We are talking about the transfer of non-residential premises that are part of an apartment building. They do not have a production purpose, are intended for personal use and are transferred under equity participation agreements. This was explained by the Ministry of Finance of the Russian Federation.

Details in today's article.

Management of apartment buildings from the developer to the choice of management method

1779728

Risks of additional VAT charges to developers - forecast of a possible new campaign by the Federal Tax Service of the Russian Federation

Most recently - March 17, 2021. — The Supreme Court put an end to the Federal Tax Service’s campaign against developers, which was called “apartment-by-object/apartment-by-apartment determination of the financial result from building a house.” In this episode, the developers won - the SKES RF Armed Forces confirmed the right to determine the financial results from the construction of an apartment building

Now trends have emerged in practice that could become the basis of a new campaign against developers. And if this “gun on the wall” goes off, some developers may have their leg or even their head shot off.

1. In accordance with subparagraphs 22, 23, 23.1 of the Tax Code of the Russian Federation, the following transactions related to residential premises are not subject to taxation (exempt from taxation) on the territory of the Russian Federation:

22) sale of residential buildings, residential premises, as well as shares in them;

23) transfer of a share in the right to common property in an apartment building when selling apartments;

23.1) services of the developer on the basis of an agreement for participation in shared construction, concluded in accordance with Federal Law of December 30, 2004 N 214-FZ “On participation in shared construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation” (with the exception of developer services provided during the construction of industrial facilities).

Services under contract agreements for the construction of residential premises are not exempt from VAT.

2. The presence of two related types of activity - the activity of a developer in the construction of housing (preferential for VAT) and the contract for the construction of housing (not preferential for VAT) - creates a situation that the tax authorities periodically try to use in order to reclassify the activity of the developer in organizing the construction of housing as an activity housing construction contractor for the purpose of additional VAT assessment.

In practice 2008-2015. The tax authorities have attempted to impose additional taxes on developers constructing residential buildings in accordance with Federal Law No. 214-FZ according to the following logic:

- the developer himself carried out the construction, in this regard, there were not investment relations, but a contract agreement;

— receipts under equity participation agreements are re-qualified as receipts under a contract for the construction of residential premises, and therefore additional VAT is charged on these amounts.

Such an attempt was made by the Interdistrict Inspectorate of the Federal Tax Service of Russia No. 8 for the Krasnodar Territory in relation to OJSC “Construction Administration No. 2” MIFTS in case No. A32-27300/2006-54/532-2007-45/1.

This case was the subject of consideration by the Supreme Arbitration Court of the Russian Federation - Determination of the Supreme Arbitration Court of the Russian Federation dated December 29, 2008 N1106/08

The Supreme Arbitration Court of the Russian Federation in this ruling supported the position of the lower courts and indicated the following:

“The courts proceeded from the fact that the inspectorate erroneously classified the funds received by the company from participants in shared construction as targeted financing for the construction of a residential building as advances for the implementation of work.

According to the courts, the disputed payments, regardless of the method of construction (contract or commercial), are investments and therefore are not subject to inclusion in the tax base for value added tax.

Based on the results of studying the application, the documents attached to it and the case materials, the judicial panel of the supervisory authority came to the following conclusion.

When adopting the appealed judicial acts, the courts proceeded from the established circumstances of the case, confirmed by the parties with evidence that testifies to the investment nature of the terms of the disputed agreements.

Since the contracts are investment, the relationship between the company and individuals on the transfer of the right belonging to it under the contract is also of an investment nature, and does not indicate the sale of goods (work, services) within the meaning of the provisions of subparagraph 4 of paragraph 3 of Article 39, subparagraph 1 of paragraph 2 Article 146, subparagraph 1 of paragraph 1 of Article 248 of the Tax Code of the Russian Federation.

The inspectorate’s arguments aimed at reassessing the factual circumstances of the case do not refute the conclusions of the courts and do not indicate a violation by the courts of the rules of law or uniformity in their interpretation and application, and therefore there are no grounds for transferring the case to the Presidium of the Supreme Arbitration Court of the Russian Federation.”

Thus, the Supreme Arbitration Court of the Russian Federation in this ruling supported the position of the courts, according to which receipts from participants in shared construction under shared participation agreements are not subject to reclassification as receipts under construction agreements, regardless of how the developer carried out the construction - by contract method (by concluding a construction agreement) or economic (carried out the construction himself).

(The decision was considered at a time when the Tax Code of the Russian Federation did not have subclause 23.1 of the Tax Code of the Russian Federation, which exempts developer services from VAT; however, the courts expressed precisely the above-mentioned legal position in favor of taxpayers.)

There is a similar position in the decision of the Federal Tax Service of April 20, 2015 N 264 (available in the Garant system) when considering a taxpayer’s complaint based on the results of an audit - during the audit, the lower tax authority also attempted to reclassify receipts from shareholders as receipts under construction contracts with additional VAT charges. The higher tax authority canceled the decision of the lower tax authority and indicated the following:

“The Inspectorate does not deny that the Company enters into agreements for participation in shared construction and carries out its activities as a developer in accordance with Law No. 214-FZ. Subclause 23.1 of clause 3 of Article 149 of the Tax Code of the Russian Federation does not contain any restrictions on its use depending on the types of services of the developer: whether these services are contract or intermediary. This norm also does not provide for any restrictions on the application of tax exemption in the event that the organization’s remuneration for performing the functions of a developer is not allocated in the agreement. »

That is, until 2015. this conclusion seemed more or less settled.

3. In 2014 The Supreme Arbitration Court of the Russian Federation adopted Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 “On some issues that arise in arbitration courts when considering cases related to the collection of value added tax”

Paragraph 22 of the resolution states the following:

"22. Based on the first paragraph of paragraph 6 of Article 171 of the Tax Code of the Russian Federation, in particular, tax amounts presented to the taxpayer by contractors (developers or technical customers) when they carry out capital construction of fixed assets are subject to deductions.

When interpreting this norm, the courts should take into account that, based on its content, the emergence of the right to a tax deduction for a taxpayer who is an investor does not depend on the order in which payments are made for the performance of contract work and, accordingly, who presented him with the mentioned amounts for payment - directly from the contractor or developer (technical customer).

At the same time, in order to apply the provisions of Chapter 21 of the Code in relations with an investor, a developer (technical customer) who does not simultaneously perform the functions of a contractor must be qualified as an intermediary and the rules of paragraph 1 of Article 156 of the Tax Code of the Russian Federation must be applied to him.”

This paragraph was not devoted to the issue of taxation of the developer, but to another issue - the issue of applying VAT deductions for the investor. However, the Supreme Arbitration Court of the Russian Federation also noted that the developer acts as an intermediary in relations with the investor.

The tax authorities used this wording to make repeated attempts to reclassify receipts from participants in shared construction as receipts under construction contracts with additional VAT charges.

