A universal transfer document (UDD) is a form that combines primary accounting documentation and an invoice, recommended by the letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3 / [email protected] The use of UTD significantly saves the resources of business entities, since any sale transaction is usually accompanied by the preparation of a delivery note and an invoice, while the UPD, combining both of these documents, simplifies the procedure for completing a transaction and does not entail tax risks for both parties. That is, the consumer (customer) can reimburse the VAT charged by the seller and recorded in the UTD, and at the same time confirm expenses when calculating income tax.

The use of this form in the document flow of companies and individual entrepreneurs is not mandatory; it is used by voluntary choice, enshrining a similar procedure in the accounting policy. And, although this document was created mainly for enterprises that pay VAT, it is not neglected by entities that do not work with this tax. Let's figure out how entrepreneurs form a UPD without tax, and we will provide a sample of filling out the UPD for individual entrepreneurs on the simplified tax system without VAT.

What is UPD

Operations carried out in the economic activities of an enterprise must be documented with primary documentation. Invoices, although they do not belong to the category of primary documents in accounting or tax accounting, serve as the basis for deducting VAT and are issued by enterprises.

Several years ago, the Federal Tax Service made a proposal to reduce the volume of document flow to introduce a single document - UPD, prepared on the basis of an invoice and supplemented with details of primary documents. Its purpose in each specific case is determined by the status, for which a separate field is provided. The Federal Tax Service's proposal is advisory in nature. The use or non-application of the IP UTD cannot entail any sanctions.

How to draw up a power of attorney to sign invoices: sample

Any employee of the company cannot sign invoices, because in clause 6 of Art. 169 of the Tax Code of the Russian Federation states that this document must contain the signatures of the manager and chief accountant or other authorized persons. As for the individual entrepreneur, he must sign the invoice himself or entrust this work to a trusted person.

In large companies with a complex management structure, the manager may delegate some of the authority to his deputies, full-time employees, or even third parties.

In companies with little document flow, the invoice is signed, as a rule, by the director and chief accountant; an individual entrepreneur often has to fulfill this responsibility alone. But if he decides to save himself from this work, he will need to be given the right to sign invoices by documenting the authority through a power of attorney certified by a notary (letter of the Ministry of Finance of Russia dated April 25, 2017 No. 03-02-08/24718). In this case, the invoice will contain the details of two documents at once - the issued power of attorney and the certificate of state registration. IP registration.

Power of attorney forms do not relate to strictly normative documents, and therefore are not defined by law. But you can draw up a sample power of attorney yourself, focusing on standard forms and thereby determining who signs invoices in the absence of management.

A power of attorney for signing invoices, a sample of which you can view on our website.

On company letterhead

POWER OF ATTORNEY No. _______

mountains ____________________ "___"____________ ___ G.

(Company name)

represented by _________________________________, acting on the basis of ____________,

(Full name of the manager, his position)

hereby authorizes _____________________________________________________

(F.I.O. and position held)

passport: series and number ________ issued by ___ ___ ______ by _________________________,

registered at: ______________________

sign invoices for the director (chief accountant).

The power of attorney was issued for a period of ______________ without the right of substitution.

Signature ______________________________ ___________________________ I certify.

(full name of the authorized representative) (signature of the authorized representative)

_______________________________ _________________ _______________

(manager position) (signature) (full name)

M.P.

You can download the finished sample:

Is UPD necessary for individual entrepreneurs?

In many cases, the use of UPD is convenient for individual entrepreneurs working on a simplified basis (without VAT), UTII or Unified Agricultural Tax:

- instead of several documents, you only have to fill out one, which reduces labor costs and the likelihood of errors;

- there are no unfamiliar details in the document;

- makes it easier for tax authorities to account for expenses and deductions;

- the use of UTD does not mean the need to pay VAT;

- if the simplifier does not use UTD himself, he must still accept such a document received from the counterparty for accounting;

- It is also possible to enter additional information into the submitted UPD form, adding new rows or columns.

However, incorrect execution of the UTD is fraught with the emergence of additional tax obligations for VAT. It is important to remember that with status 2, the UPD does not require filling out the fields required for invoices - these include columns 6-11 of the invoice section. To avoid controversial issues, it is better to put dashes in them.

