An act of offset is a document that relates to the primary documentation of accounting, therefore it is mandatory to be drawn up when conducting business transactions involving offset. The form of this document is actively used for settlements of existing debts in small or medium-sized businesses. Drawing up an act is a legal opportunity to write off debts between counterparties; it helps to reduce transactions carried out on accounts, not withdraw funds from the company’s turnover, and avoid possible disputes between companies.

The use of offsets between counterparties is enshrined in Article 410 of the Civil Code of the Russian Federation. It applies to any type of debt: financial or material. But when drawing up this document, it is important to take into account that mutual claims are of the same nature, for example, monetary on both sides.

- 1 In what situations is an act of offset between organizations needed?

- 2 How to draw up a document correctly

- 3 Instructions for filling out the act 3.1 The first part is informational

- 3.2 The second part is the main one

- 3.3 The third part is the final one

How to offset between organizations: methods of debt offset

| Methodology used | Compliance with the rules | Documentation | Base | Progress indicator |

| unilaterally | all points taken into account | A work requested by one of the participants. In case of refusal, the opponent-initiator has the right to settle everything in court | Art. 410 Civil Code of the Russian Federation |

|

| two-way | impossible to complete 2 or 3 steps | solely on the basis of an agreement | clause 4 of Decree No. 16 of March 14, 2014 of the Supreme Arbitration Court of the Russian Federation |

|

Existing restrictions

In some situations, concluding an agreement is impossible due to the following reasons:

- payment for damage caused;

- permanent guardianship;

- alimony obligations;

- the established statute of limitations has passed;

- other circumstances described by law.

For the last point, it is important to clarify specific cases:

- there are no notes in the contract for the provision of reciprocal services;

- it is impossible to remove the obligation of the notary chamber from the membership fee to the compensation funds;

- refusal of a member of the union of tour operators to pay a contribution to the reserve.

How to correctly conduct and formalize an act of offset of debt between two organizations

If all of the above requirements are met, the company has the right to carry out a transaction with its partner in 2 options for document execution:

- statement;

- general agreement.

At the initiative of one participant

The possibility of performing the procedure is determined by the legislation in Art. 410 of the Civil Code of the Russian Federation. To do this, the initiator writes a request of an arbitrary nature, and in the text indicates:

- document's name;

- creation date;

- name of the economic entity-author;

- amount in units of measurement;

- information about authorized persons (full name and signature).

Regardless of the form of preparation, the content reflects the type of obligations indicating the details of contracts, agreements, invoice and other data. Additionally, the cost and date of compilation are indicated. It is also necessary to ensure that the partner has received a copy, which is done by postal notification when sending a registered letter or through electronic document management with a read receipt. If there is no information confirming the sending, the application will be cancelled.

By agreement of the parties

This method requires a written agreement between the counterparties, which is also created in free form without a clear template. The content is completely identical.

Signing such an agreement, as a rule, takes longer than sending it by mail, but this method is preferable. In this case, the partner’s signature indicates notification.

Display in tax accounting

All accounting transactions are subject to description and recording for submission to the Federal Service.

Income tax

Accounting when calculating the amount of payment depends on the chosen methodology used by the enterprise. If you select the accrual method, accounting transactions for mutual settlement are not displayed in the calculation data. Accordingly, there will be no profit or expenses, which are calculated regardless of the payment.

With the cash method, all movements of funds will be taken into account at the time of closing the debt, which also takes into account the offset of counterclaims. Thus, on the day specified in the agreement, the company indicates in tax accounting income the amount of repaid debt on the part of the counterparty, as well as the costs of repayment.

simplified tax system

When choosing a simplified taxation system, all movements of funds are calculated using the cash method, which means that the day of closing the debt to partners is the date on which income and expenses are indicated. The costs incurred for mandatory purchases for the implementation of activities are also taken into account.

VAT

If the transaction is carried out for the counter provision of services, then this fact is not displayed to determine the amount of tax. Thus, the tax liability does not arise at the time of transfer of the product, and the right to deduction arises when indicating the received products or works.

Settlement of mutual claims

I. YAMANUSHKINA, tax consultant, Audit Invest Consult LLC

If the organization's counterparty is both a supplier and a buyer, a situation arises when both persons participating in the transactions become each other at the same time a creditor under one agreement and a debtor under another. Termination of the obligation in whole or in part in this case can be carried out by offsetting the counterclaim (offset).

When performing mutual offset, a number of mandatory conditions must be met:

1. The demands of the persons participating in the offset must be of a counter nature.

2. Requirements must be homogeneous, i.e. the subject of the obligation must be property determined by generic characteristics, including funds.

3. The deadline for fulfillment of obligations has arrived, is either not specified, or is determined by the moment of demand.

4. The law or agreement does not provide for restrictions or prohibitions on the termination of an obligation by offset.

According to Art. 410 of the Civil Code of the Russian Federation, an application from one of the parties is sufficient to carry out offset. In our opinion, in order to avoid controversial situations, it is advisable for the parties to draw up a bilateral document, which will serve as the basis for offset. These documents may be an act of offset of mutual claims (hereinafter referred to as the Offset Act), a protocol on the offset, an agreement on the termination of mutual obligations through offset, etc. There is no established form of the document, but a number of requirements for it can be identified.

