A bank account is no longer an indicator of the owner’s wealth, but simply a convenient payment tool. Almost every second person now has a payment plastic card, and a bank account is linked to it, in turn. Does an individual entrepreneur need a current account or does he have the right to make payments through a personal one?

The question is far from idle. If the account is intended for private purposes, the bank charges interest on this money, and the client has to pay for transactions on the current account. Of course, I wouldn’t want to incur additional expenses. In this article we will answer frequently asked questions from our users:

- Is it possible for an individual entrepreneur to work without opening a bank account;

- does an entrepreneur have the right to indicate his personal account for business payments;

- Is an individual entrepreneur required to open a current account specifically for business purposes;

- what are the possible consequences if you do not open a current account, but make business payments through a personal one;

- Is it necessary to pay taxes and insurance premiums by bank transfer?

Are you planning to open a current account? Open a current account in a reliable bank - Alfa-Bank and receive for free:

- free account opening

- first account in foreign currency

- certification of documents

- Internet bank

- and much more

Open an account in Alfa-Bank

Payment terms under loan agreements

The Central Bank, in its letter dated March 27, 2021 No. IN-03-31/32, indicated that if the last day of the loan payment period falls on a non-working day, then the last date is considered such a non-working day (except Saturday and Sunday).

However, the Supreme Court pointed out that the Central Bank does not have such powers and its letters cannot be above the law. Failure to pay the payments stipulated by the contract during the period from March 30 to April 3, 2021 is not a delay in the fulfillment of obligations, and the postponement of the deadline for fulfilling an obligation to the next next business day cannot be considered as a violation of the deadlines for fulfilling obligations.

Why do we advise individual entrepreneurs to open a current account?

Let's summarize. The answer to the main question of the article: “Is it possible for an individual entrepreneur to work without opening a current account” is positive. But whether an individual entrepreneur needs a current account, decide for yourself. By making only cash payments or using an individual’s personal account, you limit yourself in many ways:

- you cannot make online payments at any time and place where there is Internet access;

- do not allow your customers and clients to pay by card or payment order;

- you risk being suspected by the bank of laundering illegal proceeds;

- you are subject to additional taxation of income not related to business;

- narrow the circle of business partners, most of whom work by bank transfer;

- bear the risks associated with storing cash.

But the price of the issue is not so high. The monthly payment for account maintenance and online banking will be a little more than 1000 rubles, depending on the chosen tariff.

Penalty and writs of execution during the moratorium period

One of the consequences of the introduction of a moratorium is the cessation of accrual of penalties (fines and penalties) and other financial sanctions for non-fulfillment or improper fulfillment by the debtor of monetary obligations and mandatory payments for claims that arose before the introduction of the moratorium.

In addition, the introduction of a moratorium against the debtor also means that it is impossible for the creditor to obtain compulsory execution by presenting the writ of execution directly to the bank. However, it is worth considering that the moratorium applies only to the most affected sectors of the economy

8-921-903-17-16

| A fine of five times the cost of goods for each month and other changes to the law “On the Protection of Consumer Rights” |

An entrepreneur has the right to use a personal account, but there are some peculiarities. Unlike a legal entity, an individual entrepreneur has the right to dispose of his property, including funds, at his own discretion. All money earned is considered his property, and he can withdraw it from the account at any time. We wrote more about this earlier

A legal entity cannot boast of such an advantage, even if you are the only member of the company and the general director in one person, all the funds you earned do not belong to you. This is the money of the society you created. You can pay yourself a salary from them or transfer them as dividends. Out of the blue, difficulties arise.

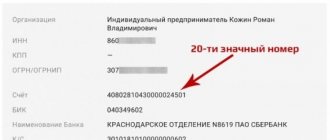

At the same time, the Central Bank of Russia obliges credit institutions to separate the accounts of individuals into those used for personal purposes and those where commercial payments occur. All this was done because the tax office cannot obtain data on account movements without a court decision. And for accounts that are opened for commercial needs - maybe.

But you shouldn’t think that there is a unanimous opinion on this matter among tax inspectors.

Why open a current account

Can an individual entrepreneur operate without a current account? Yes, if you comply with the cash payment limit (no more than 100 thousand rubles) within the framework of one agreement with another entrepreneur or legal entity. When making payments to employees and ordinary individuals, no limit is established by law.