When considering cases in 2017-2020, such attempts by the tax authorities were actually supported by the Arbitration Courts and indirectly by the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation:

- case NА19-26938/2018 Lenskoe Construction Management LLC vs. Interdistrict Inspectorate of the Federal Tax Service No. 13 for the Irkutsk Region

- case NN A19-26081/2018 SibGradStroy LLC v. Inspectorate of the Federal Tax Service for the Oktyabrsky District of Irkutsk

- case No. A71-3163/2018- JSC "Mozhginsky Construction Association" against the Inspectorate of the Federal Tax Service for the Interdistrict Inspectorate of the Federal Tax Service No. 7 for the Udmurt Republic

Excerpt from the decision of the Arbitration Court of the Irkutsk Region dated July 24, 2021 in case No. A19-26081/2018:

“As follows from the case materials, the audit established that during the audited period the Company carried out the construction of residential buildings by concluding municipal contracts for participation in shared construction of an apartment building, agreements for participation in shared construction concluded with the Administration of the Shelekhovsky urban settlement, the Administration of the Magistralninsky urban settlement, and individuals and other participants.

Payment for the developer's services was not included in the price of the contracts by the taxpayer.

All funds received by participants in shared construction (the entire amount of the contract for the construction of residential buildings) of SibGradStroy LLC were qualified as revenue for the services rendered by the developer, and were taken into account for VAT purposes as transactions exempt from taxation in accordance with subclause 23.1 of the Tax Code of the Russian Federation.

As part of the execution of municipal contracts and agreements for participation in shared construction, the Company carried out the construction of residential buildings, with the involvement of third parties (contractors) to perform certain works.

Thus, the Company carried out the construction of facilities under municipal contracts, agreements for participation in shared construction, while simultaneously accepting obligations to perform the functions of a developer, customer and general contractor. That is, as part of the execution of municipal contracts, agreements for participation in shared construction, SibGradStroy LLC, being a general contractor, carried out work on the construction of residential buildings, the result of which, upon completion of construction, was transferred to the participants in shared construction

If the developer carries out construction and installation work on his own or on his own with the involvement of contractors (subcontractors), i.e. combines the functions of a developer and a general contractor, the following must be taken into account.

In accordance with Article 1 of the Federal Law of December 30, 2014 N 214-FZ “On participation in shared construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation” (hereinafter referred to as Law N 214-FZ), the activities of developers on attracting funds from citizens and legal entities for shared construction of apartment buildings and other real estate, with the exception of industrial facilities, on the basis of an agreement for participation in shared construction is not an investment.

Law N 214-FZ, defining the rights and obligations of participants in legal relations within the framework of an agreement for participation in shared construction, does not limit developers in the volume of obligations assumed and the list of those works and services that the developer has the right to perform (provide) on their own, defining the main goal - build (create) an apartment building and (or) other real estate object and transfer the corresponding shared construction object to the participant in shared construction.

Taking into account the above, within the framework of an agreement for participation in shared construction, the developer can either act only as a construction organizer, without directly participating in the construction process, or take on the functions of constructing a shared construction project on his own or on his own with the involvement of contractors (as a general contractor) .

If the developer carries out construction and installation work on his own or on his own with the involvement of contractors (subcontractors), i.e. combines the functions of a developer and a general contractor, the following must be taken into account.

In accordance with paragraph 1 of Article 702 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), under a contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its result to the customer, and the customer undertakes to accept the result of the work and pay for it .

According to Article 706 of the Civil Code of the Russian Federation, if the contractor’s obligation to perform the work provided for in the contract personally does not follow from the law or the contract, the contractor has the right to involve other persons (subcontractors) in fulfilling his obligations. In this case, the contractor acts as a general contractor.

According to paragraph 1 of Article 740 of the Civil Code of the Russian Federation, under a construction contract, the contractor undertakes, within the period established by the contract, to build a certain object on the instructions of the customer or to perform other construction work, and the customer undertakes to create the necessary conditions for the contractor to perform the work, accept their result and pay the agreed price. Based on the provisions of paragraphs 2 and 3 of Article 706 of the Civil Code of the Russian Federation, the general contractor bears full responsibility to the customer for the result of work (including those performed by contractors).

Taking into account the above, within the framework of an agreement for participation in shared construction, the developer can either act only as a construction organizer, without directly participating in the construction process, or take on the functions of constructing a shared construction project on his own or with the involvement of contractors.

In the case under consideration, the actions of SibGradStroy LLC, related to the implementation of construction work on the construction of an apartment building on its own and with the involvement of contractors, have a material expression and cannot be consumed by participants in shared construction in the process of performing the work, and, therefore, are an object taxation in the form of implementation of work.

Under the above circumstances, the court believes that the funds received by SibGradStroy LLC, which is the general contractor for the construction of residential buildings, under municipal contracts, agreements for participation in shared construction, were legally taken into account by the tax authority for value added tax tax purposes as revenue from the implementation of construction work."

This judicial practice indicates a fundamental change in approaches in law enforcement practice:

2008, Supreme Arbitration Court of the Russian Federation - the developer has the right to a VAT benefit in relation to the services of the developer, regardless of the method of building the house

2018-2020 – if the developer carries out construction himself and/or with the involvement of subcontractors, all proceeds from shareholders are reclassified as advances under the contract with additional VAT.

As criteria for requalifying advances from participants in shared construction for housing construction contracts, judicial practice uses essentially two criteria:

— whether the developer is an intermediary between the shareholders and the general contractor/technical customer or not (rather a formal criterion).

Reason - paragraph 22 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 “On some issues arising in arbitration courts when considering cases related to the collection of value added tax,” in which the developer is indicated as exclusively an intermediary between the participants shared construction and general contractor/technical customer.

- whether the developer is constructing an apartment building or not (rather a substantive criterion).

Tax risk in the case of applying new approaches to the developer - recharacterization of the entire amount of proceeds under shared participation agreements into advances under a contract for housing construction with 1. additional VAT charges on the entire amount of proceeds from participants in shared construction; 2. simultaneously with the right of the developer to deduct VAT presented by suppliers/contractors for house construction operations.

!!! Judicial practice has supported exactly this path - not additional VAT assessment on the amount of construction and installation work performed by the developer, but a complete reclassification of all the developer’s receipts under equity participation agreements into receipts under construction agreements with additional VAT assessment on the entire amount + the right to deduct “input” VAT on this activity (the right to deduct VAT when re-qualifying transactions is confirmed in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 25, 2013 No. 1001/13 in case No. A40-29743/12-140-143, as well as from the principle of reliable determination of the volume of tax liability - for now we consider it an axiom the existence of this right will not be discussed here.).

In fact, this is a unique way to very harshly “kill” the VAT benefit for housing.

This is a key difference from the positions that the Ministry of Finance of the Russian Federation previously expressed - taxation of VAT only on the amount of construction and installation work carried out by the developer on its own (letter of the Ministry of Finance of the Russian Federation dated June 1, 2015 N 03-07-10/31550)

Moreover, it must be taken into account that in the above arbitration cases, the developers did not carry out the construction of the facility in full; in all cases, the courts indicate that the developer also involved contractors:

— in cases No. A19-26938/2018 and No. A19-26081/2018, the volume of involved contractors is not indicated;

- in case No. A71-3163/2018, the courts indicated that the scope of work of contractors ranged from 5% to 27% of the cost of the house

However, additional VAT charges were made on the entire amount of receipts from participants in shared construction.

