- Purpose of the article: displaying information about the balance of input VAT on purchased goods, works or services that was not accepted for deduction in the reporting year (or was not written off to cost accounts in some cases).

- Line number in the balance sheet: 1220.

- Account number according to the chart of accounts: Debit balance of the account..

According to the law, VAT payer organizations can deduct input tax amounts on purchased inventory items, services received and work performed in the amounts included by VAT taxpayer suppliers in the cost of the product (suppliers must pay this tax to the budget of the Russian Federation).

To claim input tax for deduction and reduce the tax accrued for payment, the following basic conditions must be met simultaneously:

- purchased goods and materials, works or services are subsequently intended for the activities of the company, subject to value added tax. For example, the purchase of goods for their further resale, the purchase of raw materials for the production of finished products for the purpose of their subsequent sale, etc.;

- purchased goods and materials, services or work received are accepted for accounting by the company, their cost is displayed to the buyer;

- correct execution of primary documentation (invoices, UPD with the allocation of the tax amount in a separate line).

Note from the author! When filling out a tax return, information from the purchase book and sales book is additionally attached, the Federal Tax Service Inspectorate automatically reconciles the interaction of counterparties, and if discrepancies are detected in the data in the buyer’s purchase book and the supplier’s sales book, the regulatory authorities have the right to request clarification on this issue, a deduction may be made cancelled.

In most cases, account 19 at the end of the reporting period is completely reset and line 1220 of the balance sheet is not filled in. However, situations may arise when a debit balance is accumulated on account 19:

- errors made in the submitted invoice or its absence;

- the deduction can be made within three years after the date of acceptance of the acquired inventory, work or services for accounting, so the enterprise can decide to transfer the deduction to subsequent periods;

- export transactions on raw materials (tax deduction can be claimed only after full confirmation of the fact of the export transaction);

- in cases where the purchased materials are used in a long production process, the tax can be deducted only after the final product has been shipped to the customer.

Note from the author! A debit balance of account 19 can also be formed when paying standardized costs for calculating income tax (these costs cannot be included at a time in calculating the tax base; accordingly, the amount of VAT that can be deducted is reduced). Balances at the end of the reporting year can be included in other expenses, since these tax amounts cannot be deducted in future periods.

Line 1220 – current assets of the company: this displays the balance of input tax on purchased goods and materials, which was not accepted for deduction in the reporting year for certain reasons, but the company’s right to deduction is transferred to subsequent periods.

Note from the author! If there is a large debit balance on account 19, the company must detail line 1220, for example, by adding additional lines.

The final figure in accounting should be reflected as the final debit balance of account 19. The financial statements display information as of the current period, December 31 of the previous year, as of December 31 of the year preceding the previous one. Comparison of indicators from previous years should be carried out comprehensively with an analysis of the reasons for the balance of input VAT.

VAT of the tax agent in the balance sheet

Good afternoon

Quote (Ekaterina Raido): in the balance sheet it is necessary to indicate the amount of transferred VAT in line 1220??? The balance sheet reflects account balances; why is the transferred VAT reflected in the balance? Look at the article on the Garant.ru website. On which line of the balance sheet should the amount of VAT included in accounts receivable or payable be reflected? How is line 1220 of the balance sheet formed? Is it necessary to include VAT in a consolidated form in the cash flow statement? In the balance sheet, a special line is provided to reflect VAT - 1220 “VAT on acquired values.” In addition, tax amounts appear on lines 1230 and 1520 of the form. Let us recall that these lines reflect accounts receivable and accounts payable, respectively. Line 1220 This line reflects the amount of “input” value added tax on incoming values (work performed, services provided), which was not written off as of the last day of the reporting period. Such amounts are taken into account on account 19 “Value added tax on acquired assets.” The debit balance of this account is entered in line 1220. The company can provide details of the amounts of “input” VAT (for example, tax on fixed assets, intangible assets, inventories, etc.) in lines 12201, 12202, 12203, etc. of the breakdown of individual balance sheet indicators (if using unified form). “Input” VAT on purchased values, works or services can be deducted regardless of the fact of their payment. The main thing is that three conditions established by the Tax Code of the Russian Federation (Tax Code of the Russian Federation) are met: – acquired assets are capitalized, work is completed, services are provided; – for the received property (work performed, services rendered) there is a correctly executed supplier invoice; – values (work, services) are necessary in activities subject to VAT. As we noted earlier, in some situations VAT is not deducted, but written off to cost accounts or included in the cost of purchased property. For example, if the property is intended for tax-free activities, or the company has received an exemption from paying it. Based on this debit balance on account 19, the company may not have (“input” tax taken for deduction, written off as expenses, included in the cost of certain assets). However, in some cases, the company may have some amounts of unwritten “input” VAT. We are talking about operations when tax is written off in a special manner (Articles 171, 172 of the Tax Code of the Russian Federation). In particular: – when the company performs the role of tax agent for VAT (the tax is deducted after transfer to the budget); – when the company pays expenses that are normalized for profit taxation (tax on expenses within the standard is accepted for deduction. In this case, the indicator necessary to calculate this standard becomes known only at the end of the year); – when the company carries out export transactions (tax is deducted only after confirmation of the fact of export);