For example, an entrepreneur rented an office from a commercial organization. The monthly rent is 10 thousand rubles, the lease term is 11 months, which means the total amount under the contract is 110 thousand rubles. This exceeds the possible limit, so payments must go through the bank.

Important: legal entities will have to open a bank account in any case. The reason is that the organization has the right to transfer taxes only by bank transfer. There is no such requirement for individual entrepreneurs; an individual can pay the budget either in cash or by payment order.

In principle, if the limit for cash payments with other entrepreneurs and organizations is met, then you don’t have to open a bank account. The question is: how convenient is it? You can pay your partner in cash at his accounting department or at the bank using a receipt. If the individual entrepreneur does not open a current account, then he will have to waste time on travel and queues.

In addition, when conducting cash transactions, you must follow the rules of cash discipline, which, although they allow for a simplified procedure for individual entrepreneurs, are quite contradictory. Finally, there is the problem of the security of cash payments and the safety of money. It turns out that although a current account is not required for an individual entrepreneur, in practice it turns out that it is difficult to do without bank payments.

Read about whether you can spend money from your current account directly for personal needs without transferring it to an individual’s card here.

Are you planning to open your own business? Don't forget to reserve your current account. To select a current account, try our bank tariff calculator:

The calculator will select the most advantageous bank offer for settlement and cash services for your business. Enter the volume of transactions you plan to make per month, and the calculator will show the tariffs of banks with suitable conditions.

Tax office

When resolving the question of the possibility or impossibility of using your personal account, you should start by contacting your tax inspector. And it is advisable not only to receive verbal approval, but also to obtain written confirmation.

But if you get a negative answer, don't give up. After all, if the inspector was always right, there would not be so many consultants.

In my case, the situation was the opposite: after a conversation with the inspector, verbal approval was received and we agreed that for such calculations it is necessary to either open an additional account or a new plastic card, so as not to mix personal income with commercial ones. A recommendation was also made to attach an account statement when submitting a completed declaration, since the desk audit department does not have access to a personal account. To receive written confirmation, I sent a request to the head of interdistrict inspection No. 26 for St. Petersburg, and received the following response:

In fact, the tax office did not prohibit me from using a personal account, but notified me that there may be problems with the bank, since the instructions of the Central Bank of Russia require that such accounts be separated.

When I called the general helpline for the North-West region, the girl clearly gave me the answer that I have the right to use my personal one. When I asked her why she made this conclusion, I received the answer: “This is not prohibited by law.”

Ministry of Finance of the Russian Federation

I asked the Russian Ministry of Finance with the same question and received two answers from them. One reported that the email to which the response was supposed to be received was not intended for receiving incoming messages, but the response somehow came:

However, the next day a letter arrived in which they indicated that this was not within their competence and the request was transferred to the Central Bank of Russia.

Central Bank of Russia

I sent all the requests at the same time and I should have received 2 answers from the Central Bank: the one that I sent, and the one that was redirected by the Ministry of Finance. It turned out that both the central office and the regional one (for St. Petersburg) responded.

The Central Bank was asked 2 questions:

- Can an individual entrepreneur use an individual’s account to make settlements with counterparties?

- Does the bank have the right not to accept a payment order if it came (from) an individual’s account?

The North-Western Department of the Bank of Russia was the first to respond, and it was clear and precise:

A few days later, a more detailed version was sent by the legal department of the Central Bank of Russia, but the general meaning was the same: all roads lead to the bank itself and references to the bank account agreement.

I tried to process an incoming payment order by issuing an invoice to my client using new details. Everything went well. But it doesn't end there

Working with clients

Even if the bank allows you to make such payments (not everyone has financial monitoring, and if they do, then it can work in other areas), this does not mean that the work is finished.

When issuing invoices, you will need to draw the attention of your clients to the fact that the recipient of the payment is not “Individual Entrepreneur Andrey Viktorovich Maksimov”, but simply “Andrey Viktorovich Maksimov”, otherwise the payment will not be accepted.

Moreover, not every accountant will agree to transfer funds in favor of an individual in the absence of an employment relationship with him. This is due to the fact that by transferring money to him, the company must become a tax agent and pay taxes and fees provided for by tax legislation for the person. In our case, this will not happen, but the tax office will require clarification on what basis this payment was made. If the organization does not have an agreement signed by you, there will be unpleasant consequences that will lead to the fact that the company will not work with you next time.