Taking this into account, there are 3 options:

1. The developer is a “pure” intermediary.

The developer enters into equity participation agreements and has nothing to do with the construction of the house; from the point of view of building the house, the developer has 2 agreements:

— general contract agreement with the general contractor for the construction of the entire house;

— an agreement for the implementation of the functions of a technical customer with a technical customer in relation to a house under construction;

(or 1 mixed contract, including both contracts with one person performing the functions of the general contractor and customer)

In this case, the developer has the right to a VAT exemption in relation to the services of the developer; the risk of reclassification of proceeds under equity participation agreements into advances under a construction agreement is minimal.

2. Developer - carries out the construction of the house with its own resources

Maximum tax risk - proceeds under equity participation agreements will be reclassified as advances under contract agreements with additional VAT charged on the entire amount of proceeds.

3. Any situation between these poles is a gray area in which there is a risk of additional VAT charges, since there is no clear criterion - when the developer ceases to be a “pure” intermediary, what volume of construction and installation work is critical for requalification:

— if the developer does not have a general contractor, but there are 50 contractors, is he an intermediary or not?

- if the developer has construction workers who perform certain functions on the construction site (auxiliary workers) - is he an intermediary or not?

- if the developer carries out a small part of the construction and installation work on his own (for example, 5-10% of the total cost of the house), and the rest is done by the general contractor?

Both criteria – “intermediary or not”, and “construction and installation work carried out or not” – are actually quite vague.

Accordingly, the risk can be completely avoided only by implementing the maximum option - the developer is only an intermediary and has nothing to do with construction and installation works in any form.

Will this gun fire or not?

In my opinion, this option of additional charges to developers has no regulatory basis - in the literal text of the Tax Code of the Russian Federation, as well as in 214-FZ, there is no requirement for a “pure intermediary”.

Also, literally in the Tax Code of the Russian Federation I cannot see a norm that would oblige VAT to be calculated on the amount of construction and installation work carried out by developers on their own - it is difficult to call the construction of a house for participants in shared construction construction and installation works for their own needs (subclause 3 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation)

All the more wonderful is the re-qualification of all equity participation agreements of the developer into a contract only because of the presence of construction and installation work in the developer’s activities - the qualification of the agreement rather depends on the structure of rights and obligations, and not on how one of the parties fulfilled its obligation to build the house. Moreover, we seem to have an established civil law consensus that an equity participation agreement is a contract for the sale and purchase of a future immovable property, where the contract comes from.

In general, in my opinion, there is no formal legal or economic logic in such approaches.

But it was the same with the “definition of finance” campaign. result for the object as a whole\apartment by apartment” - there were no formal grounds or economic logic in the requirement to determine the financial result for each apartment with a simultaneous prohibition to take into account losses for unprofitable apartments. However, there were a sufficient number of decisions against developers, and the intervention of the Supreme Court of the Russian Federation was required.

Is such a campaign possible? I think yes. Developers are a tasty target for attack. Developers, according to my completely subjective feelings, are the second industry in the Russian Federation after the extraction of natural resources (gas\oil\metals). This is, by and large, frozen oil - money from the extraction of natural resources feeds the country and turns into fields of new buildings.

On the other hand, for the same reason, developers as a whole, as an industry, are quite sharp and influential, and are able to influence decision-making at the highest level. (Traces of these teeth were visible to an attentive observer as part of the previous campaign “determining the financial result for the object as a whole\apartment by apartment.”) Some leaders from the TOP-10 who build millions of square meters a year - additional VAT charges for them under this scheme may result in billions, and none of them will give up so easily.

Well, it is clear that all this does not add stability and predictability to the rules of the game. Perhaps there will be some fun legal bloodshed and adrenaline rush.

Question about VAT

Imagine that a developer is building a residential apartment building. This house has non-residential premises, and funds for construction are raised under equity participation agreements.

After the house is built, in addition to the residential space under the contracts, the developer also transfers “outside storage rooms” to the participants in shared construction. These premises are contracted as a basement and are intended for personal use.

Value added tax is not imposed on the services of a developer on the basis of an agreement for participation in shared construction, which was concluded in accordance with Federal Law dated December 30, 2004 N 214-FZ (clause 23.1, clause 3, article 149 of the Tax Code of the Russian Federation).

The exception is the developer’s services, which he provides during the construction of industrial facilities. Such services are subject to VAT. Industrial objects include objects intended for use in the production of goods, performance of work, and provision of services.

Note that the services of the developer, that is, the owner of land plots under lease or ownership rights, are not taxed.

The object of shared construction is residential or non-residential premises, common property in an apartment building. They are transferred to the participant in shared construction after receiving permission to put the apartment building into operation. Such premises are part of an apartment building, which is being built with the funds of a participant in shared construction (clause 2 of Article 2 N 214-FZ).

In case of bankruptcy of the developer, the housing cooperative is obliged to accept shareholders

144920

What has changed in the taxation of developers under DDU

In accordance with sub. 23.1 clause 3 art. 149 of the Tax Code of the Russian Federation the following operations are not subject to taxation (exempt from taxation) on the territory of the Russian Federation: services of a developer on the basis of a DDU concluded in accordance with Federal Law of December 30, 2004 No. 214-FZ “On participation in shared construction of apartment buildings and other objects real estate and on amendments to certain legislative acts of the Russian Federation" (with the exception of developer services provided during the construction of industrial facilities). For the purposes of this subclause, production facilities include facilities intended for use in the production of goods (performance of work, provision of services).

Based on this, the relations of the parties under the shared construction agreement were considered as investment relations, and the money received from the shareholders under the shared construction agreement was not included in the turnover subject to VAT. The tax base for VAT (as well as for income tax) included only savings from construction results in the form of the difference between the amount of funds received by the developer from shareholders and the costs of constructing premises transferred to these shareholders.

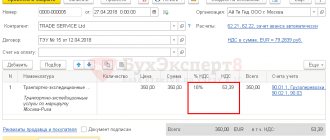

In our case, the project provides for the construction of apartments, parking spaces and individual storage rooms, which are non-residential premises for non-industrial purposes. Consequently, services to developers when they are sold under the DDU are exempt from VAT. However, the funds of participants in shared construction placed in escrow accounts are the property of the shareholder, and not the developer. The developer cannot dispose of the funds in escrow accounts for construction purposes, therefore, in this interpretation, he is not considered an intermediary.

The relationship between the developer and the shareholder can no longer be of an investment nature, since when funds are accumulated in escrow accounts until the house is put into operation, the very essence of investment in shared construction disappears. This calls into question the possibility of determining the financial result in the form of savings.

The Letter of the Ministry of Finance of the Russian Federation dated January 22, 2021 No. 03-07-07/3382 on this issue explains only the following: “We inform you that the issue of determining the cost of the above services, the payment for which comes from escrow accounts, is not regulated by the code.” In this regard, the approach of the tax authorities to determining the tax base of the developer when selling apartments, parking spaces and storage rooms (non-residential premises for non-production purposes for the personal use of citizens) through DDU, subject to settlements through escrow accounts, remains unclear. In this case, we are talking about an increase in the tax burden for VAT in the amount of about 146 million rubles, which is significant for the project.