– in the manufacture of products with a long production cycle (the tax paid when purchasing certain valuables, works or services necessary in production is deducted only after they are shipped to the final buyer). Let's talk in more detail about the second situation. A number of company expenses are normalized when taxing profits. These are, in particular, some types of advertising and entertainment expenses. “Input” VAT related to regulated expenses is subject to deduction in an amount corresponding to these standards (clause 7 of Article 171 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated March 13, 2012 No. 03-07-11/68, dated February 17, 2011 No. 03-07-11/35). The indicator necessary to calculate the standard (amount of revenue, labor costs) becomes known only at the end of the reporting year. However, such costs may be incurred much earlier (for example, at the beginning of the year). Therefore, the accountant must quarterly adjust the amount of “input” VAT, adding it as the standard and the amount of costs accepted for profit taxation increase. As a result, at the end of the first quarter, half a year and 9 months later, the company may have amounts of unwritten “input” VAT on these expenses. These amounts will be reflected in line 1220 of the balance sheet for the corresponding period. When preparing annual reports, when the final amount of standardized expenses is determined, the amounts of VAT not accepted for deduction related to excess expenses will be written off from account 19 to the debit of account 91. Accordingly, they will no longer be taken into account on line 1220 of the balance sheet. Moreover, since such amounts will be included in other expenses, they will be reflected on line 2350 of the income statement. Lines 1230 and 1520 In general, accounts receivable (payable) are reflected in the balance sheet in full, that is, including VAT. The situation is different with the listed (received) advances. Here is the following order. Repayment of the obligation of the party that received the advance (prepayment) consists of the delivery of goods (performance of work, provision of services, transfer of property rights). Based on the requirements of tax legislation regarding the payment and reimbursement of VAT, the amount of obligations to be repaid does not include the amount of tax. Consequently, in the case of a company transferring an advance payment, accounts receivable are reflected in the balance sheet at a valuation minus the amount of VAT subject to deduction (accepted for deduction). The situation is similar with accounts payable. The Russian Ministry of Finance provided such clarifications in its recommendations to audit organizations and auditors on conducting an audit of financial statements for 2012 (letter of the Russian Ministry of Finance dated January 9, 2013 No. 07-02-18/01). Elena Tarasova Deputy editor-in-chief of the magazine “Actual Accounting” 2013

Accounting accounts to display VAT on purchases

VAT is a complex tax and an accountant needs to be very careful when working with it. If a company operates on a common system, then it buys mainly from counterparties that work with VAT. Therefore, the tax on all company purchases in the total amount is the amount of the “input” tax, which usually reduces the amount of VAT transferred to the budget.

Take our proprietary course on choosing stocks on the stock market → training course

It doesn’t matter at all what is purchased for the organization’s activities - stationery or expensive equipment, or maybe a service. If the purchase and sale transaction is completed in accordance with all the rules and you have a full set of original documents, including accounting documents, then VAT can be safely taken into account. The accumulation of tax amounts on purchases is shown in account 19 .