The Settlement Certificate must necessarily indicate the parties involved in the offset, as well as the documents serving as the basis for the emergence of obligations, namely an agreement, invoice, invoice, invoice, payment order, etc. It is necessary to determine the amount and primary documents for which obligations are terminated by offsetting counterclaims, as well as indirect taxes indicated in the primary documents and which are a component of the offset amount.

Example. LLC "October" shipped PBOYUL to S.I. Sviridov. under contract dated November 14, 2004 No. 10, goods according to invoice dated November 21, 2004 No. 52 for the amount of 330,000 rubles, including VAT 30,000 rubles. (rate 10%). Invoice No. 49 was issued by Oktyabr LLC on November 24, 2004. PBOYUL Sviridov S.I. conducted marketing research in the interests of Oktyabr LLC in accordance with agreement No. 18 dated September 9, 2004 concluded by the parties. The report was submitted to the customer on December 14, 2004. The work completion certificate was signed by the parties on December 18, 2004 in the amount of 141,600 rubles, including VAT 21,600 rub. (rate 18%). Invoice No. 34 was issued by PBOYUL S.I. Sviridov. 12/18/04

The contracts contain the same provisions regarding settlements: subsequent payment for goods shipped (services rendered) is carried out within 90 days from the date of transfer of goods (signing of the certificate of completion).

On January 21, 2005, the parties signed an Act of Settlement of Mutual Claims, which stated the following:

LLC "October" is the creditor, and PBOYUL Sviridov S.I. - the debtor under agreement dated November 14, 2004 No. 10. The amount of obligations under the agreement is 330,000 rubles, including VAT 30,000 rubles. (rate 10%), based on the invoice dated November 21, 2004 No. 52 (invoice dated November 24, 2004 No. 49);

PBOYUL Sviridov S.I. is a creditor, and Oktyabr LLC is a debtor under agreement dated September 9, 2004 No. 18. The amount of obligations under the agreement is 141,600 rubles, including VAT 21,600 rubles. (rate 18%), based on the work completion certificate dated December 18, 2004 (invoice dated December 18, 2004 No. 34);

the parties came to an agreement to pay off mutual claims by offset in the amount of 141,600 rubles;

debt of LLC "October" to PBOYUL Sviridov S.I. under contract dated September 9, 2004, No. 18, according to the work completion certificate dated December 18, 2004 (invoice dated December 18, 2004, No. 34) was repaid in full in the amount of 141,600 rubles, including VAT 21,600 rubles. (rate 18%);

PBOYUL Sviridov S.I. made partial settlements with Oktyabr LLC under agreement dated November 14, 2004 No. 10 under invoice dated November 21, 2004 No. 52 (invoice dated November 24, 2004 No. 49) in the amount of 141,600 rubles, including including VAT 12,873 rub. (rate 10%);

debt of PBOYUL Sviridova S.I. to LLC "October" under the agreement dated November 14, 2004, No. 10, according to the invoice dated November 21, 2004, No. 52 (invoice dated November 24, 2004, No. 49) on the date of signing the act is 188,400 rubles, including including VAT 17,127 rub. (rate 10%);

After signing this Settlement Act, the parties will have no claims against each other for settlements arising from the provisions of this Act.

In the future, PBOYUL Sviridov S.I. transferred on January 24, 2005 the amount of 188,400 rubles, including VAT 17,127 rubles, to the bank account of Oktyabr LLC. It is not necessary to draw up any documents to close settlements under agreement No. 10 dated November 14, 2004.

In this case, the entrepreneur received revenue on the day the act was signed - January 21, 2005, which will allow him income in the amount of 141,600 rubles. minus VAT RUB 21,600. taken into account in 2005 for the purposes of calculating personal income tax. The obligation to pay VAT to the budget arises in January 2005 if the entrepreneur notified the tax authorities before the 20th day of the month following the corresponding calendar year about the chosen method for determining the tax base as funds are received. Otherwise, the moment of determining the tax base for VAT is the date of shipment and presentation of settlement documents to the buyer (clause 12 of Article 167 of the Tax Code of the Russian Federation) - December 18, 2004.

Based on the requirements of tax legislation, when applying deductions, the taxpayer must, among other conditions, confirm the fact of payment of VAT to the supplier of goods (services). The date of signing the Act of Settlement of Mutual Claims is the date of payment for the goods (services), and the act itself is a document confirming the actual payment of the tax. Accordingly, indicating the amount of tax in the act is mandatory on the basis of clause 1 of Art. 172 of the Tax Code of the Russian Federation. The entrepreneur has the right to reflect the tax amount of 17,127 rubles in the purchase book on January 21, 2005. on the basis of a partially paid invoice dated November 24, 2004, No. 49 and include it in deductions on page 310 of the declaration for January 2005 when submitting it to the tax authorities.

For Oktyabr LLC, the grounds for deducting VAT are similar. Let's consider how business transactions are reflected in the accounting of Oktyabr LLC when applying in the accounting policy for tax purposes the moment of determining the tax base for VAT as settlement documents are shipped and transferred to the buyer (Table 1).