For profit tax and accounting purposes, the developer’s revenue is determined based on the cost of the shared construction project specified in the contract. For the purpose of calculating VAT on non-residential properties, the tax base is also determined based on the value of the property. At the same time, for profit tax purposes, construction costs reduce the tax base for income tax.

Income tax

For profit tax purposes, property received by the taxpayer as part of targeted financing is not taken into account (subclause 14, clause 1, article 251 of the Tax Code of the Russian Federation). So, in particular, funds of targeted financing include property in the form of funds of shareholders and (or) investors accumulated on the accounts of the developer organization (paragraph thirteen, subclause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

When using escrow accounts in shared construction, the funds of shareholders are accumulated in special accounts of shareholders in the bank (Parts 1, 2, Article 15.5 of the Federal Law of December 30, 2004 No. 214-FZ “On participation in shared construction of apartment buildings and other real estate and on introducing amendments to certain legislative acts of the Russian Federation”, hereinafter referred to as Law No. 214-FZ, Article 860.7 of the Civil Code of the Russian Federation). In this regard, based on a direct reading of paragraph thirteen sub. 14 clause 1 art. 251 of the Tax Code of the Russian Federation, we believe that funds of shareholders held in an authorized bank in escrow accounts (not in the accounts of the developer) cannot be recognized for profit tax purposes as funds of targeted financing. In our opinion, this argument is confirmed by the fact that when raising funds from shareholders using escrow accounts, the requirements provided for in Art. 18–18.2 of Law No. 214-FZ, do not apply (Part 4 of Article 15.4 of Law No. 214-FZ).

Other rules that allow not to include in income funds received as payment for the cost of constructed objects under a shared construction agreement, the provisions of Art. 251 of the Tax Code of the Russian Federation do not contain. Since there are special rules for accounting for income and expenses for developers Ch. 25 of the Tax Code of the Russian Federation is not established, then the developer’s income and expenses must be taken into account in the generally established manner.

Sales proceeds are determined based on all receipts associated with payments for goods sold (work, services) or property rights expressed in cash and (or) in kind (clause 2 of Article 249 of the Tax Code of the Russian Federation). According to Part 1 of Art. 5 of Law No. 214-FZ, the cost of developer services is not included in the contract price from July 30, 2021. In this regard, we believe that the developer’s income should be determined based on the cost of the construction project, defined in the contract (excluding VAT), on the date of transfer of the finished construction project to the shareholder under the acceptance certificate (clause 1 of article 248, clause 3 of article 271 of the Tax Code of the Russian Federation). At the same time, the expenses take into account the tax cost of the construction project, formed from the direct expenses of the developer (Articles 318, 319 of the Tax Code of the Russian Federation). The provisions of paragraph 17 of Art. 270 of the Tax Code of the Russian Federation do not apply in this case.

VAT

The object of VAT taxation is the sale of goods (work, services) on the territory of the Russian Federation, as well as the transfer of property rights (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). The sale of goods, work or services is recognized, respectively, as the transfer of ownership of goods, the results of work performed by one person for another person, the provision of services by one person to another person (clause 1 of Article 39 of the Tax Code of the Russian Federation).

When determining the tax base, proceeds from the sale of goods (work, services), transfer of property rights are determined based on all income of the taxpayer associated with payments for the specified goods (work, services), property rights received by him in cash and (or) in kind , including payment in securities (clause 2 of article 153 of the Tax Code of the Russian Federation). The tax base when a taxpayer sells goods (work, services) is generally determined as the cost of these goods (work, services), calculated on the basis of prices determined in accordance with Art. 105.3 of the Tax Code of the Russian Federation, taking into account excise taxes (for excisable goods) and without including tax (clause 1 of Article 154 of the Tax Code of the Russian Federation).

Any special features for developers of the provisions of Art. 153, 154 of the Tax Code of the Russian Federation are not established. Since the price of the DDU does not include the developer’s remuneration and the entire cost of the object forms the developer’s income, we believe that the VAT tax base should be determined by the developer on the date of signing the acceptance certificate for the constructed object (clause 16 of Article 167 of the Tax Code of the Russian Federation) as the cost of the object specified in the contract.

At the same time, the sale of residential buildings, residential premises, as well as shares in them is not subject to VAT (subclause 22, clause 3, article 149 of the Tax Code of the Russian Federation). In Letter No. 03-07-07/64777 dated September 11, 2018 (based on the totality of the provisions of the Tax Code of the Russian Federation and the Housing Code of the Russian Federation), representatives of the Ministry of Finance of Russia concluded that the exemption from VAT taxation provided for in subparagraph. 22 clause 3 art. 149 of the Tax Code of the Russian Federation, is applied when carrying out operations for the sale of residential premises specified in the Housing Code of the Russian Federation, suitable for permanent residence of citizens. In the case of the sale of residential premises (apartments) intended for temporary residence (without the right to permanent registration), the above exemption from VAT taxation does not apply and, accordingly, operations for the sale of such residential premises (apartments) are subject to VAT taxation in the general manner. From the above position of the financial department, we can conclude that if the apartments are intended for permanent residence of citizens (where there is a right to permanent registration at the place of residence), then their sale is not subject to VAT. If the apartment is a hotel, then the VAT exemption does not apply.

If the taxpayer carries out transactions that are subject to taxation and transactions that are not subject to taxation (exempt from taxation) in accordance with the provisions of Art. 149 of the Tax Code of the Russian Federation, the taxpayer is obliged to keep separate records of such transactions (clause 4 of Article 149 of the Tax Code of the Russian Federation). There are no other explanations from authorized bodies on the procedure for determining tax obligations by developers when raising funds from equity holders using escrow accounts.

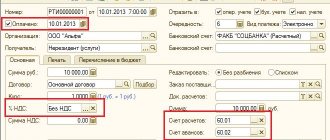

Accounting

Since the shareholders’ funds do not arrive in the developer’s bank account until the completion of construction and are not under his control, they are not an asset. Therefore, accounting for funds received into escrow accounts must be kept on the balance sheet for each DDU (for example, in account 008 “Securities for obligations and payments received”). Revenue is determined based on the price established by the agreement between the organization and the shareholder (clause 6, 6.1 of PBU 9/99). Therefore, in this case, revenue will be determined as of the date of signing the acceptance certificate for the construction project in the amount of the cost of the transferred object established in the contract (clause 12 of PBU 9/99). Construction costs are generally collected on account 08 “Investments in non-current assets” (clause 2.3 of the Letter of the Ministry of Finance of Russia dated December 30, 1993 No. 160, Letter of the Ministry of Finance of the Russian Federation dated May 18, 2006 No. 07-05-03/02).

According to sub. 23.1 clause 3 art. 149 of the Tax Code of the Russian Federation are not subject to VAT (exempt from VAT) on the territory of the Russian Federation, the services of a developer on the basis of an agreement for participation in shared construction, concluded in accordance with Federal Law of December 30, 2004 No. 214-FZ “On participation in shared construction of apartment buildings and other real estate objects and on amendments to certain legislative acts of the Russian Federation.” The exception is developer services provided during the construction of industrial facilities. For the purposes of this subclause, production facilities include facilities intended for use in the production of goods (performance of work, provision of services).