It is worth noting that it is not necessary to have the original contract. If the document contains a clause stating that copies, including receipt by fax, have equal legal force for the parties and other third parties, then a document received by email will be sufficient.

Can an individual entrepreneur on UTII accept payment to a bank account?

Question from Klerk.Ru reader Ekaterina (Voronezh)

I am an individual entrepreneur using UTII (retail trade in curtains). When making payments to customers I use cash registers. But the hospital contacted me, they want to buy curtains for the entire floor. As I understand it, this is retail trade. But the hospital wants to pay for my curtains by bank transfer to my bank account. How can this transaction be formalized correctly so that it is a retail trade? Help me please.

For the purposes of UTII taxation, retail trade should include business activities related to the trade of goods, both for cash and for non-cash payments under retail purchase and sale agreements, regardless of what category of buyers (individuals or legal entities) these goods are sold ( Article 346.27 of the Tax Code of the Russian Federation).

By virtue of paragraph 1 of Article 492 of the Civil Code of the Russian Federation, under a retail purchase and sale agreement, a seller engaged in business activities of selling goods at retail undertakes to transfer to the buyer goods intended for personal, family, home or other use not related to business activities.

Thus, one of the criteria to distinguish retail trade from wholesale trade is the purpose of the buyer’s purchase of the goods.

From paragraph 5 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 22, 1997 N 18 “On some issues related to the application of the provisions of the Civil Code of the Russian Federation on the supply agreement” it follows that purposes not related to personal use should be understood, including including the purchase by the buyer of goods to support his activities as an organization or citizen-entrepreneur (for example, office equipment, office furniture, vehicles, materials for repair work).

However, if these goods are purchased by the specified buyer from a seller engaged in business activities of selling goods at retail, the relations of the parties are governed by the rules on retail purchase and sale. In addition, paragraph 124 of GOST R 51303-99 states that retail turnover also includes the sale of goods to organizations (sanatoriums and rest homes, hospitals, kindergartens and nurseries, nursing homes) through which joint consumption of goods is carried out. Moreover, such a sale can be made both by bank transfer and in cash.

It is also important to consider the following in your situation.

In accordance with paragraph 1 of Art. 525 and paragraph 1 of Art. 527 of the Civil Code of the Russian Federation, the supply of goods for state (or municipal) needs is carried out on the basis of a state (or municipal) contract for the supply of goods for state (or municipal) needs, concluded on the basis of an order placed in the manner prescribed by the legislation on placing orders for the supply of goods, performance of work, provision of services for state (or municipal) needs. The procedure for concluding a state (or municipal) contract for the supply of goods for state (or municipal) needs is regulated by Federal Law dated July 21, 2005 N 94-FZ “On placing orders for the supply of goods, performance of work, provision of services for state and municipal needs.”

According to paragraph 1 of Art. 9 of the said Federal Law, a state or municipal contract is understood as an agreement concluded by the customer on behalf of the Russian Federation, a constituent entity of the Russian Federation or a municipal entity in order to meet state or municipal needs.

Clause 2 of Art. 525 of the Civil Code of the Russian Federation establishes that the rules on the supply agreement (Articles 506 - 523 of the Civil Code of the Russian Federation) apply to relations for the supply of goods for state (or municipal) needs, unless otherwise provided by the rules of the Civil Code of the Russian Federation.

Consequently, entrepreneurial activity related to the sale of goods on the basis of a state (or municipal) contract for the supply of goods to government institutions, in particular, schools, kindergartens and other institutions, does not relate to retail trade and, accordingly, is not subject to taxation with a single imputed tax. income, but should be taxed under other taxation regimes. Such clarifications were given by the Ministry of Finance of the Russian Federation in Letter dated May 26, 2010 No. 03-11-11/151. Based on the foregoing, we come to the conclusion that the transaction you conclude in the absence of a state (municipal) contract is considered retail.

According to the general rule established by Art. 493 of the Civil Code of the Russian Federation, a retail purchase and sale agreement is considered concluded from the moment the seller issues a cash receipt or sales receipt or other document confirming payment for the goods to the buyer. If the payment was made by bank transfer, then confirmation of payment will be a copy of the payment order with a note from the bank about the transaction performed to transfer funds.

