Procedure and timing of inventory of fixed assets

The inventory of fixed assets is carried out in the manner established by the order on the accounting policy of the enterprise, as well as in cases where its implementation is mandatory in accordance with paragraphs. 26 and 27 of the Accounting Regulations dated July 29, 1998 No. 34n, that is:

- when selling fixed assets;

- renting them out;

- acquisition of a state or municipal unitary enterprise;

- change of financially responsible persons;

- identifying facts of theft;

- the occurrence of natural disasters or fires;

- company reorganization;

- before preparing annual financial statements (at least once every 3 years, library collections - once every 5 years).

The inventory can be carried out suddenly, at the initiative of the head of the organization, to prevent theft.

In terms of the degree of coverage, it can be continuous or selective, and in terms of the method of implementation - natural (involving direct observation of the presence of accounting objects) or documentary (conducted according to the company’s accounting registers). Documentation of the inventory of fixed assets is carried out using forms unified or developed by the organization itself and enshrined in its order on accounting policies.

Each document is drawn up in two copies, one of which is transferred to the accounting department, the other to the financially responsible person.

The procedure for issuing an order to conduct an inventory of OS

Inventory begins with the manager issuing an order to conduct an inventory of fixed assets. To do this, you can use the INV-22 form, approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Download the order form in form INV-22.

The order specifies:

- location of the inventory;

- its start and end dates;

- chairman and members of the commission;

- degree of coverage of inventory objects;

- the reason for the inventory;

- deadlines for submitting documents to the accounting department.

The commission may include a chief or other responsible accountant, a person responsible for the safety of fixed assets, shop workers, administration employees, etc. The

order is registered in the inventory order register INV-23, approved by Resolution 88 and is handed over to the chairman of the commission for signature .

Download a sample order for inventory of fixed assets.

Before checking the actual availability and condition of fixed assets, it is necessary to review the availability of:

- OS inventory cards (form OS-6), other accounting registers for OS objects and the correctness of the data entered in them;

- technical passports;

- documents for receiving or leasing OS.

If necessary, accounting documents can be supplemented or adjusted.

Purpose of the document

Acceptance of fixed assets for accounting occurs on the basis of an inventory card in the OS-6 form. Small organizations have the right to use a simplified register system and submit less complex reporting.

In this regard, small-sized enterprises may not draw up an inventory document for each asset received by the company.

For companies with a small number of non-current assets, it will be enough to create a consolidated journal recording all actions (acceptance, movement, disposal) performed with the property.

This type of document is called an inventory book and has the form OS-6b.

Inventory is carried out in companies by a special commission, the composition of its members and the timing of the implementation are indicated by order of the director.

If during the work of the commission it is discovered that fixed assets are not accepted for accounting or are missing from it, and also if the initial information in the inventory book contains incorrect data, then the commission’s task is to include the correct information in the inventory. An inventory of the name of the OS is filled out in accordance with their purpose.

Fixed assets located outside the territory of the enterprise can be inspected only after their return. In the event that the commission identifies OS objects that are unsuitable for further use, they are entered into a special list recording the cause of the malfunction.

Accounting for fixed assets in small companies is carried out on the basis of an inventory book. It contains information about both the presence of OS objects and their movement.

Drawing up a statement of inventory

When conducting an inventory of fixed assets, not only their availability is checked, but also other important characteristics, such as:

- appointment,

- performance,

- inventory numbers,

- external condition,

- absence of any visible defects.

During the inspection of buildings, structures and other real estate objects, the following are checked:

- main building material,

- number of storeys,

- total and usable area,

- year of construction, etc.

Natural objects are checked: length, depth, extent.

By plantings - presence and age.

OSes of the same type received at the same time are indicated in the statement taking into account quantitative indicators.

All identified data is entered by members of the commission into the INV-1 inventory sheet, approved by Resolution 88, or an independently developed form.

On the requirements for maintaining an inventory journal

Based on the question asked, it can be judged that all the requirements for maintaining inventory logs at the enterprise are already met (firmware, page numbering, certification on the back, etc.). All that remains is to make a small clarification.