According to the position of the Ministry of Finance of Russia and the Federal Tax Service of Russia, if an agreement on shared participation in construction provides for the transfer of non-residential premises that are not included in the common property of an apartment building and are intended for the production of goods (performance of work, provision of services), then the developer’s services are not exempt from VAT. There are also clarifications from the Russian Ministry of Finance, according to which if the objects of shared construction are non-residential premises as part of an apartment building, then the developer’s services are exempt from VAT, provided that these premises are not recognized as industrial facilities.

At the same time, there are judicial acts, including the Ruling of the Supreme Court of the Russian Federation (given in paragraph 10 of the Review of Legal Positions, sent by Letter of the Federal Tax Service of Russia dated December 23, 2016 No. SA-4-7 / [email protected] to lower tax authorities for use in work), with the conclusion that developers of multi-apartment residential buildings have the right to take advantage of the VAT exemption regardless of the presence of non-residential premises in them. Our opinion coincides with judicial practice: an apartment building (as a building as a whole) is an object of non-industrial (residential) purpose, regardless of the presence of non-residential premises in it. These conclusions are contained in the Ruling of the Supreme Court of the Russian Federation dated September 21, 2016 No. 302-KG16-11410 in case No. A78-10467/2015 (Tantal LLC vs. Interdistrict Inspectorate of the Federal Tax Service No. 2 for the city of Chita).

Thus, the developer’s services for the sale of apartments, parking spaces and individual storage rooms are exempt from VAT. Provided that we are talking about the construction of an apartment building. The use of escrow accounts does not affect the tax burden.

How subjects of investment and construction activities save VAT

During the meeting, issues of taxation of subjects of investment and construction activities were discussed. In particular, methods for forming the initial cost of objects, options for transferring construction costs to the investor, as well as ways to include expenses incurred before obtaining a construction permit into capital investments were covered. In addition, the seminar explained the specifics of taxation when combining several construction functions in one legal entity, for example, a customer and a developer.

The developer can immediately include some types of costs as other expenses.

Lyudmila Khabarova began with the basic concepts and terms used in investment and construction activities. The presenter recalled that a developer is a person who has ownership of land and a construction permit (Clause 16, Article 1, Articles 51, 53 of the Town Planning Code of the Russian Federation). In this case, the developer can authorize the customer to perform part of his functions. The developer may himself be the balance holder of the facility or, after completion of construction, transfer it to the investor.

The presenter of the seminar noted that the tax obligations of the developer are directly influenced by the accounting procedure he chooses and the list of expenses. Those that arise both during the construction process and after its completion.

In particular, the developer can take into account the costs of moving communication lines that do not belong to him, but only in the initial cost of the object (letters of the Ministry of Finance of Russia dated 01.25.10 No. 03-03-06/1/18, dated 05.28.08 No. 03-03-06 /1/338). Officials expressed a similar opinion regarding the rent for the land plot on which the facility is being built (letter dated 08/11/08 No. 03-03-06/1/452). However, according to some courts, such expenses can be written off at a time on the basis of subparagraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation (resolution of the Federal Arbitration Court of the Central District dated November 25, 2008 No. A09-6949/06-31). Which is more profitable from a tax point of view due to earlier write-off of expenses.

Also, interest on loans and borrowings does not increase the initial cost of the object (letters of the Ministry of Finance of Russia dated 06.28.13 No. 03-03-06/1/24671, dated 06.11.13 No. 03-03-06/1/21757). However, the developer has the opportunity to include the amount of bank commissions in the initial cost of real estate (letter of the Ministry of Finance of Russia dated September 24, 2008 No. 03-03-06/1/544). The main thing is that costs in the form of commissions should not be expressed as a percentage determined in advance. Since such expenses are recognized as interest and normalized in accordance with the provisions of Article 269 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated December 5, 2008 No. 03-03-06/1/673). The fee for connecting real estate to engineering support networks does not increase the initial cost (letter from the Ministry of Finance of Russia dated July 18, 2013 No. 03-03-06/1/28181, Federal Tax Service for Moscow dated August 7, 2012 No. 16-15/ [email protected] , resolution of the Federal Arbitration Court of the Moscow District dated April 15, 2013 No. A40-70325/12-20-390).

As for the expenses that arise after the completion of construction, then, for example, the cost of paying the state fee for registering a real estate property and transactions with it can be classified as other expenses (subclause 1, paragraph 1, article 264 of the Tax Code of the Russian Federation, letter from the Ministry of Finance of Russia dated 01/22/08 No. 03-03-06/1/42). In addition, the fee for connecting real estate to engineering support networks does not increase the initial cost of the property, but is taken into account in other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated July 18, 2013 No. 03-03-06 /1/28181, Federal Tax Service for Moscow dated 08/07/12 No. 16-15/ [email protected] , resolution of the Federal Arbitration Court of the Moscow District dated 04/15/13 No. A40-70325/12-20-390).

The presenter also drew attention to the costs associated with construction burdens. Often, in addition to the construction of the facility itself, the investor obliges the developer to build infrastructure in the immediate vicinity of the building. However, if encumbrances are included in the estimate, indicated in the design documentation and appear in the contract itself, then the developer has every reason to believe that these are costs associated with construction. In addition, according to the Russian Ministry of Finance, costs associated with construction encumbrances are included in tax expenses (letter dated March 12, 2009 No. 03-03-06/1/131).

During the meeting, listeners had questions:

– Is it possible to take into account construction costs after receiving permission to put the facility into operation?

– Yes, if these costs were reflected in the consolidated estimate. Otherwise, these are developer expenses that are not taken into account for tax purposes.

– What to do if the full initial cost of the object has not been formed due to lack of documents, while there is permission to put the object into operation?

– Document the unaccounted amount in a special act. However, later the developer will have to clarify the initial cost of the property.

– Is it possible to take into account the costs of commissioning work after receiving permission for commissioning?

– Yes, if the facility is not put into operation. After commissioning, commissioning work can be reflected as modernization (clause 2 of Article 257 of the Tax Code of the Russian Federation) or as other expenses (subclause 49 of clause 1 of Article 264 of the Tax Code of the Russian Federation).

Transferring control and supervision functions to the technical customer will save VAT

During the seminar, Lyudmila Khabarova drew attention to the situation when the customer and the developer are different legal entities. The functions of the customer can be divided into two groups. The first is the actions that precede the start of construction. This, for example, is obtaining a construction permit, preparing data for the development of design documentation, organizing an examination of design and estimate documentation, processing documents for cutting down and replanting trees, and clearing the territory of objects interfering with construction.

The second group is measures for technical control and supervision of construction progress. Such functions include, in particular, approval of the work schedule, checking the availability of necessary permits and certificates from work performers and material suppliers, inspection of hidden work and intermediate acceptance of critical structures, acceptance of completed work from the contractor, organization of installation supervision and commissioning work.

From a tax point of view, it is more profitable for the developer not to take on most of the customer’s functions, but to transfer them to a friendly company in a simplified manner. Then the bulk of the income will be taxed at preferential rates of 6 or 15 percent. In addition, companies using the simplified tax system are not VAT payers (clause 2 of article 346.11 of the Tax Code of the Russian Federation). In the case of transfer of control and supervision functions, we are talking only about the technical customer. Again, the services of the technical customer are not subject to VAT (subclause 30, clause 3, article 149 of the Tax Code of the Russian Federation).

