Home — Consultations

Can I take advantage of a professional tax deduction when working in an organization under a GPC agreement? In what order can I receive this deduction?

Any individual who is a tax resident, but is not an entrepreneur, who receives income (remuneration) from performing work (rendering services) under civil contracts, taxed at a rate of 13% (clauses 3, 4) has the right to apply a professional tax deduction Article 210, paragraph 2 of Article 221 of the Tax Code of the Russian Federation).

Tax residents are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months.

Note. In the issue under consideration, civil law contracts should be understood as contractual relations for the provision of services for a fee (Article 779 of the Civil Code of the Russian Federation), for contracts (Article 702 of the Civil Code of the Russian Federation), for the performance of scientific research work (Article 769 of the Civil Code of the Russian Federation).

The deduction in question can be obtained either from a tax agent or from a tax authority (if there is no tax agent) (paragraphs 5 and 6 of paragraph 3 of Article 221 of the Tax Code of the Russian Federation).

Note. A tax agent can be an organization, an entrepreneur, or a person engaged in private practice. But they become tax agents only if they are a source of income for the taxpayer (clause 1 of Article 226 of the Tax Code of the Russian Federation).

To obtain this deduction, we recommend following the following algorithm.

Types of tax deduction

- Tax deduction for child(ren).

- Social tax deduction for treatment

- Social deduction for expenses on the funded part of the labor pension

- Property deduction when purchasing property, for example when buying an apartment

- Investment deduction in the amount of income from the sale of securities

- Investment deduction in the amount of funds deposited into an individual investment account (IIA)

- Social tax deduction for training expenses

- Social tax deduction for expenses on non-state pension provision and voluntary pension insurance and voluntary life insurance.

- Property deduction when selling property.

- Social tax deduction for charity expenses

- Professional tax deduction.

As you can see, there are many options for how to get a tax deduction. However, it should be noted that in order to receive a tax deduction, a person must be a personal income tax payer.

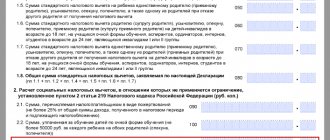

Standard

Such a deduction is provided in accordance with Art. 218 of the Tax Code of the Russian Federation, to the following persons in the amount specified by law:

- 500 rubles - Heroes of the Russian Federation or the USSR, holders of the status of full holder of state awards;

- 1400 - parents of the first and second child (the number of marriages does not matter);

- 3000 - such a significant deduction is provided for the third child and Chernobyl liquidators and disabled people of the Second World War;

- 6,000–12,000 - to legal representatives of disabled children, students of schools and educational institutions, organizations, but only full-time and only up to 24 years of age (parents, and in addition, trustees and guardians).

We invite you to read: Insured event under compulsory motor insurance: what to do for the victim, what cases are covered

An individual entrepreneur who pays personal income tax, according to Article 218 of the Tax Code of the Russian Federation, has the right to count on a reduction in the tax base by the following amounts:

- 500 rubles - if he has the status of Hero of the USSR and the Russian Federation, a full holder of several state awards, etc.;

- 1,400 rubles - for each first and second child (including if children are born in more than one marriage);

- 3000 rubles - deduction for the third and next children, as well as for disabled people of the Second World War and those who participated in the liquidation of the consequences of the Chernobyl accident;

- 6000-12000 rubles - to parents, guardians and trustees of disabled children, students of schools, full-time educational institutions up to 24 years of age.

Brief examples

IP

Tax deduction for the amount of expenses.

For example, individual entrepreneurs on the general taxation system (OSN). May reduce the tax base by the amount of expenses associated with generating income.

Individual entrepreneur received an income of 1,000,000 rubles in a year. At the same time, the expenses associated with generating income amounted to 500,000 rubles. An entrepreneur can reduce the tax base by 500,000. And pay personal income tax only on 500,000 rubles. Or if the tax has already been paid, then apply for a tax deduction.

Tax deduction of 20% of income.

There are cases when an individual entrepreneur, on an OSN, cannot confirm his expenses. In this case, he has the right to a tax deduction in the amount of 20% of the amount of income.

In this case, no documents confirming expenses need to be provided. The tax base will be reduced by 20%. That is, if the income received is 1,000,000 rubles, without providing documents, the tax base will be 800,000 rubles.

There is a small nuance here. An individual entrepreneur on the OSN can apply only one type of tax deduction. It is not possible to apply both deductions simultaneously during the tax period.

