Almost any credit institution accepts payment orders. Payers are often tormented by the question of what exactly to write in the “payment purpose” field. Not all citizens who work part-time at home are registered as self-employed. They can be paid by payment order, but everything needs to be arranged in such a way that the tax authorities cannot find fault.

What is the purpose of payment?

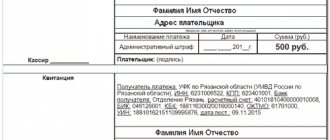

Field 24 in the payment purpose provides additional information that clarifies the purpose of the non-cash transfer. This item must be filled out without fail, otherwise the bank will not be able to accept the payment without the specified details.

Firms most often transfer funds in non-cash form, according to obligations that they have to employees, contractors, and partners. Filling out the field depends on who the payment is intended for. In this case, the explanation should not exceed 210 characters.

Resolution of the Twelfth Arbitration Court of Appeal dated February 26, 2021

In support of his objections, the defendant presented payment orders, some of which are dated earlier than the debt transfer agreement; in addition, all payment orders have specific invoices for payment purposes, the numbers of which do not coincide with the number of the invoice declared by the plaintiff.

Return to the Limited Liability Company "SaratovAlcoTrade", Saratov, from the federal budget 7,738 rubles 25 kopecks of the overpaid state duty for consideration of the appeal listed by payment order No. 199 dated January 20, 2021, by issuing a certificate for the return of the state duty.

We recommend reading: Bus benefits for pensioners in Kirov

How to correctly write the purpose of payment in a payment order?

The list of payment details with an indication of their decryption is contained in a special Appendix to the rules dated June 19, 2012, which were issued by the Central Bank. The correct indication of all payment details is the basis for its identification.

IMPORTANT!

If the document is filled out with errors, then there is a risk of money being sent to the wrong recipient or the payment not being processed. In the latter case, the treasury will not be able to correctly identify the payment, and it will fall into the group of undistributed payments.

The order must contain information about the purpose of the payment document. Among the information that is and is not provided for by law when filling out a payment order:

- name of services, goods, work performed;

- value added tax data;

- details of accompanying documentation, including contract numbers and terms.

If the payment documentation contains an estimate of the total amount with the register, then in this case it is necessary to provide a link directly to the register.

Agreement to pay part of a legal entity's debt

This instrument will be the signing of a debt repayment agreement. Form and essence of the debt repayment agreement For the agreement to have legal significance and be evidence of an unfulfilled obligation by the debtor, it should be drawn up only in writing and in no other form. As a rule, it should contain the following elements, usually typical for most documentation in this group.

Postponing the date of payments will allow the defaulter to find options for receiving money and avoid paying penalties and fines. An agreement and debt repayment is drawn up when the debtor’s income decreases. For any conflict, it is important to conduct a dialogue, not hide and not resort to tricks. If the debtor is unable to find funds to repay the debt in a short time, it is better to offer the option of installments or partial transfer.

What is the purpose of payment?

Transfer of money can be made for the following purposes:

- To other accounts of the same company.

- Repayment of tax payments: payment of taxes, payment of fines, repayment of tax debts.

- Payment of wages to company employees.

- An accountable person or company that spends money in the interests of the payer.

- Transfer of contributions and other payments to the founders.

- To counterparties: in the form of an advance payment, payment for shipped goods, as a penalty for delays and violation of the terms of the contract.

In each of the situations described, there are special rules for filling out column 24, which indicates the purpose of the payment.

What to write in the purpose of payment when paying taxes?

Many firms and entrepreneurs use a non-cash form of tax payment. This is convenient, and therefore questions about how exactly to fill out a payment form arise less and less often, and entrepreneurs begin to navigate this process. To pay, you must enter the following data in field 24:

- specific type of tax - VAT, personal income tax, other types;

- the period for which the tax is paid or for which the tax is required by the regulatory authorities;

- if necessary, indicate the grounds for payment, for example, the requirements of the tax authorities.

Purpose of payment in the payment order for contributions

There are some peculiarities of filling out a payment order when making mandatory OPS payments. You must write down the type of contributions, the period for which they are made, as well as the registration number of the person who pays the contributions to the Pension Fund. If mandatory contributions go to the social insurance department, then the payer’s registration number should also be entered.

How to fill out field 24 when paying tax by a third party?

Several years ago, the law allowed tax payments to be made for other persons. But in such a situation, it is also important to fill out the payment document correctly. Correctly enter the following information:

- TIN of the person who actually pays the tax // Checkpoint of the same person // name of the company that is the tax debtor // information about the specific tax.

IMPORTANT!

The number of characters should not exceed 210, and when filling out the field in this case, be sure to use the separating character //.

How to fill out an order when issuing a salary?

An entrepreneur can also pay wages using a payment order. To do this, in the document, all in the same column 24, you should indicate:

- employee's type of income;

- the amount to be paid;

- the period for which the payment is made.

IMPORTANT!

All data must be entered very carefully so that the payment does not have to be canceled, and also so that all payments by the bank are made on time.

How to fill out field 24 when transferring funds to counterparties?

Counterparties are one of the parties participating in a civil law agreement. When concluding civil contracts, counterparties may be:

- legal entities;

- entrepreneurs;

- citizens who conduct private practice, for example doctors, lawyers, tutors;

- any individuals without entrepreneurial status.

Field 24 must contain 3 items:

- type of payment - advance or final payment;

- the name of the work, services, and property for which payments are made;

- details of the document on the basis of which the payment is made.

Documents that may serve as a basis for making a payment include:

- contract;

- check;

- packing list;

- Act;

- executive document.

IMPORTANT!

In the same payment order, when filling out, it is necessary to clarify information about the payment of VAT. You should clarify the tax rate and amount or simply make an entry “excluding VAT”, if provided.

Purpose of payment to founders

The founders receive dividends from their companies, which remain after taxes. If the founder of the company is a legal entity, then the company additionally withholds income tax from it. If the founder is an individual, accordingly, you need to pay personal income tax. In addition to the tax, in the tax payment form, the founders should indicate in line 24 the date when dividends are paid.

The payment document itself for the amount of dividends in line 24 must contain information about the details of the protocol on the basis of which the profit of a particular company is distributed and paid. Usually this is the minutes for a certain date when a general meeting of shareholders was held on the distribution of profits.

This video is unavailable

On July 1, 2021, amendments to the Tax Code of the Russian Federation came into force stating that the tax office and banks will check money transfers to cards of individuals. Many took this to mean that the tax office in 2021 will check all transfers and perceive each as income of an individual and demand payment of taxes on income. In this case, personal income tax is paid, 13% of the amount of income of an individual. This also caused panic because for entrepreneurs and many self-employed citizens, transferring from card to card of an individual is a way to evade taxes. At the end of June this year, the Moscow Tax Inspectorate released an official statement on its website, which specified that the tax authorities will not check the accounts of all Russians. An individual’s account can be checked in the event of a tax audit (desk tax audit or on-site tax audit). The reasons for this, for example, may be: - a message from the bank to the tax office about suspicious transfers; — verification of the legal entity and identification of real beneficiaries; — deduction for the purchase of housing in the absence of official income of an individual;

We recommend reading: Scanner shock-absorbing group

Are all transfers to individual cards now checked by the tax authorities? What is personal income tax? How to properly process a money transfer from card to card so that the tax office and the bank do not pay attention? ➡️ SAVE UP TO 70% ON ACCOUNTING - https://kbdp.ru/