The speaker noted that customer services are included in the cost of construction. At the same time, the contract specifies the list of services, the frequency of reporting, and also indicates the party to the transaction that keeps records of construction costs. In practice, the transfer of costs from the customer to the developer using an advice note (official notice of a change in the status of payments) is very widely used. To reduce tax risks, you can attach a summary statement of construction costs and summary VAT invoices received from contractors to the advice note. These documents will serve as the basis for transferring construction costs to the developer.

Non-residential properties are not subject to VAT under a shared participation agreement

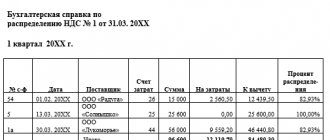

Lyudmila Khabarova focused on the fact that the use of the benefit, which provides for the exemption from VAT of developer services under an equity participation agreement (subclause 23.1, clause 3, article 149 of the Tax Code of the Russian Federation), causes many disputes with inspectors. Since this benefit does not apply to the construction of production facilities.

Therefore, when constructing residential and non-residential premises, only the transfer of part of the share of residential premises in the total area of the object is not subject to VAT (letter of the Federal Tax Service of Russia dated July 16, 2012 No. ED-4-3 / [email protected] ). Moreover, if, after completion of construction, the amount of funds received by the developer from each shareholder exceeds the costs of the transferred part of the property, then the excess is not exempt from taxation (letter of the Ministry of Finance of Russia dated July 3, 2012 No. 03-07-10/15).

For example, an organization is building a residential building within the framework of Federal Law No. 214-FZ dated December 30, 2004 “On participation in shared-equity construction of apartment buildings,” the first three floors of which are garages and parking spaces. If the developer provides services for the construction of such non-residential real estate under an equity participation agreement, their transfer to the investor is not included in the VAT tax base. At the same time, the developer may refuse the benefit in order to take advantage of the right to a tax deduction (letter of the Ministry of Finance of Russia dated March 15, 2012 No. 03-07-10/05).

It’s a different matter if non-residential premises are being built under a separate investment contract. Then the sale of these objects will be subject to VAT.

The VAT benefit for escrow should remain!

Russian developers continue to experience the delights of “life in an era of change.” And while management is looking for a common language with banks on project financing, and sales department specialists are explaining to shareholders what escrow accounts are, accounting and financiers are trying to understand how the new realities will affect the company’s tax burden.

The most sensitive issue for developers at the moment is the taxation of value added tax (VAT) on shared construction.

After the reform of the housing construction financing system, opinions began to appear in the professional community that the developer was losing the right to the previously applied VAT benefit due to the fact that the money of shareholders was now transferred to escrow accounts.

Since explanatory documents in this regard have not yet been received either from the tax authorities or from the relevant ministry, companies and experts are independently trying to figure out whether the procedure for taxing the activities of a developer will change in connection with the transition to project financing and whether this will entail an increase in its tax burden.

ECCON GROUP experts Olga Garashchenko and Natalya Brovkina are confident that despite the change in the financing scheme for shared construction, the developer’s VAT benefits should remain.

Otherwise, the balance of interests of market participants is disrupted and a bias arises towards the sale of finished housing, which, as is known, is not subject to VAT on the basis of paragraphs. 22 clause 3 art. 149 of the Tax Code of the Russian Federation.

If a similar rule for the sale of residential real estate in shared-equity construction is removed, then developers who attract funds from shareholders to escrow accounts will be put in a disadvantaged position. And this is unacceptable from the point of view of the general principles of tax calculation - this is exactly how the “shared” VAT benefit arose at one time. After all, taxation cannot depend on the legal form of the transaction, be it a purchase and sale agreement or an agreement for participation in shared construction (DDU).

At the same time, ECCON GROUP analyzed the updated legislation, a number of regulatory documents and letters and made sure that the current edition of the Tax Code of the Russian Federation does not prevent the developer from using the VAT exemption for shared construction.

Let us recall that developers, when transferring constructed apartments or parking spaces in apartment buildings to shareholders, did not impose VAT on them on the basis of the benefits provided for in paragraphs. 23.1 clause 3 art. 149 of the Tax Code of the Russian Federation. For non-residential premises for industrial purposes, VAT was payable on the amount of the difference between the funds received from investors and the actual costs of constructing the corresponding premises, that is, on the so-called “savings upon completion of construction”.

The use of this benefit implies an exemption from VAT on “developer services based on the DDU.”

In the previously valid version of the Federal Law of December 30, 2004 No. 214-FZ “On participation in shared construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation,” developer services were mentioned in two norms:

- in paragraph 1 of Art. 5 – in the context that the price of the DDU may include the services of the developer and reimbursement of construction costs;

- in paragraph 2 of Art. 18 – an indication that the developer’s services are not subject to restrictions of the law on the targeted expenditure of funds of participants in shared construction.

And for the purposes of applying the VAT exemption, the regulatory authorities interpreted the developer’s services broadly, understanding by them not only the amount of services explicitly allocated in the DDU, but also the amount of savings remaining at the developer’s disposal upon completion of construction.

In the current version of Law No. 214-FZ, which is used by developers who attract funds from citizens to escrow accounts, there is no mention of developer services.

Some experts perceived this fact as an omen that the VAT benefit can no longer be applied by developers.

ECCON GROUP specialists do not agree with this approach.

When formulating the benefit, the legislator makes reference to “developer services based on the DDU”, which are not clearly defined in the current legislation. In such conditions, the services of the developer should be considered those services that form the subject of the agreement for participation in shared construction in accordance with clause 1 of Art. 4 of Law No. 214-FZ, that is, the construction (creation) of an apartment building or other real estate object and the transfer of the corresponding shared construction object (after receiving permission for commissioning) to the participant in shared construction.

Accordingly, for VAT tax purposes, developer services are services provided on the basis of the DDU for organizing construction and transferring a shared construction project to shareholders, regardless of how these services are defined and, moreover, paid for.

This means a benefit according to paragraphs. 23.1 clause 3 art. 149 of the Tax Code of the Russian Federation on housing continues to be applied!

***********

As for the procedure for the developer to determine the VAT tax base for taxable turnover - when selling non-residential premises for industrial purposes, for example, parking spaces in a separate parking lot, we have to admit that a change in the approach to this calculation is very likely.

The fact is that traditionally, when calculating taxes, the developer was considered as an intermediary managing the funds received under the DDU. This position, in particular, was confirmed by the Plenum of the Supreme Arbitration Court of the Russian Federation in Resolution No. 33 dated May 30, 2014.

The relations of the parties under the DDU were considered as investment relations (clause 4, clause 3, Article 39 of the Tax Code of the Russian Federation), and money received from shareholders under the DDU was not included in the turnover subject to VAT on the basis of paragraphs. 2 p. 1 art. 162 of the Tax Code of the Russian Federation as not related to implementation.

In other words, the tax base for VAT (as well as for income tax) included only savings from construction results in the form of the difference between the amount of funds received by the developer from shareholders and the costs of constructing premises transferred to these shareholders.