It should be noted that the Rules for the sale of certain types of goods, approved by Decree of the Government of the Russian Federation of January 19, 1998 N 55, provide for cases when the issuance of a sales receipt to a retail buyer is mandatory. A sales receipt must be issued, including for the sale of textile, knitwear, clothing and fur goods and shoes (clause 46 of the Rules). The sales receipt indicates the name of the product and the seller, the date of sale, article number, grade and price of the product, as well as the signature of the person directly carrying out the sale.

Thus, the presence of a sales receipt as a separate document and the need to transfer it with the goods to the buyer in your case is a mandatory requirement of the Rules for the sale of certain types of goods.

Violation of the established rules for the sale of certain types of goods entails the imposition of an administrative fine on citizens in the amount of three hundred to one thousand five hundred rubles; for officials - from one thousand to three thousand rubles; for legal entities - from ten thousand to thirty thousand rubles (Article 14.15 of the Code of Administrative Offenses of the Russian Federation). Let me remind you that persons carrying out entrepreneurial activities without forming a legal entity who have committed administrative offenses bear administrative liability as officials, unless otherwise established by this Code.

As for the document typical for wholesale (consignment note), it is better not to draw it up so as not to attract the attention of inspectors and avoid unnecessary disputes with them. By the way, the servants of Themis, as a rule, support taxpayers in these cases, putting at the forefront the purpose of the purchase of goods by the buyer, and not the method of processing documents for the transaction (see, for example, Determination of the Supreme Arbitration Court of the Russian Federation dated 02/05/2009 N VAS-16354 /08, Resolutions of the Federal Antimonopoly Service of the North-Western District dated October 17, 2008 N A56-37983/2007, Federal Antimonopoly Service of the Ural District dated May 28, 2009 N F09-3314/09-С2, dated September 10, 2008 N Ф09-6446/08-С3).

It’s very easy to get a personal consultation with Svetlana Skobeleva online - you need to fill out a special form . Several of the most interesting questions will be selected daily, the answers to which you can read on our website.

Legality of using a personal account and resume

The current legislation does not provide for any punishment for using a personal account for business activities. The only question is whether your client will want to work in such conditions and whether the bank will accept the payment.

Talk to your tax preparer. Try to get a document from him that will confirm that the tax office will not have questions when transferring funds from companies to your account. So, you can attach it to your agreement when talking with the bank.

Opening a current account

To open a current account, you need:

- familiarize yourself with the conditions of banks from our list;

- choose the most suitable option for yourself;

- go to the bank's website;

- submit your application;

- reserve an account;

- discuss the package of documents with the bank manager;

- arrange a meeting;

- fill out an application;

- After checking the documents, sign a service agreement.

We recommend reading: Rating of banks for small businesses with profitable cash settlement services for individual entrepreneurs and LLCs.

Tax office

When resolving the question of the possibility or impossibility of using your personal account, you should start by contacting your tax inspector. And it is advisable not only to receive verbal approval, but also to obtain written confirmation.

But if you get a negative answer, don't give up. After all, if the inspector was always right, there would not be so many consultants.

In my case, the situation was the opposite: after a conversation with the inspector, verbal approval was received and we agreed that for such calculations it is necessary to either open an additional account or a new plastic card, so as not to mix personal income with commercial ones. A recommendation was also made to attach an account statement when submitting a completed declaration, since the desk audit department does not have access to a personal account. To receive written confirmation, I sent a request to the head of interdistrict inspection No. 26 for St. Petersburg, and received the following response:

In fact, the tax office did not prohibit me from using a personal account, but notified me that there may be problems with the bank, since the instructions of the Central Bank of Russia require that such accounts be separated.

When I called the general helpline for the North-West region, the girl clearly gave me the answer that I have the right to use my personal one. When I asked her why she made this conclusion, I received the answer: “This is not prohibited by law.”

Ministry of Finance of the Russian Federation

I asked the Russian Ministry of Finance with the same question and received two answers from them. One reported that the email to which the response was supposed to be received was not intended for receiving incoming messages, but the response somehow came:

However, the next day a letter arrived in which they indicated that this was not within their competence and the request was transferred to the Central Bank of Russia.

Central Bank of Russia

I sent all the requests at the same time and I should have received 2 answers from the Central Bank: the one that I sent, and the one that was redirected by the Ministry of Finance. It turned out that both the central office and the regional one (for St. Petersburg) responded.