Also, it is necessary to note the following: a 20% deduction, without confirmation of expenses, can only be received by individual entrepreneurs. Notaries, lawyers and other persons engaged in private practice, as well as individuals providing services under civil law contracts, without opening an individual entrepreneur. They are not entitled to receive such a deduction.

Individuals without individual entrepreneur status

Suppose a person has a permanent job, and in his free time he provides services. By concluding contracts as an individual (individual). He collects receipts confirming expenses that are associated with generating income. You can see in detail what expenses can be taken into account in the Tax Code of the Russian Federation, Article 252.

Private practice.

A person is engaged in private legal practice. I received income for the year. He can receive a tax deduction in the amount of expenses incurred in obtaining this income.

Royalties.

Let's assume that the author, who has received royalties, cannot confirm the expenses associated with generating income. In this case, he can reduce the tax base by 20%-40%, depending on the type of income.

- When writing a book or script, you can get a 20% deduction.

- There is a 30% deduction for publishing photos.

- For writing music for a play or movie there is a 40% deduction.

Deductions for royalties are described in more detail in paragraph 3 of Art. 221 Tax Code of the Russian Federation.

Simplified receipt of property and investment deductions

What to follow

A simplified procedure for obtaining investment and property tax deductions (for the purchase of housing, payment of interest on a mortgage and the amount of money deposited into IIS) from May 20 (21), 2021, is regulated by a new article. 221.1 Tax Code of the Russian Federation. As for social deductions for training, treatment and voluntary insurance, the rules about them have simply been clarified.

The new procedure applies to deductions, the right to which arose for an individual from January 1, 2020 . That is, the norms of Art. 221.1 of the Tax Code of the Russian Federation have retroactive effect (Federal Law dated April 20, 2021 No. 100-FZ).

Statement

To receive deductions in a simplified manner, you need to submit an application.

The filing deadline is at the end of the tax period (calendar year), no more than 3 years preceding the year of filing the application.

The condition for providing deductions in a simplified manner is that the tax authority has information about the income of an individual and the amounts of tax calculated, withheld and transferred by the tax agent to the budget. These are calculations in Form 6-NDFL and income and tax certificates submitted by the employer(s) for the relevant periods.

To receive a deduction for depositing money into an IIS, the tax authority must have information confirming that the payer has transferred funds to this account. They are reported by the tax agent.

In the application for a refund, you must indicate the details of a bank account opened by an individual (not to be confused with the number on a bank card).

The application is filled out and sent through the taxpayer’s personal account in the format approved by the Federal Tax Service of Russia.

The very possibility of receiving a deduction in a simplified manner will be indicated by an automatically pre-filled application for deduction in your personal account on the Federal Tax Service website, generated based on the results of a 20-day verification of information received from the bank. There you can also track the process of receiving the deduction - from the moment you sign the pre-filled application until your personal income tax is returned.

Thus, before the pre-filled application appears in your personal account, no action is required from the taxpayer.

Please note that a new approach has been in effect since 2021: the right to a property deduction arises from the moment of state registration of ownership, and not from the moment of receipt of a document (certificate) for the object.

As a general rule, other documents are not needed to obtain property and investment deductions in a simplified manner. As part of the exchange of information, the tax office receives the necessary and up-to-date information from tax agents, banks, and Rosreestr. The list of participating banks will be updated in a special section on the Federal Tax Service website.

Application processing time

First, the tax authority, based on available information, places data in your personal account (PA) for automatically filling out an application or sends a message through it about the impossibility of obtaining a tax deduction in a simplified manner, indicating the reasons within the following time frame:

- no later than March 20 of the year following the expired tax period - in relation to information submitted by the tax agent or bank before March 1;

- within 20 working days after the day of submission of information - in relation to information submitted by a tax agent or bank after March 1 of the year following the expired tax period.

A desk audit of an application is an analysis by tax authorities of compliance with the requirements of Art. 221.1 of the Tax Code of the Russian Federation and other conditions for obtaining tax deductions. As a general rule, it lasts 30 calendar days from the date of filing the application.

The period for checking an application for deductions can be extended to 3 months if, before its completion, the tax authority establishes signs indicating a possible violation of tax laws. Such a decision will be reflected in your personal account within 3 days from the date of adoption.

If an application (several applications) and a 3-NDFL declaration are submitted simultaneously for one tax period, a desk audit in relation to each document begins from the date of registration according to the order in which they are sent to the tax authority.

Decision on the application

| IF NO VIOLATIONS | THERE ARE VIOLATIONS |

| The tax authority makes a decision on granting a tax deduction within 3 days after the end of the audit. | The tax office makes one of the decisions under Art. 101 Tax Code of the Russian Federation:

And also one of the solutions:

|

The law does not provide for the opportunity to provide explanations or make appropriate corrections to the deduction application.

