After changes in legislation from 2021, alcohol can only be sold by punching a receipt through an online cash register.

Important

that drinks such as

beer, cider, mead

and

poire are

allowed for sale by individual entrepreneurs. In contrast to the retail sale of other alcohol, which is allowed only to organizations (Clause 1, Article 16 of Law No. 171-FZ).

Cash register equipment (CCT) should be used by shops and public catering establishments, including those selling alcohol and draft beer, regardless of the taxation system - simplified tax system, OSN, UTII, Patent. Any alcohol is considered an excisable product!

The main laws on the use of cash registers when selling alcoholic beverages are 54-FZ and 171-FZ. Federal Law No. 171-FZ regulates the production, sale and consumption of alcohol. Federal Law 54-FZ stipulates specific cases of use.

Deadline for switching to online cash registers for beer sales

The sale of alcoholic beverages is an area that requires strict control by the state. In this regard, the introduction of online cash registers in Russia primarily covered the trade in beer and stronger alcohol.

Federal Law No. 54 “On the use of cash register equipment” notes that from March 31, 2021, organizations that are engaged in:

- retail sale of alcoholic products (including draft beer stores);

- retail sale of alcohol within public catering establishments.

Reference! According to Federal Law No. 171 “On state regulation of the production and circulation of ethyl alcohol,” alcoholic products include vodka, cognac, wine, fruit wine, liqueur wine, sparkling wine (champagne), wine drinks, beer and drinks made from beer, cider, Poiret, mead.

From April 1, only firms engaged in the beer trade that had not previously used cash registers switched to online cash registers. If the organization had already used a cash register before, then it could only exchange it for a new one or upgrade it by July 1, 2017.

Important point! There are provisions in the legislation that allow you to count on a delay in transferring beer sales to online cash registers:

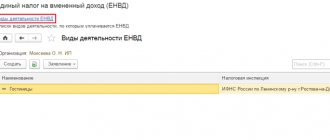

- firms operating on the basis of PSN or using UTII can switch to a new cash discipline from July 1, 2021 (FZ-290);

- companies selling excisable goods in hard-to-reach areas may not use cash register equipment (FZ-171).

Amendments to Federal Law 54 oblige firms engaged in the sale of beer to switch to online cash registers from July 1, 2021. This special norm has priority over the general norms given above (clause 13 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 47 of July 11, 2014). Therefore, there will be no delays in the transition to new cash registers.

Figure 2. From July 1, 2021, all retail alcohol sales points, including draft beer stores, switched to online cash registers. Source: online magazine “Modern Entrepreneur”

Fines for beer sellers

You can read about fines for working without an online cash register here. In addition, those selling beer and other alcohol are liable for bypassing the EGAIS system. If an individual entrepreneur does not report to the Unified State Automated Information System for drinking alcohol, he faces a fine of 1,000–15,000 rubles. Officials and LLCs are also responsible for the sale of alcohol-containing products. For them, the fine varies in the range of 150,000–200,000 rubles (Article 14.19 of the Code of Administrative Offenses of the Russian Federation). For violations related to declaration, a penalty of 5,000 - 10,000 rubles is provided for individual entrepreneurs; fines from 50,000 to 100,000 rubles can be applied to LLCs. Subsequent problems with the declaration are followed by suspension of the license to sell alcohol and complete deprivation of the license without the right to obtain it again (Article 15.13 of the Code of Administrative Offenses of the Russian Federation).

Which online cash registers are suitable for selling alcohol - a review of popular models

When choosing an online cash register model for companies that sell beer at retail, you should pay attention to several important details:

- compliance with the requirements of the Unified State Automated Information System and Federal Law-54 (presence in the register of online cash registers of the Federal Tax Service of Russia);

- ability to connect to the Internet wired or wireless;

- transfer of data to the Federal Tax Service through the fiscal data operator (FDO) online or within 30 days from the date of the transaction by sending information from the fiscal drive;

- generation of not only electronic, but also paper receipts (availability of a printer) for handing over to customers;

- availability of mechanisms for working with payment cards.

Important point! When selling beer, the company is not obliged to report to the Unified State Automated Information System on transactions with customers: usually it sends an invoice only upon receipt of a shipment of goods at the warehouse. Source: official website of the Federal Tax Service of Russia

If necessary, the cash register must be provided with functionality for non-stationary, on-site sales of alcoholic beverages.

In order to finally decide on the choice of an online cash register for selling beer, you should read the review of 7 cash register models.