The concept of “inventory accounting” is used in confidential office work

when it is necessary to take into account (identify within the document flow and index) not only the document itself, but also its carrier (sheet, form, bound or bound multi-page document, format, form, etc.

external features

of the document).

If we are talking about scientific and technical documentation of an industrial enterprise, then the concept of “inventory accounting” includes recording the composition and information about confidential technical documentation

, about bound documents, documents of dedicated storage and other documents on any medium

not included in the list of files

; Information carriers (preliminary accounting documents), as well as completed cases (cases with executed documents), the accounting journals and file cabinets themselves are placed on the inventory (list, list accounting by numbers in order). This is necessary for analytical work on information security:

- recording initial and working information about the document, its completeness and integrity of all elements;

- control of the location of documents and access to them by enterprise employees;

- checking the actual availability of documents;

- to carry out analytical work to study and check employees’ awareness of the contents of documents.

Accounting for confidential documents, including inventory, is maintained centrally

security service (records service or department for working with technical documentation, if they are entrusted with a specific area of work with relevant confidential documents) and includes the following operations:

- document indexing,

- primary registration of initial information about a document, journaling or creation of file cabinets (databases),

- daily verification of the correctness of registration of documents and their availability.

In this case, the inventory serial number of the medium is transferred from the journal (card file or database) to the medium/document, which is written in the upper right corner of the document or its title page (if the document is bound and has a cover). It's called an inventory stamp.

, since it briefly records the corresponding classification of access restrictions by type of secret (degree of confidentiality).

Why is a matching statement needed?

After completing the inspection, the commission checks the data in the INV-1 statement with the indicators reflected in the accounting registers.

All identified discrepancies between them are entered into the comparison sheet of the results of the inventory of fixed assets INV-18, approved by Resolution 88, or a similar form developed by the organization.

All unaccounted for items are entered into accounting records by the commission, and the necessary corrective entries are made for incorrectly reflected fixed assets.

Newly identified objects are registered at current market prices. The degree of wear of an object is determined taking into account its actual condition. These changes are formalized by internal acts of the enterprise.

When facts of modernization or liquidation of fixed assets are identified that were not reflected in the accounting records, adjustment entries are made in them to reflect an increase or decrease in their book value.

For objects that, as a result of modifications, have changed their technical characteristics, new data is entered into the inventory.

For fixed assets that are out of order and cannot be restored, as well as for objects that are leased or in safekeeping, additional inventories are compiled.

Those OS objects for which no discrepancies were found are not reflected in the comparative inventories.

Extract from the inventory book of fixed assets

| Object name | Initial cost | Commissioning date | Useful life |

| Lathe | 28 000 | 16.09.04 | 7 years |

| Milling machine | 35 000 | 12.03.04 | 7 years |

| Workshop building | 1 698 000 | 01.03.03 | 50 years |

| Continuation of the table. 6 | |||

| Repair equipment | 37 000 | 15.07.05 | 5 years |

| Factory management computer | 32 600 | 19.04.04 | 4 years |

| Sales truck | 1 346 000 | 13.06.05 | 10 years |

There have been no changes to the initial cost since the objects were put into operation.

Calculate depreciation for September 2005 using all possible methods. Problem 3.9

The accounting policy of Master LLC provides that the costs of repairing fixed assets are reflected in the period of their production in full and are included in the cost of production.

On November 17, 2005, by order of the manager, the workshop building was repaired using economic methods. In pursuance of the order:

- materials were released for the repair of the building in the amount of 36,000 rubles;

- wages accrued to employees carrying out repairs - 42,000 rubles;

- Unified Social Tax on employee wages – 26%;

- During the repairs, equipment was used, the depreciation of which amounted to 360 rubles.

Reflect repair operations in the accounting records of Master LLC. Problem 3.10

The accounting policy of Delta LLC contains a clause according to which repair costs are included in the cost of the current period in the full amount of expenses incurred.

On February 10, 2006, the invoice of the repair organization “Kapitalpromenergo” was accepted for the repair of main production machines in the amount of 134,000 rubles. + VAT 18%.

Record the repair work in Delta's accounting records.

Problem 3.11

The accounting policy of Promsnabsbyt LLC provides for the inclusion of repair costs as deferred expenses with a monthly write-off of the cost of repair work as current costs within a period approved by the manager.