Table 1

| Contents of operation | Debit | Credit | Amount, rub. |

| 21.11.04 | |||

| Goods shipped (including VAT) | 62 | 90 | 330000 |

| The amount of VAT on shipped goods is reflected | 90 | 68 | 30000 |

| 12/18/04 | |||

| The services received for marketing research are reflected without VAT | 26 | 60 | 120000 |

| VAT on services is reflected based on the supplier's invoice | 19 | 60 | 21600 |

| 01/21/05 | |||

| Settlement of mutual claims was carried out | 60 | 62 | 141600 |

| VAT on services received is deductible | 68 | 19 | 21600 |

In the case of LLC “October” determining the tax base for VAT as funds are received, the scheme of entries will be as follows (Table 2).

table 2

| Contents of operation | Debit | Credit | Amount, rub. |

| 21.11.04 | |||

| Goods shipped (including VAT) | 62 | 90 | 330000 |

| The amount of VAT on shipped goods is reflected | 90 | 76 | 30000 |

| 12/18/04 | |||

| The services received for marketing research are reflected without VAT | 26 | 60 | 120000 |

| VAT on services is reflected based on the supplier's invoice | 19 | 60 | 21600 |

| 01/21/05 | |||

| Settlement of mutual claims was carried out | 60 | 62 | 141600 |

| VAT payable to the budget is reflected | 76 | 68 | 30000 |

| VAT on services received is deductible | 68 | 19 | 21600 |

The obligations of the parties in total terms may be different, however, the homogeneity of the obligations and the equivalence of the offset amounts, regardless of the amount of VAT paid as part of these obligations, give the taxpayer a basis to deduct the amount of tax in accordance with the issued invoices. The fact that counterparties use different tax rates does not matter for deciding the issue of tax assessment or their use of deductions. The participant in the agreement is obliged to pay to the budget the amount of tax that was invoiced by him; accordingly, the application of a deduction within the amount paid is also made on the basis of the invoice received from the supplier (Resolution of the Federal Antimonopoly Service of the North-Western District dated September 30, 2004 No. A26 -2798/04-212, FAS of the West Siberian District dated July 19, 2004, No. F04/5122/2004 SA02-3079-32).

Based on the uniformity of application of legal norms and the illegality of a differentiated approach to taxpayers, the specified procedure for processing documents and accounting is also applied in cases where one of the parties to the offset is a payer of a single tax on imputed income, or applies a simplified taxation system, or has an exemption from taxes on the basis Art. 145 of the Tax Code of the Russian Federation, or carries out transactions that are not subject to taxation on the basis of Art. 149 of the Tax Code of the Russian Federation.

Multilateral netting

It should be noted that there is multilateral offset, i.e. when a number of creditor and debtor organizations take part in the offset: organization A is a creditor of company B, which in turn is a creditor of organization C, and that is a creditor of company D, which is a creditor of organization A. Carrying out multilateral offset does not contradict the norms of civil law. There are also no problems when determining the date of payment and the moment of determining the tax base. But the tax authorities consider the use of the deduction to be unlawful, since there is no fact of payment directly to the supplier of inventory items. However, debt closure is an agreement that combines the termination of obligations by offset and the transfer of the right of claim to a third party. Both the first and the second based on paragraphs. 2 and 3 paragraphs 2 art. 167 of the Tax Code of the Russian Federation are payment for goods. If a document is drawn up, for example, an agreement between the parties on the repayment of debt, signed by all parties involved in the transaction, then the obligations of the persons are considered fulfilled, and the calculations are considered to be made. All requirements for the document and the information contained therein specified above must be met. The courts note that the legal structure of multilateral offset consists of mutual repayment of obligations and claims of its participants (Resolution of the Federal Antimonopoly Service of the Ural District dated July 30, 2001 No. F09-1214/2001GK).

Settlement using bills of exchange

A bill of exchange as a security, on the one hand, is the property of an organization, and on the other, a means of payment. When using bills of exchange in offsets, the following should be taken into account:

income on a bill of exchange is reflected on the date of its repayment or the date of its alienation in any other way;

the sale of bills of exchange is not subject to VAT;

when using a third party's bill of exchange in payments for purchased goods, the amount of tax actually paid for this property is calculated based on the book value of the bill of exchange;

when using your own bill of exchange or a third party's bill of exchange received in exchange for your own bill of exchange in payments for purchased goods, the amount of tax actually paid for this property is calculated based on the amounts actually paid on your own bill of exchange.

Example .

LLC "October" acquired a bank bill with a nominal value of 118,000 rubles. with a 20% discount for 94,400 rubles. The bank's promissory note was used to pay for the supplied products from November LLC in the amount of 118,000 rubles. (VAT 18%). Based on clause 9 of the accounting regulations “Accounting for financial investments” (PBU 19/02), approved by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n, the bank’s bill of exchange must be accepted for accounting in the amount of the actual costs of its acquisition, t .e. 94,400 rubles, and is reflected in account 58 “Financial investments”, subaccount 2 “Debt securities”.When transferring a bank bill of exchange as payment for purchased products on the basis of an agreement and an act of transfer of securities, as well as the offset of counterclaims, Oktyabr LLC will reflect income from the sale of securities in the amount of 118,000 rubles. and expenses in the amount of 94,400 rubles. Profit from this operation is reflected on page 120 of sheet 06 of the corporate income tax declaration and is included in the tax base for calculating income tax on pages 180-200 of sheet 02 “Calculation of corporate income tax” of the declaration.