The entire amount of value added tax that comes to the organization along with the purchase of goods, services or other valuables must be very clearly reflected in the accounting accounts. There are three main entries that relate to the “input” tax.

| Contents of operation | Wiring | Explanation |

| The amount of tax billed by the seller | D19 K60 | When purchasing a product, service, or value, the buyer pays VAT along with the cost. Its amount is taken into account in account 19 |

| Tax accepted for deduction | D68 K19 | Tax that is subject to deduction from the budget is reflected in credit 19 of account |

| Write-off of VAT amount | D91 K19 | In the event that you have to write off the tax amount, the amount falls to 91 accounts |

Every accountant makes such entries when accounting for VAT on purchases.

It must be remembered that goods can be purchased for their further sale, property related to fixed assets, materials, intangible assets, as well as services. If you have an invoice, VAT from such transactions will be “input” and will ultimately reduce the accrued tax at the end of the quarter.

General information ↑

Value added tax on acquired assets is a tax that must be paid.

Since, according to the law, all profits received as a result of commercial activities must be taxed.

What it is

VAT on acquired assets is a tax that includes almost all information on various types of income received by the company.

The following transactions relate to this type of income:

- sale of goods;

- sale of services;

- the process of selling or buying valuables of various kinds.

The tax itself is usually reflected in the financial statements in account No. 19 (debit) under the name “VAT on acquired assets.”

This account also reflects:

- intangible assets;

- production and material inventories.

What problems might there be?

Most often, problems related to value added tax arise in two cases:

- When VAT on acquired assets is accepted for deduction upon application.

- When submitting a request to the tax authorities for a VAT refund (on purchased valuables in the case of the sale of imported goods).

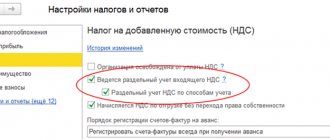

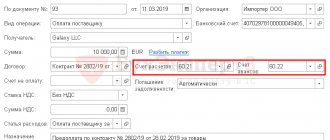

Beginning users of the 1C program experience some problems when they try to fill out a purchase book using a standard mechanism.

Sometimes all the necessary information simply does not fit. To get around this feature of the program, it is necessary to deduct not all VAT, but part of it.

The rest of the amount should just wait for some time in account No. 19. At the first opportunity, you can take the balance for deduction; there is quite an impressive reserve of time for this - three whole years.

Sometimes it happens that tax authorities refuse to refund VAT on purchased valuables based on the lack of invoices (Article No. 169 of the Tax Code of the Russian Federation).

If such a situation arises, it is necessary to be guided by Government Decree No. 914 dated 02.11.00.

According to it, the basis for registering invoices in the purchase book is payment documents (confirming payment of VAT) and a declaration (customs).

Which allows you to receive a refund when you provide these two documents. Invoices are not required.

Accounting for VAT on purchased assets ↑

All taxes must be subject to strict accounting, including value added tax. Since the appearance of various types of errors leads to questions from the tax inspectorate.

VAT inventory must be carried out without fail, so hiding errors from accountants and auditors will be quite problematic.

Formation of input VAT

Input VAT is a tax included in the price of goods purchased from a supplier who is also a payer of value added tax - this is currently regulated by the Tax Code of the Russian Federation, Art. No. 171 and art. 172.

Formation of input VAT is possible if:

- resources acquired for use in any operations are subject to VAT (production and subsequent sale of goods subject to VAT);

- when any material assets are taken into account;

- payment for resources has been made.

The formation of input VAT is not affected by the asset or liability owned by the enterprise. The only important thing is what the taxpayer company is in the chain of sale and production of goods and services.

Since the possibility of subsequent deduction of VAT when paying taxes directly depends on this. The VAT itself on purchased values is displayed in line 1220.

How to submit a VAT return electronically, see the article: Submitting VAT electronically.

What is the procedure for recovering VAT when switching to the simplified tax system?

It contains all the information on value added tax - if it should be charged. And this does not always happen.

Since if material assets are acquired for the implementation of any events or activities on which VAT is not paid, the tax is not displayed in line 1220.

It is simply written off as an expense or included in the cost of the acquired property itself.

Write-off of input tax

If certain conditions arise, input value added tax may be written off.

The easiest way to carry out this operation is for enterprises that use a simplified taxation scheme - income minus expenses. Moreover, current assets do not have any impact on this.

That is, the write-off of input tax is in no way related to accounts receivable or financial reserves.