However, in the context of the implementation of the legislative requirement for the mandatory placement of funds of participants in shared construction in escrow accounts, which, as is known, are the property of the shareholder, and not the developer, the above “design” of forming the tax base gives a serious tilt.

Obviously, the developer cannot manage the funds in escrow accounts for construction purposes, therefore, in this interpretation, he is not considered an intermediary. The relationship between the developer and the shareholder can no longer be of an investment nature, since when funds are accumulated in escrow until the house is put into operation, the very essence of investment in shared construction disappears. This calls into question the possibility of determining the financial result in the form of savings.

Such regulatory conflicts, unfortunately, do not allow an unambiguous interpretation for tax purposes of the relations of the parties to shared participation in construction under the conditions of changed legislation. ECCON GROUP experts take the position that the financial result of a developer who attracts money from shareholders to escrow accounts is determined by the service delivery model. This approach is fully consistent with the definition of developer services for which the housing benefit applies.

By receiving funds from the equity holders from the bank upon opening escrow accounts, the developer thereby receives remuneration for the services provided to these equity holders in organizing construction. In this case, the VAT tax base includes the full cost of the shared construction project in relation to non-residential premises for industrial purposes, recorded in the DDU (clause 2 of Article 153 of the Tax Code of the Russian Federation). And the tax itself is calculated at the time of sale of services, which means the signing of the transfer deed with the shareholder.

Thus, we can conclude that after reforming the legislation on shared construction, the following VAT taxation procedure applies to the developer:

- The sale of residential real estate under a purchase and sale agreement is not subject to VAT on the basis of paragraphs. 22 clause 3 art. 149 Tax Code of the Russian Federation;

- When selling non-residential real estate completed by construction, VAT is paid in accordance with paragraphs. 1 clause 1 art. 146 Tax Code of the Russian Federation;

- The transfer by the developer of residential real estate and non-residential real estate for non-industrial purposes under the DDU is exempt from VAT, since the benefit of paragraphs applies to the developer’s services. 23.1 clause 3 art. 149 Tax Code of the Russian Federation;

- the transfer of non-residential real estate for industrial purposes to equity holders entails the accrual of VAT on the entire amount of the price of the DDU, since the tax benefit does not apply to such services of the developer, and the tax base is calculated in the general manner, and not from the amount of savings from construction.

We can only hope that in the near future the issue of VAT taxation for developers will be resolved in favor of the latter, and the regulatory authorities will confirm the legality of applying the benefit in question.

In general, it’s time for legislators to pay attention to regulating the tax aspects of the activities of Russian developers and eliminate the existing uncertainty regarding the application of tax standards. After all, we all understand that an increase in the tax burden of construction companies is a direct path to increasing the final cost of housing construction for buyers.

Let us note an interesting trend that has emerged recently: the issue of taxation of developers working with escrow accounts has already been raised on several public platforms. And if earlier this topic was not raised at all, then at a round table within the framework of the PROESTATE Forum -2019, the chairman of the ICIE (r) Committee on Urban Planning, Mikhail Viktorov, said literally the following: “We still have to deal with the taxation of developers, and this is now one of the hottest topics "

Construction business ombudsman Dmitry Kotrovsky stated the same at a conference in St. Petersburg. He referred to the words of Deputy Minister of Construction and Housing and Communal Services of Russia Nikita Stasishin, who admitted that during the reform of shared-equity housing construction, no one even thought about changing taxes for developers. However, there are now some very difficult issues to be seen here. Thus, the topic of taxation of developers during the transition to working with escrow accounts has finally come out of the shadows, and there is a chance that it will be resolved properly.

Elena Medyntseva

This material was published in the October issue of the Industry magazine “Construction”. You can read or download the entire magazine here .

Share building. Accounting for developer expenses

LLC is a developer of apartments. Participation agreements are concluded. The contract sets out separately the cost of construction costs and the amount of developer services. The construction is entirely carried out by the general contractor. In the course of its activities, the developer incurs costs: office rent, communication services, legal services, salaries of the director and accountant, advertising.

How to recognize and take into account these expenses in accounting and tax accounting? Can it be taken into account upon completion of construction or must it be taken into account in the current tax period?

Relations related to the attraction of funds from citizens and legal entities for the shared construction of apartment buildings and (or) other real estate objects and the emergence of the participants in shared construction of the right of ownership of shared construction objects and the right of common shared ownership of common property in an apartment building and (or) other real estate, is regulated by Federal Law No. 214-FZ of December 30, 2004 “ On participation in shared-equity construction of apartment buildings and other real estate

and on amendments to certain legislative acts of the Russian Federation.”

For the purposes of Law No. 214-FZ, under the developer

is understood as a legal entity, regardless of its organizational and legal form, which owns or leases, subleases, or in cases provided for by Federal Law No. 161-FZ of July 24, 2008 “On

Promoting the Development of Housing Construction”,

the right of free use of land plot and attracting funds from participants in shared construction in accordance with the law for the construction (creation) of apartment buildings and (or) other real estate objects on this land plot,

with the exception of industrial facilities

, on the basis of a received construction permit.

Shared construction object

- this is

residential or non-residential premises

, common property in an apartment building and (or) other real estate, subject to transfer to a participant in shared construction after receiving permission to put into operation an apartment building and (or) other real estate and included in the specified apartment building and ( or) another real estate object being built (created) also with the involvement of funds from a participant in shared construction.

According to Art. 4 of Law No. 214-FZ, a contract for participation in shared construction must contain, in particular, the price of the contract

, terms and procedure for its payment.

The contract specifies the contract price

, that is, the amount of money payable by a participant in shared construction for the construction (creation) of a shared construction project.

The contract price can be determined

in the contract as the amount of funds to reimburse the costs of construction (creation) of a shared construction project and

funds to pay for the services of the developer

(Article 5 of Law No. 214-FZ).

Clause 1 Art. 18 of Law No. 214-FZ establishes restrictions

in terms of spending funds paid by the participant in shared construction under the contract

to reimburse costs for the construction

(creation) of a shared construction project.

In accordance with paragraph 2 of Art. 18 of Law No. 214-FZ cash

Participant in shared construction,

paid under the agreement to pay for the services of the developer, are spent by the developer at his own discretion

.

According to PBU 10/99 “Expenses of the organization”

, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n, expenses the implementation of which is associated with the performance of work or provision of services are recognized as

expenses for ordinary activities

.

Expenses are subject to recognition in accounting, regardless of the intention to receive revenue, other or other income and the form of the expense (monetary, in-kind and other).

Expenses are recognized in the reporting period in which they occur

, regardless of the time of actual payment of funds and other forms of implementation (assuming the temporary certainty of the facts of economic activity).

Depending on whether your organization carries out one or more types of activities, the expenses you indicate are taken into account either on account 20

“Main production”, or on

account 26

“General business expenses”.

Your expenses for construction organization services are reflected:

DEBIT 26

(

20

)

CREDIT 23

(

25, 68, 69, 70, 76, 60

, etc.).

Receipts related to the performance of work and provision of services are recognized as income of the organization

(clause 5

of PBU 9/99 “Income of the organization”

, approved by order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n).