LLC "October" purchased products in the amount of 118,000 rubles. The amount of VAT reflected in account 19 “Value added tax on purchased assets” amounted to 18,000 rubles. The amount of tax that Oktyabr LLC will reflect when applying deductions in the debit of account 68, subaccount “VAT Calculations”, will be calculated based on the book value of the bill - 94,400 rubles, at a rate of 18% the amount of deductions will be 14,400 rubles. The difference is 3600 rubles. in accounting it is credited to account 91 “Other income and expenses”, subaccount 2 “Other expenses”; it is not taken into account in expenses when calculating corporate income tax and is covered from own funds.

Example. LLC "October" acquired a bank's bill of exchange with a nominal value of 118,000 rubles, and issued two of its own bills of exchange with a nominal value of 59,000 rubles to secure its payment obligations. every. The bank's promissory note was used to pay for the supplied products from November LLC in the amount of 118,000 rubles. (VAT 18%). At the time of payment for the delivered products, Oktyabr LLC repaid only one bill in the amount of 59,000 rubles.

Based on the last paragraph of paragraph 2 of Art. 172 of the Tax Code of the Russian Federation, a deduction for Oktyabr LLC can be provided based on the amounts actually paid on its own bill. When applying this taxation regime, it should be taken into account that the acquisition of bills of exchange in exchange for one’s own is equivalent to the receipt of bills under a loan agreement. The obligation to pay on your own bill (repay the loan) is made directly dependent on receiving VAT deductions. The judicial authorities take a similar position (resolution of the Federal Antimonopoly Service of the Ural District dated March 1, 2004 No. F09-579/04AK).

In addition, one should distinguish between the transfer of a bill of exchange in a transaction for consideration (sale of a security) and the presentation of a bill of exchange for payment. In the second case, the right to demand payment on a bill of exchange is not identified with the transfer of ownership of property, but is conditioned by the need to fulfill an already existing obligation. If November LLC, having received a bank bill of exchange as payment for the delivered goods, presents it to the drawer for redemption, this transfer of the security will not constitute a sale (Article 39 of the Tax Code of the Russian Federation). Income in the accounting of LLC "Noyabr" will be reflected only from the sale of products, and the receipt of funds on the bill will not be income (resolution of the Federal Antimonopoly Service of the East Siberian District dated February 22, 2004 No. A74-2073/00-K2-FO2-236/ 01-S1).

Offsetting under a simplified taxation system

Letter No. 21-09/21815 of the Department of the Ministry of Taxes and Taxes of Russia for Moscow dated March 31, 2004 indicates that it is illegal to include expenses by persons applying the simplified taxation system if payment to its suppliers is made by a third party on account of mutual settlements. The cash method of accounting for income and expenses involves including income and expenses after their actual payment when calculating the single tax. In case of mutual settlements, the settlement (payment) document is the Offset Certificate, on the basis of which payment for both sold and purchased goods (works, services) by each of the parties participating in the offset is reflected simultaneously (resolution of the Federal Antimonopoly Service of the North-Western District dated July 30, 2002 No. A05-2077/02-163/13).

Taxpayers must reflect expenses taken into account when calculating the tax base in relation to the procedure provided for in paragraphs. 1 clause 3 art. 273 of the Tax Code of the Russian Federation, which states that expenses are taken into account as expenses when repaying debts in other (other than monetary) ways - at the time of such repayment.

Persons applying the simplified taxation system must remember that all income and expenses of the organization must be documented and economically justified. This rule applies to all taxpayers without exception. Recommendations for drawing up an Act of Settlement between the parties and reflecting in it the primary accounting documentation and the amounts of debt and offset are also applicable for such taxpayers, with the exception of invoices that are not issued by persons who have switched to the simplified taxation system.

The agreement of the parties on mutual offset must be distinguished from the barter agreement. According to accounting and tax legislation, an organization's property is taken into account based on the actual costs of its acquisition. In a barter exchange, the actual purchase price of the property is the sum of the value of the disposed property. Value added tax is also calculated based on the value of the property transferred as payment, and when counterclaims are offset, VAT amounts are considered paid and are subject to deduction on a general basis, as when paying in cash. The situation when the taxpayer is asked by the tax authorities to pay the entire value of the offset to the budget, and to deduct the tax amount calculated on the basis of the book value of the property, is contrary to the law. The courts adhere to a similar position (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated January 20, 2004 No. A17-2048/5).

The resolution of the Constitutional Court of the Russian Federation dated January 20, 2001 No. 3-P states that the procedure for calculating VAT when the taxpayer uses any legal forms of sale of goods (work, services), including by exchanging some goods for others, when assigning a claim and etc., being one of the essential elements of taxation, ensures a uniform understanding of the provisions on the amounts of tax actually paid to suppliers.

Thus, the tax amounts actually paid to suppliers mean the costs actually incurred by the taxpayer (in the form of alienation of part of the property in favor of the supplier) to pay the tax amounts accrued by the supplier.

When selling goods by offsetting counterclaims, the taxpayer-supplier calculates the amount of VAT payable to the budget based on the cost of goods (work, services) sold, and the corresponding amount of tax is highlighted in the settlement documents as a separate line. Thus, at the same time there is the fact of paying certain amounts of tax to the budget and presenting them to the buyer.

