Cash register and cash register - what are the differences?

What a cash register is, as a machine, that is, a cash register, is clear to everyone. As for the operating cash desk, it can be thought of as a virtual wallet of an organization (IP), which contains cash. Unlike cash registers, such a wallet reflects changes in funds not only due to sales, but also from other transactions. For example:

- operation 1 - funds withdrawn from a bank account for business needs - this is a receipt from the operating cash desk;

- operation 2 - amounts were issued to employees for reporting - this is an expense for the operating cash desk.

Moreover, neither the first nor the second operations have anything to do with CCT. The money is received by the accountant at the bank and goes into the safe. From there they are issued to employees for reporting.

The purpose of the cash register is to record changes in revenue, that is, income from the sale of goods and expenses when they are returned, as well as to issue a cash receipt. Modern cash registers are also required to transmit data to the Federal Tax Service via the Internet.

In contrast, the operating cash desk as a set of cash reflects changes in funds as a result of not only sales, but also other transactions. Thus, operating cash is a broader concept than cash register, and the use of a cash register is one of the elements of cash accounting. Such records are also maintained by those retail outlets that do not use cash registers.

How to register in Yandex.Checkout?

Before connecting, create an account on Yandex and prepare your TIN. After that, connect to the service in the following way:

- Go to the registration page on the official website.

- Fill out your contact information. Typically, information is automatically copied from your account.

- When filling out the data, indicate the country of registration of the organization. If it is not on the lists, then you cannot register.

- At the next stage, select who you are registering as – individual entrepreneur, organization or self-employed.

Depending on how the previous paragraph is completed, registration will occur.

Method for legal entities or individual entrepreneurs:

- Enter company information and Taxpayer Identification Number.

- Click the “Register” button.

After this, log into your personal account and fill out a form to receive and sign an agreement, and also make technical settings. If the company is located abroad, then contact the manager to clarify the list of documents.

Registration method for self-employed:

- Apply through the website to register as self-employed.

- Wait for your application to be approved, then follow the link you receive and enter your TIN.

- Click on the “Get personal account” button.

- Fill out the form that appears, print it and sign. After that, scan the document, upload it to the page and send.

- Wait for the notification about the creation of your personal account.

Cash accounting

There are two types of cash accounting - basic and simplified. Basic accounting involves the preparation of the following documents:

- Receipt cash order - is issued when funds are received at the cash desk.

- Expenditure cash order - when issuing cash.

- Cash book - it reflects all transactions in which PKOs and RKOs are issued.

- Advance reports - are compiled by employees to report on the amounts that were issued to them for reporting.

- Documents used to make cash payments to employees:

- settlement and payment form T-49;

- payroll T-53.

There is also the concept of a cash limit, that is, the maximum amount of cash that can be in the cash register. The limit is calculated in accordance with the procedure established by the Central Bank of the Russian Federation and is fixed by an internal document, for example, an order. It can only be violated when the funds in the cash register are intended to be issued to individuals.

Features of simplified accounting

From June 1, 2014, small businesses and individual entrepreneurs can use simplified cash accounting. It implies the abandonment of incoming and outgoing cash orders and a cash book. There is also no need to set a cash limit. Thus, entities accepting simplified cash accounting are required to draw up only payment and settlement form No. T-49 and statement No. T-53.

Cash limit at the till

The Accounting Law limits the amount of cash that can be stored on the trading floor after the end of the working day (Instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U, as amended on June 19, 2017).

The amount in excess of the limit is handed over to the bank. Companies and individual entrepreneurs set their own limit on the balance of money in the cash register. There are no restrictions, so it can be any convenient amount. It is important to follow two rules:

- The limit is indicated in an administrative document, most often this is an order from the director. The order is presented to all employees who work with money under signature.

- There are exceptions when the limit can be exceeded: for example, on days when salaries or benefits are issued. But such intervals should not exceed 5 working days.

For violation of these requirements, fines of up to 5 thousand rubles are possible for individual entrepreneurs and employees and up to 50 thousand rubles for legal entities.