On February 18, 2006, Promsnabsbyt LLC transferred 193,520 rubles from the current account of a repair organization for equipment repairs. including VAT 18%.

On February 25, an act of acceptance by Promsnabsbyt of the work performed by the repair organization for the amount of the transferred advance was signed. By order of the manager, the cost of repair work is subject to write-off to the general production expenses accounts within 10 months, starting from March 1, 2006.

Carry out accounting registration of the facts of economic activity in the accounting accounts. Problem 3.12

The accounting policy of Mirage CJSC provides for the annual creation of a reserve for the upcoming repair of fixed assets based on the estimate for repair work. For 2005, the estimate was approved by the manager in the amount of 120,000 rubles.

In November, materials worth 20,000 rubles were supplied to the auxiliary workshop for repairs;

- wages accrued to workshop workers carrying out repairs in the amount of 50,000 rubles + unified social tax - 26%;

- During the repair, equipment was used, the depreciation of which amounted to 2,000 rubles.

- In addition, the services of a subcontractor were accepted for welding work necessary for repairs in the amount of RUB 17,000. + VAT 18%.

Reflect business transactions in the accounting of ZAO Mirage for 2005. Problem 3.13

By order of the head of Voskhod CJSC, the GAZELLE company car was reconstructed with the engine and gearbox replaced. To carry out the reconstruction, an engine was purchased for the amount of 9,800 rubles. + VAT 18% and gearbox in the amount of 3400 + VAT 18%. The amount of remuneration for a specialist hired under a contract to replace the engine was 4,000 rubles. + Unified Social Tax 23.1%. As a result of the reconstruction, the useful life of the vehicle was increased by 1 year.

Document business transactions with accounting records. Problem 3.14

By order of the head of Zakat LLC, a metal-cutting machine is being liquidated, the initial cost of which was 26,000 rubles, the amount of accrued depreciation at the time of liquidation is 24,600 rubles. In order to dismantle the machine, a third-party organization was brought in, whose work cost Zakat 1,200 rubles. + VAT 18%. As a result of liquidation, the warehouse received materials with a market value of 270 rubles.

Carry out accounting procedures for business transactions. Problem 3.15

CJSC "House of Press" sells LLC "Gazeta" a used printing press for 61,360 rubles. (including VAT 18%.)

The initial cost of the machine is 64,000 rubles, the amount of accrued depreciation at the time of sale is 28,000 rubles.

For the dismantling of the machine, the workers were paid a salary in the amount of 5,300 rubles, and the unified social tax - 26%.

Reflect the business operations of Press House CJSC with accounting entries, and generate the financial result from the sale of the machine. Problem 3.16

Under a simple partnership agreement, a fixed asset is contributed to the common property, the initial cost of which is 29,000 rubles, the amount of accrued depreciation is 11,000 rubles. The participants valued the contribution at 22,000 rubles.

Carry out accounting registration of the facts of economic activity in the accounting accounts. Problem 3.17

Based on the results of the inventory, the following facts were revealed:

1) an unaccounted for milling machine was discovered. The initial cost of three similar machines at the enterprise is 75,000 rubles. The amount of accrued depreciation for similar machines is respectively 25,000, 27,000, 23,000, depending on the moment the facility was put into operation. The market value of a similar machine is 52,000 rubles.

2) a shortage of a photocopier was discovered with an original cost of 37,500 rubles, the amount of accrued depreciation at the time of inventory was 26,200.

The shortage was attributed to the financially responsible person, and the market value of the missing photocopier, equal to 15,000 rubles, was presented for recovery. The amount of the shortfall is withheld from the salary of the financially responsible person in equal shares for 3 months. Problem 3.18

As of 01.11.2004 The balance sheet of Alcan LLC includes the fixed assets listed in Table 7.