The position of the Constitutional Court of the Russian Federation is clear: identifying a barter transaction as a form of sales and offset, as a form of payment for goods (works, services) sold is unacceptable, and in the first case, when the taxpayer uses VAT deductions, the provisions of clause 2 of Art. 172, and in the second - paragraph 1 of Art. 172 of the Tax Code of the Russian Federation.

At the same time, the courts have repeatedly pointed out that when transferring property for which payment has not been made as payment for goods (work, services), the taxpayer did not incur actual costs, and accordingly he does not have the right to deductions (resolution of the Federal Antimonopoly Service of the Ural District dated 9.07.04 No. F09-2772/2004AK, FAS of the North Caucasus District dated 2.06.04 No. F08-2351/04-914A).

However, the Presidium of the Supreme Arbitration Court of the Russian Federation in its resolution dated December 14, 2004 No. 4149/04 indicates that, according to the explanation of the Constitutional Court of the Russian Federation given in the ruling dated November 4, 2004 No. 324-O, from the ruling dated April 8, 2004 No. 169-O does not mean that the taxpayer does not have the right to make a tax deduction if the amount of VAT was paid by him to the supplier with borrowed funds before he fulfills his obligation to repay the loan. The right to deduct tax amounts presented to the taxpayer and paid by him upon the acquisition of goods (work, services) cannot be granted if the property acquired in a compensated transaction has not only not been paid for by the time of transfer to the supplier in payment of the accrued tax amounts or not paid in full, but clearly not payable in the future.

Uniformity factor

The term refers to obligations expressed in the same currency with similar payment methods. This may include contracts for contracts or sales of goods that are concluded between companies. So, if at the signing stage the monetary form for payment is indicated, and the rules are followed exactly, the partners have the right to proceed to the mutual settlement procedure. However, if, according to one of the documents, the fulfillment of the requirements involves a physical expression, and according to the second - in money, then they will not be recognized as homogeneous. This rule also includes calculations in different currencies.

How to make offsets between organizations and reflect them in the reconciliation report

Before starting to draw up mutual settlement documentation, the parties sign a settlement reconciliation document, in which the requirements are divided according to the agreements. This stage helps in calculating the amount of debt that must be paid.

So, if there is a risk of disagreements between partners, the resolution of which is carried out exclusively in court, such certificates will become confirmation of the amount of debt. In the absence of such information, the agreement of the parties on the mutual settlement of claims will be declared invalid.

In what situations is an act of offset between organizations needed?

Drawing up a primary accounting document is required for:

- determine the specific amounts of debt between enterprises that can be offset;

- determine the obligations that can be repaid, their grounds and the procedure for offset;

- show the absence of claims between organizations.

For the accounting of an organization, drawing up an act makes it possible to:

- draw up business transactions that take into account the offset of all accounts;

- take into account costs in tax accounting to form a tax base;

- prevent the occurrence of fines from the Federal Tax Service.

Debt display documented

Before starting to draw up a bilateral offset agreement with the counterparty, it is necessary to draw up and sign the corresponding reconciliation report. The document is not mandatory, but thanks to it you can easily prove the existence of a debt, including if it was previously partially repaid, and also eliminate future disputes with your partner.

All certificates of this type are drawn up in any form and come into force from the moment of stamping and signing.

The documentation lists the following information:

- details of the basis document for the existence of debt with number and date;

- indication of the exact amount of debt in the prescribed form for calculation with a fixed VAT;

- recommended amount to pay including value added tax.

If there are more than two participants, then the list must indicate all the names of the companies, exact costs for each, reconciliation reports, and then the document is signed by all authorized representatives, namely: accounting and managers.

Instructions for filling out the act

The document form must contain the following information:

- data on enterprises between which an agreement on mutual offset has been reached;

- reasons for the debt (indicate the details of the documents that became the basis for the debt);

- list of obligations;

- amount of debt.

The netting act form is divided into three parts.

Free legal consultation

+7 800 350-51-81

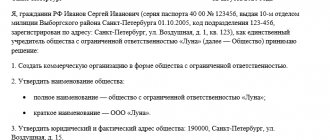

The first part is informational

- Document header (name, location of the enterprise, date of completion).

- Information about one side of the transaction: the name of the enterprise and its legal form, information about the manager (position and surname, first name, patronymic), type of document that gives the manager the authority to sign documentation (charter, regulations).

- Information about the other party to the transaction (the same information as in paragraph 2).

The second part is the main one

Here information is indicated on the basis of which documents the debts arose and their amounts;

Attention! Amounts are indicated both in words and in numbers.

Next, an agreement to repay the debt is recorded. It is necessary to indicate the type of payment: full or partial. If the debt is not repaid in full, then the period during which it must be repaid must be indicated.

The third part is the final one

Contains the signatures of all responsible persons (indicating the position and full name of the employee), as well as the seal of the organization. But having a seal is not mandatory.

How to make offsets between organizations without errors

Very often, the cause of disagreements can be the erroneous preparation of documents or the lack of certain information, which is important when calculating prices.