Important! Small businesses and entrepreneurs can use a simplified method of cash accounting. This applies to companies and individual entrepreneurs with revenues of up to 800 million rubles per year and a staff of up to 100 employees. In their authorized capital, municipalities, foundations and public organizations participate no more than 25%, and foreign companies - no more than 49%.

Accounting for transactions carried out through cash registers

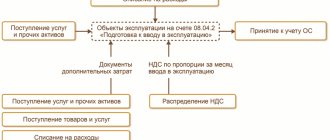

Cash transactions, that is, settlements with customers, are also documented. And this is not only a fiscal document - a cash receipt, but also PKO, RKO and some types of reports. Previously, there were much more of them, but with the introduction of online cash registers, this number has decreased significantly. A total of 9 reports were canceled, including the journal and certificate-report of the cashier-operator, the act of checking cash, as well as some other acts and journals. The information that was transmitted in these reports is now received automatically from online cash registers.

A cash receipt order can be generated electronically. This is done automatically based on sales data that is stored in the online cash register on the fiscal drive (FN). This data is generated in the form of a cash receipt, as well as reports on registering the device with the Federal Tax Service (or changing information about the cash register), opening and closing a shift, current payments and closing the Federal Tax Service. To do this, the cash register must be integrated with an accounting system or service.

A cash receipt order can also be drawn up electronically.

There are two types of expense transactions:

- Issuing money from the cash register to an employee of the organization.

- Refund to the buyer.

In the first case, the cash receipt is not processed and no data is transmitted to the Federal Tax Service. But it is necessary to indicate the reason for issuing funds, for example, salary or cash payment to the supplier for goods/services.

The case of returning money to the buyer is more complicated. There are several possible options here.

- The buyer purchased the item for cash and returned it the same day. In this case, the money is returned to the buyer from the cash register, the cashier punches the check with the calculation sign “return of receipt”, and the transaction data is immediately sent to the Federal Tax Service.

- The buyer bought the item for cash and returns it another day. The cashier must find the required shift in the cash register memory for the last 14 days, find the receipt issued when selling this product and return the receipt. The funds are returned to the buyer from the cash register, and a check with the sign “return of receipt” is sent to the Federal Tax Service.

- The purchase was paid for by credit card, and the refund will be made to it. This situation is somewhat more complicated, since not all terminals can make a refund automatically. In this case, everything is done in several stages:

- an application for return is drawn up, and on its basis - a cash receipt order;

- a payment order is drawn up based on the RKO data;

- according to the payment order, the money is returned to the buyer’s account from the seller’s current account or from his cash (in this case, cash means not the cash register cash drawer, but the operating cash desk, for example, cash in a safe).

How to use Yandex.Checkout?

Yandex.Checkout opens up many options for customers to use the service. In your personal account, configure basic and additional functions (they can be disabled if desired):

- Automatic payment and data linking. This will make it easier to pay when you return to the store.

- Payments to clients. You will need to enter into an additional agreement and obtain an API. From a special wallet account, you will be able to make simultaneous payments to different accounts.

- Invoicing. At the same time, you can send a form for paying bills via instant messengers, SMS or email.

- Payment by QR code. The code is installed on the website, the client reads it using a smartphone and goes to the payment page.

- Deferred payment. The money is frozen and debited from the buyer's account after receiving the goods.

- Payment on credit or in installments. You need to enter into an agreement with the Yandex.Money partner “Credit Line”. This is a microcredit company. Customer lending conditions are negotiated individually with the store.

Important. In your personal account, you can set up a special form for foreign clients.

This will allow you to receive payment not only in rubles, but also in some foreign currencies: tenge, Belarusian rubles, US dollars, Chinese yuan, euros. Money will be credited to your account in rubles at the exchange rate on the day of payment.

How to connect Yandex.Kassa to the site?

After registering with the service, fill out the form and sign a service agreement. All interactions take place through your personal account based on the documents provided.