Table 7

Information on fixed assets of Alcan LLC as of November 1, 2004.

| Object name | Initial cost | Commissioning date | Useful life |

| Sales car | 370 000 | 09/14/2003 | 7 years |

| Office furniture | 28 000 | 03/02/2004 | 6 years |

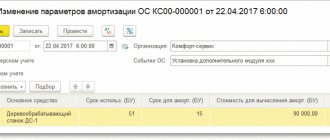

| Woodworking Machine | 67 000 | 08/12/2003 | 10 years. |

| Metal cutting machine | 82 000 | 08.111.2003 | 8 years. |

| Computer | 30 000 | 12/28/2002 | 5 years. |

Depreciation on objects is calculated using the straight-line method.

As of December 31, 2004, Alcan's management decided to revaluate fixed assets with a factor of 1.15.

02/03/2005 Alcan, under a purchase and sale agreement, purchases laboratory equipment worth RUB 50,000. + VAT 18%. Transportation costs associated with the purchase of equipment amounted to 700 rubles. + VAT 18%. Equipment testing services performed by a third party amounted to RUB 3,200. + VAT 18%.

Payment for the cost of equipment was made from the current account on 02/05/05. Commissioning of the equipment was formalized on 02/06/05, and payment for other services related to the acquisition of the facility was issued on 02/08/05.

03/31/2005 a decision was made to transfer the metal-cutting machine to conservation without a time limit from 04/01/2005.

04/25/2005 Due to the breakdown, a decision was made to liquidate the woodworking machine. Liquidation costs amounted to: staff wages - 2000 rubles, unified social tax - 26%. As a result of disassembling the machine, materials worth 14,000 rubles were credited to the warehouse.

06/14/2005 under an exchange agreement, a photocopier is purchased, in payment for which products are shipped, the selling price of which is usually 31,860 rubles. (including VAT 18%), and the cost is 24,000 rubles. (Shipment and delivery operations were carried out at a time). The costs of connecting the photocopier and installing drivers, paid through an accountable person (a cash and sales receipt is attached to the advance report, VAT is not allocated) amounted to 1,500 rubles. The copier was put into operation on June 17, 2005.

07/17/2005 A laser printer was purchased through an accountable person for use in the HR department (a cash receipt, delivery note and invoice are attached to the report) costing RUB 9,440. (including VAT 18%). On the same day the printer was put into operation.

09/19/2005 registered furniture was transferred to repay the debt to the materials supplier in the amount of 16,520 (including 18% VAT). The costs of delivering furniture to the supplier (the compensation agreement stipulates delivery by Alkan), paid by Alkan from the bank account to a third party, amounted to 500 rubles. + VAT 18%.

07.10.2005 To retrofit the computer, a CD-ROM writer, RAM and an internal fan were purchased at a total cost of 4000 + VAT 18%.

Payments under the contract to the system administrator performing additional equipment amounted to 1,000 rubles. + Unified Social Tax 26%. The reconstructed facility was put into operation on October 10, 2005, and the service life of the computer was increased by 1 year.

Reflect all business transactions on the accounting accounts for the period from November 2004 to December 31, 2005. ^

How to draw up an act based on inventory results

After inspecting all objects, compiling inventories and reflecting the identified discrepancies between the accounting and inspection data, an act on the results of the inventory of fixed assets is drawn up.

An enterprise can develop the form of the act independently or use the form approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n, form according to OKUD 0504835.

Note! Despite the fact that this form was developed for institutions and government bodies, there is no prohibition on its use by other entities.

Download the inventory list of fixed assets in the INV-1 form here.

When filling out this form please indicate:

- composition of the commission;

- financially responsible person;

- days of the beginning and completion of the inventory;

- numbers and dates of statements, acts and collating inventories.

It makes notes on the results of the work done, gives full characteristics of the detected discrepancies in quantitative and cost terms, indicating the reasons for their occurrence.

Attached to the act are: statements, collating inventories, explanatory notes from financially responsible persons.

When filling out this form please indicate:

- composition of the commission;

- financially responsible person;

- days of the beginning and completion of the inventory;

- numbers and dates of statements, acts and collating inventories.

It makes notes on the results of the work done, gives full characteristics of the detected discrepancies in quantitative and cost terms, indicating the reasons for their occurrence.

Attached to the act are: statements, collating inventories, explanatory notes from financially responsible persons.

Download a sample act based on the results of the inventory of fixed assets.

In the event that the commission has not identified any discrepancies between the accounting and actual data, an entry is made in the act about their absence.