According to current legislation, the amount of VAT can be included in the “expenses” column of an enterprise in the process of determining the object of taxation.

According to the Tax Code of the Russian Federation, or rather Art. No. 346 clause 1, an enterprise that is a payer of the tax in question has the right to deduct from the income received during the reporting period the amount of VAT on purchased goods (services).

It is only important that they are included in expenses in accordance with Art. No. 346 p. 16, 17.

This is what makes it possible, on absolutely legal grounds, to completely write off the VAT input tax on purchased assets as expenses.

It is only important that two conditions are met:

- all purchased goods must be expenses (according to the simplified taxation scheme);

- All goods purchased by the organization must be paid for at the time of reporting.

Performing the duties of a tax agent

In some cases, tax legislation imposes on an enterprise the duties of a tax agent in the presence of VAT on acquired assets.

As a rule, a tax agent is an enterprise that acts as a source of income for another organization.

The conditions under which a company becomes a tax agent are fully listed in Art. No. 161 of the Tax Code of the Russian Federation.

Thus, an organization is obliged to play the role of a tax agent if:

- Confiscated material assets, various treasures, as well as values of other origins are sold.

- The property of a previously bankrupt enterprise or individual is purchased or sold.

- All kinds of goods and valuables of imported origin are sold.

The duties of the tax agent include withholding a certain amount from his own income, after which he must transfer it to the tax service within the time limits established by law.

Thus, in fact, the tax agent acts as an intermediary between the tax authorities and the taxpayer himself.

Payment of standardized expenses

Expenses that are regulated in the Tax Code, as well as in various decrees of the Russian government, include:

- on advertising (costs of advertising structures, banners and other types);

- employee insurance (voluntary) under contract;

- interest on loans taken by the organization for various purposes;

- related to the sale of printed materials (books);

- replenishment of the reserve for unconfirmed (doubtful) debts.

There are situations when some regulated expenses simply do not fit into the standard established by the Tax Code, Art. No. 270, paragraphs 42, 44. Therefore, these expenses cannot be deducted.

As a result, the organization is obliged to pay the balance of VAT, since it is not possible to include this tax in any non-operating expenses.

Examples

The company made an advance payment of 1.118 million rubles to pay for upcoming deliveries. Prepayment is 100% of the cost of the goods. VAT in this case is equal to 118 thousand rubles.

Also, in the reporting period under review, the same company received from its future customers an advance payment amounting to 708 thousand rubles. VAT in this case is equal to 108 thousand rubles.

All transactions performed are reflected in the financial statements as follows:

| the name of the operation | Sum | Debit | Credit |

| Transfer of advance payment to supplier | 1.118 million rubles | 60 | 76 |

| Amount of accrued value added tax | 180 thousand rubles | 68 | 76 |

| Transfer of advance payment from buyers | 708 thousand rubles | 51 | 62 |

| Value added tax on advance payments received from buyers | 108 thousand rubles | 76 | 68 |

| Capitalized material assets | 90 thousand rubles | 41 | 71 |

If you display tabular data in a unified form, the record will look like this:

| Cell | Sum |

| Line No. 1230 | 1 million rubles |

| Line No. 1520 | 600 thousand rubles |

Some nuances sometimes arise when distributing VAT amounts on acquired values related to indirect expenses.

They are resolved with the help of the Tax Code and relevant Government decrees that directly relate to this issue.

When drawing up a report, it is very important to mention that all types of debts (receivables and payables) are reflected in the corresponding section of the balance sheet.

What do you need to know about the accumulation register? ↑

In a specialized software environment called 1C: Accounting, there are elements such as accumulation registers.

It is thanks to them that it is possible to record movements:

- goods;

- materials;

- funds.

Registers make it possible to automate a variety of accounting areas:

- mutual settlements;

- long-term planning;

- inventory control.

When using the savings register to automate VAT accounting on purchased assets, you should remember some features:

- the movement of inflow is indicated by the sign “+”, the movement of expenditure by the sign “-“;

- register entries are associated with the line number - it is important not to confuse them;

- When generating VAT, you must remember to control the uniqueness of records - it will not allow you to create identical values.

If you remember these features when preparing reports (declarations), then the occurrence of any problems is completely excluded.