The organization questionnaire contains several items. Their number may vary depending on the data provided. While the section is not filled out, the check mark next to it remains gray; when the information is entered completely, the check mark turns green.

The first section is called " General Information ". Choose whether payments will be accepted on the site or without it. If on a website, please indicate its address. If without a website, a list of options will appear, where you can mark the appropriate one. Next, fill out the legal information about the organization. After entering the information, click the “Save” button.

The next section is “ Contact Information ”. Enter your contact information here. The information you provided during registration will be copied, but change it at this stage if necessary.

Next, fill out the “ State registration ” section. Information about the actual and legal address of the company entered at the time of registration will be automatically copied here.

In the “ Bank Account ” section, fill in the bank’s BIC, followed by the bank’s name and other information automatically appearing. Enter the company current account manually.

The last section is “ Data of the head of the organization .” Enter the information exactly as in your passport. Do not forget to uncheck the o box if this function is assigned to another person.

After filling out the form, attach the necessary documents: a scan of two pages of your passport without additional marks. Also attach a scan of the license, if available, and a scan of the passport of the authorized employee who replaces the director (if there is one).

Make sure that all sections have green checkmarks and submit the form for verification. The verification result will appear in your personal account in 1-3 days.

The next stage of connection is filling out an application, which is also a contract. Once completed, print the document and sign it. After that, take a scan and upload it to your personal account. The application will be filled out automatically based on the previously entered data. After 1-3 business days, 2 new sections will appear in your personal account: “Agreement” and “Organization”.

After this, you need to perform technical settings. This may require the help of a specialist, but is not necessary. Try to make the settings yourself using the instructions posted in your personal account. For companies located abroad, the manager will send technical instructions upon request.

To have a payment button appear on your website, insert a payment form, which you can request from the manager or create yourself. Parameters and templates are presented on the website, in your personal account in the “Settings” parameters.

Instructions have also been developed for installing the payment module and software interface, which can be downloaded from the Yandex.Checkout website.

Login to your Yandex.Checkout personal account

To enter your personal account, click on the appropriate button on the website. After this, enter your username and password in the fields that appear. They are linked to the mobile phone specified during registration.

In your personal account, you configure the payment system interface and enable and disable various functions.

This section displays all information from all trading platforms connected to the service.

How to receive payment through Yandex.Cash? Setting up payment methods

Choose one of two payment options:

- through the payment button, where payment options are copied;

- in the traditional way, when the payer immediately sees the payment method (bank card, Internet banking, e-wallet).

The buyer will select the goods and proceed to payment. First, he will see the most popular payment options, but can choose any convenient one, after which he will enter the data and confirm the payment. Then he and the store receive information about the completed purchase.

To add a new payment method to the site, write to the manager and indicate which payment option is required. The manager will change the settings, and the method will appear in the list of available options.

If the site uses more than one payment button, and the buyer sees different payment buttons, then a new option is added manually.

The method for adding a new payment type depends on the type of connection:

- API: via the Yandex API. Money".

- HTTP protocol: by adding a button to the site code.

- Payment module: by updating the module and adding a new payment option.

- E-mail protocol: via a letter to the manager, who will change the settings.

How to issue an invoice?

In the case when the buyer wants to pay the invoice, the generated document can be obtained through his personal account. To do this, go to the section with products and prices and send an invoice to the buyer by email, link via SMS, chat, etc.

If the client does not pay the invoice and leaves it without consideration, cancel it or set a final payment date, after which the possibility of payment will disappear.

How to make a refund?

If the payment has been made, please return it in your personal account. In addition, you can use the automatic returns function or issue each of them as a separate payment order.

Returns can be made by the store owner or administrator. To do this, they must have access to a registered phone number where SMS messages will be sent.

Both full amounts and parts thereof are subject to refund, but not all payments made can be returned. Restrictions are described in the list of payment methods.