On video: Webinar: How to start working with UPD

How it works in practice

A budget organization sells services to a third-party company under a contract. At the time of provision of services, the parties are required to sign a certificate of services rendered. Only after the customer accepts the actions performed, the budget organization has the right to make payment demands. That is, generate an invoice.

General document flow is not always convenient. For example, if the customer and the contractor are located in different localities or even regions. These are additional costs for organizations.

A simplified method of document flow will allow you to reduce costs: the budgetary institution will generate a UPD, which replaces both the act and the invoice at the same time. The customer, having checked the quality and volume of services provided, will sign the form and immediately submit it for payment. This will significantly reduce the time of settlements between the parties.

Use free instructions from ConsultantPlus experts to change the UPD when the cost of goods, works, and services changes.

To read, you will need access to the system: .

Filling out the document

Two new fields A and B are filled in at the request of the product supplier and indicate the item number and activity codes. For example, for an individual entrepreneur who has chosen USN 6 for the sale and installation of air conditioners, the code OKUN 042403 is indicated in field B.

The status in the upper left corner indicates its purpose. If it will be used as an invoice and a primary document, the number 1 should be entered. This status allows you to present the UTD as a basis for deducting VAT.

The number 2 in the field indicates that the UPD acts as a primary document reflecting the taxpayer’s transaction. UPD for individual entrepreneurs on the simplified tax system and unified agricultural tax have status 2. Many simplifiers are more accustomed to working according to the old scheme, using invoices and acts. However, situations often arise when the buyer has to issue an invoice. Therefore, UPD is just convenient here.

The purpose of a document is determined not only by its status, but by what details are filled in it. The UTD number also depends on its status. According to the filling rules, invoices indicate a serial number. If the status is 1, the number must correspond to the numbering in the invoices. In primary documents, the number does not belong to the mandatory details, therefore in the UPD it is determined by the chronology of the primary documentation.

Field 8 must contain information about the date and number of the agreement, according to which services are provided and shipment is made.

On video: What you need to know about UPD and integration with the enterprise accounting system

Transfer of authority to other persons, sample order for the right to sign invoices

Let's look at an example. The director of Green World LLC, R. A. Patrikeev, often goes on business trips abroad due to official needs. The company's chief accountant is responsible for overseeing accounting in regional divisions, so she is also often away. As a result, the question arose: who signs invoices in their absence?

To resolve the issue, the company issued an order “On granting the right to sign invoices” dated September 21, 2017 No. 167, after which the question “Who signs invoices?” didn't get up again. Thus, the company complied with the requirements of the law and saved itself and its customers from potential claims from controllers.

For more information about what inaccuracies are permissible in an invoice, read the material “What errors in filling out an invoice are not critical for VAT deduction?”

IMPORTANT! Before writing an order about who has the right to sign invoices, it is better to open GOST R 6.30-2003 and familiarize yourself with the requirements for the preparation of organizational and administrative documentation.

You can view and download a sample order on our website.

Features of date indication

In the proposed UPD form, dates are entered in three different lines:

- on 1 – day of document execution;

- in 11 – carrying out a business transaction (shipment of products or presentation of an act of services provided);

- Line 16 indicates the day of acceptance.

If line 11 is left blank in the UPD, it is concluded that the document was issued on the day of shipment. If field 16 is empty, the dates of shipment and receipt of the goods are considered to coincide. Ideally, all three dates will coincide, but more often the first two lines - 1 and 11 - coincide. This means that the date of shipment of the product, i.e. line 11, is used to determine the taxable base for VAT.

Sometimes the UPD is drawn up before shipment. However, an invoice issued before a business transaction cannot be the basis for a refund. Therefore, the tax base is determined by the date of dispatch of the goods.

The law provides for the case when on the day of shipment it was not possible to draw up an STD, and it was issued later. Then the VAT base is also determined from the moment the goods are sent, that is, on line 11. In all of the above situations, the buyer has the right to claim a VAT deduction only after accepting the order (work or goods). This is the date in field 16. The sample UPD for individual entrepreneurs in the year differs in status and some blank fields.

General requirements for document flow

According to general rules, any operation is documented.

To ship goods or provide services and work, the company draws up the appropriate primary form. For example, an invoice for the supply of products or an act of completion of work or services. The company then generates an invoice to present payment requirements to the customer. This document is the basis for calculating value added tax and has a unified form.