Revenue is accepted for accounting

in an amount calculated in monetary terms equal to the amount of receipt of cash and other property and (or) the amount of accounts receivable.

At the time of recognition of revenue from the provision of services:

DEBIT 62 CREDIT 90

subaccount “Revenue.

Your costs for providing services are debited from account 26

(

20

) to the debit

of account 90

subaccount “Cost of sales”.

If you received your reward in advance:

DEBIT 62

“Settlements with equity holders”

LOAN 62

“Advances received.”

When recognizing revenue, the amounts of the advance received are offset:

DEBIT 62

“Advances received”

LOAN 62

“Settlements with equity holders.”

In accordance with paragraph 2 of Art.

271 of the Tax Code of the Russian Federation for industries with a long

(

more than one tax period

)

technological cycle

, if the terms of the concluded contracts

do not provide for the stage-by-stage delivery of work (services), income from the sale of

the specified work (services) is distributed by the taxpayer independently in accordance with the principle of generating expenses for the specified works (services).

At the same time, paragraph 1 of Art.

272 of the Tax Code of the Russian Federation

establishes that if the terms of the agreement provide

for the receipt of income during more than one reporting period

and

do not provide for the phased delivery of goods

(

work, services

),

expenses are distributed by the taxpayer independently

, taking into account the principle of uniform recognition of income and expenses.

Under long cycle production

for the purpose of calculating income tax, it is necessary to understand production, the

start and end dates of which fall on different tax periods,

regardless of the number of days of production.

The above applies only to cases of concluding a contract that does not provide for the stage-by-stage delivery of work and services (regardless of the duration of the stages).

The Ministry of Finance of the Russian Federation in a letter dated 02/04/2015 No. 03-03-06/1/4381 explained that the features

recognition for tax purposes of income and expenses in production with a long cycle, established by

paragraph 2 of Art.

271 ,

paragraph 1, art.

272 and

art.

316 of the Tax Code of the Russian Federation ,

apply to cases where an organization, as one party

to a contract, provides services, performs work, including the manufacture of products (property)

ordered by the other party

.

In particular, the norms of these articles apply to operations carried out within the framework of relations between the parties arising when concluding contracts on the terms provided for in Chapter 39 “Paid provision of services” of the Civil Code of the Russian Federation

.

The Ministry of Finance also emphasizes that if an organization uses the accrual method for calculating income tax, the settlement procedure of the parties under the agreement does not affect the procedure for recognizing revenue for tax purposes.

.

Construction organization activities

is

the provision of services

.

Art. 318 Tax Code of the Russian Federation

It has been established that

production and sales costs incurred during the reporting

(

tax

)

period are divided into

:

1)

straight;

2)

indirect.

Direct expenses may include, in particular

:

– material costs determined in accordance with paragraphs. 1

and

4 paragraphs 1 art. 254 Tax Code of the Russian Federation

;

– expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as expenses for compulsory pension insurance, used to finance the insurance and funded part of the labor pension for compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases, accrued on the specified amounts of labor costs;

– the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

To indirect expenses

include all other amounts of expenses, with the exception of non-operating expenses determined in accordance with

Art.

265 of the Tax Code of the Russian Federation , carried out by the taxpayer during the reporting (tax) period.

The taxpayer independently determines in the accounting policy for tax purposes a list of direct expenses associated with the production of goods (performance of work, provision of services).

At the same time, the amount of indirect costs for production and sales

expenses incurred in the reporting (tax) period are fully included in the expenses of the current reporting (tax) period, taking into account the requirements provided for by the Tax Code of the Russian Federation.

Non-operating expenses are included in the expenses of the current period in a similar manner.

Taxpayers providing services have the right

attribute the amount of direct expenses incurred in the reporting (tax) period in full to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress.

About the additional burden of the developer

Alpha LLC entered into an investment contract with the city administration for the construction of a microdistrict. In accordance with its terms, the developer is allocated a plot of land for the construction of five residential buildings. Alpha LLC must build a sports ground on the territory of the microdistrict and transfer it to local authorities. In addition, when issuing technical conditions for connecting ready-made houses to city backbone networks, the energy sector was obliged to transfer 5,000,000 rubles for the reconstruction of power lines, as well as to build and transfer to him a transformer substation.

In the analytical accounting registers of Alpha LLC, it is recommended to keep costs for the construction of all separate real estate objects broken down by costs for each residential building ( Debit

20, subaccounts “D1–D5”), sports ground (

Debit

20, subaccount “SP”), transformer substation (

Debit

20, subaccount “TP”).

The transfer of funds for the reconstruction of power lines is reflected in accounting by posting:

- Debit

60

Credit

51 – 5,000,000 rub. – funds were transferred for the reconstruction of power lines.

Next, the costs incurred are distributed among construction projects according to the economically justified indicator chosen by the organization. This could be the estimated cost of each facility, the estimated amount of energy consumption, etc.

Let’s assume that, according to the indicator chosen by the organization, 80% of the transfer amount was spent on the construction of houses, 15% on the construction of a sports ground, and 5% on technical infrastructure.

Thus, the distribution of costs will be reflected by the postings:

- Debit

20 of subaccount “D1–D5”

Credit

60 – 4,000,000 rub. (RUB 5,000,000 × 80%); - Debit

20 subaccount “SP”

Credit

60 – 750,000 rub. (RUB 5,000,000 × 15%); - Debit

20 subaccount “TP”

Credit

60 – 250,000 rub. (RUB 5,000,000 × 5%).

The developer entered into an agreement with the technical customer. In accordance with the contract, construction costs are transferred to the customer after completion of the construction of each separate property and receipt of permission to put it into operation in the name of the developer.

The technical customer presented costs for the construction of the transformer substation in the amount of 1,000,000 rubles. and VAT in the amount of 180 thousand rubles.

The acceptance of this object in the developer’s accounting is documented by the following entries:

- Debit

20 subaccount “TP”

Credit

60 – 1,000,000 rub. – the acceptance of the constructed facility from the technical customer is reflected; - Debit

19

Credit

60 – 180,000 rub. – the amount of VAT on the accepted object is reflected; - Debit

68 subaccount “Calculations for VAT”

Credit

19 – 180,000 rubles. – the amount of VAT is accepted for deduction.

The transfer of TP to power engineers in exchange for the right to connect to networks should be recognized as its implementation. The specified transaction is compensated, therefore, the proceeds from the sale of the object (in the amount of the actual costs of its construction) are included in the VAT base.

The actual costs for the construction of the transformer substation amounted to RUB 1,250,000. (1,000,000 rubles – expenses of the technical customer and 250,000 rubles – transfer of funds to power engineers). The transfer of technological equipment according to the acceptance certificate and invoice to power engineers is reflected by the following transactions:

- Debit

62

Credit

90 subaccount “Revenue” – 1,475,000 – transfer of TP to power engineers (RUB 1,250,000 × 118%); - Debit

90 subaccount “VAT”

Credit

68 subaccount “Calculations for VAT” – 225,000 rubles. – the amount of VAT on the transferred object (RUB 1,250,000 × 18%); - Debit

90 subaccount “Cost of sales”

Credit

20 subaccount “TP” – 1,250,000 rub. – actual costs for the construction of the transformer substation are written off.