Table 1. Overview of online cash register models for beer trade

| Name | Photo | Price | Manufacturer | Peculiarity |

| Atol Autonomous cash desk EGAIS | 26-28 thousand rubles. | Athol | For small stores (WiFi, 3G and Ethernet; transfer of information to EGAIS and OFD via cable) | |

| Barcode Mobile PTK | 30-31 thousand rubles. | NCT "Izmeritel" | For outdoor and non-stationary beer trade (connects to a smartphone via Bluetooth; works with Windows CE or Android systems) | |

| AMC 100K | 17-19 thousand rubles. | Athol | For a stationary point of sale of beer | |

| Evator Alco | 37-39 thousand rubles. | Athol | For small retail stores (touch display, ability to connect other devices) | |

| Evator Alko UTII | 33-34 thousand rubles. | Athol | For retail outlets operating on UTII (barcode scanner, data transfer to EGAIS) | |

| Stroke Light PTK | 30-32 thousand rubles. | Athol | For stationary beer trade (connection to a PC, work with basic accounting programs) | |

| F Print 22 PTK | 28-29 thousand rubles. | NCT "Izmeritel" | For stores selling any alcohol with connection to EGAIS |

The considered models of online cash registers are applicable not only to the sale of beer, but are also suitable for companies involved in the sale of any alcoholic beverages. In addition, they are suitable for any taxation system; characterized by a high level of reliability and the ability to operate autonomously for 30 days.

What to do as an LLC on UTII

In continuation of the current version of Law 261, the Supreme Court draws attention to the priority of the newer normative act. This is also stated in Article 346.26 of the Tax Code, according to which the obligation to introduce special equipment into retail locations is imposed on individual entrepreneurs and organizations.

Thus, enterprises operating under the imputed income tax regime should also use control equipment for their activities.

How to connect a cash register to sell beer?

Companies involved in the sale of beer can purchase a new cash register from the list above that complies with the requirements of Federal Law-54 and Unified State Automated Information System, or upgrade an already used cash register. In each case, the procedure for connecting to the Federal Tax Service will be different.

Table 2. Connecting an online cash register for selling beer

| Using the new cash register | Modernization of the old cash register |

|

|

Material on the topic: instructions for connecting an online cash register.

Buying a new cash register will allow you to avoid a lot of additional activities. In addition, not all CCPs can be modernized and provided with the ability to connect to the Internet.

Important point! The refusal of a company engaged in the beer trade to use an online cash register from July 1, 2021 involves the payment of fines in accordance with the provisions of the Code of Administrative Offenses:

- for failure to use a new cash register - 75-100% of the organization's revenue and from 10 thousand rubles. from officials;

- for non-compliance of the cash register with the requirements of Federal Law-54 - from 5 thousand rubles. from the organization and from 1.5 thousand rubles. from its officials.

The procedure for writing off draft beer

When products are sold on tap, they are not included in the list for sending to EGAIS. Contour.Market warns users about this by displaying the appropriate message:

Thus, you need to record the implementation in the accounting log manually. To do this you need:

- Open the sales journal for the desired date:

- Use the “Add Beer” button. A list will open from which you can select the desired product:

- Go to write-off statements with the reason “sales”. The “Sale Amount” and “Retail Price” cells must be filled in here. The user enters data on quantity and retail price, and Kontur.Market automatically calculates the sales amount:

- When the act is ready, it must be sent to EGAIS by clicking the appropriate button:

Note! After the invoice is sent to EGAIS, it will be considered that the entire keg has been sold. Thus, when subsequently selling a drink from this container, write-off reports do not need to be drawn up.

Retail price indication

So far, PAP does not provide precise explanations on how to correctly indicate the retail price for draft drinks. Therefore, market participants can act at their own discretion. A mandatory requirement is to indicate the full volume of the opened container.

It happens that the price per liter is not set. Then it should be calculated like this:

Purchase price including markup or discount / Number of liters

Here are some examples:

- Keg capacity is 30 l, price for 1 l is 80 rubles. The amount that should be indicated in the act: 80 x 30 = 2400 rubles.

- Keg capacity 50l, the price per liter is not set, the purchase price of the keg is 5000 rubles, the markup amount is 20%. The cost of selling the entire book, taking into account the markup, will be: 5000 + 5000 / 100 x 20 = 6000 rubles. The retail price for 1 liter will be: 6000 / 50 = 120 rubles.

Fines for not having a cash register

The tax office may fine the seller of beer if the store or bar fails to install new equipment on time. The fines are:

- 70–100% of the proceeds that went past the cash register.

- For individual entrepreneurs, the minimum fine is 10,000 rubles, for legal entities - 30,000 rubles.

If the inspection comes again, and the entrepreneur still has not acquired a cash register, he may be fined again for the same amount.

If the tax office finds out that the turnover of money that did not pass through the cash register reaches 1 million, the entrepreneur will be fined this million and may suspend the company’s activities for three months.