But this document flow procedure is not the only one. Officials have provided a simplified algorithm in which, instead of invoices and invoices, only one form is generated - a universal transfer document (UDD).

What signatures should be on the UPD?

Lines 10 and 15 indicate the persons from the supplier and buyer involved in sending and receiving products. Their positions must also be indicated. In lines 13 and 18, where the signatures of the persons who are responsible for the timely execution of the transaction on both sides are signed, their positions are also written down. If they indicate the same persons as in the previous lines, signatures do not need to be added.

Columns 1, 2 and 2a are filled in, which indicate the name of the product, its code, and units of measurement. For example, “Remote start device IP 535-07e “PUK””, in columns 3 and 4 the quantity and price of the device are entered.

Lines 14 and 19 provide details of the persons involved in accounting, both for the supplier of the goods and the buyer and the persons who compiled the document on their behalf. For an individual entrepreneur working without a seal, its absence on the UPD does not entail a refusal to refund VAT, because it is not provided for either the invoice or the primary accounting documentation. But if it exists and we display the name of the organization, then lines 14 and 19 are not filled in.

Who signs the document for the chief accountant if he is not on staff?

“Sick leave” benefit: is it necessary to pay for sick days worked? In the case when on the day the employee was issued a certificate of incapacity for work, he was at work and received a salary for that day, “sick leave” benefit for that day is not accrued.

The right of the General Director to sign for the Chief Accountant

How and when you can use a universal transfer document Attention Soon after amendments were made to Law No. 402-FZ, a draft of a single shipping document was proposed for consideration by the professional community on the Federal Tax Service website (at first the UPD was called that).

Both specialists from the Federal Tax Service and participants from the communities of accountants, financiers and programmers (in particular, 1C specialists) worked on the project. Attention This is how it became possible to optimize the document flow of organizations by switching to UPD. Read more about UPD in the material “Universal transfer documents”.

Mandatory details of the UPD The required set of details in the UPD is determined by the requirements of several legislative acts. We indicate the necessary articles:

The address was typed incorrectly, or the page no longer exists on the site.

Add to favoritesSend by email The right of the general director to sign for the chief accountant - when may there be a need to transfer such powers and what will need to be formalized so that the director’s signature for the chief accountant has legal force? We will talk about this in our article.

What needs to be completed so that the director can sign documents for the chief accountant? The nuances of signing documents by the general director for the chief accountant. Results What needs to be completed so that the director can sign documents for the chief accountant? Transfer of signature rights to the general director from the chief accountant is a phenomenon that often arises in modern business conditions.

This situation is typical for small businesses when the director combines his powers with the functions of the chief accountant.

There is a special “Status” field for this purpose, in which you need to enter the numbers:

- 1- if the use of UPD comes down to combining standard invoices and primary accounting documentation.

- 2- for use only in the “primary” form.

Please note that filling out the “Status” field is for informational purposes only. If the Status column is filled out incorrectly, the tax inspector will only pay attention to the correctness of filling in the details.

Features of filling out forms depending on the status How to correctly fill out a universal transfer document? Samples of filling out the UPD for the provision of services, shipment of goods or other operations are slightly different from each other, since their content may be affected by the selected status.

Who signs the document for the chief accountant if he is not on the staff list?

Here you can fill out the UPD universal transfer document form in excel for status “1”.

Federal Law “On Accounting”: “The head of an economic entity who, in accordance with this Federal Law, has the right to use simplified methods of accounting, including simplified accounting (financial) reporting, as well as the head of a medium-sized enterprise, with the exception of economic entities specified in Part 5 Article 6 of this Federal Law, may take over the accounting." 2) “Calculation of average earnings for filling out a certificate for the employment service” (E.A. Soboleva, editor of the magazine “Payment in a state (municipal) institution: accounting and taxation”; magazine “Payment in a state (municipal) institution: accounting accounting and taxation", N 11, November 2021, pp. Milestones of the accounting calendar - not so much the days of the month and days of the week, but the dates of reporting and payment of taxes. Our weekly reminders will help you not to forget about any important accounting date. Accordingly , 1% contributions for 2021 must be transferred to the budget no later than 07/02/2018 (July 1 – Sunday).

- A person authorized to act on a transaction (for example, to ship goods). Then the data on line 13 will coincide with the data on line 10. Then in line 13 you can fill in only the data of the responsible person, without duplicating the signature.