The presence of an increased VAT on purchased values indicates the presence of some error in the savings registers, which must be corrected.

Find out tax deductions for VAT and the procedure for their application in the article: VAT deduction.

How to check your VAT return according to tax rules.

What services are not subject to value added tax?

VAT on purchased assets is no less important than other taxes.

Errors in its calculation can lead to serious problems with the tax office and the imposition of penalties.

Therefore, it is imperative to carefully monitor the correctness of the submitted data. This will save time and money.

Previous article: Filing VAT electronically Next article: How to calculate VAT penalties

"Input" VAT

Line 1220 “VAT on purchased assets”

Line 1220 reflects the amount of tax that the company will be able to deduct in the future. The remaining value (debit balance) for account 19 is transferred to this balance line.

To exercise the right to deduction, a number of conditions must be simultaneously met:

- the acquired assets are intended for the type of activity that is subject to VAT;

- the cost of acquired assets is reflected in accounting;

- there is a correctly issued invoice from the supplier.

To learn how the form and rules for filling out an invoice have been updated since October 1, 2017, read the article “How to fill out a new invoice form from October 2021?”

For many organizations, account 19 is reset to zero at the end of the year, and in this case a dash is added to line 1220 of the balance sheet. The balance on account 19 may arise in such cases (all of them follow from the text of Articles 171 and 172 of the Tax Code of the Russian Federation):

- when exporting raw materials (the delay in accepting VAT for deduction is due to the fact that it is necessary to go through the procedure of confirming the fact of export);

- if the acquired assets are used by a company with a long production cycle (VAT is deductible only after the finished product is shipped to the buyer);

- if the supplier did not provide an invoice or the invoice was issued with significant violations;

- when the taxpayer decides to deduct it at a later period (before the expiration of 3 years from the date of registration of the acquired property).

NOTE! For organizations with large balances on account 19, it is better to detail the value of line 1220. This right is provided for in clause 6 of PBU 4/99 “Accounting statements of an organization” (approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n). This can be done by adding lines 12201, 12202, etc. Detailing is possible in the context of operations (purchase) by fixed assets, inventories, intangible assets and others.

Standardized expenses

A debit balance on account 19 can also be formed when paying expenses, which are normalized when calculating income tax. Thus, there are expenses that cannot be fully taken into account in the tax base when calculating income tax.

Read about what expenses are regulated and what the limits for rationing are in the material “Standards provided for by the Tax Code of the Russian Federation.”

Hand in hand, taking into account standardized expenses, comes the problem of deducting value added tax. That is, if these expenses are normalized, then the right to deduct VAT on them is also curtailed.

In this case, usually the final value of the indicator for calculating the standard becomes known only at the end of the year, and the expenses themselves can be collected throughout the year, and the accountant has the obligation to quarterly adjust the VAT amount as the base from which the standard is determined increases.

At the end of the year, some amounts of undeductible VAT may accumulate. Their last day of the year should be written off as other expenses, since tax amounts exceeding the amount corresponding to the calculated value of the standard will no longer be accepted for deduction.

An example of calculating and reflecting the tax amount on line 1220 of the balance sheet

Let's imagine a situation where Vasilek LLC purchases materials for a total amount of 120,000 rubles. Let's take a closer look at the purchase price.

As you know, the cost of purchased valuables directly includes the amount for materials and the amount of VAT.

| Contents of operation | Posting in accounting | Sum |

| Cost of purchased materials | D10 K60 | 100000 |

| Tax amount in the purchase amount | D19 K60 | 20000 |

| VAT submitted to the budget | D68 K19 | 20000 |

If the company decides to reduce the accrued tax by the amount of “input” VAT, then line 1220 in the balance sheet will not be filled in.

In a situation where, for example, the supplier does not provide an invoice on time for the purchased materials and the amount of tax to be deducted in the current period, then on line 1220 you will need to indicate the amount of VAT equal to 20,000 rubles.

Another nuance is that the tax amount on account 19 can be deducted within three years from the date of the transaction.

Or maybe such a story. Romashka LLC completed an export transaction for the sale of raw materials at the end of December. The amount of VAT in this case was 50,000 rubles. Such VAT can be deducted, but only after confirmation of the tax rate has been received. Until this moment, VAT from such a transaction should be taken into account in the debit of account 19, and since there was no confirmation at the end of the year, the tax amount will be reflected in line 1220 of the balance sheet asset.

