In accordance with subparagraph 22 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, other expenses include entertainment expenses associated with the official reception and service of representatives of other organizations participating in negotiations in order to establish and maintain cooperation. For tax purposes, these expenses are subject to normalization (included in the base in the amount of four percent of labor costs for this reporting (tax) period).

On a note

Entertainment expenses include the costs of an official reception, transportation, buffet service, and payment for translation services.

Tax legislation also does not contain a specific list and forms of primary documents confirming these expenses. In light of recent trends, tax authorities have been instructed to eliminate excessive requirements for confirmation of entertainment expenses. Thus, in accordance with paragraph 10 of Section IV (“road map”) “Improving tax administration”, approved by Decree of the Government of the Russian Federation dated February 10, 2014 No. 162-r, measures are envisaged to reduce the number of documents required to confirm hospitality expenses.

The letter of the Federal Tax Service of Russia dated 05/08/2014 No. GD-4-3/8852 states that to justify entertainment expenses, in addition to primary accounting documents confirming the fact of acquisition of goods, works, services (attached to the advance report), any primary document from the contents is sufficient which follows that these acquisitions were used by the organization during entertainment events. This may be a report on entertainment expenses approved by the head of the company. All costs listed in the report must be supported by relevant primary documents (letter of the Ministry of Finance of Russia dated April 10, 2014 No. 03-03-RZ/16288).

Purchase of alcohol in bulk under a supply agreement

A wholesale company must have a separate license to sell alcohol. In this case, wholesale sales can be carried out by concluding a supply agreement, which is regulated by Article 506 of the Civil Code of the Russian Federation. The purchase of alcohol under a supply agreement presupposes its use for business purposes, which in principle corresponds to the use of alcohol for entertainment expenses. Payment under the supply agreement can be made both in cash and in non-cash form.

It is possible to purchase alcohol from a company with a wholesale license under a supply agreement; the buyer does not need a license. There is also no need to declare the purchase of alcoholic beverages in accordance with paragraph 1 of Article 14 of Federal Law No. 171-FZ of November 22, 1995.

Note!

From July 1, 2021, when purchasing alcohol under a supply agreement, the receipt must indicate the name of the buyer, the TIN of the purchasing organization, the amount of excise duty and the registration number of the customs declaration (if any), and the country of origin of the goods.

Basic rules for writing off hospitality

Entertainment expenses (hereinafter also referred to as PR) are standardized and accounted for separately only for tax accounting purposes. In accounting, they can be taken as all similar costs.

If, at the expense of representative services, the payer reduces its tax base, the regulatory authorities are especially careful in checking them. Therefore, it is important to comply with the basic criteria for writing off PR:

- Documenting.

- Economic justification.

- Limit of 4% of payroll.

These criteria are approved in paragraph 1 of Art. 252 and paragraph 2 of Art. 264 Tax Code of the Russian Federation.

Our article “How to properly document entertainment expenses in 2020” will help you correctly draw up PR.

The rationing of PR can also be found in the following publications: “How are entertainment expenses rationed” and “What is the rationing of entertainment expenses?”

Retail purchase of alcoholic beverages under a sales contract

We are considering the option of purchasing alcohol at retail. A company selling alcohol at retail must have a separate license to allow its retail sale.

You can purchase alcohol at retail for your own needs on the basis of a retail purchase and sale agreement, which involves the use of the goods for personal, family, home or other use not related to business activities. In this case, the buyer from the organization will be a representative - an individual - an accountable person of the organization. When purchasing alcohol at retail, the company will not be identified in the documents.

Note!

Due to the fact that it is purchased by an individual (accountable person of the organization), additional details that came into effect from July 1, 2021 will not be indicated on the receipt for the sale of alcohol at retail.

Thus, we can conclude that alcohol can be purchased both wholesale, under a supply agreement, and retail. When purchasing alcohol for entertainment expenses, an organization does not need to have a license or declare the purchase of goods.

Accounting services for individual entrepreneurs and LLCs - any amount of work depending on your needs. Leave a request on the website, or find out the cost by phone!

Author: Shiryaeva Natalya

Documentary justification is the prerogative

When challenging decisions of the tax authority on additional assessment of income tax in relation to entertainment expenses incurred on alcoholic beverages, judges have the following arguments. If the taxpayer has documented the fact of incurring these expenses in order to establish and maintain cooperation with counterparties, and also confirmed the relationship with the implementation of activities aimed at generating income, then he has every chance to challenge the decision of the inspectorate.

Entertainment expenses include the costs of holding an official reception (breakfast, lunch or other similar event) for representatives of other organizations, transportation support for the delivery of these persons to the venue of the representative event or meeting of the governing body and back, buffet service during negotiations, payment for translation services, who are not on the taxpayer's staff, to ensure translation during entertainment events. Since Article 264 of the Tax Code of the Russian Federation does not contain a list of foods and drinks that cannot be included in entertainment expenses, the applicant’s arguments are justified (Resolution of the Federal Antimonopoly Service of the Volga District dated January 15, 2013 No. A55-14189/2012).

Tax legislation does not contain a specific list and forms of primary documents confirming entertainment expenses...

And in the resolution of the Federal Antimonopoly Service of the Central District dated August 27, 2009 No. A48-2871/08-18, the judges also refer to the fact that tax legislation does not detail the list of expenses that relate to entertainment expenses, and also does not define the list of products and drinks that are not may be included in entertainment expenses. Therefore, with proper documentary justification, such entertainment expenses as the cost of purchasing food, alcoholic beverages, paying for breakfasts, lunches and other similar events in public catering organizations, confirmed by employee advance reports, meeting programs, estimates, cash receipts, can be attributed to representative.