The table below lists the typical and most common shortcomings that should be avoided.

| Type of defect | What's happening |

| VAT is not displayed in the documentation as a separate line with the amount for each counterclaim agreement | Costs for goods not specified in invoices are not taken into account, as a result of which disagreements arise and contractual and tax sanctions are imposed. |

| Creation of an act on transactions not provided for by law | Illegality of action |

| Using a Great Currency | Cancellation |

| Failure to indicate a partner's obligation | The agreement is invalid once the right to transfer the demand for payment of the debt to the partner arises, that is, the creation of a reciprocal obligation |

| Making payments for the largest amount | Illegal operation |

Stages of debt settlement between organizations

Below we present a step-by-step description of the procedure, listing the necessary certificates, as well as the requirements for their preparation. Each step is of fundamental importance and will help you avoid the most common mistakes.

| № | Stage name | Documentation | Peculiarities |

| 1 | Determining the type of mutual obligations | Act of reconciliation of accounts | Documents are drawn up with a breakdown of existing agreements that are signed between partner participants. As a result, it becomes possible to calculate the exact amount of debt. |

| 2 | Exchange of reconciliation reports | Signing by responsible persons of each certificate and certification with a seal | |

| 3 | Development of an application for mutual settlement and sending to the counterparty (unilaterally) | Statement | Fixing in the letter the exact amount of the smallest debt, as well as indicating the details of the contracts under which the operation is carried out. Sending a registered letter with a notification, which in the event of disputes will allow you to prove the receipt or sending of the message by the parties. |

| 4 | Uniformity Factor Tracking | Accounting for exchange rate differences on a foreign currency account | When using different currencies, choose the most convenient one |

| 5 | With several participants - development of an act | Contract agreement | Requirements for content and uniformity factor must be maintained. |

What is an act of offset

It is worth noting that the document is drawn up only if both parties agree to it. If there are debts of one type, they can be repaid if the other party presents counter monetary obligations. There is no need to move funds from one account to another many times. Thanks to such a document, transactions on various accounts can be significantly reduced and, accordingly, time can be saved on their processing.

( Video : “Act of mutual settlement with the counterparty in 1s 8.3.0”)

The main goal of drawing up such a document is to avoid disagreements between organizations. However, this can only be achieved if this act is executed correctly. The main advantages of drawing up this document include:

- saving time, because instead of many different documents you will need to draw up only one act;

- since there is no need to make a large number of payments, it is possible to get rid of numerous bank commissions;

- even long-term and large debts between the parties can be repaid quite simply.

Although the law allows for unilateral settlement, doing so is quite problematic. It is much easier to perform this procedure according to mutual desire.

By whom and when is the document drawn up?

We can say that this document is very popular among organizations that are representatives of medium and small businesses.

Experience shows that these are the companies that most often experience financial difficulties. It is the act of offset that is the best option for solving money-related problems. The act is drawn up on the basis of a statement that can be drawn up by one of the parties. At mutual request, the document may allow you to repay all or part of the debt. If the debt is not repaid in full, it is necessary to indicate what will happen next with the remaining part. For example, the debtor company undertakes to transfer the balance of the debt to the counterparty's current account within a certain period of time.

Before drawing up the act, responsible employees of the organization verify the documents. Then the chief accountant, with the help of other authorized employees, begins to draw up an act of offset. After this, the document must be signed by the director of the company.

However, you need to know that the main condition for drawing up this act is that the obligations between the counterparties are homogeneous. For example, you can offset only services rendered, only funds, or any work performed. If the obligations are not homogeneous, drawing up the act loses all meaning, because the document will not have legal force.

Accounting

The netting transaction must be shown using the debit and credit write-off method. To do this, accounts receivable are recorded for the amount of mutual claims on account 62. In some situations, it is permissible to use Article 76, as is often customary when concluding lease agreements. If the price matches exactly, no additional payment is provided. If one of the parties has a larger debt, the difference is paid extra. VAT on goods or services used refers to reimbursement by the budget at the time of signing the relevant act.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Offsetting in accounting

As is known, carrying out offsets is associated with the requirement to pay VAT in cash, which raises questions among accountants about the deduction. Elena Dirkova, General Director of BUSINESS ACCOUNTANT LLC, comments on the situation.

Termination of an obligation by offset In the business activities of a company, a situation is possible when the same counterparty firm is a creditor under one agreement, and a debtor under another agreement in the upcoming cash settlements.

Let's say one company acts as a customer, transferring customer-supplied raw materials to another for processing. But at the same time, the second company buys the same raw materials from the first to produce its own finished products. This means concluding two independent contracts - contract and supply. In conditions of mutual debt, termination of obligations by offset, provided for in Article 410 of the Civil Code of the Russian Federation, is applied. Having compared the amounts of receivables and payables, the company has the right to balance them by notifying the company about this. Of course, notice of offset must be made in writing. Only homogeneous claims can be settled by offset. But the law does not explain how to understand the meaning of the term “homogeneity.” Yet claims expressed in different currencies are not recognized as homogeneous. An obligation to pay money and a demand to transfer things are not considered as such. In addition, offset is provided only in civil legal relations. It does not apply to settlements in the field of labor relations - wages and accountable amounts (Example I).