Advances listed

Line 1230 “Accounts receivable”

This line reflects the full amounts of buyer (debtor) debts remaining at the end of the year, including VAT. Here we summarize the data corresponding to the balances (debit) of accounts 60, 62, 76, as well as the total values for the debit of the “Settlements with ...” accounts: 68, 69, 70, 71, 73 and 75, reduced by the balance (credit) of the account 63.

Starting from 2011, organizations are required to form a reserve for doubtful debts (account 63, the balance of which is subtracted from the value accumulated in line 1230 of the balance sheet). This includes those debts of debtors for which they no longer hope to receive payment.

The organization independently determines such debts by assessing the likelihood of full or partial non-repayment (letter of the Ministry of Finance of Russia dated January 27, 2012 No. 07-02-18/01).

According to the explanations of the Ministry of Finance of Russia, when the buyer transfers an advance to the supplier, receivables are reflected in the balance sheet minus VAT, subject to deduction or accepted for deduction (attachment to the letter of the Ministry of Finance of Russia dated 01/09/2013 No. 07-02-18/01).

This means that in line 1230, in addition to existing accounts receivable with VAT, the amount of advances transferred to suppliers against a future transaction (shipment of goods, provision of work (services), transfer of property rights) is reflected minus VAT.

The amount of VAT reflected in lines 1230 and 1520 of the balance sheet

In addition to line 1220 of the balance sheet asset, VAT can be reflected in two more lines of the report.

- Let's start with the asset. The situation when tax can be reflected in the balance sheet concerns both VAT as part of receivables and the amount of tax as part of transferred advances. Advance payments are a receivable of the organization. They are subject to reflection in Form No. 1 without taking into account tax, which in turn is accepted for reduction. Other types of receivables are reflected on line 1230 including VAT

- Another line where the amount of tax can be reflected is line 1520. It reflects the amount of accounts payable and is part of the liability side of the balance sheet. There is also a peculiarity here. It concerns the receipt of advances and assumes that the amount of advance payments received is reflected without VAT. The rest of the creditor is accounted for as a line item, taking into account tax.

Advances received

Line 1520 “Debt to creditors”

The line “Debt to creditors” (balance sheet liability) summarizes the balances (credit) on the following accounts: 60, 62, 68, 69, 70, 71, 73, 75 and 76, including VAT. These are all the debts of the enterprise that it is obliged to repay within a year, or during the production cycle if it exceeds a calendar year.

IMPORTANT! The amounts of debts to the budget must be verified with the fiscal authorities. It is strictly prohibited to arbitrarily calculate unsettled debts to the budget (clause 74 of the PBU on accounting and accounting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

When forming line 1520 of the balance sheet, you should take into account a certain nuance with the reflection of advances received. Here there is a situation similar to that of the advances listed. The Russian Ministry of Finance also recommends that advances received be reflected in the balance sheet minus VAT (attachment to the letter of the Russian Ministry of Finance dated January 9, 2013 No. 07-02-18/01).

So on line 1520 you should include:

- accounts payable including VAT,

- advances received minus VAT.

Read about the nuances of working with advances received in the material “What is the general procedure for accounting for VAT on advances received?”

Line 1240 “Financial investments (except for cash equivalents)

In line 1240, reflect data on short-term financial investments. Here we are talking about assets with a circulation or maturity period of no more than 12 months. For example, these are loans issued for a period of less than a year, bills or bonds with a maturity of no more than 12 months. Data on long-term investments are indicated in line 1170 of the first section of the balance sheet.

In line 1240 enter the debit balance of account 58 “Financial investments”

(in terms of short-term investments).

If a company creates a reserve for reducing the cost of financial investments, then the indicator in line 1240 of the balance sheet is reflected minus contributions to this reserve. That is, when filling out line 1240, the credit balance of account 59 “Provisions for impairment of financial investments”

.

If at the reporting date you cannot determine the market value of a previously assessed object, reflect it at the cost of the last assessment.

Information about interest-free loans is not indicated in line 1240. Such loans are not financial investments.