Submit your return in one of two ways:

- Through the "Payment History" section. Select the desired operation and find the “Return” arrow next to it. Please indicate the required amount and reason for the return. Confirm the procedure and enter the code received in SMS. To send the return, click the “Next” button. If the transaction is successful, the payment status will change to “Refund” or “Partial Refund”.

- Through the "Returns" section. Only full refunds are processed here. In the “Operations” section, click “Make a return” and fill out the form that appears. Confirm the operation and enter the verification code received on your registered phone.

- Wait for the “Refund” payment status to appear.

If an error occurs during registration and the operation does not take place, the payment status will not change and an error message will appear.

How to withdraw money?

Money from customers for purchases goes to Yandex.Checkout. According to the terms of the agreement, on the next business day they are credited to the account opened by the organization in the bank. There is no need to send any additional withdrawal requests.

Important. Please note that not the entire amount will be received, since the system takes its own commission.

A payment register will be sent to the email address from Yandex.Checkout, which will indicate the number of transactions and the amount of each of them. At the end of the month, a certificate of service provision for the entire period is sent.

The procedure for sales on credit

Selling on credit is beneficial to both customers and the store. Stores offering goods in installments or on credit, according to analysts, increase not only the percentage of sales, but also the percentage of customer returns. Buyers, in turn, receive the following benefits:

- Fill out an application for a loan or installment plan in a few minutes.

- Opportunity to purchase more products.

- Interest-free period and early repayment of the loan.

- Any method of loan repayment.

The service is activated on the website in your personal account via the API.

The money arrives the next day, and payment notification comes immediately. Ask your manager about lending conditions that suit your clients.

"Yandex. Kassa is a provider that makes payments via the Internet. By activating the service, the user gains access to all features of the system. Cash management takes place in your personal account, where you can customize the system interface and receive a financial report on all transactions. To register in the system, you will need to fill out a form and conclude an agreement. The service works with individual entrepreneurs, companies and the self-employed population.

The concept of cash, the main tasks of accounting

Modern economics defines money as one of the main attributes of economic activity. Settlements with suppliers for purchased raw materials, purchase of fixed assets, settlements with the budget for taxes and fees, all this and much more involve the use of cash. In addition, money is the most important element in the circulation of funds of an enterprise.

The origin of the concept of "money" refers to the ancient Greek word "donaka", which translates as "copper coin". This concept came into the Russian language from Turkic languages.

Since ancient times, the circulation of goods implied barter relations, that is, the exchange of a certain amount of one product for another. Later, among different nationalities, precious stones, gold, skins, furs, metal, etc. began to act as a general equivalent for the exchange of goods. The first coins appeared in the 7th century BC, and the first paper money in China in 910 AD. e.

The essence of the concept of “money” is revealed in more detail in economic theory and is defined as a measure of value, as a commodity with absolute liquidity.

Within the framework of accounting, this concept is interpreted as follows. Conceptual help!

Cash is the funds of an enterprise accumulated in monetary form, in circulation and used to achieve business goals.

Cash at an enterprise can be in the following forms (types of cash):

- cash:

- cash in the cash register;

- non-cash (cash in bank accounts):

- current accounts;

- foreign currency accounts;

- loan accounts;

- special accounts.

The objectives of cash accounting in an enterprise are as follows:

- Reflection in primary documents of transactions for the receipt and expenditure of funds;

- Generating data on cash flow transactions in synthetic and analytical accounting registers;

- Ensuring the safety of funds, conducting inventories;

- Monitoring the economic feasibility of spending, identifying ways for the most rational use.

What is the penalty for exceeding the cash limit?

In this case, the tax authorities apply the sanctions described below:

- Warning on first offense for small businesses.

- A fine of 4,000–5,000 rubles for an official and 40,000–50,000 rubles for an enterprise. The sanction does not apply to the cashier, but may apply to the chief accountant or the head of the company.

Punishment must follow within two months from the date of excess (Administrative Code of the Russian Federation). If the inspection reveals a violation later than this period, the business entity will not face fines due to the expiration of the statute of limitations.