- Person authorized to sign invoices. Then the data on line 13 will coincide with the mandatory signature of the manager or chief accountant. In this case, it is also possible not to duplicate the signature, entering in the line only the position and full name of the already specified person.

Another authorized person” and below the note “the right to sign for the manager and chapter. buh. has a bay. Ivanov." then on the left side in lines 10 and 13 there is simply a position and full name. However, they may not coincide with the date of shipment, transfer of claims or other events of economic life;

- information about the business entity;

- the essence of the business transaction;

- units in which goods or services sold are valued;

- information about the employee responsible for drawing up the UPD and for compliance with shipping standards;

- the signature of this employee with a transcript;

- signatures with transcripts of other persons participating in the business event.

If any questions regarding filling out an invoice remain unclear for taxpayers, the Federal Tax Service always leaves them the opportunity to use ready-made forms with examples of completion.

Source: https://advocatus54.ru/kto-podpisyvaet-upd-za-gl-buhgaltera-esli-ego-net-v-shtatnom/

Required and optional fields

The following fields may not be filled in:

- Line 9 is optional, but the details of the transport documentation indicated in it will allow you to confirm the delivery of the goods.

- Line 12 is completed if there is additional information that needs to be shown.

- Field 17 indicates the occurrence of claims from the buyer during receipt of the order.

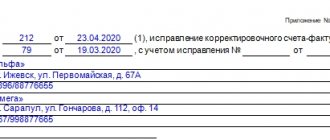

Lines 1a – 7 and the remaining fields of the invoice are intended for entering the details of the seller and buyer, data on payment documents, and the type of currency for settlements. They are filled out by organizations that pay VAT. The photo shows a sample of filling out the UTD for individual entrepreneurs with VAT.

In the section of the invoice with status 1, the signatures of the manager and chief accountant must be present; for individual entrepreneurs, details must be indicated. Sometimes a document may be endorsed by several persons. Status 2 does not require signatures in these fields.

We reflect the shipment of goods in the UPD

The Federal Tax Service of Russia, in a letter dated October 21, 2013 No. ММВ-20-3/ [email protected] , offered taxpayers a new type of document - a universal transfer document (UDD). How to create this document in 1C, what fields need to be filled in and how to receive the document back from the counterparty? Let's look at the detailed instructions from GANDALF.

Let's consider the use of UTD using the following example.

Progress LLC entered into an agreement with Trading House LLC for the supply of 20 sets of furniture.

Cost: 236,000.00 rub. (including VAT 18% - RUB 36,000.00).

The transfer of goods and the transfer of ownership of them take place at the warehouse of Trading House LLC.

The goods are delivered by the seller - Progress LLC, using a third-party transport organization.

How to reflect the shipment of goods in “1C: Enterprise Accounting 8”

To reflect the operation of shipping goods, go to the “Sales” section, subsection “Sales”. In our example, we create a document “Sales (act, invoice)” with the type “Shipment without transfer of ownership”, however, if you do not use this type of shipment, create a document “Goods (invoice)”.

We fill in the following fields in the document:

- “from” – the date of shipment of goods (corresponds to the date the transaction is reflected in the accounting system);

- “Counterparty” – the name of the buyer of the goods;

- “Agreement” – the number of the supply agreement;

- “Invoice for payment” – information about the number and date of the invoice (if it was issued).

The data for the tabular section will be automatically pulled from the invoice.

Using the “Signatures” hyperlink of the document, you can open an additional window to indicate clarifying information about the participants in the transaction in order to automatically fill in the corresponding lines of the UPD:

- in the “Dispatched” field - information about the person who shipped the goods to fill out line [10] of the UPD.

- in the field “Responsible for registration (for UPD)” - information about the person responsible for the correct registration of the fact of economic life for filling out line [13] of the UPD.

By clicking the “Delivery” hyperlink of the document, you can open an additional window to indicate:

- Who is the carrier? In our example, this is a third-party company.

When delivering goods by an engaged transport company, you must indicate its name in the “Other” field and fill in the “Transportation information (for UTD)” line with the number and date of the carrier’s invoice, as well as, if necessary, the type of packaging, net/gross weight of the cargo etc. This data will appear in line [9] of the UPD.