The Central Bank was asked 2 questions:

- Can an individual entrepreneur use an individual’s account to make settlements with counterparties?

- Does the bank have the right not to accept a payment order if it came (from) an individual’s account?

The North-Western Department of the Bank of Russia was the first to respond, and it was clear and precise:

A few days later, a more detailed version was sent by the legal department of the Central Bank of Russia, but the general meaning was the same: all roads lead to the bank itself and references to the bank account agreement.

I tried to process an incoming payment order by issuing an invoice to my client using new details. Everything went well. But it doesn't end there

Working with clients

Even if the bank allows you to make such payments (not everyone has financial monitoring, and if they do, then it can work in other areas), this does not mean that the work is finished.

When issuing invoices, you will need to draw the attention of your clients to the fact that the recipient of the payment is not “Individual Entrepreneur Andrey Viktorovich Maksimov”, but simply “Andrey Viktorovich Maksimov”, otherwise the payment will not be accepted.

Moreover, not every accountant will agree to transfer funds in favor of an individual in the absence of an employment relationship with him. This is due to the fact that by transferring money to him, the company must become a tax agent and pay taxes and fees provided for by tax legislation for the person. In our case, this will not happen, but the tax office will require clarification on what basis this payment was made. If the organization does not have an agreement signed by you, there will be unpleasant consequences that will lead to the fact that the company will not work with you next time.

It is worth noting that it is not necessary to have the original contract. If the document contains a clause stating that copies, including receipt by fax, have equal legal force for the parties and other third parties, then a document received by email will be sufficient.

Retail sales of goods to legal entities and individual entrepreneurs

LLC applies two taxation systems: simplified tax system and UTII. For goods and materials, funds are transferred to the current account of both organizations and individual entrepreneurs. The individual entrepreneur purchased building material for his own (personal needs), and a retail purchase and sale agreement was concluded. This transaction was classified as UTII. Are we right?

Some businesses buy building material not for sale, but for property renovation. What to do in this situation? USN or UTII? Retail purchase and sale agreements have been concluded.

In accordance with paragraphs 6 paragraph 2 art. 346.26 Tax Code of the Russian Federation

The taxation system in the form of a single tax on imputed income for certain types of activities is applied to retail trade carried out through shops and pavilions with a sales area of no more than 150 square meters. m for each trade organization object.

Art. 346.27 Tax Code of the Russian Federation

It has been established that

retail trade includes

business activities related to the trade of goods (including in cash, as well as using payment cards) on the basis of retail purchase and sale contracts.

Based on Art. 492 of the Civil Code of the Russian Federation under a retail purchase and sale agreement

a seller engaged in business activities of selling goods at retail undertakes to transfer to the buyer goods intended

for personal, family, home or other use not related to business activities

.

A retail purchase and sale agreement is a public contract

, establishing the responsibilities of a commercial organization for the sale of goods, performance of work or provision of services, which such an organization, by the nature of its activities, must carry out in relation to everyone who applies to it.

A commercial organization does not have the right to give preference to one person over another with regard to concluding a public contract, except in cases provided for by law and other legal acts ( Article 426 of the Civil Code of the Russian Federation

).

At the same time, according to Art. 493 Civil Code of the Russian Federation

, unless otherwise provided by law or

contract, a retail purchase and sale agreement is considered concluded from the moment

the seller

a cash receipt or sales receipt or other document

confirming payment for the goods to the buyer.

Thus, for the purposes of applying Chapter 26.3 of the Tax Code of the Russian Federation, retail trade includes

entrepreneurial activity related to the trade of goods

both for cash and for non-cash payments

under retail sales contracts,

regardless of which category of buyers

(

individuals or legal entities

)

these goods are sold

(resolution

of the Presidium of the Supreme Arbitration Court of the Russian Federation

dated 03/05/2013 No. No. 157, dated July 5, 2011, No. 1066/11, letter of the Ministry of Finance of the Russian Federation dated April 24, 2014, No. 03-11-11/19107).

The defining feature of a retail purchase and sale agreement for the purposes of applying UTII is the purpose for which

the taxpayer sells goods to organizations and individuals: for personal, family, home or other use not related to business activities, or for the use of these goods for the purposes of conducting business activities.

