Bookmarked: 0

Individual entrepreneurship is the most common form of business organization. For an individual who does not have a special education, relatively simple management and tax accounting is offered, as well as a more favorable payment regime. The question remains open: how can an individual entrepreneur use the profit? To clarify all the nuances, it is important to clearly distinguish between the basic concepts. For example, what is the revenue, income and profit of an individual entrepreneur in a year.

Distribution of net profit of individual entrepreneurs

The profits and losses of a limited partnership are distributed among its participants in proportion to their shares in the share capital, unless otherwise provided by the constituent agreement or other agreement of the participants. An agreement to exclude any of the partnership participants from participating in profits or losses is not permitted.

The income of an entrepreneur is considered to be all funds received both in cash and in kind from the sale of goods, works, services, both self-produced and purchased, the sale of property (including securities) and property rights (income from sales).

Various aspects of production, sales, supply and financial activities receive a complete monetary assessment in the system of financial performance indicators.

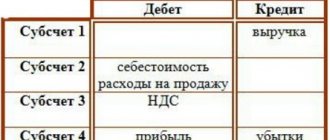

The distribution of profits and losses is carried out in the accounting documentation under account 99. The uncovered loss, like profit, is shown at the end of each reporting period. The financial result is transferred to account 84, which shows the actual loss or profit of the LLC. Opening an individual entrepreneur, compared to other forms of enterprise ownership, is significantly simplified: there is no need for lengthy legal red tape or significant capital investments. But a number of actions will still have to be done.

IP costs that can be classified as expenses

Participants in general partnerships can only be individual entrepreneurs and (or) commercial organizations.

Consequently, no entries are made in account 80 “Authorized capital” or in account 75 “Settlements with founders” in connection with this transaction in the company’s accounting records.

The legislator regulates the distribution of profits in terms of tax revenues to budgets. Determining other areas for spending the remaining part of the profit is the prerogative of the company. The procedure for the distribution and use of profits is necessarily recorded in the constituent documents and approved by the head of the company.

It is important to remember that some activities are carried out under specific tax schemes. Therefore, all questions should be clarified before registering a business.

Tax payment system

When an entrepreneur uses the general system, he is required to pay certain taxes. For example: VAT and 13% personal income tax. It is also necessary to pay for the individual entrepreneur’s property, transport, and land resources. The simplified scheme includes filing the necessary declarations and paying tax according to the rates: 15% and 6% of income. Such a system has a number of advantages.

Under the simplified tax system, taxpayers' income is exempt from collection:

- VAT.

- Personal income tax.

- Property tax if the business did not use transport or land.

In addition, under the simplified tax system, tax is calculated subject to the presence of actual income. This rule does not apply if the entrepreneur is on OSNO. The collection is not made in case of business suspension and lack of income. For example, when trade or the provision of any services was stopped.

Using UTII per year, a businessman must pay tax at a rate of 15%. Imputed income is calculated according to the approximate revenue from a specific type of activity. The patent type includes payment of 6% of the amount of probable income for the year. The annual amount for a business located on UTII is calculated taking into account the specifics of the region and type of activity.

Since the tax when using UTII and a patent is calculated taking into account future income, it must be paid under any circumstances, even if the business stops during the reporting period . Timely contributions to the tax service and submission of quarterly and annual reports will avoid penalties or freezing of accounts.

How is the profit of an individual entrepreneur distributed between him and three individuals?

The Accounting Book (Section I of the Accounting Book) reflects all income received by individual entrepreneurs from carrying out entrepreneurial activities, without reducing them by tax deductions provided for by the tax legislation of the Russian Federation.

The charter of Dom LLC states that profits are distributed equally between the participants. According to the decision of the meeting dated March 28, 2018, the net profit for 2021 is in the amount of 900,000 rubles. subject to distribution among participants. Not the last place in the formation of profit is played by the innovative activity of the enterprise. It ensures the renewal of manufactured competitive products, growth in sales volumes and, accordingly, profits.

Most often, this form of cooperation between an individual entrepreneur and an individual occurs between close relatives. Unfamiliar people are unlikely to decide to engage in this form of business.

Income or profit

Income is the amount by which the company's capital increases . In this case, the contributions of the founders are not taken into account. Increasing net income is the main goal of an entrepreneur. The net profit of an individual entrepreneur is determined by subtracting all possible costs from the total (gross) profit.

These include:

- possible fines;

- taxes on personal income persons;

- interest on loans.

What taxes an entrepreneur must pay directly depends on the taxation system he chooses.

The Russian Federation provides a wide range of possible options:

- OSNO – general type of taxation.

- USN is a simplified scheme.

- UTII is a single tax on imputed income.

- Unified agricultural tax - for agricultural activities.

- Patent.

Does the individual entrepreneur pay income tax? No. Obligatory payers are legal entities. In turn, entrepreneurs make personal income tax contributions. At the same time, a profit declaration for individual entrepreneurs is not filed only with the patent option of paying taxes, since the entrepreneur provides all the indicators required to determine its size when submitting an application. In other cases, the income statement of an individual entrepreneur depends on the chosen taxation method.

On video: Profit in retail trade (Assortment management)

Distribution and use of enterprise profits

Selecting in the OKVED directory the code of the activity you plan to engage in. It will need to be indicated in the application.

To the extent that it exceeds the proportional share of participation in the authorized capital, dividends are recognized as another source of income.

The result of the company's activities for a certain period is the profit received. We will tell you in this publication how the formation, distribution and use of profit occurs, diversifying the general information with specific examples.