If necessary, indicate information about other documents that are integral annexes to the UPD (for example, passports, certificates of conformity, etc.) to fill out line [12] of the UPD.

The fields “Car”, “Driver”, “Cargo” are filled in if we check the box for the “Transportation by road” value.

They are used to generate a waybill if the goods are delivered by the seller himself. In this case, in line [9] of the UPD, the details of the waybill are automatically indicated, which coincide with the number and date of the UPD.

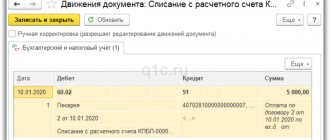

Creating an invoice in 1C for UPD

To create an invoice for shipped goods, you must click on the “Write an invoice” button at the bottom of the document.

In this case, the “Invoice issued” document is automatically created - you can see the link at the bottom of the implementation document.

In the new posted document “Invoice issued”, all fields will be filled in automatically based on the data in the “Sales” document:

- in the line “Base documents” there will be a hyperlink to the corresponding implementation document;

- in the field “Operation type code” the value “01” will be indicated, which corresponds to the acquisition of goods, works, services in accordance with the Appendix to the order of the Federal Tax Service of the Russian Federation dated February 14, 2012 No. ММВ-7-3/ [email protected] , as well as the letter of the Federal Tax Service of the Russian Federation dated 01/22/2015 No. ГД-4-3/ [email protected] ;

- in the line “Amount” it will be indicated that the amounts for registration in the accounting journal are equal to zero, since from January 1, 2015, taxpayers who are not intermediaries acting on their own behalf, forwarders, developers, do not keep a journal of received and issued invoices - textures;

- the tabular section will indicate the details of the payment document for the received prepayment amount (if any);

- in the field “Issued (transferred to the counterparty)” the date of registration of the document “Sales (deed, invoice)” will be entered, which, if necessary, should be replaced with the date of actual issuance of the invoice.

If you use electronic document management, then the date of sending the electronic invoice file by the EDF operator, indicated in its confirmation, will be entered in the field.

The “Compiled” switch will be set to “On paper” if you do not exchange electronic documents with this counterparty. If you have an EDF agreement, the switch will be in the “Electronic” position.

NOTE!

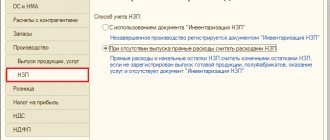

An invoice issuance for the document “Sales (act, invoice)” with the type of operation “Shipment without transfer of ownership” is available if the organization’s accounting policy (“Main” – “Accounting policy”) is set to “VAT” on the “VAT” tab checkbox for the value “Calculate VAT on shipment without transfer of ownership.”

Viewing and printing UPD

You can view and print the UPD from the document “Implementation (act, invoice)” using the “Print” command.

You can also view and print the UPD from the “Invoice issued” document.

The UPD lines will be filled with the following data:

- in the upper left corner in the “Status” field – the value “1”, since in this case the UPD is used as a complex document that combines a primary accounting document and an invoice;

- in Column A “Item No.” of the tabular part – the position numbers in order;

- in column B “Code of goods/works, services” of the tabular part - the relevant information from the nomenclature directory;

- in the line “Base for transfer (delivery)/receipt (acceptance)” [8] – information about the agreement specified in the document “Implementation (act, invoice)”;

- in the line “Data on transportation and cargo” [9] – details of the waybill, name of the transport organization, data on the cargo, for example, net/gross weight, type of packaging, transportation conditions, etc., if additional delivery information includes such information has been entered;

- in the line “Goods (cargo) transferred / services, results of work, rights handed over” [10] – position, as well as the surname and initials of the person who made the shipment, if such information is included in the additional information about the seller and buyer;

- in the line “Date of shipment, transfer (delivery)” [11] – the date corresponding to the date of the document “Sales (act, invoice)”;

- in the line “Other information about shipment, transfer” [12] – links to integral annexes, for example, to quality certificates (certificates of conformity, safety certificates, etc.), if such documents must be submitted along with the goods according to the terms of the contract and if such information will be included in the additional delivery information;

- in the line “Responsible for the correct registration of the fact of economic life” [13] - the position, as well as the surname and initials of the person who completed this operation, if such information is included in the additional information about the seller and buyer. If the field “Responsible for registration (for UPD)” is not filled in, then this line will by default indicate the manager or other person authorized to sign invoices on behalf of the manager;

- in the line “Name of the economic entity drafting the document (including commission agent/agent)” [14] – information about the seller

; - in the line “Name of the economic entity drafting the document” [19] – information about the buyer

.