In the next dispute, additional assessment of income tax was also associated with the inclusion of entertainment expenses for the purchase of alcoholic beverages, taken into account when calculating taxable profit, as expenses.

Since there is no specific list of foods and drinks that cannot be included in entertainment expenses, the judges overturned the inspectorate’s decision to assess additional income tax. In addition, the company provided in support of advance reports, sales and cash receipts, acts of write-off of entertainment expenses, memos and executive estimates (Resolution of the Federal Antimonopoly Service of the Ural District dated November 10, 2010 No. F09-7088/10-S2).

Tax consultant A.P. Ilyushin

, for the magazine “Regulatory Acts for Accountants”

If you have a question, ask it here >>

Alcohol and entertainment

Expenses for the purchase of alcoholic beverages can also be attributed to the PR, taking into account the position of the Ministry of Finance, published in letter dated January 22, 2019 No. 03-03-06/1/3120. As the department explains, the list of products is not fixed by the Tax Code. Therefore, expenses for alcohol purchased as part of a business event can be included in the PR.

A similar point of view is expressed in the resolution of the Federal Antimonopoly Service of the Ural District dated November 10, 2010 No. F09-7088/10-C2 in case No. A60-2408/2010-C6. It is also said here that the list of PR is not exhaustive. These may include the cost of purchasing alcoholic beverages.

However, do not forget about the design and justification of these expenses. Thus, it is unlikely that the inspection bodies will leave the cost of alcohol in the amount of 5 bottles of whiskey for five meeting participants as part of the PR, since with such an amount of alcohol it is simply impossible to discuss important issues.

In addition, the cost of alcohol must in advance . Then the controllers will not have any questions that these expenses are attributed specifically to this business event.

Accounting

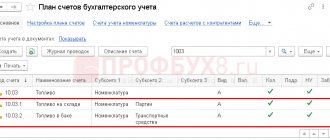

Alcohol is reflected in accounting, first of all, according to the rules applied to food supplies in accordance with PBU 5/01. As an example, let's look at the wiring used by alcohol production organizations.

According to PBU, alcohol in this case is inventory intended for sale. It is accounted for in account 43 “Finished products” or 40 “Product output”. Theoretically, it is possible to account for alcohol at actual cost or at standard, planned prices; standard (planned) prices are almost always used.

Postings (actual cost):

- D43 K20 - within a month, finished products arrive at the warehouse.

- D90/2 K43 - the cost of finished products is written off.

The method is used extremely rarely: the cost of production in the production process cannot be determined in fact, only at the end of the month, when calculating all costs (direct, indirect).

Postings (planned cost). Planned indicators and the amount of deviations can be taken into account on one account 43 :

- D43 K20 - within a month, products arrive at the warehouse at discount prices.

- D90/2 K43 - the cost is written off at the end of the month at accounting prices.

- D20 K10, 70, 02 and other costs - production costs are reflected at the end of the month.

- D43 K20 (reversal or direct posting) - deviations of the actual cost from the planned one.

- D90/2 K43 (reversal or direct posting) - the amount of deviations in terms of alcohol sold.

It is also permissible to use account 40 according to the following posting scheme:

- D20 K10, 70, 02 and other costs - production costs are reflected at the end of the month.

- D40 K20 - the actual cost of the product is recorded.

- D43 K40 - products at planned prices are taken into account.

- D90/2 K43 - planned cost written off.

- D90/2 K40 - deviations are taken into account in the cost price: savings or overruns (reversal or regular posting).

When accounting for revenue, the following entries can be used:

- D90/1 K62 - sales revenue is recorded in accounting.

- D90 K68 (according to subaccounts) - calculation of VAT and excise taxes.

By analogy, guided by PBU 5/01 and other regulations, alcohol is also taken into account during its wholesale or retail sale. In this case, standard postings are used with accounts 41,42 and corresponding accounts.

If an organization uses alcohol in retail, for example, for making cocktails, you can also use a score of 10.

Main

- Since July 1, 2018, unit accounting of alcohol has been in effect in Russia.

- Violations are subject to large fines in accordance with the Civil Code of the Russian Federation.

- Participants in the alcohol market, in particular, traders of strong alcohol, are exempt from the obligation to provide a declaration under f. eleven.

- The obligation to provide “beer” reporting under form 12 remains.

- Accounting for alcohol is carried out according to the rules for accounting for inventories, finished products, trade operations, using the appropriate accounts and their correspondence.

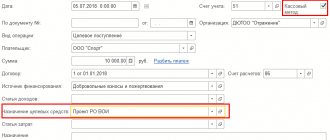

Documents for writing off hospitality expenses

Write-off of entertainment expenses is done on the basis of documents recommended by the Ministry of Finance and independently developed by taxpayers. Among them:

- order to carry out PR;

- estimate for a business event;

- business meeting program;

- PR report;

- act on write-off of PR;

- primary, etc.

The meeting program can be set out in the order for holding an official event or documented as an appendix. If the program of the event is extensive, then it is more logical to make it a separate appendix to the order.

The better and more detailed the issues discussed are, the fewer questions the inspection authorities will have. Phrases like “Discussion of current issues”, “Plans for implementing the development strategy”, etc. are unlikely to justify the feasibility of a business meeting.

The PR report should summarize the results of the meeting between the parties and give some understanding of the effect that can be achieved as a result of the negotiations.

The report should also indicate the issues that were discussed and the decisions that were made.

In general, the main documents for writing off PR are the report and the primary document for it. However, many companies prefer to prepare a full set of documents for a representative event, insuring themselves. The final document in this case for them is an act for writing off entertainment expenses.

You can read this document in detail in the article “How to write off entertainment expenses: a sample act.”

It is worth noting that the initial PR report must be completed in any case, regardless of which set of documents you choose to write off entertainment expenses.