2]

.

Also, one of the reasons for not filling out these columns may be the purchase by the supplier of goods from a counterparty that is not a VAT payer. In this case, the supplier should put dashes in these columns [3]

.

College of Tax Consultants, May 30, 2021

[1] Despite the fact that the court decision was made in favor of the tax authority, it is necessary to take into account the fact that the error in column 11 of the invoice was not the main complaint of the tax authorities: they questioned the very reality of business transactions

[2] Letter of the Ministry of Finance of the Russian Federation dated July 25, 2012 No. 03-07-13/01-43

[3] Letter of the Ministry of Finance of Russia dated 08.20.15 No. 03-07-08/48092

Answers to the most interesting questions on our telegram channel knk_audit

Back to section

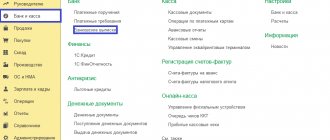

Line 8 in the invoice from July 1, 2017

By Decree of the Government of the Russian Federation dated May 25, 2017 No. 625, changes were made to the forms of invoices and adjustment invoices. The amendments provide that from July 1, 2021, the invoice form is supplemented with line 8 “Identifier of the government contract, agreement (agreement).” The adjustment invoice, in turn, from July 1, 2021 is supplemented with a new line 5 with the same name.

Starting from July 1, 2021, the new line will require the identification of the state contract for the supply of goods (performance of work, provision of services), contract (agreement) on the provision of subsidies from the federal budget to a legal entity, budget investments, contributions to the authorized capital.

It was necessary to make changes to the invoice form due to the entry into force of Federal Law No. 56-FZ dated 04/03/2017, which expanded the scope of information that must be indicated in the invoice issued for the sale of goods (work, services), transfer of property right Here is a sample of the new invoice effective July 1, 2021 in Excel format.

You can also create a new form for an adjustment invoice, valid from July 1, in Excel format.

Conclusion

From July 1, 2021, when selling goods (work, services) under government orders, suppliers will be required to indicate the identifier of the government contract, agreement (agreement) in invoices. New requirements are established by Federal Law dated April 3, 2017 No. 56-FZ. However, the forms of the invoice and adjustment invoice have not changed. They will still need to be exhibited in the forms established by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Introduction to Invoices

Attention! As of October 1, 2021, the invoice form has changed again. New forms of the invoice journal, sales and purchase books have also been introduced. You can download the new document forms in the article “Changes to VAT from October 1, 2021.”

An invoice is the basis for the buyer to accept the VAT amounts presented by the seller for deduction (reimbursement) (Clause 1 of Article 169 of the Tax Code of the Russian Federation). An invoice is required to be issued for each sale of goods, work, services or property rights. Invoices can be issued on paper or in electronic format.

The invoice form and the rules for filling it out are approved in Appendix 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. This form is used when drawing up an invoice form “on paper”.

Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 approved the current forms and Rules for filling out (maintaining) the following documents used in VAT calculations:

- invoices (Appendix No. 1);

- adjustment invoice (Appendix No. 2);

- log of received and issued invoices (Appendix No. 3);

- purchase books (Appendix No. 4);

- sales books (Appendix No. 5).

The seller can also send invoices to buyers electronically (if the buyer agrees). However, the means by which the seller and buyer receive, exchange and process invoices electronically must be compatible. They must comply with the established formats (paragraph 2, paragraph 1, article 169 of the Tax Code of the Russian Federation).

When are adjustment invoices issued?

The Tax Code of the Russian Federation establishes the obligation to issue adjustment invoices (paragraph 3, clause 3, article 168 of the Tax Code of the Russian Federation). Sellers of goods (work, services) issue such invoices in the event of an adjustment to the cost of goods shipped (work performed, services rendered) or transferred property rights. This can happen when, for example, prices or quantity (volume) of goods (work, services), property rights change.