You can reflect the missing information in the printed form of the document or make the necessary corrections from the editing mode, which can be turned on or off using the button at the top of the menu in the form of a table with a green pencil.

In addition, from the mode of viewing and editing the printed form of a document, you can:

- save the UPD in the appropriate folder in the selected format using the button or the “Save” command from the list of available commands, opened by clicking the “More” button;

- send the UPD by email using the button or using the “Send” command from the list of available commands, opened by clicking the “More” button.

The right side of the UPD is filled in by the buyer upon acceptance of goods. When receiving a document from the buyer, the seller must only make sure that the buyer has provided all the necessary information correctly.

Sales of shipped goods

The sale of previously shipped goods after their transfer to the buyer (after transfer of ownership) on the basis of the UPD completed by the buyer is formalized using the document “Sales of shipped goods”, which is created on the basis of the document “Sales (act, invoice)” with the type of operation “Shipment without transfer of title” property” by clicking the “Create based on” button.

All fields of the document will be filled in automatically based on the document “Sales (act, invoice)”.

Before posting the document, you must make sure that in the “from” field of the document “Sale of shipped goods” the date is indicated, which corresponds to the date of sale of goods (the date of transfer of ownership of the goods to the buyer according to the terms of the contract) and which is indicated in the line “Date of receipt (acceptance) » [16] UPD.

As a result, to issue a UTD for the shipment of goods:

- We create a sales document with the type “Goods (invoice)” or “Shipment without transfer of ownership.”

- We fill out the document fields, including the “Signatures” and “Delivery” hyperlinks.

- We issue an invoice based on the sales document.

- We print a universal transfer document.

Based on materials from the 1C:ITS information system.

Results

The issue of who signs invoices must be resolved in a timely manner. If this is done by the manager (IP) or the chief accountant, no additional actions are needed, but if other persons sign, then it is necessary to consolidate their powers by issuing the corresponding local act (order, instruction) or issuing a power of attorney.

These documents will officially identify who signs the invoices, and your counterparty will not have to argue with inspectors and defend a deduction if the invoice is signed by unauthorized persons.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Purpose of UPD

The main prerequisite for the emergence of the UTD (universal transfer document) was the fact that in the previously established forms included in the usual transaction package, many details and information are duplicated. Therefore, to simplify the execution of transactions, it would be more logical to use one document that includes all the necessary sections and data.

The idea of creating a UPD was implemented in 2013. The beginning was the amendments to the law “On Accounting” dated December 6, 2011 No. 402-FZ, as a result of which the need to apply mandatory unified forms of accounting documentation disappeared. Soon after amendments were made to Law No. 402-FZ, a draft of a single shipping document (at first the UPD was called that) was proposed for consideration by the professional community on the Federal Tax Service website. Both specialists from the Federal Tax Service and participants from the communities of accountants, financiers and programmers (in particular, 1C specialists) worked on the project. The result was that on October 21, 2013, the UPD form appeared on the Federal Tax Service website. At the same time, the Federal Tax Service issued a letter “On the absence of tax risks when taxpayers use UTD” dated October 21, 2013 No. ММВ-20-3 / [email protected]

Thus, it became possible to optimize the document flow of organizations by switching to UPD.

Read more about UPD in the material “Universal transfer documents”.

Do I need to sign the invoice on both sides?

Given the large amount of information that needs to be reflected in this document, it may happen that one page is not enough. The Tax Code of the Russian Federation does not contain a prohibition on issuing an invoice on several sheets.

So that the recipient does not have concerns about the reliability of the data, we recommend transferring part of the tabular form to another sheet so that it looks like a continuation of the previous one. In addition, the document originator may be required to endorse each page of the invoice.

For clarity, all information is reflected on separate sheets, stapled and numbered. You can also display the data on the back, but this is inconvenient for accountants processing documents bound for archiving. Details that determine who signs invoices in the organization (“Head of the organization” and “Chief accountant”) are indicated on the last sheet. This arrangement of signatures is not a violation if the continuous numbering is not broken.