To the extent that it exceeds the proportional share of participation in the authorized capital, dividends are recognized as another source of income.

Profit is generated from various sources, the main of which is sales volume, defined as the difference between sales income and the accompanying costs. The amount of profit depends on:

- sales volume;

- product price levels;

- correspondence of the level of costs to the costs incurred.

The cost of acquired material resources is included in the expenses of the tax period in which income from the sale of goods, performance of work, and provision of services was actually received.

Profit as the main incentive for entrepreneurial activity meets the needs of the enterprise itself and the state as a whole. Therefore, it is important to determine not only the composition of the entrepreneur’s profit, but also to reveal the mechanism of its formation.

The cost of goods sold, work performed and services rendered is reflected taking into account the actual costs of their acquisition, implementation, provision and sale.

Profit or loss cannot be determined until the company pays all tax obligations and records full payment of the authorized capital. A decision on the distribution of profits cannot be made if, as a result, the organization has bankrupt status or the distribution of profits will lead it to this.

In your situation, you should conclude a multilateral Agreement on cooperation (joint activities).

Still have questions? Ask them to our lawyer for FREE!

Phys. persons registered in accordance with the procedure established by law and carrying out entrepreneurial activities without forming a legal entity. Another important issue is the distribution of individual entrepreneurs’ profits. It is important to know exactly what part of the profit needs to be allocated to business development, what is desirable, and what can be withdrawn from circulation and spent on your own needs. Underfunding, as well as ineffective investments, is a frequent problem, so you should approach the distribution of profits very carefully.

To prevent this from happening, loan agreements are usually drawn up. Those participants who contributed to the development of the company apply for a loan for the contributed share in relation to the individual entrepreneur himself. The profit received by the company is distributed among all participants in proportion to their contributions.

Skills and knowledge (do you know the algorithms for preparing accounting entries or are you well versed in vehicle repairs?

Which tax system should you choose?

Depending on what condition of income distribution is specified in the agreement between the allies, profits can be divided equally or within specified limits.

Withdraws cash from the current account through the cash desk at the bank. In this case, you must indicate in the purpose of the payment that the money is withdrawn for personal needs.

Thus, income in the form of dividends received by an individual entrepreneur as a participant in an LLC will be subject to personal income tax at a tax rate of 9% (clause 4 of Article 224 of the Tax Code of the Russian Federation) if he is a tax resident of Russia, or at a rate of 15% if he is not recognized as a tax resident of the Russian Federation (clause 3 of Article 224 of the Tax Code of the Russian Federation).

To avoid problems, it is better not to withdraw large sums and try to pay expenses by card, as well as provide the bank with clarifications and documents in a timely manner, if necessary.

conclusions

Managing the profits of an individual entrepreneur is simple - you can spend everything in the account for any needs: business and personal. You just need to make sure that there is money left for payments to suppliers, the budget and staff. If there is no money left, you will have to pay from your personal money.

There is no need to ask someone’s permission, to account for the money spent, and to pay tax on the money withdrawn a second time.

It is advisable to spend money non-cash, and withdraw cash only in case of emergency. Cash transactions may result in account blocking if the bank becomes suspicious.

Enterprise profit distribution

The issue of paying dividends from previous years also remained controversial for a long time. Until 2002, the Ministry of Finance was of the opinion that the company did not have a legal obligation to distribute the profits of previous years, therefore the transaction on the distribution of income was void.

The concept of dividends is applicable to legal entities and, accordingly, taxation provided for by the provisions of the Tax Code is also applicable to legal entities.

The law does not require an individual entrepreneur to have any fixed amount to start a business; entrepreneurship does not officially require initial funds. But business always involves some costs, and you will definitely have to invest. The capital of an individual entrepreneur, however, remains at his discretion.

It follows that an individual entrepreneur is not a legal entity and does not form an authorized capital to carry out entrepreneurial activities.

Your income is taxed once depending on the regime: personal income tax, simplified tax system, PSN, UTII or Unified Agricultural Tax. You do not need to pay any additional taxes on the funds you withdraw from your account. There is no need to deposit funds withdrawn for personal needs into KUDiR, because this is not an expense.

The partnership is liable for its obligations with all its property. If the company's property is insufficient, the creditor has the right to make a claim against any general partner or all of them at once to fulfill the obligation.

Shareholders bear the risk of losses associated with the company's activities within the limits of the value of the shares they own.

Each set of documents is prepared strictly in accordance with the current legislation of the Russian Federation and, before being submitted to the Federal Tax Service for registration, undergoes a very high-quality check by a lawyer.

Expenses on material resources purchased for future use, or used for the manufacture of goods (performance of work, provision of services), not sold in the tax period, and also not fully used in the reporting tax period, are taken into account when receiving income from sales in subsequent tax periods.

The goal of any business activity is to make a profit. The totality of profit and interest received from its use forms the finances of the individual entrepreneur.

Revenue

Revenue is the funds that a business entity receives for the sale of goods or services provided . Often this term refers to real money received by the seller and placed in the cash register.

When a buyer purchases products with deferred payment, then the money will arrive at the cash register a little later. In this case, income is taken into account upon enrollment. Money is considered credited from the moment the sales agreement is signed. Thus, the daily income increases by the full cost of the goods, and not by the amount of the credited advance.

In addition, revenue can be gross or net . The first includes the entire amount of funds received during payment. Net revenue involves the money remaining in the hands of the individual entrepreneur after paying taxes, excise taxes and duties.