Example I

Let’s assume that as of December 20, 2007, the following debts are included in the accounts:

- accounts receivable for 100,000 rubles. (account 62 “Settlements with buyers and customers”);

- accounts payable for RUB 150,000. (under account 60 “Settlements with suppliers and contractors”).

Guided by the norms of civil law, the accountant will close these debts by posting the smaller of two amounts:

DEBIT 60 CREDIT 62 - 100,000 rubles. — offset of mutual obligations has been completed.

After this, it remains to transfer money to the account of Mayak LLC only for the outstanding difference: DEBIT 60 CREDIT 51 - 50,000 rubles. - transferred to pay off accounts payable.

Offsetting is attractive because it saves the company's working capital. But it cannot be applied without taking into account the requirements of tax legislation. The considered option is permissible only in the case when both debts do not contain VAT.

VAT and “civil” rules Clause 3 of Article 2 of the Civil Code of the Russian Federation contains a noteworthy clause that civil legislation may not be applicable in tax legal relations. This applies to offsets if at least one of the debts contains VAT. Since January 1, 2007, the tax legislation has included a rule according to which participants in civil transactions have the right to carry out non-monetary offsets for amounts from which VAT is excluded. This requirement follows from paragraph 4 of Article 168 of the Tax Code of the Russian Federation. It can be understood in such a way that partners have the right to make decisions on offsets within the limits of “their” money - without taking into account VAT. And calculations for this tax are regulated by the state. So, non-monetary offset of VAT amounts is not allowed. Participants in the mutual offset are required to transfer this tax in “real” money and, moreover, by a separate payment order (Example II).

Example II

Let's return to the situation discussed in Example I. Faced with the “expanded” debt of Mayak LLC, the accountant must find out how much VAT each debt contains. Let the VAT rate of 18% apply to both agreements, then the VAT in the “receivables” is 15,254 rubles. (100,000 rubles × 18/118), and in the “creditor” - 22,881 rubles. (RUB 150,000 × 18 / 118). And only amounts that do not contain VAT are allowed to be rolled up with each other:

- by debit (from the balance sheet asset) - 84,746 rubles. (100,000 - 15,254);

- on the loan (from the balance sheet liability) - 127,119 rubles. (150,000 - 22,881).

Therefore, offset is possible only for the smaller of these “non-essential” amounts:

DEBIT 60 CREDIT 62 - 84,746 rubles. — offset of mutual obligations without VAT has been completed.

After this, the counterparties must “exchange” in cash the VAT attributable to the offset amount. In our case, both transactions are subject to VAT at the same rate, so both parties will transfer the same amounts to each other - 15,252 rubles. (RUB 84,748 × 0.18):

DEBIT 60 CREDIT 51 - 15,252 rub. — Mayak LLC lists the VAT related to the offset;

DEBIT 51 CREDIT 62 - 15,252 rubles. — VAT related to offset was received from Mayak LLC.

As a result, the same amount will remain unrolled as in Example I - 50,000 rubles. But without transferring money it will not be possible to balance the debt.

For intermediaries Mutual settlements between the principal and the commission agent are subject to clause 4 of Art. 168 of the Tax Code of the Russian Federation does not apply. This is explained by letter of the Ministry of Finance of Russia dated April 12, 2007 No. 03-07-11/104. Although the Federal Tax Service of Russia for Moscow has the opposite opinion on this matter (letter dated March 21, 2007 No. 19-11/25332).

What to do with VAT deduction It is noteworthy that the legislation does not establish a period during which VAT payments must be made when netting. At the moment, failure to comply with this requirement does not result in sanctions. In this regard, the question arises: will non-payment of VAT affect the deduction? Accountants are concerned that they may have to restore VAT, which was legally accepted for deduction at the time of capitalization of assets. In reality, the taxpayer does not have such an obligation, and this position is reflected in the letter of the Ministry of Finance of Russia dated March 23, 2007 No. 07-05-06/75. If the buyer has received an invoice, then he has all the legal grounds to accept the presented VAT for deduction earlier than the moment at which the offset is made. But there is no obligation to restore VAT during offsets (clause 3 of Article 170 of the Tax Code of the Russian Federation) - but only if each of the agreements participating in the offset provides for settlement in cash.

But in letter dated May 24, 2007 No. 03-07-11/139, the Russian Ministry of Finance expressed a different position. Officials believe: if in the tax period in which the offset is carried out, the amount of VAT from the buyer is not transferred to the taxpayer, then the tax must be restored. At the same time, they refer to paragraph 2 of Article 172 of the Tax Code of the Russian Federation, according to which when the taxpayer uses his own property in payments for purchased goods (work, services), a deduction is provided subject to the actual payment of the tax. But one can argue with this opinion. Indeed, in netting, the role of own property is played by the property right of claim on receivables. And for tax purposes, property rights are not considered property. This is directly stated in paragraph 2 of Article 38 of the Tax Code of the Russian Federation. This conclusion is supported by the arbitration practice of recent years (resolutions of the FAS of the Ural District dated August 7, 2006 No. Ф09-6738/06-С2 in case No. A47-17551/05, FAS of the Volga District dated February 9, 2006 in case No. A72-5466 /05-7/442, etc.).