At the same time, the Ministry of Finance of the Russian Federation indicated in letter dated April 24, 2014 No. 03-11-11/19107, for purposes not related to personal use

, should be understood as including

the purchase by the buyer of goods to support his activities as an organization or citizen-entrepreneur

(for example, office equipment, office furniture, vehicles, materials for repair work, etc.).

Subject to the above norms of the Civil Code of the Russian Federation and Chapter 26.3 of the Tax Code of the Russian Federation, business activities related to the retail trade of goods for non-cash payments and carried out under retail sales contracts can be transferred to the taxation system in the form of UTII.

Does not apply to retail trade

sales in accordance

with supply contracts

.

At the same time, the Tax Code of the Russian Federation does not establish for organizations

and individual entrepreneurs

selling goods, the obligation to exercise control over the subsequent use by the buyer of the purchased goods

(for business activities or for personal, family, home or other use not related to business activities).

Regulatory authorities indicate that if

for the purpose of selling goods, for example,

contracts are concluded that define the range

of goods,

the terms of their delivery, the procedure and form of payments

for the supplied goods, and also

invoices and invoices

are drawn up and transferred

to customers , logs of received and issued invoices are kept, purchase books and sales books, then

such activity refers to entrepreneurial activity in the field of wholesale trade

.

The Federal Tax Service of the Russian Federation, in a letter dated December 30, 2011 No. ED-4-3/ [email protected] , stated that if, when selling goods, the seller issues a cash register and (or) sales receipt to the buyer

or another document confirming payment for the goods (for example, operational or warranty documentation for the goods, in which a note about payment is made),

then such sales are recognized as retail trade

.

In the Information letter dated March 5, 2013 No. 157, the Presidium of the Supreme Arbitration Court of the Russian Federation

clarified that

the Tax Code of the Russian Federation does not establish

obligations for organizations and individual entrepreneurs selling goods to

identify the purpose of purchase

by buyers of goods

and control their subsequent use

.

One of the main conditions

allowing the taxation system in the form of UTII to be applied to retail trade

is the implementation of this activity exclusively through the objects of a stationary and

(

or

)

non-stationary retail network

mentioned in

paragraphs.

6 and

7 clause 2 art.

346.26 Tax Code of the Russian Federation .

paid by the taxpayer-seller also covers transactions for the sale of goods to legal entities and individual entrepreneurs

.

Legality of using a personal account and resume

The current legislation does not provide for any punishment for using a personal account for business activities. The only question is whether your client will want to work in such conditions and whether the bank will accept the payment.

Talk to your tax preparer. Try to get a document from him that will confirm that the tax office will not have questions when transferring funds from companies to your account. So, you can attach it to your agreement when talking with the bank.

What are the consequences if you use a personal account in business?

Can an individual entrepreneur use his personal account in business? Until 2014, Article 23 of the Tax Code of the Russian Federation contained a clause that directly prohibited the use of an individual’s current account for business activities. Now this provision of the Tax Code has lost force, but in fact the ban continues to apply, and an individual entrepreneur cannot use a personal account in a business. Why?

- Central Bank Instruction No. 153-I, which is in force in 2021, prohibits transactions related to business or private practice on current accounts. The bank may simply refuse to carry out transactions if it considers that constant cash receipts are related to business activities.

- If you receive large sums of money as an ordinary individual, and not as an individual entrepreneur, then be prepared for questions from the bank’s security service about the source of these funds. As part of the fight against terrorist financing and money laundering, the bank has the right to stop suspicious transactions.

- Your business partners may refuse to transfer payment to an individual’s current bank account. The reason is that the Federal Tax Service in such cases considers them tax agents and obliges them to withhold 13% income tax from the transferred amounts and transfer the tax to the budget.

- The basis for non-cash payments for your counterparties is the agreement concluded with the entrepreneur. If you transfer amounts under such an agreement to a current account, and not to a current account for an individual entrepreneur, then the costs of the transaction will be difficult to justify to the tax authorities.

- Tax authorities will try to tax not only income received into a personal account from a business, but also other personal funds of an individual not related to entrepreneurship.

- In the OSNO, simplified taxation system Income minus expenses, unified agricultural tax modes, an individual entrepreneur must confirm the costs associated with the business. When paying expenses from an individual's current account, the tax office will not accept them to reduce the tax base. As a result, you will have to part with a larger amount when paying taxes.