The remainder of the property deduction can be used in a simplified manner.

Return of deduction

If there is arrears of personal income tax, other taxes, arrears of penalties and/or fines, the tax authority independently offsets the amount of tax to be refunded in connection with the provision of a tax deduction. The deadline for making such a decision is 2 days after the day the decision was made to grant the deduction in whole or in part.

sends it to the territorial body of the Federal Treasury within 10 days He, in turn, makes a refund within 5 days .

KEEP IN MIND

If the deadline for returning the deduction is violated, from the 16th day after the decision to provide it is made, interest is accrued at the Central Bank refinancing rate that was current on the days the return deadline was violated.

Cancellation of the deduction decision

A tax agent or bank can provide updated information leading to a reduction in the amount of tax returned to an individual in connection with the provision of a deduction. Then the Federal Tax Service within 5 days makes a decision to cancel in whole or in part the decision to provide a deduction in whole or in part.

Within 3 days, such a decision with the amount of tax and/or interest to be refunded by the individual is posted in your personal account.

The excess received as part of the deduction must be reimbursed to the budget within 30 calendar days from the date of sending the specified decision through your personal account.

KEEP IN MIND

Interest is charged on amounts that an individual must repay at the Central Bank refinancing rate during the period of using budget funds. This occurs from the date of receipt of money in the account or the date of the decision to offset until the date of the decision to cancel the deduction.

In case of non-payment or incomplete payment within 30 calendar days , a request for payment of tax and/or interest will be sent to your personal account within 20 days If you ignore it, the tax office will launch a collection procedure under Art. 48 Tax Code of the Russian Federation.

If the taxpayer’s access to his personal account is terminated, the Federal Tax Service will send documents by registered mail.

How to get a professional tax deduction

Now we come to the most important question. How to get a tax deduction, or rather a professional tax deduction?

- Write to the tax agent (source of payments) in any form, a statement requesting a professional tax deduction.

or

- Independently contact the tax office with an application for a professional deduction, attaching documents confirming the expenses.

If the tax agent has not paid personal income tax, the taxpayer is obliged to submit 3NDFL in the tax return by April 30 of the following reporting year. In this case, the taxpayer can take into account the professional tax deduction.

Features of simplified receipt of social deductions

With deductions for training, treatment and contributions to voluntary life insurance, the procedure is somewhat different. According to the new version of Art. 219 of the Tax Code of the Russian Federation, to obtain them you need not only an application to the tax office, but also supporting documents .

The application and documents can be submitted in 3 ways:

- in writing;

- electronically via TKS;

- through your personal account on the Federal Tax Service website.

The period for consideration of the application is 30 calendar days from the date of submission. At the same time, the tax office reports via the personal account the results of the review, and also provides the tax agent (and not the payer, as now) with confirmation of the right of the individual (employee) to receive social benefits. Naturally, a negative outcome is also possible when it is revealed that there is no right to such a deduction.

From the author

In the following articles, other issues will be discussed. How to get a tax deduction for a purchased apartment? Is it possible to get a tax deduction for a pensioner? How to apply for a tax deduction through State Services? How to get money back on interest paid on a mortgage? And other issues related to tax deductions.

This concludes the article on professional tax deductions. I hope the information was useful to you. Feel free to write your opinion in the comments. Share the article on social networks. Don't forget to subscribe to blog updates. Thank you for your attention.

Sincerely, Anton Vlasov.

Investment

Individual entrepreneurs who invest money with a long-term perspective (investments) have the right to claim an investment deduction. In this case, the tax base may be reduced:

- for the positive difference between the original cost and the sale amount - if the securities were held for more than 3 years;

- on the amount of funds deposited into the investment account in the reporting period;

- on the total income that was received through investments.

As you can see, an individual entrepreneur using OSNO can count on a large number of tax benefits. We can say that this is a kind of compensation from the state for the fact that an entrepreneur pays several types of taxes - personal income tax, VAT.

But still, this is not a reason to choose a general taxation system when conducting business. In the long term, special regimes (STS, UTII, patent) will allow you to save much more money.

What do you think about this, friends?

Best regards, Sergey Chesnokov

This type of deduction is received by entrepreneurs engaged in investing funds with a long-term perspective. Taxable amounts can be reduced by the difference between the sale amount and the original cost (if it is positive), by the amounts deposited into the investment current account during the reporting period, and by the total profit from investment activities.