In addition, letter No. 03-07-11/139 refers to a special case of offset - when the buyer applies a special tax regime and is not a VAT payer. And the Ministry of Finance of Russia, in letter dated August 7, 2007 No. 03-02-07/2-138, precisely warns against extending conclusions on specific issues to all other cases.

Reason for disagreement The structure of the VAT tax return also raises concerns among taxpayers. It specifically provides a breakdown of deductions when offset: in a separate line 240 you must indicate the paid VAT. In our opinion, this fact does not provide grounds for linking the right to deduction with payment of tax. This transcript can be considered as a reference.

How is offset between three or more enterprises done?

Such a procedure is also considered possible and is described in detail by law in Art. 421 Civil Code of the Russian Federation. General provisions apply only if they do not conflict with the nature of the agreements between several parties.

The rules are identical:

- the deadline for fulfilling the requirements for each member has already begun;

- offset is possible when calculating the smallest amount of debt;

- certificates contain information for payment by all partners.

When it is possible and when it is impossible to offset

Settlement is an example of a civil transaction and is therefore regulated by the Russian Civil Code. Despite the fact that the legislation does not define a single sample of documents (acts, statements and agreements for offsets), the Code directly defines cases when offset is permitted and when it is not allowed. You can read more details in articles 410 and 411.

In accordance with the law, companies can offset liabilities:

- if the performance deadline has arrived, a specific one is not specified in the contract or is intended to be demanded (in rare cases that do not contradict the legislative norms of the Russian Federation, offset is possible for those obligations that have not yet occurred);

- if organizations are both creditors and debtors to each other;

- if the obligations are homogeneous (counterparties owe each other money in a single currency, in some cases, if there is a difference in currencies, offset is possible by agreeing on a transfer at the current exchange rate).

To count the requirements, a statement on one side is sufficient. However, it is best to have a mutual agreement.

Article 411 specifies cases when offset is prohibited:

- on claims for collection of alimony payments, compensation for damage to health and life, lifelong maintenance;

- on claims with an expired statute of limitations;

- in other cases provided by law.

Thus, offset is prohibited if the agreement prohibits it; in cases where one of the parties goes through bankruptcy; in cases of conducting foreign economic activity with a foreign organization and others.

Settlement cannot be carried out if the parties’ requirements for each other are not homogeneous. It is impossible to count when one organization must supply material resources (for example, construction), and the second must supply funds.

The article is over, do you have any questions? Contact the site's duty lawyer.

Don't forget to download sample acts for free.

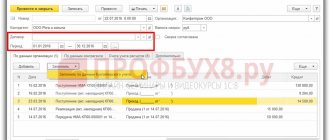

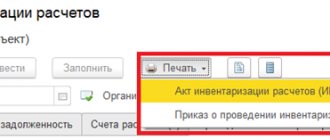

Posting adjustments in 1C

Sometimes there are times when the counterparty acts as a supplier or buyer (in account sections 60 and 62), and income and expenses overlap, that is, there is no debt, which is established automatically.

However, in accounting, offsets under agreements of one counterparty are impossible, so it is necessary to generate a report for a given period in the “Account Card”.

In the “Calculations” section, you must select the “Debt Adjustment” option. Having entered it, a new factor is created according to the following algorithm, go to “Supplier”, then “On account of the supplier’s debt”. Next, you need to select a lender from the list. In the “Debt to Supplier” Tab we record the receipt of goods for the adjustment amount.

Then, in the “Supplier’s debt” section, we record the sales in accordance with the invoice and change the data. When you click on the icon, all the manipulations performed are displayed, and the generated document can be certified with the seals and signature of officials. After reporting on accounts 60 and 62 for a given period, you can study the conduct of mutual offset, as well as the absence of an outstanding amount of debt.

Normative base

All transactions for the offset of payments for the provision of services and the sale of goods are described and enshrined at the legislative level. Among the regulatory documents describe the rules:

- Civil and Tax Code of the Russian Federation;

- Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”;

- Letters from the Ministry of Finance of Russia;

- Resolutions of the Federal Antimonopoly Service.

The form of mutual settlement of submitted claims is relevant only in situations where one of the accomplices is experiencing a financial shortage and is looking for various methods to resolve work issues, and sometimes even disputes. The technique is in demand when optimizing internal processes, and is also popular for partners who offer similar products and are ready for long-term cooperation. In any case, mutual settlements between organizations are a beneficial event for both parties that do not entail unreasonable costs, provided that the rules and deadlines are observed. If you need optimization software, contact Cleverence. Our company has been working in the industrial process automation market for many years, offering a wide range of ready-made solutions for enterprises operating in various fields, and is also ready to offer software to simplify transactions with partners.

Number of impressions: 3269

How to draw up an act correctly

The use of any approved form of this document is not provided for by regulations. Therefore, enterprises have the right to compose it in free form or use an independently developed template containing all the details established by Federal Law-402 “On Accounting”.

The act must have two copies. One copy for each party to the transaction. If there are more parties, then a separate form is filled out for each party. All copies of documents have legal force.

Important! Each copy of the netting act must bear the signature of the manager.

It must be accompanied by copies of the documentation that is the cause of the debt.

Before starting to draw up the act, a reconciliation act must be drawn up between the enterprises to reconcile mutual settlements. Filling it out is not strictly necessary, but it will help accounting employees confirm debts and avoid conflict situations with counterparties.